The Primacy of Capital Allocation

“Proper allocation of capital is an investor’s number one job.”

Munger asserts that capital allocation is the most critical responsibility of investors and business managers. This perspective is grounded in the idea that effectively deploying resources determines the long-term success of any enterprise.

Example: The Hot Dog Stand

Imagine you own a hot dog business and need to decide what to do with the profits. Should you buy more ingredients? Open a new location? Or save the money?

The returns for each option should be based on the owner’s choice of what will maximize future profit. In essence, he is going through the NPV (Net Present Value) process, which gives a course of action regarding whether an investment’s returns are greater than its cost.

“Passing the NPV test means that $1 invested in the business is worth more than $1 in the market.”

The Simplicity of High Returns on Capital

“It’s obvious that if a company generates high returns on capital and reinvests at high returns, it will do well.”

Munger advocates for simplicity in evaluating investments. He and Warren Buffett criticize the complexity often found in academic approaches, preferring straightforward analysis focusing on high capital returns.

Example: Small Business Growth

Suppose you have a small coffee shop, and your initial investment was $100,000. Assume that in the first year, it made $150,000 in revenues with a profit of $50,000. You would have a 50% ROI.

The owner now faces a capital allocation decision: either to expand the coffee shop or save the profits to open a new one.

- Expanding the Current Coffee Shop: Reinvesting the $50,000 profit in expanding the current coffee shop can result in a 25% annual increase in revenues and profit. This comes down to an additional $12,500 toward profit from operations, for an annual profit total of $62,500. Although this turns out to be good, given the small reinvestment that has to be made, only 25% ROI would be yielded from such reinvestment.

- Opening a New Coffee Shop: The owner could take two years of profits and save up $100,000 to open a new coffee shop. Assuming that the new store yields the same 50% ROI, it would add an extra $50,000 to the annual profit, covering the owner’s total expenses for both shops and resulting in a total annual profit of $100,000.

Decision Making:

According to Munger’s principle, the owner should opt for the option with the highest return on capital. In this case, opening a new coffee shop with a 50% ROI is more advantageous than expanding the existing one with a 25% ROI.

Experience in Capital Allocation

“Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration, or sometimes, institutional politics.”

Munger notes that many CEOs lack experience in capital allocation because they often ascend through roles unrelated to financial decision-making. To become skilled in capital allocation, one must gain experience and learn from mistakes.

Centralized Decision-Making

“We have extreme centralization at headquarters where a single person makes all the capital allocation decisions.”

At Berkshire Hathaway, capital allocation decisions are centralized, leveraging Warren Buffett’s expertise. This approach ensures that the most competent person makes these crucial decisions.

Balancing Retention and Distribution of Capital

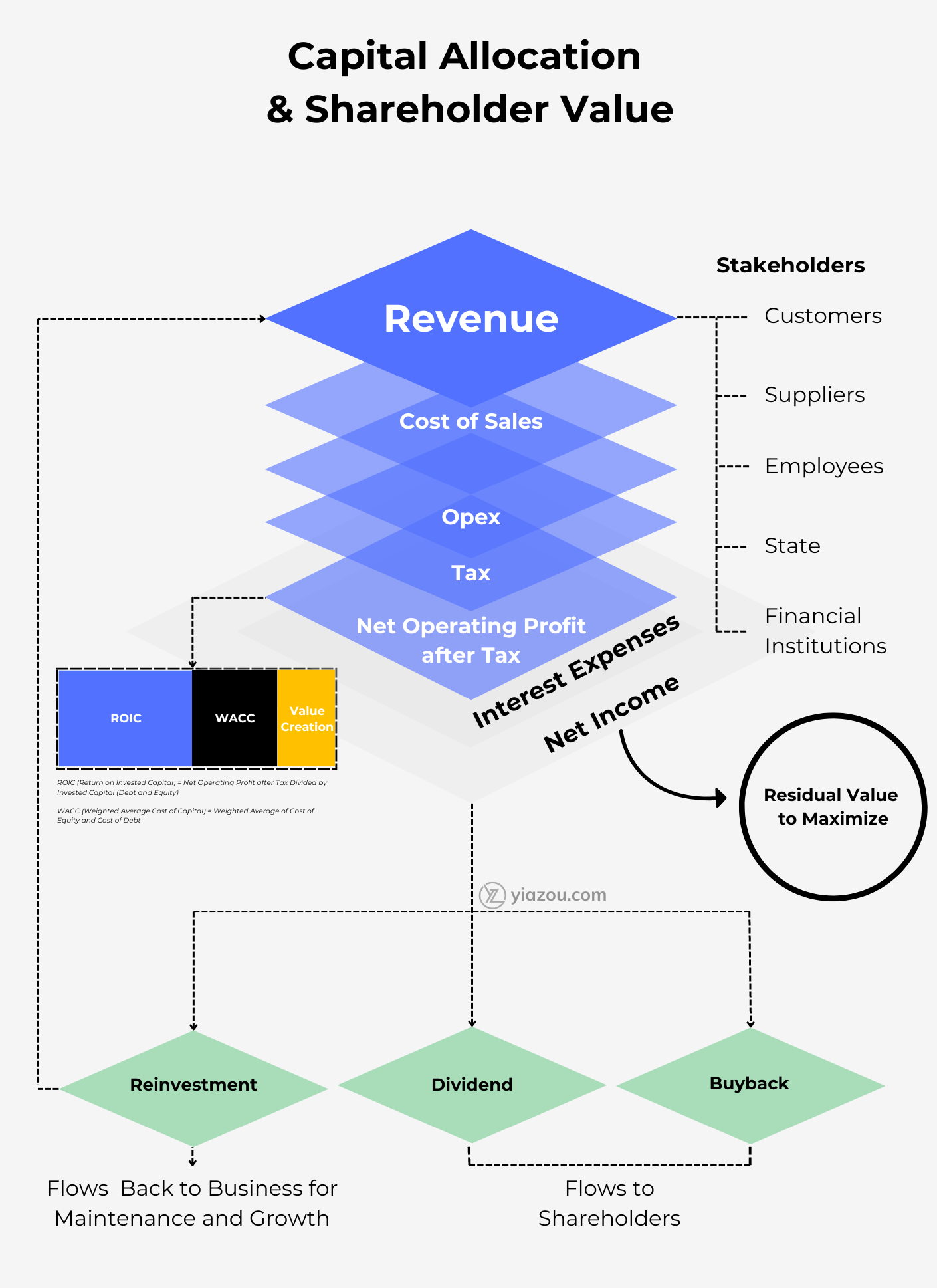

“In allocating Berkshire’s capital, we ask three questions:

Should we keep the capital or pay it out to shareholders?

If pay it out, then you have to decide whether to repurchase shares or issue a dividend.”

Munger points out the factors that matter when deciding whether to retain or distribute profits to shareholders for reinvestment.

Assessing Capital Allocation Metrics

1. Return on Invested Capital (ROIC)

- What it is: ROIC measures how effectively a company uses its capital to generate profits. It’s calculated by dividing Net Operating Profit After Tax (NOPAT) by the average invested capital (debt + equity).

- Why It Matters: A high ROIC versus the company’s WACC represents efficient capital allocation and value creation. For instance, if a firm has an ROIC of 12% and WACC of 8%, it will generate 4% more return against its cost of capital, thus signaling it as a good investment.

Capital allocation is vital for a business looking to grow and sustain its position over time. An equally important factor in this respect would be the incremental return on capital—the profit a company makes from every extra dollar invested. This becomes vital because it reflects how efficiently a company could reinvest its earnings to generate further growth.

Warren Buffett, arguably one of the most successful investors of all time, places great emphasis on this concept. He argues:

“The ideal business is one that generates very high returns on capital and can invest that capital back into the business at equally high rates.

Imagine a $100 million business that earns 20% in one year, reinvests the $20 million profit, and earns 20% of $120 million in the next year.”

But there are very, very few businesses like this.”

High returns on incremental capital build a company’s capacity to compound its growth without significantly increasing dependence on debt or equity financing and thereby create large shareholder value. Coca-Cola is one such company that continues to reinvest its earnings at high rates of return and assures substantial long-term growth and profitability.

2. Return on Capital (ROC)

- What it is: The profitability ratio of every amount of capital engaged in the business. ROC measures how well the company generates profits from its entire capital base.

- Why It Matters: ROC provides the bigger picture of the company’s efficiency in using all its capital resources, debt, and equity.

ROC vs. ROIC:

- ROC considers the total capital employed, whereas ROIC focuses on invested capital.

- ROIC is often preferred for evaluating the efficiency of capital use, while ROC provides a broader profitability measure.

3. Return on Equity (ROE)

- What it is: ROE measures how well a firm uses its owners’ or shareholders’ equity to derive profits. It’s computed by dividing the net by shareholders’ equity.

- Why it matters: ROE shows the return generated on the shareholders’ investments. A high ROE indicates that equity is efficiently used to generate profits, a very important parameter for equity investors.

Suppose a firm generates a net income of $5 million if it has an equity stake worth $50 million; the ROE will be 10%. This measure will help investors estimate the firm’s profitability from an equity holder’s point of view to some extent.

4. Weighted Average Cost of Capital (WACC)

- What it is: WACC is the weighted average cost of capital that a firm will pay to its capital providers—debt and equity holders—explaining the increasing cost of funds.

- Why It Matters: WACC can be used as a hurdle rate in investment decisions. Any new investment has to yield more than the WACC to be considered worthwhile.

For instance, if a company’s WACC is 8%, everything from investments to projects would ideally yield more than 8% to ensure value creation.

Stock Picking vs. Business Buying: The Buffett Approach to Investment Success

Many investors mistakenly focus solely on stock picking as the primary driver of investment success. However, Buffett’s success is more attributable to his ability to buy high-quality businesses rather than merely picking successful stocks. His investment philosophy revolves around acquiring businesses with sustainable competitive advantages and high returns on capital.

Charlie Munger articulates this well:

“We’ve really made the money out of high-quality businesses…

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount.

Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

Capital Allocation Decisions: Capital-Light vs. Capital-Heavy

Broadly speaking, any business can be divided into Asset-light and Asset-heavy businesses. The former is most appealing to Munger because it can generate very high returns on capital without requiring further investments from time to time.

Charlie Munger explains this distinction succinctly:

“There are two kinds of businesses: The first earns 12%, and you can take it out at the end of the year.

The second earns 12%, but all the excess cash must be reinvested – there’s never any cash.

It reminds me of the guy who looks at all of his equipment and says, ‘There’s all of my profit’. We hate that kind.”

Buffett highly values businesses that do not require significant capital reinvestment. These include great consumer businesses that need relatively little capital and service businesses that can operate with minimal fixed investments.

Negative Capital Allocation: Secret to High-Return Businesses

Buffett has often highlighted the attractiveness of businesses with adverse capital requirements. These businesses can generate cash flows upfront, reducing the need for significant ongoing capital investments. Coca-Cola is a prime example of such a business. Buffett states,

“You could run Coca-Cola with no capital. There are a number of businesses that operate on negative capital.

Great magazines operate with negative capital. Subscriptions are paid upfront; they have limited fixed investments.

There are certain businesses like this.”

Takeaway

Capital allocation is how to succeed in any business over the long haul. Businesses that can generate high returns on incremental capital and have the capacity to reinvest those earnings at similarly high rates are generally truly exceptions.

Warren Buffett and Charlie Munger demonstrated through their investment philosophy that superior long-term returns can be gained by owning businesses with sustainable competitive advantages and low capital requirements.

In investing, investors should focus on business fundamentals with the potential for sustainable growth. Concentrate first on businesses with high returns on incremental capital and little reinvestment—this is the way to attain superior returns and create lasting wealth.