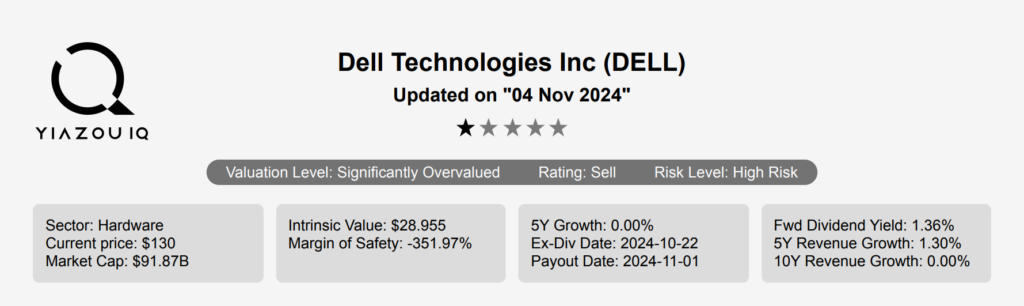

Dell Stock: Capitalizing On Solid Market Position and Core Offerings

Dell Technologies (DELL) is a broad information technology vendor primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on premises data center hardware. It holds top-three market shares in its core personal computers, peripheral displays, mainstream servers, and external storage markets. Dell has a robust ecosystem of component and assembly partners and relies heavily on channel partners to fulfill its sales. Dell stock is currently trading near $131. Lets dive into Dell stock forecast and analysis.

Earnings Trends and Growth Outlook Through 2025

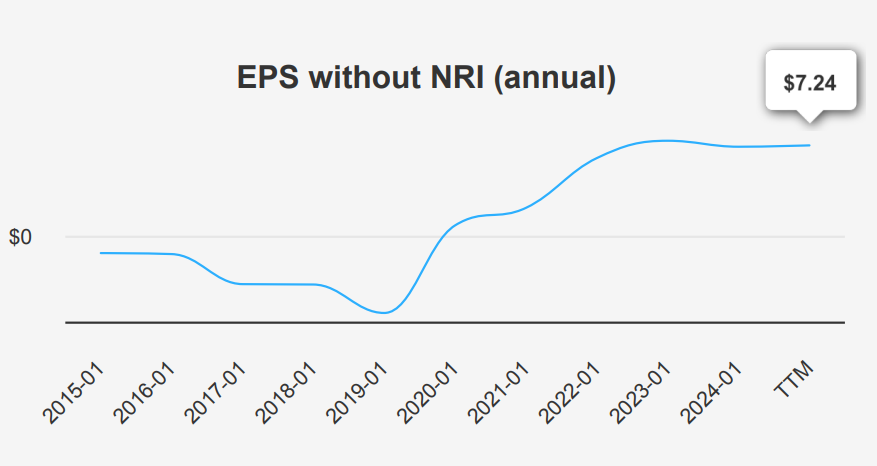

In the latest quarter ending July 31, 2024, Dell reported an EPS without NRI (excluding non-recurring items) of $1.89, a significant increase from $1.27 in the previous quarter and up from $1.74 a year earlier. The EPS (Diluted) was $1.17, a decrease from $1.32 in the previous quarter but notably higher than the $0.63 reported in the same quarter last year. Revenue per share also saw a rise to $34.57 from $30.60 in the prior quarter. Over the past five and ten years, Dell’s EPS without NRI has not shown a positive Compound Annual Growth Rate (CAGR), highlighting a need for sustained improvement.

Dell’s gross margin for the quarter was 22.41%, slightly below its 5-year median of 23.24% and well below its 10-year high of 27.65%. The company has been actively repurchasing shares, with a 1-year buyback ratio of 2.50%, indicating that 2.50% of its outstanding shares were bought back over the past year. Over three years, the buyback ratio stands at 2.10%, suggesting a consistent strategy to enhance shareholder value by reducing the number of shares outstanding, which can help improve EPS by distributing profits across fewer shares.

Looking forward, under Dell stock forecast, analysts estimate Dell’s revenue to grow steadily, with projections of $97.60 billion in 2025, $104.98 billion in 2026, and $110.23 billion in 2027. The estimated EPS for the next fiscal year ending January 2025 is $6.064, increasing to $6.790 for the following year. The next earnings report is scheduled for November 26, 2024, when these forecasts will be closely scrutinized in light of Dell’s strategic initiatives and industry conditions, which are anticipated to grow by approximately 5% annually over the next decade.

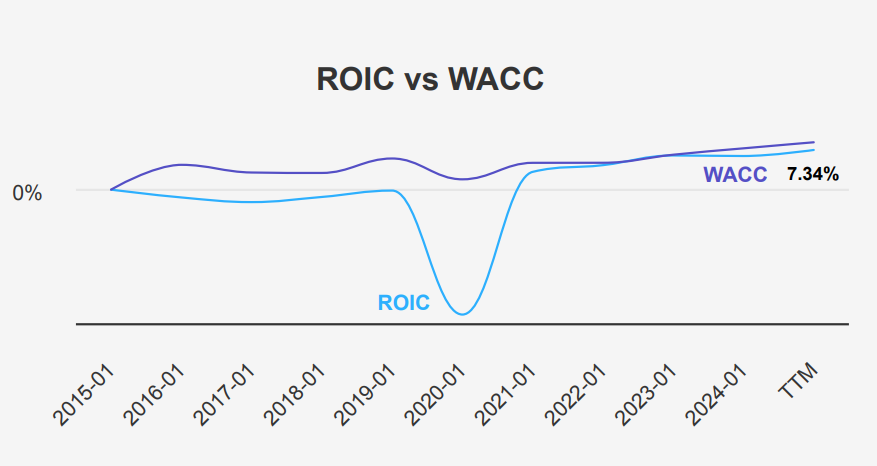

Assessing Dell’s Capital Efficiency: ROIC vs. WACC

Assessing Dell’s financial performance requires examining the Return on Invested Capital (ROIC) relative to its Weighted Average Cost of Capital (WACC). Currently, Dell’s ROIC is 7.34%, which is higher than its WACC of 8.76%. This indicates that, at present, Dell is generating a return on its invested capital that does not exceed its cost of capital, suggesting a negative value creation.

Historically, Dell’s median ROIC over five years was 4.53%, below the five-year median WACC of 4.97%, indicating a consistent trend of not meeting its cost of capital. However, the recent improvement to a 7.34% ROIC might suggest operational improvements or strategic shifts, yet it still falls short of the WACC.

Dell’s negative equity return (ROE) further complicates its financial efficiency, reflecting potential issues with leverage or profitability. The company needs to enhance its capital allocation efficiency to consistently surpass its WACC, thus transitioning towards positive economic value creation under Dell stock forecast.

Dividend Analysis: Potential Increases and Yield Comparison

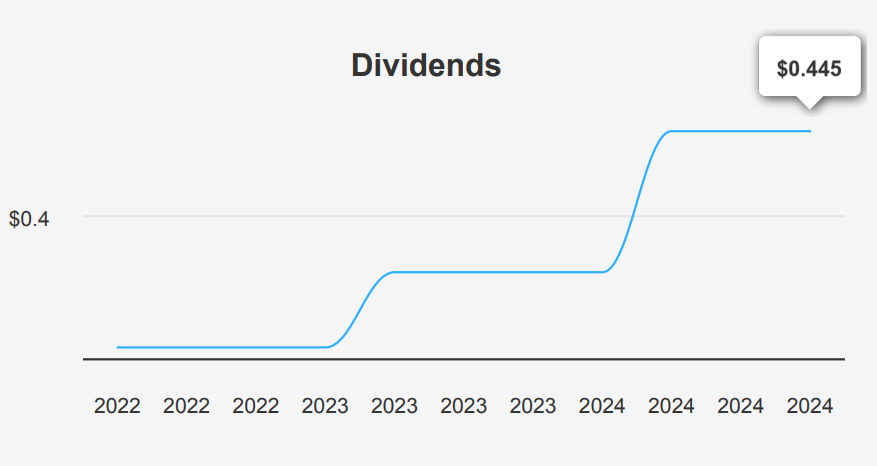

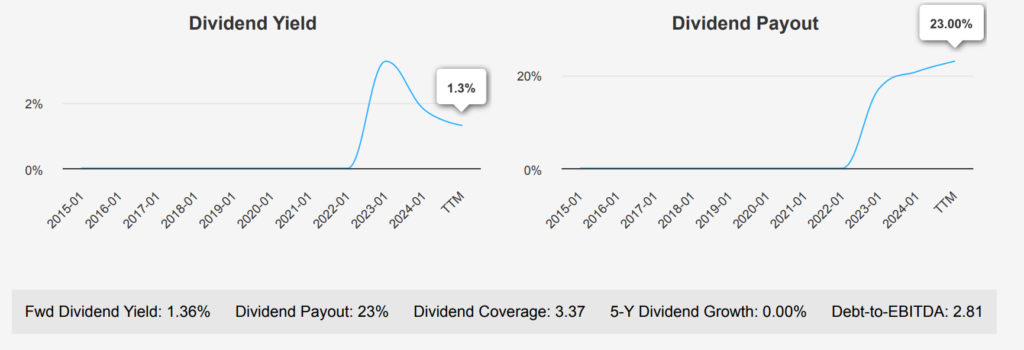

Dell’s recent increase in the dividend per share from $0.37 to $0.445 indicates a positive shift, suggesting a commitment to enhancing shareholder returns. The forward dividend yield stands at 1.36%, lower than its historical median yield of 1.86%, implying potential for yield improvement.

The company’s Debt-to-EBITDA ratio is 2.81, which falls within the moderate range. This suggests a balanced approach to leveraging, though it remains crucial for Dell to maintain or improve its earnings to ensure comfortable debt servicing. The dividend payout ratio is notably low at 23.0%, offering ample room for future dividend increases without straining financial resources.

Looking ahead, Dell’s estimated dividend growth rate of 11.33% for the next 3-5 years indicates a strong commitment to increasing shareholder value. Based on the latest data, Dell’s next ex-dividend date is October 22, 2024. Since the company pays dividends quarterly, the subsequent ex-dividend date is likely around January 22, 2025, assuming no weekend conflicts.

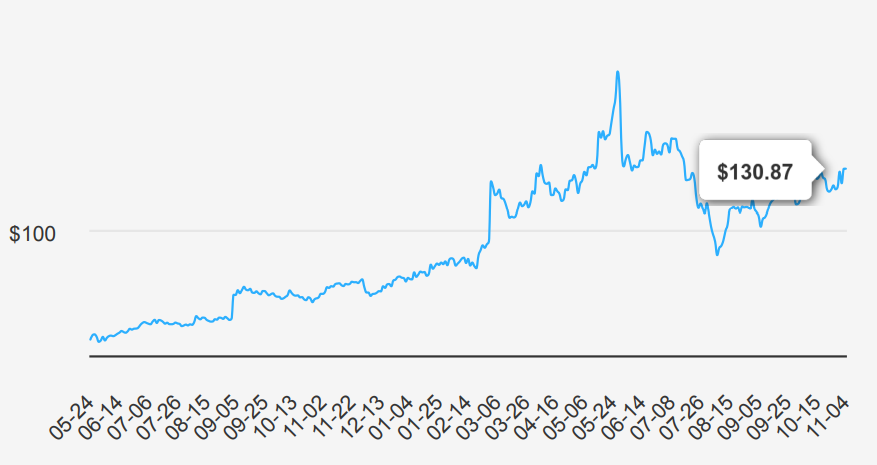

Dell’s Valuation: Overvaluation Risks and P/E Trends

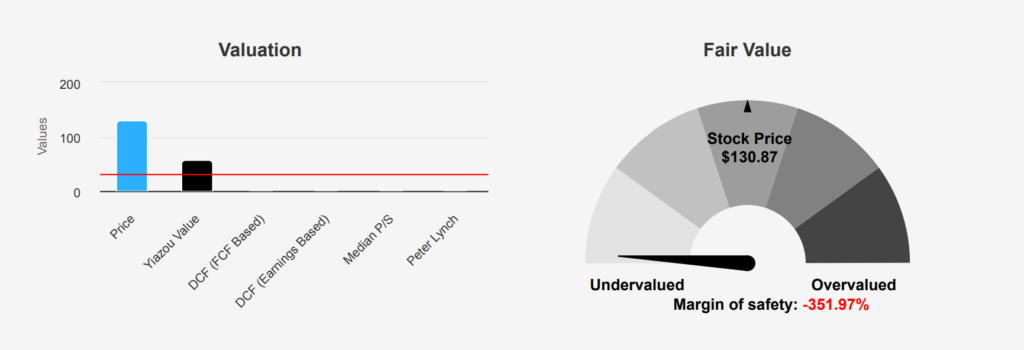

Dell stock currently trades at $130.87, significantly above its intrinsic value of $28.95, suggesting a negative margin of safety of -352.06%. The Forward P/E ratio stands at 13.96, lower than the TTM P/E of 23.83, indicating potential earnings growth. Historically, the P/E ratio has ranged from a low of 2.72 to a high of 32.35 over the past decade, with a median of 10.88. This positions the current TTM P/E above the median, suggesting the stock may holds overvaluation against its historical averages.

The TTM EV/EBITDA ratio is 12.79, above the 10-year median of 8.03 but within the historical range of 4.31 to 15.93. This could indicate that the market values Dell’s earnings more highly now than in the past, possibly due to improved operational efficiency or market conditions. The TTM P/S ratio is 1.04, above the 10-year median of 0.34, indicating that investors are willing to pay more for each unit of sales than historically, potentially due to perceived growth prospects.

The TTM Price-to-Free-Cash-Flow is 28.54, significantly higher than the 10-year median of 4.66, suggesting the market is pricing in a strong future cash flow generation. Whereas the TTM P/B is notably zero, reflecting potential accounting anomalies or asset write-downs, as past values ranged significantly. Analyst ratings indicate a stable price target of around $147, reflecting optimism about Dell’s market position despite the apparent valuation discrepancies. Overall, the stock appears overvalued compared to its intrinsic value and historical valuation metrics, raising caution under Dell stock forecast.

Evaluating Dell’s Financial Risks and Distress Indicators

Dell currently faces several financial challenges that investors should consider. The company is experiencing a long-term decline in its gross margin, averaging a decrease of 3.2% annually, which may impact profitability. Additionally, its revenue growth has slowed over the past year, potentially affecting future earnings. A concerning factor is the Altman Z-score of 1.71, placing the company in the distress zone, indicating a possibility of bankruptcy within two years if conditions do not improve. Furthermore, insider selling activity has been significant, with no corresponding insider purchases, which might signal a lack of confidence from those closest to the company’s operations.

Despite these concerns, Dell maintains a Piotroski F-Score of 7, suggesting a generally healthy financial condition. The Beneish M-Score of -2.51 indicates that the company is unlikely to be manipulating its earnings, which provides some assurance of financial transparency. However, the company’s return on invested capital is currently below its weighted average cost of capital, which questions its capital efficiency. Additionally, Dell’s lower-than-average tax rate may have temporarily inflated earnings, suggesting a potential risk if tax conditions change. Under Dell stock forecast, one should weigh these mixed indicators carefully when considering an investment.

Insider Trading Insights: Heavy Selling Without Buying

The insider trading activity for Dell Technologies Inc. over the past year indicates a significant trend toward selling by those within the company. Over the last 12 months, there have been no insider purchases, while 62 sell transactions have been recorded. This pattern is consistent across shorter time frames, with 35 insider sells in the past six months and eight in the last three months, again with zero purchases in both periods. Such a pronounced selling trend may suggest that company insiders, which include directors and management, are capitalizing on current stock valuations or possibly anticipating less favorable conditions under Dell stock forecast.

Insider ownership stands at a modest 3.01%, while institutional investors hold a more substantial 31.81% of shares. The lack of buying activity from insiders, combined with their minority ownership, might indicate limited confidence in the stock’s near-term performance or could be attributed to personal liquidity needs. However, the significant institutional presence could offset some concerns, as these entities generally conduct thorough analyses before investing.

Dell’s Stock Liquidity: Dark Pool Activity and Volume Trends

Dell exhibits robust trading activity with a recent daily trading volume of 12,512,516 shares. This is significantly higher than its two-month average daily trade volume of 9,747,973 shares, indicating heightened investor interest or news catalysts driving increased market activity.

Dell’s stock appears to have strong liquidity, as evidenced by its ability to execute large volumes of trades without significant price impact. This liquidity is crucial for both institutional and retail investors who require confidence in entering and exiting positions efficiently.

Additionally, the Dark Pool Index (DPI) for DELL is 62.97%. A DPI above 50% suggests that more trades are occurring in dark pools, which are private exchanges used to execute large trades outside of public markets. This can imply substantial institutional interest, as these entities often use dark pools to minimize market impact when trading large volumes.

Overall, Dell’s current trading and liquidity conditions suggest a healthy market environment, with strong investor engagement and institutional participation. Such conditions typically provide a conducive environment for both short-term trading strategies and long-term investment considerations.

Government Contracts: Decline Projected in 2024 and Strategic Implications

DELL’s government contracts have shown significant growth from 2019 to 2023, rising from $1.13 billion to $3.08 billion. This upward trend reflects a strong demand for DELL’s products and services in the public sector. However, projections for 2024 indicate a substantial decrease to $1.07 billion, suggesting potential shifts in government procurement priorities or budget constraints. Strategies to address this decline could involve exploring new government partnerships or diversifying contract offerings.

Congressional Investment: Marjorie Taylor Greene’s Dell Stock Purchases

Representative Marjorie Taylor Greene, a Republican from the House of Representatives, made notable transactions in DELL stock recently. On October 4, 2024, she purchased shares valued between $1,001 and $15,000, as reported on October 8, 2024. This transaction suggests a continued interest in DELL, as it follows a similar purchase made on July 23, 2024, which was reported on July 24, 2024. Both trades were within the same value range, hinting at a consistent investment strategy in this particular company.

These trades might reflect a positive outlook on DELL’s performance or potential strategic developments that align with Greene’s investment objectives. Such repeated investments could indicate confidence in the technology sector, particularly in the products or services offered by DELL. As with any congressional stock activity, these transactions might also attract attention regarding potential insights into legislative impacts on business sectors.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.