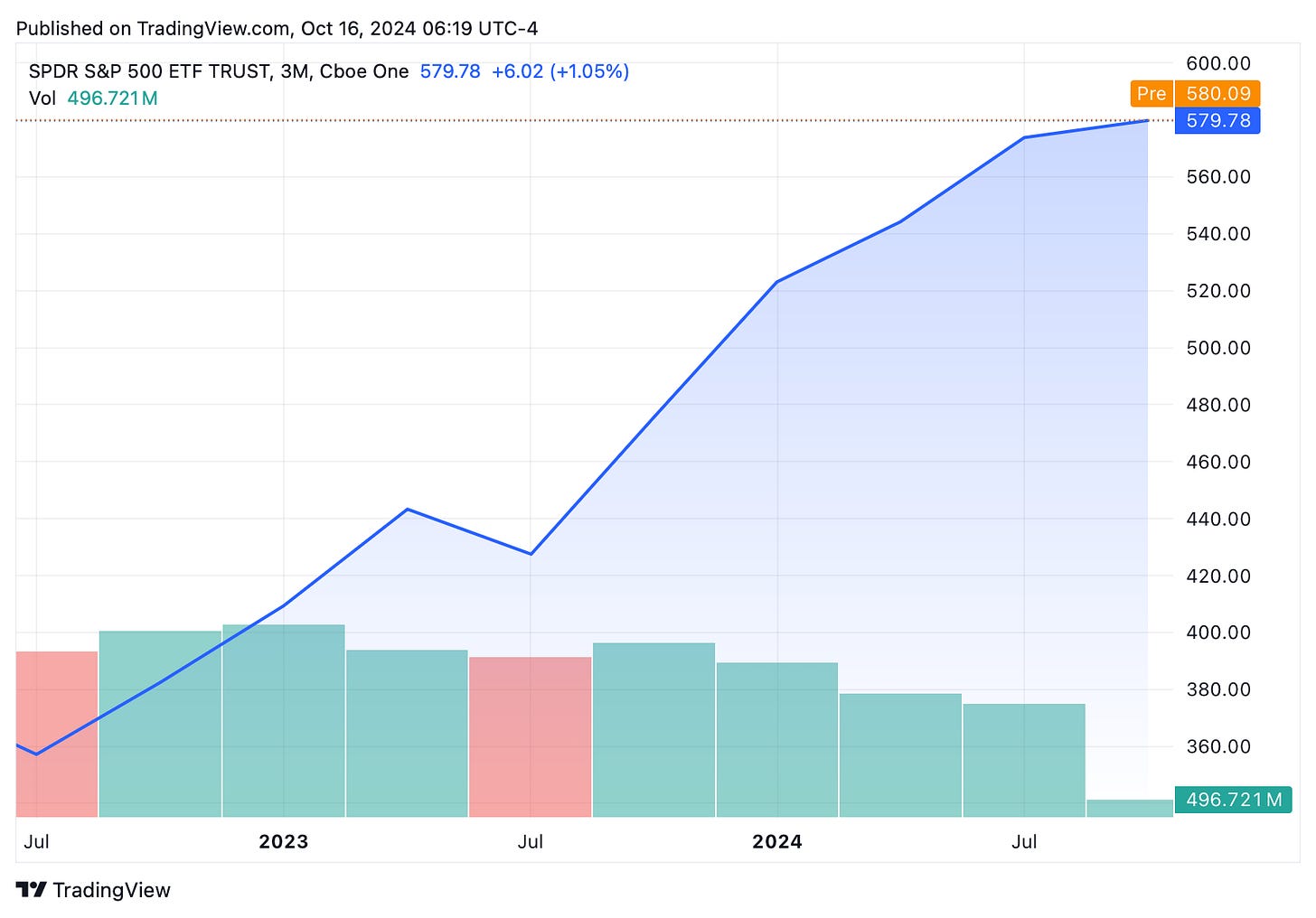

The S&P 500 Soars Amid Mixed Signals

The S&P 500 has gotten off to one heck of a start for 2024 against cautious analyst consensus estimates and whispers of overvaluation. The index exploded by an astonishing 23% YTD, good for its best start since 1997, while setting fresh record highs. This is further supported by the bullish momentum, even while some onlookers raise eyebrows at a disconnect between stock valuations and traditional market indicators.

Market Warning Signals: Buffett Indicator and Shiller P/E Flash Red

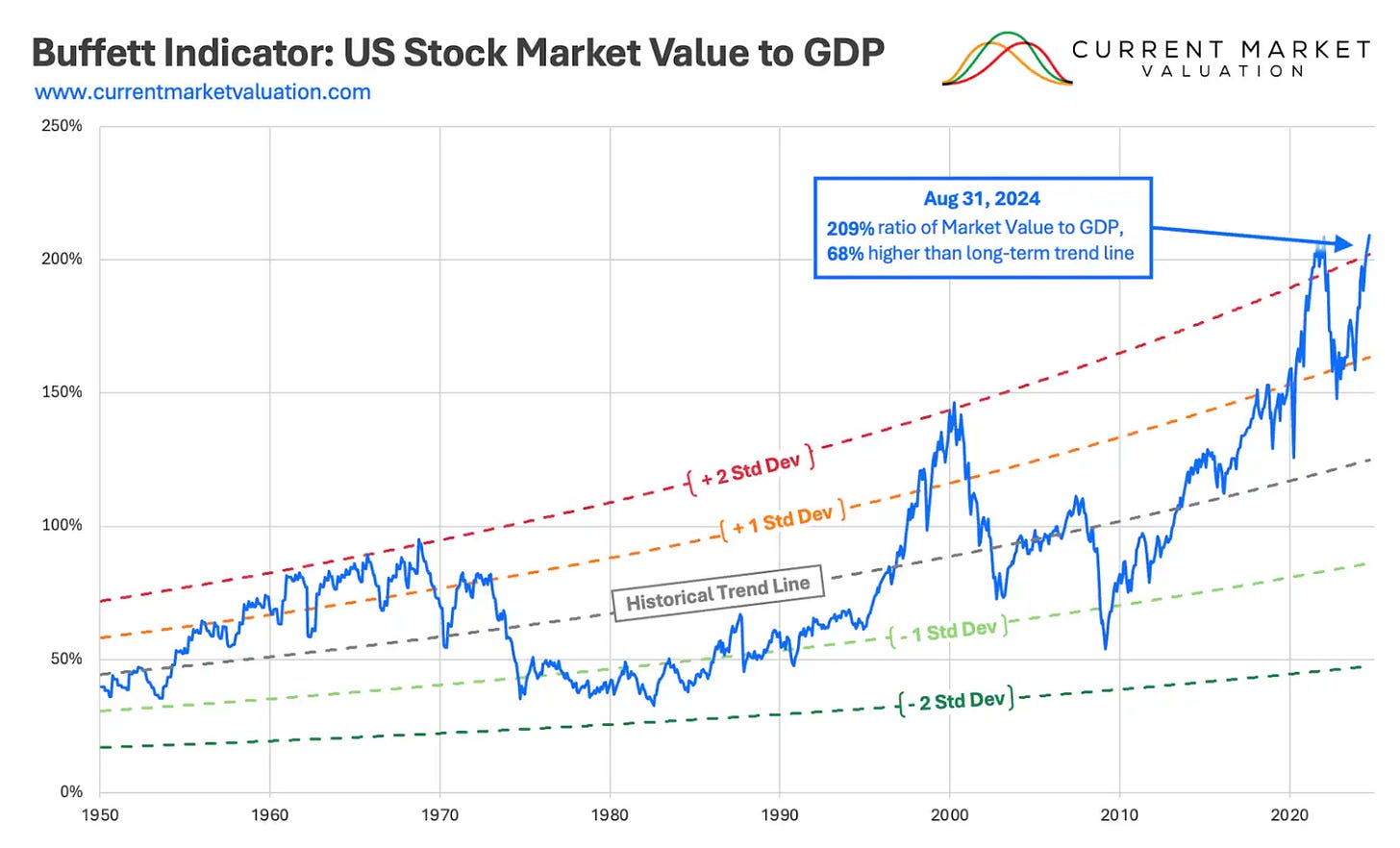

The Buffett Indicator, known as the market cap versus Gross Domestic Product ratio, is a simplistic yet efficient technique that attempts to tie the total market capitalization of publicly traded stocks to the nation’s GDP.

Warren Buffett has popularized it as a means for him to approximate the valuation of the markets. This would show that when this ratio is well above its historical average, it would mean overvaluation in the stock market. The Buffett Indicator, as of August 31, 2024, shows a ratio of 209%, calculated by dividing the total U.S. stock market value of $59.71 trillion by the annualized GDP of $28.56 trillion.

A ratio of 209% is approximately 67.57% above the historical trend line, or about 2.2 standard deviations higher, which suggests that the stock market is strongly overvalued relative to GDP. When the ratio rises significantly above historical norms, the market could be overheated and potentially due for a correction.

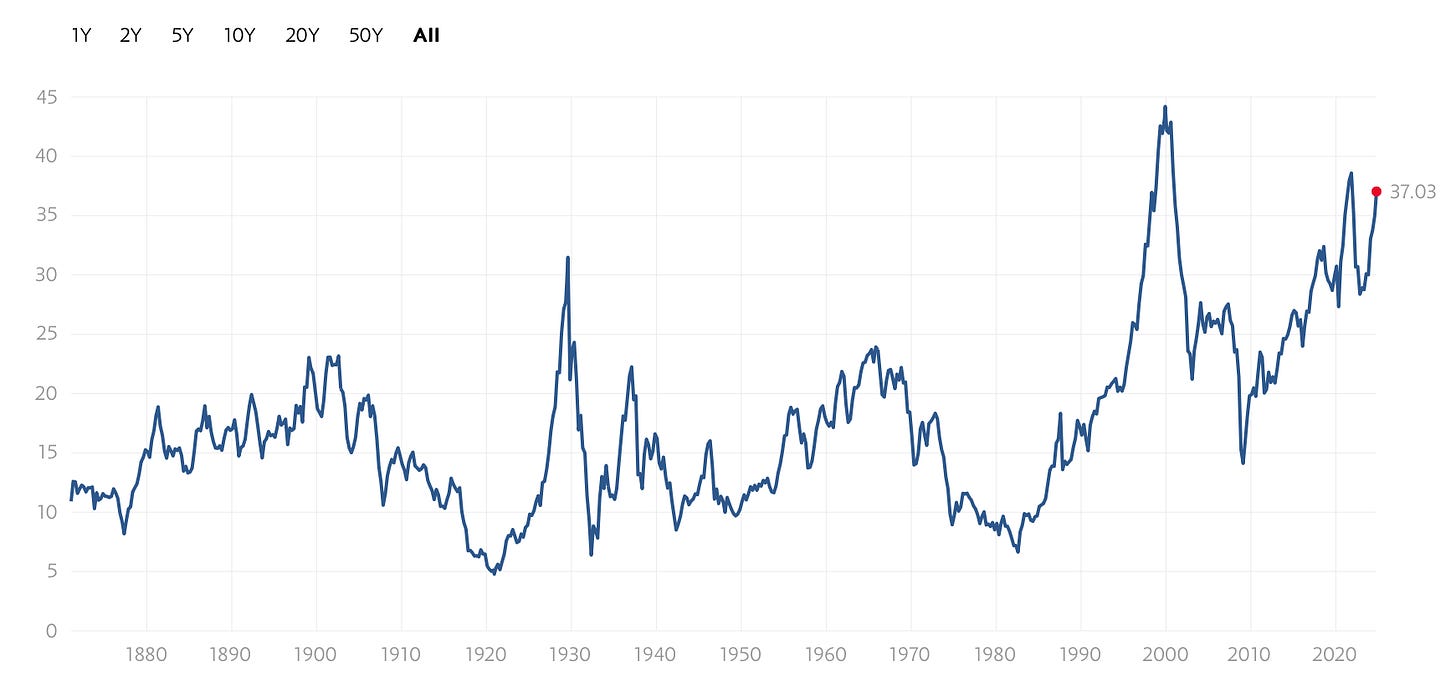

The other key indicator is the Shiller P/E Ratio, sometimes the Cyclically Adjusted PE or CAPE Ratio. This important measure of the market normalizes the standard P/E by inflating for inflation and then taking an average of earnings on a trailing 10-year basis. It reduces volatility and hence gives a far more reliable indication of the market’s overvalued or undervalued. With such a high Shiller P/E Ratio, currently standing at 37, stocks are trading at relatively high valuations compared with their historical standards and are always subject to correction.

Analysts vs. Corporations: A Tale of Two Outlooks

Data compiled by Bloomberg Intelligence show a sharp disconnect between analyst estimates and company guidance. Analysts see the S&P 500’s third-quarter earnings rising just 4.2% from a year earlier, down from a 7% estimate in mid-July. In stark contrast, the companies suggest a robust 16% jump in earnings.

Gina Martin Adams, Chief Equity Strategist at Bloomberg Intelligence, highlights this unusual gap:

“The significantly stronger outlook suggests companies should easily beat expectations,”

A positive earnings-per-share (EPS) turn further bolsters this optimism guidance. A Bloomberg Intelligence model scored 0.14 for the three months through September, surpassing the post-COVID average of 0.03.

Earnings Season: Will Companies Beat the Odds Again?

Investors are betting that the first quarter, where companies outperformed the generally gloomy expectations, will repeat itself. At that time, earnings growth forecasts stood at a miserable 3.8%, while actual figures came in at 7.9%. The continued strength in the market does seem to indicate a consensus view of history repeating in this earnings season.

Financial heavyweights like JPMorgan Chase & Co. have already set a positive tone after the bank reported a surprise gain in net interest income for the third quarter while raising its forecast for the key revenue source. Its stock added about 5% post-earnings, while Wells Fargo & Co. rose about 6% to show the feared impact of falling interest rates was less deep than expected.

Michael Wilson, a strategist at Morgan Stanley, noted:

“Several large-cap bank stocks had de-risked in mid-September ahead of earnings season,”

“This fostered a lowered expectations bar into the quarter.

Initial results indicate that banks are clearing that bar.”

The Magnificent Seven: Slowing Down or Poised for a Comeback?

Much of the market’s rally earlier this year was fueled by the “Magnificent 7″—a group of tech giants. Consensus estimates now project their profits to rise about 18% year-over-year, a slowdown from the staggering 36% growth in the second quarter.

Michael Wilson suggests that this deceleration in EPS growth could explain their recent underperformance.

“If earnings revisions show relative strength for the Mag 7, these stocks will likely outperform once again, and market leadership may narrow—like it did during the second quarter and all of 2023,”

Is the Market Overvalued? Expert Opinions Diverge

Amid the market’s bullish run, concerns about overvaluation have surfaced. Piper Sandler’s Chief Investment Strategist, Michael Kantrowitz, estimates the S&P 500 is overvalued by about 8%. However, he dismisses this as a reason for bearishness.

“An 8% overvaluation is no reason to get bearish. Stocks can remain at rich valuations as long as a ‘fear’ catalyst doesn’t arise from the usual suspects: interest rates, employment, or inflation”

He emphasizes that the upward trend should continue without imminent spikes in these areas. Kantrowitz advises investors to focus on stocks with strong earnings momentum, as they will likely sustain their valuations and outperform the market.

Berkshire Hathaway’s Big Sell-Off: What Does It Mean?

Adding another layer of intrigue, Berkshire Hathaway has been quietly offloading significant portions of its stock holdings. In the second quarter, the conglomerate sold $75 billion in various stocks, swelling its cash reserves to nearly $277 billion. Recent sales include reductions in Apple and Bank of America holdings.

Several theories to explain Berkshire’s moves:

- Valuation: Mega-cap stocks like Apple trade at significant multiples, but Berkshire could cash in on the overvaluation of assets. Take the example of Apple, which today exchanges at about 35 times earnings, compared to eleven times when Berkshire first invested.

- Recession Anticipation: The company may be preparing for a recession, hoping to take advantage of opportunities such as those available during the 2008 financial crisis by continuing to raise its cash reserves.

- Acquisitions: Most believe that Berkshire is targeting a big acquisition, presumably an insurance company.

Strategies for Investors Navigating Uncertain Waters

Given the complex market dynamics, what should investors consider?

- Focus on Earnings Momentum: Target companies demonstrating strong and improving earnings. These are more likely to justify higher valuations and offer better returns.

- Diversify Portfolios: Avoid overexposure to any single sector, especially with potential shifts in market leadership.

- Monitor Economic Indicators: Keep an eye on interest rates, inflation, and employment data. Changes here could act as catalysts for market movements.

- Assess Valuations Prudently: While overvaluation isn’t the sole reason to exit positions, it’s wise to be cautious when entering new ones.

- Stay Informed on Corporate Actions: Company announcements regarding earnings, guidance, and strategic moves can offer valuable investment insights.

Conclusion: Balancing Optimism with Caution

The S&P 500’s remarkable performance in 2024 underscores a market characterized by optimism and contradiction. While companies signal confidence through strong earnings guidance, analysts remain cautious, and some economic indicators flash warning signs.

Investors face the challenge of navigating this mixed landscape. On one hand, the absence of immediate negative catalysts suggests the market’s upward trajectory could persist. Conversely, actions by influential players like Berkshire Hathaway hint at potential overvaluation concerns and the possibility of future market adjustments.

Balancing these factors requires a strategic approach that combines vigilance with opportunism. By focusing on solid fundamentals, staying diversified, and keeping informed about market developments, investors can be well-placed to capitalize on opportunities while mitigating risks.

The Road Ahead: Stay Agile and Informed

Everything is about adaptability in an ever-evolving market. As earnings season fully sets in and companies begin to show more of their performance and outlook, it will be essential to stay informed. Whether this market continues on its bullish run or sees a shift, one thing for sure is that preparedness for change in strategy will continue to serve investors well.

The combination of a long-term outlook, resistance to reactionary moves, and proper research will see one through the days ahead. After all, in the financial market’s labyrinth, knowledge and prudence remain an investor’s best friends.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. Test Yiazou IQ Yiazou IQ for free and experience instant, AI-driven stock market reports today.