Citi Stock: Global Banking Powerhouse with Diverse Services

Citigroup (C) is a global financial services company in over 100 countries and jurisdictions. Citigroup’s operations are organized into five primary segments: services, markets,

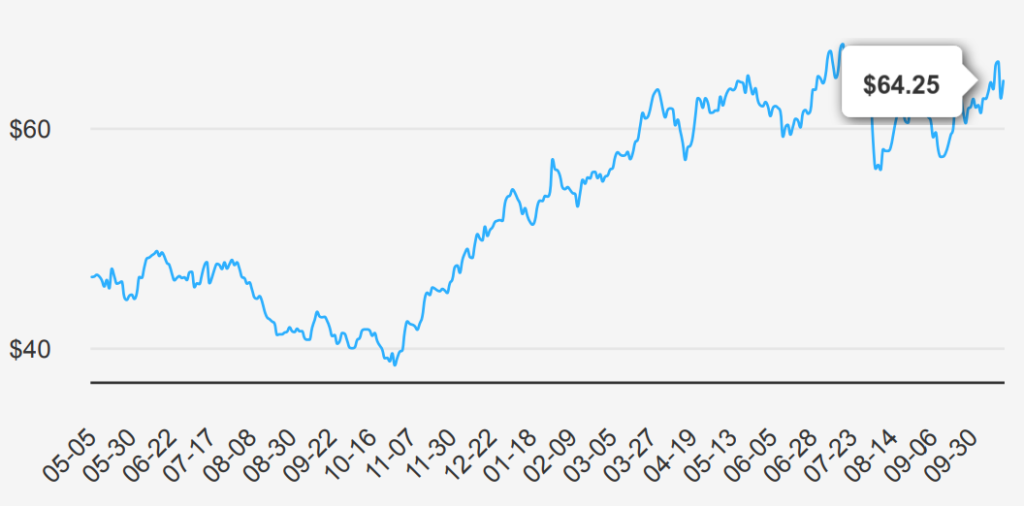

banking, US personal banking, and wealth management. The bank’s primary services include cross-border banking needs for multinational corporations, investment banking and trading, and credit card services in the United States. C stock is trading at ~$64.

Citi’s Earnings Show Mixed Trends Amid Challenges

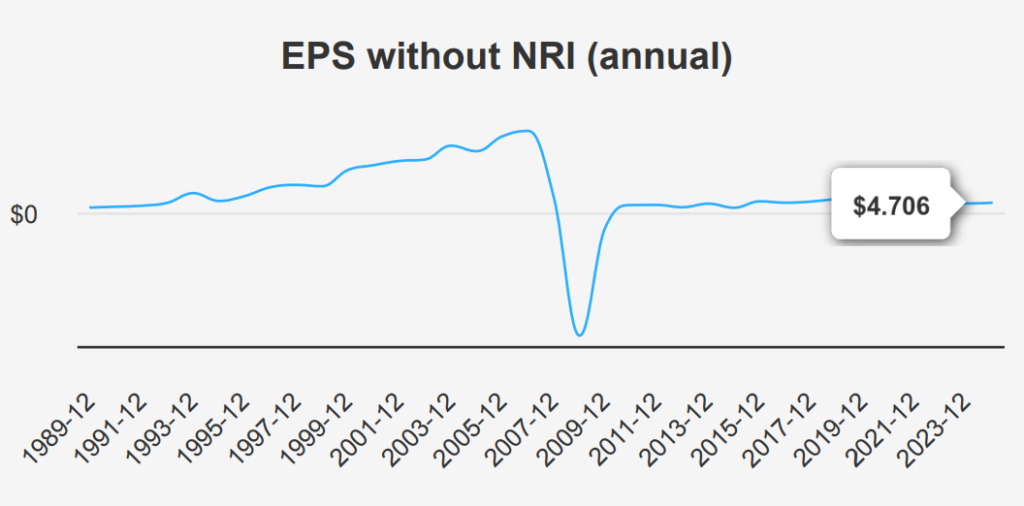

In the latest quarter ending September 30, 2024, C reported an EPS without NRI (excluding non-recurring items) of $1.513, showing a slight decrease from the previous quarter’s $1.534 and nearly stable compared to the $1.515 from the same period last year. Over a 5-year period, C has experienced a compound annual growth rate (CAGR) of -5% in its annual EPS without NRI, while the 10-year CAGR stands at 6.60%. The revenue per share for this quarter was $10.444, indicating a marginal increase from $10.353 in the prior quarter and a modest rise from $10.117 in the third quarter of 2023.

The company’s gross margin remains zero, reflecting its ongoing challenges in maintaining profitability at the operational level. However, the impact of share buybacks on EPS is notable, with a 10-year buyback ratio of 5.40%, indicating a reduction of 5.40% of the outstanding shares over the decade. This reduction in share count has likely helped support EPS, even as other factors have pressured profitability. Analysts forecast industry growth at approximately 6.5% annually over the next decade, suggesting room for potential improvement if C can align with broader market trends.

Looking forward, analysts estimate C’s revenue to reach $80,449.59 million by the end of 2024, with further increases to $82,349.31 million in 2025 and $85,325.79 million in 2026. The estimated EPS for the next fiscal year is $5.622, rising to $7.048 the following year, reflecting expectations of improved performance. The next earnings release is on January 10, 2025, which will provide further insights into the Citi stock’s trajectory and the effectiveness of its strategic initiatives.

Stagnant Rising Costs: C’s Value Crisis

C’s financial performance indicates challenges in generating economic value. Its WACC has varied, with a recent high of 17.74%. Additionally, C’s ROE has declined from a ten-year high of 10.94% to a current rate of 3.99%, further indicating a downward trend in profitability relative to equity. Overall, C’s current financial trajectory appears unsustainable without significant adjustments.

Citi Stock’s Dividend Growth: Accelerating Payouts Amid Financial Discipline

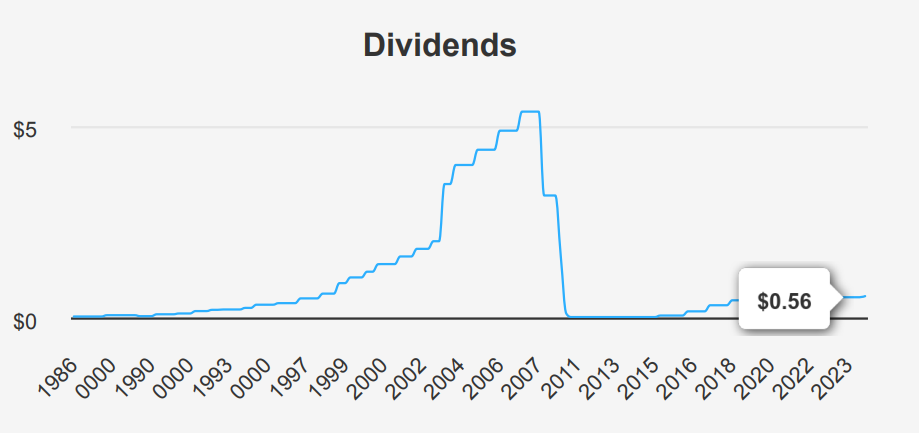

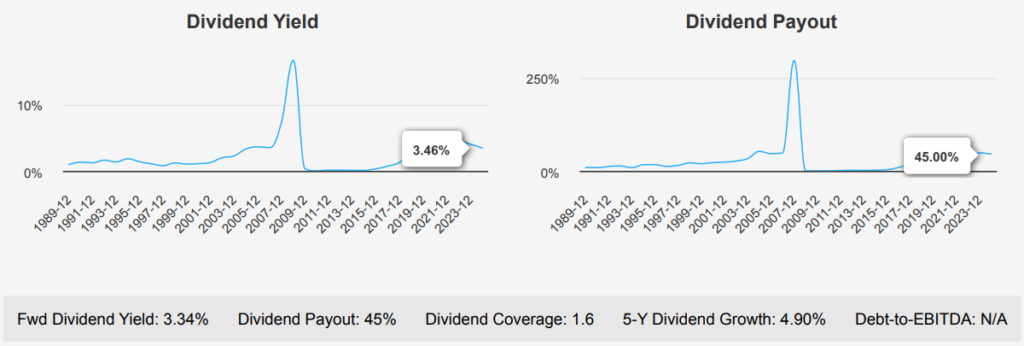

C stock’s dividend growth has shown stability, with a modest 3-year growth rate of 0.60% and a slightly higher 5-year growth rate of 4.90%. Recently, the company increased its quarterly dividend from $0.53 to $0.56 per share, reflecting a commitment to returning value to shareholders. The forward dividend yield stands at 3.34%, which is competitive within its sector.

The dividend payout ratio is currently 45%, significantly lower than its historical highs, indicating a more sustainable approach to dividend payments. Historically, the dividend payout ratio has been quite high, with a 10-year median of 100.22%, suggesting past challenges in maintaining dividend payments aligned with earnings.

While the debt-to-EBITDA ratio is not provided, understanding its importance is crucial. A lower ratio is preferable, typically below 2.0, to ensure manageable debt levels, although this varies by industry. The estimated future dividend growth rate of 6.56% suggests optimism about the company’s earnings potential. The next ex-dividend date may be on November 3, 2024, following its quarterly frequency. This continued growth and favorable yield position the company well among its peers, assuming it maintains manageable debt levels.

Citi Stock’s Balancing Act: Navigating Risk and Reward

Citi’s recent financial activities suggest a mixed risk profile for investors. The issuance of $50.7 billion in new debt over the past three years could be a concern, although the overall debt level remains within acceptable limits. This could indicate strategic expansion or refinancing. However, the lack of insider buying and the occurrence of insider selling, with 38,553 shares sold over the last three months, might raise questions about management’s confidence in the stock’s near-term performance.

The stock price nearing a two-year high, alongside a price-to-sales ratio of 1.53, also approaching its two-year peak of 1.6, suggests the stock might be overvalued. This is compounded by the dividend yield nearing a two-year low, which may reduce the stock’s attractiveness to income-focused investors. On the positive side, Citi’s Beneish M-Score of -2.38 is comfortably below the threshold, indicating a low

likelihood of financial manipulation. Furthermore, the company has demonstrated consistent revenue and earnings growth, which provides a stable foundation for long-term investors.

Overall, while there are some red flags, Citi’s financial stability and growth prospects might still

appeal to those with a higher risk tolerance.

Insider Selling Trends Raise Concerns Amid Institutional Confidence

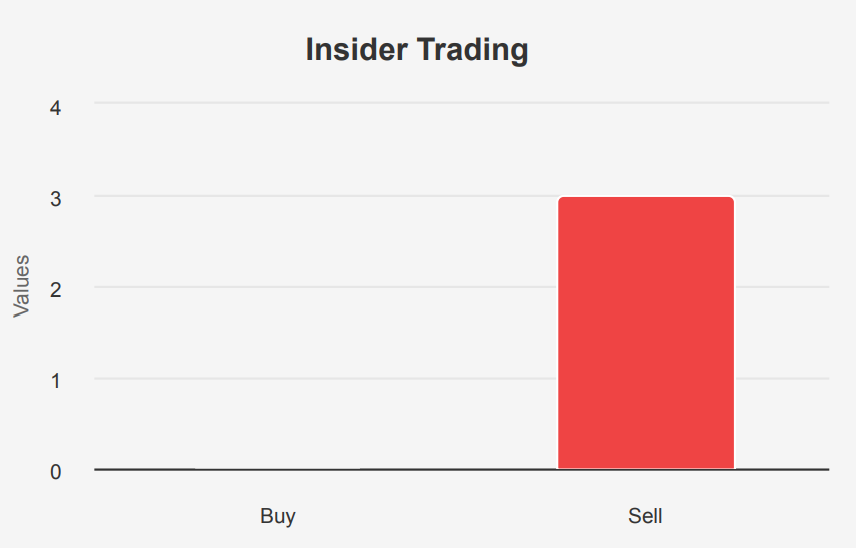

In analyzing the insider trading activities for company C, there has been a notable absence of insider buying over the past 3, 6, and 12 months, with insider sell counts recorded at 2, 2, and 3, respectively. This consistent selling pattern suggests a cautious or potentially negative outlook from those with substantial insight into the company’s operations.

Insider ownership stands at 3.44%, which indicates a relatively modest stake by insiders in the company. This level of ownership can sometimes imply less alignment of management’s financial interests with those of shareholders, although this is just one factor to consider. On the other hand, institutional ownership is quite high at 73.21%, suggesting that the company is well-covered and supported by large, professional investors. This could be a stabilizing factor, given the insider selling trend.

Overall, the insider trading trends indicate a bearish sentiment among insiders, contrasting with the strong institutional presence that may reflect differing perspectives or investment strategies.

Citi Stock Trading Surge: Liquidity and Dark Pool Dynamics

For Citi stock, liquidity and trading metrics indicate active market participation. The daily trading volume stands at 19,979,328, significantly exceeding the average daily trade volume of 12,232,310 over the past two months. This suggests heightened investor interest and robust liquidity, allowing for ease of entry and exit from positions without substantial price impact.

The Dark Pool Index (DPI) is 44.63%, indicating that a substantial portion of trading occurs off-exchange. A DPI of this magnitude suggests considerable institutional activity and possibly a strategic interest in maintaining anonymity in trades. While high DPI can sometimes obscure true market sentiment, it also reflects the confidence of institutional investors.

Overall, Citi exhibits strong liquidity with its current trading dynamics, supported by both high trading volumes and significant dark pool activity. These factors combine to create a favorable trading environment for both retail and institutional investors, enhancing market efficiency and price discovery.

Congressional Moves: Insights into Citigroup Transactions

In an analysis of recent congressional trades involving Citi Stock, two significant transactions stand out. On July 17, 2024, Senator Shelley Moore Capito, a Republican from the Senate, executed a partial sale of Citi stock valued between $1,001 and $15,000. This transaction was reported on August 11, 2024, reflecting a careful reevaluation of her investment portfolio, possibly influenced by market conditions or personal financial strategies.

Earlier, on October 24, 2023, Representative Greg Stanton, a Democrat from the House of Representatives, completed a full sale of Citigroup shares in the same value range. His transaction was reported on November 9, 2023. This sale could suggest a strategic move in response to personal investment goals or shifts in market sentiment regarding Citigroup.

Both trades highlight the ongoing financial activities of Congress members and provide insight into their investment decisions amidst evolving economic landscapes.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.