Palantir Stock: Edge On Transforming Data into Organizational Efficiencies

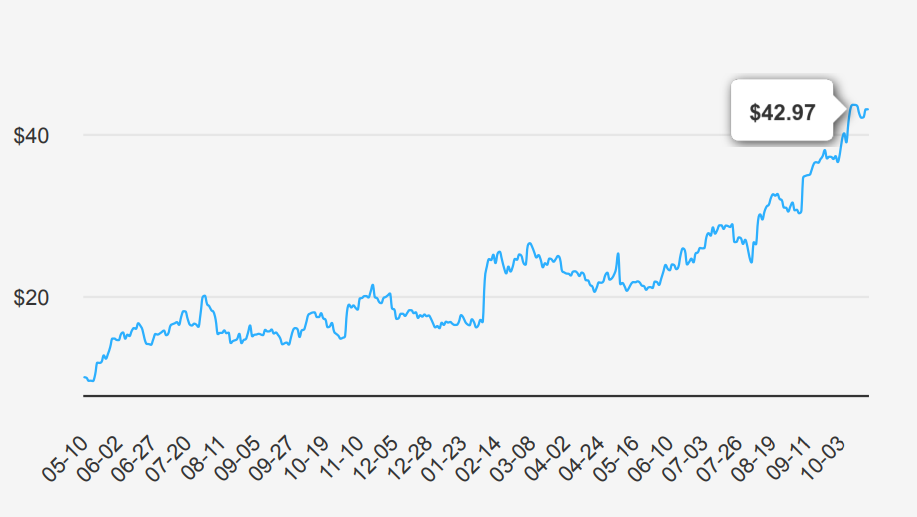

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients’ organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020. Currently, PLTR stock is trading around $43.

Palantir Earnings Q2 2024: Growth Metrics and Projections

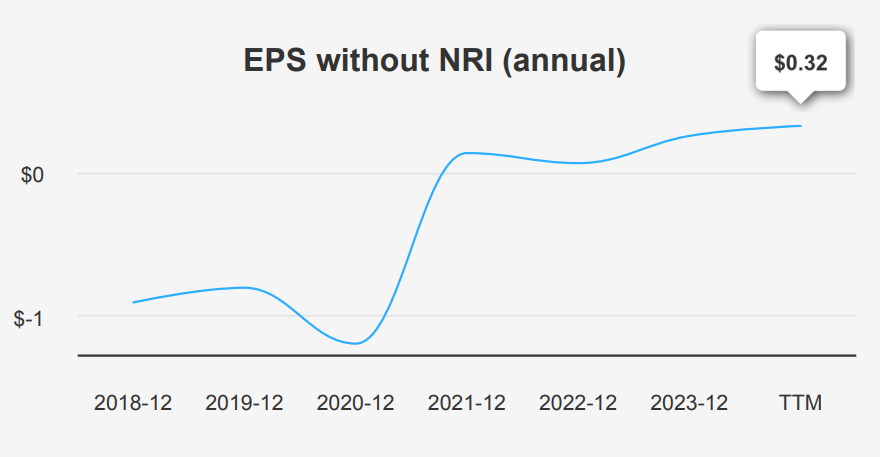

Palantir Technologies reported earnings for the quarter ending June 30, 2024, showcasing an EPS without non-recurring items (NRI) of $0.09, up from $0.08 in the previous quarter and a significant increase from $0.05 in the same quarter last year. This improvement reflects a continuous positive trajectory in earnings. The EPS (Diluted) rose to $0.06, from $0.04 in the first quarter of 2024 and $0.01 a year ago, indicating strong operational performance. Revenue per share also climbed to $0.281, a steady rise from $0.264 in Q1 2024 and $0.234 in Q2 2023. The company doesn’t have a significant compound annual growth rate (CAGR) over the 5 or 10 years, but the present growth is promising.

Palantir’s gross margin reached 81.39%, the highest in a decade, reflecting robust efficiency in managing production costs relative to revenue. This margin is above both the 5-year median of 77.99% and the 10-year median of 75.11%, indicating improved operational efficiency. However, the company’s share buyback ratio remains negative over various periods, with a 1-year buyback ratio at -4.10%, suggesting Palantir has issued more shares than it has repurchased, diluting earnings per share (EPS) slightly.

Looking forward, the next earnings announcement is scheduled for November 4, 2024. Analysts estimate that the company will generate an EPS of $0.188 for the next fiscal year and $0.240 for the year after. Revenue forecasts suggest a growth trajectory, with estimates reaching $2,758.19 million by 2024, $3,328.35 million by 2025, and $3,991.43 million by 2026. The industry is expected to grow at an average annual rate of 11% over the next decade, which could support Palantir stock’s expansion if it capitalizes on market opportunities effectively.

Quantitative Analysis of Palantir’s ROIC vs. WACC Trends

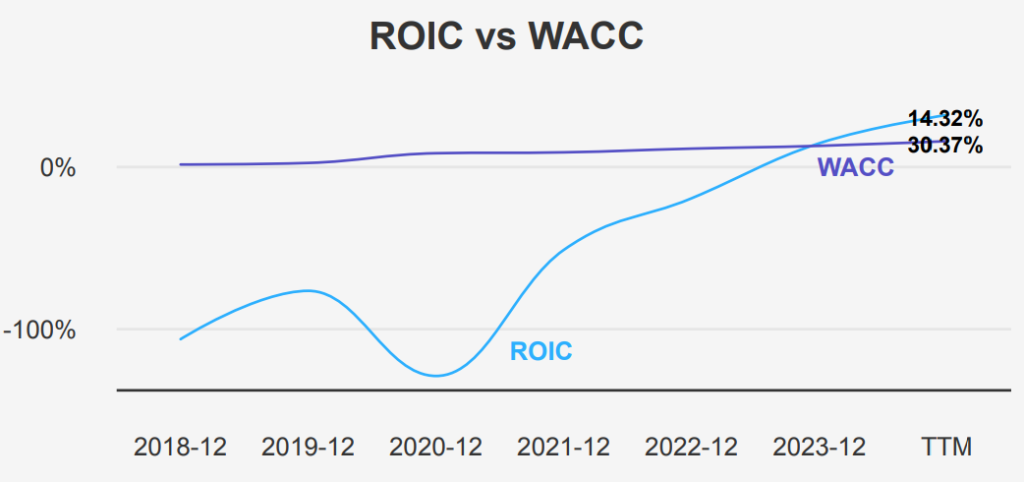

Palantir Technologies has shown a notable improvement in its financial performance, as indicated by the key metrics of Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). Currently, PLTR’s ROIC stands at 30.37%, which significantly exceeds its WACC of 14.31%. This indicates that the company is generating substantial economic value over its cost of capital, reflecting efficient capital allocation and effective operational management.

Historically, PLTR’s financial efficiency was poor, with a 5- year median ROIC of -52.27% and a WACC of 7.46%, indicating a period when the company destroyed value rather than created it. The current ROIC surpassing the WACC suggests effective capital allocation and improved operational efficiency. This shift not only marks a crucial step in enhancing shareholder value but also reflects PLTR’s strategic adjustments, which contribute to better returns on investments. The improvement in ROIC highlights the company’s capacity to leverage its capital more effectively, redefine its cost structure, and focus on more profitable ventures, ultimately representing a positive outlook for Palantir stock price prediction 2040.

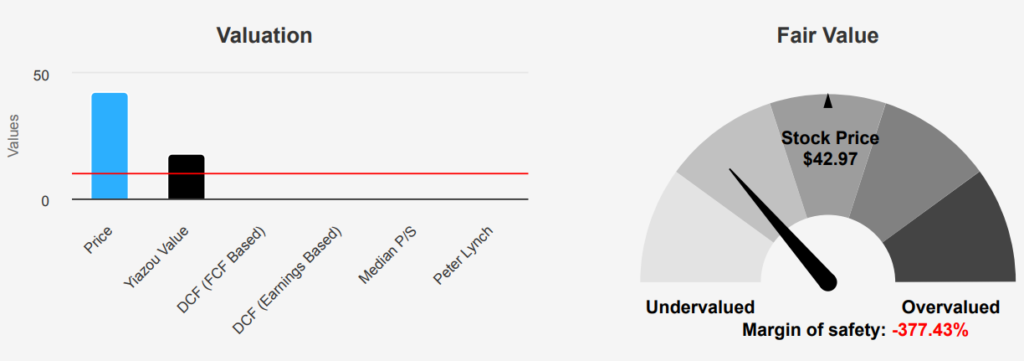

PLTR Stock Valuation: Overvaluation Risks Quantified

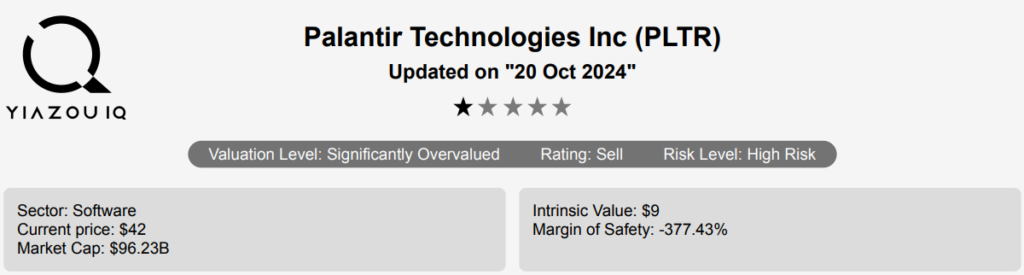

Palantir stock currently trades at $42.97, significantly higher than its calculated intrinsic value of $9, indicating a negative margin of safety of -377.44%. This indicates that the stock is considerably overvalued relative to its intrinsic value. The Forward P/E ratio stands at 99.47, and the TTM P/E ratio is 252.76, both of which are above the 10-year median of 209.35, suggesting a potential

overvaluation. The TTM P/S ratio is at 41.16, slightly below the 10-year high but substantially above the median of 18.53, further indicating a high market valuation compared to historical standards.

Examining other valuation metrics, the TTM EV/EBITDA ratio is 222.21, with historical extremes ranging widely but a negative median of -33.57, reflecting potential volatility and previous periods of negative EBITDA. The TTM Price-to-Free-Cash-Flow stands at 145.66, which, while below the extreme historical high, is far above the median of 86.52, indicating investors are paying a premium for cash flow. The TTM

Price-to-Book ratio is 23.74, nearly twice the 10-year median of 12.86, reinforcing the assessment of overvaluation.

Under Palantir stock price prediction 2040, Analyst outlooks suggest a price target of $28.59, which is gradually increasing, yet it remains well below the current trading price, indicating a consensus view that the stock is trading at overvaluation. With 19 analyst ratings, the trend reflects skepticism about the current pricing sustaining itself long-term. Overall, PLTR appears overvalued based on these metrics, with significant deviations from historical norms,

suggesting caution for potential investors.

Evaluating Palantir Stock Through Quantifying Risk Versus Reward

Palantir stock price prediction 2040 presents a mixed risk profile for potential investors. On the positive side, the company demonstrates strong financial stability, indicated by its high Altman Z-score of 54.99 and a robust Piotroski F-Score of 7, suggesting overall financial health. Additionally, its Beneish M-Score of -2.16 indicates a low likelihood of earnings manipulation, and the firm’s ability to cover interest expenses with its cash reserves reflects a solid financial footing.

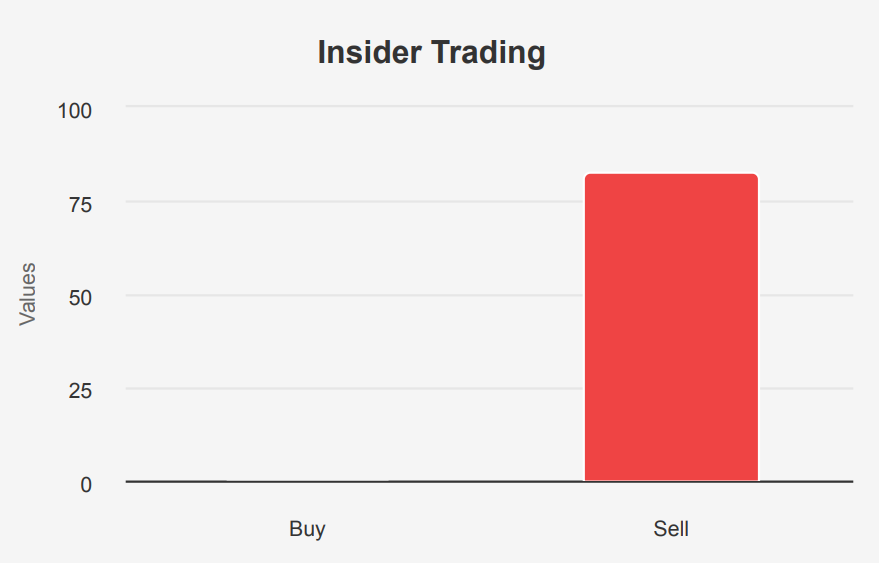

However, there are significant warning signs to consider. The stock is trading near its 5-year high, with a price-to-sales ratio close to its historical peak, suggesting potential overvaluation. The company’s declining revenue per share over the past three years raises concerns about its growth prospects. Furthermore, the high Sloan ratio indicates that a large portion of earnings may be accrual-based, questioning earnings quality. Insider selling is another red flag, with 27 transactions and over 40 million shares sold, which could imply a lack of confidence from within the company. Lastly, the lower tax rate boosting earnings may not be sustainable in the long term, posing potential risks to future profitability.

Insider Trading Trends: High Sell Volume, Low Ownership

The insider trading activity for Palantir stock over the past year reveals a significant trend of selling by the company’s directors and management, with no recorded insider purchases. In the past three months alone, there were 28 sell transactions, and this trend accelerates when looking at the six-month (47 sales) and twelve-month periods (83 sales). This consistent pattern of selling without any buying could indicate that insiders might perceive the stock as being overvalued, or it could be part of planned sales for liquidity or diversification purposes.

Currently, insider ownership stands at a modest 0.51%, suggesting that those within the company have a relatively small stake in PLTR. Meanwhile, institutional ownership is notably higher at 39.91%, which might imply that institutional investors have more confidence or interest in the company’s prospects. The disparity between insider and institutional ownership could be a point of interest for potential investors assessing the Palantir stock price prediction 2040 and governance dynamics.

Assessing Palantir’s Trading Volume and Liquidity Dynamics

Palantir Technologies Inc. (PLTR) has demonstrated a robust trading volume, with a current daily volume of 33,674,471 shares. However, this is below its average daily trading volume over the past two months, which stands at 62,098,929 shares. This discrepancy suggests a reduction in current trading activity compared to its recent average, potentially indicating less market interest or liquidity pressure.

The Dark Pool Index (DPI) for PLTR is 56.29%, indicating that more than half of the trades are occurring in dark pools, away from traditional exchanges. This level of dark pool activity can imply that significant trading is happening out of the public eye, which might affect market transparency and impact liquidity. High DPI levels could suggest that institutional investors are actively trading the stock, potentially leading to price movements that are not immediately visible to retail investors.

In summary, while PLTR maintains a significant trading volume, the decrease from its two-month average and high dark pool activity could suggest a shift in trading dynamics. Investors should consider these factors when assessing PLTR’s liquidity and potential price volatility.

Palantir’s Government Contracts: Growth at 21% CAGR

Palantir Technologies Inc. (PLTR) has shown a consistent upward trend in government contracts from 2019 to 2024. This reflects a compound annual growth rate (CAGR) of around 21% over the six-year period. Over the years 2019 to 2024, contract amounts increased from $163.2 million to an estimated $435.4 million. Notably, 2020 and 2022 marked significant surges, with amounts reaching $269.4 million and $376.8 million, respectively. The projected increase in 2024 suggests continued expansion and reliance on government partnerships, highlighting Palantir’s strong foothold and strategic positioning in the public sector market.

Palantir’s Patent Filings: Growth Trend with Projected Decline

Over the past five years, Palantir Technologies (PLTR) has shown a consistent increase in patent filings in the United States, with a notable upward trend from 2019 to 2023. Starting with 151 patents in 2019, the company experienced steady growth each year, reaching 210 patents by 2023. This indicates a strong focus on innovation and expansion in intellectual property. However, there’s a projected decline to 137 patents in 2024, suggesting a possible shift in strategy or focus.

Congressional Trading Insights: Representative DelBene’s PLTR Exchange

On June 18, 2021, Representative Suzan K. DelBene, a Democrat in the House of Representatives, executed a significant transaction involving Palantir Technologies (ticker: PLTR). The transaction was categorized as an “exchange” and the amount involved was between $100,001 and $250,000. The report for this transaction was filed on July 19, 2021. This trade is noteworthy not only because of its size but also due to the timing and the choice of stock, considering Palantir’s prominence in data analytics and its potential for growth in government and commercial sectors. Such trades often attract attention as they may reflect a legislator’s confidence in a company’s future performance or strategic moves. It’s important for observers to consider the broader market context and any relevant legislative activities that could impact the value of Palantir’s stock at the time of the transaction.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.