McDonald’s Stock: High Lead In Sales and Global Footprint

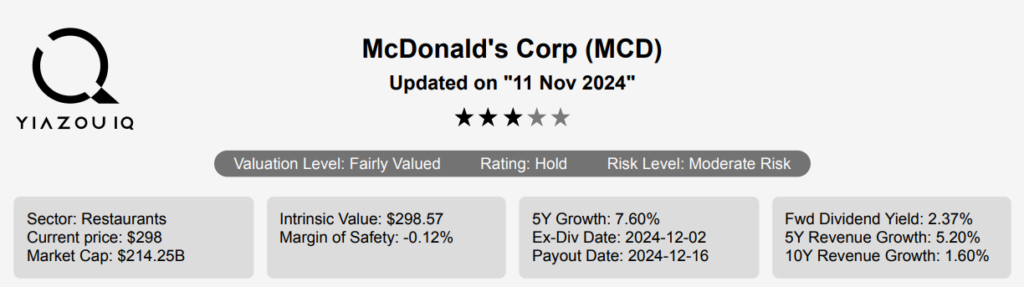

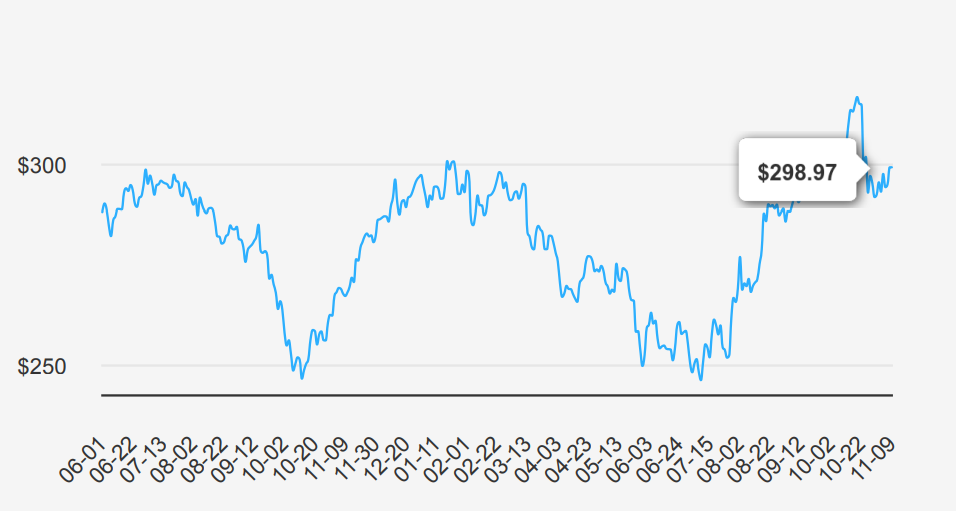

McDonald’s (MCD) is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly 42,000 stores and 115 markets. The company pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets. MCD stock is currently trading at nearly $299.

McDonald’s Earnings Growth and 2024 Forecast

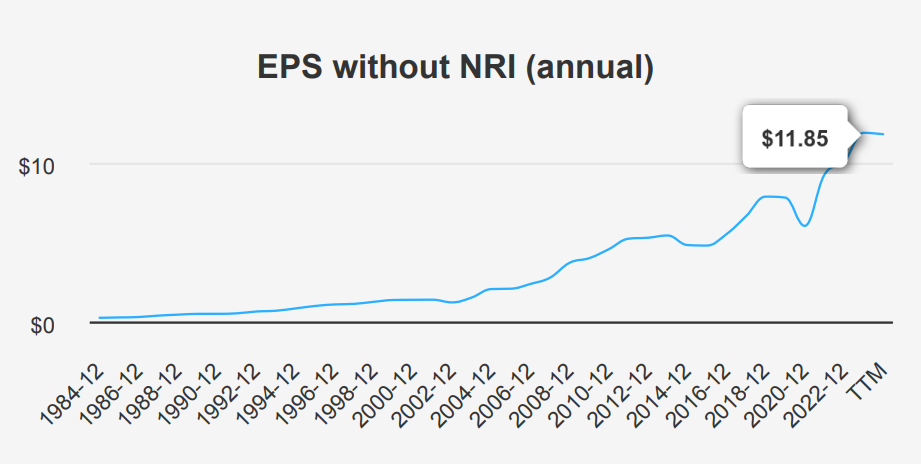

In the latest quarter ending September 30, 2024, McDonald’s reported earnings per share (EPS) without non-recurring items (NRI) of $3.23, marking an increase from $2.97 in the previous quarter (Q2 2024) and $3.19 in the same quarter last year (Q3 2023). This reflects a robust performance, supported by a revenue per share of $9.547 compared to $8.989 in Q2 2024 and $9.147 in Q3 2023. Over the past five years, MCD has achieved a Compound Annual Growth Rate (CAGR) in EPS without NRI of 9.70%, while the 10-year CAGR stands at 8.70%. Industry forecasts project a growth rate of approximately 3.5% annually over the next decade, suggesting a stable MCD Stock Forecast.

McDonald’s gross margin for the quarter was 56.62%, above its five-year median of 54.17% and close to its 10-year high of 57.12%. This indicates effective cost management and operational efficiency. The share buyback ratio over the last year was 1.60, meaning 1.6% of the shares outstanding were repurchased. This strategy has contributed to enhancing EPS by reducing the number of shares outstanding, thereby increasing shareholder value. Historically, McDonald’s has maintained a disciplined approach to buybacks, with a 10-year buyback ratio averaging 3.20.

Looking ahead, analysts estimate MCD’s revenue to rise to $26,062.85 million by the end of 2024 and further to $28,513.24 million by 2026. The EPS may continue its upward trajectory, with an estimate of $11.510 for FY1 ending and $12.606 for FY2. The next earnings announcement may be on February 5, 2025, when a further dive into the company’s performance and strategy may happen. These projections reflect confidence in the MCD Stock Forecast with sustained growth and market position.

ROIC vs. WACC: McDonald’s Effective Capital Management in Focus

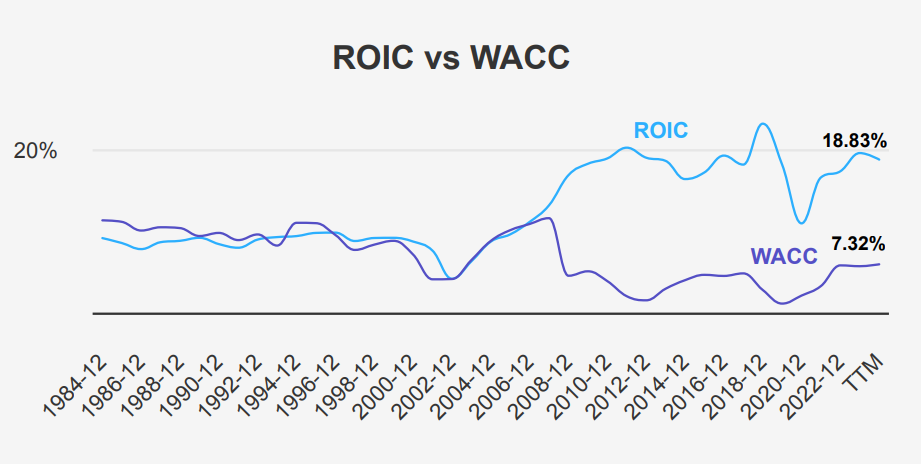

Analyzing McDonald’s Corporation’s financial metrics, we observe a strong capital efficiency and value creation performance. The company’s Return on Invested Capital (ROIC) currently stands at 19.11%, significantly higher than its Weighted Average Cost of Capital (WACC) of 7.32%. This indicates that McDonald’s is generating positive economic value, as it earns more on its invested capital than the cost of capital required to finance it.

The five-year median ROIC of 17.55% further supports this assertion, consistently exceeding the WACC median of 4.93% over the same period. This spread suggests that McDonald’s has effectively allocated capital to projects that yield higher returns than the cost incurred to fund them, enhancing positives under the MCD Stock Forecast.

Despite the negative equity reported, which impacts Return on Equity (ROE) metrics, McDonald’s robust ROIC underscores its ability to generate substantial profits from its investment base. This efficiency in capital allocation translates into sustainable economic value creation, reinforcing its financial strength and strategic advantage in the market.

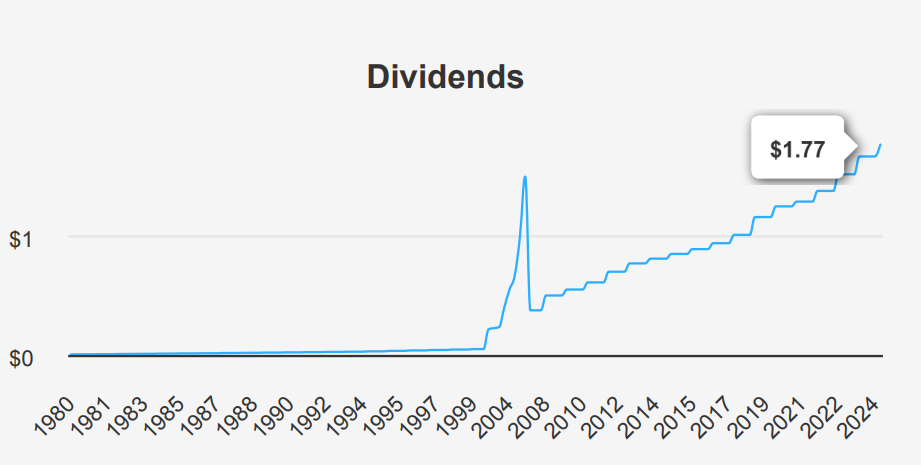

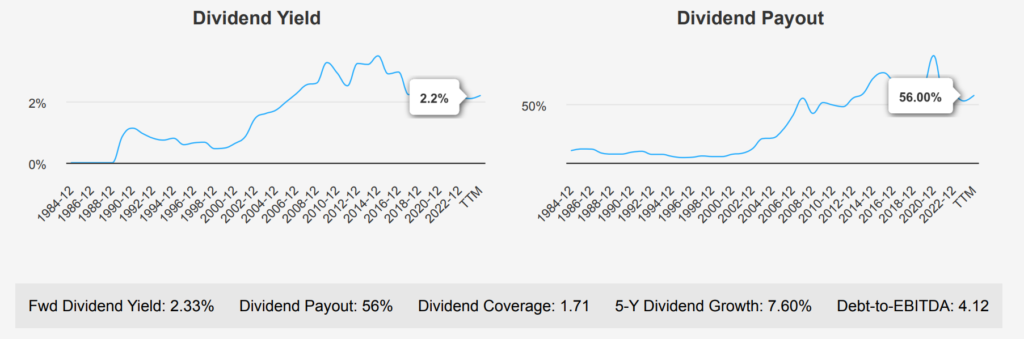

McDonald’s Dividend Growth and Financial Health Outlook for 2024

McDonald’s has demonstrated a robust dividend growth trajectory, with a 5-year growth rate of 7.60% and a 3-year growth rate of 7.30%. In the most recent quarter, the dividend per share increased to $1.77 from $1.67, indicating continued strength in dividend payouts. This is a forward dividend yield of 2.33% and a payout ratio of 56%, below the historical 10- year median of 100.59%, suggesting room for sustainable dividend payments.

The company’s Debt-to-EBITDA ratio stands at 4.12, slightly above the threshold where financial risk becomes a concern under MCD Stock Forecast. This suggests that McDonald’s should be cautious about its leverage, although steady dividend growth might reassure investors of its financial health. Comparatively, the sector’s average dividend yield often ranges similar to MCD’s current yield, making it competitive within its industry.

Looking forward, McDonald’s may have a dividend growth rate of 7.11% over the next 3-5 years. The next ex-dividend date, based on the quarterly frequency, maybe around March 1, 2025, as December 2, 2024, is the latest recorded date. This maintains a pattern of consistent quarterly cash distributions, aligning with investor expectations.

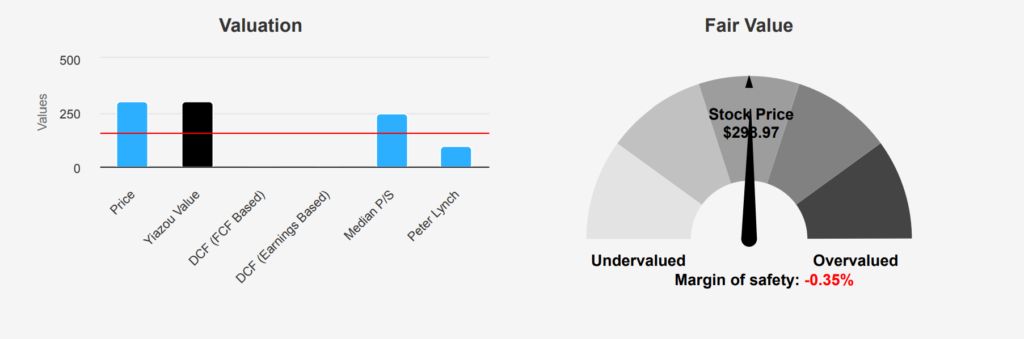

Is MCD Stock Overvalued? Valuation Metrics Breakdown

McDonald’s currently trades at an intrinsic value of $297.89, with a market price slightly above $298.97, suggesting a negative margin of safety of -0.36%. This indicates that the stock is slightly overvalued relative to its intrinsic value. The TTM P/E ratio of 26.25 is close to its 10-year median of 25.32 but below its historical high of 35.69, suggesting moderate overvaluation. The Forward P/E of 23.7 aligns with these observations, reflecting expectations for continued earnings growth.

Examining other valuation metrics, the TTM EV/EBITDA ratio stands at 19.02, above the 10-year median of 17.97 but well below the peak of 23.84, indicating a slight premium to its historical norms. The TTM Price-to-Free-Cash-Flow ratio of 30.69 is slightly above its median of 29.74, suggesting a higher valuation relative to cash flows. Notably, the TTM Price-to-Book ratio registers at zero, which may reflect accounting or capital structure adjustments, thus requiring further investigation.

Analyst sentiment appears optimistic, with the price target increasing steadily over the past three months to $324.07, suggesting potential upside. However, the close alignment of the current market price with its intrinsic value and the absence of a significant margin of safety warrant a cautious approach. Investors should consider these factors, along with potential market and economic risks, before making investment decisions.

Evaluating McDonald’s Financial Risks and Stability Factors

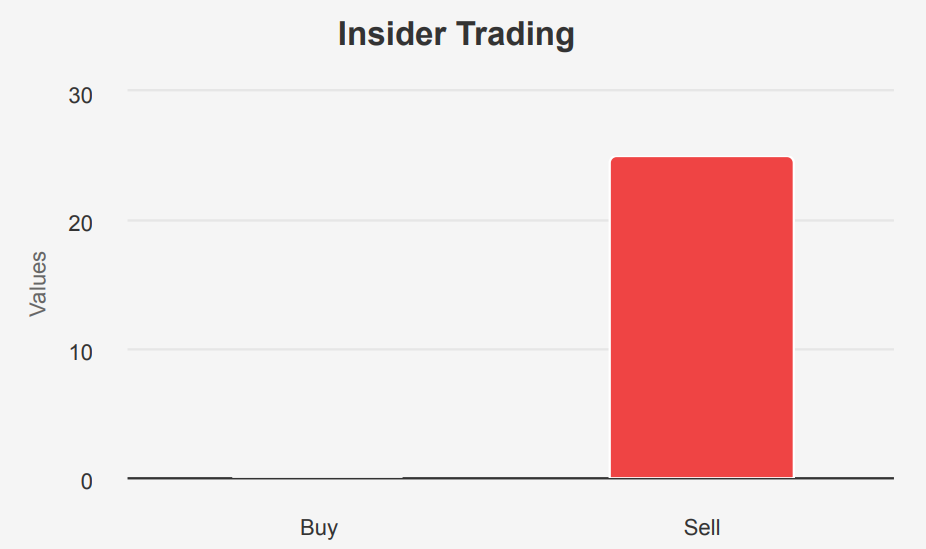

McDonald’s presents a mixed risk profile with certain concerns and strengths. Its recent increase in long-term debt by $4.5 billion over three years is notable yet remains within acceptable levels. The company’s asset growth rate of 7.3% surpassing its revenue growth of 5.2% might indicate declining operational efficiency, posing a potential risk to profitability. Additionally, the recent insider selling activity, with 47,484 shares sold and no insider purchases, could signal a lack of confidence from those closest to the company.

However, McDonald’s also shows robust financial health indicators. Its Beneish M-Score of -2.42 suggests a low likelihood of earnings manipulation, and an expanding operating margin indicates improving profitability. Furthermore, the company’s Altman Z-score of 5.07 reflects strong financial stability, suggesting low bankruptcy risk. While the stock price nearing a 10-year high may raise valuation concerns, these positive metrics provide reassurance about its underlying financial strength.

Overall, while MCD faces some challenges, particularly in asset efficiency and insider sentiment, its solid financial metrics and expanding margins offer a counterbalance. Investors should weigh these factors and consider potential market conditions before making investment decisions.

Insider Sales: What It Means for MCD Stock Forecast

An analysis of insider trading activity for McDonald’s stock over the past year reveals a notable trend of selling activity among the company’s insiders. Over the last 12 months, there have been 25 insider sell transactions, with no corresponding insider buys recorded. This trend is consistent across shorter time frames as well, with 11 sell transactions in the past three months and 16 in the past six months, yet zero buys in both periods.

The lack of insider buying, coupled with consistent selling, may suggest that those closest to the company perceive the current stock price as a favorable point to sell. Insider ownership stands at a modest 0.21%, indicating that insiders hold a relatively small stake in the company. In contrast, institutional ownership is significantly higher at 72.82%, which suggests that institutional investors have a substantial influence over the stock’s movement.

Overall, the trend of insider sales might be interpreted as a signal that insiders are capitalizing on the stock’s current valuation, possibly indicating expectations of limited near-term upside under the MCD Stock Forecast.

MCD Stock Liquidity and Institutional Interest Signals

McDonald’s stock has a current daily trading volume of 3,277,951 shares, slightly below its average daily volume of 3,617,899 shares over the past two months. This indicates a moderate level of liquidity, which facilitates relatively smooth trading for investors.

The Dark Pool Index (DPI) for MCD stands at 54.49%. This suggests that a significant portion of the stock’s trading activity is occurring in dark pools, private exchanges where institutional investors trade large blocks of shares discreetly. A DPI above 50% indicates that more than half of the trades are being executed away from public exchanges, which could imply that institutional players are actively trading this stock.

Overall, MCD’s trading activity shows healthy liquidity with consistent trading volumes close to its average. The DPI suggests potential interest from larger institutional investors, which could lead to significant price movements based on their trading actions. Under MCD Stock Forecast, Investors might consider monitoring any substantial changes in volume or DPI as indicators of shifting market sentiment or potential volatility.

Congressional Trades and What They Indicate About McDonald’s Stock

In a recent series of trades involving McDonald’s, Representative Josh Gottheimer, a Democrat from the House of Representatives, purchased stock valued between $1,001 and $15,000 on September 10, 2024. This transaction was reported on October 3, 2024. Just a few days earlier, on September 4, 2024, Republican Representative John James from the same chamber executed a sale of McDonald’s stock within the same value range, which he reported on September 6, 2024. These trades highlight differing strategies or insights among the two representatives, with Gottheimer choosing to invest in McDonald’s while James opted to divest. Such transactions might reflect their individual expectations about the company’s future performance or broader market conditions. The close timing of these transactions could suggest a response to specific market signals or news affecting McDonald’s stock.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.