Pfizer Stock: Invest In A Global Pharmaceutical Leader

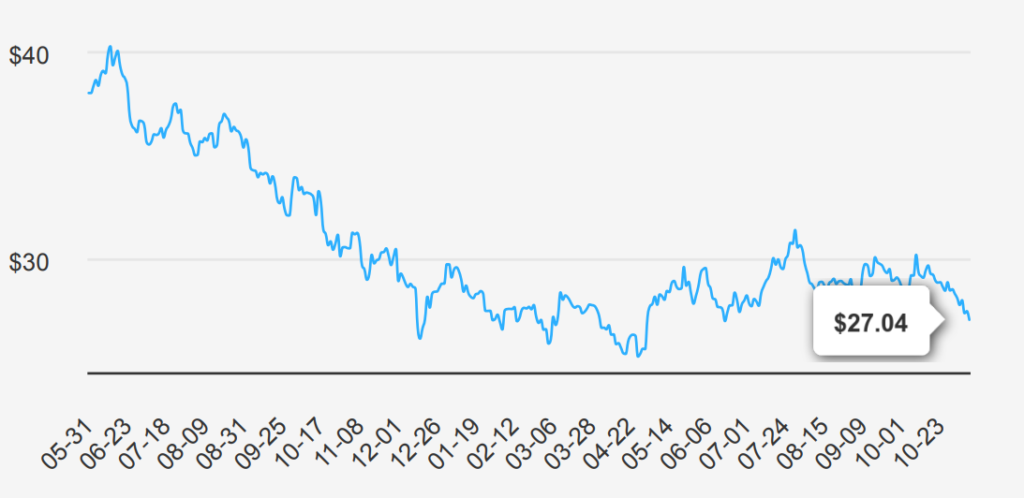

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor. PFE stock is currently trading at $27. Discover more on PFE intrinsic value.

Earnings Surge: Evaluating Pfizer’s Growth Potential

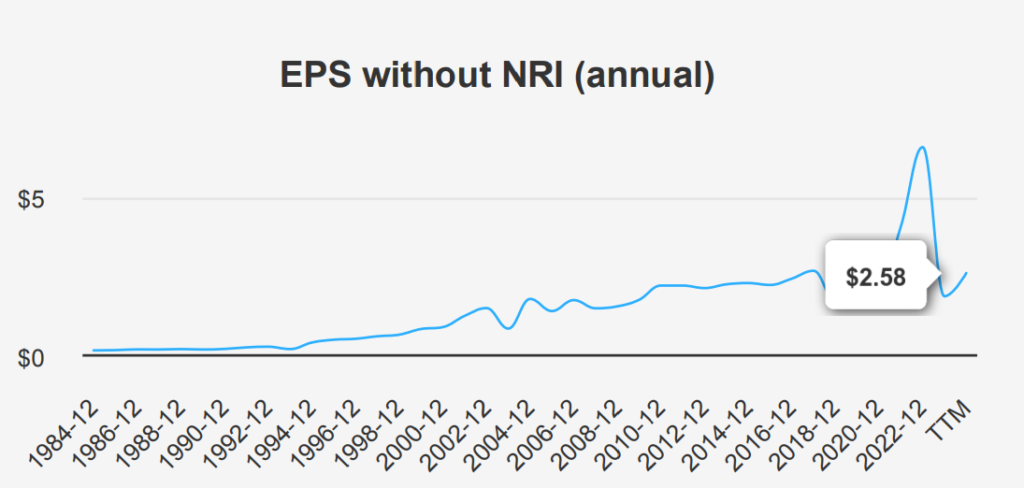

Pfizer reported robust results for the quarter ending September 30, 2024, with an EPS without NRI (excluding nonrecurring items) of $1.06, a significant increase from $0.6 in the previous quarter and $-0.17 YoY. This marks a notable recovery, as the EPS (Diluted) also improved to $0.78 from $0.01 in Q2 2024 and $-0.42 in Q3 2023. The revenue per share increased to $3.103 from $2.332 QoQ, showing strong performance. The 5-year Compound Annual Growth Rate (CAGR) for annual EPS without NRI is 10.60%, and the 10-year CAGR is 4.80%, indicating steady long-term growth. Industry forecasts predict a growth rate of approximately 4-5% annually over the next decade, reflecting a positive on PFE Intrinsic Value.

Pfizer’s gross margin is currently 67.15%, slightly above its 5-year median of 65.77% but below its 10-year high of 80.69%. This demonstrates efficient cost management amidst fluctuating market conditions. The company’s share buyback activity has been modest, with a 10-year buyback ratio of 1.50%, translating to 1.5% of shares repurchased over the period. However, recent years have seen negative ratios, indicating limited buybacks, which have not significantly impacted EPS.

Looking ahead, analysts estimate revenue growth to $62,990.4 million in 2024 to $63,774.7 million by 2026. Estimated EPS for the next fiscal year is at $1.764, rising to $2.248 the following year. The next earnings report will be on January 30, 2025, where further insights into PFE Intrinsic Value and market positioning will be anticipated. Despite challenges, the outlook remains optimistic, supported by strong pipeline developments and strategic investments.

Analyzing Pfizer’s Return on Investment

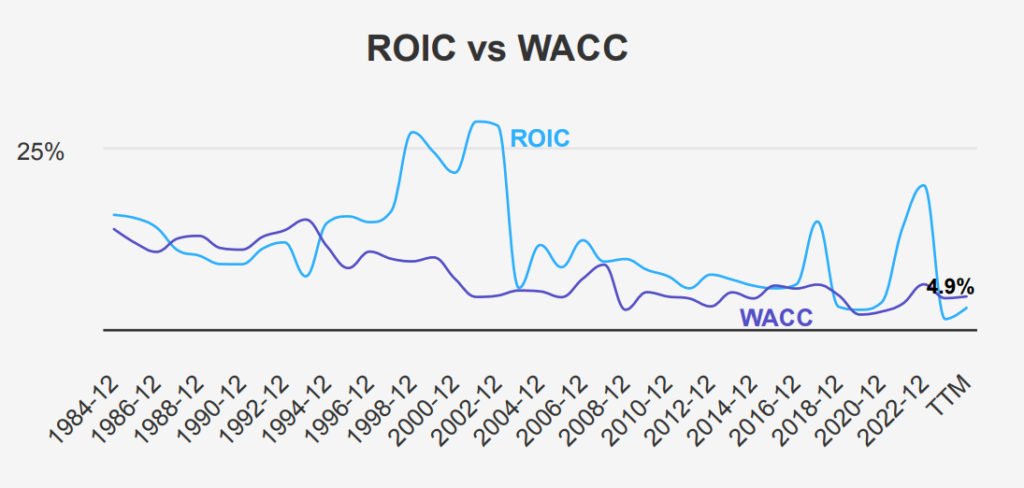

Pfizer’s performance, based on its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC), indicates important insights into PFE Intrinsic Value and its value creation capabilities. Over the past five years, Pfizer’s median ROIC of 5.53% slightly exceeds its median WACC of 5.40%, suggesting the company has been able to generate a small amount of value over its cost of capital during this period. However, the current ROIC of 4.90% falls below the current WACC of 6.26%, indicating that the company is currently not covering its cost of capital, thus not creating economic value at present, and hurting PFE Intrinsic Value.

The discrepancy between historical and current figures emerges from changes in business conditions, capital structure, or investment decisions. Pfizer’s ROE has also declined from its 10-year high, reflecting potential challenges in generating returns from equity. While historical data shows periods of strong value creation, the current performance highlights the need for Pfizer to reassess its capital allocation strategy to ensure sustainable positive value creation moving forward.

Understanding Pfizer’s Dividend Strategy

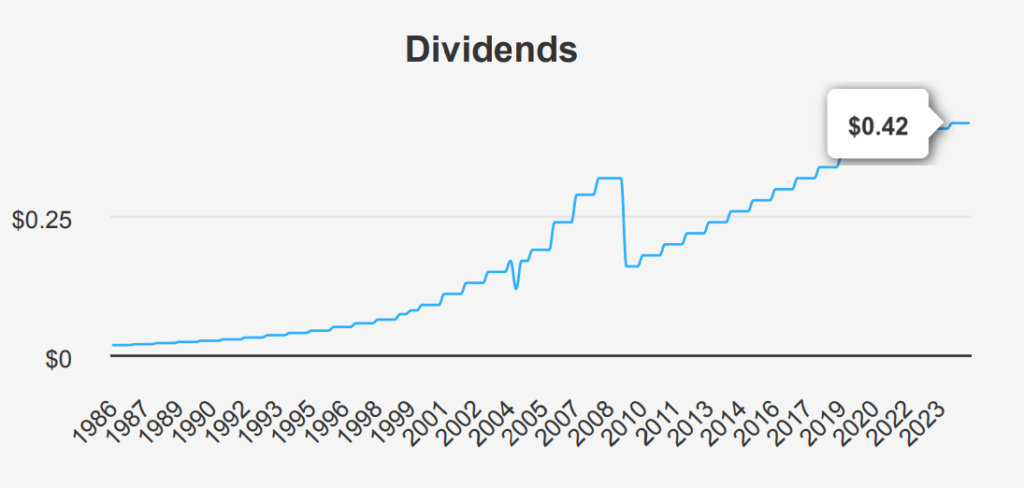

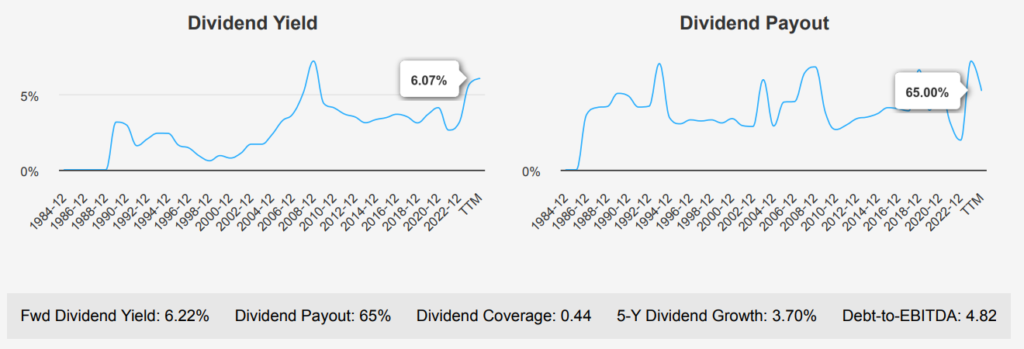

Pfizer (PFE) has demonstrated a steady dividend growth pattern with a 5-year growth rate of 3.70% and a 3-year rate of 2.60%, which is modest compared to its sector. The company’s forward dividend yield is currently 6.22%, substantially higher than its 10-year median yield of 3.76%, indicating an attractive return for investors at present.

In the latest quarter, PFE maintained its dividend at $0.42 per share, consistent with previous payouts, suggesting a stable but flat growth trajectory. This aligns with the forecasted 3-5 year dividend growth rate of only 1.55%, reflecting potential constraints due to higher financial risk as indicated by its Debt-to-EBITDA ratio of 4.82. This ratio is above the moderate threshold, suggesting that Pfizer faces significant leverage and debt-servicing challenges.

The dividend payout ratio stands at 65.0% relatively conservative against historical highs, providing some buffer for future payouts. The next ex-dividend date may be February 9, 2025, based on a quarterly dividend frequency, ensuring investors can plan accordingly.

Is Pfizer Stock Undervalued? A Valuation Perspective

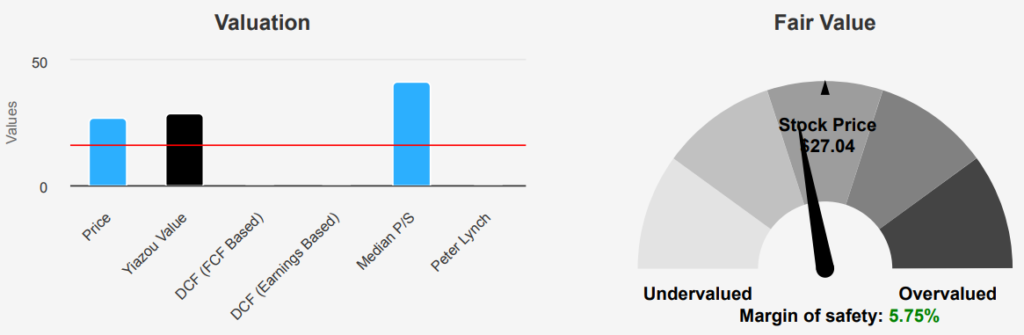

Pfizer currently trades at $27.04, slightly below its intrinsic value of $28.69, suggesting a margin of safety of approximately 5.75%. This indicates a modest buffer for investors, which might appeal to value-oriented buyers. The Forward P/E ratio of 9.24 is significantly lower than the TTM P/E of 36.54, suggesting expectations of higher future earnings compared to current valuations. Historically, the P/E ratio has fluctuated between 7.19 and 81.86 over the last decade, with a median of 19.44, indicating that the current TTM P/E is high relative to the median.

The TTM EV/EBITDA of 15.34 is above the 10-year median of 12.87 yet well below the historical high of 59.08, suggesting that the company might hold a moderate valuation relative to its earnings before interest, taxes, depreciation, and amortization. The TTM P/B ratio of 1.66 is near the 10-year low of 1.55, indicating a potentially undervalued position based on book value. This ratio is significantly below the median of 3.05, which could indicate a good entry point for long-term investors.

Analyst ratings suggest a cautious but stable outlook, with the price target slightly declining from $33.15 a week ago to $32.89 currently. This suggests market sentiment is stable but not overly optimistic. The moderate Price-to-Free-Cash-Flow ratio of 18.66, against a historical median of 14.92, suggests that while PFE is not undervalued based on cash flows, it remains within a reasonable range. Overall, Pfizer’s financial metrics indicate that it may be slightly holding undervaluation, especially when considering the intrinsic value and book value metrics, providing a potential opportunity for investors seeking a safety margin.

Navigating Pfizer’s Risk Profile and Investment Opportunities

Pfizer faces several financial challenges that warrant careful consideration for potential investors. The company’s declining gross and operating margins, with average annual decreases of 6.6% and 7.6%, respectively, indicate that its profitability is under pressure. Additionally, the decline in revenue per share over the past year suggests potential difficulties in sustaining revenue growth. The ROIC is also below the WACC, raising concerns about capital efficiency, the company’s ability to generate returns above its cost of capital and PFE intrinsic value.

Moreover, Pfizer’s Altman Z-score of 1.88 places it in a “grey area” of financial stress, hinting at potential financial difficulties if the score drops below 1.8. This risk is compounded by the buildup of inventory, which may suggest challenges in selling products. However, some positive indicators include recent insider buying, which may signal confidence from within the company, and a Beneish M-Score indicating a low likelihood of earnings manipulation. Additionally, the stock’s price-to-book ratio and price level are near historic lows, and the dividend yield is near a 10-year high, potentially attracting value-focused investors. Overall, while there are significant risks, there are also elements that might appeal to contrarian investors seeking undervalued opportunities.

Insider Trading Trends: What They Indicate

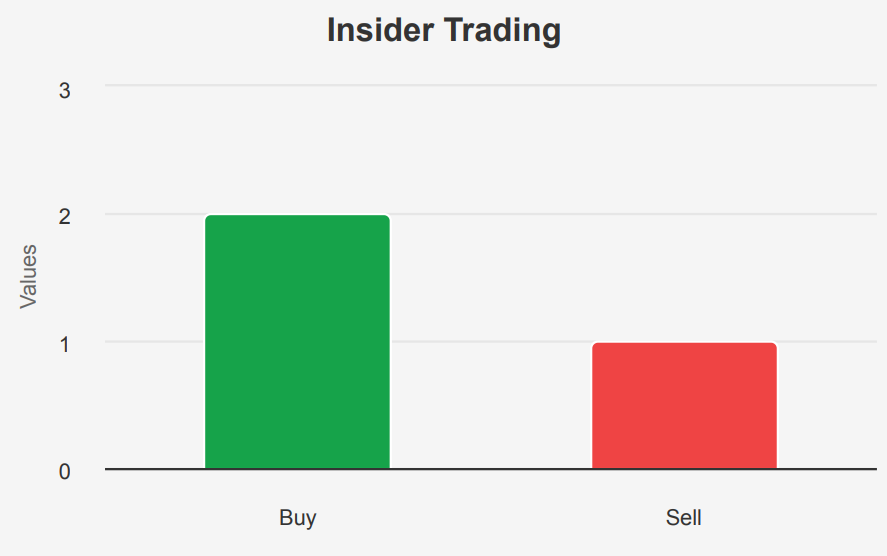

The insider trading activity for Pfizer over the past year shows minimal movement, with only minor buying and selling actions noted among the company’s directors and management. In the past three months, there was one insider buy and one insider sell, indicating a neutral stance among insiders. Over a six month period, the activity remains the same with one buy and one sell, suggesting no significant shifts in insider sentiment.

Over the past 12 months, Pfizer insiders executed two purchases against one sale. This slight increase in buying activity could be interpreted as a positive sign, potentially reflecting confidence in the company’s future performance. Insider ownership remains low at 0.28%, indicating limited direct stake by insiders in the company’s equity. However, institutional ownership is notably high at 67.48%, underscoring a strong institutional presence and confidence in the stock.

Overall, the trend analysis suggests stability in insider trading activity, with a slight leaning towards purchasing, aligned with steady institutional support.

Assessing Pfizer’s Trading Volume and Liquidity

Pfizer stock demonstrates robust liquidity, reflected by its average daily trading volume of 34,243,176 shares over the past two months. This high trading volume suggests that there is active trading for PFE, offering investors good liquidity and the ability to enter or exit positions with ease, minimizing the impact of large trades on the stock price. The daily volume on a recent trading day was 651,099 shares, which is significantly lower than the average, indicating a temporary dip in trading activity. However, this anomaly does not detract from the general liquidity profile of the stock, given its consistent historical averages.

The Dark Pool Index (DPI) for PFE stands at 35.95%, suggesting that a substantial portion of the trades occurs in dark pools, where institutional investors may seek to execute large buy or sell orders without impacting the market price. A DPI of 35.95% implies a moderate level of off-exchange trading, which could indicate strategic positioning by large investors.

Overall, PFE exhibits strong liquidity characteristics, supported by its high average trading volume, which ensures ease of trading and reflects a healthy interest from diverse market participants.

Congressional Transactions: Lawmakers’ Moves on PFE Stock

On August 6, 2024, Representative C. Scott Franklin, a Republican, sold shares valued between $15,001 and $50,000. Shortly after, on August 9, 2024, Representative Kathy Manning, a Democrat, sold shares valued between $1,001 and $15,000. Both sales were reported in early September and late August, respectively, highlighting potential bipartisan concerns or strategic financial decisions regarding Pfizer stock during this period.

Such trades might reflect the representatives’ responses to shifts in the pharmaceutical sector or broader economic sentiments impacting stock prices.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.