Meta Stock Forecast 2025: 4 Billion Users, A Social Media Powerhouse

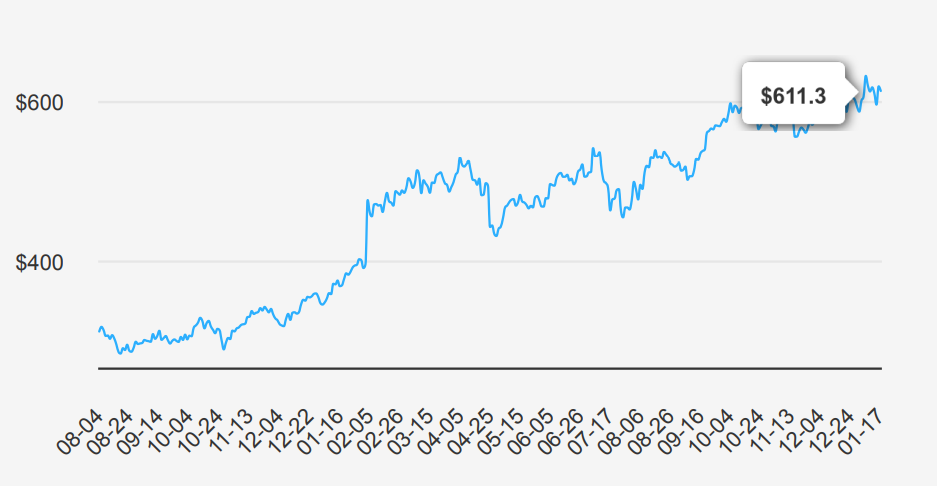

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm’s “Family of Apps,” its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta’s overall sales. META stock is trading around $611 as of now. Let’s dive into Meta stock forecast 2025.

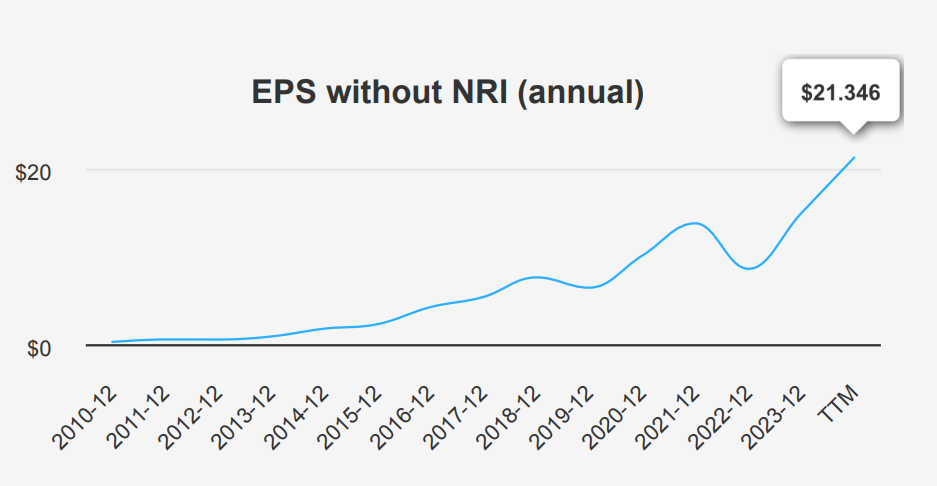

Meta’s EPS Projected to Reach $22.593 by 2025

Meta reported a strong performance in its latest quarter ending September 30, 2024, with Earnings Per Share (EPS) without non-recurring items (NRI) reaching $6.026. This marks a notable increase from the previous quarter’s EPS of $5.217 and a significant rise from $4.421 in the same quarter last year. Revenue per share also saw growth, hitting $15.611 compared to $14.97 in the prior quarter and $12.929 a year ago. Over the past five years, Meta’s annual EPS without NRI has grown at a Compound Annual Growth Rate (CAGR) of 13.90%, and impressively, 28.80% over ten years. The industry is forecasted to grow at around 12% annually over the next decade, indicating a promising trajectory for Meta within the tech sector.

The company maintained a robust gross margin of 81.43% this quarter, slightly above its five-year median of 80.76%. Meta’s ongoing share buyback strategy has also played a critical role in enhancing shareholder value and boosting EPS. The one-year share buyback ratio stands at 1.80%, meaning that 1.8% of shares outstanding from the previous year were repurchased. This strategy of reducing the share count can lead to a higher EPS in the short term, assuming net income remains stable or increases, which can be particularly beneficial in sustaining investor confidence under Meta stock forecast 2025..

Looking ahead, analysts estimate Meta’s future EPS to be $22.593 for the fiscal year ending 2025 and $25.327 for 2026, reflecting positive growth expectations. Revenue estimates suggest continued expansion, with forecasts reaching $210.624 billion by 2026. The next earnings report is anticipated on January 29, 2025, providing further insights into Meta’s financial health and strategic direction.

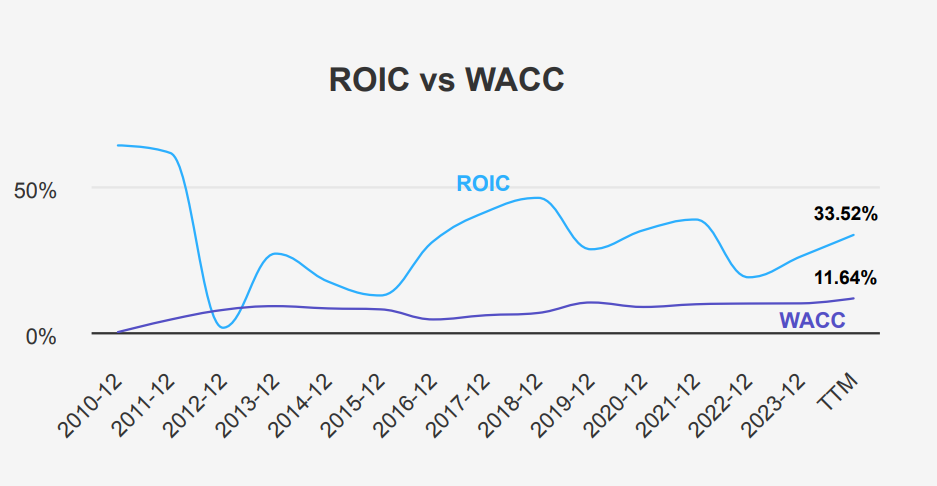

ROIC of 33.52%: Meta Stock’s Exceptional Value Creation

Meta demonstrates strong financial efficiency and value creation, as evidenced by its Return on Invested Capital (ROIC) consistently exceeding its Weighted Average Cost of Capital (WACC). Over the five-year median period, Meta’s ROIC stands at 28.57%, significantly higher than its WACC of 9.86%. This spread indicates that Meta is generating substantial economic value, as it earns returns well above the cost of capital.

In the most recent evaluation, Meta’s ROIC is 33.52%, again surpassing the WACC of 11.54%. This positive differential suggests that the company continues to invest capital effectively, ensuring that each dollar invested yields a return that exceeds the capital’s cost. This efficiency in capital allocation is further highlighted by Meta’s strong Return on Equity (ROE) of 36.21%, affirming the company’s ability to generate profit from shareholders’ equity under Meta stock forecast 2025.

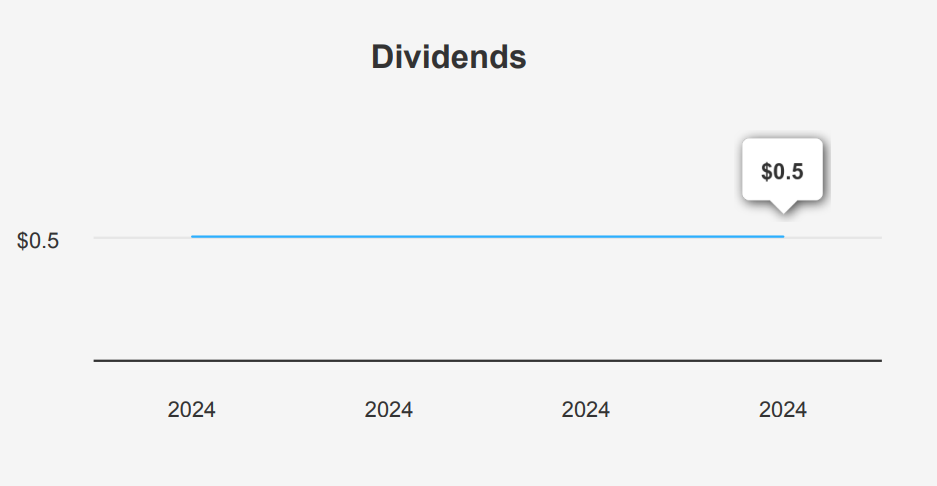

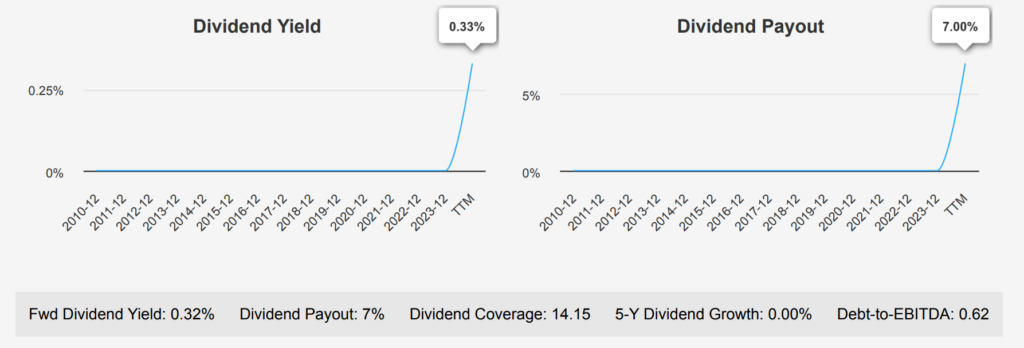

Meta Stock’s Flat Dividend Strategy: 0.32% Yield with Ample Payout Capacity

Meta maintains a consistent dividend per share of $0.5, distributed quarterly, resulting in a forward dividend yield of 0.32%. This yield positions Meta at the lower end of its 10-year range, which peaked at 0.32%, reflecting a conservative dividend strategy.

The company’s dividend payout ratio stands at a minimal 7.0%, significantly lower than its historical high of 100.07%, suggesting ample capacity to maintain or potentially increase dividends if strategic priorities shift. However, the forecasted dividend growth rate remains flat, indicating that dividend growth is not currently a focus. Meta’s Debt-to-EBITDA ratio is notably low at 0.62, well below the 2.0 threshold, signifying strong financial health and robust debt-servicing capabilities, which is favorable against industry norms.

With the next ex-dividend date set for February 19, 2025, Meta’s regular dividend schedule reinforces its reliability in payouts, though without growth prospects in the near term. Investors seeking income growth might look elsewhere, given the flat dividend trajectory and conservative financial deployment.

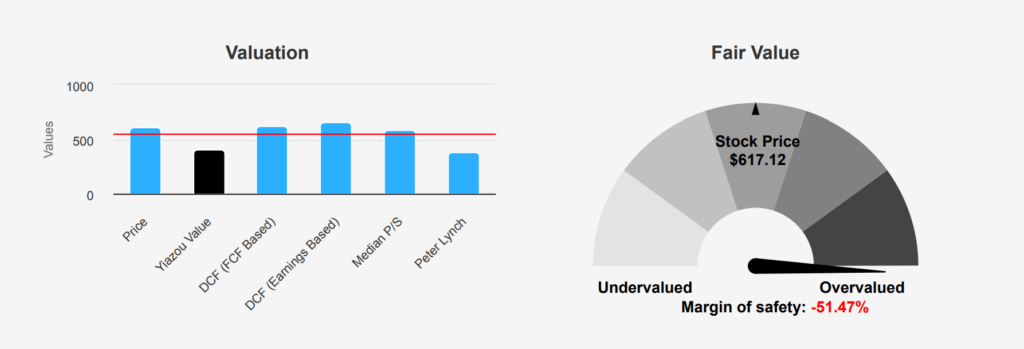

Meta Overvalued? Market Price Exceeds Intrinsic Value by 51.48%

Meta’s current market price of $617.12 significantly exceeds its intrinsic value of $407.39, indicating a negative margin of safety of -51.48%. This suggests that the stock is overvalued relative to its intrinsic worth. The Forward P/E ratio is 24.17, lower than the TTM P/E of 29.07, yet it remains within the higher end of its historical range, with the 10-year median at 30.13. This positions the stock at a premium compared to its historical median, reflecting possibly high investor expectations for future earnings growth.

Examining other valuation metrics, the TTM EV/EBITDA ratio stands at 18.78, closely aligned with its 10-year median of 19.13, indicating a valuation consistent with historical norms. The TTM Price-to-Sales ratio is 10.01, slightly above its 10-year median of 9.48, suggesting a mild overvaluation relative to its sales. The Price-to-Free-Cash-Flow ratio of 30.86 is near the 10-year median, reflecting stability in cash flow valuation. However, the TTM Price-to-Book ratio of 9.47 is at the upper range of its historical values, highlighting a potential overvaluation on a book value basis.

The outlook for Meta appears optimistic, as indicated by a rising price target trend over the past three months, reaching $655.26. Analyst sentiment remains positive, with a strong number of analysts following the stock and providing ratings. Despite the current overvaluation suggested by intrinsic value analysis, investor confidence seems bolstered by Meta’s growth prospects, although Meta stock forecast 2025 may need to justify the existing premium valuations.

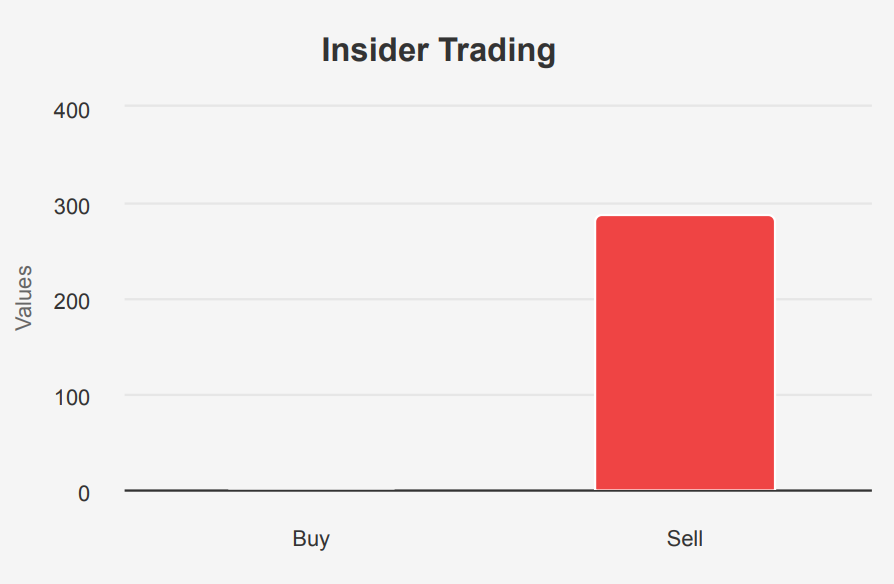

Balancing META Stock Insider Selling with Strong Financial Health

Recent insider selling activity at Meta with 58 transactions and 846,126 shares sold, indicates potential concerns about the stock’s current valuation. The lack of insider buying further underscores this sentiment. Additionally, the company’s steadily declining operating margin over the past five years, at an average rate of -6% per year, raises questions about its long-term profitability. Moreover, the stock’s price-to-book (PB) and price-to-sales (PS) ratios are near historical highs, suggesting the stock might be overvalued relative to its fundamentals.

Despite these risks, Meta Platforms Inc shows strong financial health, as evidenced by a high Piotroski F-Score of 8 and an Altman Z-Score of 11.97, indicating financial stability and low bankruptcy risk. The Beneish M-Score suggests that the company is unlikely to be manipulating its financial statements. Its predictable revenue and earnings growth further contribute to a positive outlook, along with a dividend yield close to its one-year high. These strengths could potentially offset some of the valuation concerns, suggesting that while the stock may hold overvaluation, it still holds strong underlying fundamentals.

META Stock Insider Selling Dominates: 287 Sells, 0 Buys in 12 Months

The insider trading data for META over the past year shows a notable trend of selling by the company’s directors and management, with no recorded insider buys. Over the last 12 months, there have been 287 insider sells, with 121 of these occurring in the past 6 months, and 63 in the last 3 months. This consistent selling activity suggests that insiders may be capitalizing on current stock valuations, possibly indicating a lack of confidence in short-term stock performance or a strategic rebalancing of personal portfolios.

Insider ownership at META is relatively low at 0.22%, which may limit the impact of insider transactions on overall market perception. In contrast, institutional ownership stands at a substantial 73.72%, highlighting the significant influence of institutional investors on META’s stock performance and strategic direction. The high level of institutional ownership might provide some stability against the backdrop of insider selling, as institutional investors tend to focus on long-term company fundamentals. Overall, this trend calls for a closer analysis of external factors influencing insider decisions.

Trading Volume Surges 18.7% Above Average: Robust Liquidity

Meta stock showcases dynamic liquidity and trading behavior. With a recent daily trading volume of 14,440,084 shares, META exhibits a robust trading activity, surpassing its two-month average daily volume of 12,164,658 shares by approximately 18.7%. This volume surge indicates heightened investor interest and potentially increased market volatility, providing ample liquidity for both entry and exit positions.

On the institutional front, META’s Dark Pool Indexes (DPI) stand at 52%, suggesting that over half of the trading volume occurs in nontransparent venues. This indicates significant institutional activity and potential strategic positioning by large investors. The high DPI percentage reflects a strong institutional interest, which often correlates with informed trading and long-term investment strategies.

Overall, META’s trading dynamics portray a liquid stock with active participation from both retail and institutional investors. The above-average trading volume enhances its appeal for traders seeking liquidity, while the substantial DPI underscores the ongoing interest from larger market players. This combination suggests a balanced market with opportunities for both short-term trading and long-term investment strategies.

Bipartisan Confidence? Congressional Members Buy Meta Shares in Late 2024

In December 2024, members of the U.S. House of Representatives reported two notable trades involving shares of Meta. On December 24, 2024, Representative Marjorie Taylor Greene, a Republican, made a purchase valued between $1,001 and $15,000. This transaction was filed shortly thereafter on December 27, 2024. Earlier, Representative Jared Moskowitz, a Democrat, also reported purchasing Meta shares in a similar range on November 8, 2024, with the report submitted on December 9, 2024.

These transactions suggest a bipartisan interest in Meta, reflecting potential confidence in the company’s future performance or strategic positioning. Such trades by congressional members could influence public perception and investor sentiment, considering their access to pertinent economic and policy information. It is worth monitoring Meta’s market dynamics and any related legislative developments to better understand the implications of these trades.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.