Visa Stock: Value Backed By Global Reach and Transaction Processing Power

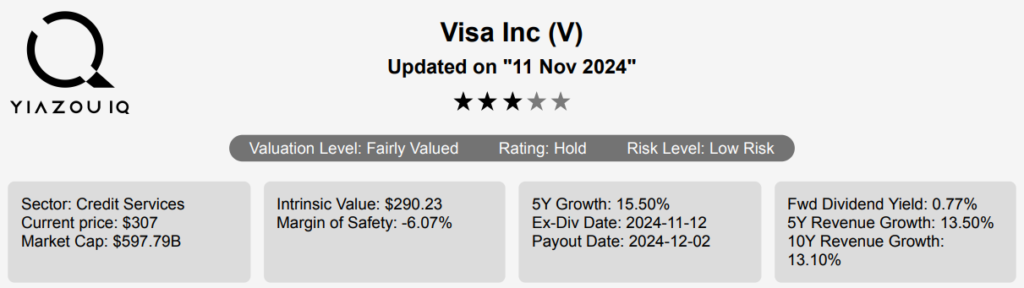

Visa (V) is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second. V stock is currently priced at $308. Let’s explore more on the Visa stock forecast.

Solid Q4 2024 Earnings and Impressive Long-Term Growth Trends

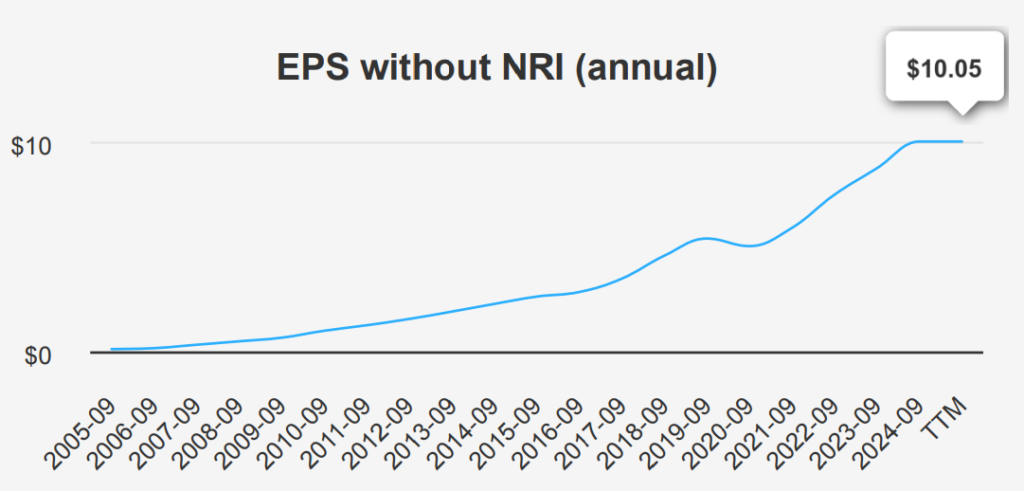

In the latest quarter ending September 2024, Visa reported an EPS without NRI (excluding non-recurring items) of $2.71, marking an increase from $2.42 in the previous quarter and $2.33 in the same quarter last year. The diluted EPS was $2.65, up from $2.40 in the previous quarter. Revenue per share grew to $4.801 from $4.386 quarter-over-quarter (QoQ) and from $4.171 year-over-year (YoY). Over the past five years, Visa’s EPS has grown at a compound annual growth rate (CAGR) of 15.40%, while the ten-year CAGR stands at 16%.

Visa’s gross margin for the quarter was 80.4%, slightly higher than its five-year median of 79.89%. The company’s consistent ability to maintain high margins is a testament to its operational efficiency

and pricing power in the payment processing industry. The share buyback ratio for the past year was 6.10%, indicating that Visa repurchased 6.10% of its outstanding shares, positively impacting EPS by

reducing the share count. Over the past decade, Visa’s buyback ratio has averaged 2.10%, showcasing a significant return of capital to shareholders.

Looking ahead, analysts forecast Visa’s revenue to continue its upward trajectory, with estimates of $39,399.62 million for 2025, $43,411.22 million for 2026, and $47,595.96 million for 2027. EPS for the next fiscal year may be at $11.156, rising to $12.630 in the following year, indicating strong future growth expectations. The next earnings report may be on January 24, 2025, where investors will closely watch further insights into Visa’s performance.

High ROIC and ROE Reflecting Strong Financial Efficiency

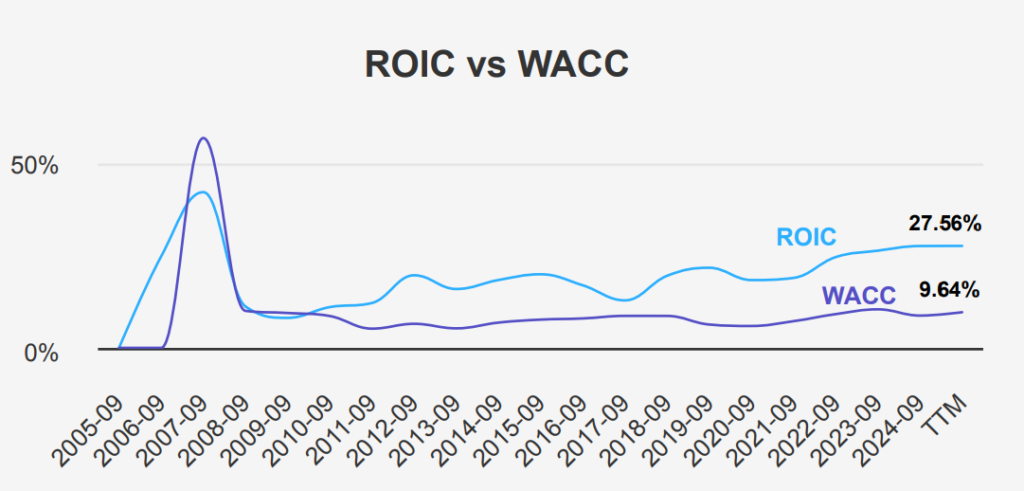

Visa demonstrates robust financial efficiency and effective capital allocation, as evidenced by its Return on Invested Capital (ROIC) consistently outpacing its Weighted Average Cost of Capital (WACC). Over the past five years, Visa’s median ROIC stands at 24.53%, compared to a WACC of 8.73%. This significant spread indicates that Visa is generating substantial economic value above its cost of capital, suggesting effective capital deployment and operational efficiency.

In the most recent figures, the ROIC reached a high of 27.56%, further highlighting Visa’s capability to enhance profitability from its invested capital, while the current WACC is 9.64%. This positive differential underscores Visa’s ability to create value for shareholders, reflecting strong competitive positioning and

strategic investment decisions.

Overall, the high Return on Equity (ROE) of 49.90% complements this narrative, showing that the company effectively leverages equity to generate profits. Visa’s financial metrics illustrate a consistently value-generating enterprise capable of sustaining long-term growth under the Visa stock forecast.

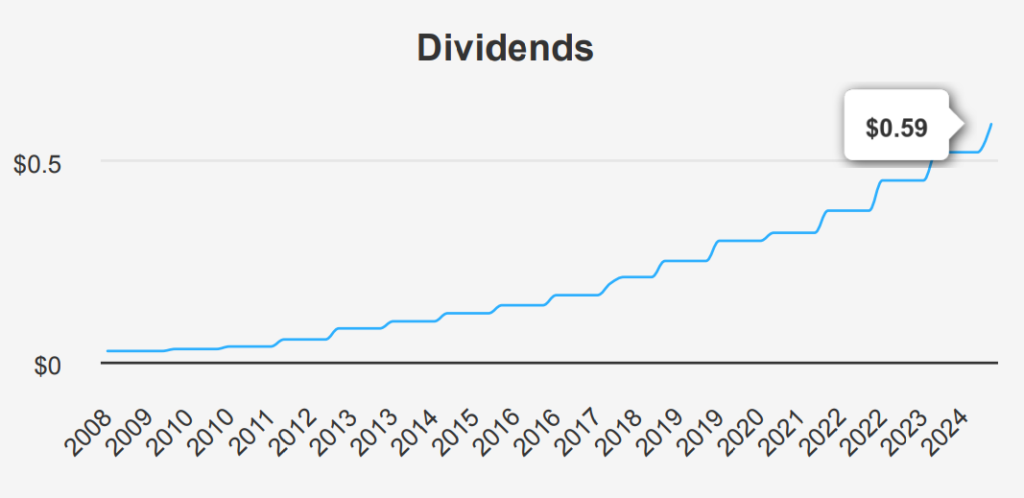

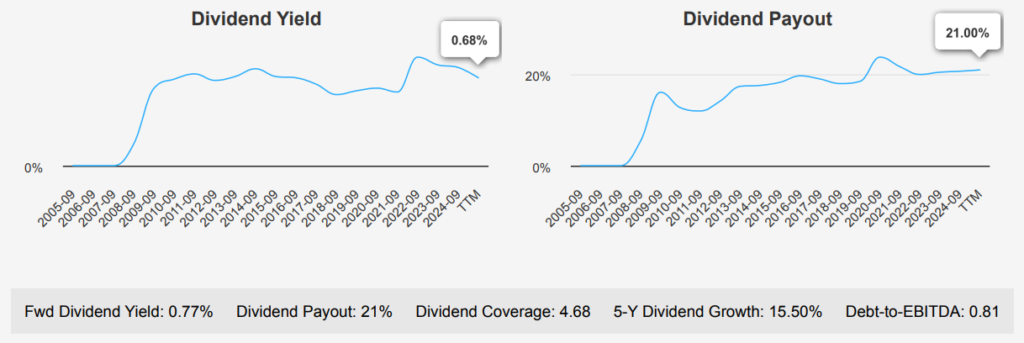

Visa’s Rising Dividend Supported by Strong Financial Position

Visa has demonstrated robust dividend growth, with a 5-year growth rate of 15.50% and a 3-year rate of 17.60%. In the most recent quarter, the dividend per share increased to $0.59 from $0.52, reflecting a continued commitment to returning value to shareholders. The forward dividend yield stands at 0.77%, slightly below the 10-year high of 0.84% but above the median of 0.63%. The company maintains a conservative dividend payout ratio of 21%. This suggests ample room for future dividend increases, supported by a future 3-5 year dividend growth rate estimate of 8.98%.

Visa’s Debt-to-EBITDA ratio is an impressive 0.81, indicating a very low financial risk and strong debt-servicing capacity, well below the cautious threshold of 2.0. This financial stability supports its ability to sustain and grow dividends. The next ex-dividend date is projected to be February 14, 2025, given the quarterly frequency. This date is a weekday and aligns with Visa’s typical dividend cycle. Overall, Visa’s dividend performance is strong, with solid growth prospects under the Visa stock forecast supported by a healthy financial structure.

Visa’s Fair Valuation with Potential for Moderate Upside

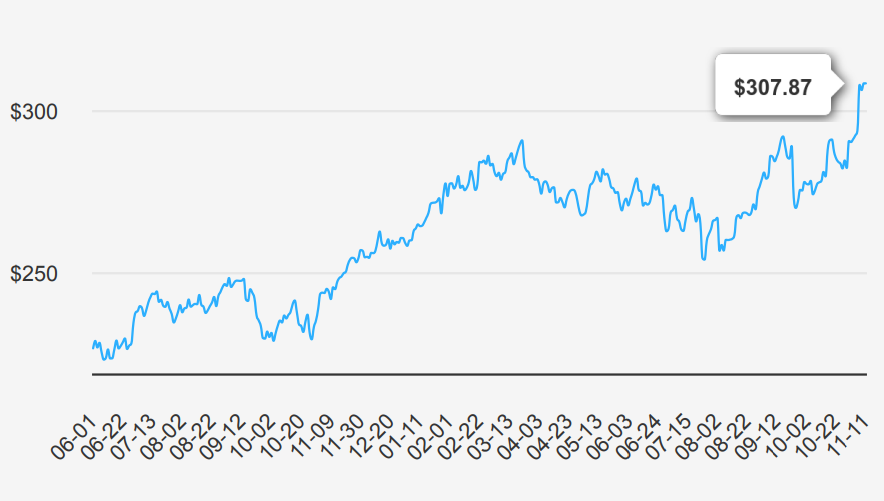

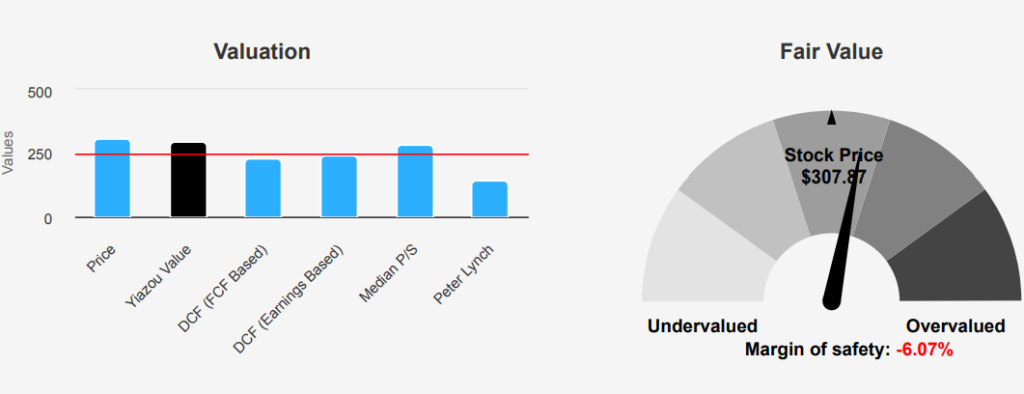

Visa currently trades at $307.87, slightly above its intrinsic value of $290.23, indicating a negative margin of safety of -6.08%. This suggests that the stock is overvalued relative to its intrinsic worth. The Forward P/E ratio stands at 27.47, lower than its 10-year median of 32.62, implying a potential undervaluation based on future earnings expectations. However, the TTM P/E ratio of 31.64 is close to the 10-year median, indicating its valuation is in line with historical norms.

The TTM EV/EBITDA ratio is 23.62, marginally below its historical median of 23.72 but comfortably within its range, suggesting a fair valuation in terms of enterprise value relative to earnings. The TTM P/B ratio at 15.69 matches its 10-year high, indicating the stock holds overvaluation against its book value. In contrast, the TTM Price-to-Free-Cash-Flow ratio of 33.35 is above its 10-year median of 30.28, reinforcing a view that the stock could be priced higher than historical cash flow trends might support.

Analyst sentiment remains optimistic, with a current price target of $322.73, which has been gradually increasing over the past three months. This reflects a positive outlook for Visa despite its current overvaluation relative to intrinsic value. The number of analysts covering the stock also suggests robust interest, which could support its price in the near term. However, investors should be cautious of the limited margin of safety and consider these factors in the Visa stock forecast.

Balancing Visa’s Financial Strength with Valuation Concerns

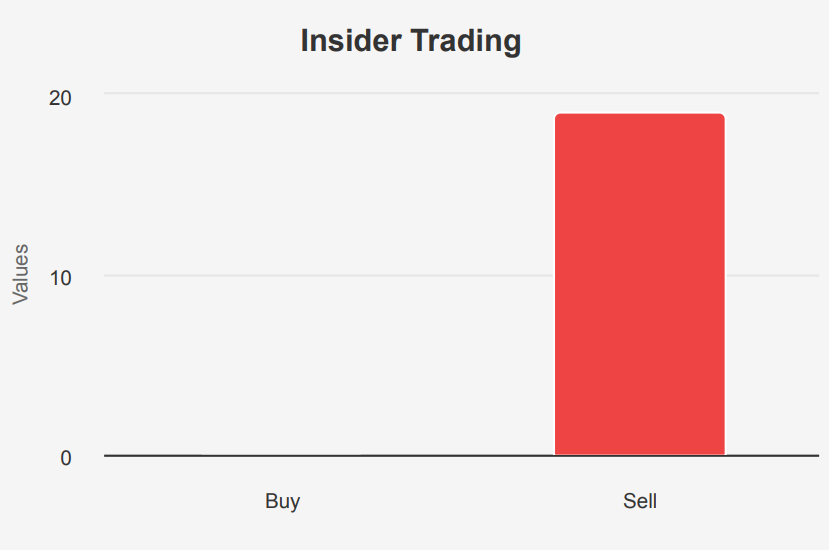

Visa presents a mixed risk profile considering recent market activities and financial indicators. The insider selling activity, with 77,430 shares sold in the last quarter and no insider purchases, might indicate a lack of confidence from insiders at the current price level. Additionally, the Price-to-book (PB) ratio of 15.69 is at a ten-year high, suggesting the stock could be overvalued relative to its book value. The current stock price also being at a decade high further underscores potential overvaluation concerns.

Contrastingly, Visa’s financial health appears robust, as indicated by a Piotroski F-Score of 8, reflecting strong financial performance and operational efficiency. The company’s expanding operating margin points to effective cost management and profitability enhancement. Visa’s revenue and earnings growth have been consistent, supporting the company’s stable financial trajectory. Moreover, the Altman Z-score of 8.07 suggests a very low risk of financial distress, and the Beneish M-Score indicates minimal likelihood of earnings manipulation.

Overall, while valuation metrics suggest caution due to potential overpricing, the company’s strong operational performance and financial health provide a solid foundation for growth under the Visa stock forecast.

Recent Insider Sales and High Institutional Ownership In Visa Stock

The insider trading activity for V over the past year indicates a consistent trend of selling by the company’s directors and management, with no buying activity recorded. In the last three months, there have been seven insider sales, and this number has increased to eight over six months and 19 in the last 12 months. This pattern suggests a potential lack of insider confidence in the company’s future performance or the realization of profits from previous investments.

Insider ownership stands at a modest 0.10%, indicating that the company’s management does not hold a significant stake, which might lessen their vested interest in the company’s long-term success. In contrast, institutional ownership is significantly high at 81.49%, suggesting that institutional investors have a major influence over the company’s stock. Such a high level of institutional ownership often reflects strong market confidence in the company’s overall management and prospects despite the ongoing insider selling trend. This dichotomy between insider and institutional perspectives could be a point of interest for potential investors.

Visa’s Strong Liquidity and Institutional Trading Indicators

Visa demonstrates a solid liquidity profile with a daily trading volume of 6,148,683 shares, closely aligning with its 2-month average daily trade volume of 6,759,603 shares. This consistency in trading volume suggests a stable investor interest and a healthy level of market activity, which is crucial for maintaining liquidity.

The Dark Pool Index (DPI) for Visa stands at 38.63%, indicating that a significant portion of trading occurs off major exchanges, possibly reflecting institutional interest and strategic trading activities. A DPI below 50% typically suggests that more trades are occurring on public exchanges than in dark pools, implying a good balance between transparency and liquidity.

Overall, Visa’s trading volume and DPI figures highlight a robust liquidity environment, facilitating ease of entry and exit for investors without significantly impacting the stock price. This liquidity is essential for both individual and institutional investors seeking to execute large trades efficiently. Visa’s liquidity metrics position it as a reliable and attractive option within the financial markets.

Recent Visa Stock Purchases by Representative Marjorie Taylor Greene

In October 2024, Marjorie Taylor Greene, a Republican representative in the House, made two notable stock purchases of Visa. The first transaction occurred on October 4, 2024, with a reported date of October 8, 2024, involving an investment range between $1,001 and $15,000. The most recent purchase was made on October 21, 2024, and reported on October 22, 2024, also within the same investment range. These transactions suggest a continued interest in Visa, reflecting a personal investment strategy or confidence in the company’s market potential. It’s important to note that these trades are modest in size, indicating either a cautious investment approach or a strategic diversification move in a broader portfolio. Observing such activity can provide insight into how policymakers manage their financial interests and legislative responsibilities.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.