SMCI Stock Backed By Modular Innovations for Diverse Markets

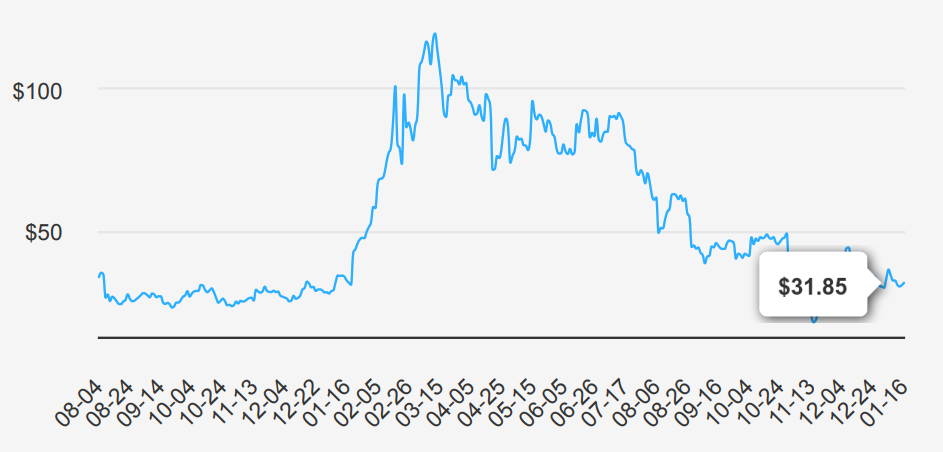

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one segment, which develops and provides high-performance server solutions based on innovative, modular, and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions. SMCI stock is trading at ~$32. Let’s explore SMCI stock forecast 2025 analytically.

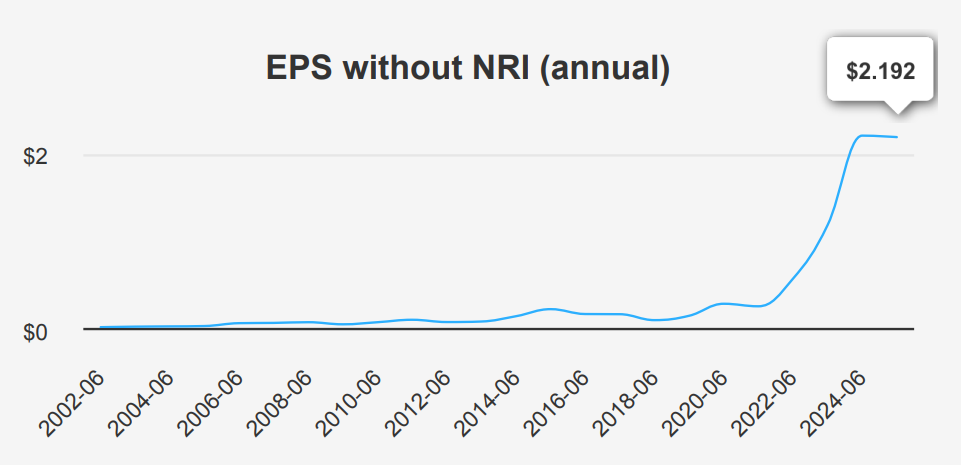

72.10% EPS CAGR and 2025 EPS Forecast of $2.783

In the latest quarter ending June 30, 2024, SMCI reported an EPS without non-recurring items (NRI) of $0.625, showing a slight decline from $0.665 in the previous quarter (Q1 2024) but an increase compared to $0.351 in the same quarter last year (Q2 2023). The EPS (Diluted) for the quarter was $0.551, also reflecting a decrease from $0.656 in Q1 2024. Revenue per share increased significantly to $8.267, up from $6.267 in the prior quarter, indicating robust top-line growth. Over the past five years, SMCI’s annual EPS without NRI has grown at a compound annual growth rate (CAGR) of 72.10%, while the 10-year CAGR stands at 27.50%.

SMCI is currently operating with a gross margin of 14.13%, which is slightly below its 5-year median of 15.40% and well below its 10- year high of 18.01%. The company’s aggressive share buyback strategy over the past year, evidenced by a buyback ratio of -10.70%, indicates a significant reduction in outstanding shares, which can enhance EPS by reducing the share count. However, over the longer term, the 10-year buyback ratio of -1.90% suggests a more moderate reduction in shares. This buyback ratio indicates the percentage of shares repurchased, where a negative value reflects a decrease in total outstanding shares.

Looking ahead, analysts estimate that SMCI will achieve revenues of $24,945.86 million in FY2025, with projections increasing to $32,945.28 million by FY2027. The estimated EPS for the next fiscal year is $2.783, rising to $3.487 in the following year. The technology industry, where SMCI operates, is expected to grow at approximately 7% annually over the next decade. The next earnings release is anticipated on January 29, 2025, which will provide further insights into the company’s financial trajectory and allow analysts to adjust their SMCI stock forecast 2025 accordingly.

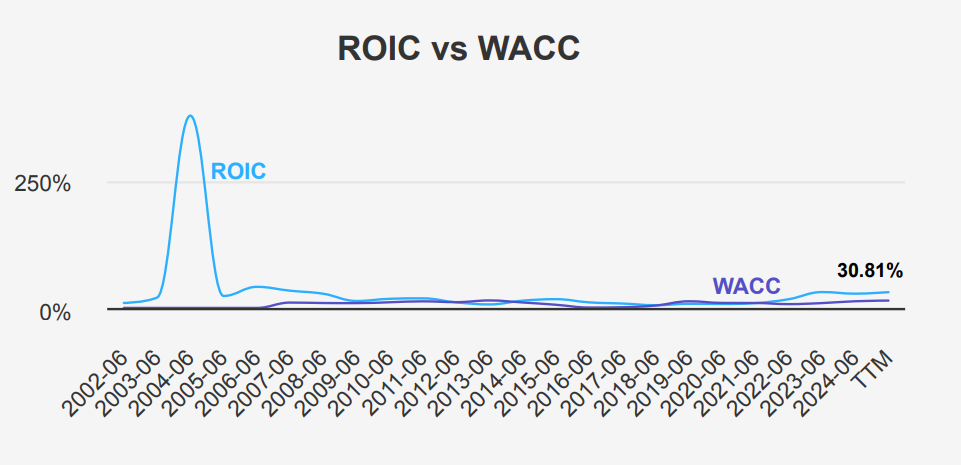

SMCI Stock: ROIC Surpasses WACC, Value Creation Insights

Super Micro demonstrates strong financial efficiency and economic value creation, as evidenced by its Return on Invested Capital (ROIC) consistently surpassing its Weighted Average Cost of Capital (WACC). The current ROIC of 30.81% significantly exceeds the WACC of 14.30%, indicating that SMCI is generating substantial economic value for its shareholders by effectively allocating capital to profitable investments.

Over the past five years, SMCI maintained a median ROIC of 17.03%, which was consistently above the median WACC of 9.60%. This performance reflects the company’s ability to efficiently manage its capital structure and investment decisions, contributing to robust shareholder returns. Furthermore, the high median ROE of 22.62% over five years suggests effective use of equity capital.

Overall, SMCI’s ability to generate returns above its cost of capital highlights its strategic focus on projects that enhance value creation and underscores its competitive advantage in capital allocation. This efficiency in managing resources is pivotal for its long-term profitability and growth prospects under SMCI stock forecast 2025.

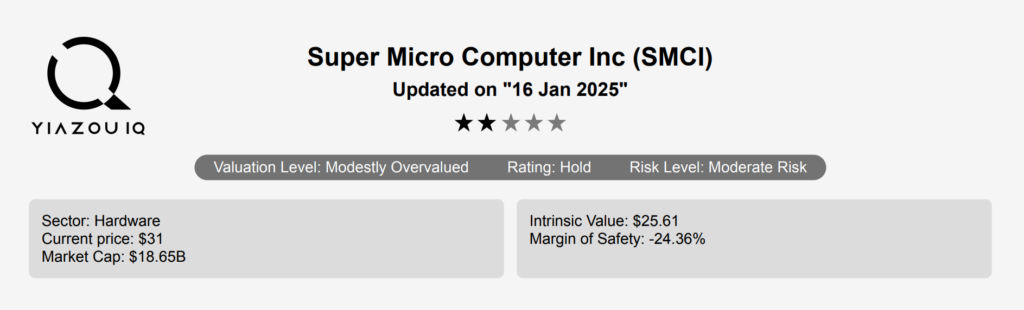

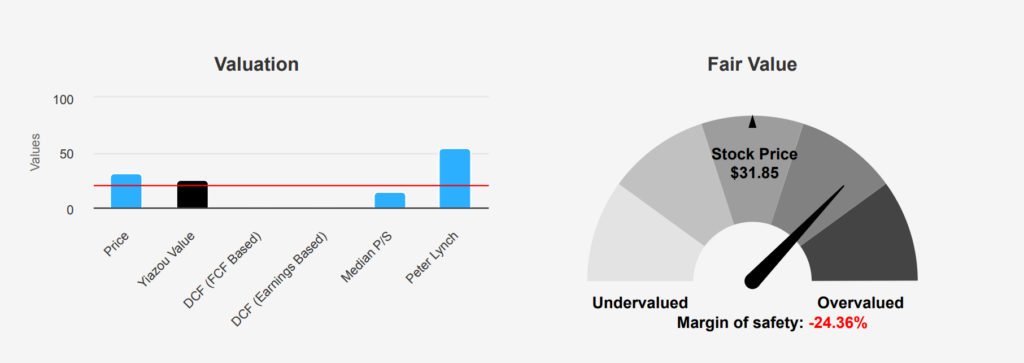

SMCI Stock’s Intrinsic Value vs. Market Price: -24.37% Margin of Safety

SMCI’s current intrinsic value stands at $25.61, significantly lower than its market price of $31.85, resulting in a negative margin of safety of -24.37%. This discrepancy suggests that SMCI stock may hold overvaluation when compared to its intrinsic value. The Forward P/E ratio of 10.91 is below the TTM P/E of 15.99, indicating expectations of earnings growth. Historically, the P/E ratios have fluctuated widely, with a 10-year median of 17.28, suggesting that the current valuation is not excessively high against its historical norm.

Examining other valuation metrics, the TTM EV/EBITDA ratio is 14.54, above the 10-year median of 11.28, which may indicate a premium valuation relative to historical levels. The TTM P/S ratio is 1.27, more than double the 10-year median of 0.56, suggesting that the stock is trading at a higher sales multiple than it has on average in the past. The TTM P/B ratio of 3.41 is also significantly higher than its 10-year median of 1.75, reinforcing the notion of potential overvaluation under SMCI stock forecast 2025.

Analyst sentiment offers a mixed outlook; while the price target has increased marginally from last month to $40.11, it remains below the levels seen three months ago. The adjustments in analyst price targets indicate some uncertainty about future growth prospects. Overall, the current valuation metrics suggest SMCI is trading above its historical averages, implying potential overvaluation relative to its intrinsic value and historical norms.

Debt, Manipulation Risks, and Earnings Sustainability

SMCI presents a mixed risk profile. On one hand, the company has been actively issuing debt, accumulating $1.8 billion over three years, yet it maintains an acceptable debt level. The ability to manage debt effectively supports its strong financial strength, as evidenced by a robust Altman Z-score of 5.5. This suggests a low risk of financial distress in the near term. Additionally, the company’s expanding operating margin is a positive indicator, reflecting improved profitability.

However, there are areas of concern. The company’s annual growth in total assets is 37.2%, surpassing its revenue growth rate of 29.2%, indicating potential inefficiencies. Moreover, the Beneish M-Score of 0.47 suggests possible manipulation of financial results. The high Sloan ratio of -39.11% also hints that a significant portion of earnings may stem from accruals, raising questions about earnings quality. Furthermore, while the company currently benefits from a lower tax rate, this may not be sustainable and could inflate earnings artificially.

Investors should weigh these risks against the company’s strong balance sheet and operational improvements. Continuous monitoring of debt management and earnings quality will be crucial for assessing the long-term investment potential of SMCI.

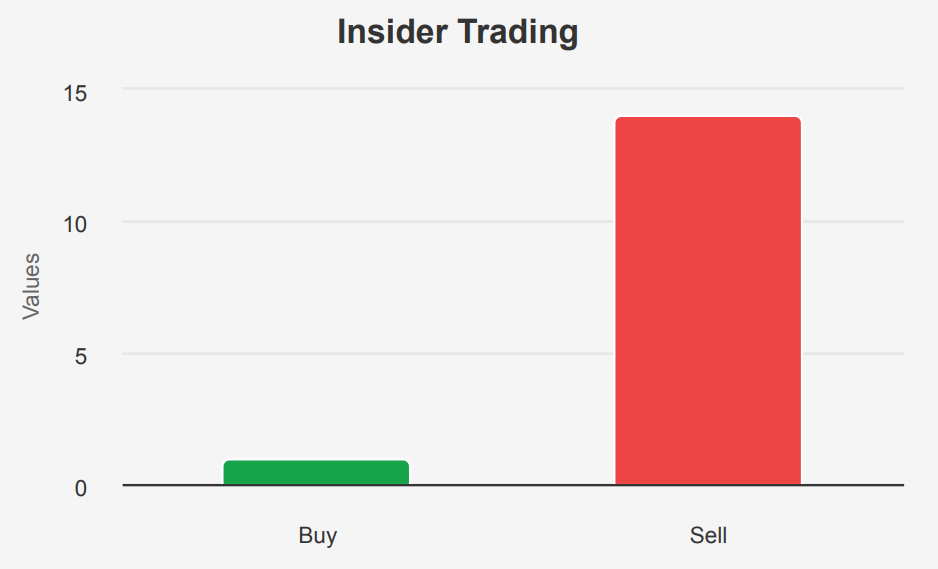

Insider Selling Dominates SMCI Stock: A Closer Look

The insider trading activity for SMCI over the past year reveals a notable trend. In the last 12 months, there has been a single insider buy against 14 insider sell transactions. This indicates a significant skew towards selling among the company’s directors and management, which could suggest that insiders are capitalizing on potential stock value gains or may have a less optimistic outlook on the company’s future performance and SMCI stock forecast 2025.

Furthermore, the absence of any buying activity over the past 3 and 6 months emphasizes the lack of confidence or interest in increasing their holdings in the near term. Insider ownership stands at 11.71%, which is relatively moderate, indicating that insiders do have a vested interest in the company’s success, but perhaps not strongly enough to deter selling.

Institutional ownership is significantly higher at 62.05%, suggesting that institutional investors hold a majority stake, which could influence the stock’s stability more than insider trades. Overall, the trend indicates potential caution or profit-taking by insiders, meriting close attention by investors.

High Trading Volume and Dark Pool Activity Analysis

Super Micro stock exhibits significant liquidity characteristics with a daily trading volume of 1,248,318 shares. This is relatively high, indicating that the stock is actively traded and can generally be bought or sold quickly without causing a drastic change in its price. The average daily trade volume over the past two months is 80,320,883 shares, suggesting that trading activities have been robust.

In terms of trading analysis, a high average daily volume, as seen in SMCI, typically implies greater interest from traders and investors, offering tighter bid-ask spreads and reduced transaction costs. This liquidity is favorable for both short-term traders and long-term investors, as it ensures easier entry and exit from positions.

The Dark Pool Index (DPI) percentages provided give an insight into the off-exchange trading activities. DPI1 is 43%, DPI2 is 49%, and DPI3 is 47%. These figures reflect a substantial amount of trading occurring in dark pools, which might suggest that institutional investors are actively involved in trading SMCI. However, a high DPI percentage can also indicate less transparency in the trading process, which could impact price discovery and lead to potential liquidity concerns if not monitored carefully under SMCI stock forecast 2025.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.