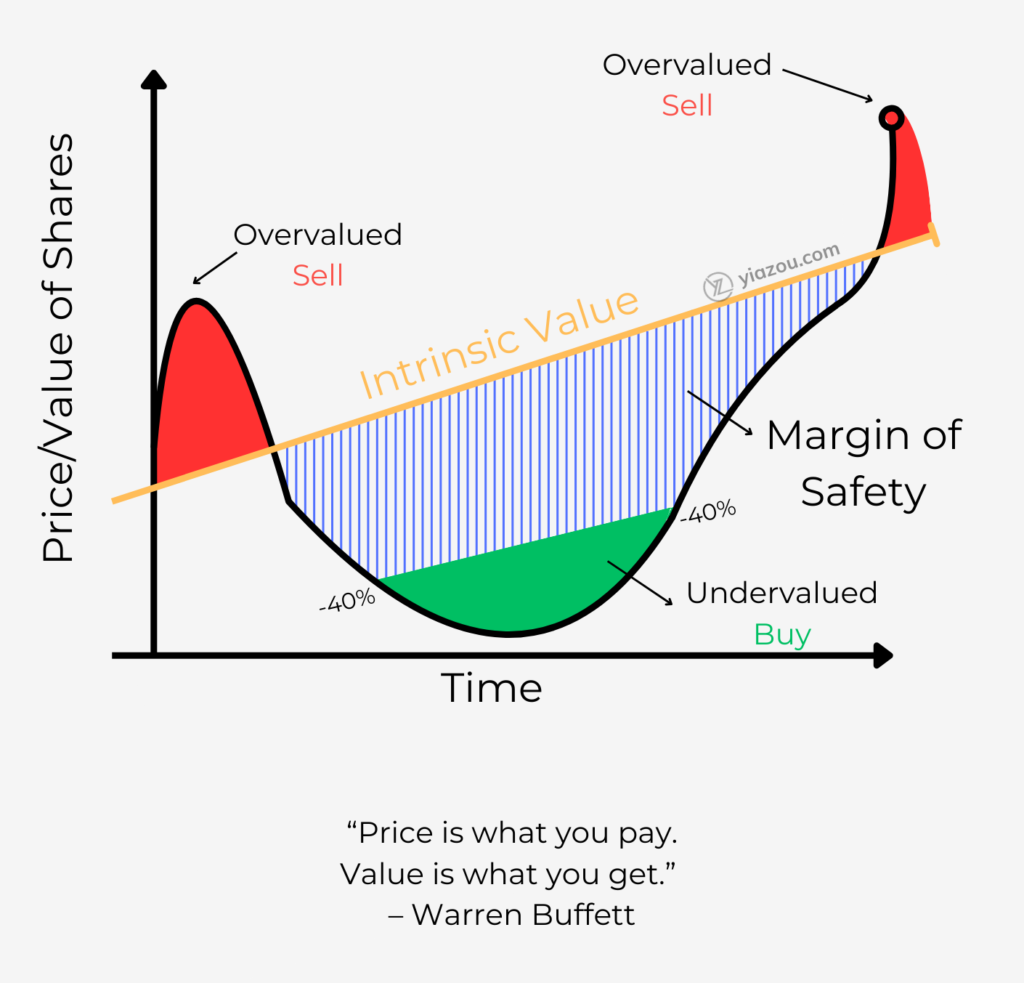

The Margin of Safety is probably Benjamin Graham’s most well-known concept and possibly the cornerstone on which he built his entire view of investments. The idea is straightforward yet incredibly powerful: an investor should buy stocks only when available at a considerable discount to their intrinsic value. This discount protects against estimation errors, market volatility, and unforeseen events.

What is the Intrinsic Value?

What is intrinsic value? Intrinsic value or fair value is the true worth of an asset based on its fundamentals, NOT its market price. To calculate it, estimate the future cash flows the asset will generate, then discount these cash flows to their present value using a discount rate that reflects the investment’s risk. Add up these discounted cash flows to get the intrinsic value.

For example, if a company is expected to generate $100,000 annually for 5 years with a 10% discount rate, the intrinsic value would be about $379,079. An investor would first have to estimate a security’s intrinsic value and then relate it to its market price. The gap between the intrinsic value and the current market price increases the margin of safety.

If the company has 100 shares, the intrinsic value per share is $3,79 or $3.80. Suppose the current stock price is $3 per share; the margin of safety is approximately 21%, as the investor can buy the company now at $3 per share (cheaper than its intrinsic value of $3.80).

The margin of safety protects the investor in two essential ways;

- First, it lowers the risk of losing the capital whereby the investor pays for security less than its intrinsic or fair value, and second,

- It increases potential gains when the market price discounts and converges to the intrinsic value over time.

The margin of safety is the difference between the intrinsic value and the market price. Intrinsic value is an approximate estimation of the stock’s actual value, considering factors such as earnings, dividends, and growth potential, among others, through fundamental analysis. When investors buy below intrinsic value, they make a protective cushion against potential losses for the invested money.

Importance of Margin of Safety

The margin of safety is important in reducing the impacts of several risks, including:

- Errors associated with the calculation involve estimation errors; a company’s intrinsic value is arrived at by various assumptions and calculations. A margin of safety provides a buffer against inaccuracies.

- Share prices fluctuate due to market sentiment, economic conditions, and many other factors. The margin of safety protects investors from short-term volatility.

- The economic downturn, natural disasters, or problems within a particular company may all negatively affect the price of a stock. A margin of safety cushions the ‘shock’ of these unexpected events.

Using Margin of Safety in Your Portfolio

This is how you can adopt the margin of safety into your investment strategy:

- Detailed Research: Study a company’s financial statements, industry positioning, and growth prospects from various sources to forecast its intrinsic value.

- Set an appropriate margin: Then, decide on a margin of safety, considering your risk tolerance and the reliability of the intrinsic value estimate. Of course, expected margins run from 20% to 50%.

- Be Patient: Wait until markets allow you to buy at prices with a sufficient margin of safety. This patience can be a demanding requirement but is an essential element in the risk-minimization process.

- Diversify: Spread out in industry and asset class to minimize risk further.

Takeaway

Investors should buy securities at a deep discount to their intrinsic value to protect themselves from the downside, market volatility, and unforeseen events.

Understanding and applying the margin of safety concept enables investors to build a solid, disciplined investment strategy, ensuring protection and profitability for each invested dollar.