Over 50% Revenue from U.S., Strong Position in Data Center Market

Super Micro Computer (SMCI) provides high-performance server technology services to cloud computing, data centers, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include servers, storage, blades, and workstations, as well as full racks, networking devices, and server

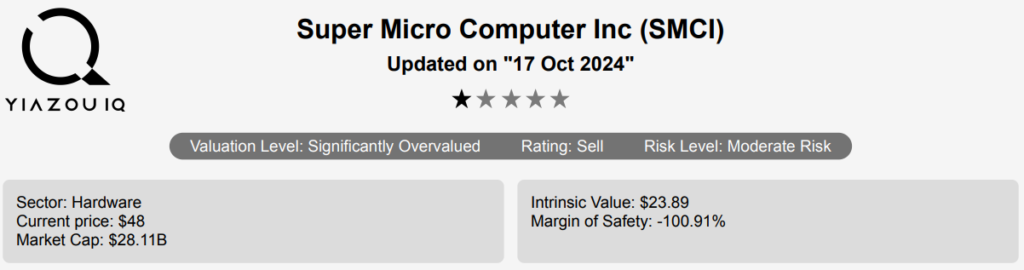

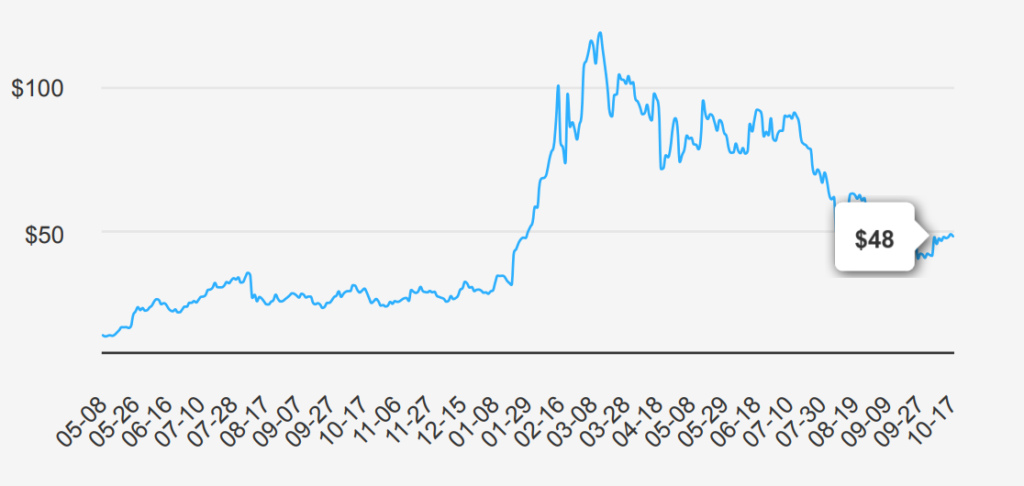

management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one segment, which develops and provides high-performance server solutions based on innovative, modular, and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions. SMCI stock is currently trading at $48. Lets explore, SMCI stock forecast 2025.

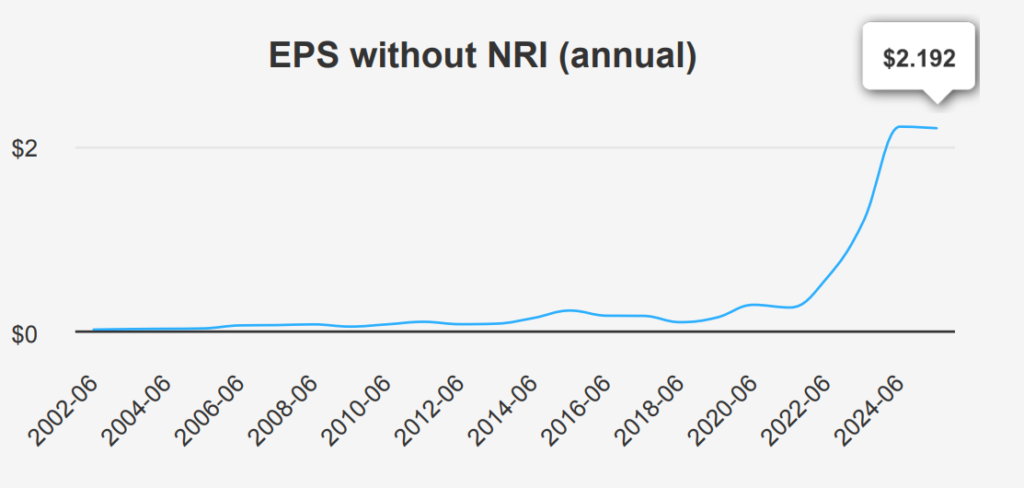

72.10% 5-Year EPS CAGR and $27.8B Revenue Forecast by 2025

In the latest quarter ending June 2024, SMCI reported an EPS without NRI (non-recurring items) of $0.625, showing a decline from the previous quarter’s $0.665 but an improvement from $0.351 in the same quarter last year. The EPS (Diluted) followed a similar trend, decreasing to $0.551 from $0.656 in the prior quarter, yet it marked an increase from $0.343 year-over-year (YoY). Revenue per share rose to $8.267 from $6.267 in the last quarter, indicating strong sales growth and reflecting a substantial YoY increase from $3.868. Over a 5-year period, the company achieved a remarkable EPS CAGR of 72.10% and a robust 27.50% over the past 10 years, showcasing consistent long-term earnings growth.

The company’s gross margin stood at 14.13% for the quarter, slightly below its 5-year median of 15.40% and well below the 10-year high of 18.01%. This suggests a narrowing margin resulting from increased competition or rising costs. SMCI’s 10-year share buyback ratio is -1.90%, indicating a net issuance of shares rather than repurchases. This is evident from the more recent 1-year buyback ratio of -10.70%, highlighting a significant issuance of new shares, which could dilute earnings per share if not offset by earnings growth.

Looking forward, analysts estimate SMCI’s revenue to reach $27,847.67 million by mid-2025, with a further increase to $38,274.99 million by mid-2027. The estimated EPS for the next fiscal year is $3.070, escalating to $3.921 the following year, suggesting a positive outlook. The industry forecasts project a steady 10-year growth rate, supporting a favorable environment for SMCI’s expansion. The next earnings report is anticipated on November 1, 2024, when further EPS forecasts will be unveiled, potentially impacting SMCI stock forecast 2025.

10.13% Median ROIC Over 10 Years, Current ROIC at 30.81%

SMCI’s financial performance over the last decade demonstrates robust economic value creation, evidenced by its return on invested capital (ROIC) consistently exceeding the weighted average cost of capital (WACC). With a ten-year median ROIC of 10.13% and a current ROIC at a near-all-time high of 30.81%, SMCI has effectively utilized its capital to generate substantial returns. This significantly surpasses the median WACC of 8.41% and the current WACC of 12.14%, indicating the company is

generating value well above its cost of capital.

Furthermore, the company’s return on equity (ROE) figures, with a five-year median of 22.62% and a current ROE of 33.98%, reinforce its strong profitability and efficiency in leveraging shareholders’ equity. SMCI’s ability to maintain a high ROIC relative to WACC suggests effective capital allocation strategies and operational efficiency. This financial profile positions SMCI as a company that sustains and enhances shareholder value, indicating positive economic value creation and solid financial health.

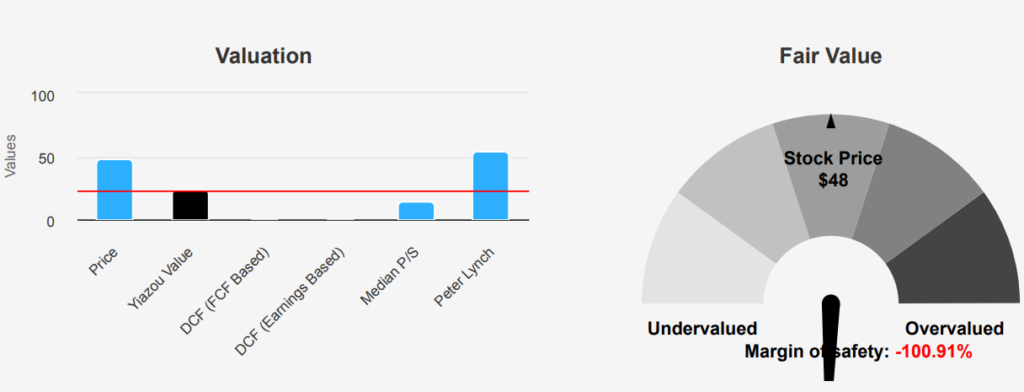

SMCI Stock Holds -100.92% Margin of Safety

The current valuation of SMCI, with its intrinsic value at $23.89 and the market price at $48.00, suggests a significant overvaluation, as indicated by a negative margin of safety of -100.92%. The Forward P/E ratio stands at 14.38, which is lower than its TTM P/E ratio of 24.1, indicating expectations of improved future earnings. Historically, the 10-year median P/E ratio is 17.65, suggesting the current P/E is slightly above average but not excessively high compared to historical highs of 88.99. This discrepancy between current and historical averages may indicate potential overvaluation under SMCI stock forecast 2025.

Assessing the TTM EV/EBITDA of 21.93 against its 10-year median of 11.28 reveals that SMCI is trading at a premium relative to its historical norm. Similarly, the TTM P/B ratio of 5.14 is substantially above the 10-year median of 1.75, hinting at overvaluation. Notably, the TTM P/S ratio of 1.97 exceeds the 10-year median of 0.56, further supporting this assessment. These figures, especially the elevated EV/EBITDA and P/B ratios, suggest that SMCI may be overestimating its current market valuation compared to historical metrics.

Looking forward, the analysts’ price target has declined from $1,026.50 three months ago to $76.69 currently, reflecting adjustments in market expectations. Despite a sharp decrease in price targets, the stock still trades above its intrinsic value, indicating caution. Analysts seem to have a mixed outlook, with 18 ratings tracked, suggesting varied opinions on future performance. Overall, the significant divergence from historical valuation metrics and intrinsic value highlights potential risks of overvaluation despite market optimism reflected in analyst targets.

The Beneish M-Score Raises Concerns About Possible Financial Manipulation

Super Micro presents a mixed risk profile. The company has been expanding its long-term debt, issuing $1.8 billion over the past three years. While the current debt level remains within acceptable limits, the increase in leverage could pose a risk if not managed carefully. Additionally, the rapid growth in total assets at 37.2% annually, outpacing revenue growth, suggests potential inefficiencies.

The tax rate advantage currently boosting earnings may not be sustainable, posing future volatility risks. Furthermore, the Beneish M-Score of 0.47 raises concerns about possible financial manipulation, while a Sloan ratio of -39.11% indicates a high reliance on accruals for earnings, potentially impacting earnings quality. On the positive side, SMCI’s expanding operating margin reflects improved cost efficiency, a favorable trend. The company’s Altman Z-score of 6.86 suggests strong financial health, reducing the likelihood of bankruptcy.

Overall, while under SMCI stock forecast 2025, SMCI exhibits solid financial fundamentals and margin improvements, investors should be cautious of potential earnings quality issues and the implications of increased debt and asset growth. Monitoring these risk factors will be crucial for assessing the company’s future financial stability and performance.

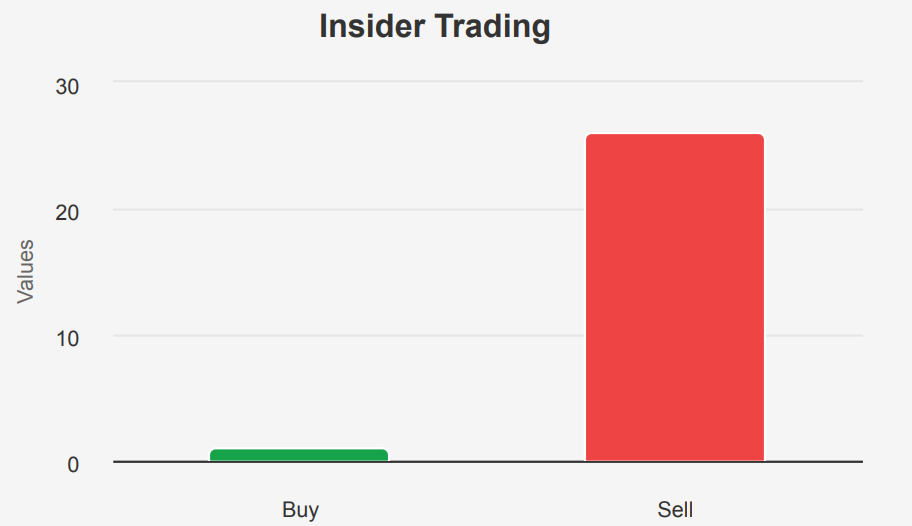

SMCI Stock Insider Activity: 26 Sells vs. 1 Buy in Last 12 Months

The insider trading activity for Super Micro over the past year reveals a notable imbalance between buying and selling actions by the company’s directors and management. Within the last 12 months, insiders have executed 26 sell transactions compared to just one buy transaction. This indicates a significant trend of insiders divesting their shares, with no buys recorded over the past 3 and 6 months, highlighting a consistent selling pattern.

Insider ownership stands at a modest 1.24%, suggesting that company insiders hold a relatively small portion of the company’s shares. This low level of insider ownership might imply limited influence or confidence among insiders regarding the company’s prospects. Meanwhile, institutional ownership is substantially higher at 5.44%, indicating a more significant stake institutional investors hold.

Overall, insider selling, combined with low insider ownership, may raise questions about the insiders’ confidence in the company’s growth or valuation prospects, warranting a closer examination by potential investors.

SMCI Stock’s Liquidity & Trading: 55.3% Dark Pool Activity Last Week

Super Micro stock demonstrates significant liquidity with a 2-month average daily trading volume of 77,300,738 shares. This high level of liquidity indicates that investors can easily enter and exit positions without causing a significant price impact. The daily trading volume on the most recent day was 16,888,937 shares, which is below the 2-month average, suggesting slightly lower trading activity relative to the recent historical average.

The Dark Pool Indexes (DPI) for SMCI are at 39.3% for the past 3 months and 55.3% for the past 7 days. The DPI measures the proportion of shares traded in dark pools compared to the overall trading volume. A DPI of 55.3% over the past week suggests a significant portion of trades are conducted away from public exchanges, which might imply larger institutional investors are actively trading SMCI in less transparent venues.

Overall, the liquidity metrics suggest SMCI is actively traded with sufficient volume to support both retail and institutional trading activities. The relatively high DPI indicates a substantial level of interest from institutional investors, which could influence future market movements for the stock.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.