In the quest to uncover undervalued dividend stocks, investors can gain both income stability and long-term growth potential by identifying them. CVS Health (CVS), Altria Group (MO), and AT&T (T) currently stand out for their combination of attractive yields and favorable valuations relative to intrinsic value.

CVS Health, with a forward yield of 4.70% and trading at a 45.97% discount to its intrinsic value, presents a significant margin of safety. Altria bolsters its 8.17% yield through strong debt management and steady dividend growth. Meanwhile, AT&T’s yield of 5.03%, combined with stable cash flow metrics, positions it as a viable option despite a higher valuation. Together, these stocks offer promising entry points for dividend-focused investors seeking both value and reliable income. Let’s explore: what dividend stocks are undervalued?

CVS Health: Dividend Stock With A Stable Growth and Margin Of Safety In Valuation

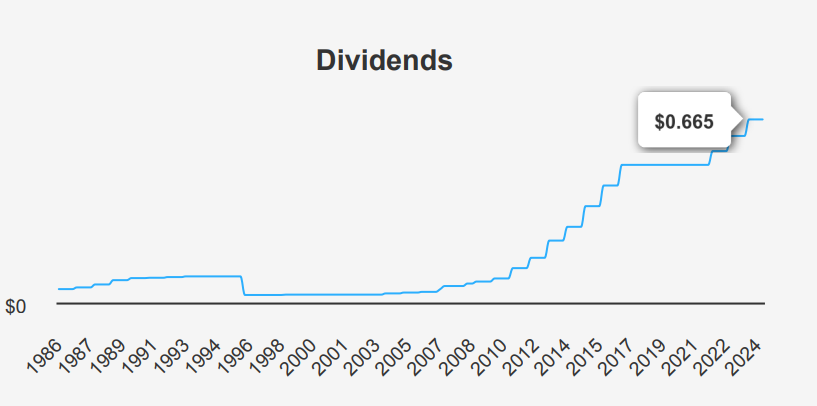

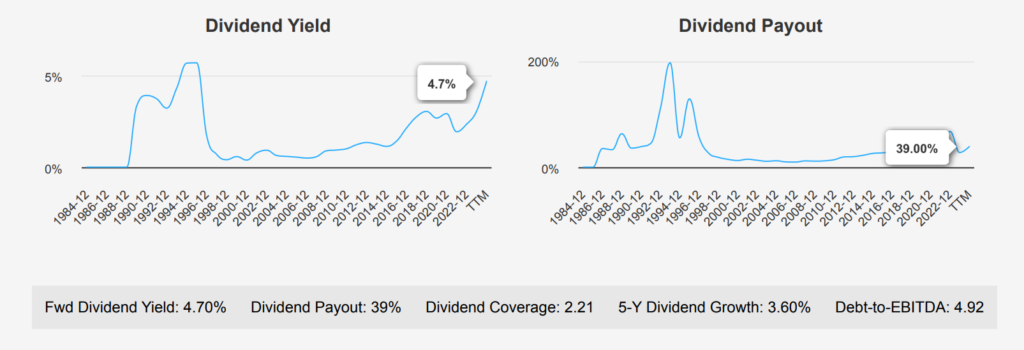

The first stock on the exploration of ‘what dividend stocks are undervalued’ is CVS Health (CVS). Its recent dividend performance shows stable growth, with a quarterly dividend per share of $0.665. This reflects a 9.9% increase from $0.605 in the previous year. CVS’s forward dividend yield is 4.70%, aligning with its 10-year high, indicating strong dividend attractiveness in the current market. The 3-year dividend growth rate stands at 6.60%, with a slightly lower 5-year growth rate of 3.60%, suggesting a deceleration in recent enhancements. The estimated future 3-5-year dividend growth rate of 4.56% implies moderate but steady increases ahead.

CVS’s debt-to-EBITDA ratio of 4.92 is above the moderate risk threshold of 4.0, indicating higher financial leverage which may pose concerns regarding debt servicing. This high leverage could potentially limit aggressive dividend growth strategies. The company maintains a relatively low dividend payout ratio of 39.0%, marking room to sustain or increase dividends, despite having had historically high payout ratios over the last decade. Based on the quarterly frequency, the next ex-dividend date, following October 21, 2024, would be January 22, 2025, ensuring it falls on a weekday. Sector comparison shows CVS’s yield is competitive, although its leverage remains a cautionary factor for its inclusion in the list.

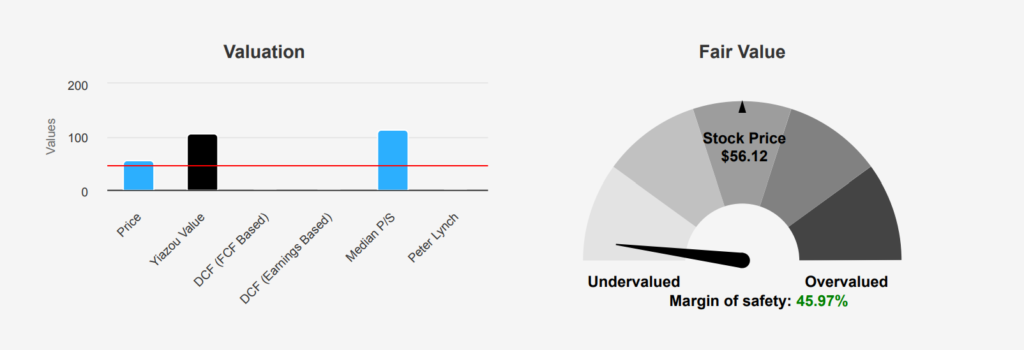

CVS Health is currently trading at $56.12, significantly below its intrinsic value of $103.87, suggesting a margin of safety of 45.97%. This indicates a substantial buffer, as the intrinsic value exceeds the current market price by a wide margin. The current P/E ratio stands at 9.99, which is near its 10-year low of 9.11 and well below the median of 16.40, indicating potential undervaluation. Similarly, the TTM P/S ratio of 0.2 matches the 10-year low, further suggesting the stock holds undervaluation relative to its historical performance.

Altria: Dividend Sustainability Amid A Relative Undervaluation

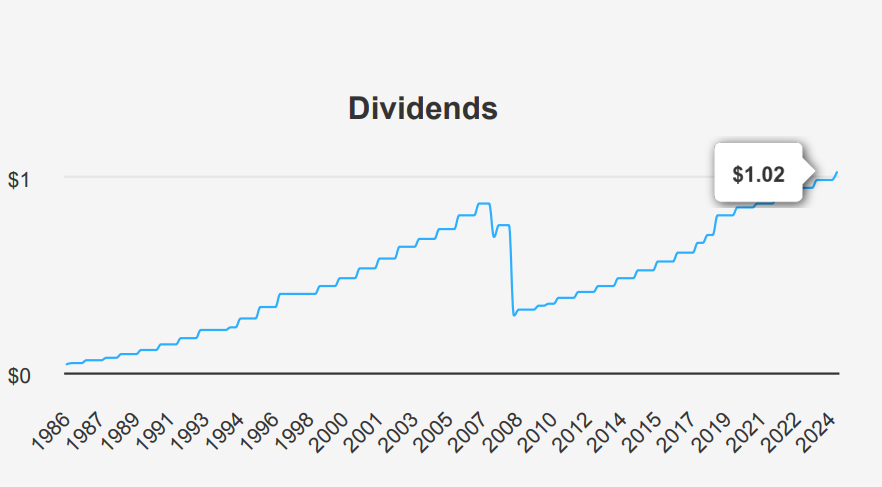

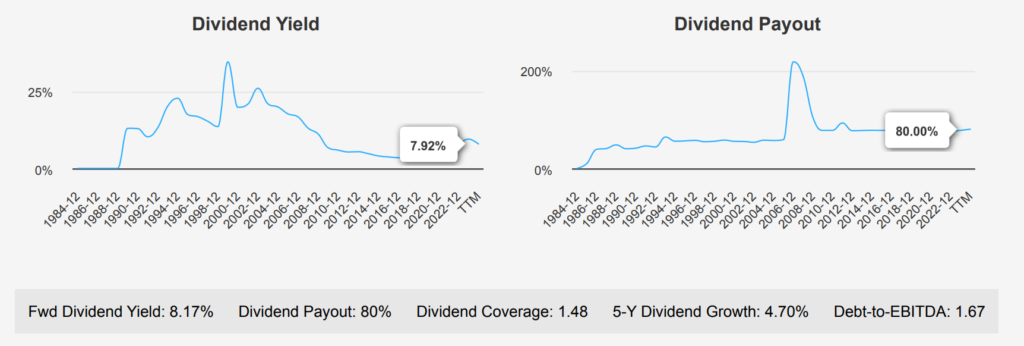

The next one on the ‘What dividend stocks are undervalued’ list is Altria (MO). It has consistent dividend growth, with a 5-year growth rate of 4.70% and a slightly lower 3-year rate of 4.10%. The most recent dividend, at $1.02 per share, marks an increase over previous quarters, reflecting the company’s commitment to returning value to shareholders. The forward dividend yield stands at a robust 8.17%, which is competitive within its sector. The debt-to-EBITDA ratio of 1.67 indicates a strong capacity to service debt, aligning with lower financial risk thresholds.

However, the dividend payout ratio at 80% is relatively high, though it has decreased from historical highs (10y high of 100.8%). This indicates a cautious approach toward dividend sustainability, possibly influenced by sector-specific challenges. The forecasted dividend growth rate of 3.90% suggests moderate expansion in shareholder returns, potentially impacted by market conditions and strategic investments. Based on the quarterly dividend frequency, the next ex-dividend date may be December 13, 2024.

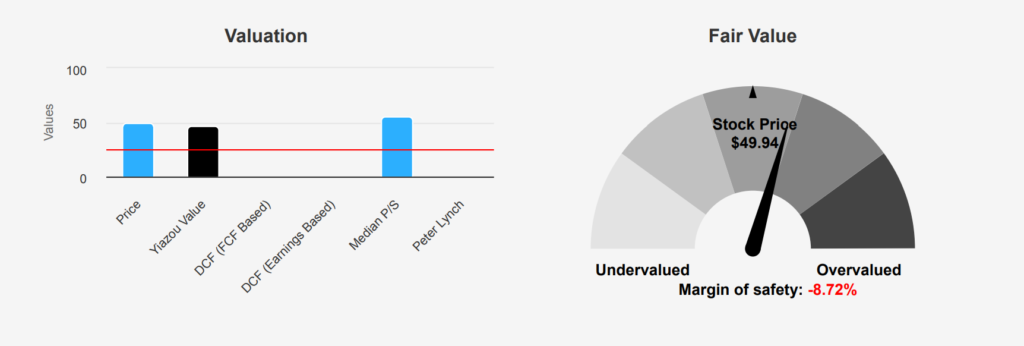

Altria Group (MO) currently trades at $49.94, above its intrinsic value of $45.93 with a negative margin of safety of -8.73%. This suggests the stock potentially holds overvaluation against its intrinsic value. The TTM P/E ratio is at 8.6, below both its 10-year median of 17.20 and its 10-year low of 7.84, which may point to a relative undervaluation in terms of earnings. The forward P/E ratio stands at 9.42, hinting at a modest growth expectation. The TTM P/S ratio is 4.29, slightly below the 10-year median of 4.68, suggesting a fair relative valuation based on sales.

AT&T: A Sustainable Payout Ratio Amidst Stable Cash Flow Valuation

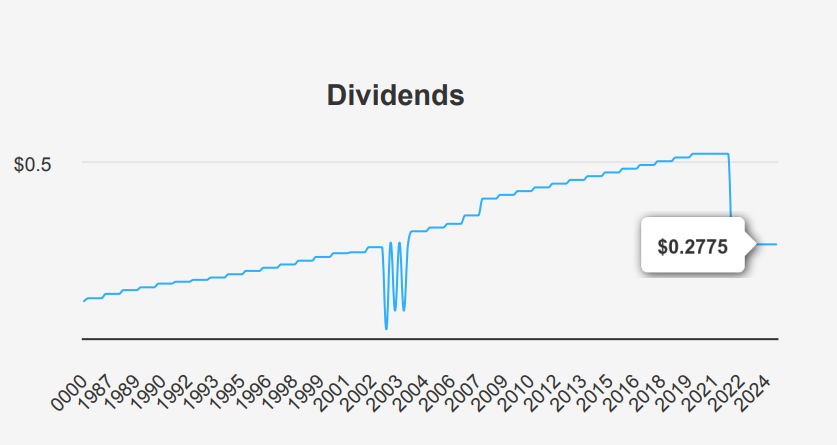

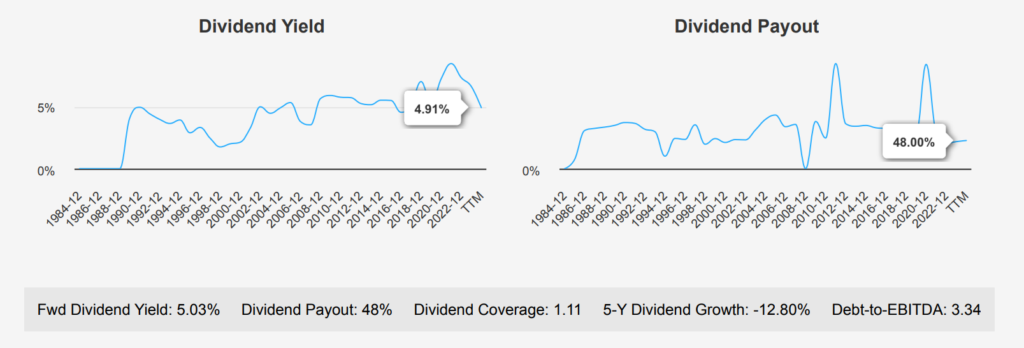

The final pick on the ‘What dividend stocks are undervalued’ list is AT&T (T). In the most recent quarter, AT&T maintained its dividend per share at $0.2775, continuing a consistent payout despite a historical decline in dividend growth rates. Over the past five years, T has experienced a -12.80% dividend growth, with a sharper -18.90% decline over the last three years. This stagnant growth reflects strategic financial adjustments and a focus on maintaining a sustainable payout ratio, which currently stands at 48%.

Comparatively, T’s forward dividend yield of 5.03% remains attractive within the sector, though it has decreased from historical highs. Its yield has ranged between 4.91% and 12.07% over the past decade, showing a median of 7.36%. The debt-to-EBITDA ratio is 3.34, placing T in a moderate risk category. This suggests an approach is wise, but the company appears capable of managing its debt obligations effectively. The forecasted 3-5-year dividend growth rate is a modest 1.31%, reflecting limited growth potential. The next ex-dividend date is November 1, 2024.

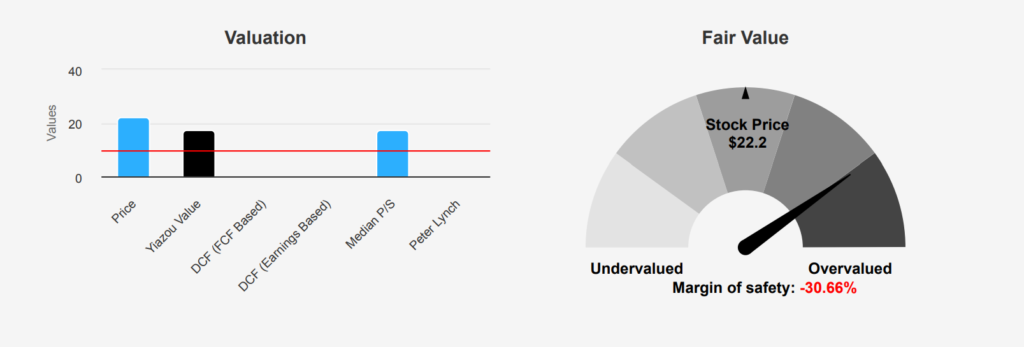

The intrinsic value of T stands at $16.99, while the market price is $22.20, pointing to a negative margin of safety of 30.67%. This suggests the stock is trading above its intrinsic value, potentially signaling overvaluation. The Forward P/E ratio is 9.8, lower than the TTM P/E of 18.05, which may indicate expectations of increased earnings. Historically, the P/E ratio has ranged between 4.04 and 256.25, with a median of 12.05, suggesting current valuations are above historical norms but align with sector trends.

Finally, the Price-to-Free-Cash-Flow ratio is 7.59, which is nearly at its 10-year median of 7.84, reflecting stable cash flow valuation. Notably, the TTM P/S ratio is 1.3, near its 10-year high of 1.32, suggesting a potentially overvalued position based on sales.

Disclosure:

Yiannis Zourmpanos has a beneficial long position in the shares of CVS and MO either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.