Palantir Technologies (PLTR) keeps getting stronger in the data analytics and AI-driven software space, with its latest earnings showing sharp momentum across customer acquisition, commercial diversification, and financial performance. The company’s Q3 2024 results show a strong rise in customer count, a revenue mix shifting toward commercial clients, and financial headwinds that need strategic management.

Customer Growth: Increase of 71% Reflective of Growing Demand

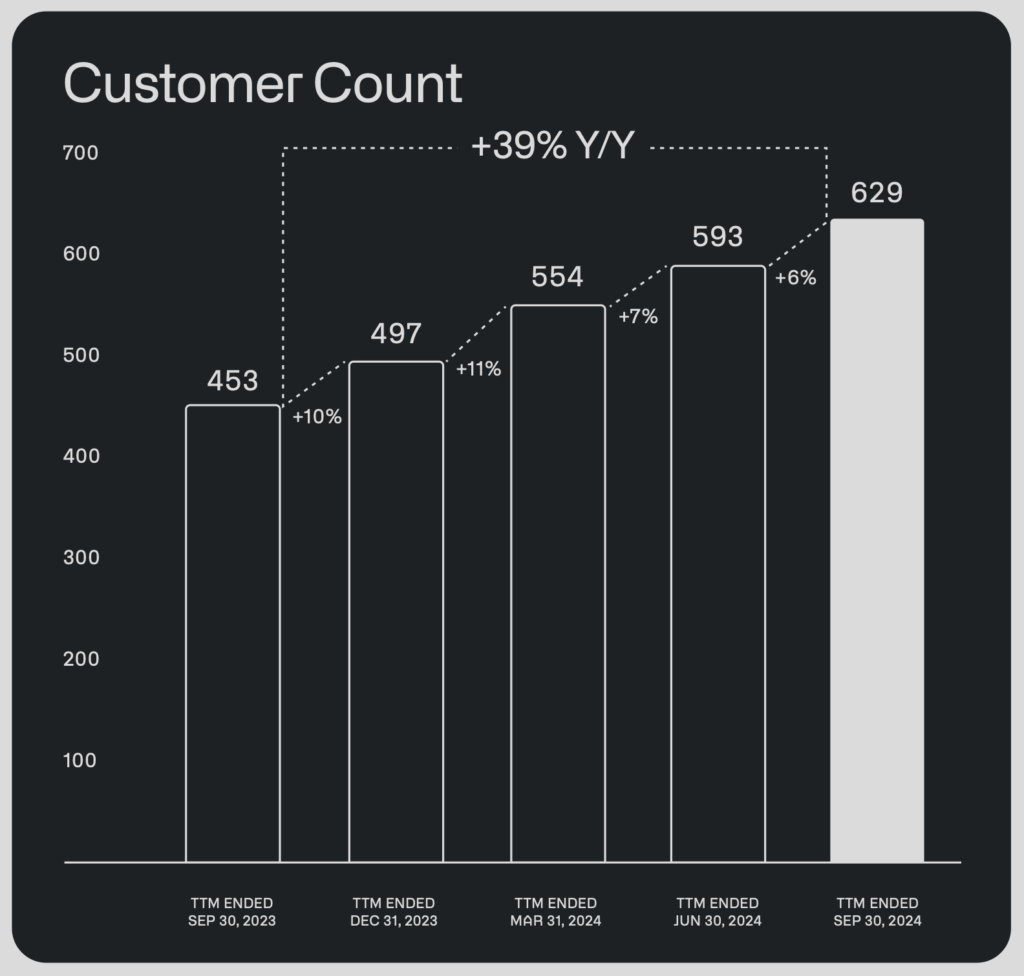

From December 2022 to September 2024, Palantir’s overall customer count increased 71%, from 367 to 629 customers. That steady growth gave evidence of the strong demand it has been experiencing for what Palantir has sold into both commercial and government areas. More importantly, customers surged 39% year-over-year (YoY) during Q3 ’24, showing evidence of how well the company sells its offerings effectively and uses its AI platforms. Additionally, when aggregated, such a surge in customers works as a strong catalyst and one of the major reasons for positive sentiment regarding the PLTR stock forecast.

Commercial Expansion Drives Growth

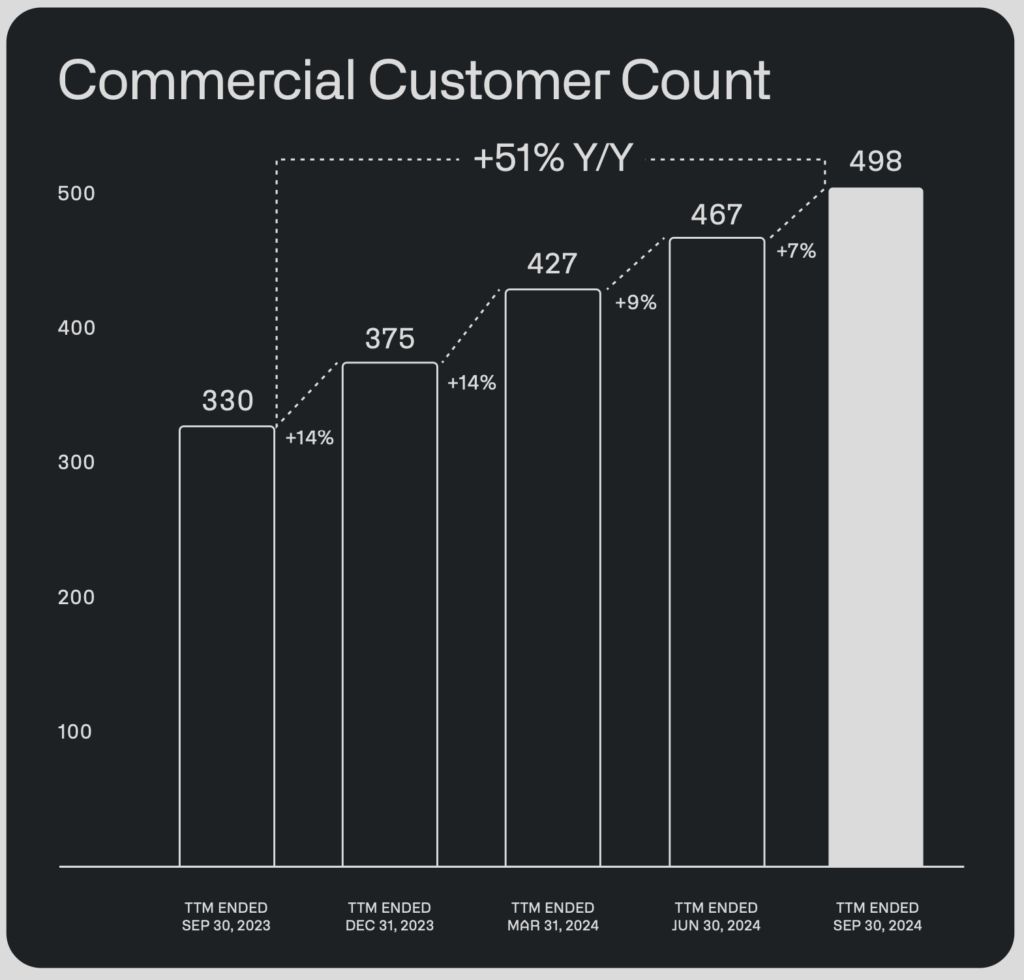

The commercial sector has always contributed to the company’s overall growth. In the period between Q4 2022 and Q3 2024, this company’s commercial customer count surged from 260 to 498, representing an astonishing 91.54% increase. This growth has been especially robust in the U.S., where the commercial customer base has grown 124.48% in the same period while managing a YoY growth rate of 77.35% in Q3 2024 alone. Because of this, such rapid growth underlines the ability of the company to grasp emerging enterprise demand for advanced data analytics, operational insights, and decision-making tools, buoying bullishness in PLTR’s stock forecast.

International Growth: Opportunities and Challenges

While domestic commercial growth is still the highest for Palantir, the international commercial segment also represents positive trends, though at a slower pace. From Q4 2022 to Q3 2024, the international commercial customer count grew by 51.28%, with an 18.79% YoY increase in Q3 2024. Compared to the domestic market, the international markets show slow growth because of various reasons, such as regulatory barriers, regional competition, and local market adaptation.

This might represent a steady increase but underlines the possibility that Palantir could expand further in diversifying its revenue sources at large and reducing dependence on the US market. This is actually one of the facts increasing long-term promise for this PLTR stock forecast.

Government Sector: Stability Amid Modest Growth

Growth in Palantir’s government customer base has been modest compared to the commercial segment. Government customers grew from 107 in Q4 2022 to 131 in Q3 2024, up 22.43%. YoY growth in Q3 2024 was at just 6.50%, reflecting longer sales cycles and budgetary constraints commonly associated with government contracting. Slower growth is juxtaposed by the fact that the government segment continues to represent a core element of its business operations, which comes along with stability and very predictable, long-term revenues complementing faster-paced growth elsewhere in its commercial arena. This provides stability and a well-balanced outlook for a PLTR stock forecast.

Forward Revenue Prospects: RPO and Billings Growth

Palantir’s forward revenue visibility remains strong, supported by consistent growth in Remaining Performance Obligations (RPO) and billings. These metrics highlight the company’s ability to lock in long-term contracts and translate them into near-term revenue. The solid trajectory of these metrics adds confidence to the PLTR stock forecast.

RPO represents the contract value that is signed but not executed and thus serves as a proxy for future revenues. As of Q3 ’24, this stood at 1.57 billion dollars, representing a 58% increase from 0.99 billion dollars one year ago. The growth manifests Palantir’s success in securing larger, longer-term contracts, especially in the Commercial sector.

It gets even more interesting if one drill down RPO into short-term and long-term components. Short-term RPO increased 30% YoY to $0.73 billion, while long-term RPO grew 95% to $0.84 billion. The substantial increase in long-term RPO indicates that customers are locking in for multi-year deals with Palantir’s platforms, thereby stabilizing the company’s revenue base and reinforcing the PLTR stock forecast.

Billings Growth: Translating Contracts into Revenue

Billings, which reflects the revenue Palantir has billed its clients in a given quarter, also showed strong growth. In Q3 2024, billings reached $823 million, a 50% YoY increase from $550 million in Q3 2023. This growth highlights Palantir’s ability to effectively convert its growing pipeline of signed contracts into realized revenue.

The rising RPO and billings combination indicates that a robust deal pipeline well supports Palantir’s top-line growth. As the company continues to expand its customer base and secure high-value contracts, its ability to sustain revenue growth will depend on the efficient execution and delivery of its services. These factors play a crucial role in shaping an optimistic PLTR stock forecast.

Stock-Based Compensation: A Persistent Challenge

Although Palantir’s Q3 2024 earnings did show impressive profitability growth, SBC remains a high burden on the company’s margins and, consequently, shareholder value. With the lofty valuation added on top, a rising SBC expense is the last thing it needs for long-term financial health. These are some of the financial dynamics that will prove critical in setting the forecast for PLTR stock.

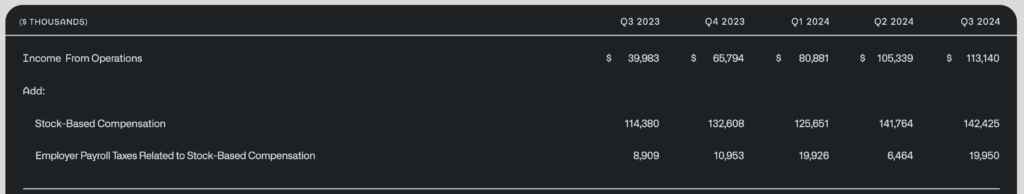

SBC remains a large concern for Palantir since the costs increased from $114.4 million in Q3 2023 to $142.4 million in Q3 2024. While the company has tried to rein in these expenses, SBC has proven to be highly volatile for the last few quarters-a signal that the company relies heavily on equity-based compensation to retain talent. This isn’t out of the ordinary in technology companies, but the extent of Palantir’s SBC expenses raises a serious risk of shareholder dilution and also impairs the potential to achieve sustainable profitability.

Notably, SBC accounted for nearly all of Palantir’s net income in Q3 2024. Although the company’s net income doubled YoY to $143.5 million, SBC expenses represented 99.23% of this figure, underscoring the thin margin for profit growth. If SBC costs continue to rise, Palantir’s ability to fund growth initiatives and enhance shareholder returns could be severely limited, which could dampen optimism around the PLTR stock forecast.

Takeaway

Palantir’s Q3 2024 results reflect a company in transition, capitalizing on its strengths in customer acquisition and commercial diversification while grappling with financial challenges such as SBC expenses and lofty valuations. The 71% surge in customer count, driven by a 91.54% increase in commercial customers, underscores Palantir’s growing relevance across industries and geographies. Meanwhile, the company’s expanding RPO and billings provide strong visibility into future revenue growth.

Palantir must address these financial wrinkles to maintain investor confidence and justify its premium valuation. The company needs to actively control SBC costs and focus on profitability as it scales up and expands its international operations. If Palantir could balance growth initiatives with discipline on financials, then the company would keep strengthening its positioning as a leader in AI and data analysis for value creation for both customers and shareholders. Investors following the PLTR stock forecast will find both opportunities and risks as Palantir navigates these challenges.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.