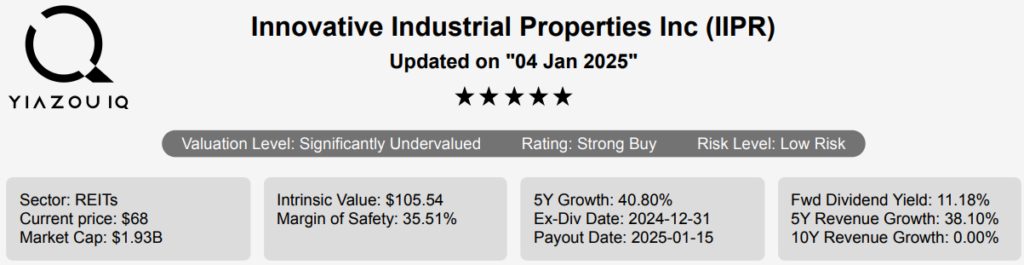

IIPR Stock Forecast Is Based On An Expanding US Property Portfolio and Cannabis Real Estate Strategy

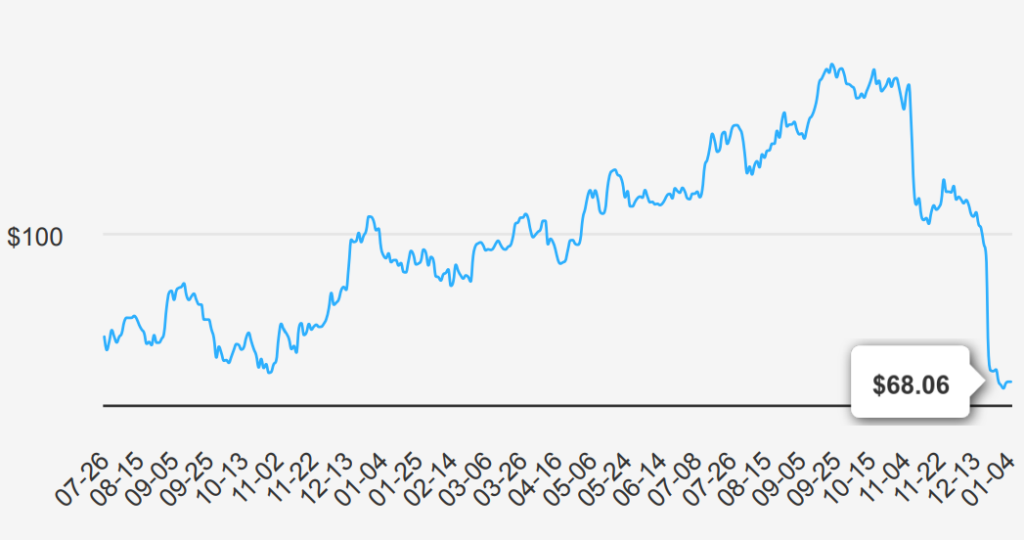

Innovative Industrial Properties (IIPR) is a real estate investment trust engaged in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. It conducts its business through a traditional umbrella partnership real estate investment trust, or UPREIT structure, in which properties are owned by an Operating Partnership, directly or through subsidiaries. Its property portfolio is spread across the United States. IIPR stock is currently trading at ~$68. Lets explore IIPR stock forecast in detail.

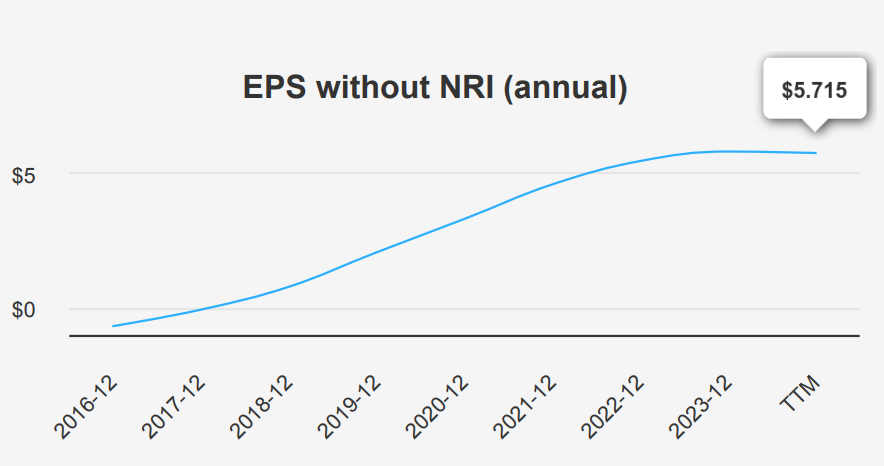

IIPR’s Quarterly EPS Declines Amid Long-Term CAGR Strength

IIIPR reported its earnings for the quarter ending September 2024, with an EPS (Earnings Per Share) without NRI (non-recurring items) of $1.37, down from $1.535 in the previous quarter and matching the $1.45 from the same period last year. Revenue per share was $2.678, a decline from $2.793 in the previous quarter. Over a five-year period, the company’s annual EPS without NRI has grown impressively at a compound annual growth rate (CAGR) of 47%, while it has remained flat over a decade, indicating recent growth momentum.

The cannabis-related real estate industry, which IIPR operates in, may grow at an annual rate of ~15% over the next ten years, according to market forecasts. The company maintained a strong gross margin of 90.98%, although this is slightly below its five-year median of 96.19%. The gross margin has varied significantly over the past decade, hitting a high of 98.16%. IIPR has been reducing its share count with a one-year share buyback ratio of -1%, indicating a 1% decrease in outstanding shares. Over five years, the buyback ratio stands at -24.7%. This reduction in shares has a positive impact on EPS, as earnings are distributed over fewer shares, potentially boosting per-share earnings.

Looking forward, analysts estimate IIPR’s EPS for the fiscal year ending December 2025 to be ~$5.503, decreasing to $4.828 for the following fiscal year. Revenue projections suggest a slight contraction in 2025 before picking up again in 2026. These estimates highlight a cautious but optimistic outlook for IIPR, with the next earnings release expected on February 27, 2025. IIPR stock forecast will likely hinge on the broader cannabis market expansion and its ability to maintain high margins amidst industry fluctuations.

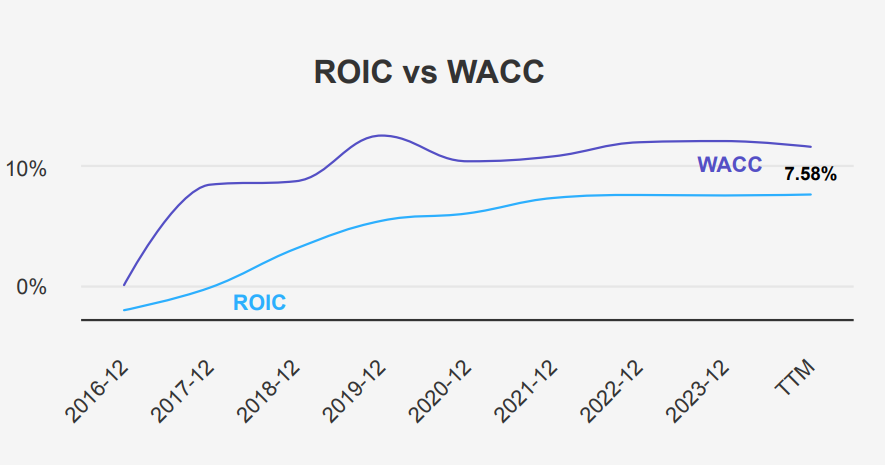

ROIC Below WACC: Economic Value Gaps in IIPR’s Operations

IIPR has shown a Return on Invested Capital (ROIC) of 7.58% currently, with a 5-year median of 7.29%. This is consistently below its Weighted Average Cost of Capital (WACC), which is 11.52% presently, with a 5-year median of 11.95%. Under IIPR stock forecast, this indicates that the stock is not generating sufficient returns on its invested capital to cover its cost of capital, thus failing to create economic value for its investors.

The company’s Return on Equity (ROE) has improved to 8.37%, higher than its 5-year median of 7.27%. However, this improvement in ROE does not offset the fact that both ROIC and ROE remain below the WACC, suggesting inefficiencies in capital allocation. Despite IIPR’s ability to generate returns, the cost of capital remains too high, undermining value creation.

For IIPR to enhance shareholder value, it would need to improve operational efficiency, optimize capital allocation, and potentially reduce its cost of capital to ensure ROIC exceeds WACC.

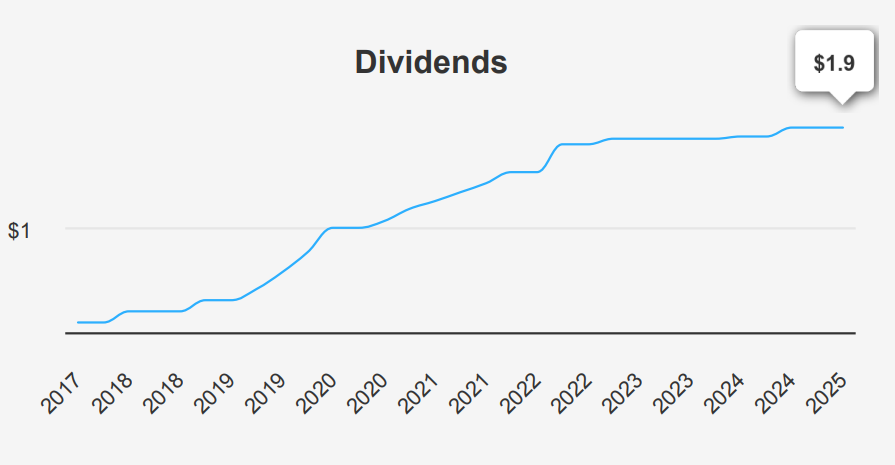

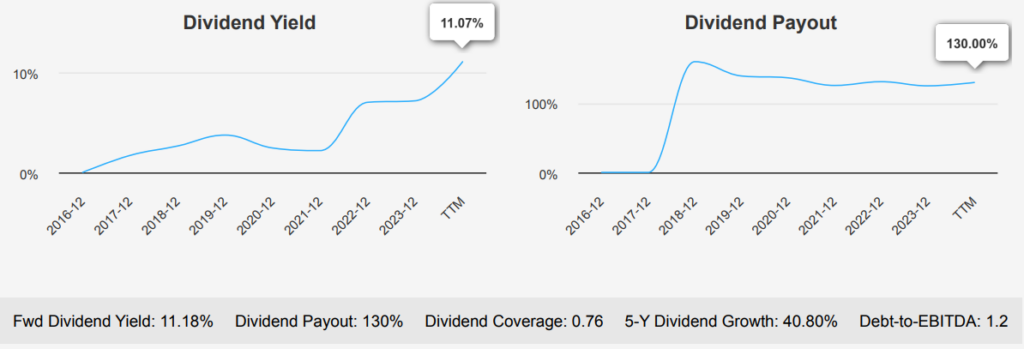

Dividend Growth Slows as High Payout Ratio Limits Flexibility

Innovative Industrial Properties, Inc. (IIPR) has demonstrated robust dividend growth over the past five years, with a 5-year growth rate of 40.80% and a 3-year per share growth rate of 17.30%. However, the company’s forward dividend growth rate may be slow considerably to 1.82% over the next 3-5 years. This deceleration is likely due to the high dividend payout ratio of 130%, which significantly exceeds its historical median of 101.34%. Such a high payout ratio suggests that the company is distributing a substantial portion of its earnings as dividends, potentially limiting future growth under IIPR stock forecast.

IIPR’s current forward dividend yield stands at an attractive 11%, positioning it favorably within its sector. The company’s debt-to-EBITDA ratio is 1.20, indicating low financial leverage and strong capacity to service debt, which is a positive sign amidst its high payout ratio.

The next ex-dividend date is on March 31, 2025, given the quarterly dividend frequency, allowing investors to plan accordingly. Overall, while IIPR maintains a solid yield and manageable debt levels, its dividend growth potential appears constrained by an unsustainable payout ratio.

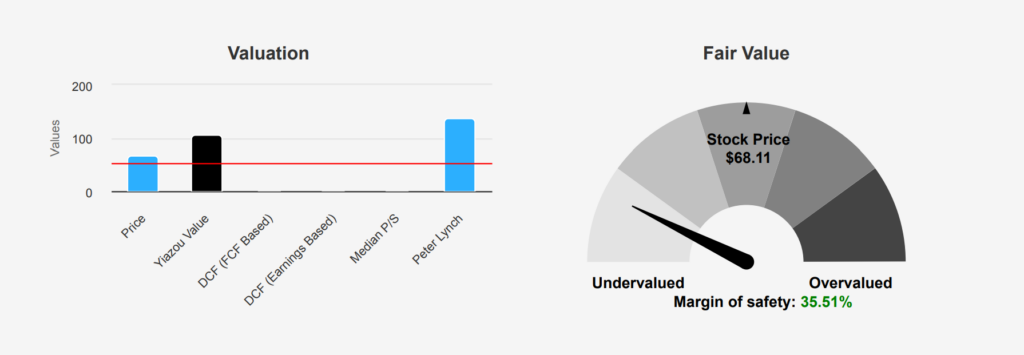

IIPR Stock Trading Below Intrinsic Value: Margin of Safety at 35.51%

IIPR currently trades at $68.06, significantly below its intrinsic value of $105.54, suggesting a margin of safety of 35.51%. This indicates potential undervaluation. The current TTM P/E ratio of 12.11 is near its historical 10-year low of 11.98, significantly below the median of 41.25, indicating relative undervaluation in the context of its earnings.

Similarly, the TTM EV/EBITDA ratio stands at 8.42, well below its 10-year median of 25.65, further supporting the undervaluation thesis. The TTM P/S ratio of 6.16 is at the lower end of its historical range, aligning with its 10-year low, which contrasts markedly with the median of 18.31. This low ratio might suggest market mispricing given the company’s revenue generation potential. Moreover, the TTM P/B ratio of 1 is close to its 10-year low of 0.96, yet significantly lower than the median of 1.81, pointing to a potentially undervalued asset base.

Importantly, the TTM Price-to-Free-Cash-Flow ratio of 7.18 is at its 10-year low, well below the median of 19.76, indicating robust cash generation relative to market valuation. Analyst sentiment provides a mixed outlook, with recent price targets decreasing from $135.80 to $95.60 over the past three months, reflecting possible concerns about future performance or market volatility. Despite this, the substantial margin of safety and favorable valuation ratios suggest IIPR offers an attractive investment opportunity relative to its historical valuation benchmarks and intrinsic value assessment.

Investors should weigh these factors against prevailing market conditions and sector-specific risks.

Balancing Asset Growth and Financial Stress in IIPR Investments

IIPR presents a mixed risk profile. The rapid growth in total assets at 51.8% annually, outpacing its revenue growth of 38.1%, suggests potential inefficiencies in asset utilization. This discrepancy could indicate that the company is investing heavily without equally increasing revenue, which might not be sustainable. Moreover, the dividend payout ratio of 1.30 is exceptionally high, raising concerns about the sustainability of its dividends. Additionally, the company’s return on invested capital is lower than its weighted average cost of capital suggests potential inefficiencies in capital allocation.

The Altman Z-score of 2.84 places the company in the grey area, indicating potential financial stress. On the positive side, IIPR maintains a strong Piotroski F-Score of 7, suggesting sound financial health. The Beneish M-Score of -2.63 implies a low likelihood of earnings manipulation. Encouragingly, the operating margin is expanding, reflecting improved profitability. The stock’s valuation metrics, including a price-to-book ratio close to its 10-year low, a price-to-earnings ratio near historic lows, and a high dividend yield, suggest that the stock may currently be undervalued. Investors should weigh these factors carefully, considering both the financial stresses and the potential for value and income.

Neutral Insider Activity with High Institutional Ownership in IIPR

The insider trading activity for IIPR Stock over the past 12 months shows no transactions by company directors or management, indicating a neutral stance from insiders. With zero insider buys or sells recorded in the last three, six, and twelve months, there is a lack of direct signals of insider confidence or concern regarding the company’s future performance. This inactivity may suggest that insiders are waiting for clearer market signals or developments within the company before making any moves.

Insider ownership remains low at 1.42%, which suggests that company insiders have a relatively small stake in the business. This could imply limited influence or alignment with shareholder interests. On the other hand, institutional ownership is high at 87.5%, indicating strong confidence and interest from institutional investors. This level of institutional ownership might reflect a positive outlook on IIPR’s strategic direction and financial health, as institutions typically conduct extensive analysis before committing to such significant holdings.

IIPR Stock’s Trading Volume Surge and Dark Pool Activity Insights

IIPR Stock exhibits a moderate level of liquidity, as evidenced by its daily trading volume and average daily trade volume over the past two months. The current daily volume stands at 240,166 shares, which is slightly below the two-month average of 401,377 shares. This suggests that the stock experiences fluctuations in trading activity, potentially due to market conditions or investor interest.

The Dark Pool Index (DPI) for IIPR is 45.89%. This DPI percentage indicates that nearly half of the trading volume is occurring off-exchange, which can impact the transparency and price discovery of the stock. A high DPI might suggest that institutional investors are actively trading IIPR, possibly leading to less visibility in the public markets.

Overall, the trading dynamics of IIPR suggest a balance between liquidity and potential hidden institutional activity. Investors should consider both on-exchange and dark pool trading when assessing the stock’s liquidity and potential price volatility. Understanding these factors can provide insights into the trading behavior and market sentiment surrounding IIPR.

Congressman Goldman’s IIPR Stock Trades: Investment Strategy or Market Signal?

Representative Daniel Goldman, a member of the Democratic Party in the House of Representatives, recently executed two notable transactions involving Innovative Industrial Properties (IIPR). On July 12, 2023, he sold IIPR shares valued between $1,001 and $15,000. This sale was reported on August 13, 2023. Earlier, on April 10, 2023, he executed another sale of IIPR shares within the same value range, reported on May 19, 2023. These transactions might indicate a strategic shift or a response to market conditions affecting IIPR’s performance. Given that both sales occurred within a few months, it could suggest a broader trend or a particular investment strategy by Goldman.

Under IIPR stock forecast, Investors and analysts might consider these sales as part of their assessment of market sentiment towards IIPR or the representative’s investment portfolio adjustments.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.