Key points:

- Palantir’s Q1 2025 revenue rose 39% YoY to $884M, with U.S. commercial revenue growing 71% and a 44% operating margin.

- Free cash flow reached $370M in Q1 with a 42% margin, driven by disciplined reinvestment and low CapEx infrastructure.

- AIP adoption surged across finance, healthcare, and logistics, with 139 $1M+ deals and net dollar retention rising to 124%.

- Ontology-driven architecture enables autonomous agents to scale AI in enterprise, creating unmatched defensibility and deployment leverage.

- Despite Rule-of-40 leadership and 40%+ FCF margins, Palantir trades at a discount due to outdated defense-tech narratives.

From Outlier to Operating System: The Philosophy Behind Palantir’s Rise

Palantir’s success is more than a tale of robust bottom-line statements, it’s an expression of the contrarian worldview of its leader, Alex Karp. While the rest of the tech world chases short-term wins and fleeting trends, Palantir operates on a different beat. Its strategy is rooted in a unique combination of long-term perspective, patriotic ideals, and urgency forged in wartime experience. It may seem strange within a tech environment characterized by sleek consumer software and buzzword-laced pitches, but it is precisely Palantir’s reversal of that trend that makes it distinct.

Karp’s shareholder letters aren’t typical CEO updates. They read more like philosophical manifestos grounded in execution. Palantir’s defense-first posture made it an outlier for years, often dismissed by critics who failed to see the long-term vision. But as global tensions rise and world powers heavily invest in defense tech and artificial intelligence, Palantir is getting its turn in the sun. It’s no longer just a vendor; it’s the platform of choice for NATO, the U.S. Department of Defense, and a growing number of Fortune 500s companies deploying operational AI.

Culture Over Convention: How Palantir Works Differently

Palantir is not governed by layers of middle management or playbook-driven SaaS norms. It lives by disciplined conviction and adaptive execution. Thousands of “Palantirians” work in lean teams: some debugging military-grade software in war zones, others solving logistics problems for global corporations. These aren’t typical tech teams. They’re engineered to be elite, self-contained, and fast-moving.

Where other businesses pursue engineering scale by hiring in large numbers, Palantir does the opposite. It consciously hires only what it defines as the “elite technical minds,” reinforcing its flexible, robust framework. This is not just a quality play; it’s about building an antifragile organization that thrives under stress. During a period in which AI tools are being commoditised, Palantir’s edge isn’t just in its software; it’s in the culture behind it. AIP, its AI platform, embodies that mindset. It wasn’t created in theory, but in response to real operational needs.

Q1 2025: Growth Without the Traditional Bloat

Palantir’s 2025 first-quarter performance was a statement. Revenue rose 39% year-over-year to $884 million, driven by a 71% surge in U.S. commercial revenue. That’s not growth, that’s scale, executed efficiently.

The company posted a Rule of 40 score of 83%, a rare feat for a company its size, demonstrating that it is walking the tightrope of revenue growth and profitability with surgical precision. Adjusted operating margins reached 44%, with free cash flow of $370 million at a 42% margin.

What stands out most is how that cash is being used. Palantir is in the infrastructure-building stage now. CapEx is still moderate but R&D investment is taking off. They’re not spending extravagantly, they’re building quickly. AIP allows clients to deploy tailored AI agents in just weeks. That pace suggests Palantir’s R&D is maturing into a self-sustaining platform rather than a traditional product roadmap.

Reinvestment With Discipline and Momentum

Palantir’s reinvestment approach is what makes its growth meaningful. Its customer base keeps growing with a 39% year-over-year lift and net dollar retention up 124%. Importantly, the company closed 139 deals exceeding $1 million, and U.S. commercial contract value jumped 183% to $810 million. This isn’t growth powered by discounts or headcount inflation but a result of deeper, high-value engagements and disciplined reinvestment.

Palantir is demonstrating that it’s possible simultaneously to grow rapidly, remain profitable, and create defensible technology. With startup vigor and large-company discipline, it’s creating a long-term growth formula that’s not built on hype. It’s fueled by a peculiar combination of culture, belief, and an explicit unwillingness to play according to the standard tech playbook. And that, ironically, could make it one of the most durable companies in the race for artificial intelligence.

The Invisible Moat: How Ontology and Asset-Light Scale Make Palantir Unstoppable

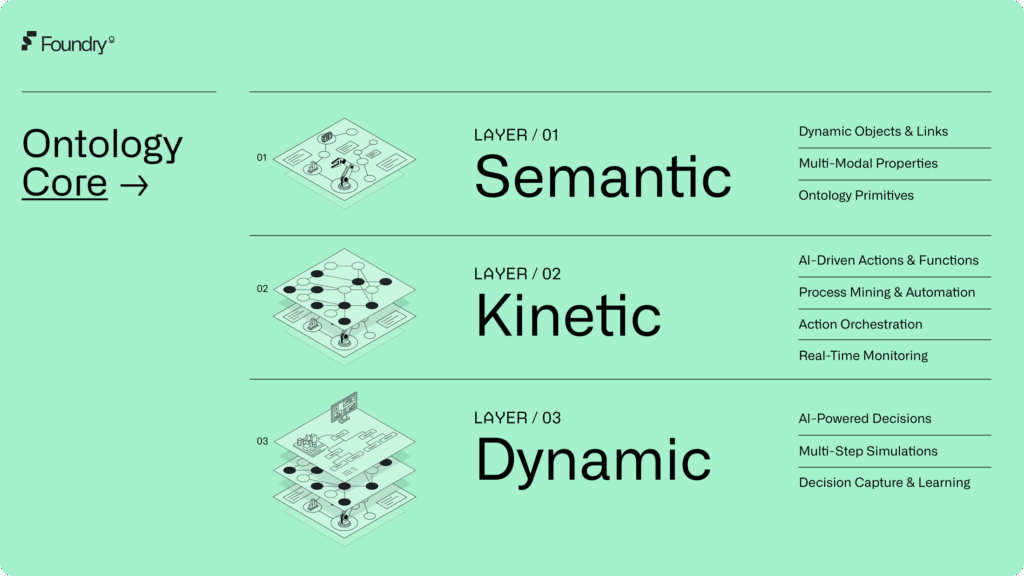

The technological advantage comes from ontology, a data representation system that allows Palantir’s agents, humans, and LLMs to work within a common context. It allows not only copilots but also autonomous agents that manage whole workflows.

Foundry, AIP, and Apollo now function as a meta-operating system for decision-making in high-risk, uncertain environments. Whether it’s the TITAN platform for the U.S. Army, the C2 platform for NATO, or supply chain logistics in Operation Warp Speed, Palantir is embedding itself in domains where failure is not an option. Its alignment with national security, mission complexity, and AI deployment at scale is no accident; it’s by design.

Palantir’s model is also notably asset-light. With minimal CapEx and $5.4 billion in cash and U.S. Treasuries, the company reinvests in high-ROI areas like R&D and top-tier talent, avoiding balance sheet strain. Unlike GPU-intensive peers, it doesn’t rely on massive data center buildouts to scale. Instead, it monetizes intellectual capital through its ontology-driven software, enabling high-margin growth at low incremental cost.

This model is what enabled Palantir to deliver a 42% free cash flow margin in Q1 2025 while growing revenue 39% YoY, and it sets the company up to grow AI adoption profitably without the CapEx drags that drive returns to ground for hardware-heavy incumbents.

Strategically speaking, Palantir’s moat today depends less on leadership in AI models and more on orchestration of demand. WWith LLMs increasingly commoditized, the company’s ability to embed contextual agents into enterprise workflows is what makes it irreplaceable. AIG and Walgreens also claim quantified ROI within months of using AIP. The framework allows AI agents to work independently across domains-from underwriting to logistics-that represent a more profound moat than model fine-tuning.

From Use to Dependence: Why Palantir’s Moat Compounds

Palantir isn’t building a moat. It’s already operating inside one. AIP’s architecture isn’t merely sticky, it’s self-reinforcing. Each enterprise that puts AIP into production adds to a proprietary, adaptive ontology, the semantic scaffolding that turns raw LLM power into concrete business results. This isn’t the domain of open source. You cannot replicate ontology. It has to be constructed iteratively, in the enterprise, using context-specific data and logic. Which makes Palantir’s moat n-dimensional: use generates depth, depth generates dependence.

This is how Palantir sidesteps the gravity of model commoditization. While startups offer “preflight” productivity boosts, Palantir delivers full-stack operational autonomy. One Fortune 500 client automated 384 billion daily decisions across 4,000 stores in just eight months. AIG forecasts that Palantir’s stack will double its five-year CAGR by compressing underwriting cycles from weeks to hours. These aren’t marginal wins. They are foundational process shifts that secure long-term incumbency.

The firm now finds itself cited on earnings calls by Walgreens, BP, L3Harris, and Citi. These integrations are not logos, They are pipelines of lock-in. As Palantir agents spread to new areas, such as healthcare payments to combat simulations for the CEOs of the alliance which includes NATO, data feedback loops further cement the platform. Would a $5M startup succeed in mimicking this in six months? Not without rebuilding a decade’s worth of hardened integrations, domain-specific ontologies, and earned government trust.

Palantir’s ontology-first model turns usage into defensibility. The deeper the adoption, the harder it is to replace. That’s what makes the moat exponential.

The Inflection Point that Goes Unseen: Transference of Freakshow to Infrastructure

Two years ago, Palantir was written off as a paranoid defense-focused oddity. Today, it is being brought into the boardrooms of Fortune 500 companies, in many cases to the CEO level, to rewire the way companies work in the AI era. It’s not a perception change, it’s an inflection point indicator. The change is reflected in recruiting trends (rocketing technical hires), in the acceleration of 432 U.S. commercial customers (+65% YoY), and the cross-domain deployment of AIP agents now live across finance, logistics, healthcare, and manufacturing.

This wave remains U.S.-dominant. While Europe trails in AI maturity, Palantir’s U.S. segment grew 55% YoY and represents 71% of revenue. More impressively still, customers are transitioning from pilots to five-year contracts in less than a quarter. A global bank transitioned from pilot to $19M ACV in four months. A top healthcare company signed a $26M five-year contract five weeks after a boot camp. The momentum is no longer anecdotal; it’s systemic.

Source: 6sense

Narratively, Palantir is shifting from “controversial defense contractor” to “AI-native operations infrastructure backbone.” It’s expanding from government and healthcare into commercial command centers as the operational layer for compliant, mission-critical AI deployment. In a world where every firm is being re-architected to a cloud-native or AI-native model, Palantir is the one building the scaffolding.

The market hasn’t yet priced in this platform pivot. Palantir’s evolution from specialty software to core infrastructure is the inflection that may drive a major rerating.

Valuation Disparities and Virality Triggers: A Mispriced Platform

In spite of its Q1-2025 revenue run rate above $3.5B and rule-of-40 performance in the top-decile public software companies, Palantir’s valuation still resembles that of a high-risk defense contractor. The earnings formula has now altered. With $1.6-$1.8B adjusted free cash flow FY25 guidance and a 42% FCF margin, Palantir is on the cusp of GAAP profitability with a venture-like potential. It’s a reverse-unicorn, an infrastructure platform that’s valued as a consulting company.

Optionality is still being ignored. AIP isn’t valued as an enterprise autonomy layer. The Maven Smart System, implemented by NATO and proliferating to DoD combatant commands, receives little recognition by analysts still valuing it as standard government SOW revenue. Meanwhile, institutional demand is quietly rising, driven by geopolitical urgency, and mentions of Palantir on non-tech earnings calls are increasing organically.

This type of organic, bottom-up evangelism recalls the early momentum of platforms like Snowflake and Nvidia en route to index-level re-ratings. Retail sentiment, however, remains hesitant, still wounded by SPAC-era volatility.That creates a compelling contrarian setup: accelerating fundamentals, lagging narrative, and deeply mispriced optionality.

Palantir’s current valuation still reflects yesterday’s perception. Its operations, however, are building a platform for a structurally different future. That delta is the asymmetry.

Final Takeaway

Palantir is no longer the freakshow, it’s the foundation. Follow U.S. commercial TCV ontology agent deployment and persistent 40%+ FCF margins. If these persist in the next 6-12 months, the stock isn’t a buy, it’s a possible 5x platform rerating waiting to be realized.

Disclosure:

Yiannis Zourmpanos has a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives.