ASML Stock: Invest In A Dominance in Photolithography That Derives Semiconductor Advancements

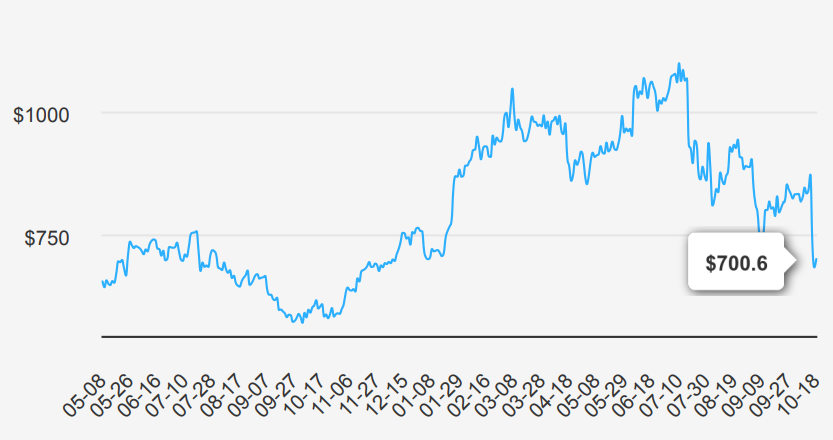

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML’s main clients are TSMC, Samsung, and Intel. ASML stock is currently trading at ~$700. Let’s explore: Is It A Good Time To Buy ASML Stock?

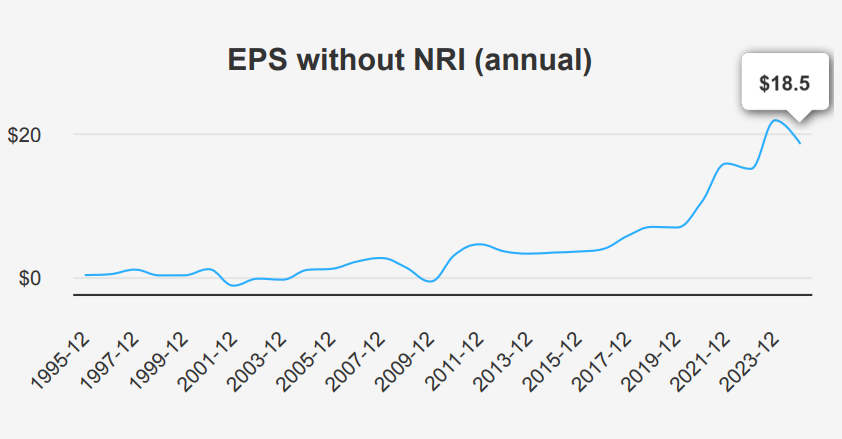

ASML Q3 2024 EPS Growth Outpaces 5-Year CAGR by 35%

ASML reported an EPS without NRI (excluding non-recurring items) of $5.86 for Q3 2024, marking a significant increase both quarter-over-quarter (QoQ) from $4.316 in Q2 2024 and year-over-year (YoY) from $5.133 in Q3 2023. This growth is supported by a 23.3% QoQ increase in revenue per share to $21.056 from $17.077 in the previous quarter. ASML has maintained a strong 5- year and 10-year CAGR for annual EPS without NRI at 29.00% and 24.00%, respectively. The semiconductor industry’s forecasted growth over the next 10 years suggests robust expansion, predicted to rise at an annual rate of approximately 6-8%.

ASML’s gross margin stands at 51.15%, slightly above its 5-year median of 50.54%, indicating solid profitability. The company has effectively leveraged share buybacks to enhance shareholder value, with a 1-year buyback ratio of 0.40%, meaning 0.40% of outstanding shares were repurchased over the past year. Over a 10-year period, the share buyback ratio is at 1.10%, reflecting consistent share repurchase activity. These buybacks contribute positively to EPS by reducing the number of shares outstanding, thereby improving earnings per share.

Looking ahead, ASML stock may yield continued growth, with analysts estimating EPS for the next fiscal year at $20.521 and $32.123 for the following year. Revenue may rise to $30,027.31 million by the end of 2024, further increasing to $43,669.86 million by 2026. Further, the next earnings report is on January 29, 2025, where these estimates may gauge the company’s trajectory in the competitive semiconductor landscape and build a positive towards the question ‘Is It A Good Time To Buy ASML Stock?’.

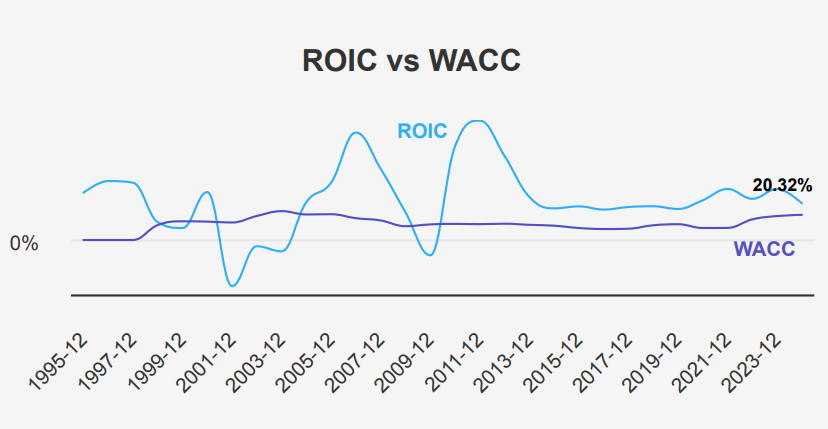

ASML’s 5-Year 23.53% ROIC Exceeds 8.76% WACC

ASML has demonstrated strong financial performance and effective capital allocation over the past decade. The company’s Return on Invested Capital (ROIC) consistently exceeds its Weighted Average Cost of Capital (WACC), indicating efficient value generation. Specifically, ASML’s 5-year median ROIC is 23.53%, significantly higher than the 5-year median WACC of 8.76% and even the current WACC of 13.96%. This spread between ROIC and WACC reflects ASML’s ability to create shareholder value by generating returns well above its cost of capital.

Moreover, ASML’s Return on Equity (ROE) is robust, with a 5-year median of 49.01% and a current ROE of 49.40%, underscoring its ability to effectively leverage shareholder equity to produce profits. The company’s high ROE, compared to its historical lows, shows consistent financial strength.

Overall, ASML’s financial metrics indicate that it is not only sustaining but also enhancing economic value, benefiting from its strategic investments and operational efficiency in the semiconductor industry.

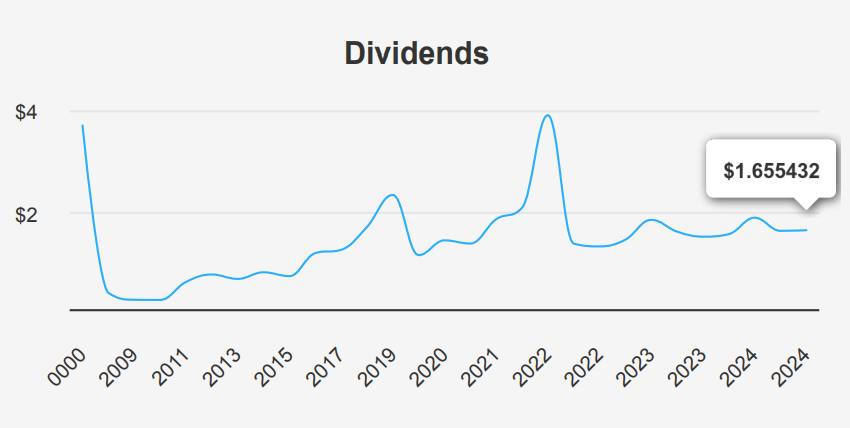

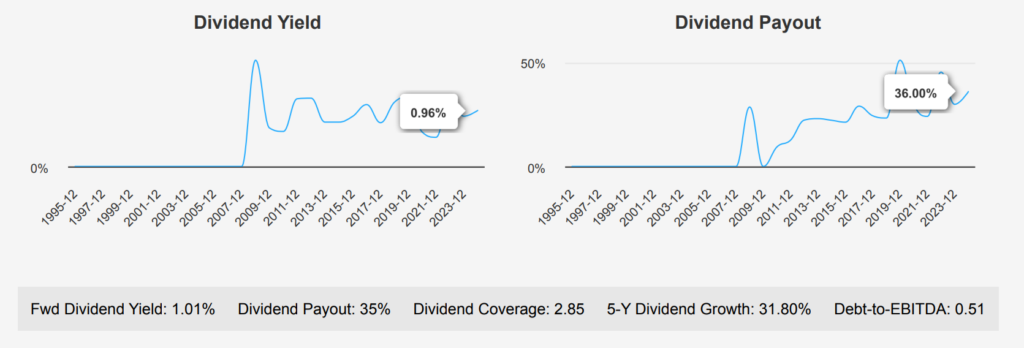

ASML’s 5-Year Dividend Growth Exceeds 31% Annually

ASML has demonstrated robust dividend growth with a notable 5- year growth rate of 31.80% and a 3-year rate of 32.70%. In the most recent quarter, ASML declared a dividend per share of $1.655432, marking a consistent upward trend in its dividend payouts. The forward dividend yield stands at 1.01%, which is relatively modest against the sector’s 10-year high of 1.73%. However, this yield is consistent with ASML’s historically prudent payout ratios, currently at 35.0%.

The company’s Debt-to-EBITDA ratio is a low 0.51, indicating strong debt-servicing capacity and minimal financial risk. This places ASML in a favorable position against the industry benchmark, where a ratio below 2.0 is considered low-risk.

Looking forward, ASML’s dividend growth rate may be ~16.41% over the next 3-5 years, suggesting continued strength in its dividend policy. The next ex-dividend date is on January 29, 2025, given the quarterly dividend frequency. This prediction assumes market conditions remain stable and the company continues its current dividend policy. A positive tick on ‘Is It A Good Time To Buy ASML Stock?’.

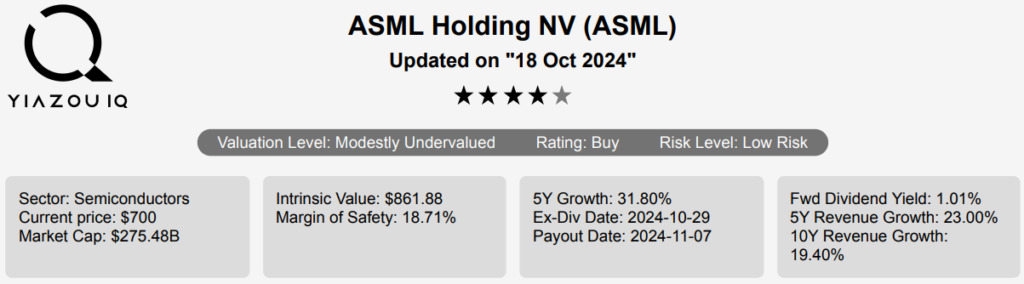

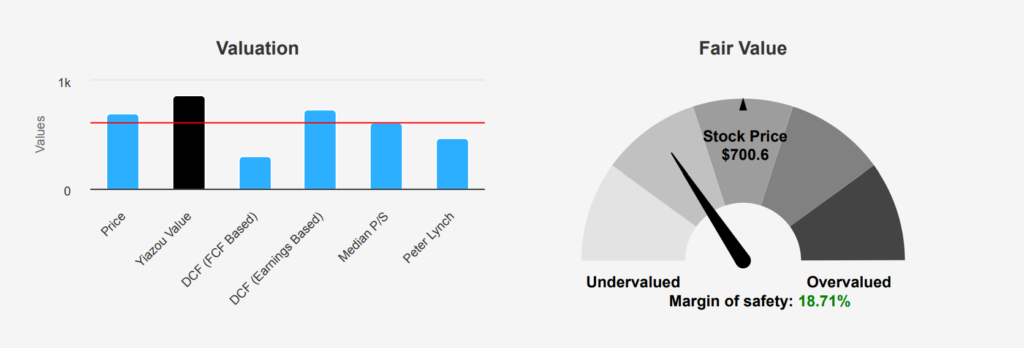

ASML Valuation: Intrinsic Value of $861.88 Shows 18.71% Upside

ASML’s current intrinsic value of $861.88 exceeds its market price of $700.60, suggesting a potential margin of safety of 18.71%. This indicates that the stock may hold undervaluation relative to its intrinsic worth. The Forward P/E ratio stands at 22.2, slightly below the 10-year median of 34.46, suggesting a more favorable earnings outlook compared to historical standards. The TTM EV/EBITDA ratio is 27.37, close to its 10-year median of 26.48, indicating that the current valuation is in line with historical norms.

The TTM Price-to-Book ratio, at 15.81, is significantly higher than the 10-year median of 8.09. This suggests that the stock is trading over its book value against its historical averages. Similarly, the TTM Price-to-Free Cash Flow ratio, at 90.26, is well above its 10-year median of 42.46, indicating potential overvaluation in terms of free cash flow generation. Despite these elevated ratios, the intrinsic value analysis suggests there may be a buffer against market price, supporting a cautious optimism towards ‘Is It A Good Time To Buy ASML Stock?’.

Recent analyst ratings reflect a positive outlook on ASML, as evidenced by the price target trends, although they have shown some downward revisions over the past months. The consensus price target of $996.31, while declining from previous months, still points to significant upside potential from the current market price. This mix of valuation metrics and analyst sentiment suggests a cautiously optimistic stance, balancing intrinsic value advantages with elevated valuation ratios.

Evaluating ASML Stock: Risk, Reward, and Valuation

ASML Holding NV’s stock presents a mixed risk profile, with several indicators pointing to its financial stability and growth potential. The company’s Beneish M-Score of -2.22 suggests a low likelihood of earnings manipulation, which is a positive signal for investors concerned about financial transparency. Furthermore, the expanding operating margin indicates improved efficiency and profitability, which could enhance the company’s earnings potential over time.

The company’s price-to-book (PB) ratio is at a three-year low of 15.43, suggesting that the stock is undervalued relative to its historical levels. If investors believe in the company’s long-term growth prospects, this could present a buying opportunity. Additionally, ASML’s strong Altman Z-score of 8.82 reflects robust financial health, reducing the risk of bankruptcy and enhancing investor confidence.

Despite these strengths, the slowdown in revenue growth over the past year is a concern that investors should monitor closely. This deceleration could indicate potential challenges in sustaining growth momentum, which might impact future stock performance. Investors should weigh these factors carefully, considering the company’s solid financial foundation and the recent revenue trends before making investment decisions, ‘Is It A Good Time To Buy ASML Stock?’.

ASML Stock Insider Activity Analysis: Implications and Ownership Trends

The insider trading activity for ASML over the past 12 months shows a complete absence of transactions by the company’s directors and management. There have been zero insider buys, and zero insider sells in the last 3, 6, and 12 months. This lack of activity suggests insiders may simply be content with their current holdings and see no immediate reason to adjust their positions.

Moreover, ASML’s insider ownership is notably at 0%, indicating that the company’s management and directors do not hold significant personal stakes in the company. This could suggest a potential misalignment of interests between the management and shareholders. However, institutional ownership stands at a robust 20.35%, reflecting strong interest and confidence from institutional investors. This significant institutional presence might stabilize the company’s stock, as these investors often pursue long-term value-creation strategies.

ASML’s Liquidity Surge: Trading Volume and DPI Insights

ASML showcases a robust liquidity profile, with a significant increase in its trading volume. The recent volume of 7,160,161 shares traded in a day notably surpasses its average daily trading volume of 1,713,990 shares over the past two months. This surge indicates heightened investor interest and potentially increased market activity, which may lead to greater price discovery and narrower bid-ask spreads.

The Dark Pool Index (DPI) for ASML stands at 42.89%. It suggests a substantial portion of its trades are executed in dark pools. This could imply that institutional investors are actively engaging in the stock, possibly due to strategic transactions or to minimize market impact. A DPI of this level could also reflect a balanced mix of public and private trading, contributing to overall market stability for the asset.

Overall, ASML’s current trading and liquidity metrics suggest a highly active stock with considerable interest from large market players, enhancing its attractiveness to both institutional and retail investors seeking opportunities in the semiconductor sector.

Congressional Transactions: ASML Stock Activity Analysis

In recent congressional trading activity, two notable transactions involving ASML, a major player in the semiconductor industry, were reported. On October 8, 2024, Representative Marjorie Taylor Greene, a Republican from the House of Representatives, disclosed a purchase of ASML stock valued between $1,001 and $15,000. This transaction occurred on October 4, 2024. Just a few days earlier, on October 3, 2024, Democratic Representative Josh Gottheimer reported selling ASML shares within the same value range, with the transaction date recorded as September 23, 2024.

These trades may reflect differing outlooks on ASML’s market performance or strategic portfolio adjustments by the representatives. Greene’s purchase suggests a bullish perspective or confidence in ASML’s future growth, while Gottheimer’s sale might indicate profit-taking or a shift in investment strategy. Such activities can offer insights into how political figures are positioning themselves in the fast-evolving tech sector.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of ASML either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.