Micron Stock: Edging on Its Role in the Global Semiconductor Market

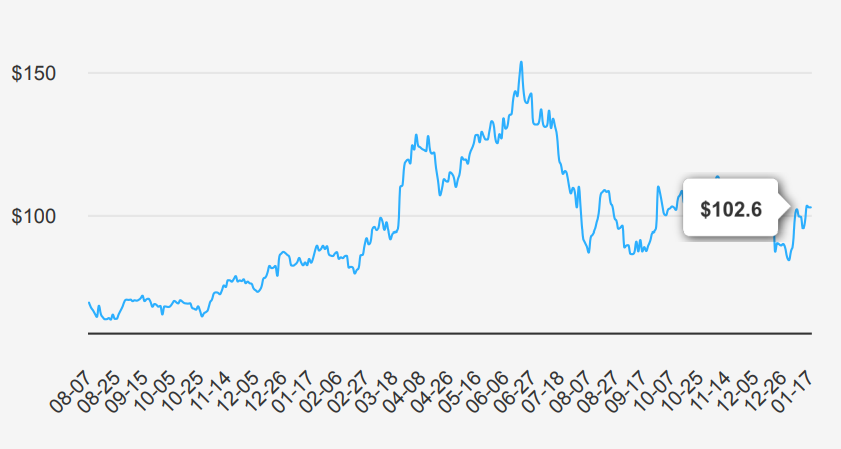

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory or DRAM, and it also has minority exposure to not-and or NAND flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated. The stock is trading at ~$103. Let’s explore Micron stock price forecast.

Micron’s Quarterly Performance and Future Projections

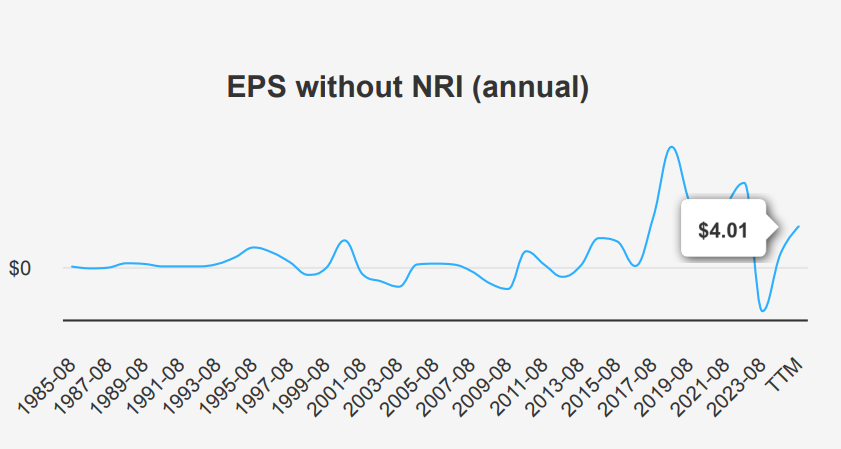

Micron reported substantial improvements in its latest quarterly earnings, with EPS without non-recurring items (NRI) increasing to $1.79, up from $1.18 in the previous quarter, and significantly recovering from a loss of $0.95 in the same quarter last year. The company also saw its revenue per share rise to $7.762 from $6.681 quarter-over-quarter and $4.296 year-over-year. The company’s five-year and ten-year compound annual growth rates (CAGR) for annual EPS without NRI remain stable, indicating flat long-term earnings growth, despite short-term recovery.

Micron’s gross margin for this quarter was 30.92%, slightly above its five-year median of 30.57%, though below its ten-year median of 34.92%. The margin improvement reflects operational efficiency and favorable market conditions. Share buyback activities have been minimal recently, with a one-year buyback ratio of -0.90%, indicating a reduction in shares outstanding, which can enhance EPS by spreading earnings over fewer shares. Analysts estimate Micron’s EPS to grow to $6.330 for the next fiscal year and $9.769 for the following, supported by revenue growth forecasts of $35,058.68 million and $43,876.99 million respectively in the coming years.

The semiconductor industry may grow at a steady pace over the next decade, with some forecasts suggesting an annual growth rate of around 6-8%. This growth may drive demand for memory and storage solutions, benefiting companies like Micron. The next earnings release is on March 20, 2025, offering further insights into Micron stock price forecast.

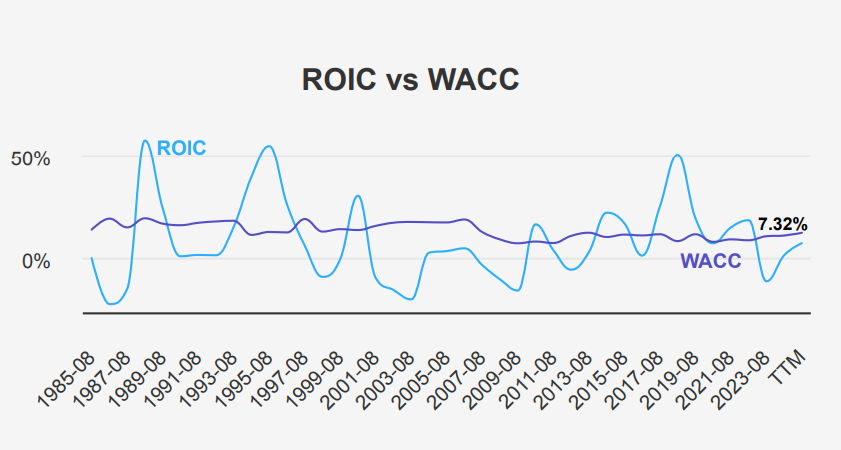

Assessing Micron Stock’s ROIC vs. WACC Efficiency

Analyzing MU’s financial performance through its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) offers insights into its economic value creation. The company’s current ROIC stands at 7.32%, which is below its current WACC of 12.37%. Over the past five years, the median ROIC was 7.29%, while the median WACC was 9.17%. This trend indicates that, historically, MU has struggled to generate returns above its cost of capital, thus not creating positive value consistently.

When the ROIC is less than the WACC, it suggests that the company is not generating sufficient returns to cover its cost of capital, implying negative value creation. This situation might lead investors to question the efficiency of capital allocation and the company’s ability to generate shareholder value. However, it’s important to consider the broader context, such as market conditions and industry cycles, which can impact these metrics. Overall, MU’s need to improve its financial efficiency and strategic investments is evident to enhance economic value creation.

Stable Payouts with Room for Modest Growth

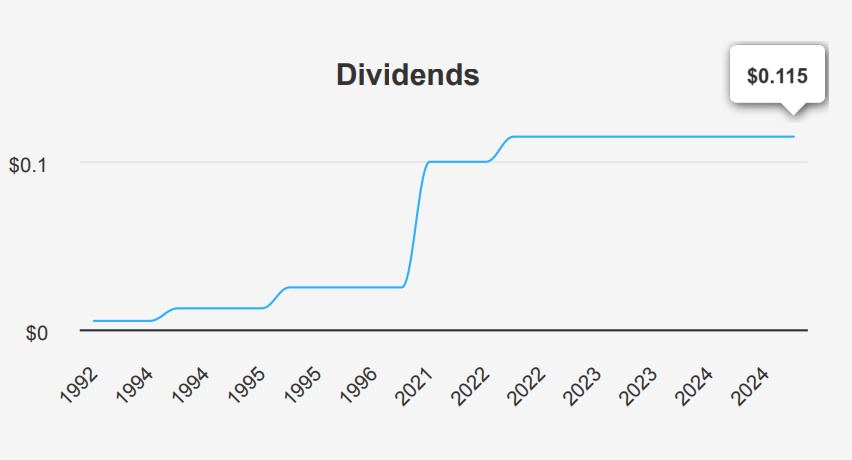

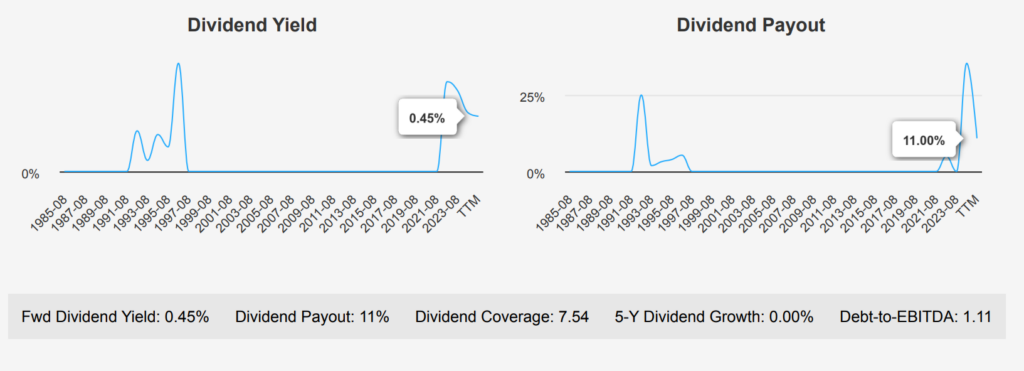

In the most recent quarter, Micron Stock has maintained a consistent dividend per share of $0.115, reflecting no growth in dividends over the past five years. This flat dividend trend is in the 3-year dividend growth rate, suggesting stability rather than growth in dividend payments.

The company’s forward dividend yield stands at 0.45%, which sits below the 10-year median yield of 0.52%, indicating a more conservative dividend strategy in comparison to its historical performance. The dividend payout ratio is notably low at 11.0%, a stark contrast to its historical highs, suggesting ample room for future dividend increases if earnings allow.

Micron’s Debt-to-EBITDA ratio is 1.11, well below the threshold of 2.0, indicating a strong capacity to service its debt and lower financial risk. The future dividend growth rate is at 3.15% over the next 3-5 years, hinting at potential modest increases. The next ex-dividend date is on March 27, 2025, ensuring it falls on a weekday, taking into account the quarterly dividend frequency of four times a year.

Is Micron Stock Overvalued Amid Recovery?

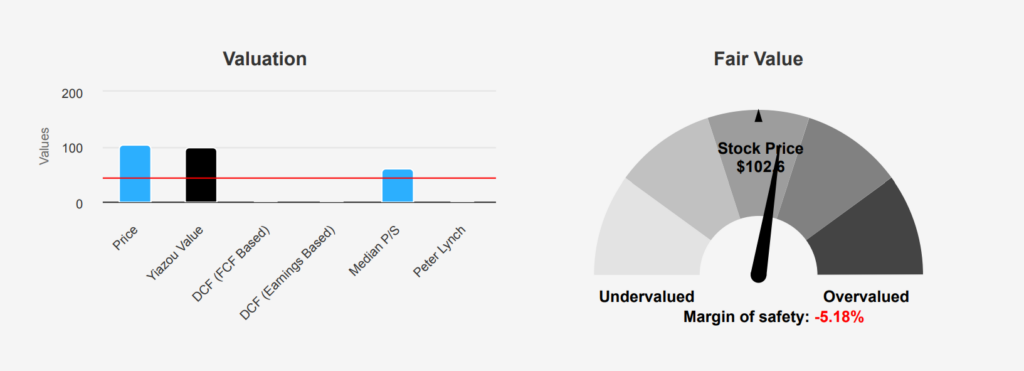

MU stock presents a nuanced valuation profile with its intrinsic value pegged at $97.54, slightly below the current market price of $102.6. This indicates a negative margin of safety of -5.19%, suggesting the stock might holds overvaluation against its intrinsic worth. The TTM P/E ratio is 29.57, higher than its 10-year median of 10.24, indicating potential overvaluation in the current market context. The forward P/E ratio of 14.83, however, suggests expectations of improved earnings, possibly aligning closer to historical norms.

Examining other valuation metrics, the TTM EV/EBITDA ratio of 9.37 exceeds its 10-year median of 6.14, pointing towards a higher valuation compared to its historical average. The TTM P/B ratio of 2.44 is above the 10-year median of 1.72, also suggesting the stock is trading higher than historical norms. Notably, the TTM Price-to-Free-Cash-Flow ratio is exceptionally high at 211.55, significantly above the median, highlighting potential concerns about cash flow valuation.

Analysts’ outlook for MU reflects cautious optimism, with a current price target of $128.45, albeit this has seen a decline over recent months. With 39 analyst ratings, the sentiment appears mixed, possibly indicating concerns about valuation and future growth prospects. The discrepancies in valuation metrics signal a need for investors to tread carefully under Micron stock price forecast, as the stock might be overvalued against its historical performance and intrinsic value.

MU Stock: Insider Selling and Financial Resilience

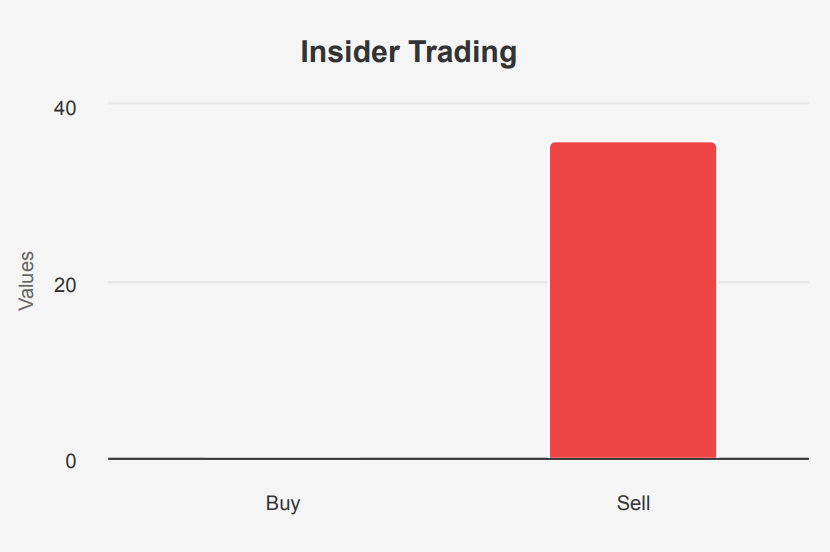

The insider selling activity over the past three months signals potential caution, as three transactions have resulted in the sale of 19,890 shares, with no insider buying. This could indicate a lack of confidence among insiders about the company’s near-term prospects. Additionally, the decline in revenue per share over the past three years raises concerns about Micron Technology Inc.’s ability to grow its top line. The fact that the return on invested capital (ROIC) is lower than the weighted average cost of capital (WACC) suggests inefficiencies in capital utilization, which might hinder overall profitability.

Despite these concerns, Micron Technology Inc. demonstrates strong financial health. The Beneish M-Score of -2.56 indicates that the company is unlikely to be manipulating financial statements, which is reassuring for investors. Furthermore, the company’s Altman Z-score of 4.53 signifies a low risk of bankruptcy, highlighting its financial resilience. The firm’s strong balance sheet provides a solid foundation, mitigating some of the risks associated with declining revenues and capital efficiency issues. Overall, while there are areas of concern, the company’s robust financial position offers a buffer against potential challenges under Micron stock price forecast.

Tracking Insider and Institutional Sentiments

Over the past 12 months, there has been a notable trend of insider selling at MU, with 36 insider sales and no purchases. This pattern suggests a bearish sentiment among company insiders, possibly indicating their belief that the stock currently holds overvaluation or that future company performance may not meet expectations. In the short term, the last 3 months alone saw 3 insider sales, further reinforcing this trend.

Insider ownership remains relatively low at 1.48%, implying that company executives and directors have limited personal financial exposure to the company’s stock performance. This could mean that their financial interests are not strongly in line with those of shareholders.

In contrast, institutional ownership is significantly high at 86.80%, indicating that investment funds and large entities hold a substantial stake in the company. This level of institutional confidence could counterbalance the negative insider sentiment to some extent, but the overall trend of insider selling should be under the eye as a potential red flag for Micron stock price forecast.

Micron Stock’s Recent Volume Trends

Micron stock has a current daily trading volume of 16,042,202 shares, which is significantly lower than its two-month average daily trade volume of 24,948,313 shares. This discrepancy indicates a potential decrease in trading activity or investor interest in recent days compared to the average over the past two months.

The Dark Pool Index (DPI) for MU stands at 63.07%, suggesting that a significant portion of its trades occur off-exchange in dark pools. A high DPI can indicate substantial institutional interest, as these trades are for large investors to avoid market impact.

The liquidity of MU holds a high average trading volume, which typically facilitates ease of entry and exit for investors. However, the recent drop in daily trading volume could imply reduced liquidity in the short term. Investors should monitor whether this trend persists, as sustained lower volumes could impact stock price volatility and the cost of trading. While MU generally maintains strong liquidity, the current lower trading volume may require attention from active traders and longer-term investors.

Bipartisan MU Stock Sales and Market Implications

Two notable transactions involving MU stock were reported in recent congressional trading activity. On September 4, 2024, Representative John James, a Republican from the House of Representatives, sold shares of MU valued between $1,001 and $15,000. This transaction was reported on September 6, 2024, and last modified on September 9, 2024. Earlier in the year, on January 23, 2024, Representative Kathy Manning, a Democrat from the House of Representatives, executed a similar sale of MU shares within the same value range. This transaction was reported on February 6, 2024, and last modified on February 7, 2024. Both sales suggest a potential bipartisan concern or strategy regarding MU’s market performance, reflecting broader market sentiments or possibly insider insights into the company’s future prospects. Monitoring this stock for any forthcoming news or earnings reports could provide context for these transactions.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.