Walgreens Stock: The Cornerstone of The American Pharmacy Services Market

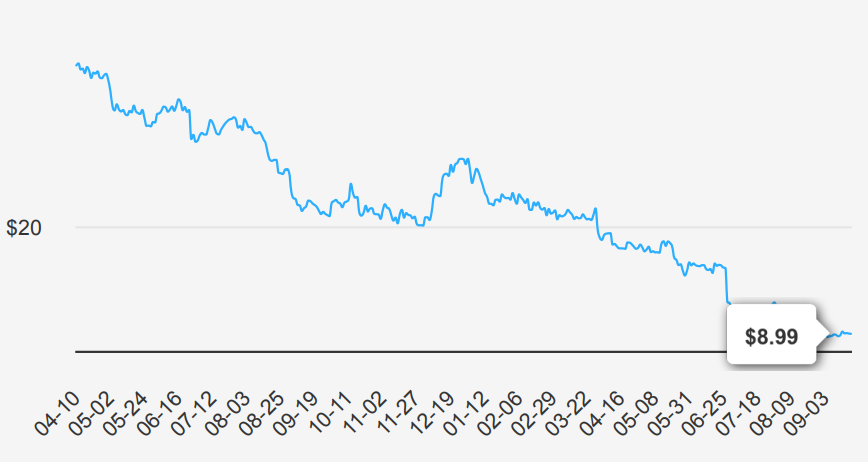

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the US, with over 8,500 locations. Nearly three-quarters of Americans live within five miles of a Walgreens location. Roughly two-thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the US. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider. WBA stock is currently trading at nearly $9.

Walgreens Earnings: Navigating Challenges Amidst Change

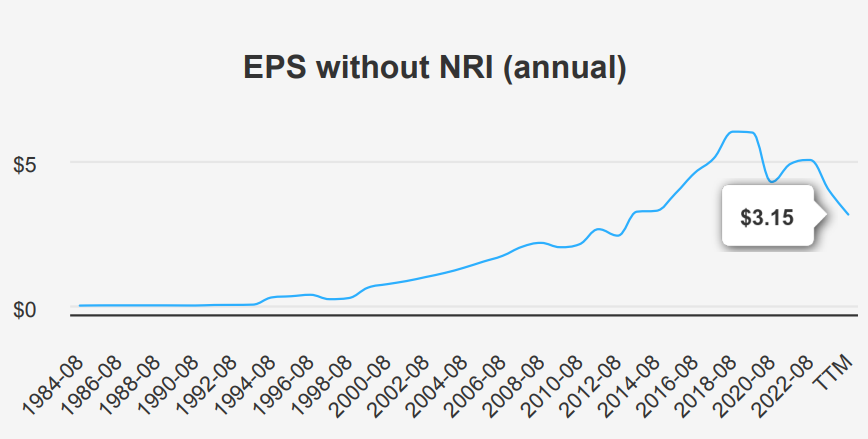

Walgreens Boots reported its latest quarterly earnings for the period ending May 31, 2024. The EPS without non-recurring items (which provides a clearer view of ongoing profitability) was $0.63, down from $1.20 in the previous quarter (QoQ) and $1.00 in the same quarter last year (YoY). This decrease highlights ongoing challenges as the company navigates a changing retail landscape. Revenue per share slightly decreased to $42.058 from $42.959 in the prior quarter, reflecting continued pressure on sales. Over the last 5 years, the company has experienced a negative compound annual growth rate (CAGR) in annual EPS without NRI of 6.80%, though it maintained a positive 3.20% CAGR over a decade.

The gross margin for the quarter was 18.38%, matching the 10- year low and notably below the 5-year median of 21.30%. This indicates a significant squeeze on profitability, likely due to increased competition and operational costs. Share buybacks have been minimal, with a 1-year ratio of 0.00% and a 5-year ratio of 1.70%, indicating limited impact on EPS enhancement through reduced share count. The buyback ratio shows the percentage of shares repurchased, with a historical high of 6.10% over three years in the past decade.

Looking forward, analysts project revenue growth with estimates reaching $150,483.57 million by 2026, suggesting potential recovery and expansion. The next earnings date is set for October 15, 2024, where updated EPS forecasts will be closely watched to gauge the company’s trajectory amidst industry forecasts predicting a steady growth trend of around 5% per annum over the next decade.

Walgreens Boots Alliance: Navigating Economic Value Challenges

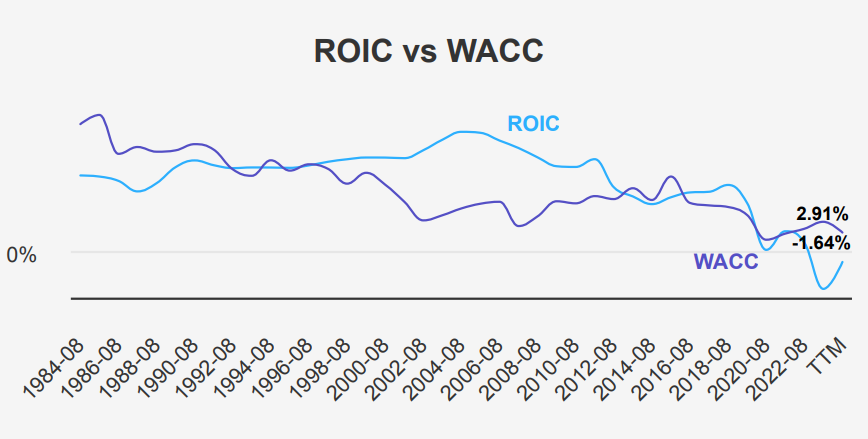

As indicated by its financial metrics, Walgreens Boots Alliance currently faces challenges in creating economic value. The company’s Return on Invested Capital (ROIC) is -1.64%, which falls below its Weighted Average Cost of Capital (WACC) of 2.91%. This suggests that WBA is not generating returns to cover its cost of capital, leading to value erosion rather than value creation.

Historically, WBA’s ROIC has been volatile, with a 10-year high of 10.29% and a low of -5.82%, indicating periods of both strong and weak performance. The 5-year median ROIC of 1.34% also highlights a consistent struggle to surpass the WACC, with the 5- year median WACC standing at 3.50%.

The negative Return on Equity (ROE) of -33.13% further underscores financial inefficiencies, compared to a 10-year high ROE of 18.79%. These metrics suggest that WBA needs to reassess its capital allocation strategies to enhance operational efficiency and improve shareholder returns, aiming to achieve an ROIC that consistently exceeds its WACC for sustainable value creation.

WBA Stock: Dividend Challenges and Opportunities

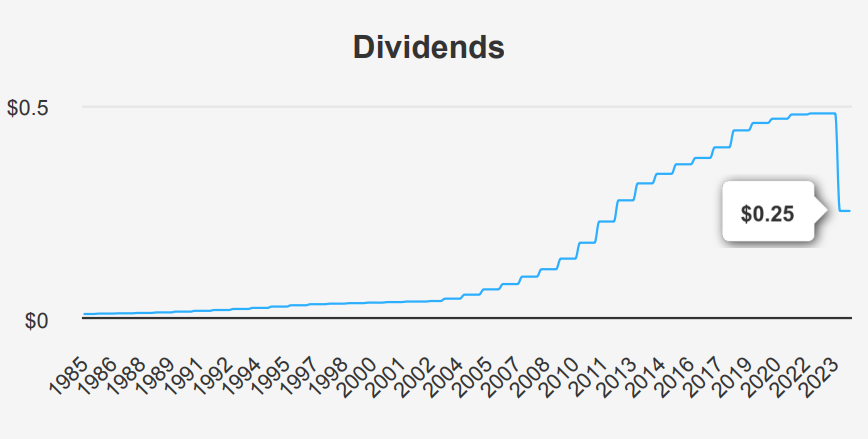

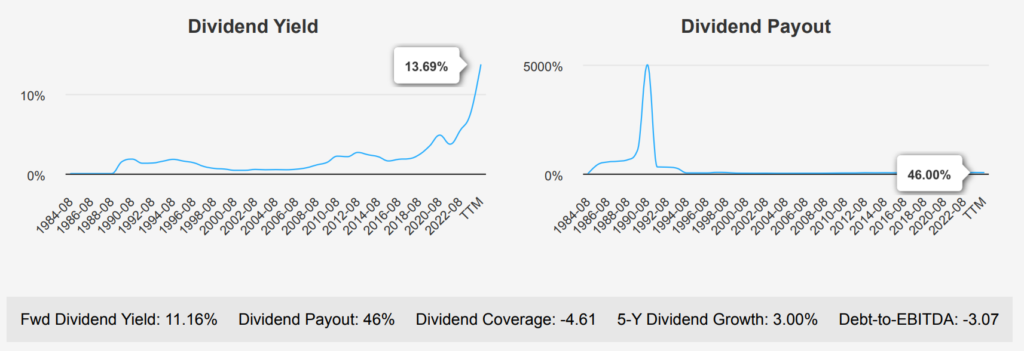

Walgreens Boots Alliance stock has shown a mixed performance regarding dividend growth and financial health. The company’s 3- year dividend growth rate is a modest 1.4%, while the 5-year rate stands at 3%. This indicates a slow growth trend. This is concerning given the estimated future 3-5 year dividend growth rate of -17.22%, pointing towards potential dividend cuts.

The current forward dividend yield is a high 11.16%, which might appeal to income-focused investors. However, this high yield is juxtaposed against a declining dividend per share. It can be observed in the recent reduction from $0.48 to $0.25 per share. The dividend payout ratio is at 46%, which is sustainable, but historically, the company’s payout ratio has been quite high.

The Debt-to-EBITDA ratio is significantly negative at -3.07. This suggests potential issues in financial management and leverage that require close monitoring, as it deviates from industry norms.

Considering the quarterly dividend frequency, the next ex-dividend date is projected to be November 20, 2024. It is ensuring continuity in dividend distribution despite financial challenges.

Walgreens Stock’s Intriguing Valuation Landscape

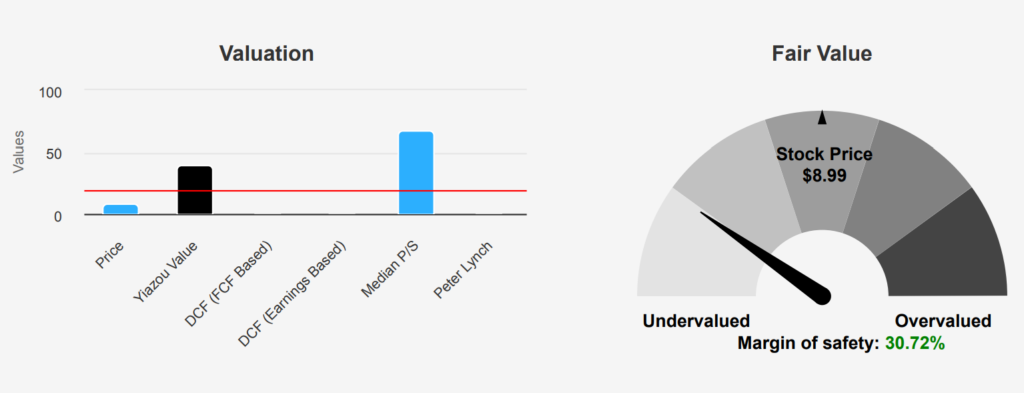

The current valuation metrics for Walgreens Boots Alliance stock present a mixed picture, with the intrinsic value calculated at $12.98. It is significantly higher than the current market price of $8.99, suggesting a margin of safety of approximately 30.74%. This indicates that the stock is potentially undervalued, offering a buffer for investors. The Forward P/E ratio of 4.86 suggests a low valuation compared to its historical 10- year median P/E of 19.37, which could indicate potential upside if earnings stabilize. However, the TTM P/E ratio is at a loss, reflecting recent financial challenges.

The TTM Price-to-Sales (P/S) ratio stands at a very low 0.05, at the lowest end of its 10-year range. This suggests significant undervaluation, especially when compared to the 10-year median of 0.39. The TTM EV/EBITDA is negative at -3.73, a discrepancy from the 10-year median of 12.51. It indicates potential issues with earnings before interest, taxes, depreciation, and amortization. Similarly, the TTM Price-to-Book (P/B) ratio is at 0.57, near its 10-year low. This typically indicates a deep undervaluation but may also reflect underlying business risks.

Analyst ratings show a cautious outlook, with price targets trending downwards over the past three months, currently at $11.59. This suggests that while there is potential upside from current levels, analysts are wary of WBA’s earnings potential. The significant drop in price targets over recent months may reflect concerns over sustainable earnings growth and operational challenges.

Walgreens: Risks and Rewards

Walgreens Boots Alliance displays several financial red flags that warrant caution. The company’s assets have been growing at a rate (7.4%) significantly faster than its revenue growth (4.6%) over the past five years. This suggests diminishing efficiency in asset utilization. Additionally, the declining gross margin at an average annual rate of -3.4% indicates potential challenges in maintaining profitability. Furthermore, the Altman Z-score of 1.62 places the company in the distress zone. It hints at a notable risk of financial distress or even bankruptcy within the next two years.

On a more positive note, WBA’s Beneish M-Score of -2.2 suggests that the company is unlikely to be engaging in earnings manipulation. This offers some reassurance about its financial reporting integrity. The stock is currently trading at historically low valuation metrics. Here, the price-to-book (PB) ratio is 0.57 and price-to-sales (PS) ratio is 0.05, both near their 10-year lows. This could present an opportunity for value investors if the company stabilizes its operations and improves its financial health. However, potential investors should weigh these opportunities against the significant risks highlighted by the company’s financial indicators.

Walgreens Stock Insider Trading Trends Mark Cautious Optimism

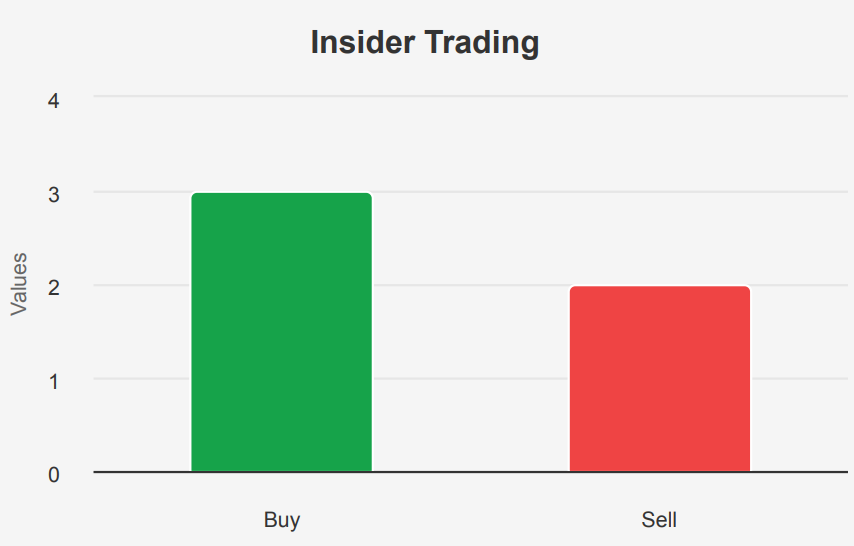

Over the last three months, there have been no insider buys or sells. This indicates a period of stability or perhaps uncertainty about the company’s short-term prospects. However, over a six-month period, there were two insider purchases and no sales. This suggests cautious optimism or strategic accumulation by insiders. In the full 12-month span, there were three insider buys and two sells, reflecting a balanced stance with slightly more purchases. This may indicate confidence in the company’s longer-term potential.

Insider ownership stands at 1.57%, a modest level that suggests insiders have a limited direct stake in the company’s equity performance. Institutional ownership is significantly higher at 59.49%, highlighting the substantial influence of large investors on WBA’s stock movements. The relatively low insider trading activity could imply that insiders are holding onto their shares, potentially anticipating future growth or awaiting clearer market signals.

Walgreens Stock’s High Liquidity and Trading Dynamics

Walgreens exhibits a current average daily trading volume of approximately 18.78 million shares over the past two months. However, the most recent daily trading volume was 12.61 million shares. This indicates a decrease in trading activity compared to the two month average. This reduction in volume could suggest a decrease in investor interest or potential market fatigue.

Analyzing the liquidity further, the DPI (Dark Pool Index) metrics provide insight into off-exchange trading activity. The DPIs are as follows: 43% for DPI 1, 45% for DPI 2, and 47% for DPI 3. These percentages reflect the proportion of WBA shares traded in dark pools, which are private exchanges used by investors to trade large volumes without directly impacting the market. A higher DPI can sometimes signal lesser transparency but also indicate substantial institutional trading interest.

Overall, WBA stock’s trading and liquidity profile is characterized by moderate trading activity, with a significant portion occurring in dark pools. This dynamic suggests that while retail investor participation may be declining, institutional investors continue to play a significant role in trading WBA shares.

Volatile Government Contracts: A Five-Year Analysis

From 2019 to 2024, WBA’s government contracts show significant volatility. Starting modestly at $21,663 in 2019, there was a steep rise to $438,839 in 2020, followed by a slight decrease in 2021. However, 2022 marked a dramatic surge to $1.25 billion, likely due to pandemic-related contracts. This peak was unsustainable, with amounts subsequently dropping to $85.3 million in 2023 and $18.8 million in 2024, suggesting a return to more typical levels as emergency needs declined.

Walgreens Boots Alliance: A Patent Powerhouse Emerges

Over the 2018-2022 period, Walgreens Boots Alliance has consistently secured patents, with a total of 21 patents. The year 2020 saw the highest activity, with 6 patents granted, indicating a focused effort on innovation during that period. Other years, such as 2021 and 2022, maintained a steady pace with 5 and 4 patents, respectively. This trend reflects WBA’s ongoing commitment to enhancing its business capabilities through technological advancements and intellectual property development.

Senator Tuberville’s Quick Moves in Walgreens Stock

Senator Tommy Tuberville, a Republican from the Senate, reported two significant trades involving Walgreens Boots in 2024. On March 21, he purchased shares valued between $15,001 and $50,000. This transaction suggests an initial interest or confidence in the company’s prospects at that time or a potential strategic move to diversify his investment portfolio.

However, within a month, on April 30, Tuberville fully sold his holdings in Walgreens stock, with the sale valued between $50,001 and $100,000. This rapid turnaround from purchase to sale could indicate several possibilities. These are a response to market conditions, short-term profit realization, or investment strategy shifts. The quick sale could also reflect a change in his outlook on the company or broader market trends affecting the retail and pharmaceutical sectors.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.