Innovative Industrial Properties Stock: A Leading Cannabis-Related Real Estate Investment Trust

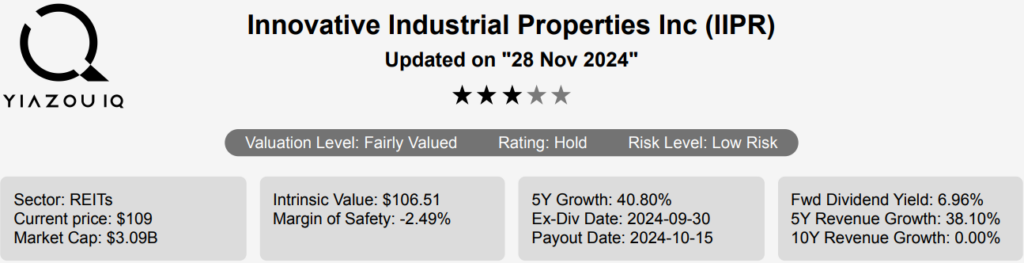

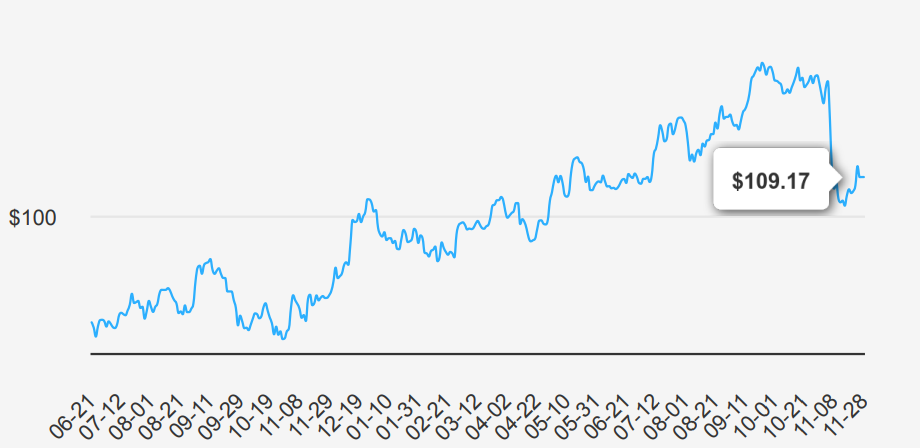

Innovative Industrial Properties (IIPR) is a real estate investment trust engaged in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. It conducts its business through a traditional umbrella partnership real estate investment trust, or UPREIT structure, in which properties are owned by an Operating Partnership, directly or through subsidiaries. Its property portfolio is spread across the United States. IIPR stock is currently trading at $109.17. Let’s explore the IIPR Stock Forecast.

IIPR’s Q3 2024 Performance: A Mixed Earnings Report

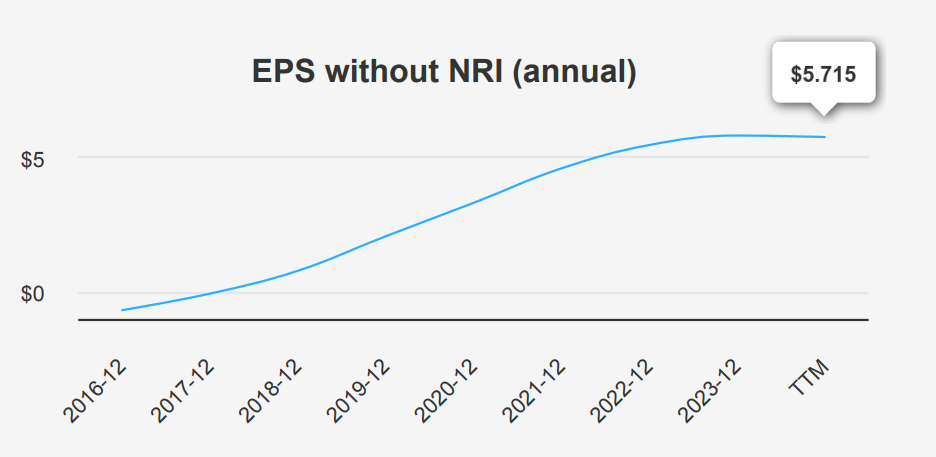

Innovative Industrial Properties reported its Q3 2024 results, showing an EPS without non-recurring items (NRI) of $1.37, a decrease from $1.535 in Q2 2024, and slightly below the $1.45 reported for the same quarter last year (YoY). The revenue per share for Q3 2024 was $2.678, down from $2.793 in Q2 2024, also reflecting a minor decline from Q3 2023’s $2.753. Over the past five years, IIPR’s EPS without NRI has grown at a compound annual growth rate (CAGR) of 47%, indicating strong historical performance, despite the current quarterly downturn. Analysts forecast continued industry growth, projecting approximately 20% annual growth over the next decade.

The company’s gross margin for this quarter stands at 90.98%, slightly below its five-year median of 96.19%. This suggests some compression in profitability, potentially due to increased operational costs or changes in pricing strategy. IIPR has not engaged in significant share buybacks recently, with a one-year buyback ratio of -1.00%, indicating a slight increase in shares outstanding, which can dilute EPS if earnings do not grow proportionately. Over three years, the buyback ratio is -5.50%, suggesting a similar trend of increasing shares.

Looking forward, analysts estimate IIPR’s EPS to reach $5.570 for the next fiscal year, with further growth to $5.765 in the following year. Revenue may grow modestly, with estimates of $309.15 million by the end of 2024 and $321.08 million by 2025. The next earnings announcement may be on February 27, 2025, providing further insights into the company’s strategic adjustments and IIPR Stock Forecast.

Analyzing IIPR’s Capital Efficiency and Return on Invested Capital

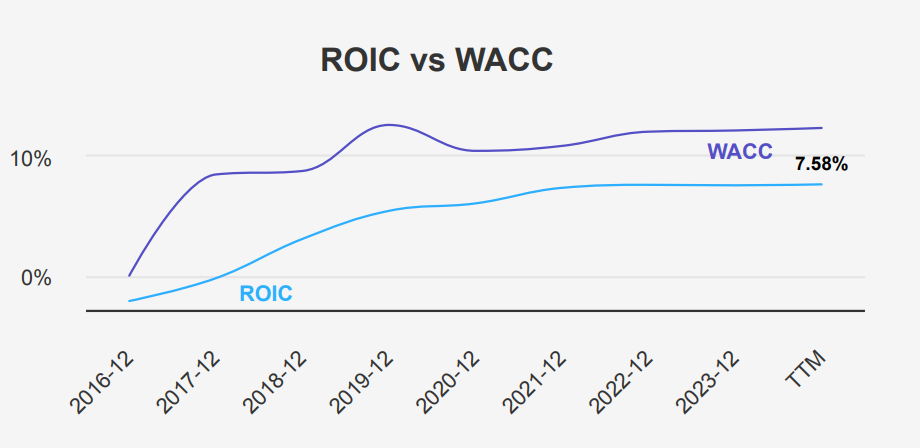

Innovative Industrial Properties appears to struggle with creating economic value, as indicated by its Return on Invested Capital (ROIC) consistently falling below its Weighted Average Cost of Capital (WACC). Over the past five years, IIPR’s median ROIC was 7.29%, while the median WACC was higher at 11.95%. This discrepancy suggests that IIPR is not generating sufficient returns on its investments to cover the cost of capital, resulting in value erosion rather than creation.

Currently, IIPR’s ROIC stands at 7.58%, still below its current WACC of 12.26%. This persistent gap between ROIC and WACC highlights inefficiencies in capital allocation, indicating that the company may not be effectively using its invested capital to generate adequate returns. The economic value creation remains negative, as the cost of financing its operations exceeds the returns generated. For IIPR to enhance value for shareholders, it would need to improve its operational efficiency or reassess its investment strategies to ensure that ROIC surpasses WACC consistently. This could involve optimizing asset utilization or reducing capital costs.

Robust Dividend History Faces Sustainability Concerns Amid High Payouts

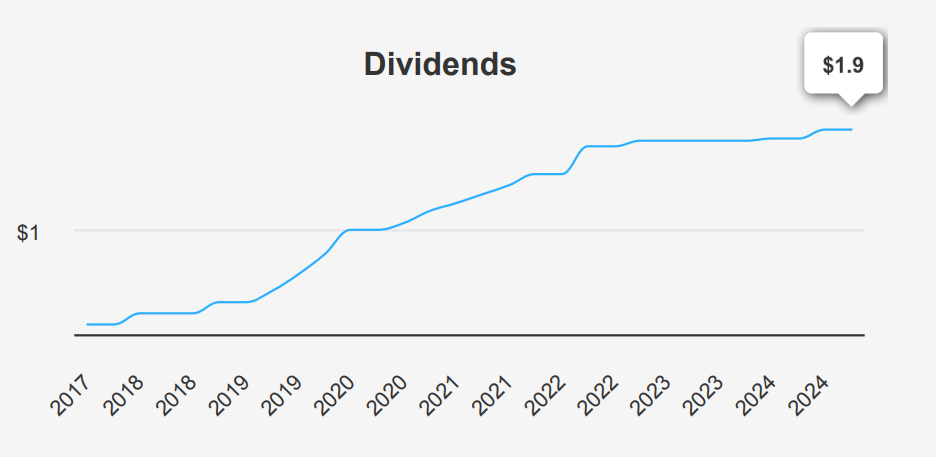

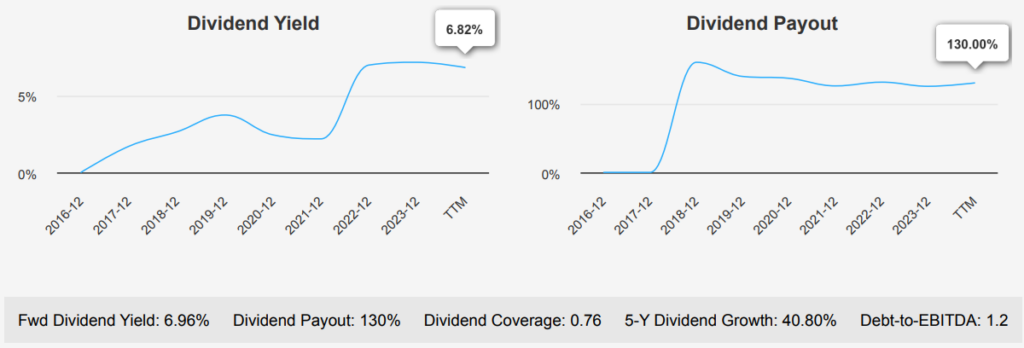

Innovative Industrial Properties has demonstrated robust dividend growth over the past five years, with a compound annual growth rate of 40.80%. The most recent quarterly dividend of $1.90 per share, payable in October 2024, maintains the trend of increasing dividends, albeit at a slower pace in recent quarters. The forward dividend yield stands at a competitive 6.96%, significantly higher than the sector median of 2.96% over the past decade.

Despite the attractive yield, the dividend payout ratio of 130% raises sustainability concerns, as it significantly exceeds the 10-year median of 101.34%. This suggests that the company is paying out more in dividends than it earns, which can be risky if earnings do not improve. The Debt-to-EBITDA ratio of 1.20 indicates a strong capacity to service debt, reflecting low financial risk compared to industry norms. This financial stability could support continued dividend payments despite the high payout ratio.

The forecasted dividend growth rate is stagnant over the next 3-5 years, indicating potential challenges in maintaining current dividend levels or further increases. The next ex-dividend date is on December 27, 2024, a Friday, based on the quarterly frequency.

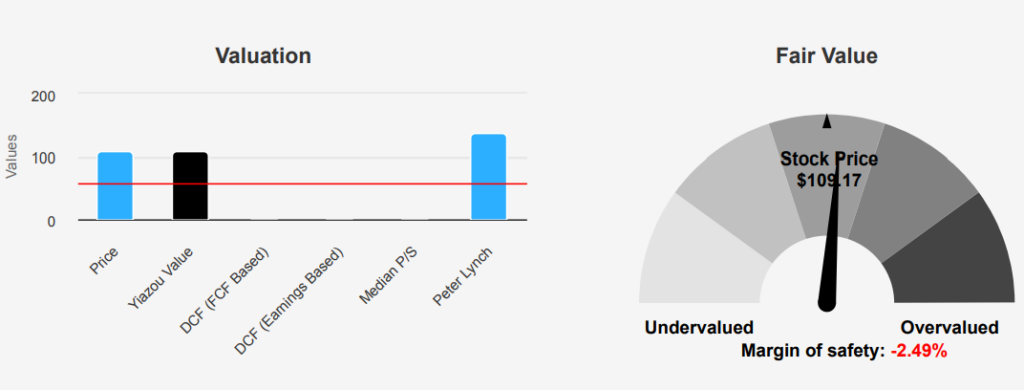

IIPR’s Undervalued Stock: A Deep Dive into Valuation Metrics

Innovative Industrial Properties (IIPR) is currently trading at $109.17, which is below its intrinsic value of $106.51, offering a margin of safety of –2.5%. This indicates the stock holds overvaluation based on its intrinsic value. The TTM P/E ratio stands at 19.43, below its 10- year median of 41.61, suggesting a potential undervaluation relative to historical norms. However, the Forward P/E ratio is slightly lower at 18.92, indicating moderate expectations for earnings growth. The TTM EV/EBITDA ratio of 13.13 is significantly below the 10-year median of 26.14, pointing towards a more favorable valuation compared to past averages.

Examining other key metrics, IIPR’s TTM Price-to-Free-Cash-Flow is 11.61, notably lower than the 10-year median of 19.82, which could signal a more attractive entry point for investors focusing on cash flow generation. Meanwhile, the TTM P/B ratio of 1.61 is close to its 10-year low of 0.96, yet beneath the median of 1.82, suggesting the stock holds attractive price relative to its book value. The TTM P/S ratio is 9.94, a reduction from its 10-year median of 18.56, indicating a more reasonable price in relation to sales.

Despite the current overvaluation against intrinsic value, analyst sentiment remains moderately positive, with a price target of $135.40, consistent over recent months. This target suggests potential upside, albeit contingent on market conditions and company performance aligning with analyst expectations. Overall, under IIPR stock forecast some valuation metrics indicate potential undervaluation, the lack of a margin of safety should be considered by investors, as the stock’s current price exceeds its calculated intrinsic value.

IIPR’s Risk Profile: Strong Financials but Dividend and Capital Efficiency Issues

Innovative Industrial Properties presents a mixed risk profile. On the downside, the company’s total assets have expanded at a rapid pace of 51.8% annually compared to its revenue growth of 38.1% over the past five years. This discrepancy suggests potential inefficiency in asset utilization. Moreover, the dividend payout ratio of 1.30 is alarmingly high, indicating that the current dividend might not be sustainable.

Additionally, the slowdown in revenue growth over the last 12 months and the company’s return on invested capital falling short of its weighted average cost of capital further highlight concerns regarding capital efficiency. However, IIPR also demonstrates significant strengths. The Piotroski F-Score of 7 reflects a very healthy financial state, and the Beneish MScore of -2.63 suggests a low risk of financial manipulation.

Under IIPR stock forecast, The expanding operating margin is a positive indicator of improving profitability, and an Altman Z-score of 4.41 suggests financial solid stability, reducing the likelihood of bankruptcy. In conclusion, while there are areas of concern, particularly regarding dividend sustainability and capital efficiency, the company’s strong financial metrics and expanding margins provide a robust counterbalance, indicating a potentially stable but cautious investment opportunity.

Minimal Insider Activity Reflects Confidence in IIPR’s Operations

Over the past year, Innovative Industrial Properties has exhibited minimal insider trading activity. Specifically, there have been no insider purchases in the last 3, 6, or 12 months and only one insider sale over the past 12 months. This low level of insider trading may suggest steady confidence among company insiders regarding the firm’s current operations and future prospects, as frequent insider selling could indicate potential concerns about the company’s performance under the IIPR stock forecast.

Insider ownership stands at a modest 1.42%, suggesting a relatively low level of alignment between insider interests and those of shareholders. This is offset, to some extent, by the substantial institutional ownership of 70.,5whichhat indicates strong institutional confidence and support in the company. The lack of recent insider buying or selling trends further implies stability, though stakeholders might consider the implications of the low insider ownership for governance and strategic influence. Overall, the trends suggest a stable insider sentiment with potential reliance on institutional investors for strategic backing.

IIPR Stock Has Solid Liquidity and Institutional Support, But Watch the Dark Pool Activity

Innovative Industrial Properties exhibits moderate liquidity and trading activity. The average daily trading volume over the past two months is 215,359 shares, suggesting a relatively stable interest from investors. However, the recent daily trading volume of 174,563 shares indicates a slight drop, potentially reflecting decreased investor activity or market sentiment fluctuations.

The Dark Pool Index (DPI) stands at 45.15%, signifying that a substantial portion of trades are on off-exchange in dark pools. This level of dark pool activity suggests significant interest from institutional investors, who often use these platforms to execute large trades with minimal market impact. Overall, IIPR’s trading metrics suggest a steady investor engagement, with liquidity supported by both traditional exchanges and dark pool activities. Under the IIPR stock forecast, investors should monitor trading volumes closely to gauge shifts in market sentiment and liquidity conditions.

Congressional Sales of IIPR Stock: A Reflection of Sector Sentiment

Daniel Goldman, a Democratic member of the House of Representatives, executed two notable sales of Innovative Industrial Properties stock in 2023, each valued between $1,001 and $15,000. The more recent transaction occurred on July 12, 2023, and was reported on August 13, 2023. This sale may indicate a strategic financial decision, potentially in response to market conditions or personal financial strategy. Earlier in the year, on April 10, 2023, Goldman conducted another sale of the same stock, reported on May 19, 2023. These transactions suggest a consistent approach in managing holdings in IIPR. Given the nature of IIPR as a company involved in the leasing of industrial properties to medical-use cannabis growers, these sales might reflect shifts in confidence in the sector or broader market trends. Monitoring further activity in this sector could provide insights into the evolving investment strategies of congressional members.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.