Bristol-Myers Squibb Stock Is A Lead Investment Option In Immuno-Oncology Market

Bristol-Myers Squibb (BMY) discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Bristol derives nearly 70% of total sales from the U.S., showing a higher dependence on the U.S. market than most of its peer group.

Bristol Myers Squibb: Earnings Trends and Future Outlook

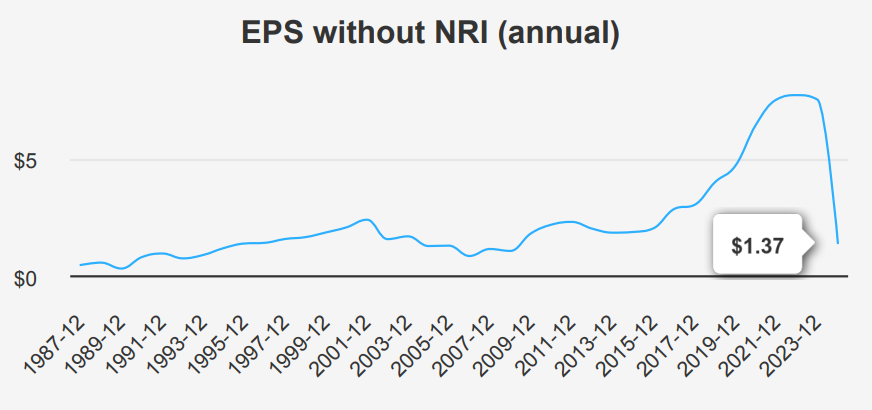

Bristol Myers Squibb reported an EPS without non-recurring items (NRI) of $2.07 for the quarter ending June 30, 2024. It is a recovery from the unusual dip of -$4.4 in the previous quarter. Compared to the same quarter last year, where EPS without NRI was $1.75, this represents a significant year-over-year (YoY) improvement. The company has shown consistent long-term growth with a 5-year Compound Annual Growth Rate (CAGR) of 14.80% and a 10-year CAGR of 18.70% in annual EPS without NRI. Revenue per share increased to $6.013 from $5.865 in the previous quarter. Looking forward, industry growth is forecasted at approximately 5% annually over the next decade.

The company’s gross margin was 75.38% this quarter, slightly below its 5-year median of 76.24% but comfortably within its historical range. This reflects stable operational efficiency. Share buybacks have had a modest impact on earnings per share (EPS); with a 1- year buyback ratio of 3%. This indicates that 3% of outstanding shares were repurchased over the last year. This typically helps boost EPS by reducing the share count. Over the last decade, the buyback strategy has varied, with a 10-year buyback ratio of -3.40%. It indicates periods of both repurchasing and issuance.

Looking ahead, analysts estimate a challenging outlook for BMY, with a projected EPS of -$2.131 for the next fiscal year and a rebound to $5.851 in the following year. Revenue may slightly decrease over the next few years, with predictions of $46,800.62 million in 2024. This is tapering off to $44,269.57 million by 2026. The next earnings report is anticipated on October 31, 2024, where more insights into future performance and adjustments to these estimates may be revealed.

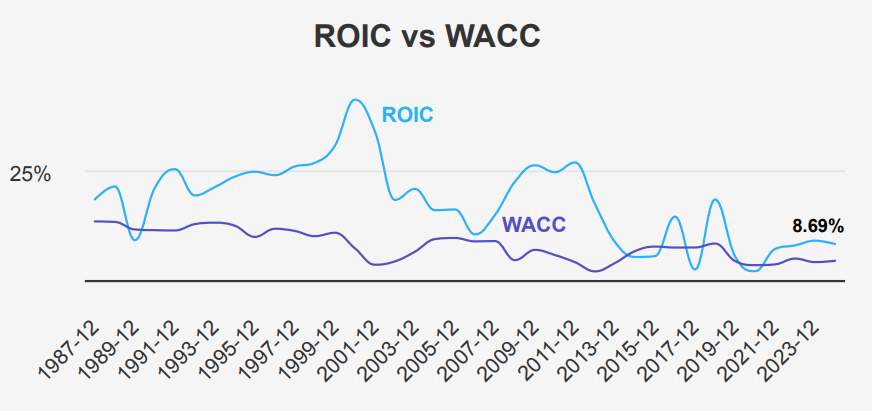

Bristol-Myers Squibb: Strong Returns and Value Creation

Bristol-Myers Squibb has demonstrated strong financial performance and efficient capital allocation over recent years. The company’s Return on Invested Capital (ROIC) has consistently outpaced its Weighted Average Cost of Capital (WACC), indicating effective value creation. Specifically, the 5-year median ROIC of 7.58% and the current ROIC of 8.69% both exceed the 5-year median WACC of 4.66% and the current WACC of 4.94%. This positive spread suggests that BMY is generating returns above its cost of capital, thereby creating shareholder value.

Furthermore, the substantial ROIC compared to WACC highlights the company’s ability to efficiently convert capital into profits, aligning with its strategic financial management goals. Despite a recent negative Return on Equity (ROE) at -26.40%, the historical high of 38.18% suggests potential for recovery. Overall, BMY’s performance metrics indicate robust capital efficiency and an ability to generate economic value, positioning it favorably in its industry.

Bristol-Myers Squibb Stock Holds Solid Dividend Performance

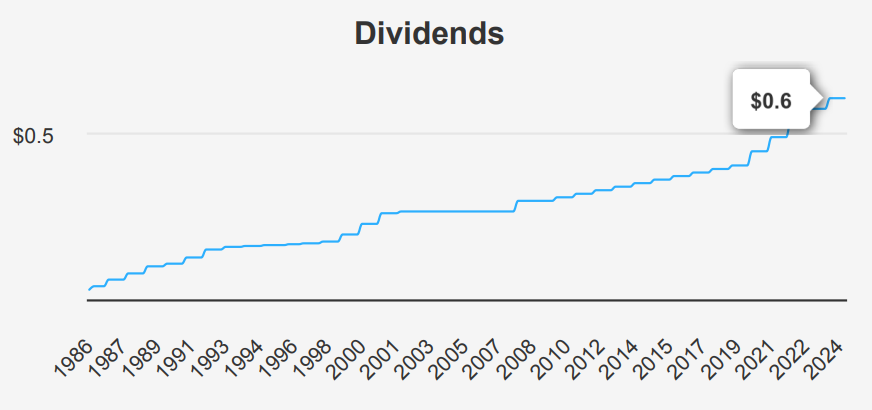

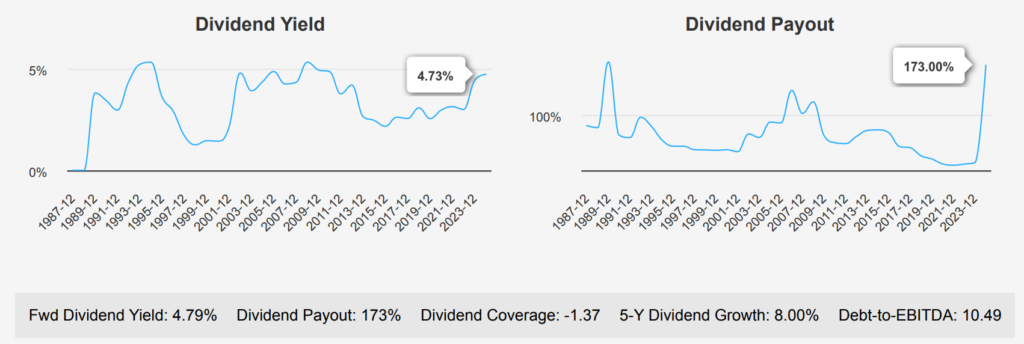

Bristol-Myers Squibb stock has demonstrated a consistent dividend growth pattern, with a 5-year growth rate of 8.00% and a slightly lower 3-year growth rate of 7.90%. The most recent quarter maintained a dividend per share of $0.60, reflecting stability and a slight increase from previous periods. However, the company’s Debt-to-EBITDA ratio at 10.49 is notably high. This indicates potential financial risk compared to general industry guidelines, where ratios above 4.0 suggest elevated risk levels.

The forward dividend yield stands at 4.79%, which is attractive compared to the sector average. It suggests that BMY provides a higher income potential relative to its peers. However, the dividend payout ratio of 173.0% is concerning as it exceeds the sustainable thresholds indicated by its 10-year median of 100.38%. This suggests that current dividends might not be sustainable without earnings growth.

Given the current dividend frequency of four times a year and the most recent ex-dividend date of October 4, 2024. The next ex-dividend date can be predicted as January 4, 2025. The forecasted 3-5 year dividend growth rate of 4.22% suggests slower growth. This is likely due to the financial leverage and high payout ratio.

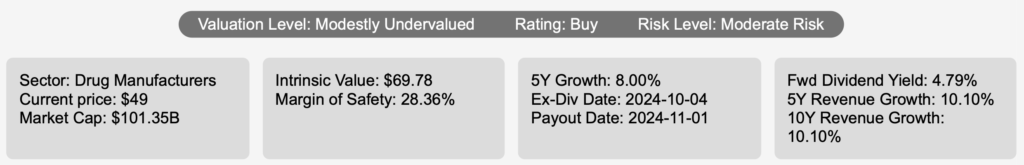

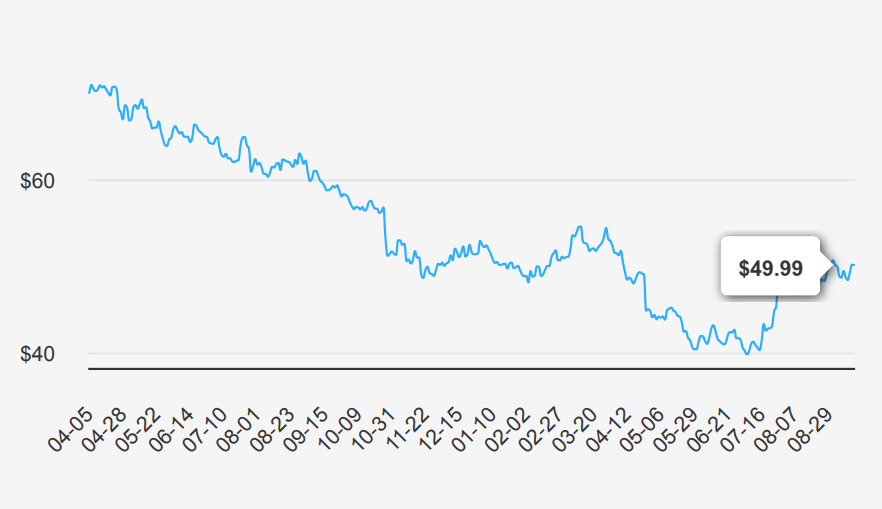

Bristol Myers Squibb Valuation: Opportunities and Cautions

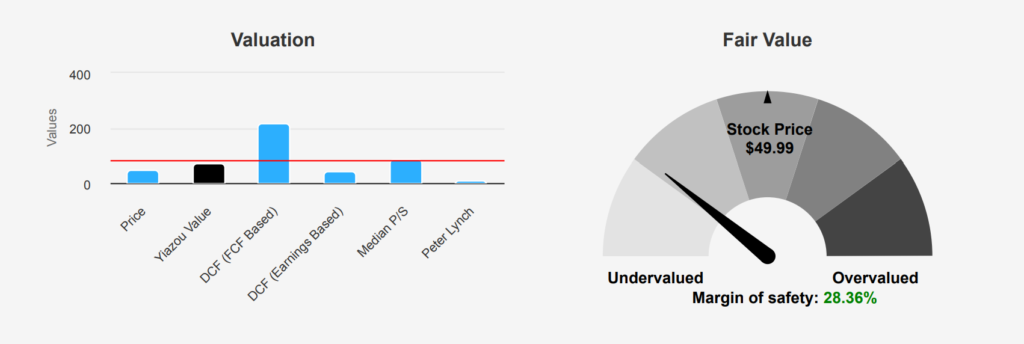

Bristol Myers Squibb currently trades at $49.99, presenting a significant margin of safety of 28.36% based on its intrinsic value of $69.78. This substantial gap suggests undervaluation, given the intrinsic value comfortably exceeds the market price. The Forward P/E ratio of 7.14 indicates a potential discount relative to BMY’s historical median of 25.52. It suggests that future earnings could make the stock attractive at its current price. However, its TTM P/E ratio is at a loss, reflecting recent earnings challenges.

The TTM EV/EBITDA ratio stands at 28.87, notably higher than the 10-year median of 16.13. This may indicate overvaluation of this metric, especially when compared to the norms of the sector. Meanwhile, the TTM P/S ratio of 2.19 is below the 10-year median of 3.66. This suggests a potential undervaluation when considering sales. The TTM P/B ratio is currently 5.96, higher than the historical median of 5.24. It indicates that the stock is slightly expensive based on book value.

Analyst sentiment remains moderately positive, with a stable price target of around $51.72, suggesting limited immediate upside. Given these mixed signals, BMY appears undervalued from an intrinsic perspective. However, due to its current earnings trajectory and the elevated EV/EBITDA ratio, it may face market skepticism. It warrants cautious optimism among potential investors.

Balancing Risks and Rewards in Bristol-Myers

Bristol-Myers Squibb’s financial health presents a mixed picture based on several key indicators. The company’s asset growth at 14.9%, outpacing revenue growth of 10.1% over five years, suggests potential inefficiencies, as increased assets without proportionate revenue growth might indicate underutilization or overinvestment. Additionally, the dividend payout ratio of 1.73 raises concerns about sustainability, implying that the company could be returning more capital to shareholders than it earns. This might not be sustainable in the long term.

Furthermore, the Altman Z-score of 1.39 places the company in the distress zone, indicating a higher risk of financial instability or even bankruptcy within two years. This is a critical warning sign that suggests the need for a cautious evaluation of the company’s financial strategies and risk management.

On the positive side, the Beneish M-Score of -2.99 indicates a low likelihood of earnings manipulation. This provides some reassurance regarding the integrity of its financial reporting. Moreover, Bristol-Myers Squibb Co has demonstrated predictable revenue and earnings growth on a per-share basis, suggesting underlying business stability. Investors should weigh these factors carefully, balancing the risks with the company’s operational strengths.

Quiet Insider Activity: Minimal Buying and Selling

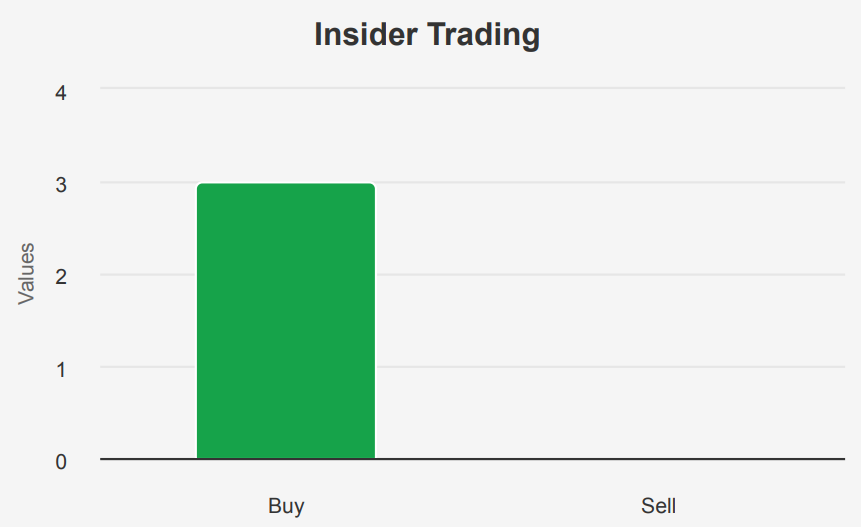

Over the past 12 months, insider trading activity at Bristol-Myers Squibb stock has been relatively quiet, with a total of three insider buying transactions and no selling activities recorded. There have been no insider transactions in the recent six-month and three-month periods. This indicates a lack of immediate personal investment actions from the company’s directors and management.

Insider ownership remains low at 0.32%, which suggests that insiders hold a minimal portion of the company’s shares. This level of ownership might imply limited direct financial incentive in stock performance or a professional distance maintained by the directors and management. Meanwhile, institutional ownership stands significantly higher at 75.94%. This highlights strong interest and control by institutional investors who could be more influential in the company’s market movement.

The absence of insider selling over the past year could be interpreted positively, indicating a lack of concern from insiders about future company performance. However, the low insider ownership may also suggest that any significant insider trading trends could be more reflective of institutional movements rather than personal stakes by company leaders.

Bristol-Myers Squibb Stock: High Liquidity and Trading Dynamics

Bristol-Myers Squibb Company exhibits a robust liquidity profile, as evidenced by its recent volume of 11,057,527 shares traded in a single day. Though slightly below its two-month average daily trading volume of 13,187,935 shares. This figure still indicates significant market activity and investor interest.

The trading volume suggests that BMY is a liquid stock. It facilitates ease of entry and exit for investors without causing a substantial price impact. High liquidity generally implies lower transaction costs and tighter bid-ask spreads, benefiting traders and investors alike.

The Dark Pool Index (DPI) for BMY is 54.84%, which signifies that a notable portion of its trading activity occurs in dark pools, venues where trades are executed privately away from public exchanges. A DPI above 50% indicates higher institutional participation in these non-transparent venues. These trades are often large and can impact supply and demand, influencing the stock’s price dynamics.

Overall, BMY’s liquidity and trading volume levels suggest a healthy trading environment, with sufficient activity to support its market operations while maintaining attractive conditions for both retail and institutional investors.

Soaring Government Contract Success

Bristol-Myers Squibb has seen a remarkable increase in government contracts over the years. In 2013, the company secured contracts worth $20,984. This figure saw a dramatic spike in subsequent years, reaching $312,731 in 2022 and escalating further to $947,212 in 2023. The projected amount for 2024 is an impressive $3,760,798, suggesting a strong and growing relationship with government entities, likely driven by increased demand for pharmaceuticals and healthcare solutions.

Senator Tuberville’s Dual Bristol-Myers Trade Insight

On April 3, 2024, Senator Tommy Tuberville, a Republican serving in the Senate, executed a full sale and purchase transaction involving Bristol-Myers Squibb. The transactions were reported on May 15, 2024. The financial range for both the sale and purchase was between $1,001 and $15,000, indicating moderate trading activity. This dual transaction on the same date suggests a possible strategy to balance his portfolio or respond to market conditions involving BMY stock. The concurrent buy and sell activity could indicate an attempt to leverage market movements or changes in the stock’s valuation. Such trades might reflect Senator Tuberville’s specific investment strategy or response to broader pharmaceutical sector trends at that time. These actions exemplify the nuanced financial activities often undertaken by congressional members, which are publicly disclosed for transparency.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.