AMD Stock: AI Products and Market Landscape in 2025

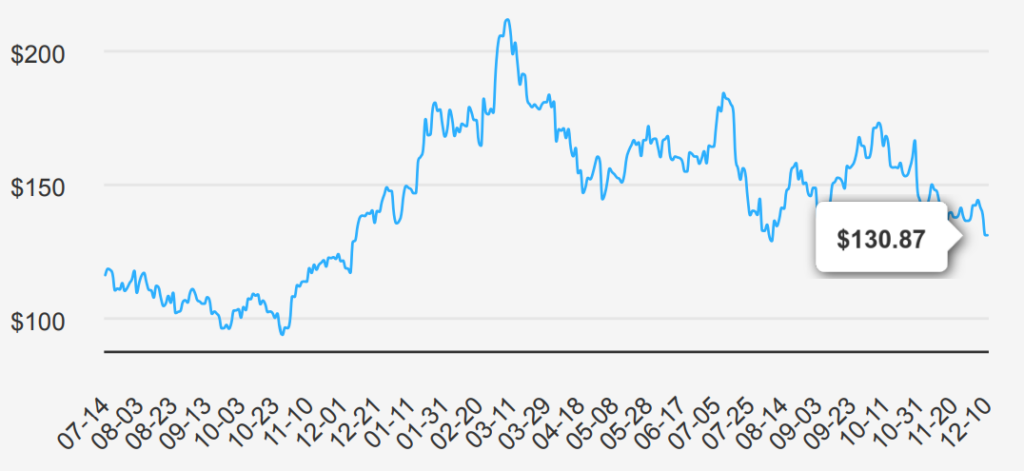

Advanced Micro Devices (AMD) designs a variety of digital semiconductors for markets such as AI, PCs, gaming consoles, data centers, industrial, and automotive applications. AMD’s traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive. AMD stock is currently trading at ~$131. Let’s explore AMD forecast 2025.

Major Drivers and Challenges for AMD’s EPS in 2025

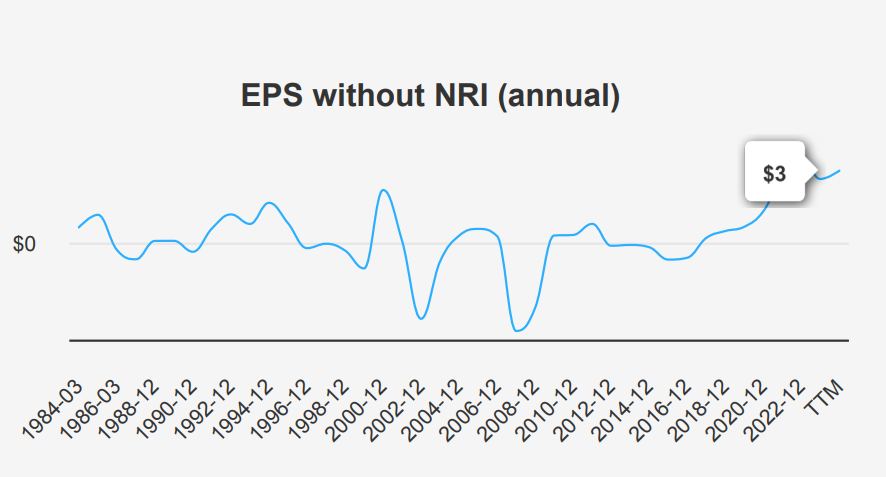

AMD reported robust earnings for the quarter ending September 2024, with EPS without non-recurring items (NRI) reaching $0.92, a significant increase from the previous quarter’s $0.69 and from $0.70 in the same quarter last year. This trend underscores a strong year-over-year (YoY) and quarter-over-quarter (QoQ) performance, indicating a solid recovery and growth trajectory. Revenue per share also increased to $4.168 from $3.564 in the previous quarter and $3.56 a year ago. Over the past five years, AMD’s annual EPS without NRI has grown at a compound annual growth rate (CAGR) of 51.90%, reflecting the company’s strong financial health and strategic initiatives.

The gross margin for this quarter stood at 48.38%, aligning with the highest level over the past decade and significantly above the five-year median of 44.93%. This suggests improved operational efficiency and a favorable product mix. The share buyback ratio, which stands at -0.50% for the past year, indicates a slight reduction in outstanding shares, enhancing earnings per share (EPS) by reducing the share count. A negative buyback ratio implies that shares have not been repurchased in significant quantities relative to the total shares outstanding, which can be seen as a strategic reserve of capital for further investment.

Looking forward, AMD’s growth prospects appear strong, with revenue estimates projected to rise to $40,415.66 million by 2026. Analysts forecast an EPS of $1.461 for the next fiscal year and $3.232 for the subsequent year, highlighting optimism about AMD’s future earnings potential. The industry growth forecast for the next decade suggests a promising upward trajectory in the semiconductor sector, which is expected to grow at an annual rate of around 9%. The next earnings report is anticipated on January 30, 2025, where further insights into AMD’s operational strategy and market positioning are expected.

ROIC vs. WACC and Value Generation Trends

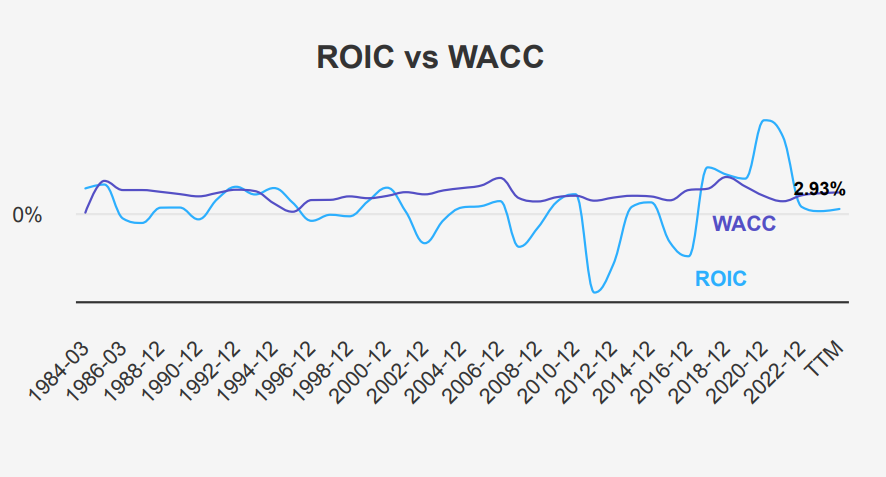

AMD’s financial performance shows significant variability, reflecting both strengths and challenges in its capital allocation and value creation strategy. Over the past five years, AMD’s median Return on Invested Capital (ROIC) stands at 26.67%, comfortably exceeding its median Weighted Average Cost of Capital (WACC) of 13.62%. This indicates strong value generation, as the company earns more on its investments than it costs to finance them.

However, recent figures demonstrate a concerning shift. The current ROIC has dropped to 2.93%, well below the current WACC of 15.71%. This gap suggests that AMD is currently destroying value, as the returns on its invested capital do not meet the cost of capital. This decline in ROIC may be attributed to increased operational challenges or strategic investments that have yet to yield expected returns.

Despite historical strengths in economic value creation, the recent performance underscores the need for AMD to reassess its investment strategies and operational efficiencies to realign ROIC with or above its WACC, ensuring sustainable value creation under AMD forecast 2025.

Financially, AMD’s Debt-to-EBITDA ratio of 0.47 is well below the 2.0 threshold, indicating a strong capacity to service its debt and a low risk of financial distress. This financial leverage position suggests robust operational performance and efficient management of its capital structure.

Intrinsic Value and Market Sentiment for 2025

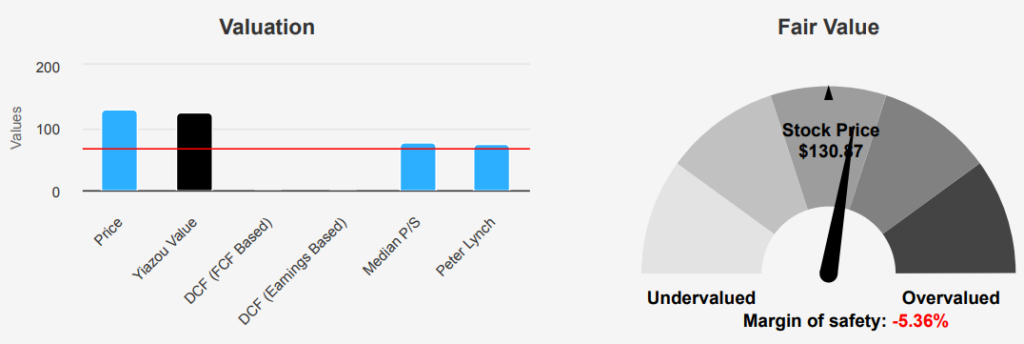

AMD stock’s current market price of $131 exceeds its intrinsic value of $124.2, indicating a negative margin of safety of -5.37%. This indicates that the stock is currently trading above its intrinsic value, suggesting a potential overvaluation. The TTM P/E ratio is notably high at 117.9, compared to the Forward P/E ratio of 25.77. Historical data shows the 10-year median P/E ratio at 105.76, highlighting a current valuation level that is slightly above historical norms. The TTM P/S ratio is 8.81, above the 10-year median of 5.32, which may reflect premium pricing compared to historical averages.

Examining the TTM EV/EBITDA ratio, AMD is valued at 46.58, slightly above its 10-year median of 41.33, yet far below its historical high of 1082.58. This suggests that while the company is valued higher than its median historical figure, it is not at its peak valuation levels. The TTM Price-to-Book ratio is 3.73, which is significantly below the 10-year median of 17.54, indicating a potential undervaluation in terms of book value. However, the TTM Price-to-Free-Cash-Flow ratio stands at 137.59, above its historical median, suggesting that the stock might be overvalued based on free cash flow.

Analyst ratings present a mixed AMD forecast 2025, with the current price target slightly declining over recent months from $187.07 to $184.00. This suggests a cautious stance from analysts, with the number of ratings and price targets indicating active coverage but a lack of significant upward momentum. In conclusion, while AMD shows some signs of overvaluation relative to its intrinsic value and certain historical metrics, there are areas where it remains attractive, notably in its P/B ratio. Under AMD forecast 2025, Investors should weigh these factors carefully against the broader market conditions and AMD’s growth prospects.

Challenges and Strengths of AMD’s Financial Position

AMD stock presents a complex risk profile for investors. On the cautionary side, AMD’s aggressive asset accumulation, growing at 91% annually, overshadows its 23.6% revenue growth, suggesting potential inefficiencies. Additionally, the decline in operating margins, averaging a 20.6% drop annually over five years, and a lower return on invested capital compared to its weighted average cost of capital raise concerns about long-term profitability.

Conversely, AMD exhibits strong indicators of financial health. The company’s Piotroski F-Score of 7 and a Beneish M-Score of -2.16 suggest robust operational efficiency and a low likelihood of earnings manipulation. Market valuations, with price-to-book and price-to-sales ratios near their annual lows, hint at potential value opportunities. Furthermore, the Altman Z-score of 11.32 demonstrates significant financial stability, reducing bankruptcy risk. While the low tax rate might temporarily boost earnings, it’s not sustainable long-term. Investors should weigh these opposing factors, considering the company’s strong financial metrics against operational inefficiencies and internal signals of caution under AMD forecast 2025.

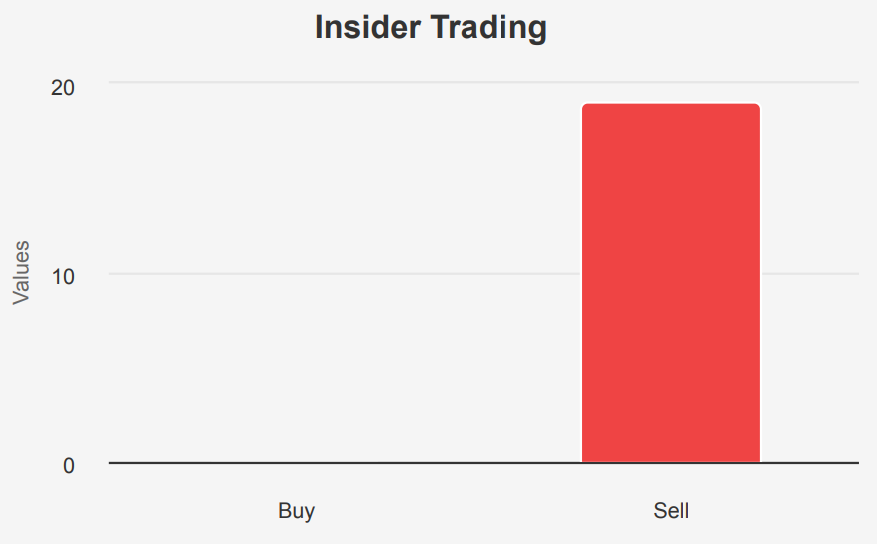

Trends in Insider and Institutional Trading

The insider trading activity for AMD stock over the past year indicates a pattern of consistent selling by company insiders, with no recorded purchases. Over the last three and six months, there were 4 and 8 insider sales, respectively, culminating in 19 sales over the past twelve months. This trend suggests that insiders may be capitalizing on potentially high stock valuations or reallocating their personal portfolios.

Insiders hold just 0.95% of the company’s stock, showing minimal personal investment in the company. In contrast, institutional ownership is quite significant at 74.33%, indicating strong interest and confidence from institutional investors, who often have a broader market perspective and influence. This divergence could suggest differing views on AMD’s future prospects between company insiders and external investors. Overall, the trend of insider selling, coupled with strong institutional ownership, could be indicative of differing expectations regarding AMD’s future stock performance and strategic direction.

Analyzing AMD’s Trading Volume and Dark Pool Activity

Advanced Micro Devices (AMD) is experiencing a high volume of trading activity, with a daily trading volume of 55,263,831 shares, significantly exceeding its two-month average of 34,682,927 shares. This indicates heightened interest and liquidity, suggesting that investors are actively buying and selling AMD shares.

The Dark Pool Index (DPI) for AMD is at 58.54%, highlighting that a substantial portion of trades are on dark pools, which are private exchanges or forums for trading securities. A DPI above 50% suggests that there is considerable institutional activity and potential interest in AMD that might not be fully visible on public exchanges. This level of dark pool activity could imply strategic positioning by large market players.

The increased trading volume and high DPI indicate robust liquidity, allowing investors to enter and exit positions without significantly impacting the stock price. This can be attractive for both short-term traders looking for volatility and long-term investors seeking stability in execution. The current trading environment for AMD reflects a dynamic market interest, possibly driven by market events or changes in the company’s fundamentals.

Implications of Recent Political AMD Stock Moves

Marjorie Taylor Greene, a Republican Representative, made two notable trades in November 2024 involving AMD stock. The first transaction occurred on November 1, where she purchased shares valued between $1,001 and $15,000. This was on record on November 4, 2024. Shortly after, on November 25, Greene’s another purchase of AMD stock within the same value range reported two days later on November 27.

These transactions might indicate Greene’s confidence in AMD’s potential or her strategic positioning in the semiconductor market, which has been volatile yet promising. Given the timing close to the end of the year, these investments could also be part of year-end portfolio adjustments. Observers might consider AMD’s market performance and any legislative developments around technology that could influence such investment decisions by a member of Congress.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.