The Big Picture: Tesla’s High-Stakes Inflection Point

Tesla (TSLA) is poised at one of its most lopsided moments. Following a rocky Q1 2025 with delivery declines, accelerating op-ex, and growing brand pushback, the company’s valuation has been squeezed.

Beneath the market’s near-term cynicism, however, is a revolution waiting to happen: Tesla’s quest for autonomy and humanoid robots could unlock a new growth S-curve that Wall Street is currently underestimating.

With a fully functional Robotaxi network planned for mid-2026 and a mass rollout of Optimus humanoid robots scheduled by 2030, Tesla is transforming from a core EV manufacturer into a full-stack AI physical infrastructure firm. The magnitude of this shift could expand Tesla’s addressable market by orders of magnitude, but the journey is fraught with execution risks, regulatory hurdles, and capital intensity challenges.

As we break down the company’s new business model, competitive dynamics, financial trends, and valuation, it becomes apparent that Tesla is not just competing for EV share, it is reinventing its very existence in a perilous macro environment.

Reinventing the Assembly Line: Tesla’s Fundamental Strategic Overhaul

Tesla’s core auto business, though still profitable from a gross margin perspective, has started to reveal cracks that suggest a need for a sooner-rather-than-later reinvention. Q1 2025 deliveries were down 9% year-over-year, that is Tesla’s first volume contraction of substance in a decade.

Management attributes the slowdown to factory retoolings for new Model Ys, brand headwinds tied to Elon Musk’s political activism, and new tariffs. Still, the underlying truth is more structural: the EV adoption curve within Tesla’s core markets is maturing, as competitive intensity from Chinese EV manufacturers such as BYD and egacy OEMs accelerates.

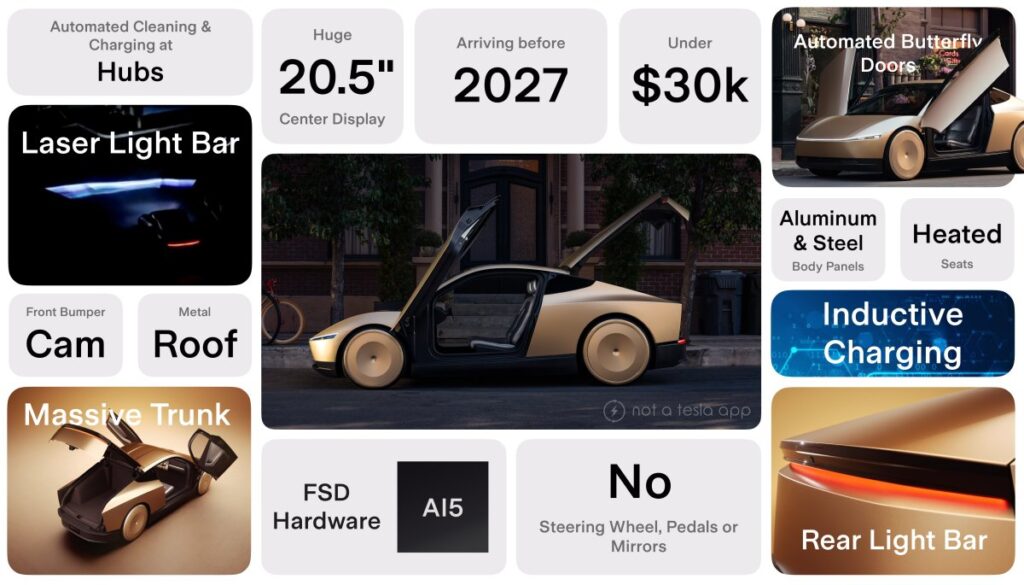

In response, Tesla is making a radical pivot. The pivot is based on two breakthroughs: the introduction of the Cybercab robotaxi platform and the “unboxed” automotive assembly architecture. Cybercab promises fully autonomous city rides at volume, skipping over conventional human driver expenses altogether. At the same time, Tesla’s new unboxed approach to assembly, where huge subassemblies are married together with little direct human touch, is set to cut cost per unit and cycle time by orders of magnitude.

Executives indicate that future Gigafactories might assemble a car every five seconds, a sixfold improvement over today’s leading-in-industry lines. If successful, these technologies might set Tesla’s gross margins back into the mid-20% range, even in a deflationary EV pricing environment.

But the stakes are extremely high. At the same time, Tesla is simultaneously scaling up AI model training with its Dojo supercomputer, upgrading its existing fleet with autonomous capabilities through OTA software updates, and localizing battery and parts manufacturing to reduce tariff risk. Coordination complexity is monumental, with a single miscalculation, whether technical, regulatory, or operational, threatening to derail timelines and ramp up costs.

The Competition Tightens: Tesla’s Disappearing Moat

Tesla’s early-mover advantage in electric vehicles (EVs) has largely faded. As noted in the 10-Q, Tesla is now confronted by “significant and increasing competition” across all key vehicle segments. In China, BYD’s plug-in hybrids and low-cost EVs are forcing Tesla to lower prices. Ford, GM, Hyundai, and even upstart entrants such as Rivian and Lucid, are closing the performance and cost gaps with Tesla in the United States. Waymo and Cruise are ramping up robotaxi operations aggressively, while Chinese firms such as XPeng are funding extensive autonomy stacks that can potentially equal Tesla’s Full Self-Driving (FSD) suite.

Most importantly, Tesla’s camera-based autonomy strategy, compared to the lidar+radar fusion employed by its competitors, is a technology gamble as much as a philosophy gamble. Elon Musk believes vision-based AI is the only scalable path to full autonomy. However, regulators and safety boards, particularly in Europe and some parts of America, may favor systems with sensor redundancy. This could hinder Tesla’s Robotaxi scalability abroad, even if the technology proves viable domestically.

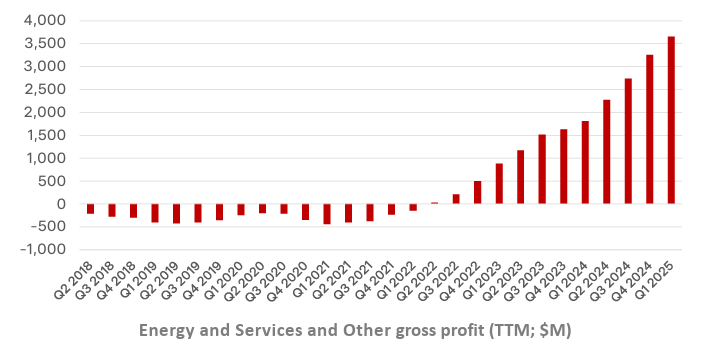

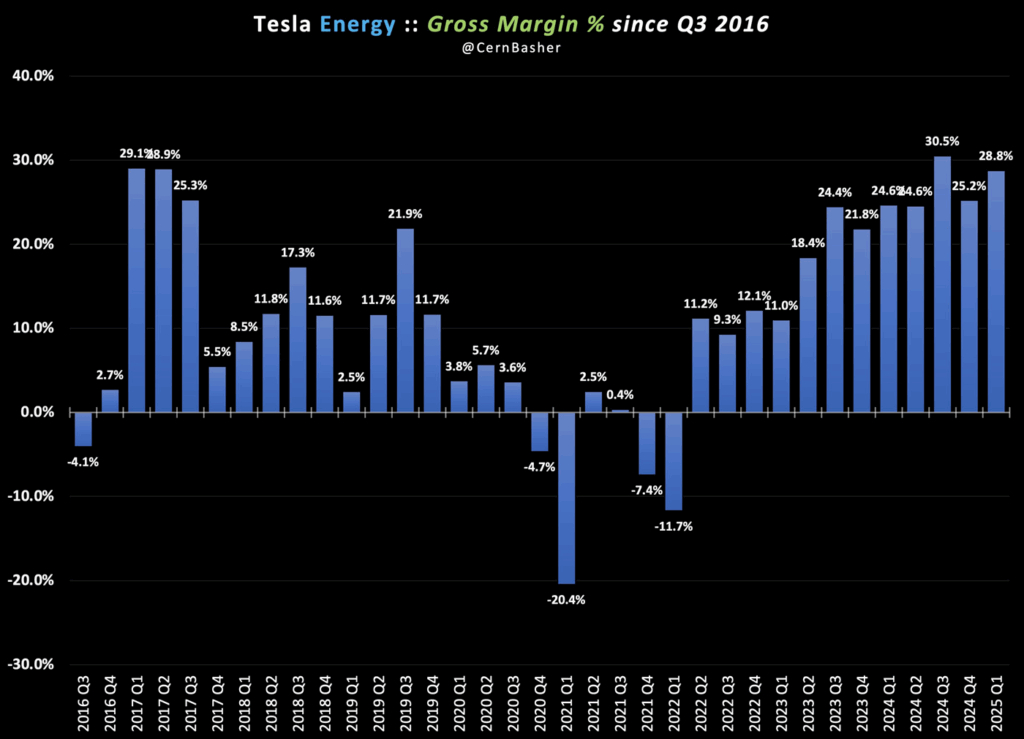

Another often underappreciated weakness is the energy storage business of Tesla. While Tesla’s Megapack business reported a record level of gross profit margins for Q1 2025, its LFP (lithium iron phosphate) battery supply chain is still dependent to a significant degree on Chinese supply chains, a key vulnerability as Chinese battery import tariffs tighten from May 2025. Tesla’s attempts to shift LFP manufacturing to the United States are encouraging but early-stage, implying that a near-term margin squeeze is probable.

Growth Engines vs. Profit Drains: Financial and Strategic Insights

Tesla’s Q1 2025 results present a mixed financial picture. Automotive gross margins (excluding regulatory credits) fell to 16.3%, down from over 20% two years ago, constrained by price reductions, increased factory retooling expenses, and decreased fixed-cost absorption. While FSD subscription revenue is growing, it has yet to meaningfully offset the pressure on core automotive profitability.

The sole bright spot is Tesla Energy. Energy generation and storage revenue increased 67% year-on-year to $2.73 billion, with gross margins up a record 14.3%. The company’s Lathrop Megapack factory and its upcoming Shanghai Megafactory represent a scalable platform to capitalize on the global trend toward grid decarbonization.

On the other hand, Tesla’s AI ambitions are increasingly capital-intensive. The company raised its 2025 CapEx guidance above $10 billion, reflecting investments in Dojo, Optimus development, and Cybercab production infrastructure.

With regards to liquidity, Tesla still holds a strong cash position of $37 billion as of March 31, 2025 and remains free cash flow positive. However, unless we see a dramatic reacceleration of deliveries or monetization of the autonomy features, Tesla might need to turn to external capital within 12–18 months to finance its AI and robotics aspirations.

Strategically, the company is betting everything on three interconnected growth flywheels converging between 2026 and 2027:

- Monetization of the Robotaxi network

- Deployment of humanoid robots at scale within internal operations

- Expansion of Tesla Energy, driven by AI-optimized power grids

Each of these holds transformative potential, but each also introduces unprecedented levels of operating and regulatory risk.

Valuation: Pushing Traditional Measures to New Horizons

Tesla’s valuation metrics project a stark picture of premium valuations with weakening fundamentals. In nearly every metric, P/E, EV/Sales, EV/EBITDA, and Price/Cash Flow, Tesla trades on astronomical multiples against its sector peers. For example, its forward P/E (Non-GAAP) of 148.96 sits 935% above its sector median, while its EV/Sales (FWD) multiple of 9.01 is 711% higher than its peers.

Despite recent price compression, Tesla also sits at 64.49x forward cash flow, 633% higher than its sector median. These record premiums imply that the market still discounts in decades-long lead times on AI, autonomy, and energy dominance, but near-term profitability is fraying at the seams. In Q4 2024, we saw a 23% operating income drop and a 6.2% margin, a reflection of structural pressure from ASP declines and increased R&D expenditure on autonomy and AI infrastructure.

Relative to its own history, the narrative is mixed. Tesla’s forward EV/EBITDA of 62.06 is a bit lower than its 5-year average of 54.11 but still constitutes a 580% sector premium. Likewise, its 12.33 price-to-book ratio, down 43% from its 5-year average, suggests a little multiple compression. AlthoughTesla is still fundamentally out of alignment with its core autos peer group on a valuation basis, its growth profile (PEG of 6.93) no longer warrants that discount.

Unless Tesla makes a quick leap to monetization of FSD, Robotaxi, or energy storage, items that are still aspirational in 2025, the stock risks further re-rating. The market is finally beginning to reprice Tesla, not as tech hypergrowth play, but as a maturing autos-energy hybrid with thinner margins and increased competition.

Risks: Exploring the Unknown

Tesla faces considerable near-term and structural risks. These include escalating U.S.–China geopolitical tensions, which could disrupt supply chains and pressure Megapack margins; regulatory obstacles to Robotaxi deployments; over-reliance on the Model 3 and Y (which account for 96% of all deliveries); and growing brand polarization linked to Elon Musk’s political activity. Rising capital intensity may also weaken Tesla’s historically strong cash flow profile.

Furthermore, general economic slowdown, higher interest rates, as well as a growing consumer EV fatigue, may subdue demand elasticity just as Tesla’s lower-priced, next-generation platform cars are coming to market.

Conclusion: Tesla’s Asymmetric Future Calls

Tesla is no longer just an electric vehicle company. It is rapidly evolving into a full-stack AI and robotics enterprise, with ambitions spanning humanoid robots, energy grids, and autonomous transportation. Volatility in the short term is likely, as are sustained margin headwinds. Yet the groundwork being laid today could ultimately transform Tesla into a trillion-dollar AI infrastructure company by 2030.

Risk of execution is high – but so is the risk vs. reward for patient investors.