Emerson Electric Stock: An Investment In Automation for Industry

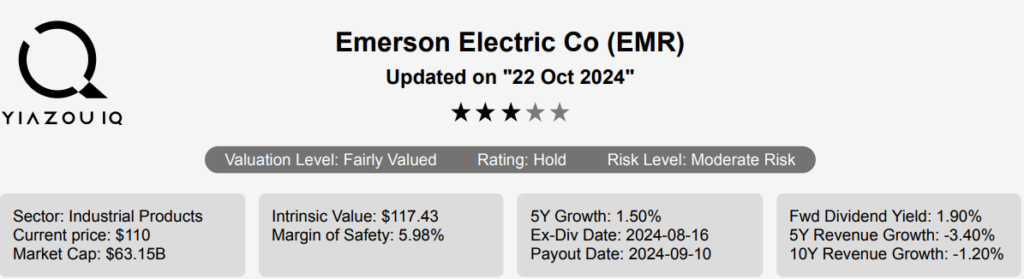

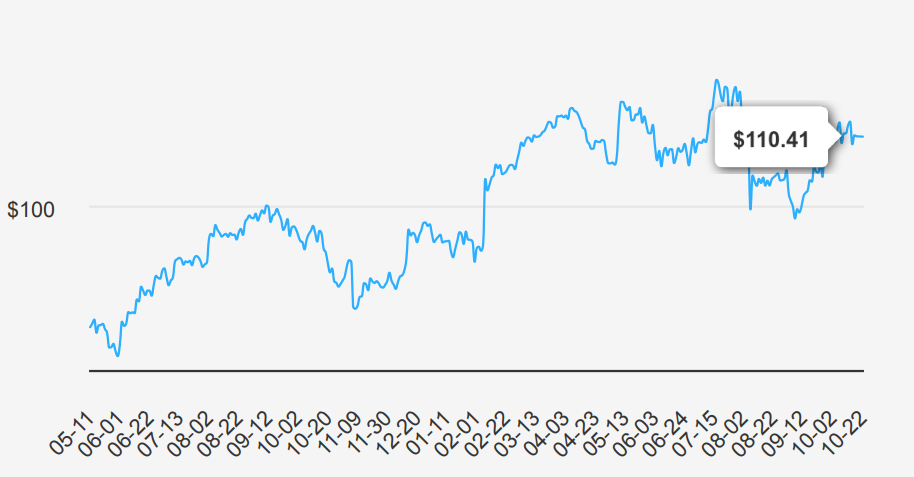

Emerson Electric (EMR) sells automation equipment and services under two segments: intelligent devices and software control. Within software and control, it also holds a majority interest in AspenTech, an industrial software business, and owns a test and measurement business that was formerly National Instruments. Intelligent devices also holds Emerson’s tools business, which boasts several household brands, like Ridgid. Emerson’s automation business is most known for its process manufacturing solutions, which consists of measurement and analytical instrumentation, as well as control valves and actuators, among other products and services. Nearly half of the firm’s geographic sales come from the Americas. EMR stock is currently trading at~$110. Lets assess, is Emerson Electric a buy or sell?

EMR Earnings: A Strong Quarter and Promising Future

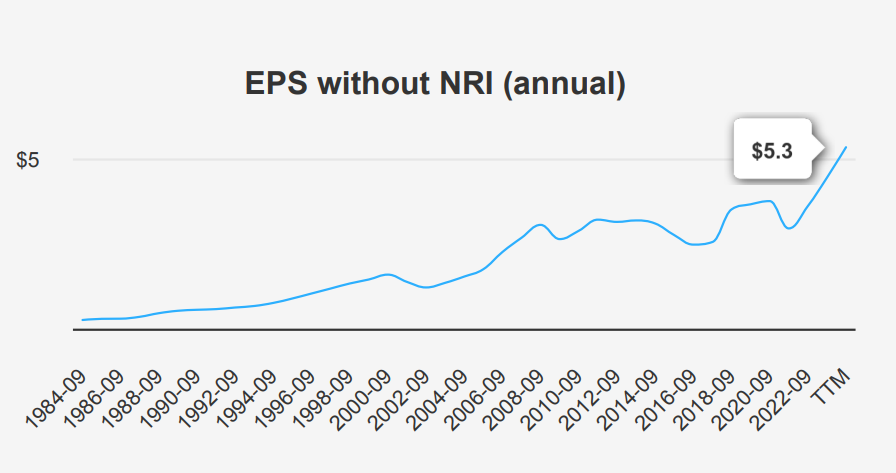

Emerson Electric reported its latest quarterly results, showing an EPS without Non-Recurring Items (NRI) of $1.43, up from $1.36 in the previous quarter and $1.29 in the same quarter last year. This indicates a positive quarter-over-quarter (QoQ) growth and a year-over-year (YoY) improvement, reflecting steady operational performance. Revenue per share also increased to $7.62 compared to $7.114 in the prior quarter, suggesting robust sales growth. Over the long term, EMR has demonstrated annual EPS growth rates of 2.50% over five years and 3.20% over ten years, showcasing consistent financial performance. Looking ahead, analysts project revenues to reach $19,181 million by 2026, indicating an optimistic outlook on ‘is Emerson Electric a buy or sell?’.

EMR’s gross margin reached a 10-year high of 50.26%, significantly above its five-year median of 44.31%, highlighting improved efficiency and cost management. The company’s share buyback strategy remains a key component of its capital allocation. The 1-year share buyback ratio is -0.10%, suggesting minimal repurchase activity recently, contrasting with a 5-year buyback ratio of 1.60%. The buyback ratio represents the percentage of outstanding shares repurchased. For instance, a ratio of 1.60 indicates that 1.60% of the shares have been bought back, potentially enhancing EPS by reducing the share count.

Industry forecasts suggest a growth rate of approximately 4-5% annually over the next decade, which aligns well with EMR’s strategic initiatives and growth trajectory. Analysts estimate the next fiscal year EPS to reach $3.126, climbing to $4.411 in the following year, suggesting continued earnings expansion. With the next earnings date estimated on November 7, 2024, investors will be keenly watching for updates on EMR’s strategic plans and further insights into ‘is Emerson Electric a buy or sell?’.

Assessing Emerson Electric’s Value Creation Dynamics

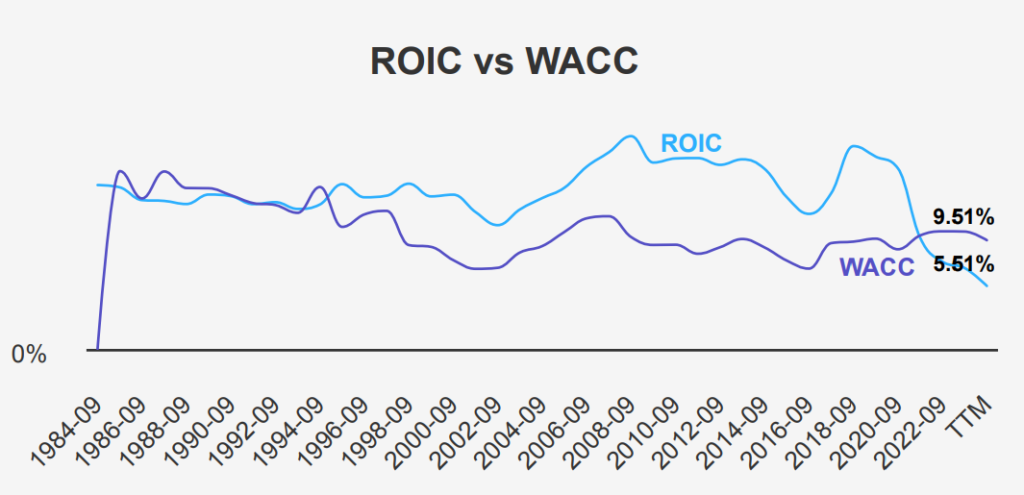

Evaluating EMR’s financial performance through the lens of economic value creation involves comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). The 5-year median ROIC for EMR stands at 9.72%, slightly below the 5-year median WACC of 9.93%. This indicates that historically, EMR’s capital allocation has been marginally inefficient, as it slightly underperforms the cost of capital.

The current ROIC of 5.51% is significantly below both the median and the current WACC of 9.51%, suggesting that in recent periods, the company is not generating sufficient returns to cover its cost of

capital, leading to potential value destruction. However, it’s important to note the historical strength in EMR’s performance, as evidenced by the high ROE and ROIC figures in the past, such as the 10-year high ROIC of 17.75%. The figures suggest that while EMR has had periods of strong performance, recent metrics indicate challenges in maintaining efficient capital allocation and generating economic value.

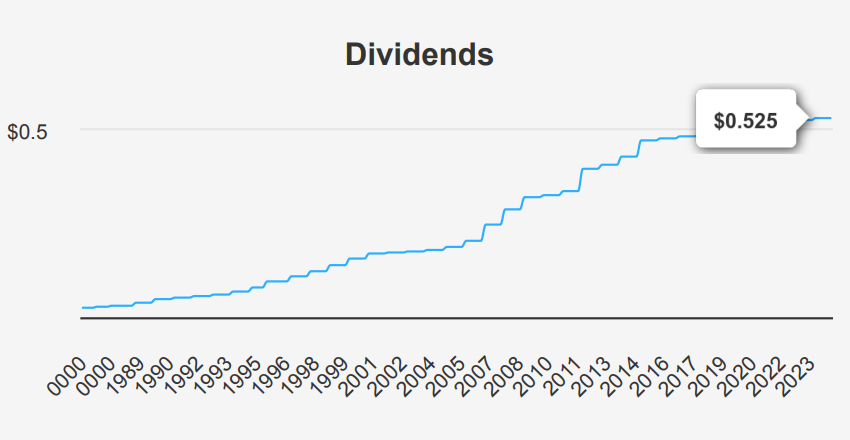

Steady Dividends: Emerson Electric’s Commitment to Shareholders

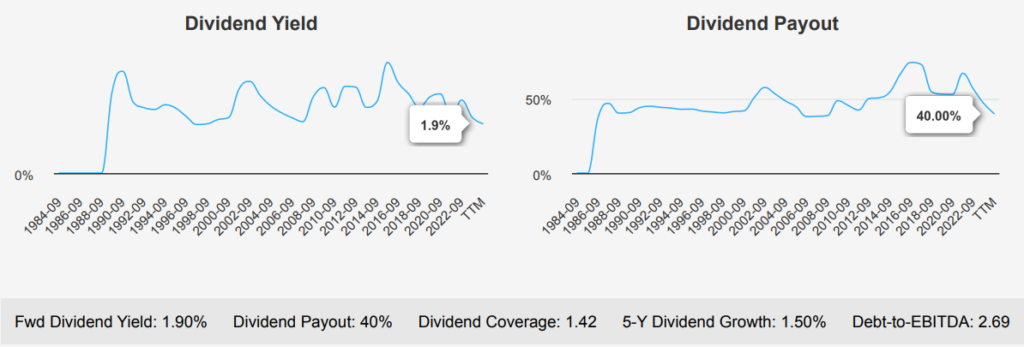

Emerson Electric demonstrates moderate dividend growth, with a 5-year growth rate of 1.50% and a 3-year rate of 1.30%, reflecting steady but modest increases. For the most recent quarter, EMR maintained its dividend per share at $0.525, consistent with prior quarters, suggesting stability in its dividend policy.

The company’s forward dividend yield stands at 1.90%, which is below the 10-year median yield of 2.74%, indicating potential undervaluation compared to historical norms. However, the dividend payout ratio is 40%, significantly improved from its historical highs, suggesting more sustainable dividend payments going forward.

EMR’s Debt-to-EBITDA ratio is at 2.69, which lies within the moderate range. While this indicates some financial leverage, it remains manageable given the industry context. The forecasted 3-5 year dividend growth rate of 3.19% suggests a slightly accelerated pace of dividend increases, aligning with the company’s financial capacity and outlook on ‘is Emerson Electric a buy or sell’.

The next ex-dividend date is slated for November 15, 2024, based on a quarterly frequency. This ensures the next date will be a weekday, avoiding weekends, and aligns with the company’s regular dividend schedule.

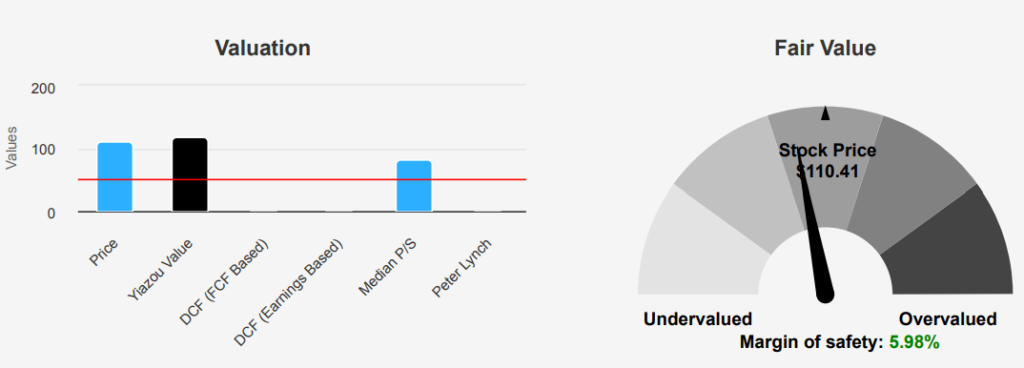

Unlocking EMR’s Valuation: Opportunities and Risks Ahead

EMR’s current market price of $110.41 offers a slight margin of safety of 5.98% compared to its intrinsic value of $117.43. The current Forward P/E of 18.62 is below the 10-year median of 19.16, suggesting a valuation slightly below its historical norm. The TTM P/E stands at 37.05, indicating a higher valuation compared to its long-term median, but still below the 10-year high of 39.21. This mixed signal may suggest a transition phase or market anticipation of future earnings growth.

The TTM EV/EBITDA ratio is 17.89, above its 10-year median of 13.58, indicating a potential overvaluation relative to historical averages. Similarly, the TTM Price-to-Free-Cash-Flow ratio of 53.47 is significantly higher than its 10-year median of 18.98, which could indicate investor optimism or cash flow concerns. However, the TTM Price-to-Book ratio of 3.04 is below the 10-year median of 4.71, suggesting that the stock is undervalued from a book value perspective.

Analyst sentiment appears cautiously optimistic, with a current price target of $125.58, slightly down from recent months but still above the current trading price. This suggests that analysts see upside potential. Overall, while certain metrics suggest overvaluation, the intrinsic value and analyst price targets indicate a reasonable opportunity on the question ‘is Emerson Electric a buy or sell?’ with a modest margin of safety, primarily driven by favorable forward earnings expectations and a relatively stable P/B ratio.

Balancing Risks and Rewards in Emerson Electric

Emerson Electric presents a mixed risk profile. On the positive side, its Altman Z-score of 3.82 suggests strong financial health, indicating a low risk of bankruptcy. The expanding operating margin also reflects improved efficiency in the company’s operations, which can be beneficial for profitability. Additionally, the Beneish M-Score of -2.26 suggests that the company is unlikely to be manipulating its financial statements, providing a level of transparency and reliability in financial reporting.

However, there are several concerns to consider. The company has been increasing its debt, having issued $1.7 billion over the past three years, though the overall level remains within acceptable limits. The decline in revenue per share over the last five years and a high PE ratio nearing a 10-year high indicate potentially overvalued stock. Furthermore, the return on invested capital falling below the weighted average cost of capital suggests inefficiencies in capital allocation. Coupled with a low dividend yield near a decade low, these factors could pose risks to investors seeking growth and income stability.

In light of these factors, potential investors should weigh the company’s strong financial health and expanding margins against the risks of high valuation, debt levels, and declining revenue metrics. A cautious approach, perhaps waiting for more favorable valuations or improvements in revenue trends, might be advisable.

Understanding Insider Activity: EMR’s Quiet Year Ahead

Over the past year, insider trading activity for EMR has been relatively minimal, with a total of five insider buys and four insider sells. This suggests a balanced sentiment among company insiders, reflecting neither strong confidence nor significant concern about the company’s prospects. Over shorter periods, such as three and six months, there has been no insider trading, indicating a lack of recent shifts in insider perception.

Insider ownership in EMR stands at 1.41%, which is quite low, implying that insiders hold a relatively small stake in the company. This low level of insider ownership might suggest limited alignment between management and shareholder interests. Meanwhile, institutional ownership is significantly higher at 76.48%, indicating that institutions have a strong influence on the company’s stock and could impact its market dynamics significantly.

Overall, the lack of recent insider activity and low insider ownership, coupled with high institutional involvement, suggests that external factors may play a more pivotal role in EMR’s stock performance than insider sentiment.

Elevated Trading Activity Signals Strong Market Interest

Emerson Electric exhibits a healthy liquidity profile with a daily trading volume of 2,072,987 shares. This is slightly below its two month average daily trade volume of 2,736,888 shares, indicating a moderate level of investor activity and interest in the stock. The lower current trading volume compared to the average could suggest a temporary dip in trading interest or market fluctuations.

Furthermore, the Dark Pool Index (DPI) stands at 45.01%, indicating that a significant portion of trading activity is occurring off-exchange. A DPI at this level suggests that nearly half of the trades happens in dark pools, which could imply that institutional investors are actively trading EMR, potentially due to the stock’s stability or strategic importance in portfolios. This level of dark pool activity may also impact the stock’s price discovery process, leading to fewer price fluctuations as trades are executed away from public exchanges.

Overall, EMR maintains a robust trading environment with a strong institutional interest, as evidenced by its substantial DPI, while the slight variance in trading volume from the average reflects normal market dynamics rather than any significant liquidity concerns.

Bipartisan Interest: Congressional Trades in Emerson Electric

In June 2024, members of Congress reported two notable trades involving Emerson Electric. Representative Kevin Hern from the House of Representatives, affiliated with the Republican Party, purchased shares valued between $1,001 and $15,000. This transaction took place on June 10, 2024, and was reported on July 15, 2024. It signifies a strategic investment decision amid market conditions that may have been perceived as favorable for the industrial giant.

Earlier, on May 9, 2024, Senator Thomas R. Carper, a Democrat, also made a similar purchase of EMR shares within the same value range. This purchase was reported on June 3, 2024. The timing of these transactions suggests a bipartisan interest in Emerson Electric, possibly reflecting confidence in the company’s performance or anticipated growth prospects. Both transactions highlight a keen interest in the industrial sector among these legislators during this period.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.