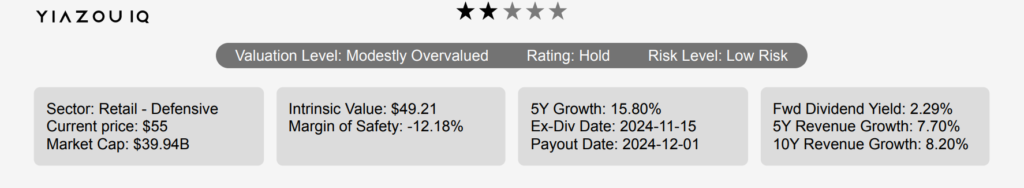

Kroger Stock: Dominating US Grocery Retail with Private-Label Strength

Kroger Co. (KR) is one of the largest grocery retailers in the United States, with more than 2,700 stores across a portfolio of over 20 supermarket banners. The company boasts an ingrained presence in US communities, citing that it is a top-two grocer in most of its major market areas. Over one-fourth of Kroger’s roughly $110 billion in nonperishable and fresh food sales (about 75% of revenue) stems from its private-label portfolio, of which the company manufactures about 30% of units via its 33 food production plants. The firm also operates fuel stations and pharmacies at 60% and 80% of its locations, respectively. KR stock is trading at ~$55. Let’s explore, Kroger Stock Is A Buy Now?

Growth Slows but Long-Term Prospects Remain Strong

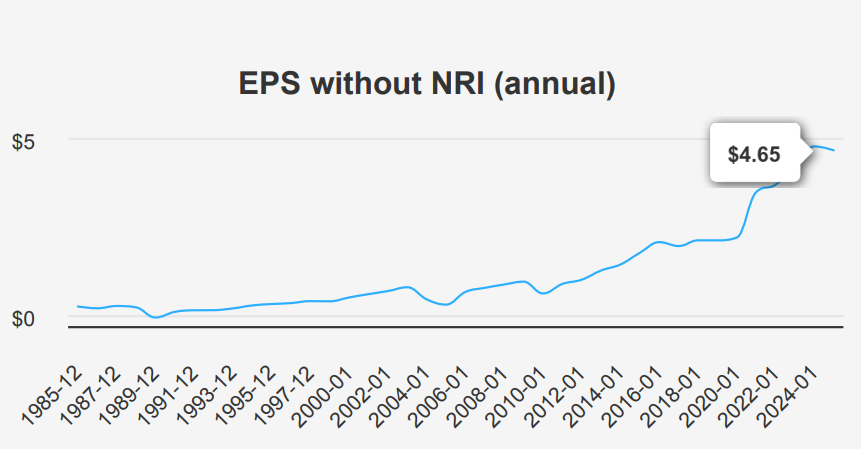

In the latest quarter ending August 31, 2024, Kroger reported an EPS without non-recurring items (NRI) of $0.93, showing a decrease from $1.43 in the previous quarter (Q2 2024) and a slight decline from $0.96 in the same quarter last year (Q3 2023). The EPS (Diluted) was $0.64, down from $1.29 in Q2 2024, but improved compared to the negative $0.25 in Q3 2023. Revenue per share was $46.65, a drop from $62.27 in Q2 2024 and slightly lower than $47.08 in Q3 2023. Over the last five years, KR achieved an annual EPS without NRI growth rate of 19.00%, with a 10-year CAGR of 12.00%.

Kroger’s margins remain relatively stable, with a gross margin of 22.43%, slightly above its 5-year median of 22.07% and close to the 10-year median of 22.12%. The impact of share buybacks on earnings per share has been mixed recently, with a one-year buyback ratio of -0.40%, indicating a net increase in shares outstanding. Over the longer term, the 5-year buyback ratio stands at 2.40%, suggesting a reduction in shares outstanding over this period, which typically supports EPS growth. The 10-year share buyback ratio is 3.80%, reflecting consistent buyback activity that contributes positively to EPS.

Looking ahead, analysts estimate KR’s revenue to reach $149.07 billion in 2025, $152.04 billion in 2026, and $155.15 billion in 2027. The next earnings report is expected on November 29, 2024, with EPS forecasts for fiscal years ending in 2025 and 2026 estimated at $4.024 and $4.444, respectively. The grocery industry is projected to grow at a modest pace over the next decade, with online sources predicting growth of around 3% annually. This steady growth, strategic share buybacks, and improved operational efficiency positions well on ‘Kroger stock is a buy now’.

Kroger’s Strategic Capital Allocation Drives Long-Term Value Creation

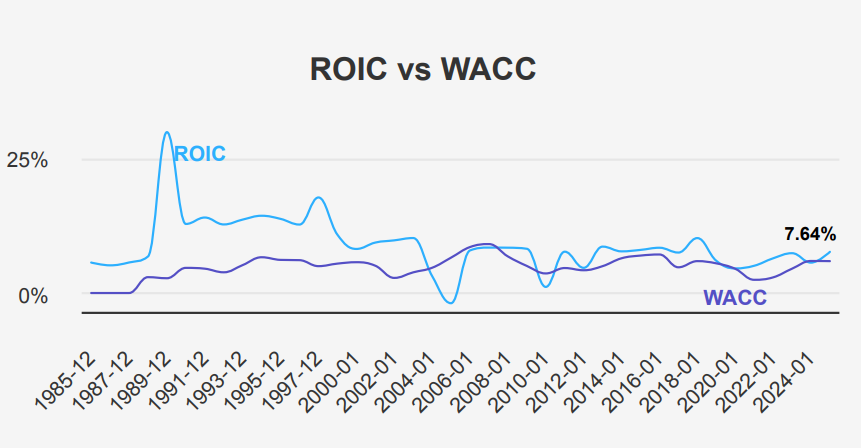

Kroger demonstrates solid economic value creation by maintaining a Return on Invested Capital (ROIC) consistently above its Weighted Average Cost of Capital (WACC). Over the past five years, KR’s median ROIC stands at 5.63%, noticeably above its five-year median WACC of 4.49%. This indicates efficient capital allocation and value generation for shareholders.

In the most recent period, KR’s ROIC was 7.64%, surpassing the current WACC of 5.88%. This further affirms the company’s capability to create value above its cost of capital. This performance suggests that KR is utilizing its capital effectively to generate returns that exceed the costs associated with its invested capital.

The stability and strength in KR’s ROIC, peaking at 10.18% over the past decade, coupled with a high ROE of 23.94%, indicate strong internal financial efficiency and robust profitability. Overall, KR’s financial metrics reflect that Kroger stock is a buy now with a consistent ability to generate economic value, ensuring long-term growth and sustainability for its stakeholders.

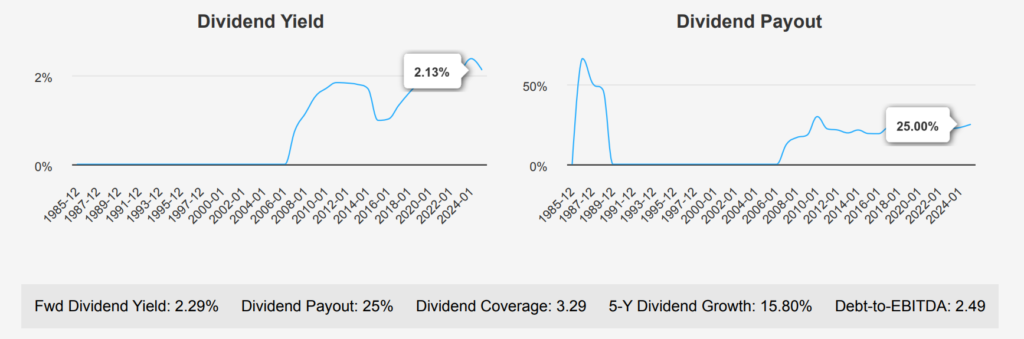

Kroger Stock’s Dividend Growth: Steady Gains with Room to Rise

Kroger has demonstrated robust dividend growth, with a 5-year growth rate of 15.80% and a 3-year growth rate of 17.40%. The recent quarterly dividend per share increased from $0.29 to $0.32, reflecting steady dividend growth. The forward dividend yield stands at 2.29%, slightly above the 10-year median yield of 1.84%, suggesting attractive returns relative to its historical performance.

The company’s debt-to-EBITDA ratio of 2.49 falls within the moderate range, indicating manageable financial leverage. This level is typical for the sector, suggesting the company maintains a balanced approach to debt and growth investment. Kroger’s dividend payout ratio is low at 25.0%, providing ample room for future dividend increases.

The future 3-5-year dividend growth rate estimate is 7.91%, indicating continued optimism for dividend expansion, though at a slower pace than in recent years.

The next ex-dividend date is November 15, 2024, as per the quarterly dividend frequency. This aligns with the company’s consistent pattern of quarterly payments, maintaining investor confidence in its dividend policy. Overall, Kroger’s dividend performance remains strong, supported by a reasonable debt level and a conservative payout strategy.

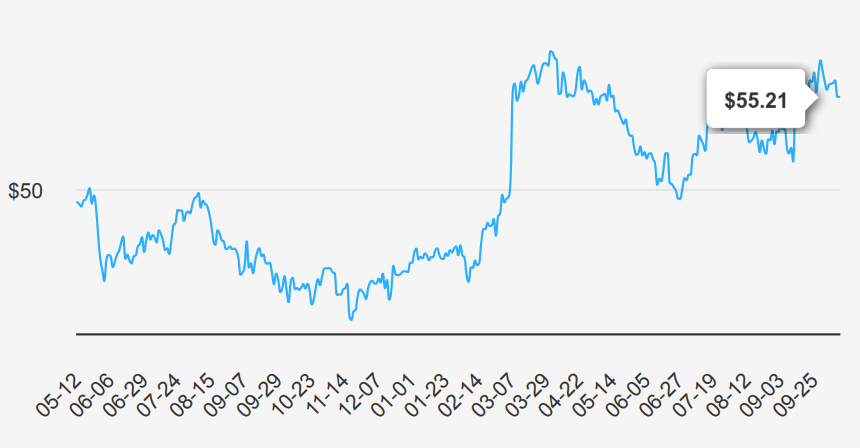

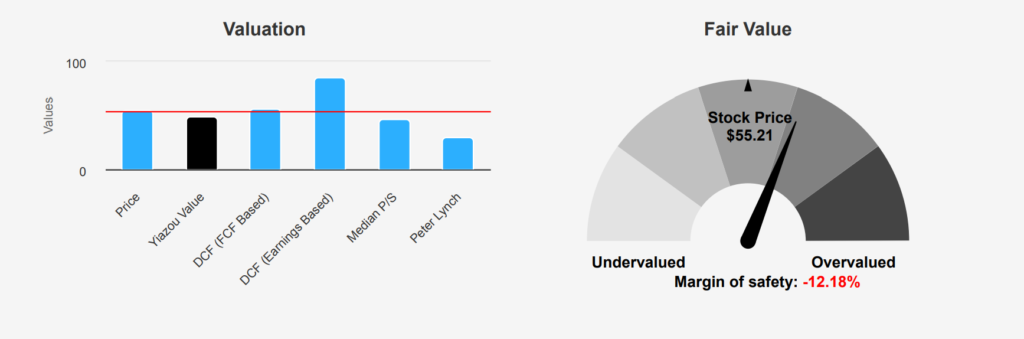

Is Kroger Stock Fairly Priced or Overvalued

Currently, KR’s intrinsic value stands at $49.21, while the stock is trading at $55.21, indicating a negative margin of safety of 12.19%. This suggests that KR is overvalued relative to its intrinsic value, as the current market price exceeds its intrinsic worth. The TTM P/E ratio is 14.45, lower than the 10-year median of 15.26 but significantly below the 10-year high of 36.93, indicating a relatively moderate valuation. The forward P/E ratio of 12.06 further suggests potential undervaluation against future earnings. However, the TTM P/S ratio of 0.27 is slightly above its 10-year median of 0.23, hinting at a marginal overvaluation in terms of sales. A negative factor on ‘Kroger stock is a buy now’.

The TTM EV/EBITDA ratio is 7.12, closely aligning with the 10-year median of 7.45, suggesting a fair valuation relative to earnings before interest, taxes, depreciation, and amortization. A TTM P/B ratio of 3.19 compares closely to the 10-year median of 3.28, indicating consistency in book value evaluation. However, the TTM Price-to-Free-Cash-Flow ratio of 22.8 is noticeably above the 10-year median of 18.73, which could suggest overvaluation if cash flow growth does not accelerate. These discrepancies may reflect KR’s current strategic investments or market conditions impacting cash generation.

Analyst sentiment appears cautiously optimistic, with a price target of $59.49, slightly increasing over the past months. This indicates a minor potential upside from the current price, suggesting analysts are moderately bullish about KR’s near-term prospects. With 21 ratings, the consensus suggests holding, as the intrinsic value analysis does not indicate a significant margin of safety. Investors should consider these insights, especially the high free cash flow valuation, before making investment decisions.

Mixed Signals: Kroger’s Risk-Reward Balance Examined

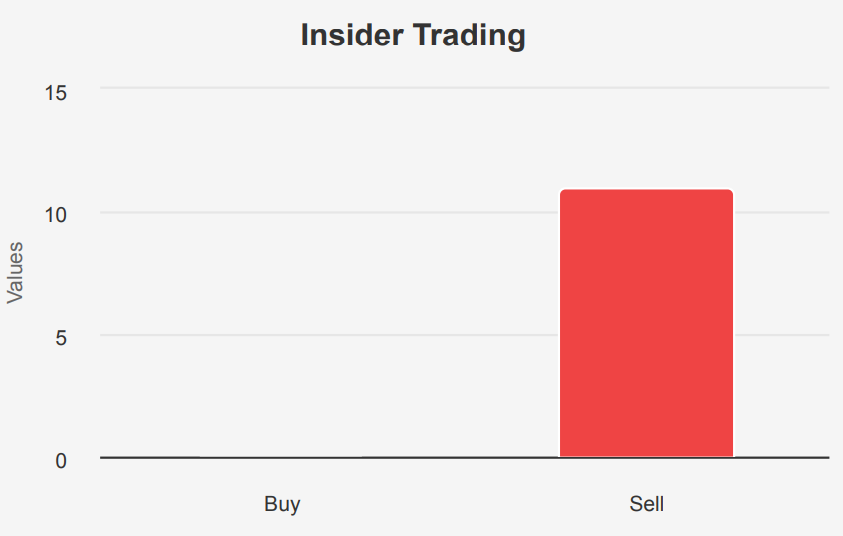

Kroger Co (KR) presents a mixed risk profile, with several warning signals and positive indicators. The recent insider selling activity—five transactions totaling 18,932 shares without any insider buying—could signal a lack of confidence among executives, which investors should monitor closely. The stock price is near a two-year high, and the price-to-sales ratio is also high. This suggests that the stock might be overvalued. Additionally, the dividend yield is at a one-year low, potentially reducing its attractiveness to income-focused investors.

On the positive side, Kroger’s Piotroski F-Score of 7 indicates strong financial health, suggesting efficient use of assets and robust financial performance. The expanding operating margin is a positive sign, indicating improved efficiency and potential for increased profitability. The low PE ratio, close to a three-year low, implies that the stock may hold undervaluation compared to historical levels. Additionally, the Altman Z-score of 3.74 and a Beneish M-Score of -2.65 suggest financial stability and a low likelihood of earnings manipulation.

Overall, while there are concerns about valuation and insider selling, Kroger’s strong financial metrics and operational improvements provide a buffer against potential risks. Investors should weigh these factors against market conditions and risk tolerance before deciding whether ‘Kroger stock is a buy now’.

Insiders Sell as Institutions Hold Strong Belief

Analyzing insider trading activity for KR over the past year reveals a noticeable trend of insider selling without any purchasing activity. Over the last 3 months, there have been 5 insider sell transactions and no buys. This pattern continues over a 6-month period with 11 sell transactions, and the same trend is evident over the 12-month period with 11 sells and no buys.

Insiders’ lack of buying activity could suggest a lack of confidence in the company’s short-term prospects, or it might simply reflect personal financial decisions unrelated to company performance. Consistent selling without buying may signal that insiders take advantage of company stock prices or reallocate their investment portfolios.

Insider ownership currently stands at 1.87%, which indicates a relatively low level of direct financial stake by insiders in the company. In contrast, institutional ownership is significantly higher at 80.56%, suggesting that larger financial entities substantially influence the company. These factors combined may influence market perceptions and investor strategies regarding KR.

Kroger Stock’s Liquidity Dynamics: A Surge in Trading Activity

Kroger exhibits a mixed picture in terms of liquidity and trading activity. Over the past two months, the average daily trading volume stands at 4,298,459 shares, indicating healthy investor interest and sufficient liquidity for trading. However, the recent trading volume of 2,579,014 shares suggests a significant deviation below the average, reflecting either a temporary dip in trading activity or reduced market interest.

Furthermore, the Dark Pool Index (DPI) is 47.08%. This index represents the proportion of trades occurring in non-exchange trading venues, commonly called dark pools. A DPI of 47.08% indicates that nearly half of KR’s trades are on outside traditional exchanges, which can have implications for market transparency and the stock’s price discovery process.

Overall, while KR maintains a robust average trading volume, the lower recent volume warrants attention from investors who may be cautious about potential liquidity constraints. Additionally, the substantial dark pool trading activity suggests that a significant portion of KR’s trading is subject to less visible market dynamics, which could impact volatility and price movements. Investors should monitor these factors alongside broader market conditions when evaluating KR’s trading prospects and whether ‘Kroger stock is a buy now’.

Congressional Moves: Divesting from Kroger Shares Together

In recent trading activity involving Kroger, two Congressional members have disclosed sales. On April 4, 2024, Representative Earl Blumenauer, a Democrat from the House of Representatives, sold shares valued between $1,001 and $15,000. This trade was reported a month later, on May 4, 2024. Earlier, on December 14, 2023, Senator Jerry Moran, a Republican, executed a full sale of his KR holdings, also within the same value range, which was reported on January 17, 2024. Both transactions reflect a strategic withdrawal from Kroger positions, potentially indicating a bipartisan shift in sentiment towards the stock. The timing of these transactions, amidst evolving market conditions, may suggest a common assessment of Kroger’s prospects, possibly influenced by broader economic factors or specific developments within the retail sector.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.