Wells Fargo Stock Represents Leading US Banking Gaint

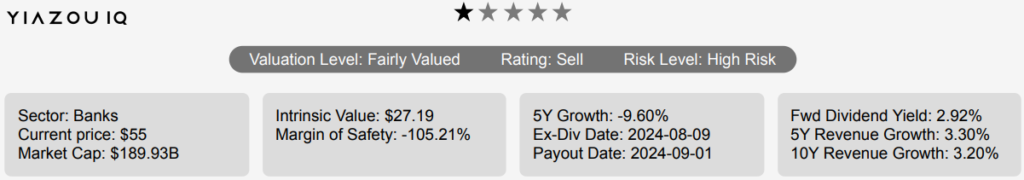

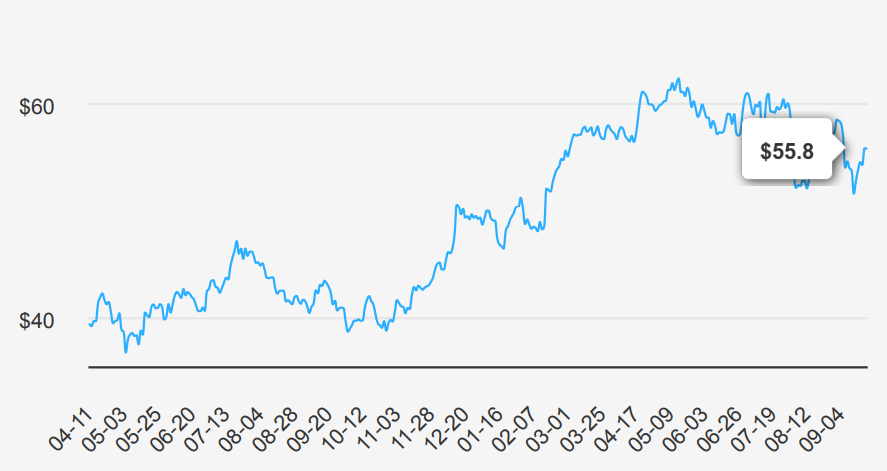

Wells Fargo (WFC) is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S. WFC stock, which is trading at nearly $56.

Wells Fargo Boosts EPS Amid Strategic Buybacks

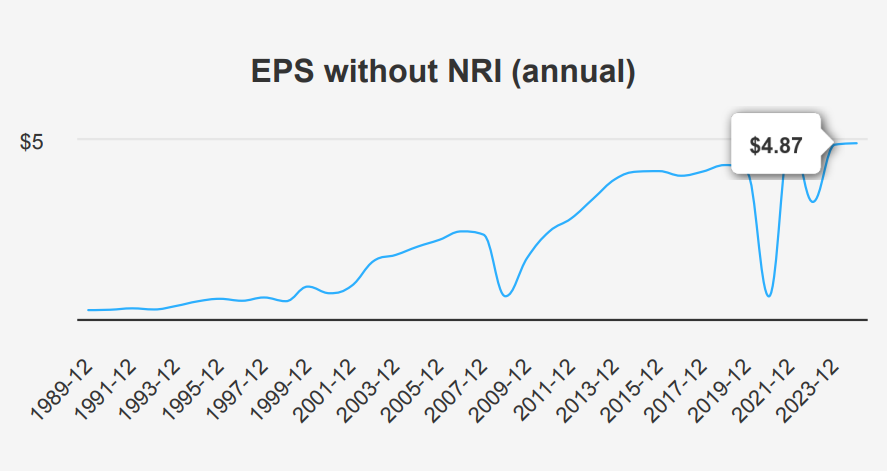

Wells Fargo reported its earnings for the quarter ending June 30, 2024, with EPS (Earnings Per Share) without NRI (non-recurring items) at $1.33, up from $1.20 in the previous quarter and $1.25 in the same period last year. The company’s revenue per share increased to $5.935 from $5.795 in the previous quarter and $5.512 year-over-year (YoY). Over the past five years, the EPS without NRI has grown at a Compound Annual Growth Rate (CAGR) of 5.70%, although it has declined by 2.40% over the last decade. Industry forecasts suggest a growth rate of approximately 3% annually over the next ten years.

Wells Fargo’s financials are impacted by its share buyback activities, with a 1-year buyback ratio of 7.20%, indicating that 7.20% of the company’s shares were repurchased over the past year. The 5-year buyback ratio stands at 4.20%, suggesting consistent efforts to return capital to shareholders, positively impacting EPS by reducing the number of outstanding shares. However, the gross margin percentage remains unspecified, which is crucial in assessing the company’s profitability.

Looking forward, analysts estimate Wells Fargo’s EPS to reach 5.055 for the fiscal year ending 2024 and 5.466 for the following year. Revenue is projected to steadily increase, with forecasts reaching $82,284.71 million in 2024 to $85,762.52 million by 2026. The next earnings announcement is expected on October 11, 2024, providing further insights into the company’s performance and growth trajectory. Investors and analysts will closely monitor these earnings for indications of how strategic initiatives and market conditions might influence future results.

Wells Fargo Faces Struggles with Capital Efficiency and Returns

Wells Fargo presents a challenging picture in terms of economic value creation, particularly when evaluating its Return on Invested Capital (ROIC) against its Weighted Average Cost of Capital (WACC). The current ROIC also stands below the WACC of 13.69%. In contrast, the company’s Return on Equity (ROE) has shown more favorable results, with a 5-year median of 10.29% and a current ROE of 10.37%. This suggests better performance in terms of shareholder equity returns. However, since the ROIC remains below the WACC, the company is not efficiently converting its capital investments into profits.

This situation implies that WFC has not been creating economic value for its investors, as the cost of capital consistently exceeds the returns generated. The company may need to reassess its capital allocation strategies to improve its financial efficiency and value generation.

Steady Dividends, Growth Potential, and Financial Resilience

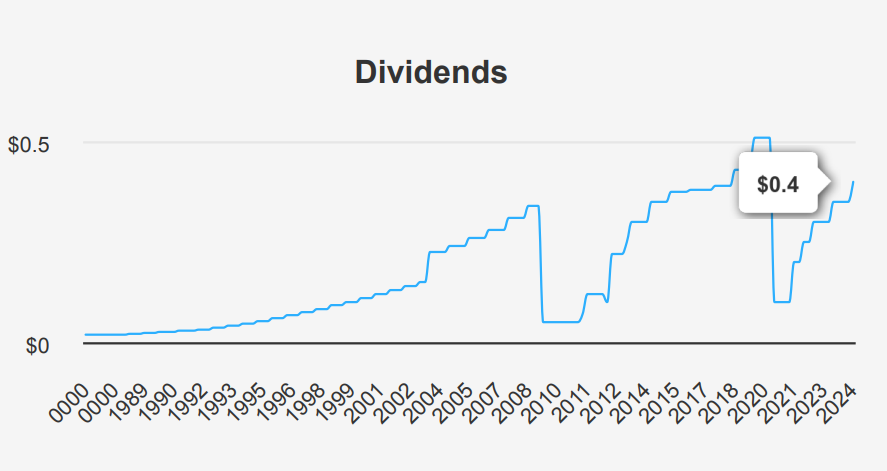

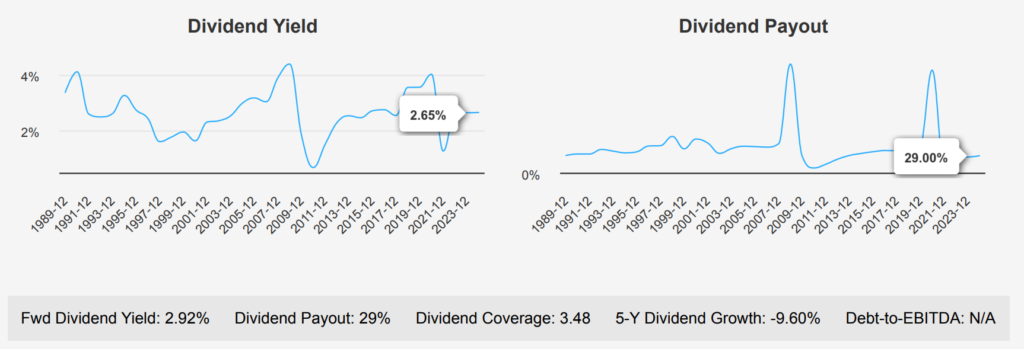

Wells Fargo stock has demonstrated a modest 3-year dividend growth rate of 2.10%, despite a negative 5-year dividend growth of -9.60%. Over the most recent quarters, WFC’s dividend per share has increased from $0.30 to $0.40. This improvement aligns with the forward dividend yield of 2.92%, which is slightly above its 10-year median yield of 2.77%, indicating a stable return compared to historical performance.

The company’s dividend payout ratio stands at 29%, reflecting a conservative approach compared to its 10-year high of 101.76%. This lower payout ratio suggests WFC is well-positioned to sustain its dividends and possibly increase them. It is supported by an optimistic future 3-5-year dividend growth estimate of 13.07%.

However, without a specified Debt-to-EBITDA ratio, evaluating financial leverage is challenging. Generally, a lower ratio indicates stronger debt management and financial health.

Given a quarterly dividend frequency, the next ex-dividend date is projected to be November 6, 2024. This is a Wednesday following the provided August date, ensuring it is a future weekday. Overall, WFC appears stable in its dividend strategy, with room for growth in a competitive financial sector.

Financial Strength and Debt: Wells Fargo’s Balance

Wells Fargo & Co’s financial health appears robust when considering various key indicators. The Piotroski F-Score of 7 suggests a strong financial position. This indicates that the company is proficient in generating profits, maintaining low leverage, and efficiently using assets. This score reflects the company’s capacity to sustain healthy operational practices and suggests resilience against potential market fluctuations.

Moreover, the Beneish M-Score of -2.63 signifies that Wells Fargo is unlikely to be engaging in financial manipulation, adding another layer of reassurance regarding its financial integrity. Predictable revenue and earnings growth further reinforce the company’s stable outlook, highlighting its ability to generate consistent returns over time.

However, it’s important to note the company’s long-term debt issuance, amounting to USD 95.9 billion over the past three years. While this level of debt is deemed acceptable, investors must monitor how this debt is managed in relation to the company’s revenue streams and interest coverage. Overall, Wells Fargo’s financial indicators are favorable, but vigilance regarding debt management remains essential to ensure long-term stability.

Insiders Quiet: Limited Trading Reflects Wary Sentiment

An analysis of insider trading activity at Wells Fargo stock over the past year indicates minimal engagement from the company’s directors and management in terms of buying or selling shares. Specifically, there were no insider buys or sells recorded in the last three or six months. Over the last 12 months, there was only one insider buy and no insider sell transactions. This limited insider activity suggests a lack of significant insider trading trends. This could imply that insiders are neither particularly optimistic nor pessimistic about the company’s short-term stock performance.

Insider ownership currently stands at a modest 0.21%, which is relatively low. This might indicate that insiders have limited personal financial exposure to the company’s stock performance. Meanwhile, institutional ownership is high at 75.81%. This indicates strong institutional confidence and potentially more significant influence over company strategy and share price movements. Overall, the data suggests a stable but cautious outlook from insiders, with institutional investors playing a more dominant role in the ownership structure.

Wells Fargo Stock Holds Huge Liquidity

Wells Fargo stock exhibits robust trading volume, with a recent daily volume of 21,364,055 shares. This surpasses its two-month average daily trade volume of 16,335,578 shares, which indicates heightened trading activity and potentially increased investor interest or volatility in the stock.

The Dark Pool Index (DPI) for WFC stands at 58.87%. It suggestes that a significant portion of trading is occurring away from public exchanges. A DPI above 50% may indicate that institutional investors are actively trading the stock. This possibly reflects strategic positioning or large block trades that are less visible in public markets.

Overall, the elevated trading volume and substantial DPI percentage imply that WFC is a liquid stock with active institutional participation. This liquidity is beneficial for investors looking to enter or exit positions efficiently. However, the high DPI also calls for careful consideration of market movements, as significant trades in dark pools can impact price dynamics without immediate visibility in the public market.

Government Contracts: A Rollercoaster Ride for WFC

Wells Fargo experienced substantial fluctuations in government contracts over the years. Between 2014 and 2016, WFC secured significant contracts, peaking in 2015 at approximately $520 million. However, from 2017 onwards, there was a sharp decline, with contracts dwindling to about $1.4 million in 2017 and further decreasing to around $1.08 million in 2018. By 2024, there was a slight recovery, as contracts increased to approximately $3.3 million. This indicates potential for growth in government engagements.

Congressional Moves: Divergent Views on WFC Stock

In early September 2024, there were notable trades involving Wells Fargo stock by two Republican members of Congress. On September 1, 2024, Senator A. Mitchell Jr. McConnell purchased shares valued between $1,001 and $15,000. This purchase was reported on September 16, 2024. Just a few days later, Representative John James from the House of Representatives sold shares in the same value range on September 4, 2024, which was reported on September 6, 2024.

These trades highlight differing perspectives or strategies regarding WFC stock among Republican lawmakers. McConnell’s purchase could signal confidence in the company’s future performance. Meanwhile, James’s sale might indicate a different outlook or a need to reallocate his investment portfolio. Such transactions are part of the broader financial activities of Congress members and can sometimes provide insight into market sentiment or individual financial strategies.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.