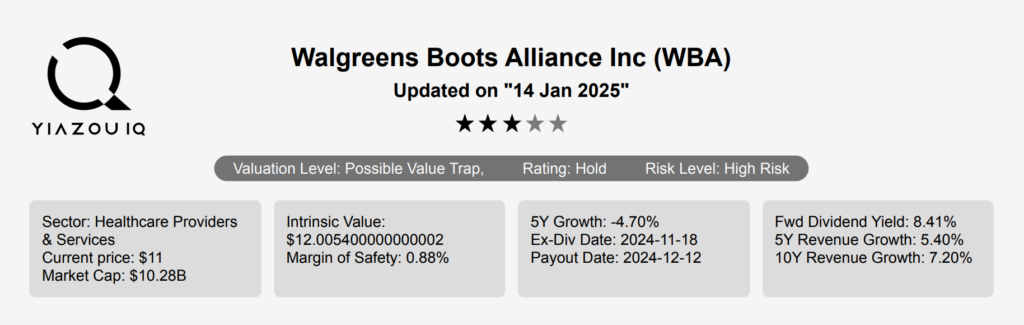

Walgreens Stock Dividend Is Supported By Its Role in US Pharmacy and Omnichannel Evolution

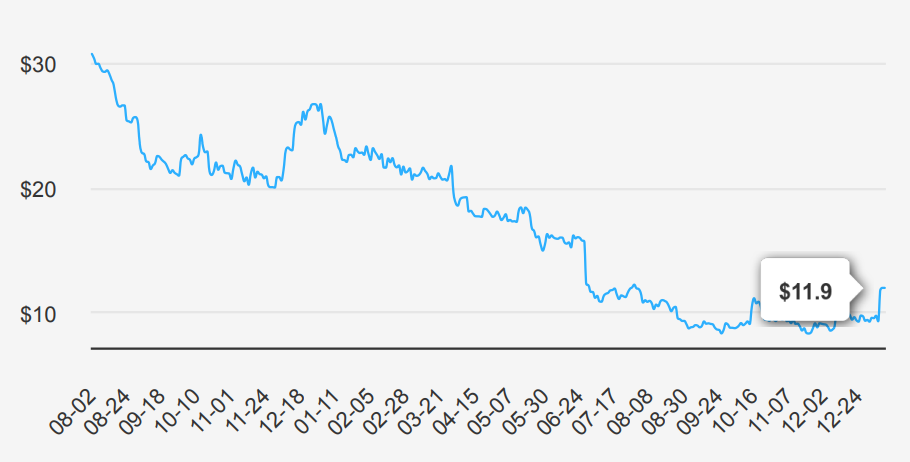

Walgreens Boots Alliance (WBA) is one of the largest retail pharmacy chains in the US, with over 8,000 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the US. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider. Walgreens Stock is currently trading at ~$12. Lets learn more about Walgreens stock dividend.

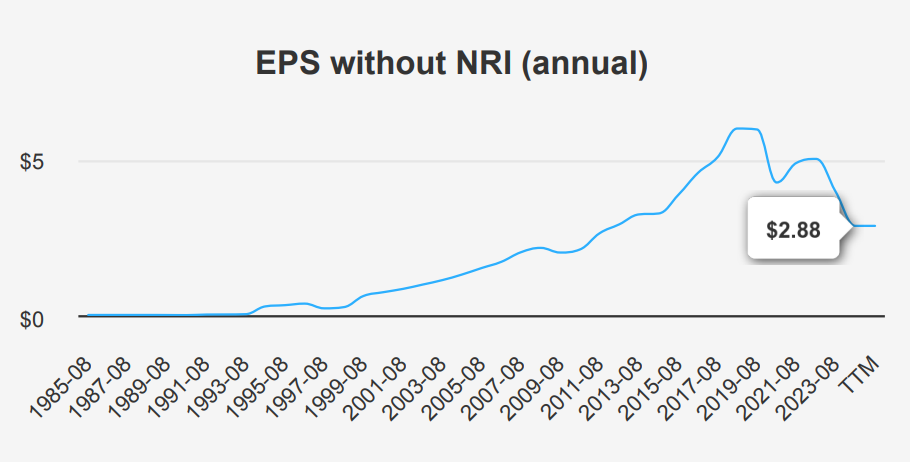

Revenue Rises Amid EPS Declines: Walgreens’ 2024 Performance Highlights

In the latest quarter ending August 2024, WBA reported an EPS without NRI (excluding non-recurring items) of $0.39, declining from $0.63 in Q2 2024 to $0.66 in Q3 2023. This reflects a continuous downward trend over the past year. Revenue per share increased to $43.472 from $42.058 in the previous quarter, showing a positive revenue trend quarter-overquarter. On a broader scale, WBA’s EPS without NRI has witnessed a 10.40% decrease annually over the past five years and a more modest 0.60% decrease over a decade. Industry forecasts suggest a projected growth of around 4-5% annually over the next ten years, indicating potential sector resilience despite WBA’s current challenges.

WBA’s gross margin stands at 17.96%, which is at the 10-year low end, significantly below the 5-year median of 21.18%. This compression in margins highlights ongoing cost pressures and competitive dynamics within the industry. The company’s share buyback activity has been minimal, with a 1-year buyback ratio of 0%, indicating no shares were repurchased recently. Over the last decade, the buyback ratio averaged 2.3%, meaning 2.3% of shares were repurchased over that period. This limited buyback activity suggests minimal impact on EPS enhancement through share reduction.

Analysts project WBA’s revenue to grow steadily, estimating $149.77 billion by 2025, rising to $156.01 billion by 2027. However, the estimated EPS for the next fiscal year end points to a loss of $0.113, improving to $0.226 the following year, indicating expected recovery. The next earnings date is on March 28, 2025, which will give more clarity on performance and strategic direction.

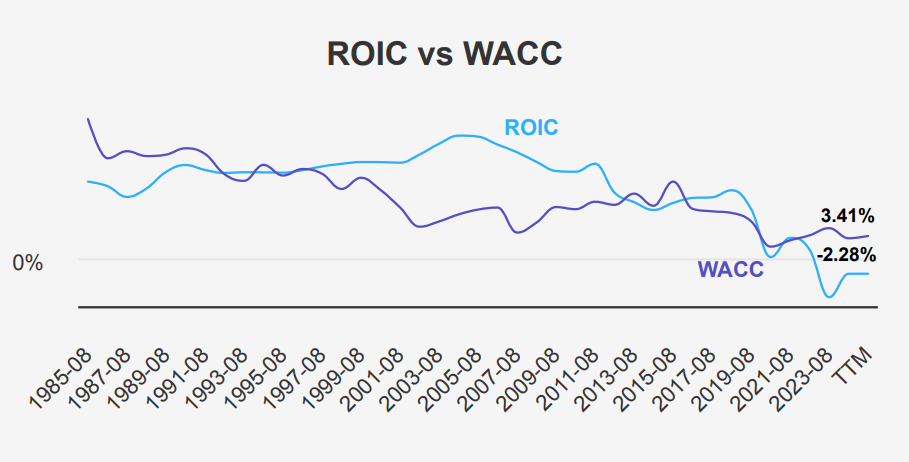

ROIC vs. WACC: Walgreens’ Struggles in Creating Shareholder Value

Walgreens Boots Alliance (WBA) demonstrates a concerning trend in its economic value creation, as evidenced by its Return on Invested Capital (ROIC) compared to its Weighted Average Cost of Capital (WACC). The five-year median ROIC is 0.23%, which falls significantly short of the five-year median WACC of 3.06%. This suggests that, on average, WBA has not been generating returns sufficient to cover its cost of capital, thereby indicating a destruction of shareholder value.

Moreover, the current ROIC is -2.28%, while the current WACC stands at 3.41%. This negative spread further highlights WBA’s struggle to achieve financial efficiency and positive value creation. The company’s negative ROE of -56.02% further emphasizes financial difficulties, contrasting sharply with its 10-year high of 18.79%.

Overall, WBA’s inability to produce an ROIC exceeding its WACC suggests inefficient capital allocation and an economic value loss, which may signal a need for strategic reassessment to enhance financial performance and Walgreens stock dividend.

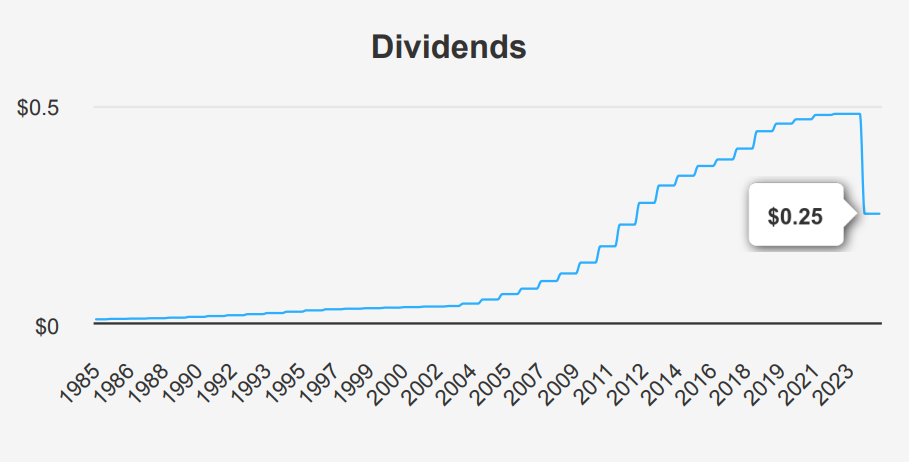

Walgreens Stock Dividend Slashed to $0.25 Amid 3-Year -13.20% Growth Decline

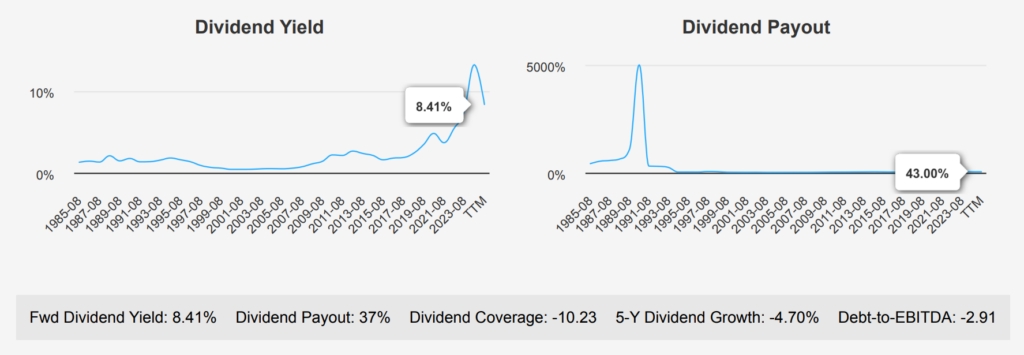

Walgreens Boots Alliance (WBA) has experienced a declining dividend growth trend over recent years. The most recent quarter continues this trend, with the dividend per share reduced from $0.48 to $0.25, reflecting a notable cut. The 5-year dividend growth rate stands at -4.70%, with a more significant drop over the last 3 years at -13.20%. This decline contrasts sharply with the sector, which typically sees more stable or growing dividends.

The company’s forward dividend yield is 8.41%, suggesting a high yield relative to historical norms (10-year median yield of 3.39%). However, the negative forecasted dividend growth rate of -8.28% indicates continued challenges. The high yield may partly result from a reduced stock price rather than a strong dividend performance. WBA’s Debt-to-EBITDA ratio is -2.91, which is anomalous and suggests a data anomaly or potential error, as typical guidelines consider ratios below 2.0 as low risk.

The next ex-dividend date is on February 16, 2025, assuming a quarterly schedule. Given the current dividend payout ratio of 37%, the company maintains a conservative payout strategy amid financial adjustments. Walgreens stock dividend cuts are likely due to efforts to manage financial risk, as indicated by the recent financial performance challenges.

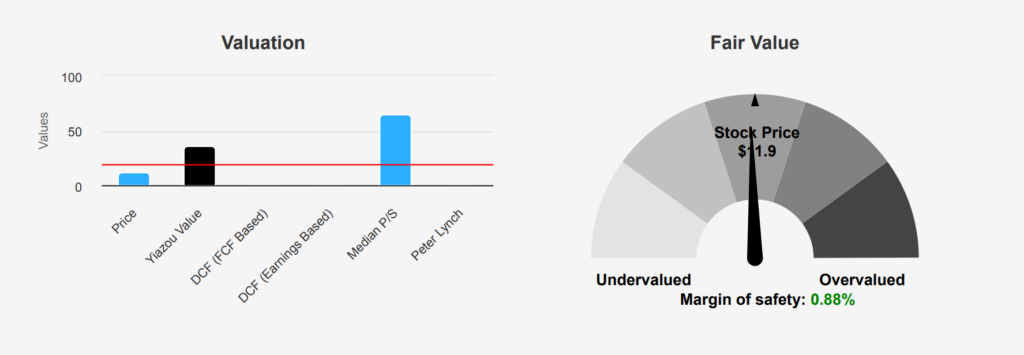

Is Walgreens Undervalued? Examining Its 0.92% Margin of Safety

Walgreens Boots Alliance (WBA) presents an interesting valuation case with its intrinsic value at $12.01, slightly above its current market price of $11.90, offering a modest margin of safety of 0.92%. The Forward P/E ratio stands at 7.73, indicating a potentially undervalued stock compared to its 10-year median of 18.78. However, the TTM P/E suggests a loss, highlighting recent financial challenges. The TTM P/S ratio at 0.07 is near its historical low, suggesting undervaluation, while the TTM EV/EBITDA of -3.62 signals negative earnings before interest, taxes, depreciation, and amortization, reflecting operational difficulties.

The TTM Price-to-Book ratio is 0.98, which is below the 10-year median of 2.04, pointing to potential undervaluation. This could suggest that WBA’s assets are currently valued lower than their historical norms. Analyst ratings suggest a cautious outlook, with the average price target slightly decreasing over recent months, currently at $10.64, which is below both the intrinsic value and the current stock price. This downward trend in analyst price targets indicates market skepticism about WBA’s near-term prospects. While some valuation metrics imply potential undervaluation, the negative EV/EBITDA and zero free cash flow highlight underlying financial struggles, suggesting investors should be cautious and consider these discrepancies when evaluating investment potential and Walgreens stock dividend.

Debt, Losses, and Liquidity Challenges: Assessing Walgreens’ Investment Risks

WBA presents several financial risks that potential investors should consider. The company has been increasing its long-term debt, adding $1.8 billion over the past three years, which could strain its financial flexibility if not managed well. Furthermore, despite repurchasing shares, the stock now trades 41% below its average buyback price, indicating that past buyback strategies have not effectively supported share value. Operating income concerns are visible in losses in 67% of the past 12 quarters, suggesting persistent profitability challenges. Additionally, a low Piotroski F-Score of 3 suggests poor operational efficiency, while the gross margin has declined by an average of 4.5% annually, impacting the company’s pricing power and profitability.

The company’s Altman Z-score of 1.63 places it in the distress zone, indicating a heightened risk of bankruptcy within the next two years. This is compounded by the dividend yield being near a 1-year low, which may make the stock less attractive to income-focused investors. However, on a positive note, the Beneish M-Score of -2.34 suggests that WBA is unlikely to engage in financial manipulation. This provides some reassurance about the integrity of its financial reporting, although the broader financial health concerns warrant careful consideration for Walgreen’s stock dividend.

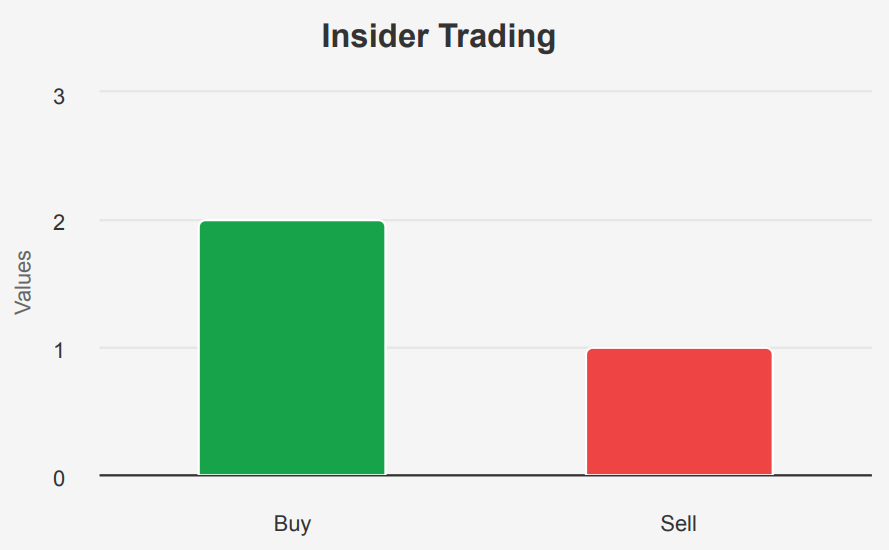

WBA Stock Minimal Insider Activity: Stable Outlook or Strategic Uncertainty?

The insider trading activity for WBA stock over the past year shows minimal movement, with only two buy transactions and one sell transaction recorded within the last 12 months. Over shorter periods of three and six months, there were no insider transactions at all. This lack of activity may suggest a cautious or stable outlook from the company’s directors and management, who hold a relatively small insider ownership stake of 1.90%.

The low level of insider transactions, combined with substantial institutional ownership of 67.65%, indicates that institutional investors heavily influence WBA’s stock. The absence of recent insider buying or selling could imply that insiders perceive the stock price as fairly valued or are uncertain about near-term prospects. Overall, the data reflects a period of limited insider trading engagement, which could be a confidence in the company’s current strategic direction or a sign of awaiting clearer signals in the company’s operational or financial performance before making significant moves.

Trading Surge: Walgreens Stock Volume Hits 35.9 Million Shares

Walgreens Boots Alliance (WBA) has shown a significant surge in trading activity, with its volume on the latest trading day reaching 35,947,806 shares, which is substantially higher than its two-month average daily trading volume of 24,794,030 shares. This indicates increased investor interest and liquidity in the stock, potentially driven by recent market developments or company announcements.

The high trading volume suggests that WBA currently has good liquidity, making it easier for investors to enter or exit positions without causing significant price changes. This level of liquidity is advantageous for both retail and institutional investors who may be looking to adjust their portfolios quickly.

The Dark Pool Index (DPI) for WBA stands at 41.9%, which signifies that a considerable portion of the trading volume occurs in private exchanges, away from public stock exchanges. This percentage indicates moderate activity in dark pools, which can often suggest institutional interest or trading strategies that aim to minimize market impact.

Overall, the elevated trading volume and moderate DPI levels reflect a dynamic trading environment for WBA, implying active market participation and healthy liquidity conditions. Investors should monitor these trends as they can affect price movements and market sentiment.

Senator Trades Signal Mixed Confidence in Walgreens Stock

Senator Tommy Tuberville, a Republican from Alabama, recently executed two significant trades involving WBA stock. On March 21, 2024, Tuberville purchased shares valued between $15,001 and $50,000. This purchase, reported on April 15, 2024, suggests an initial interest or a strategic move to capitalize on perceived growth or value in Walgreens’ stock at that time.

However, shortly after, on April 30, 2024, Tuberville sold his entire holding in WBA, with the transaction amounting to between $50,001 and $100,000. This full sale was reported on May 15, 2024. The quick turnover might indicate a reassessment of the stock’s performance or external factors influencing the decision to liquidate. Such trading activity reflects a dynamic approach to stock market investments, possibly driven by short-term strategies or unforeseen market changes affecting the pharmaceutical retail sector.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article.This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.