SoFi Technologies Inc (SOFI) is a fast-growing, full-fledged fintech company with nine million customers, a vast range of products that touch every aspect of financial needs, and more than $2 billion in revenue (trailing twelve months). SoFi’s one-in-all financial services platform with robust technology makes it a contender for becoming the largest Neobank in North America. Today, we dive into SoFi’s business model and take a closer look at SOFI stock forecast 2025.

From Student Loans to Fintech Powerhouse: The SoFi Story

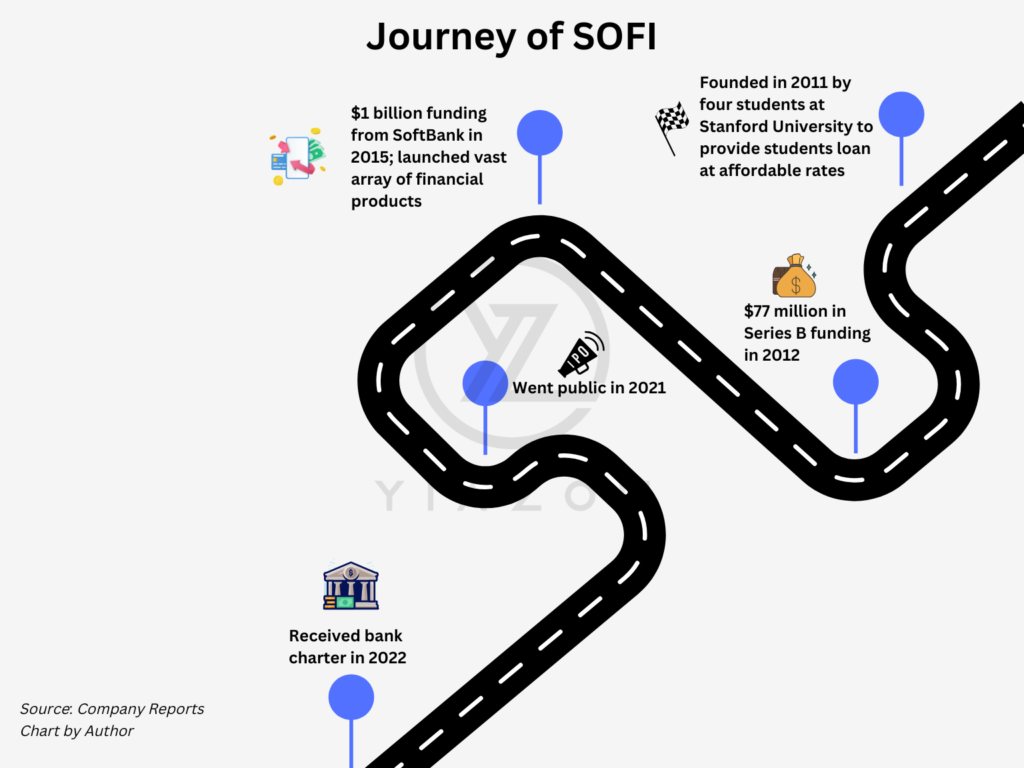

SoFi (short for Social Finance) is an app-based financial services company with a bank charter, which you would call a Neobank. Founded in 2011 by four students at Stanford University, SoFi started with a mission to provide student loans at affordable interest rates. Initially, Stanford alumni funded the loan at a low cost, enabling them to offer student loans at interest rates lower than those of traditional banks.

The name Social Finance came from this peer-to-peer loan structure. The company expanded to over 50 universities after raising $77 million in Series B funding. SoFi started gaining popularity among students and recent graduates, and the company realized it could scale these services to include personal loans, mortgages, and investment products.

In 2015, the company raised $1 billion from SoftBank, which helped them to invest heavily in their technology platforms and expand product offerings. Following the funding, they launched SoFi Money (digital checking and savings account) and SoFi Invest (access to investment options). In continuation of the rapid expansion, SoFi went public in June 2021 through a SPAC (Special Purpose Acquisition Company) deal with Social Capital Hedosophia Corp V (SCH).

Through the merger, the company raised $2.4 billion and reached a valuation of $9 billion. Then, in 2022, SoFi received a bank charter following the acquisition of Golden Pacific Bancorp, which widened the business scope of the company. Now, the company is a fintech and a bank business together. The company now boasts close to nine million members who availed of thirteen million products in aggregate, which suggests that each member, on average, opts for more than a single product from the wide array of financial services from SoFi.

How SoFi Makes Money?

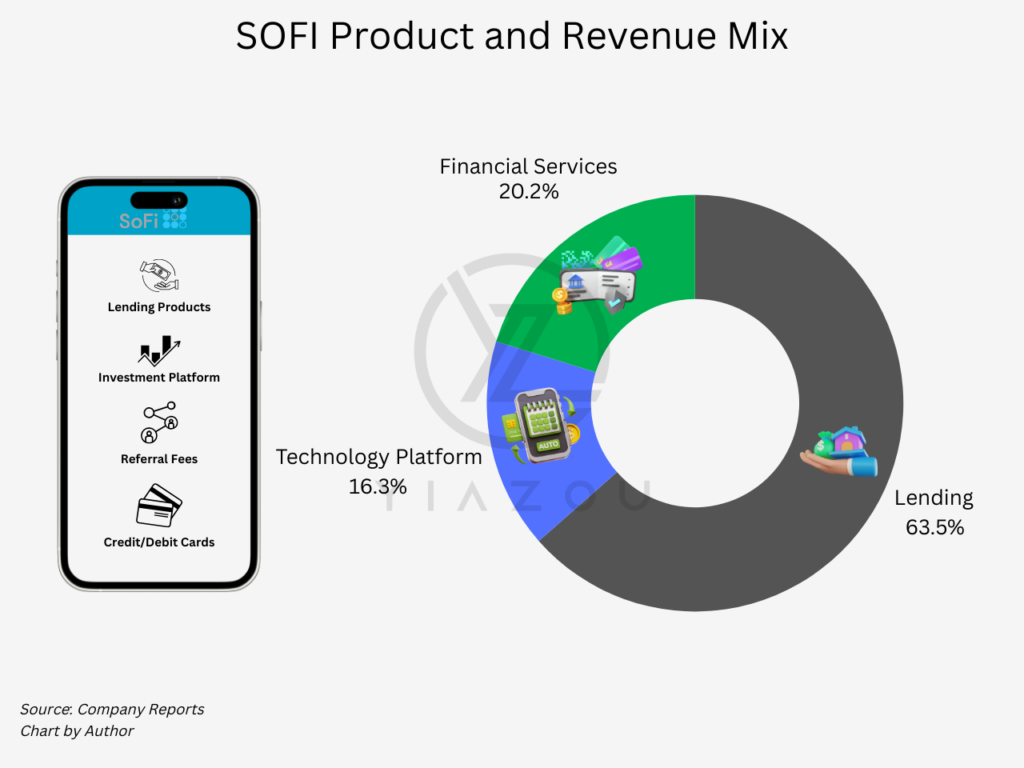

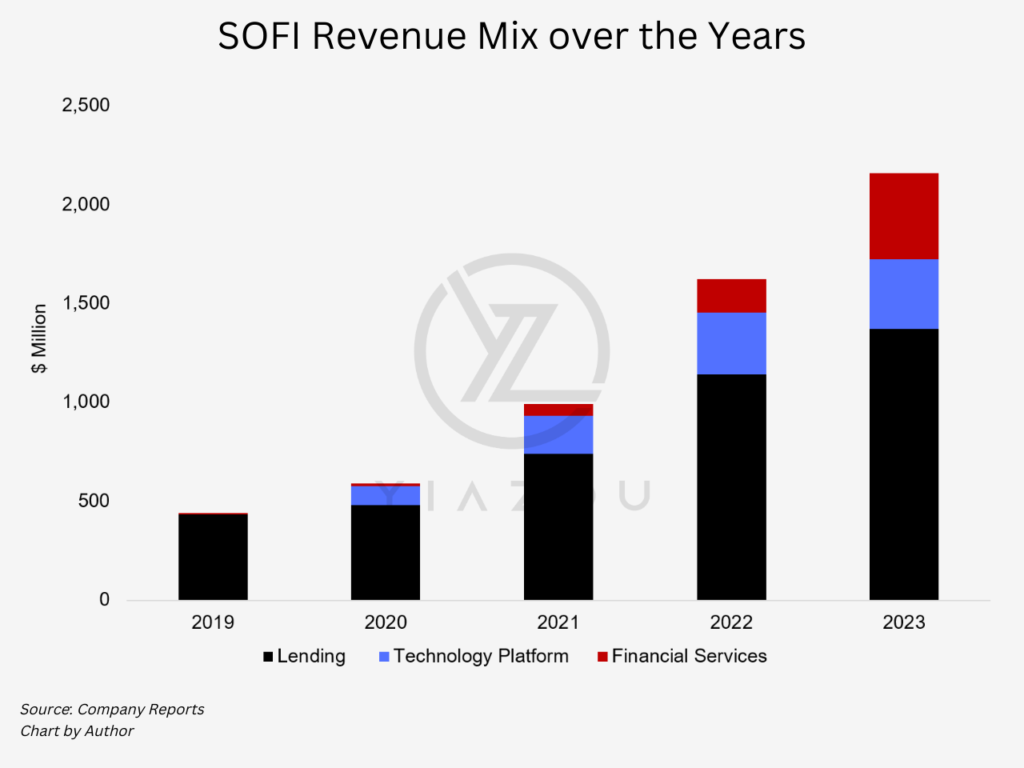

SoFi generates revenue through three segments: lending, technology platform, and financial services.

Lending Segment: The company provides three types of loans: personal loans, student loans, and home loans. The company originates personal loans to meet customers’ financial needs, including debt consolidation, home improvement projects, family planning, travel, weddings, etc. The loan size ranges between $5,000 and $100,000, with terms ranging from 2 to 7 years. SoFi also offers student loan refinancing, a segment the company started with where it offers loan sizes of $5,000 or higher with terms ranging from 5 to 15 years. In the home loan space, SoFi offers agency, non-agency, and certain government loans for members purchasing a home or refinancing an existing mortgage.

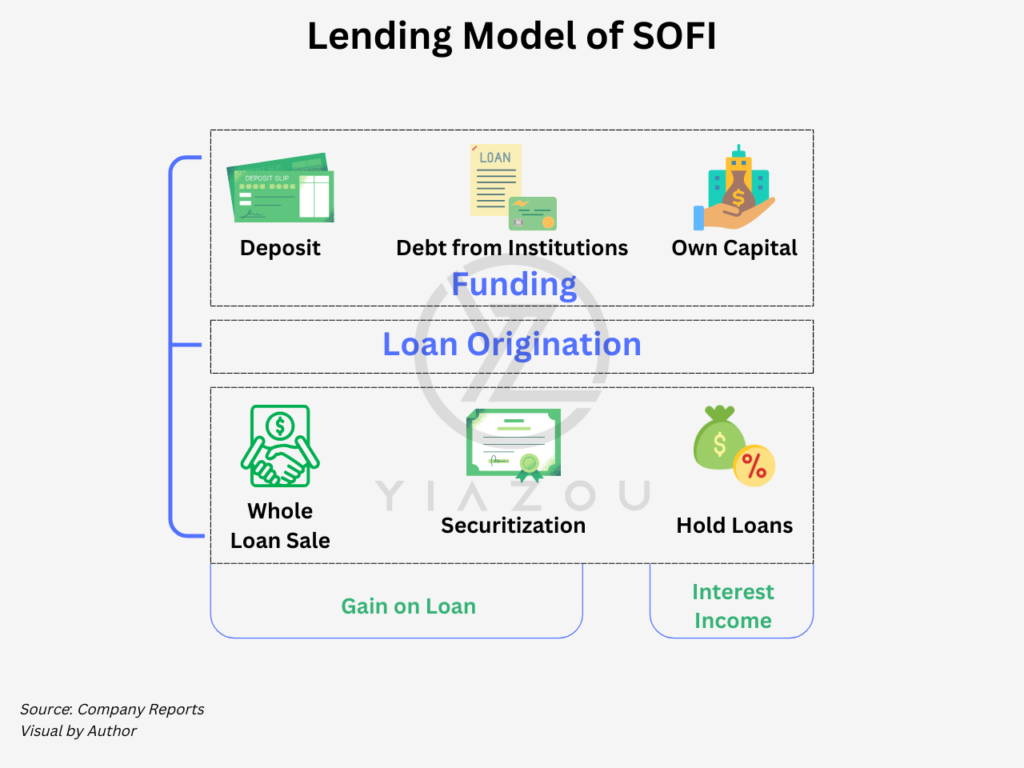

SoFi originates loans, funded mostly by deposits it books from customers. The company either sells the loan or securitizes it for a gain or holds the loans on the balance sheet to earn interest income when it seems advantageous.

Additionally, SoFi sells whole loans to large financial institutions. If a loan is securitized but doesn’t meet the criteria for sale accounting, the associated assets remain on the balance sheet, with cash proceeds recorded as liabilities. However, if it qualifies for sale accounting, SoFi retains minimal involvement as an investor. When deemed profitable, the company holds onto certain loans to generate interest income over a longer period, adopting a more selective approach to sales arrangements. The lending segment plays a pivotal role in shaping the SoFi stock forecast 2025.

Technology Platform: SoFi provides technology solutions to financial and non-financial institutions across North and Latin America. Through its robust financial technology setup, the company provides digital banking software to multiple banks and offers API access to its technology platform, which supports banks in processing credit card payments and launching financial products. SoFi charges its clients on a pay-per-use basis or through comprehensive licensing and maintenance fee arrangements. SoFi’s acquisition of Galileo and Technisys made their technology platform more robust. Galileo provides APIs that allow fintech companies to easily create bank accounts and issue virtual credit and debit cards, among other services. Galileo and Technisys, a cloud-based core banking system, will continue to push SoFi to expand into the B2B segment, apart from the consumer segment.

SoFi’s Financial Services: A Key Driver for Growth and the 2025 Stock Forecast

Financial Services: SoFi offers its members various financial services (e.g., SoFi Money, SoFi Invest, and SoFi Credit Card) that enable the platform to have more daily interactions with the customers, which is absent in lending products. This is the second largest segment and critical to the SOFI stock forecast 2025.

SoFi Money: SoFi’s checking and savings accounts provide a digital banking experience through which members can spend, save, and earn interest and rewards. Members hold checking and savings accounts at SoFi Bank to get competitive interest rates on deposits. These deposits are now the dominant funding source for SoFi to originate loans. SoFi bears interest expense for the deposits and earns income when these deposits are channeled to originate loans.

SoFi Invest: SoFi’s mobile-first investment platform offers members trading and advisory solutions such as active investing and robo-advisory. Members interact with the platform in various ways. They can look at other investors’ activity, which increases engagement within the platform. Members buy and sell stocks and ETFs, as well as alternative investment funds, mutual funds, and money market funds. They can also engage in options trading, purchase shares in IPOs before they trade on an exchange, buy and sell fractional shares, take on margin investing, and access retirement savings accounts. Moreover, members can buy and sell digital currencies through SoFi Digital Assets.

SoFi Credit Card: SoFi offers credit cards with no limits and various cash-back rewards, generating interest income from credit card loans.

Lantern Credit: Lantern Credit is a financial services marketplace platform that helps applicants who do not qualify for SoFi products to seek alternative products from other providers.

Other lending as a service: It includes referred loans originated by a third-party partner to whom SoFi provides pre-qualified borrower referrals.

SoFi Relay: It is a personal finance management product that allows members to track their financial accounts in one place and gain meaningful insights into their financial health and habits, such as credit score monitoring and spending behaviors. SoFi Relay provides the company with comprehensive insights into its members, identifying which SoFi products and features best support their financial goals. This allows SoFi to enhance the personalization of the member experience.

SoFi Protect: SoFi Protect offers third-party insurance products to help members protect their assets, including auto, life, homeowners, renters, cyber insurance products, and estate planning.

SoFi Travel: SoFi partners with a provider to offer a travel search and booking experience that members can manage directly through the SoFi app or website.

SoFi At Work: SoFi partners with other enterprises looking for a seamless way to provide financial benefits to their employees, such as student loan payments made on their employees’ behalf.

SoFi’s financial services earn net interest income through deposit services and credit card offerings and non-interest income through fees charged on financial services.

SoFi’s Evolving Business Model

Initially, SoFi started as a loan origination company but has since evolved into a comprehensive banking and technology-driven financial services provider.

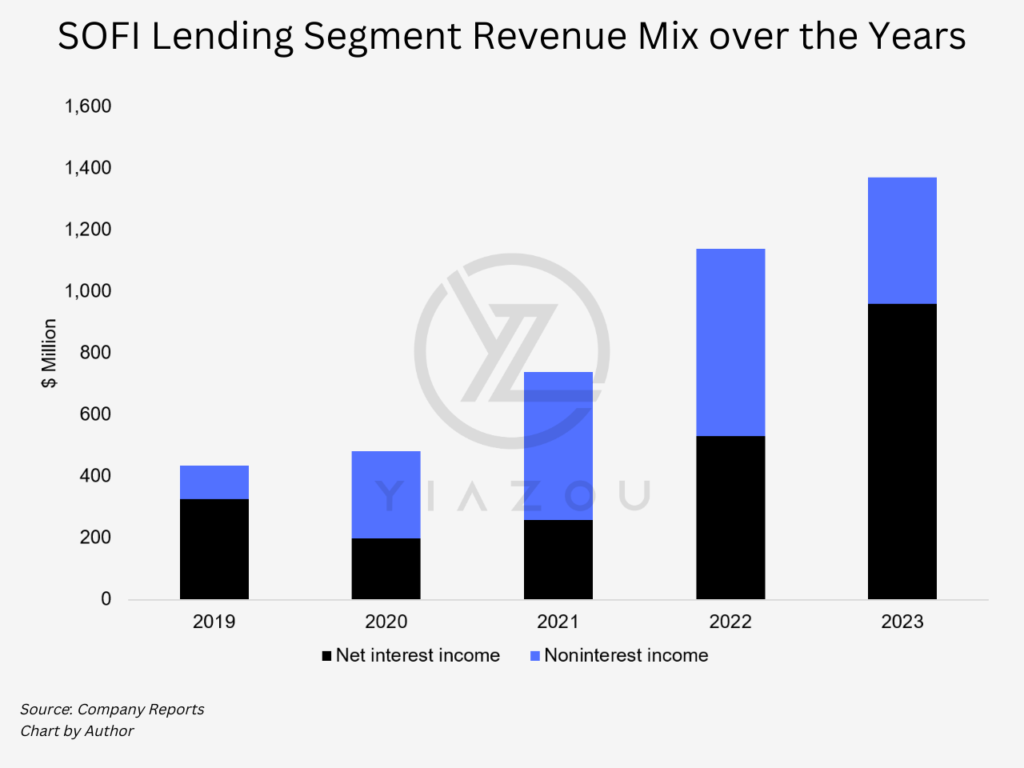

Earlier, SoFi used to originate different segments of loans, including student, personal, and home loans, and then sell those loans to other financial institutions at a premium to generate cash and profit. This initial lending model operated as an originate-to-distribute model. SoFi used to take on debt and utilize its equity to originate loans. After obtaining its banking charter, SoFi has begun holding loans on its balance sheet for extended periods to generate interest income while selectively selling or securitizing portions of its loan portfolio. The result of this transition is the growing contribution of net interest income to the revenue compared to previous years.

Meanwhile, the company’s funding source has transformed over the years. As of June 2024, interest-bearing deposits support 77.2% of earning assets, a significant increase from the 27.9% recorded in March 2022 and the non-existence of deposits in earlier years. Deposit is now the dominant funding source for SoFi.

As SoFi strengthened its technological capabilities through in-house development and acquisitions like Galileo and Technisys, it expanded its range of financial services, creating a financial services productivity loop. The more members engage with the platform, the more effectively SoFi can tailor products to meet their needs.

Initially established as a cost-effective student loan provider, SoFi has since evolved into a versatile financial solutions provider. Catering to a clientele of tech-savvy young individuals, the company aims to offer accessible and convenient financial services just a tap away.

SOFI Stock Forecast 2025 – DCF Free Cash Flow to Firm

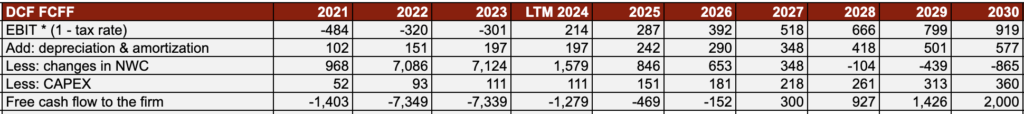

For SOFI stock forecast 2025, we adopted the free cash flow to firm DCF (discounted cash flow) approach, where we estimated 18.0% of WACC (weighted average cost of capital) and a 5.0% terminal growth rate. We estimate that the revenue can grow at 20.0% for the next five years and then gradually drop to 10.0% during 2025-40. We also estimate that the EBIT (earnings before interest and taxes) margin will grow by 25.0%. Lastly, for our SOFI stock forecast 2025, we have considered the recent trend of depreciation and amortization, capex, and net change in working capital. Based on our estimation, we value SOFI at ~$53 per share as of 2030.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article.