Advanced Micro Devices Inc (AMD) is one of the leading suppliers of microprocessors and graphics processors worldwide. The company was founded in 1969 and went through an evolving journey. It transitioned to a fabless model from manufacturing to outsourcing production to foundries like TSMC (TSM). Outsourcing allowed the company to leverage top manufacturing technologies without substantial capital expenditure. The arrangement helped AMD concentrate on a more scalable stage, design, and innovation.

The company designs and develops CPUs (central processing units) and GPUs (graphics processing units) for desktops, notebooks, gaming consoles, data centers, and professional environments. It has a range of product lines for different computing and networking needs. Key products of AMD include Ryzen processors for personal computers, Radeon processors for graphics, and EPYC processors for servers. AMD’s business segments include data centers, client (PCs), gaming, and embedded systems. The company has positioned itself as a formidable competitor to industry giants like Intel and NVIDIA, especially in the gaming and data center markets.

How AMD Makes Money:

AMD has multifaceted business segments that entail the design, manufacturing, and sale of semiconductor products. The primary revenue sources include data centers, client or personal computers, gaming, and embedded.

- Data Center: The data center segment of AMD contributes the most to the company’s revenue mix. During Jan ’24 – Sep ’24, the data center segment accounted for 48.1% of the total revenue. The segment is dedicated to delivering complex computing solutions for enterprise customers. The company designs and develops EPYC processors for data center applications ensuring efficiency and scalability.

- Client: AMD’s client segment caters to personal computing markets. The company’s Ryzen processors hold a substantial market share in the space. According to mercury research, it holds 28.7% market share in the desktop CPU market. This segment contributed 26.2% to the total revenue during the first nine months of 2024.

- Gaming: AMD’s gaming segment consists of Radeon graphics cards and semi-custom chips that are used in gaming consoles such as PlayStation and Xbox. This segment contributed 11.2% to the total revenue of AMD during Jan’ 24-Sep’24. The segment used to be a dominant part of the revenue mix in prior years; however, in 2024, it faced a slowdown due to fierce competition from Nvidia in the space.

- Embedded: Embedded segment offers solutions for industrial and automotive systems. It accounted for a 14.5% share of the revenue mix.

AMD’s Superior Chiplet Architecture: Redefining AI Performance and Outpacing NVIDIA’s Monolithic Designs

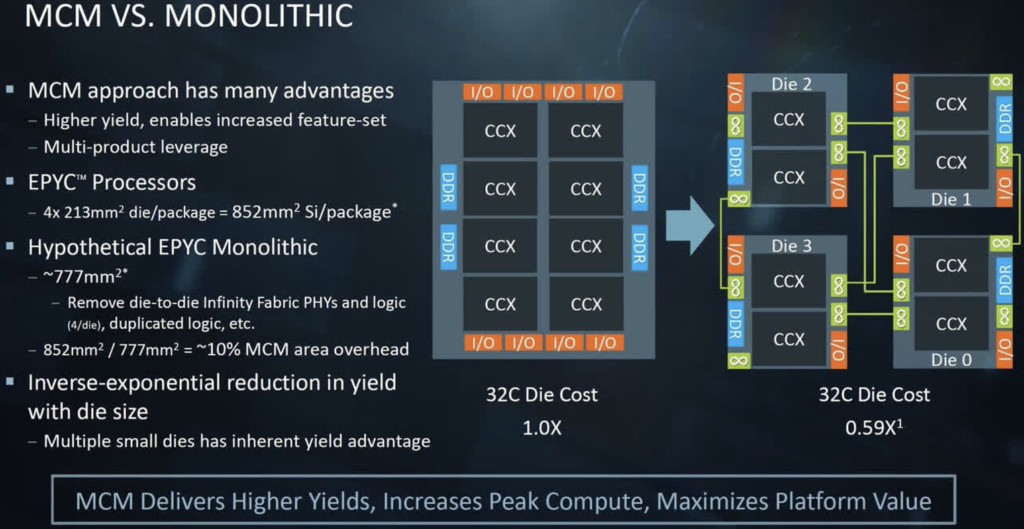

AMD’s adoption of a modular chiplet design represents a significant advancement in semiconductor engineering, offering notable benefits over traditional monolithic architectures. By integrating multiple smaller chips, or chiplets, into a single package, AMD enhances manufacturing efficiency and yield. This approach ensures that defects in individual chiplets do not compromise the entire processor, akin to assembling a complex structure with Lego blocks rather than sculpting from a single piece. This methodology not only reduces production costs but also accelerates development cycles, enabling AMD to introduce innovative products like the MI300X GPU.

The MI300X exemplifies AMD’s strategic implementation of chiplet technology in the GPU sector. With 192 GB of HBM3 memory and up to 5.3 TB/s of memory bandwidth, the MI300X is designed for demanding AI workloads, including large language models and complex simulations. Compared to NVIDIA’s H200, which offers 141 GB of HBM3e memory and 4.8 TB/s of bandwidth, the MI300X boasts a 36% higher memory capacity and a notable bandwidth advantage. This substantial edge allows the MI300X to handle larger datasets and more memory-intensive applications efficiently, positioning it as a strong competitor in AI and high-performance computing while challenging NVIDIA’s dominance in these domains.

NVIDIA’s reliance on monolithic GPU designs, while historically effective, presents challenges in adapting to the evolving demands of AI and data-intensive applications. The monolithic approach can lead to increased production costs and complexities, potentially hindering scalability and rapid innovation. In contrast, AMD’s chiplet architecture offers flexibility and cost-effectiveness, allowing for the seamless integration of diverse functionalities and swift adaptation to market needs. This adaptability is crucial as the industry shifts towards AI-driven solutions requiring expansive memory and computational capabilities.

Furthermore, AMD’s strategic focus on the AI inference market, exemplified by the MI300X’s optimization for large language models, signifies a deliberate effort to penetrate sectors traditionally dominated by NVIDIA. The MI300X’s enhanced memory and bandwidth capabilities make it particularly well-suited for inference tasks, where rapid data processing and model deployment are essential. This positions AMD to capitalize on the growing demand for AI inference solutions, potentially eroding NVIDIA’s market share in this lucrative segment.

In summary, AMD’s innovative chiplet design, as embodied in the MI300X GPU, offers tangible advantages over NVIDIA’s monolithic architecture, particularly in terms of memory capacity, bandwidth, and manufacturing efficiency. This technological superiority enables AMD to effectively compete in the AI and high-performance computing markets, challenging NVIDIA’s established dominance and potentially reshaping the competitive landscape.

AMD’s AI Surge: Outpacing Semiconductor Growth in 2025

The global semiconductor industry is going through a rapid growth phase thanks to the AI rush that is pushing the demand for high-end logic process chips. According to IDC, the industry will grow 15.0% year over year in 2025. We view that given AMD’s major leaps in supplying high-end AI chips at competitive pricing, the company will grow at a higher rate than the industry. Data centers will remain dominant, propelling AMD to a higher growth trajectory. Meanwhile, the PC (client) and gaming segment will also get a boost in 2025 from one of the biggest years for the computer refresh cycle. Overall, AMD has a high probability of registering a 30.0% revenue growth in 2025, with data center, client (PC), gaming, and embedded segments posting 50.0%, 10.0%, 10.0%, and 20.0% growth, respectively.

Data Center Fueling AMD’s Growth Journey: The global data center market is estimated to be $243 bn in 2024 and is projected to grow at a CAGR (compounded annual growth rate) of 11.6% to reach $585 billion by 2032. Generative AI (artificial intelligence) models based on deep learning demand robust computational capability for training and interference which require more powerful data centers. The growing market offers AMD a great opportunity to fuel its revenue at an accelerated rate. Meanwhile, the company’s superior EPYC processors offer high core counts and strong performance per watt at a competitive pricing range, which lends it the power to compete against rivals. Data centers find AMD’s EPYC processors a cost-effective choice especially when dealing with large-scale server deployments. EPYC processors offer up to 96 cores against Intel Xeon’s 60 cores.

Meanwhile, EPYC provides high energy efficiency and more scalability, ensuring efficient scaling in multi-socket setups, which is more suitable for data centers with increasing workloads. Meanwhile, the price competitiveness of AMD’s processors makes it a great choice. AMD’s top-tier 96-core EPYC 6979P processor costs around $11,800, or $6,000 less than Intel’s flagship 128-core Xeon 6980P Granite Rapids processor. All these advantages led AMD to outshine Intel in the data center segment in Q3’24 (Jul’ 24-Sep’24). Intel will have a hard time catching up with AMD’s superior, cost-effective solutions, which are already making waves.

Meanwhile, AMD’s MI300 series, launched in early December 2023 and designed to train and run large language models, is considered to be one of the highest-performance accelerators in the world of generative AI. Right after launch, MI300 AI chips surpassed $1 bn in sales in less than two quarters. The dominance in AI chips through superior products like MI300, along with EPYC lineups, will fuel further market expansion in the data center segment.

AMD’s Strategic Acquisitions: Building a Data Center Powerhouse

AMD’s acquisitions of Xilinx (acquired in February 2022), a leading provider of adaptive computing solutions, and Pensando (acquired in May 2022), which specialized in data processing units, have started delivering synergistic outcomes for the company in their data center business.

Xilinx is renowned for inventions in Field-Programmable Gate Arrays (FPGAs), System-on-Chips (SoCs), and the latest Adaptive Compute Acceleration Platforms (ACAPs). Xilinx’s FPGAs and ACAPs complement AMD’s processors by offloading specific tasks, which enhances overall system performance and efficiency. This is particularly beneficial in data-intensive applications such as AI inference and real-time data processing. With the integration of Xilinx’s adaptive computing capabilities, AMD is better positioned to address future technological trends such as edge computing, AI, and IoT solutions.

Pensando specializes in developing DPUs, which are specialized processors designed to offload various tasks from traditional CPUs. With the addition of Pensando’s DPU technology, AMD can now provide a more comprehensive solution that includes CPUs, GPUs, and DPUs. This integrated approach allows AMD to address a broader range of customer needs in data centers. The acquisition also allows AMD to tap into Pensando’s existing relationships with major cloud providers and enterprises, expanding its customer base and market reach.

AMD’s acquisition of ZT Systems, announced in August 2024 for $4.9 billion, is a strategic move aimed at enhancing its capabilities in the rapidly growing AI infrastructure market. The integration of ZT Systems into AMD is set to provide several key benefits and synergies.

Following the acquisition, ZT Systems will be integrated into AMD’s Data Center Solutions Business Group, allowing for a streamlined approach to developing and deploying AI infrastructure solutions tailored for cloud and enterprise customers. This integration aims to leverage ZT’s expertise in systems design and rack-scale solutions alongside AMD’s advanced silicon technology.

AMD’s Product Roadmap

AMD’s product roadmap for 2025 is shaping up to be robust, with a focus on expanding its offerings across CPUs, GPUs, and APUs. Here’s a detailed overview of what to expect:

| Timeline | CPU Product Roadmap | GPU Product Roadmap |

| Q1 2025 | Launch of Ryzen AI Max Series (300 series) | RDNA 4 GPUs expected to launch early 2025 |

| January 2025 | Launch of Ryzen 9000 Series (X3D) | RX 8000 Series (Navi 48, Navi 44) debut |

| Q2 2025 | Epyc Turin CPUs (Zen 5) expected | Instinct MI350X launch |

| Late Q2 2025 | Epyc Turin-X (3D V-Cache variant) anticipated | RDNA 4 “Navi 4X” lineup introduction |

| Q3/Q4 2025 | Launch of Ryzen AI 200 Series | Continued rollout of RDNA 4 GPUs and APUs |

| Late 2025 | Introduction of Zen 6 and Zen 6c architectures | Ongoing enhancements in Radeon RX and Instinct series |

AMD’s roadmap for 2025 indicates a strong emphasis on enhancing its product lineup across various segments, particularly in gaming and mobile computing. With new graphics cards, advanced processors, and innovative APUs on the horizon, AMD aims to solidify its competitive edge in both consumer and enterprise markets.

AMD’s Path to a $1 Trillion Valuation

AMD reaching a $1 trillion market cap from its current ~$200 billion valuation requires substantial revenue growth and strong valuation multiples continuously, powered by its concentration on AI, data centers, gaming, and embedded systems. The competitive AMD MI300 series GPUs teamed with EPYC CPUs will ensure an edge in the class of high-performance workload while locating the company strategically in the AI-driven data center market, which is expected to be valued at $585 billion by 2032, at a CAGR of 11.6%. With AMD’s lead in chiplet technology and the development of power-efficient processors, its data center revenue is bound to rise from an estimated $8 billion in 2024 to $50-60 billion by 2030, particularly in the era of AI accelerators like the MI300 series that are gaining significant traction. Capturing just 10-15% of the $150 billion AI accelerator market would alone contribute $15-$20 billion annually by 2030 to further advance its leadership position in this space.

In the gaming segment, AMD’s relationships with key console manufacturers and its leading position in PC gaming GPUs suggest continued success. With the oncoming hardware refresh cycle in gaming, accelerating demand for scale gaming systems would see AMD raise its addressable gaming business from $6.0 billion in 2024 to approximately $15.0 billion-$20.0 billion by 2030. Besides this, embedded provides massive opportunities via strategic acquisitions, which includes Xilinx and Pensando, wherein they fuel further traction at edge, IoT, and automotive AI. From that viewpoint, with the progress in adaptive computing solutions and the proliferation of AI-empowered applications, at the end of this decade, embedded might become a business of $10 billion to $15 billion yearly. As consumer PC replacement cycles would increase in maturity but with significant growth still left on high-performance as well as mainstream devices for AMD’s Ryzen AI-powered processor offerings, upwards of another $10 billion to $15 billion will add to revenue on that trend through the end of this decade, making it more differentiated on the consumer end of technology devices.

In combination with these high-growth markets, AMD’s annual revenues could scale from $25 billion in 2024 to as high as $85-$110 billion by 2030. On a P/S multiple of approximately 10x, reflective of the AI-driven premium trading multiple of its peer NVIDIA today, this would position AMD with a market cap well above $1 trillion. Or, alternatively, with a net profit margin of 30% and a P/E multiple of 33x, AMD would reach the same valuation on $30 billion of net earnings. These assumptions are based on successful product execution, such as the upcoming MI350 GPUs, and the extension of its market share in AI and data centers. If AMD were to provide economical yet high-end solutions and capture more workload in AI and edge, it could deliver at par, if not above, to the expectations set by the markets, firmly etching its space as a one trillion dollar plus semiconductor leader until the end of the decade.

Takeaway

For long-term investors, AMD presents a compelling opportunity to reach a valuation of $1 trillion. With the explosive growth in AI-driven markets, surging demand for high-performance data center solutions, and its leadership in cutting-edge chiplet technology, AMD is well-positioned to dominate the future of computing. Strategic acquisitions, expanding product lines, and growing adoption in AI inference and generative AI further solidify its path to unprecedented growth. As the AI market approaches $990 billion by 2027, AMD’s ability to deliver scalable, cost-effective solutions makes it a cornerstone for tomorrow’s tech-driven economy.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives.