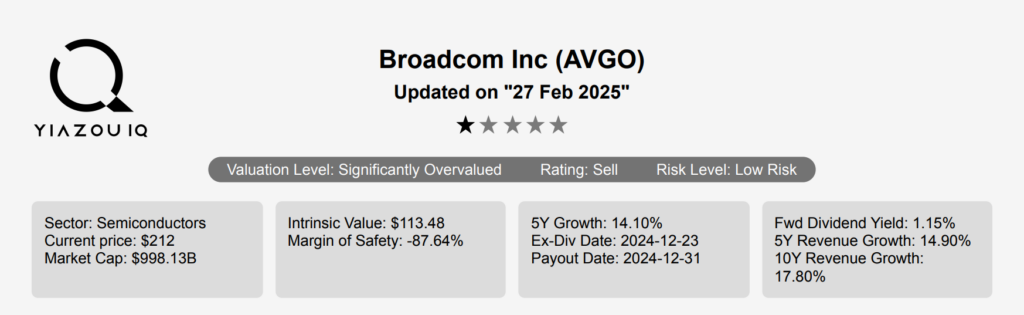

Broadcom Stock Represents A Semiconductor Giant Expanding into Software

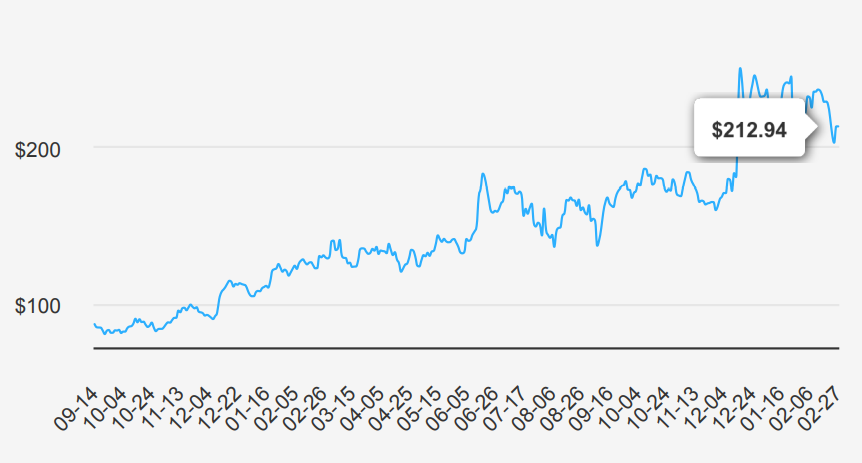

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments. Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software. Broadcom stock is currently trading ~$213.

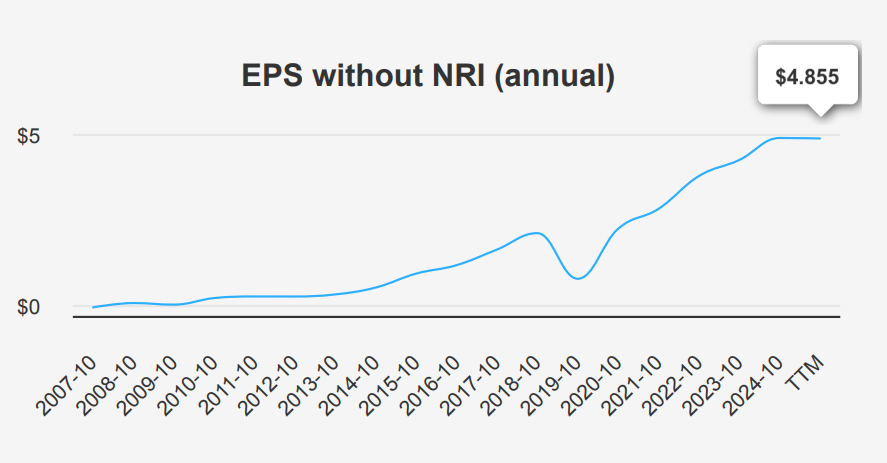

AVGO’s EPS Grows 28.4% YoY – Can This Momentum Continue?

In the latest quarter ending October 31, 2024, AVGO reported an EPS without non-recurring items (NRI) of $1.42, reflecting a sequential quarter-over-quarter (QoQ) increase from $1.24 in the previous quarter and a year-over-year (YoY) increase from $1.106 in the same quarter last year. This consistent growth aligns with the company’s 39.40% 5-year CAGR and a robust 22.60% 10-year CAGR in annual EPS without NRI. The revenue per share rose to $2.912, up from $2.803 QoQ and $2.179 YoY, indicating strong revenue growth momentum. The gross margin remained stable at 63.03%, consistent with its 5-year median, showcasing AVGO’s ability to maintain profitability.

AVGO’s share buyback strategy has been significant, with a 1-year buyback ratio of -13.20%, indicating a reduction in shares outstanding by 13.20% over the past year. Over a 10-year period, the share buyback ratio stands at -4.50%, illustrating consistent efforts to enhance shareholder value through repurchase programs. This reduction in shares has positively impacted the EPS, as fewer shares result in higher earnings per share. The company’s gross margin percentages reflect a strong operational efficiency, with a 10-year high of 68.93% and a median of 55.91%, providing a solid foundation for future growth.

Looking ahead, analysts forecast continued revenue growth for AVGO, with estimates reaching $61,436.31 million by 2025, $71,282.65 million by 2026, and $82,830.89 million by 2027. The industry may grow by an average of 5% annually over the next decade. AVGO’s EPS may increase to $4.223 for the next fiscal year ending and $5.422 for the following year, suggesting strong earnings potential. The next earnings date is on March 6, 2025, which will provide further insights into the company’s performance and growth trajectory.

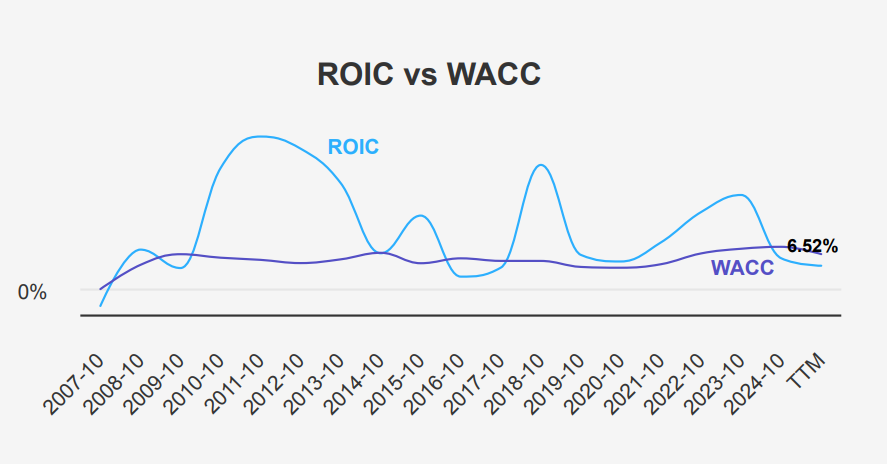

ROIC Drops Below WACC – A Warning Sign for Investors?

Analyzing AVGO’s performance through the lens of ROIC and WACC reveals insights into its capital efficiency and value creation. The company’s 5-year median ROIC stands at 13.03%, while its WACC for the same period is 9.94%. This suggests that historically, AVGO has been generating returns on its investments that exceed its cost of capital, indicating positive value creation. However, the current ROIC is 6.52%, now falling below the current WACC of 9.74%. This shift implies that, at present, AVGO’s return on invested capital is not covering its capital costs, potentially leading to value erosion.

The decline in ROIC compared to its historical highs indicates challenges in maintaining profitability from invested capital. Despite a strong historical ROE and ROIC performance, the current figures suggest potential inefficiencies or changes in market conditions affecting profitability. Monitoring how AVGO adjusts its capital allocation strategies will be critical in determining future value generation and financial health.

Broadcom Stock’s Dividend Growth at 14.1% – Sustainable or Stretched?

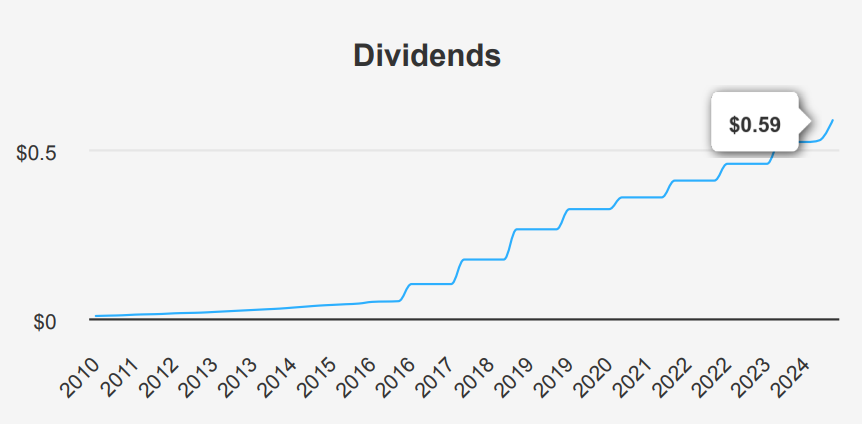

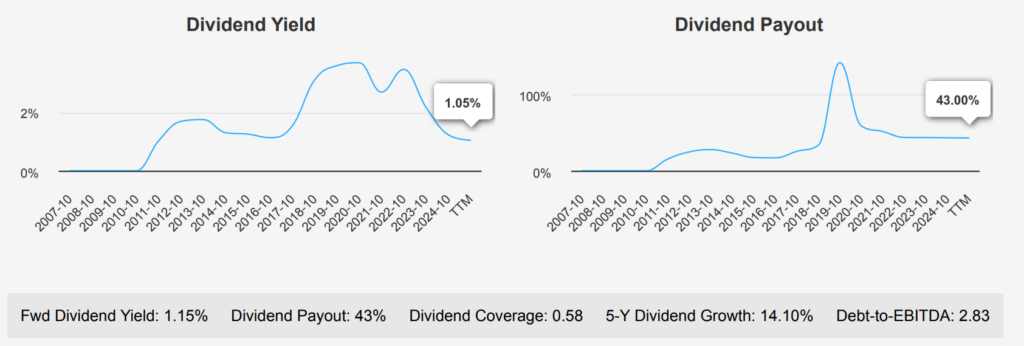

Broadcom stock has demonstrated robust dividend growth, with a 5-year growth rate at 14.10% and a 3-year growth rate at 13.50%. The recent quarterly dividend payments have shown a consistent increase, with the most recent dividend per share at $0.59, up from $0.53 the previous quarter. The forward dividend yield stands at 1.15%, which is relatively modest compared to a historical median yield of 2.16%, indicating strong price appreciation relative to dividends.

The company’s Debt-to-EBITDA ratio is 2.83, which falls within a moderate range. While this suggests some caution, it remains manageable within industry norms, providing room for continued dividend growth without excessive financial risk.

AVGO’s dividend payout ratio is 43.0%, well below its historical highs, signifying ample room to maintain or increase dividends. The future dividend growth rate is estimated at 14.33%, suggesting continued positive momentum. Given the reported next ex-dividend date of December 23, 2024, the subsequent ex-dividend date, assuming a quarterly frequency, would likely be around March 20, 2025, which falls on a Thursday, thus adhering to the typical dividend schedule.

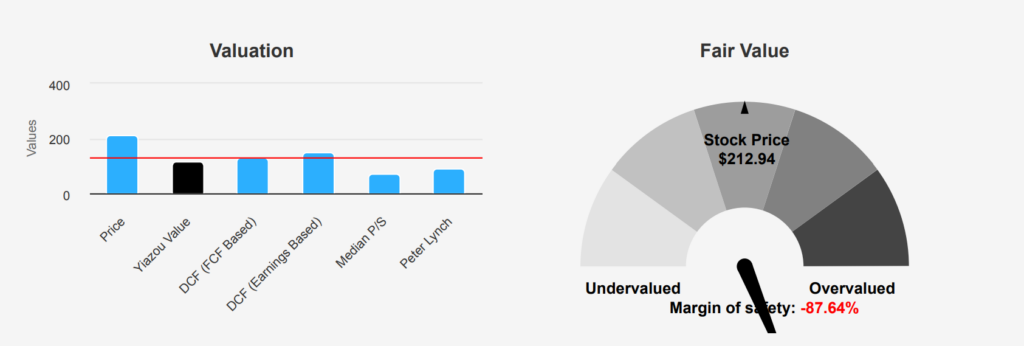

Broadcom Stock’s Market Price 87.65% Above Intrinsic Value – Overheated?

AVGO’s intrinsic value of $113.48 is significantly lower than its current market price of $212.94, indicating a negative margin of safety of -87.65%. This suggests that the stock is currently trading at a substantial premium relative to its intrinsic worth. The Forward P/E ratio stands at 34.14, which is somewhat below the 10-year median of 37.46 but still indicates a valuation higher than many historical norms. The TTM P/E ratio is especially high at 173.69, reflecting a potentially overheated market sentiment when compared to the median.

The TTM EV/EBITDA ratio is 42.2, which is well above the 10-year median of 17.72, suggesting AVGO is priced at a significant premium relative to its earnings before interest, taxes, depreciation, and amortization. Similarly, the TTM Price-to-Book ratio is 14.75, indicating that investors are paying a high price relative to the company’s book value, surpassing the 10-year median of 7.67. These elevated ratios, especially when compared to historical values, may signal overvaluation against the company’s historical benchmarks.

Analyst ratings suggest a positive outlook, as reflected in the rising price targets, which have increased from $196.23 three months ago to $243.97 currently. Despite this optimism, the high valuations across metrics such as P/S and EV/EBITDA relative to historical medians indicate a need for cautious analysis. Investors should weigh these high multiples against the risks of market corrections, particularly given the lack of a margin of safety at current price levels.

Insider Selling and Declining ROIC – Red Flags for AVGO?

Broadcom stock presents a mixed risk profile. On the positive side, the company’s financial integrity appears solid with a Beneish MScore of -2.26, suggesting a low likelihood of earnings manipulation. Additionally, Broadcom’s Altman Z-score of 6.42 indicates a strong financial position, reducing the risk of bankruptcy. Furthermore, the expanding operating margin and predictable revenue and earnings growth are signs of operational efficiency and business stability.

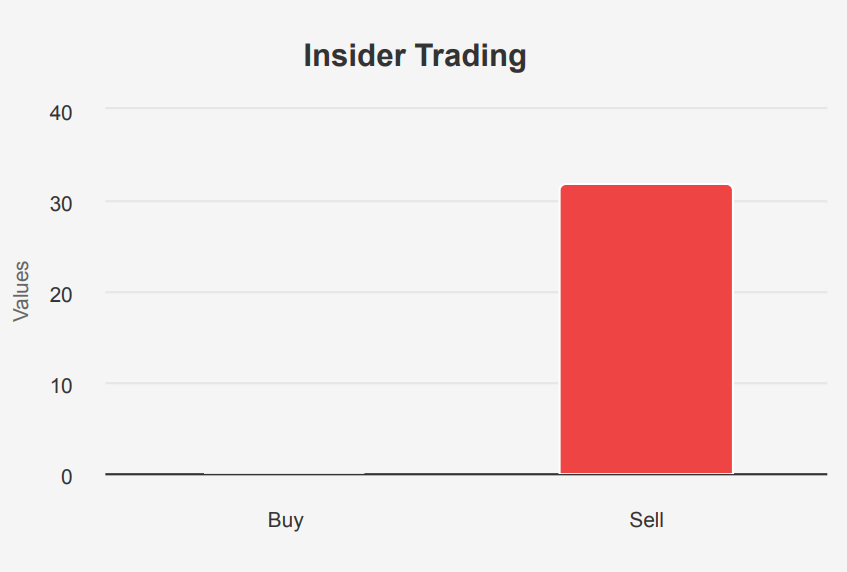

However, investors should be cautious due to several warning signals. A significant concern is the insider transaction activity, where 191,278 shares were sold by insiders over the past three months, with no insider purchases, potentially indicating a lack of confidence in the stock’s near-term performance by those closest to the company. Moreover, Broadcom’s return on invested capital falling below its weighted average cost of capital suggests inefficiencies in capital utilization, which could hamper long-term profitability.

Overall, while Broadcom’s financial health and operational performance are robust, the insider selling activity and concerns regarding capital efficiency warrant careful monitoring. Investors should weigh these factors against their risk tolerance and investment horizon before making decisions.

Zero Insider Buys, 32 Sales in a Year – What’s Driving This Trend?

The insider trading activity for Broadcom Inc. (AVGO) over the past year reflects a significant trend of selling by company insiders. In the last three months, there have been zero insider purchases and eight sales. Expanding this view to six months, there are still no insider buys, while sales increase to 18. Over the span of a year, the data shows a total of 32 insider sales with no purchases.

This pattern indicates a consistent trend of insiders divesting their holdings, which might suggest that they believe the stock is currently overvalued or that they are reallocating their portfolios for other reasons. Given that insider ownership stands at a low 0.05%, the impact of their selling could be limited in terms of overall company control but might signal caution to potential investors. However, institutional ownership is quite high at 73.46%, which can often provide a stabilizing influence on the stock price. Investors should consider these dynamics and any underlying reasons for insider sales when evaluating AVGO’s stock potential.

AVGO Trading Volume Dips Below Average – Liquidity Concerns?

Broadcom stock is experiencing a significant level of trading activity, with a daily trading volume of 20,871,107 shares. This is below its two-month average daily trade volume of 27,700,516 shares, suggesting a recent dip in trading interest or liquidity compared to the previous period.

The Dark Pool Index (DPI) for AVGO stands at 31.27%, indicating a moderate level of trading occurring in dark pools relative to the overall volume. This suggests that a substantial portion of AVGO’s trading is happening away from public exchanges, which could impact transparency and price discovery.

Overall, AVGO’s trading dynamics reflect active market participation, but the lower current daily volume compared to the average could signal a temporary decline in liquidity. Investors should consider these factors, alongside broader market conditions, when evaluating AVGO’s stock performance and potential trading strategies.

Congressman Bets Against Broadcom Stock – What Does This Mean for Investors?

On January 29, 2025, Representative Gilbert Cisneros, a Democrat from the House of Representatives, made a notable purchase of a put option on Broadcom with a strike price of $215, set to expire on February 21, 2025. The transaction, valued between $1,001 and $15,000, resulted in an excess return of 4.40%. This strategic move suggests anticipation of a potential decline in AVGO’s stock price, as reflected by the option’s significant excess return compared to the SPYChange of -1.20%.

Following this, on January 30, 2025, Cisneros sold shares of AVGO, again within the same value range of $1,001 to $15,000. The sale yielded an excess return of 0.46%, despite a price change of -1.26% in AVGO stock, which outperformed the broader market decline indicated by the SPYChange of -1.72%. These trades reflect an active trading strategy possibly aimed at capitalizing on short-term stock movements.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.