Dollar General Stock Represents A Leader In Rural Retail with Low-Cost Goods

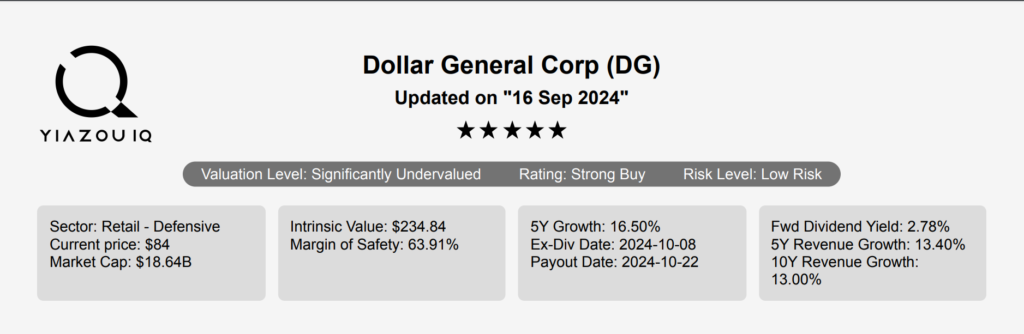

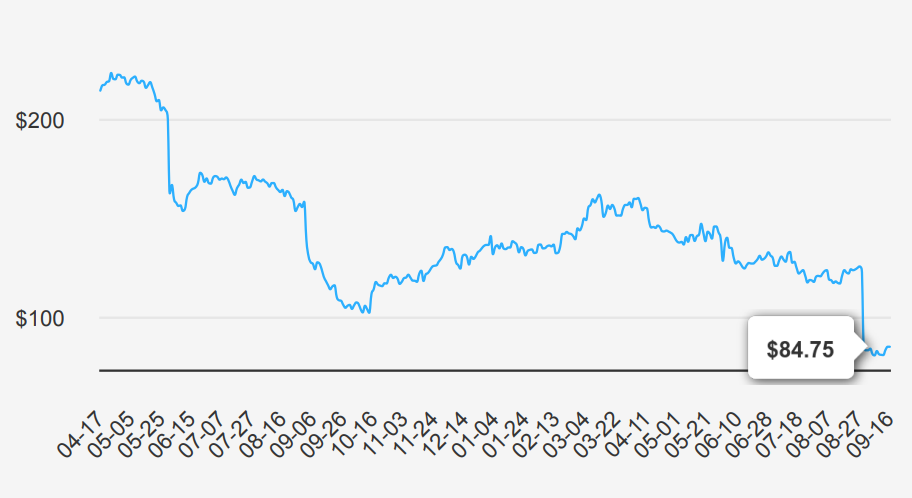

With more than 20,000 locations, Dollar General’s (DG) banner is ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips. Its value proposition is most relevant to consumers in small communities with a shortage of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales). These include paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less. Dollar General stock is currently trading at around $85.

Earnings Dip Amid Rising Growth Challenges Ahead

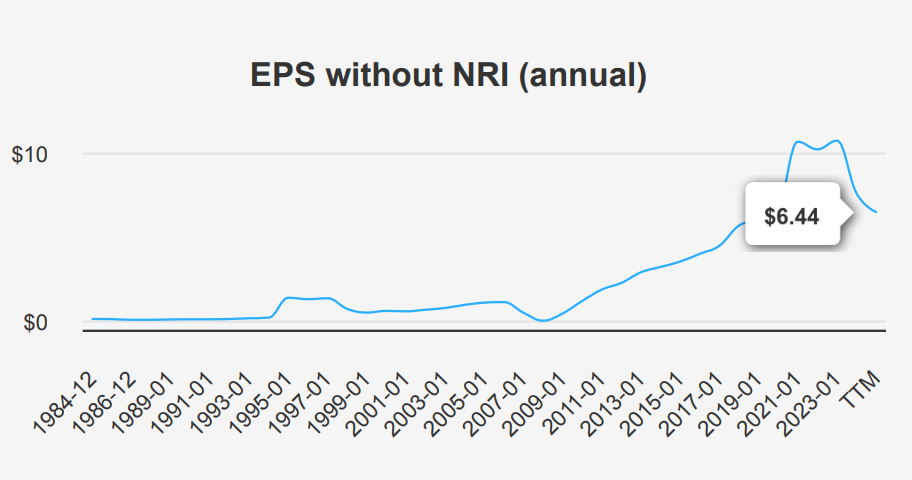

In the latest quarter ending July 31, 2024, DG reported an EPS without NRI (excludes non-recurring items) of $1.70. This is slightly up from $1.65 in Q2 2024 but down from $2.13 in Q3 2023. This decline from the previous year highlights a challenging environment. Revenue per share increased to $46.40 from $45.05 in the previous quarter, indicating some growth in sales despite the earnings pressure. Over the last five years, the company’s annual EPS without NRI has grown at a compound annual rate of 7.60%. Meanwhile, the 10-year CAGR is a healthier 13.10%, reflecting long-term growth potential of Dollar General Stock.

DG’s gross margin for the quarter stood at 29.67%. It is at the lower end of its 10-year range, indicating increased cost pressures or pricing challenges. Historically, its gross margin has been higher, with a 5-year median at 31.23%. The company’s share buyback activity has been modest recently, with a negative 1-year share buyback ratio of -0.20%. This suggests it has not repurchased shares recently. Over 10 years, the buyback ratio has averaged 3.70%. It indicates a more aggressive approach to returning capital to shareholders in the past and supports EPS by reducing the number of shares outstanding.

Looking ahead, analysts estimate the next fiscal year’s EPS to reach $5.906, increasing to $6.463 in the following year, suggesting a positive outlook. Revenue forecasts for the next three years show steady growth, with projections of $40,525.37 million in 2025, rising to $44,803.72 million by 2027. This aligns with industry growth forecasts, which predict steady expansion. The next earnings release is anticipated on December 5, 2024. This will provide further insights into the company’s trajectory and financial health.

Sustaining Capital Efficiency Amid Declining ROIC

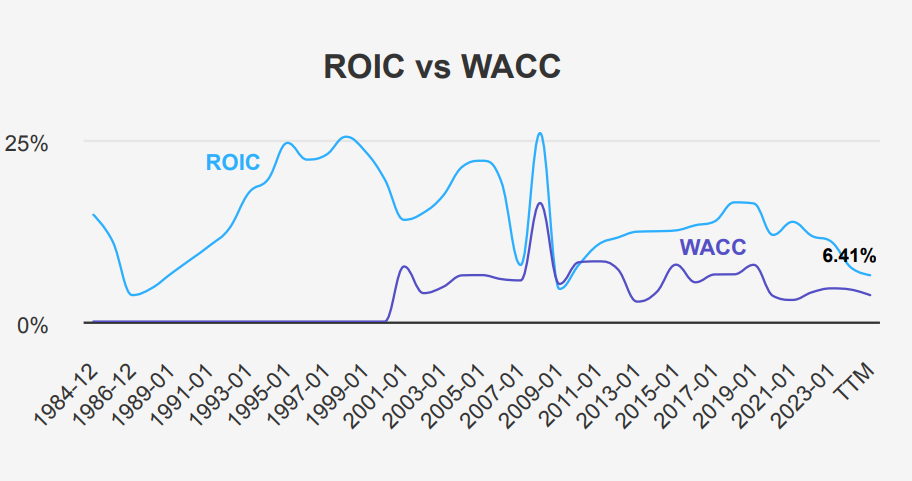

Dollar General shows a strong track record of capital efficiency and value creation through its historical financial metrics. The company’s 5-year median Return on Invested Capital (ROIC) is 11.83%, significantly exceeding its 5-year median Weighted Average Cost of Capital (WACC) of 4.05%. This indicates that DG has been generating positive economic value over this period. This is effectively utilizing its capital to produce returns greater than its cost of capital.

However, the current ROIC of 6.41% represents a decline from its 5-year median and is closer to the 10-year low, yet it still surpasses the current WACC of 3.65%. This suggests that although the company’s efficiency in generating returns has decreased. It continues to create value above its cost of capital.

The high Return on Equity (ROE) metrics, with a 5-year median of 37.13% and a current ROE of 20.97%. It reinforces DG’s strong profitability and effective equity utilization. Despite fluctuations, DG maintains a robust capacity for value creation through effective capital management.

Dollar General Stock Dividend: Strong History, Slower Growth Ahead

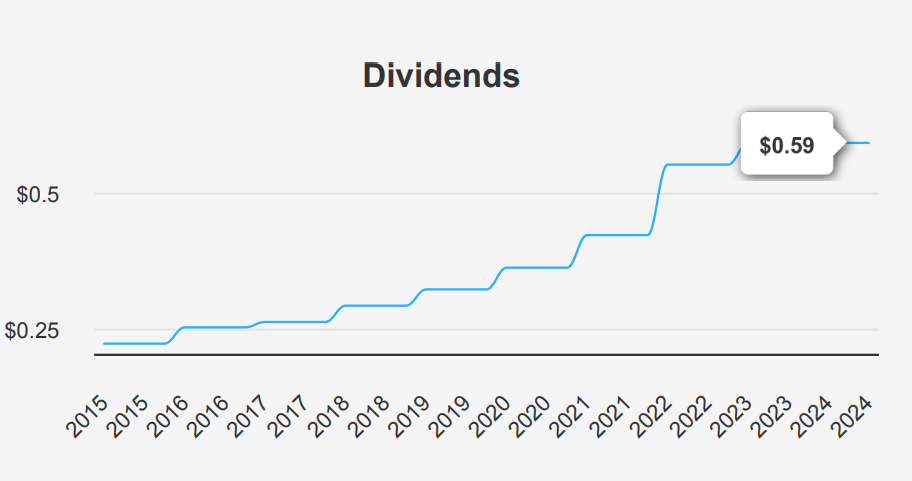

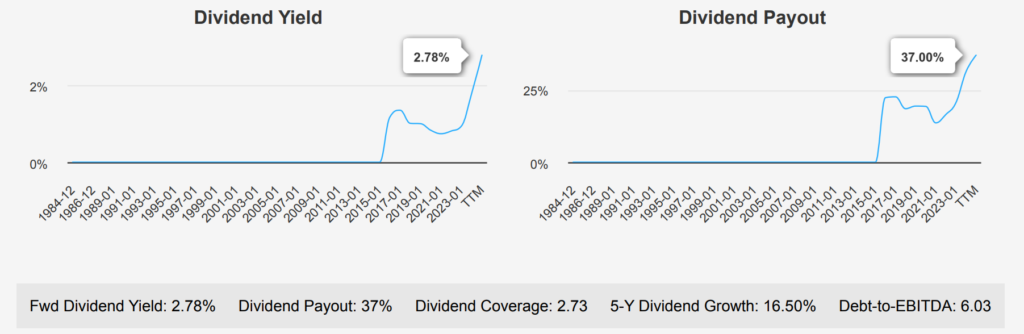

In the most recent quarter, DG has maintained a consistent dividend per share (DPS) of $0.59, continuing its trend over the past fiscal year. The company’s forward dividend yield stands at 2.74%. This is favorable compared to its 10-year median of 0.97% but slightly below the historical high of 2.86%, despite a robust historical dividend growth rate of 16.50% over five years and 17.90% over three years. The future dividend growth rate may decelerate to 2.74%.

This slowdown in dividend growth can be attributed to the company’s high debt-to-EBITDA ratio of 6.03. This is significantly above the 4.0 threshold, which suggests elevated financial risk. This ratio indicates potential challenges in the company’s ability to manage its debt effectively, which could affect its capacity to increase dividends.

DG’s dividend payout ratio is currently at 37.0%, providing some cushion for future increases, although past highs have reached over 100%, indicating variability. Sector comparison shows DG’s yield is competitive, yet the high leverage poses risks. The next ex-dividend date is set for October 8, 2024, assuming today is before this date and not a weekend, ensuring investors can plan accordingly.

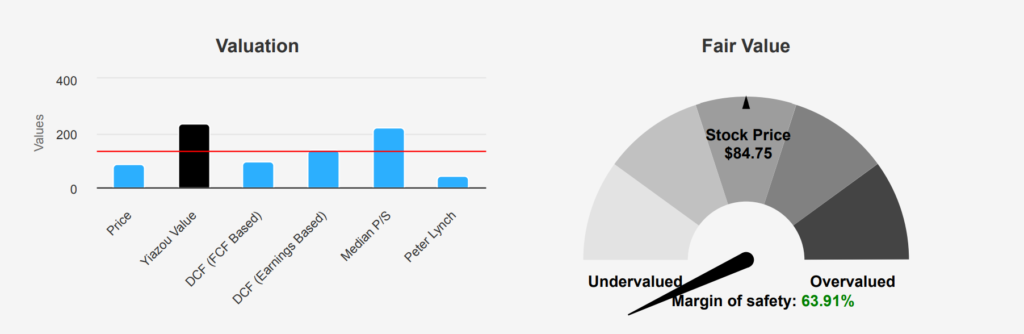

Dollar General Stock: Significant Undervaluation with 64% Safety Margin

Dollar General stock trades at $84.75, significantly below its intrinsic value of $234.84. It presents a substantial margin of safety of 63.91%. This discrepancy suggests a potential undervaluation, providing investors with a notable buffer. Examining DG’s valuation metrics, the TTM P/E ratio is 13.16, which, while above its 10-year low of 10.62. This remains well below the 10-year median of 19.99, indicating a favorable entry point. The forward P/E ratio of 14.52 still reflects a relatively modest valuation compared to historical highs.

The TTM P/S ratio stands at 0.47, nearing its 10-year low and significantly under the median of 1.20, further illustrating potential undervaluation. DG’s TTM EV/EBITDA ratio of 11.8 is below the 10-year median of 13.18, reinforcing this perspective. The TTM Price-to-FreeCash-Flow ratio at 11.03 also suggests an attractive valuation. This is particularly given its proximity to the 10-year low of 10.75. However, the TTM P/B ratio at 2.57 is near the 10-year low, indicating potential undervaluation in terms of book value.

Despite these valuation metrics indicating a potential undervaluation. Analyst sentiment has been conservative, reflected in recent downward revisions of the price target from $150.50 three months ago to $102.88. With 31 analyst ratings, the consensus may signal caution, yet the substantial margin of safety and attractive valuation ratios provide a compelling case for value-oriented investors to consider DG for potential long-term gains.

Mixed Signals: Dollar General’s Risk and Potential

Dollar General presents a mixed risk profile. The company’s issuance of $2.8 billion in new debt over three years is concerning, though its debt level remains within acceptable bounds. However, the poor track record of share buybacks, with stock trading at 63.7% below the average buyback price, indicates inefficiency in capital allocation. Additionally, total assets growth at 15.4% annually, outpacing revenue growth of 13.4%, suggests declining operational efficiency. It is further highlighted by a 5-year decline in operating margins at an average rate of -3.6% per year. The Altman Z-score of 2.13 places DG in a financial “grey area,” indicating potential financial stress.

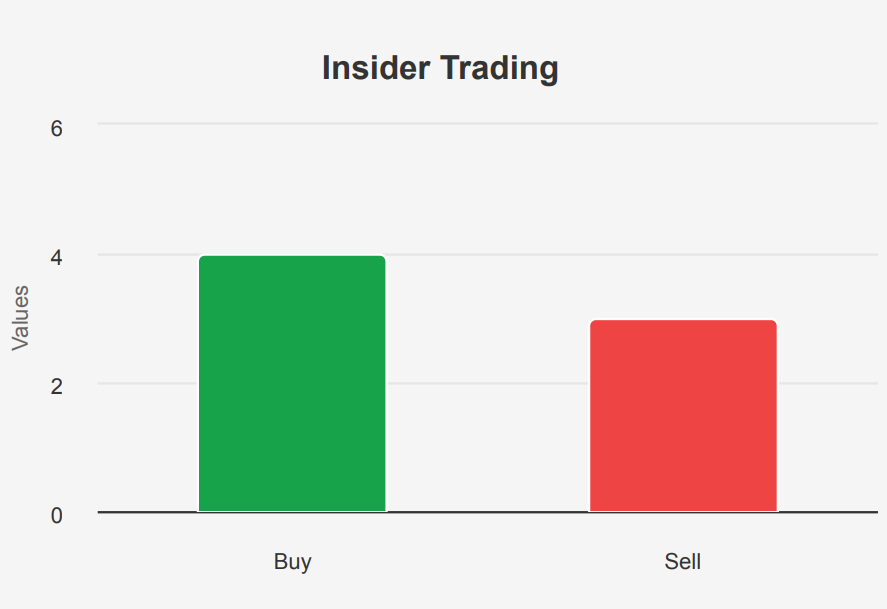

On the positive side, recent insider buying activity suggests confidence from those within the company, with 1,500 shares purchased in the past three months. The Beneish M-Score of -3.3 indicates a low likelihood of financial manipulation. While both the PB and PS ratios are near their 10-year lows, potentially signaling the undervaluation of Dollar General Stock. Additionally, the dividend yield is near a 10-year high, which may attract income-focused investors. Overall, while DG faces challenges, specific valuation metrics and insider activities provide a more optimistic outlook.

Insider Trading Trends and Ownership Dynamics for Dollar General Stock

The insider trading activity for Dollar General over the past year shows a relatively balanced pattern of buying and selling from the company’s directors and management. Over the last 12 months, there have been 4 insider purchases compared to 3 insider sales. This suggests a moderate level of confidence from insiders, potentially indicating their belief in the company’s long-term prospects. However, the recent 3-month period displays more caution with only 2 purchases against 1 sale, which might reflect short-term concerns or profit-taking.

Dollar General stock’s Insider ownership stands at 5.20%, which is relatively modest and indicates that insiders hold a limited stake in the company. On the other hand, institutional ownership is significantly high at 92.91%. This suggests that the company is largely controlled by institutional investors who might substantially influence company policies and strategies. This high level of institutional ownership often indicates investors’ confidence in the company’s management and future performance.

Dollar General Stock: Volume Trends and Dark Pools

Dollar General stock’s liquidity analysis shows a slight decrease in the daily trading volume compared to its average over the past two months. The current volume stands at 4,257,941, which is marginally lower than the 4,567,811 average. This indicates a potential reduction in market activity or investor interest in the short term.

The Dark Pool Index (DPI) is 55.32%, suggesting that over half of DG’s trading occurs in dark pools. This level of dark pool activity can imply that larger trades are being executed away from the public exchanges, possibly to minimize market impact. Such a DPI percentage indicates a healthy level of liquidity, as significant volumes are being transacted, albeit privately.

Overall, while daily trading volume slightly declines, the relatively high DPI suggests that DG maintains good liquidity through alternative trading venues. This setup benefits large investors looking to execute trades without causing significant price movements. However, the reliance on dark pool transactions could mask true market sentiment, making it crucial for traders to remain vigilant of any shifts in trading patterns or volumes that might impact DG’s price stability in public markets.

Government Contracts: Peak and Decline Trends

From 2015 to 2022, DG’s government contracts fluctuated significantly. In 2015, the amount was $136,080, which surged to $972,815 in 2017, indicating strong growth. However, by 2020, there was a steep decline to $17,945, dropping to $7,864 in 2022. This pattern suggests DG experienced peak performance in 2017 but faced challenges in sustaining contracts, possibly due to changes in government spending priorities or competitive pressures.

U.S. Patent Growth: A Winning Trend

The data indicates a consistent increase in the number of patents held by DG in the U.S. from 2017 to 2021. Starting with 1,011 patents in 2017, DG’s portfolio grew steadily each year, reaching 1,562 patents by 2021. This represents a notable growth trend, suggesting a strong commitment to innovation and intellectual property development. The consistent annual increase highlights DG’s strategic focus on expanding its technological assets. This enhances competitive advantage and value creation in the market.

Congressional Stock Moves: A Tale of Divergence

In recent congressional trades, Representative John James, a Republican from the House of Representatives, reported a sale of shares in Dollar General on June 3, 2024, valued between $1,001 and $15,000. The report was filed on September 2, 2024. This transaction follows a purchase by fellow Republican Representative Dan Newhouse, also from the House of Representatives, who acquired shares in the same company on April 10, 2024, within the same valuation range, with his report filed on April 25, 2024.

These trades reflect potentially differing perspectives on Dollar General’s market position or financial strategy. Newhouse’s purchase in April suggests an optimistic view of Dollar General stock’s future performance, while James’s sale in June might indicate a reevaluation or profit-taking strategy.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.