Palantir’s (NYSE:PLTR) US commercial segment is driving impressive growth, fueling Palantir stock discussion across the market. With its advanced Artificial Intelligence Platform (AIP) and strategic partnerships with cloud giants, Palantir is expanding its influence across industries. The company’s innovative AIP boot camps have become a game-changer, attracting high-value clients, enhancing profitability, and solidifying its market presence. This blend of cutting-edge technology and strategic execution sets Palantir on a clear path to sustained momentum and market leadership.

Palantir’s US Commercial Segment Propelling the Growth

The US commercial segment has been the star for Palantir, propelling the company’s growth momentum. The segment’s revenue grew by 48.7% year-over-year (YoY) in the last 12 months and contributed 22.4% to the overall revenue. During Q2’24, US commercial revenue contributed 23.5% to the overall revenue. The contribution will continue to increase, driven by the company’s AIP, channel partnerships with major cloud platforms, and burgeoning demand for AI adoption in different sectors.

Palantir stock discussion often highlights the company’s success in the commercial segment, especially with the 123 US commercial deals (98.0% YoY growth) in a quarter during Q2’24, and the total contract value in this segment stood at $262 million (152% YoY growth). The company credits its success in the commercial segment to the AIP boot camps, which have proven to be a brilliant marketing strategy. This also aligns with the company’s philosophy of being frugal in marketing expenses. The boot camps are multiday events that bring in current and prospective customers to find their unique use cases in the artificial intelligence platform.

Palantir’s AIP Boot Camps: Converting Prospects into Lifetime Clients

Current customers are expanding their service, and prospective customers are converting to their lifetime clients. Palantir hasn’t disclosed the conversion rate from the boot camps; however, they shared some examples of booking large clients from the boot camps, which include their deal expansion with companies like Panasonic Energy, Eaton, and many other companies across different sectors.

Panasonic Energy of North America signed a three-year expansion using AIP across finance, quality control, and manufacturing operations. AARP is utilizing AIP to provide targeted, personalized experiences for its 29 million unique visitors every month. Eaton leveraged AIP to modernize ERP deployments in addition to finance, sales, and supply chain use cases. Kinder Morgan signed a five-year Foundry and AIP enterprise expansion with production use cases, including storage optimization, pipeline integrity monitoring, and power optimization.

For instance, to trace the success of the boot camps, the company shared that a leading convenience store chain went from a prototype out of Bootcamp to a paid pilot in 25 days, then converted the inventory management and pricing optimization use case into initial production immediately following the pilot.

The boot camps have also been a major factor in keeping the net dollar retention rate (previous customers contributing in the current quarter in dollar revenue terms) above 100.0%. AIP Boot Camps are increasing engagement with their current client base and bringing in new deals. Net dollar retention of Palantir was on a declining trend until Q3’23. In recent quarters, it has started picking up, and a major driver has been the AIP bootcamps.

Palantir’s Margins Are Going Up

The marketing strategy adopted through AIP boot camps is cost-effective and eliminates the need for the more expensive approach of deploying a sales force. The company has successfully controlled operating expenses while sustaining hypergrowth in revenue. AIP boot camps are turning out to be an efficient marketing strategy that expands their customer base with minimal cost.

Sales and marketing expenses at Palantir dropped to 29.7% of overall revenue from 60.6% five years ago. As a result, the company’s profitability has picked up substantially. In Q2 ’24, the company achieved GAAP profitability for the seventh consecutive quarter, a notable achievement often highlighted in Palantir stock discussion, as it indicates the company’s steady move towards sustainable profitability with a cost-efficient revenue scale.

Palantir’s Diverse Client Base: Reducing Dependency on Select Few

As the commercial segment, both in the US and outside the US, contributes more to overall revenue, the company’s dependence on a few key customers is decreasing. Furthermore, reliance on government deals will gradually decline, which usually remains lumpy and depends on federal budget plans.

As Palantir’s client base continues to expand, average revenue per customer is declining, which is positive for the company. The company now has a more diverse client base, which ensures consistent revenue growth.

Ramping up AIP Use Cases by Partnering with Different Channels

Palantir’s partnerships with various cloud platforms, including AWS, Google Cloud Platform, Microsoft Azure, and Oracle Cloud, further amplify the vast potential of AIP. Although Palantir primarily deploys its products on-premise, the rapid growth of the commercial segment requires the company to quickly and efficiently make its products available for cloud deployment. Hence, the company’s channel partnership with top cloud platforms remains a key factor in maintaining momentum in the commercial segment.

The Industry is Only Getting Started

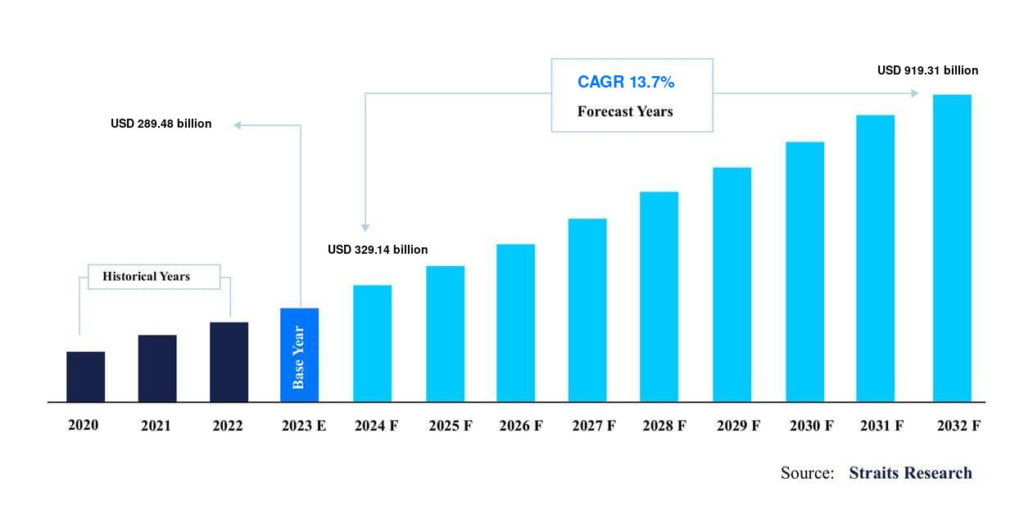

The big data analytics market stands at $329 billion in 2024, and according to some estimates, it will grow to $919 billion by 2032, reflecting a CAGR of 13.7%. Building on the success of AIP, Palantir can significantly expand its presence in the commercial segment by offering products and services beyond its traditional intelligence focus, which has primarily served government projects. With a current market share of 1.67%, Palantir leverages cutting-edge technologies to deliver services that meet the government’s and commercial sectors’ diverse needs.

Source: Straits Research

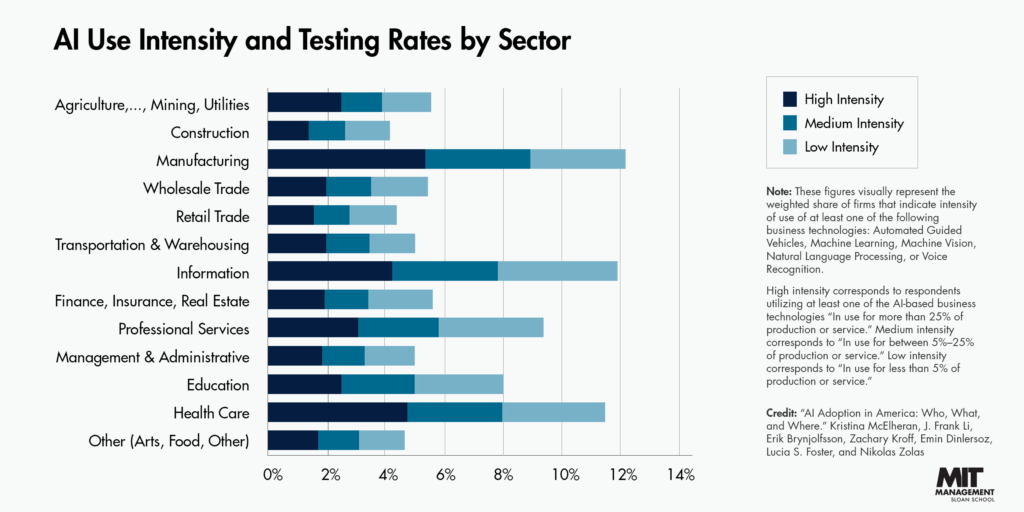

The AI revolution is accelerating the adoption of new technologies across industries. Palantir’s AIP boot camps can specifically target companies uncertain about integrating AI into their operations, providing tailored solutions to meet their needs. The information & technology, healthcare, and manufacturing sectors are leading the charge, adopting AI in their data analytics operations with increasing intensity.

Source: MIT Management Sloan School

The company has struck some major deals in the healthcare sector, and the latest one was with Parexel to enhance its healthcare artificial intelligence work. Palantir hasn’t disclosed the size of the deal, but it shows how the company collaborates with commercial enterprises to find their unique use cases and offer them tailored services. Before striking the deal, the two companies worked together for a year.

Additionally, Palantir started working with a clinical research organization for the first time. Other major deals of Palantir in the healthcare segment include deals with NHS, Cardinal Health, etc. At its core, the company has robust technology and processes to widen its market in different sectors.

Palantir’s Free Cash Flow is Positive

Palantir has started generating consistent positive free cash flow due to net cash flow growth from operations and low capex requirements. Meanwhile, the company is also reducing its stock-based compensation (SBC), which is positive as the current SBC level provides enough incentives to management and employees without triggering major dilution. SBC % of revenue fell to 20.4% in the first six months of 2024 from 116.3% in 2020 and 50.5% in 2021.

Rule of 40 Suggests that the Company is in a Sweet Spot for Ensuring Sustainable Growth

In any Palantir stock discussion, the Rule of 40 is a crucial metric for software and SaaS companies, indicating that those with a combined score of 40.0% in revenue growth and margin (using EBITDA margin here) are more likely to sustain long-term growth.

PLTR currently has a Rule of 40 score of 34% (Revenue Growth + EBITDA Margin) based on trailing twelve months’ data, approaching the 40.0% threshold. The company is striking a delicate balance between growth and profitability. As the company continues to optimize its sales and marketing efficiency and achieve greater scalability, its EBITDA margin is expected to expand further.

Finally, growth momentum is expected to persist, driven by the commercial segment and supported by the government segment, supporting the company to surpass the 40.0% threshold.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. The information provided in this paper is for educational purposes only and does not constitute investment advice, and should not be construed as investment advice or a recommendation to buy, sell, or otherwise transact in any investment, including any products or services or an invitation, offer or solicitation to engage in any investment activity.