Microsoft Stock: Value Supported By Multiple Business Segments and Core Competencies

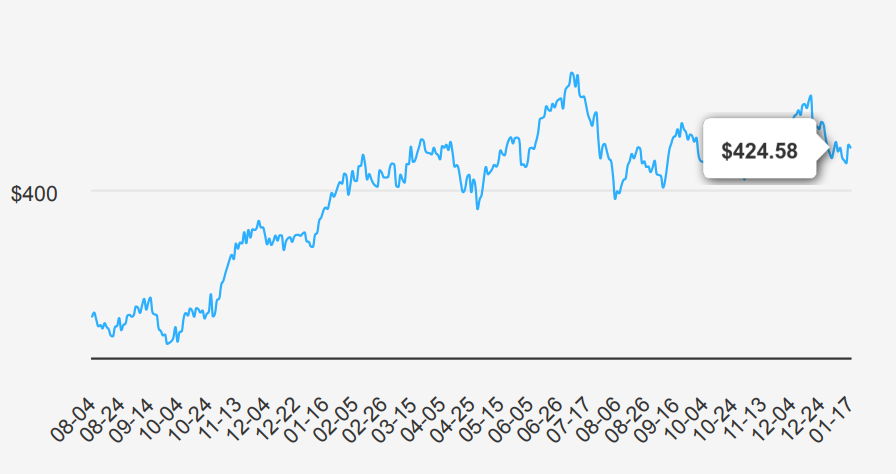

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops). MSFT stock is trading near $425. Let’s delve into Microsoft stock forecast.

10-Year CAGR Trends and 2025 Revenue Forecast

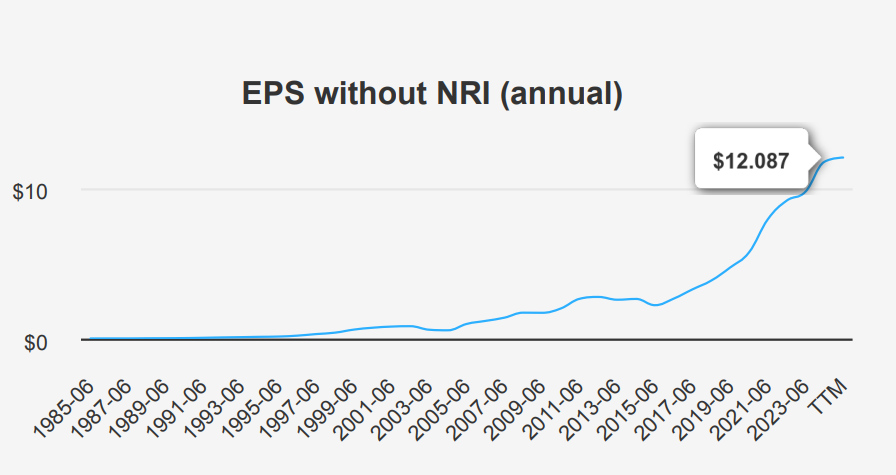

Microsoft’s recent earnings for the quarter ending September 30, 2024, showed an EPS without NRI (excludes non-recurring items) of $3.267, up from $2.95 in the previous quarter and $3.003 for the same quarter last year. The EPS (Diluted) was slightly higher at $3.3, reflecting a continued strong performance. Revenue per share increased to $8.78 from $8.659 in the prior quarter and $7.574 a year ago. Over the past five years, Microsoft has achieved a Compound Annual Growth Rate (CAGR) of 19.70% in EPS without NRI, and 19.20% over the last decade, indicating robust growth. Industry forecasts suggest a significant growth of about 10% annually over the next decade, driven by advancements in cloud computing and AI technologies.

Microsoft maintained a gross margin of 69.35% this quarter, marginally above its five-year median of 68.92% and close to its 10-year high of 69.76%. This demonstrates effective cost management and strong pricing power in its core markets. The share buyback ratio over the past year was -0.10%, indicating a slight net issuance of shares, contrasting with a more aggressive buyback approach seen in previous years. A buyback ratio of 0.90 over the past decade translates to 0.90% of outstanding shares being repurchased, reflecting strategic capital allocation to enhance shareholder value.

Looking ahead, analysts estimate revenue to reach $278.4 billion by June 2025, increasing to $317.9 billion by 2026 and $365.1 billion by 2027. The next earnings release is scheduled for January 29, 2025. The estimated EPS for the upcoming fiscal year is projected at $13.007, rising to $14.967 the following year, underscoring a positive growth trajectory as Microsoft continues to capitalize on its strategic investments in cloud infrastructure and AI development.

MSFT Stock: ROIC, WACC, and Shareholder Value Metrics

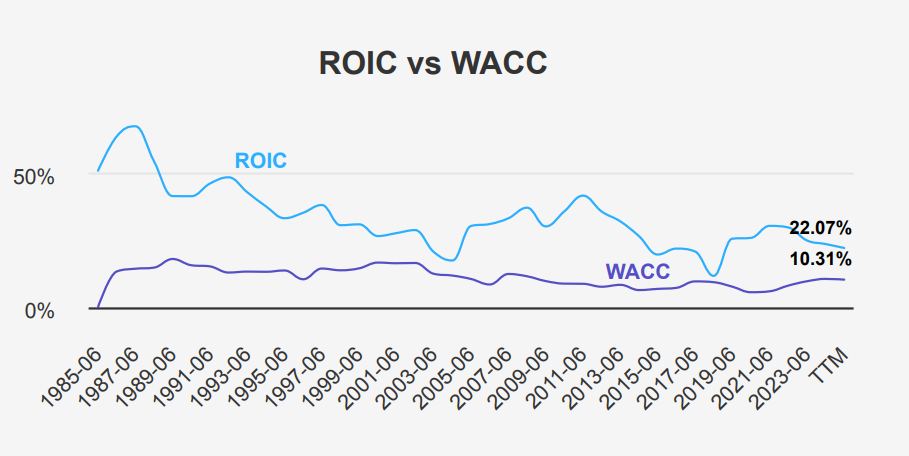

Microsoft demonstrates strong financial performance and efficient capital allocation, as evidenced by its Return on Invested Capital (ROIC) consistently exceeding its Weighted Average Cost of Capital (WACC). Over the last five years, MSFT’s median ROIC stands at 25.83%, significantly higher than its median WACC of 8.09%. This indicates that Microsoft is generating substantial economic value, as the returns on its invested capital far surpass the costs of obtaining that capital.

The company’s ability to maintain an ROIC of 22.07% in recent periods, despite a WACC of 10.31%, further underscores its efficient use of capital to drive shareholder value. This positive spread between ROIC and WACC suggests that Microsoft effectively allocates its resources to projects that yield high returns.

Moreover, Microsoft’s high median ROE of 40.14% over five years highlights its robust profitability and capacity to generate returns on equity, reinforcing the company’s position as a value creator in the industry. Overall, MSFT’s financial metrics reflect a well-managed capital structure that contributes to enduring shareholder value.

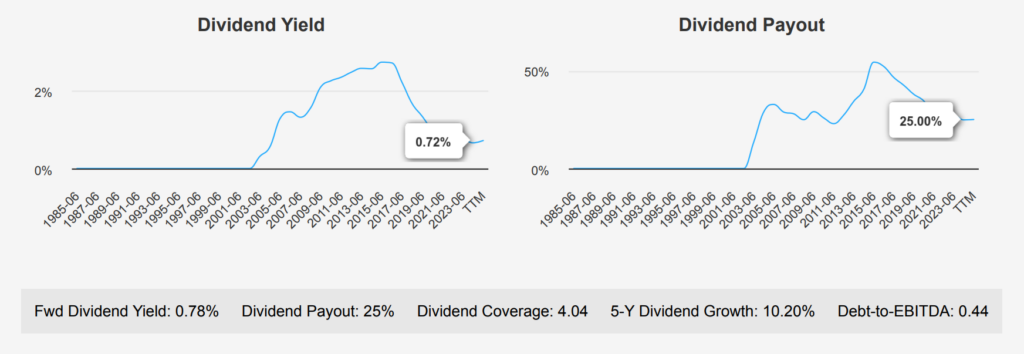

Sustained Growth with Low Payout Ratio

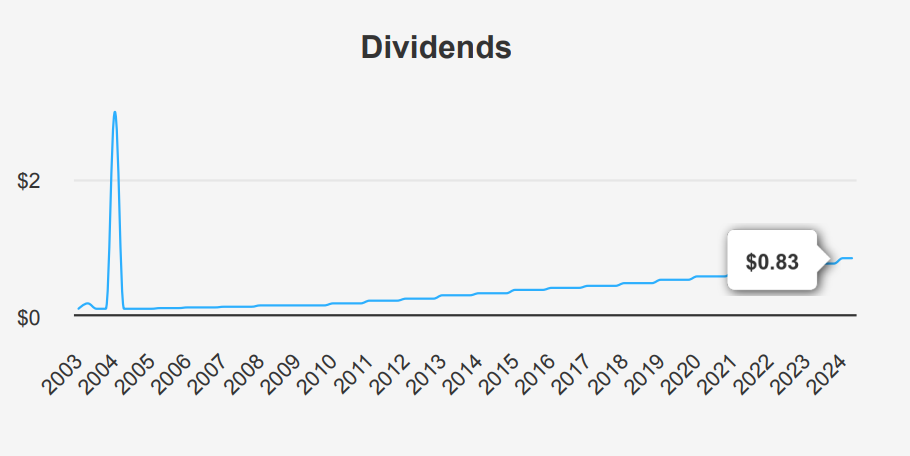

MSFT stock has shown a robust dividend growth performance, with a 5-year growth rate of 10.20% and a similar 3- year rate. The most recent increase in the dividend per share from $0.75 to $0.83 highlights continued confidence in financial health. The forward dividend yield stands at 0.78%, which is below the 10- year median yield of 1.18%, reflecting a relatively high stock price or lower yield environment.

The company’s debt-to-EBITDA ratio is notably low at 0.44, indicating strong debt servicing capacity and lower financial risk, well below the cautionary threshold of 2.0. This suggests a solid financial foundation supporting its dividend policy.

Despite a low % dividend payout ratio of 25%, there is substantial room for future dividend increases, aligned with the forecasted 3-5 year dividend growth rate estimate of 9.80%. This positions Microsoft favorably compared to its sector peers. The next ex-dividend date is on February 20, 2025, following the company’s quarterly dividend schedule, which aligns with regular expectations. Under Microsoft stock forecast, its strong financial metrics and consistent dividend growth make it an attractive option for income-focused investors looking for stability and growth potential.

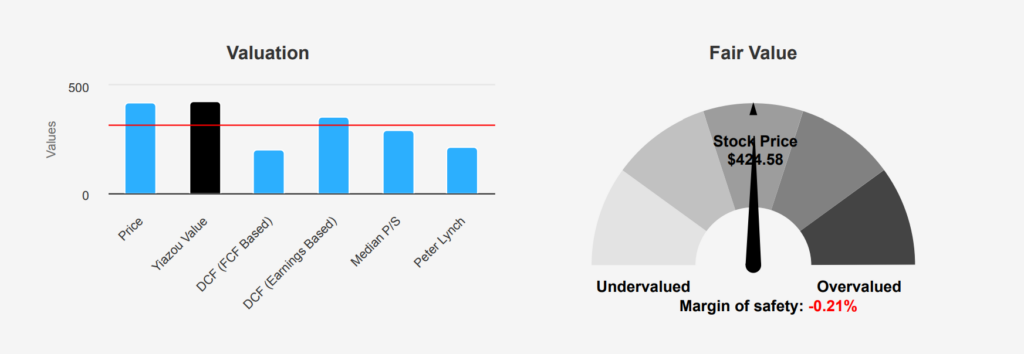

Intrinsic Value and Premium Multiples

Microsoft’s current intrinsic value is pegged at $423.64, slightly below its market price of $424.58, resulting in a negligible margin of safety of -0.22%. This suggests that the stock holds fair value with minimal room for price appreciation. The Forward P/E ratio stands at 32.64, compared to the TTM P/E of 35.03, indicating expectations of continued earnings growth. Both metrics are above the 10-year median of 32.30, pointing to a valuation on the higher end historically. However, the current P/S ratio of 12.45 is significantly above the 10-year median of 8.81, suggesting potential overvaluation.

The TTM EV/EBITDA ratio is 22.6, which sits above the 10-year median of 17.60 but well within the range observed over the past decade. This highlights a premium being placed on the company’s operational earnings. The TTM Price-to-Free-Cash-Flow at 43.71 is notably higher than its 10-year median of 29.33, reflecting strong free cash flow generation but also possibly indicating that investors are paying a premium for that cash flow. The TTM P/B ratio stands at 10.97, slightly above its historical median, suggesting that investors are currently valuing Microsoft somewhat more richly than usual.

Analyst ratings suggest a positive outlook, with a price target of $503.47, which has seen a slight increase over the past three months. This implies confidence in Microsoft’s future performance despite its current tight valuation. Given the current metrics, the stock appears relatively fully valued with little margin of safety, indicating that while Microsoft remains a strong company, investors should weigh these valuations carefully against growth prospects under Microsoft stock forecast.

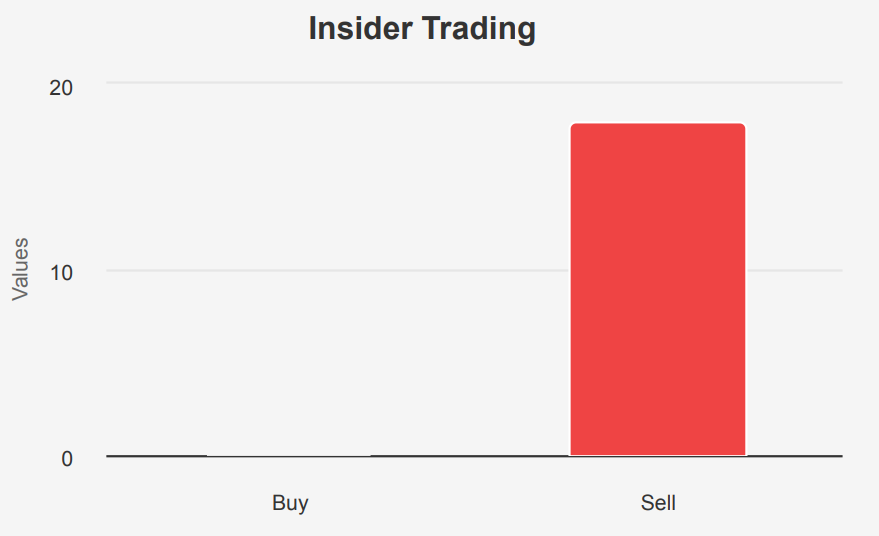

MSFT Stock: Insider Selling and Operational Efficiency Concerns

Microsoft’s financial indicators present a mixed outlook. The company’s total assets have been growing at 23.2% annually, outpacing its revenue growth of 15.2% over the past five years. This may suggest potential inefficiencies in asset management, raising concerns about its operational efficiency. Additionally, insider activity shows six selling transactions with no buying, totaling 41,200 shares sold, which might indicate a lack of confidence among insiders. This is along with the stock trading near a 10-year high, potentially limiting the upside due to valuation concerns.

On the positive side, Microsoft’s financial health appears robust. Its Beneish M-Score of -2.35 suggests low manipulation risk, while a strong Altman Z-score of 9.87 indicates financial stability. The company’s expanding operating margin is a positive sign of improved profitability. Furthermore, valuation metrics like the price-to-book ratio at 11.02 and price-to-earnings ratio at 35.17 are near their one-year lows, suggesting the stock may not be overly expensive relative to recent history. Overall, Microsoft demonstrates solid financial strength and predictable growth, although potential inefficiencies and high market valuation warrant cautious optimism under Microsoft stock forecast.

Institutional Confidence vs. Insider Transactions

The insider trading activity for Microsoft stock over the past year shows a consistent trend of selling among insiders, with no recorded insider purchases. In the last 3 months, there have been 6 insider sell transactions and no buys, reflecting a pattern that extends across 6 and 12 months, with 12 and 18 sells respectively. This persistent selling trend could indicate that insiders might be capitalizing on recent gains or reallocating their portfolios, rather than expressing a lack of confidence in the company’s future prospects.

Insider ownership stands at 6.18%, suggesting that while insiders hold a notable stake, they are not significantly increasing their positions. In contrast, institutional ownership is robust at 79.50%, indicating strong institutional confidence and support for the stock. This divergence between the actions of insiders and institutions may warrant closer scrutiny by investors, as institutional investors continue to see value in holding MSFT despite insider selling. This trend analysis provides insight into potential shifts in insider sentiment, balanced by institutional commitment.

Robust Metrics Despite Volume Dip

MSFT stock exhibits a robust liquidity profile, supported by its significant trading volume metrics. The daily trading volume stands at 15,163,556 shares, which, while substantial, is lower than its two-month average daily trade volume of 20,383,404 shares. This indicates that current trading activity is slightly below recent averages, which could reflect typical market fluctuations or changes in investor sentiment.

The Dark Pool Index (DPI) is at 52.08%, suggesting that a moderate proportion of trades are happening in non-public exchanges. This DPI level indicates a balanced interest in MSFT shares within the dark pool environment, potentially reflecting institutional investor interest without significantly impacting the stock’s market price.

Overall, the current trading volume and DPI suggest that MSFT maintains strong liquidity, allowing for smooth transactions in both public and private exchanges. This liquidity is crucial for investors, providing ease of entry and exit in the stock with minimal price impact. However, the slight dip below the average trading volume should be under eye to assess if it represents a short-term variance or a longer-term trend. Under Microsoft stock forecast, this analysis highlights MSFT’s capacity to sustain investor interest and maintain trading efficiency in varied market conditions.

Notable Stock Purchases by Key Representatives

In early January 2025, Representative James Comer, a Republican from the House of Representatives, made a notable transaction by purchasing shares of MSFT stock valued between $1,001 and $15,000. The transaction occurred on January 2, 2025, and was reported on January 10, 2025. This purchase aligns with a similar transaction made by Representative Marjorie Taylor Greene, also a Republican, who bought Microsoft shares in the same value range on December 24, 2024, reported on December 27, 2024.

Both transactions indicate a potential Republican interest in Microsoft shares around the turn of the year. These trades could reflect confidence in Microsoft’s performance or strategic positioning within the tech sector. The timing, during a typically quieter holiday trading period, might suggest opportunistic moves anticipating favorable developments under Microsoft stock forecast.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.