PepsiCo Stock: Invest In Snacks and Beverages Giant

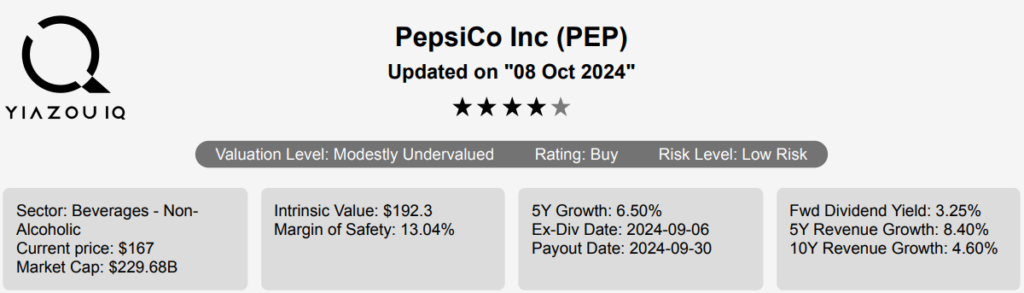

PepsiCo is a global leader in snacks and beverages, owning well-known household brands, including Pepsi, Mountain Dew, Gatorade, Lay’s, Cheetos, and Doritos. The company dominates the global savory snacks market and ranks as the second-largest beverage provider in the world (behind Coca-Cola), with diversified exposure to carbonated soft drinks, or CSD, as well as water, sports, and energy drink offerings. Convenience foods account for approximately 55% of its total revenue, with beverages making up the rest. Pepsi owns most of its manufacturing and distribution capacity in the US and overseas. International markets comprise 40% of total sales and one-third of operating profits. PEP stock is currently trading at ~$167. Let’s explore: Is PepsiCo A Good Stock To Buy?

PepsiCo’s Earnings Surge: Strong Growth and Strategy

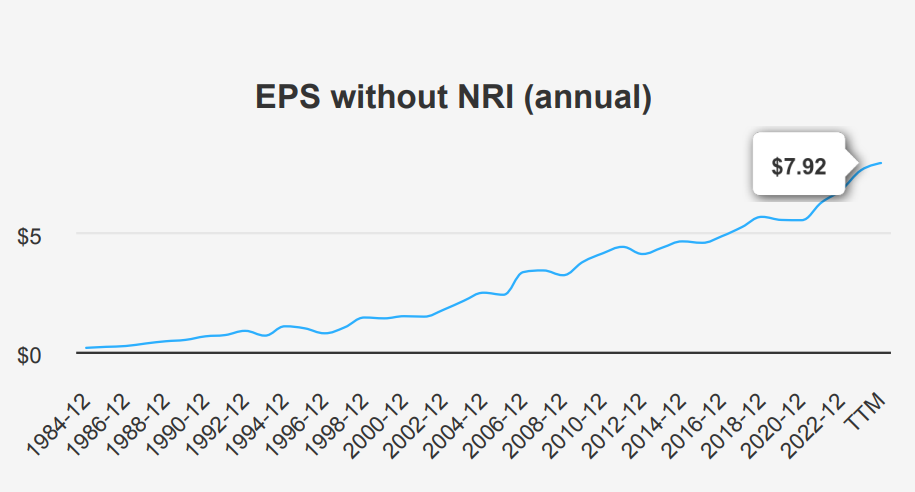

PepsiCo (PEP) delivered strong financial results for the second quarter of 2024, with an EPS without NRI (excluding non-recurring items) of $2.28, up from $1.61 in the previous quarter and $2.09 year-over-year. The EPS (Diluted) also showed significant growth, reaching $2.23 compared to $1.48 in the prior quarter. This performance underscores solid operational execution, with quarterly revenue per share increasing to $16.317 from $13.225 in Q1 2024. Over the past five years, PEP has achieved a compound annual growth rate (CAGR) of 6.60% in EPS without NRI, reflecting consistent expansion, while the 10-year CAGR stands at 5.20%. The industry may grow at an average rate of 4% annually over the next decade. This is a positive development to answer ‘Is PepsiCo A Good Stock To Buy?’.

PepsiCo’s gross margin for the quarter was 54.44%, slightly above the five-year median of 54.21% and near the 10-year median of 54.50%, indicating stable profitability. The company’s share buyback strategy Is moderate, with a 10-year buyback ratio of 1%. This indicates that 1% of outstanding shares have been repurchased. This year’s buyback ratio is 0.20%, suggesting a more conservative approach recently, which still positively impacts EPS by reducing the number of shares outstanding.

Looking ahead, analysts project steady revenue growth, with estimates reaching $101,685.5 million by 2026. The estimated EPS for the next fiscal years is $7.807 for FY1 and $8.551 for FY2, reflecting ongoing confidence in PepsiCo’s growth trajectory. The next earnings report is on October 8, 2024, where analysts will look for continued improvements in operational efficiencies and strategic investments.

PepsiCo’s Financial Performance: Value Creation Unveiled

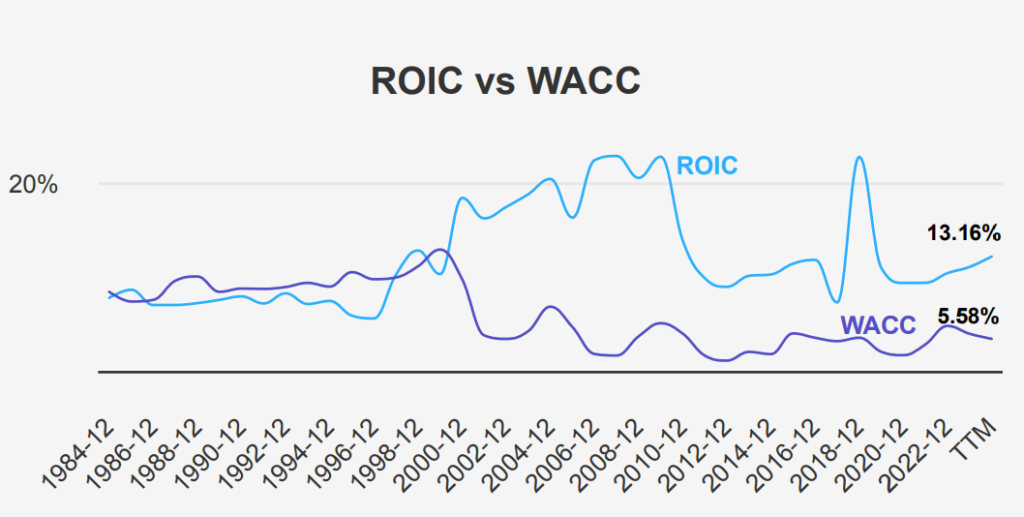

PepsiCo, Inc. (PEP) demonstrates strong financial efficiency and value creation, as evidenced by its Return on Invested Capital (ROIC) consistently outperforming its Weighted Average Cost of Capital (WACC). Over the past five years, PEP’s median ROIC is 11.63%, while the WACC stands at 5.07%. This indicates that the company is generating returns significantly above its cost of capital, creating economic value for shareholders.

The current ROIC at 13.16% exceeds the WACC of 5.58%, reaffirming PEP’s capability to invest in profitable projects contributing to shareholder wealth. This positive spread between ROIC and WACC suggests efficient capital allocation and prudent management decisions.

Furthermore, PEP’s robust Return on Equity (ROE) at 50.91% highlights exceptional shareholder returns, underscoring its effective use of equity capital. The consistently high ROE, even with a ten-year median of 50.90%, supports the conclusion that PEP optimizes its resources to maintain superior financial performance and sustained economic value creation. Again, it is a positive element towards ‘Is PepsiCo A Good Stock To Buy?’.

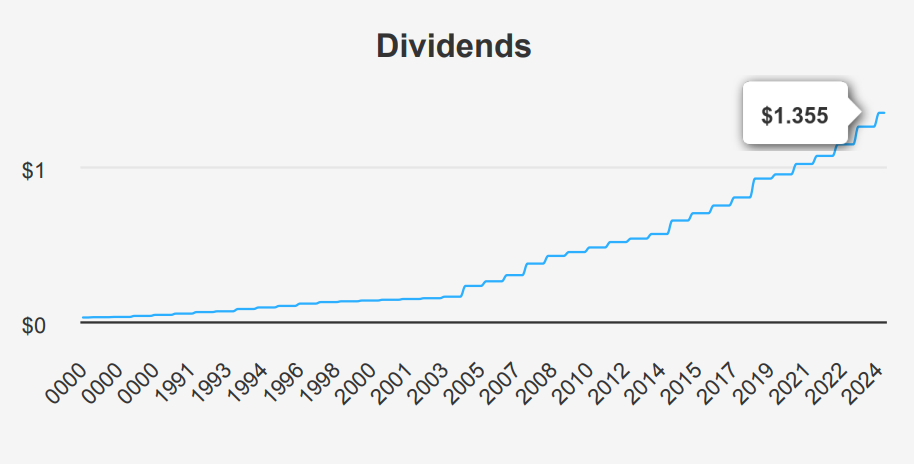

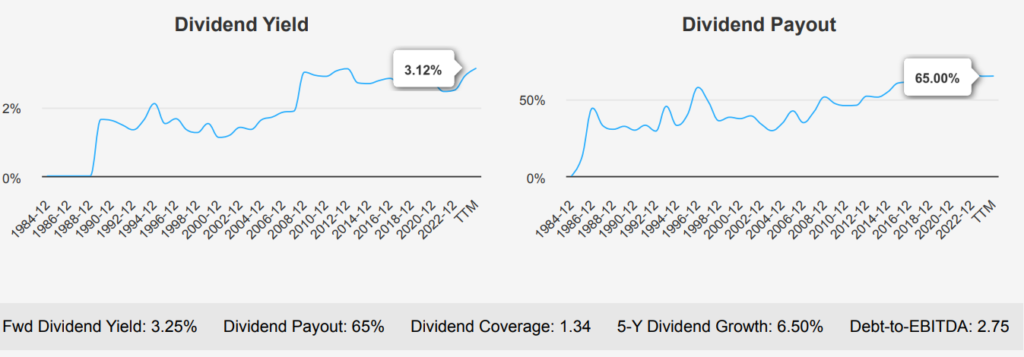

PepsiCo Stock Reliable Dividend Growth: A Smart Investment

PepsiCo Stock has demonstrated consistent dividend growth, with a 5-year growth rate of 6.50% and a 3-year rate of 7.10%. In the most recent quarter, PEP declared a dividend of $1.355 per share, reflecting a steady increase from previous quarters. The forward dividend yield stands at 3.25%, slightly higher than the 10-year median yield of 2.76%, indicating a competitive return relative to historical performance.

The company’s debt-to-EBITDA ratio is 2.75, which falls within the moderate range, suggesting manageable financial leverage while maintaining a solid debt-servicing capacity. This level is generally acceptable for a company of PepsiCo’s size and sector, which typically allows for some leverage to finance growth and operations.

The dividend payout ratio is 65%, significantly lower than historical highs, indicating room for future dividend increases. The forecasted 3-5-year dividend growth rate is 6.74%, suggesting continued moderate growth in shareholder returns. This may support the answer to ‘Is PepsiCo A Good Stock To Buy?’.

Given the last ex-dividend date of September 6, 2024, and the quarterly dividend frequency, the upcoming ex-dividend date would be December 6, 2024, assuming it does not fall on a weekend. The company’s robust dividend policy and manageable debt levels make it an attractive option for income-focused investors.

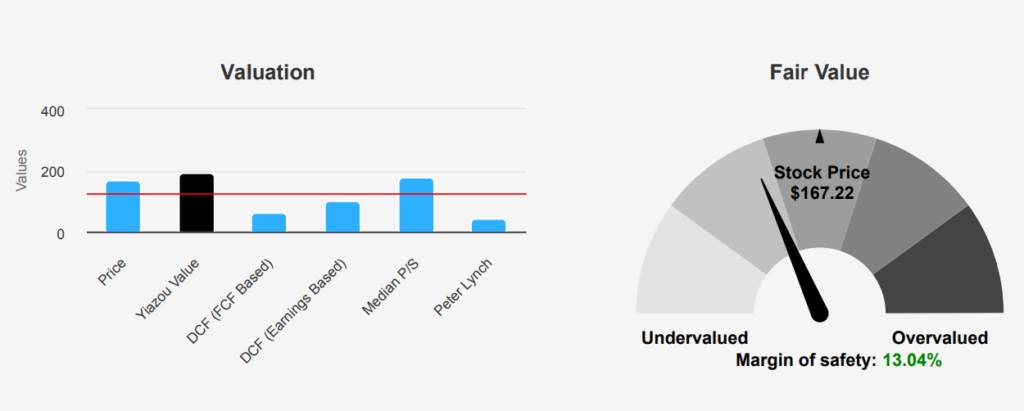

PepsiCo Valuation: Insights on Market Potential Ahead

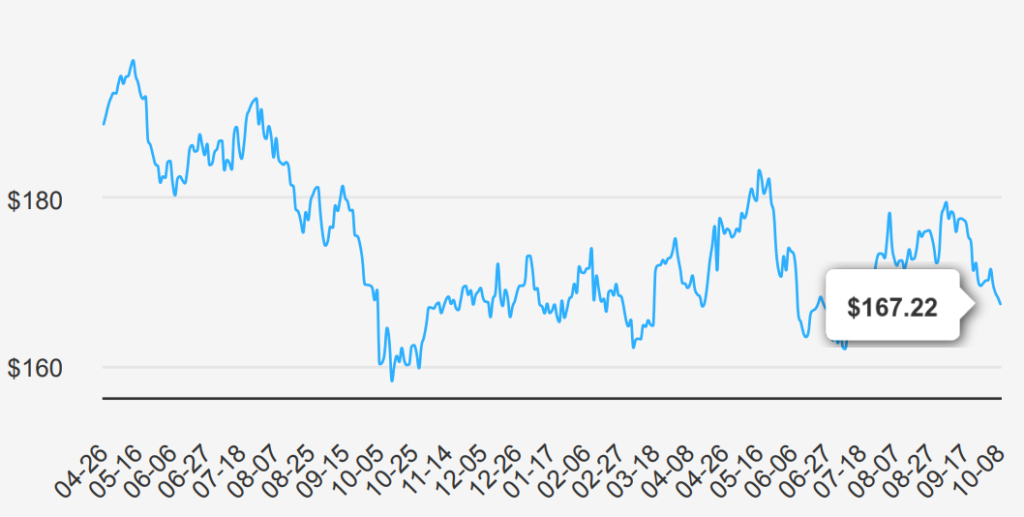

PepsiCo stock currently trades at $167.22, below its intrinsic value of $192.3, suggesting a margin of safety of approximately 13.04%. The Forward P/E ratio stands at 19.24, indicating a potential undervaluation compared to its 10-year median of 26.13, although it’s slightly above the 10-year low of 12.29. This suggests a moderate valuation relative to its historical norms, providing an opportunity for investors seeking growth at a reasonable price. The TTM Price-to-Free-Cash-Flow ratio is 32.85, above its 10-year median of 29.30, hinting at a higher valuation but still within acceptable range compared to its historical peaks.

The EV/EBITDA ratio for PEP is 16.44, nearly aligning with its 10-year median of 16.35, indicating a fair valuation of enterprise value relative to earnings before interest, taxes, depreciation, and amortization. The TTM P/S ratio is 2.51, slightly below the 10-year median of 2.64, suggesting a reasonable valuation relative to sales. The TTM Price-to-Book ratio is 11.81, below the 10-year median of 13.25, potentially indicating undervaluation in net asset value.

Analysts’ price targets have shown slight upward adjustments over the past months, with the current consensus at $183.18, suggesting a potential upside from the current market price. The analyst sentiment remains generally positive, with 23 ratings supporting a favorable outlook. The combination of intrinsic value exceeding the current market price and relatively moderate valuation metrics suggests PEP may be undervalued, offering investors a potential margin of safety and growth opportunity based on historical valuation trends. A clear positive mark for ‘Is PepsiCo A Good Stock To Buy’.

Evaluating PepsiCo: Balancing Risks and Rewards

PepsiCo’s financial health presents a mixed picture. Although the company has increased its debt by $2.9 billion over the past three years, the overall debt level remains manageable. However, the declining operating margin, a decrease of 2.8% annually over the last five years, and the revenue growth slowdown indicate potential profitability challenges. Additionally, the stock price nearing a 1-year high may suggest limited upside potential in the short term.

On a positive note, PepsiCo exhibits strong financial stability, with a Piotroski F-Score of 7, reflecting a robust financial position. The Beneish M-Score of -2.58 suggests that the likelihood of earnings manipulation is low. The current Price-to-Book (PB) and Price-to-Earnings (PE) ratios are near their historical lows, indicating potential undervaluation. Furthermore, the Altman Z-score of 4.02 highlights strong financial health, reducing the risk of bankruptcy. The dividend yield approaching a 3-year high also enhances the stock’s appeal to income-focused investors.

Overall, while there are some areas of concern regarding profitability and growth, PepsiCo’s financial fundamentals remain solid, offering a balanced risk profile for investors.

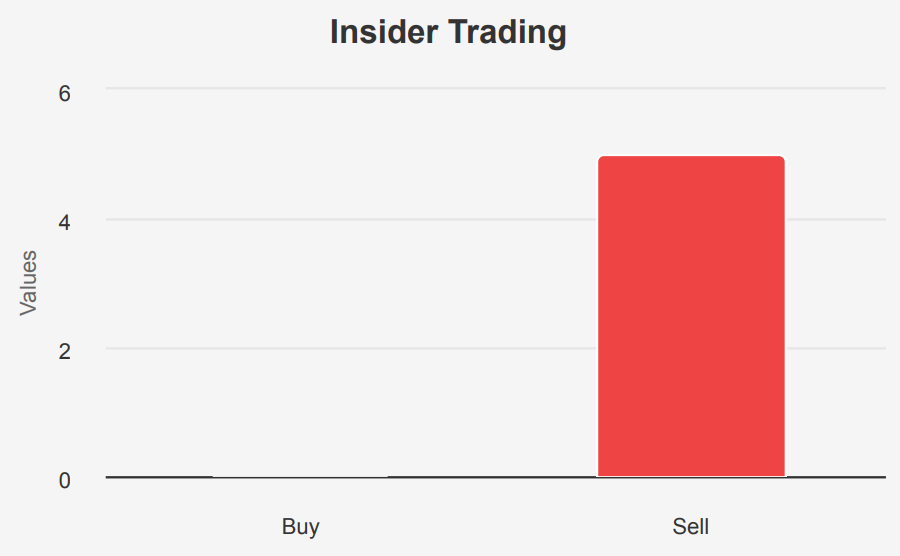

PepsiCo Insider Activity: Signals or Red Flags

An analysis of insider trading activity (to assess ‘Is PepsiCo A Good Stock To Buy’) at PepsiCo over the past year reveals a cautious approach by the company’s directors and management. In the last three months, there have been no insider buys or sells, suggesting a period of stability or uncertainty regarding the stock’s future performance. Over six months, there were two insider sales, and over the past 12 months, this number increased to five. This trend indicates that some insiders have opted to reduce their holdings, though the numbers are not particularly high.

Insider ownership at PepsiCo stands at 0.47%, which is relatively low, indicating that company insiders do not have a significant personal financial stake. On the other hand, institutional ownership is quite high at 74.25%, suggesting that large financial institutions hold a dominant position in the company’s shares, which can influence market perceptions and stability. Overall, the trend analysis suggests a more passive insider trading activity, with institutional investors playing a key role in the company’s ownership structure.

PepsiCo Stock’s High Liquidity and Market Sentiment

PepsiCo demonstrates a robust liquidity profile, though there are some areas to monitor. With an average daily trading volume of 5,354,350 shares over the past two months, the company’s stock is frequently traded, suggesting strong market interest and ample liquidity. However, the recent daily volume of 4,504,628 shares falls below this average, indicating a temporary reduction in trading activity.

The Dark Pool Index (DPI) stands at 48.19%, a significant metric in assessing the proportion of trades occurring in non-transparent venues. A DPI near 50% suggests a balanced trading activity between dark pools and traditional exchanges, implying stability in stock price movements and indicating potential hidden liquidity.

Navigating the Ups and Downs of Government Contracts

PepsiCo experienced fluctuating government contract values from 2019 to 2024. The amount peaked in 2022 at $8,505,360, indicating a significant increase in government engagement that year. The initial rise from 2019 to 2021 suggests strategic efforts to expand in this sector, but the subsequent decline in 2023 and 2024 to $3,675,380 and $2,842,469, respectively, indicates variability in contract acquisition or government spending. This pattern suggests volatility in government contracts, requiring adaptive strategies to stabilize this revenue stream.

Congressional Trades: Political Insights on PepsiCo Moves

In recent congressional trading activities, two notable transactions involving PepsiCo Inc. (PEP) were reported. On September 4, 2024, Representative John James, a Republican from the House of Representatives, sold shares valued between $1,001 and $15,000. This transaction was reported on September 6, 2024, and last modified on September 9, 2024. Earlier, on August 2, 2024, Representative C. Scott Franklin, also a Republican from the House of Representatives, purchased shares in the same value range, which was reported on August 20, 2024, and last modified on August 21, 2024.

Both transactions involved relatively modest investments by congressional standards, falling within the $1,001 to $15,000 range. This suggests a strategic management of portfolio holdings in PEP, with the purchase by Franklin preceding James’s sale by about a month. These trades reflect varied strategic positions on PepsiCo’s market performance, possibly influenced by differing views on the company’s prospects or broader market conditions.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.