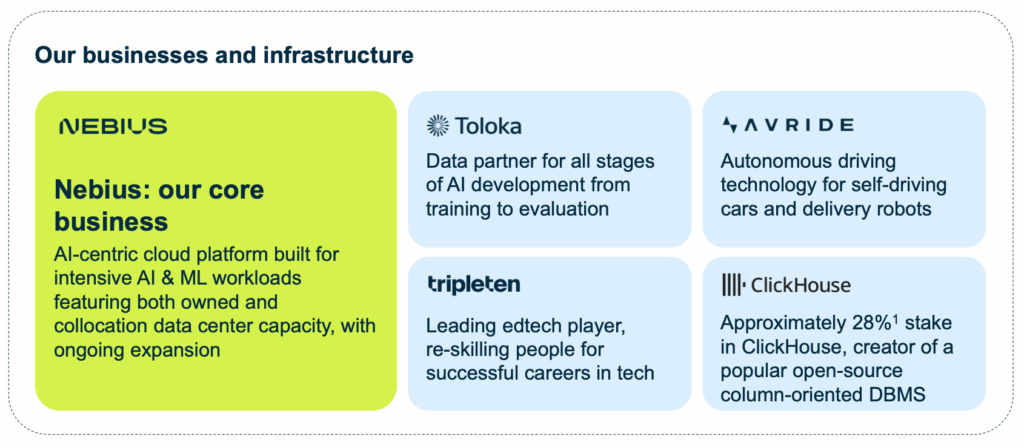

Nebius Group (NBIS) is now one of the most highly capitalized and fastest-growing international players in the AI infrastructure race. The business inherited, from the former Yandex carve-out, not only massive intellectual property but one of the largest GPU buying queues beyond the hyperscalers.

Supported by Nvidia, Accel, and Orbis, to name just a few, the company raised $700 million late in 2024 to support an ambitious rollout of full-stack compute clusters in the U.S. as well as Europe. Nebius held $2.45 billion in cash as of the close of 2024 with an unequivocal mandate in hand: be the leading vertically integrated platform for creating, training, and inferring AI models.

Source: Nebius Investor Presentation

Its Q1 2025 numbers confirmed accelerating momentum, with revenue up 385% year over year to $55.3 million and contracted ARR surpassing $220 million. Its year-end ARR target of $750 million to $1 billion, along with estimated 2025 revenue of $520.5 million, suggests a front-loaded buildout and growing enterprise traction.

Source: Nebius Q1 2025 Financials

Yet despite this momentum, the company’s stock trades at an EV of ~$10.3B and a market cap of ~$11.6B, or just ~10x on the 2025E ARR midpoint ($750M–$1B), a substantial discount to public and private comps. Investors continue to misprice Nebius as a GPU lessor, not as a vertically integrated, full-stack AI platform.

Unlock Asymmetry

High-conviction ideas in mispriced assets

You’re Almost In!

Check your inbox (+ spam folder) to verify your email.

Nebius SOTP: Unlocking Hidden Value

The valuation framework for Nebius applies a bottom-up Sum-of-the-Parts (SOTP) approach to capture the company’s multi-segment structure. Each unit, AI Cloud, Toloka, Avride, TripleTen, and strategic stakes, is valued independently based on 2025E revenue, peer multiples, and operational momentum.

1. Core AI Infrastructure – Nebius.AI ($9.0 Billion)

The core of Nebius’s value proposition rests in its cloud-native AI-infrastructure. Unlike conventional hyperscalers, Nebius was purpose-built for high-density, low-latency GPU compute. Its thermal design, orchestration layer, and AI-centric software stack (AI Studio) position the platform to serve demanding AI customers, LLM developers, and inference-heavy enterprises.

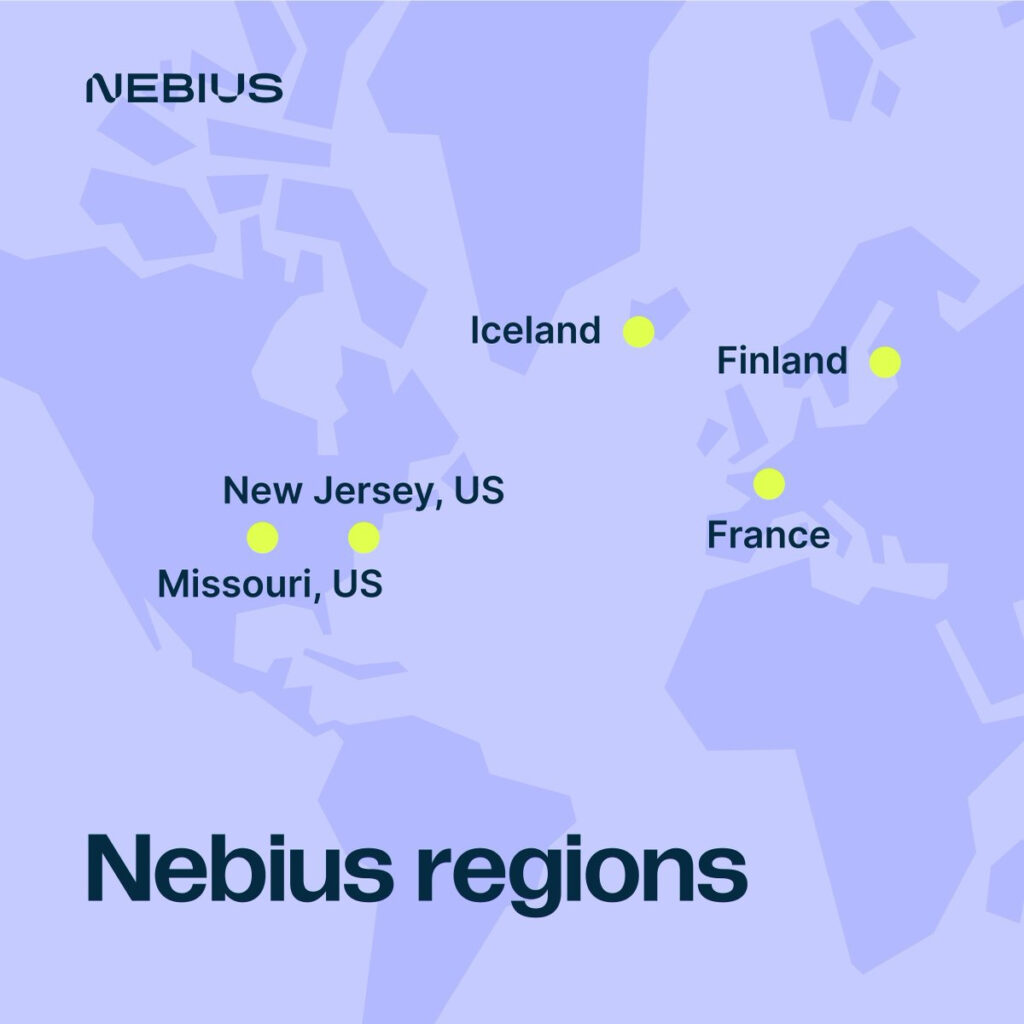

As of Q1 2025, Nebius had over 30,000 H100 GPUs online, with another 22,000 Blackwell-class chips on order. New capacity is coming online in Finland, Iceland, Kansas City, and New Jersey, with a goal of reaching 100MW of live capacity in 2025.

The AI Cloud Infrastructure segment, Nebius AI, is the company’s foundational business unit, providing full-stack, high-density compute for model training and inference. As of March 2025, management disclosed an ARR of $220 million for this segment alone, with clear internal guidance pointing to $600+ million ARR by year-end.

With projected 2025 revenue of $605 million and benchmarking against CoreWeave’s ~29x EV/Sales multiple, Nebius AI deserves a conservative 15x multiple—supporting a standalone ~$9 billion valuation. The business benefits from high AI workload stickiness, proprietary orchestration software (AI Studio), and a capex-heavy moat via data centers scaling toward 99MW usable capacity and ~78,000 GPUs by year-end.

This multiple is well-justified on several fronts:

- Growth Velocity: With ARR growing over 300% year-over-year and GPU capacity scaling aggressively, the business is not in a steady-state phase but in hyper-expansion. Growth-adjusted multiples (PEG-like logic for infrastructure) support higher valuation thresholds.

- Hardware Moat and Vertical Integration: Unlike AWS or Azure, Nebius builds and operates proprietary racks, orchestration software (AI Studio), and controls physical thermal/latency architecture, justifying a premium over “GPU rental” businesses.

- Infrastructure Stickiness: AI workloads tend to be sticky. Clients don’t migrate inference or training pipelines easily. This durability makes ARR more “SaaS-like,” reinforcing justification for high revenue multiples.

In sum, a $9.0 billion valuation for Nebius.AI’s cloud business reflects strong visibility, structural advantages, and comp-driven conservatism.

Source: Nebius Investor Presentation

2. Toloka – AI-Powered Data Labeling ($600 Million)

Toloka’s data solutions business line using AI generates the data backbone layer used to train frontier models. It is used to perform the functions of evaluation, red-teaming, generation of synthetic data, and alignment with safety, which is essential for model quality as well as regulatory compliance. During Q1 2025, Toloka introduced AI-augmented workflows combining LLM-based automation with domain specialist review, with cost as well as throughput benefits.

With revenue growth as high as 140% year over year, with clients such as global AI labs, cloud platforms, and e-commerce leaders, Toloka is rapidly transforming from an audience marketplace to an all-stack alignment platform. Valuation is sanctioned with the May 2025 funding from Jeff Bezos’s family office as well as the hiring as chairman of an ex-Shopify executive.

Source: Nebius Investor Presentation

We assign a 10x multiple to $60 million in estimated 2025 revenue, giving it a $600 million valuation. This aligns with private comps like Scale AI (15–20x) and reflects the improving margin profile of hybrid AI-data services. A future spin-out or merger into a global AI safety infrastructure is plausible.

3. TripleTen – Scalable, Strategic EdTech ($250 Million)

TripleTen is the edtech segment of Nebius, providing affordable AI-literate bootcamps in software engineering, cybersecurity, and data science. Though not central to the AI infrastructure thesis, it plays a strategic role. With over 14,000 new learners in 2024 and expansion into Latin America, TripleTen is gaining ground on high-cost incumbents like Coursera and General Assembly.

Source: Nebius Investor Presentation

Approaching breakeven, the business is increasingly productized with AI features like automated grading and tutor bots. We estimate $50 million in 2025 revenue and apply a 5x multiple, valuing the segment at $250 million. It delivers stable growth and cash flow, while reinforcing Nebius’s broader mission to enable the full-stack AI economy.

4. Avride – Autonomous Systems ($3.5 Billion)

We assign a $3.5 billion valuation to Avride, Nebius’s autonomous systems unit, based on a triangulation of market comps, deployment metrics, and pipeline optionality. This figure reflects a rational midpoint between scaled delivery autonomy players and high-capex full-stack AV platforms.

First, Avride’s operational footprint already exceeds that of most early-stage robotics companies. The business has completed over 200,000 autonomous deliveries across college campuses and urban pilots, a figure that places it in the top tier of active delivery robotics operations globally. For reference, Serve Robotics, which recently filed for a public listing via SPAC, operates at smaller scale and was last valued around $300–400 million with under 50,000 lifetime deliveries.

Second, Avride’s roadmap extends well beyond sidewalk bots. It includes robotaxi pilots, logistics partnerships, and a developing autonomy-as-a-service (AaaS) layer—comparable to the vision of Zoox (acquired by Amazon for ~$1.2 billion) and Motional, which has received multi-billion dollar funding despite unclear revenue traction. While Avride is not competing in the same capital intensity bracket as Zoox, its integration within Nebius’s AI cloud infrastructure stack offers unique synergies (real-time inference, model retraining), enhancing its operating leverage.

Third, regulatory tailwinds are emerging. The EU Commission’s 2025 Autonomous Mobility Framework creates a favorable sandbox for scaling across logistics and micromobility verticals. As urban infrastructure adapts and legal clarity improves, deployment friction will decline—allowing for faster monetization of Avride’s capabilities.

Taken together, these inputs justify a ~7x multiple on projected forward revenue (~$500M estimate for 2026) or a strategic value-based midpoint vs peers. This supports the $3.5 billion valuation until further upside catalysts emerge.

Source: Nebius Investor Presentation

5. ClickHouse Stake ($1.68 Billion)

ClickHouse is raising a new round at a $6 billion post-money valuation. If Nebius maintains its 28% stake (by contributing ~$168M), the position is worth $1.68 billion. If it declines to participate, its stake drops to ~25% ($1.5B), still materially above prior estimates.

6. Net Cash

Q1 net cash was $1.44 billion, down from $2.4 billion due to elevated CapEx. We assume $168M will be used to preserve the ClickHouse stake. Remaining deployable capital: $1.27 billion.

Sum-Of-The-Parts Valuation Summary

| Segment | Valuation |

|---|---|

| Nebius AI Cloud | $9.0B |

| Avride | $3.5B |

| TripleTen | $0.25B |

| Toloka Stake | $0.6B |

| ClickHouse Stake | $1.68B |

| Net Cash | $1.27B |

| Total Valuation | $16.3B |

Diluted Shares Outstanding: 239.4M

Implied Intrinsic Value/Share: ~$68.1 → Rounded to $70 Target

Why Nebius Could Rerate to $70/share

A $70/share price implies a ~$16.8 billion fully diluted equity value. This reflects ~46% upside from the current share price of $48, justified by three drivers:

- Revenue Repricing: CoreWeave trades at 9.8x on 2025E revenue. Applying a slightly higher multiple to Nebius’s $605 million base case yields $9 billion for Nebius AI alone.

- Asset Visibility: The $1.68 billion ClickHouse stake and $600 million Toloka stake provide tangible strategic value.

- Capital Flexibility: With $1.27 billion in cash, Nebius can scale without dilution—an advantage few AI infrastructure firms enjoy.

If Avride monetizes externally or GPU utilization improves from 60% (April) to modeled 70% in Q3/Q4, a $70/share re-rating becomes conservative. This is not blue-sky optimism—it’s simply market normalization.

The Street still sees Nebius as a GPU rental shop. We believe it’s a platform company laying the rails and building the station for the AI economy.