Altria Stock Represents Leading the Tobacco Market Leader

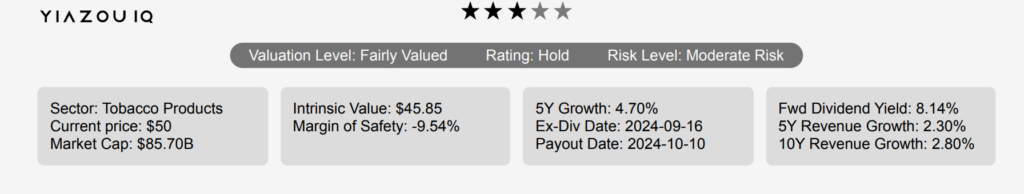

Altria (MO) comprises Philip Morris USA, Smokeless Tobacco, John Middleton, Horizon Innovations, and Helix Innovations. Through its tobacco subsidiaries, Altria maintains the leading position in cigarettes and smokeless tobacco in the United States and the number two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in us, with a 42% annual share in 2023. Beyond its core business, it holds an 8% interest in the world’s largest brewer, Anheuser-Busch InBev, a 42% stake in cannabis manufacturer Cronos, acquired Njoy Holdings in 2023, and operates a joint venture with Japan Tobacco in the heated tobacco category. It also recently disposed of its investment in Juul Labs. MO stock is currently trading at ~$50. Let’s explore: Is Altria Stock a Buy Or Sell?

Altria’s Earnings: Consistent Growth and Strategic Insights

In the latest quarter ending June 2024, Altria reported an EPS without NRI (excludes non-recurring items) of $1.31, consistent with the same quarter last year but up from $1.15 in the prior quarter, reflecting a 13.9% sequential increase. The EPS (Diluted) for Q2 2024 was $2.21, showing strong growth from $1.21 in Q1 2024. Revenue per share increased to $3.072, compared to $2.683 in the previous quarter and $3.052 a year ago. Altria’s 5-year Compound Annual Growth Rate (CAGR) for annual EPS without NRI is 4.40%, while the 10-year CAGR stands at 7.80%. Industry forecasts predict a moderate growth rate of around 2% annually over the next decade, influenced by regulatory challenges and shifting consumer preferences.

Altria’s gross margin for the quarter was 69.74%, the highest in a decade, compared to a 5-year median of 66.28%. This margin improvement can be attributed to cost optimization and product mix enhancements. The company has actively repurchased shares, with a 1-year buyback ratio of 3.70%, meaning 3.7% of outstanding shares were repurchased, which has been a significant factor in boosting the EPS. Over the past decade, the average buyback ratio has been 1.20%. Such buybacks reduce the number of shares outstanding, increasing the earnings per share and returning capital to shareholders.

Looking ahead, analysts project Altria’s EPS for the next fiscal year ending in December 2024 to be 6.278, with a decrease to 5.146 by the following fiscal year. Revenue estimates for the next three years suggest stability, hovering around $20 billion annually. The next earnings announcement is anticipated on October 31, 2024. Analysts remain cautiously optimistic about Altria’s ability to navigate the evolving regulatory landscape and consumer trends, while the company’s commitment to shareholder returns and operational efficiencies supports a positive outlook on whether Altria stock is a buy or sell.

Altria’s Financial Mastery: Efficiency Meets Value Creation

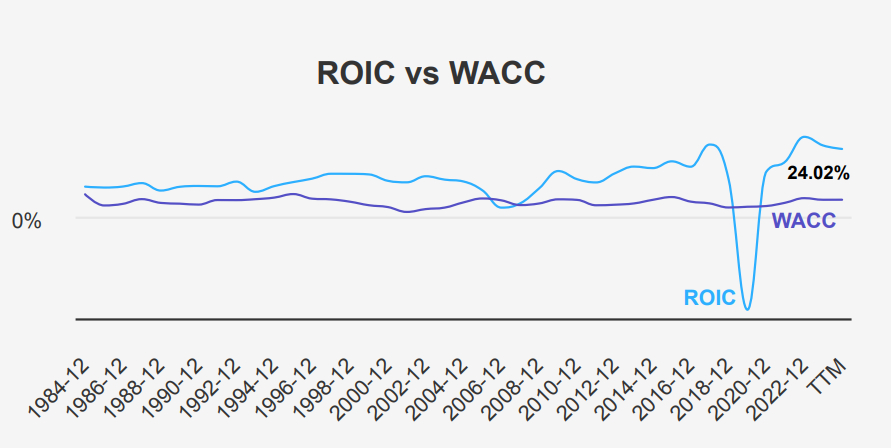

Altria demonstrates strong performance in terms of economic value creation, as evidenced by its Return on Invested Capital (ROIC) consistently exceeding its Weighted Average Cost of Capital (WACC). Over the past five years, MO’s median ROIC is 19.60%, significantly higher than its median WACC of 5.23%. This indicates that MO is effectively generating positive economic value, as it earns more on its investments than the cost of capital.

In the most recent figures, MO’s ROIC stands at 24.02%, while its WACC is 6.38%. This gap highlights MO’s ability to allocate capital efficiently and generate substantial returns for shareholders.

Additionally, MO’s 10-year high ROIC of 28.25% further underscores its robust capital efficiency despite a history of negative equity impacting certain return metrics such as ROE. The company’s strategic capital allocation and high ROIC relative to WACC suggest a strong foundation for sustainable growth and value creation for investors, making it a potentially attractive investment opportunity in the long term.

Altria’s Dividend Stock: Stability Amidst Financial Challenges

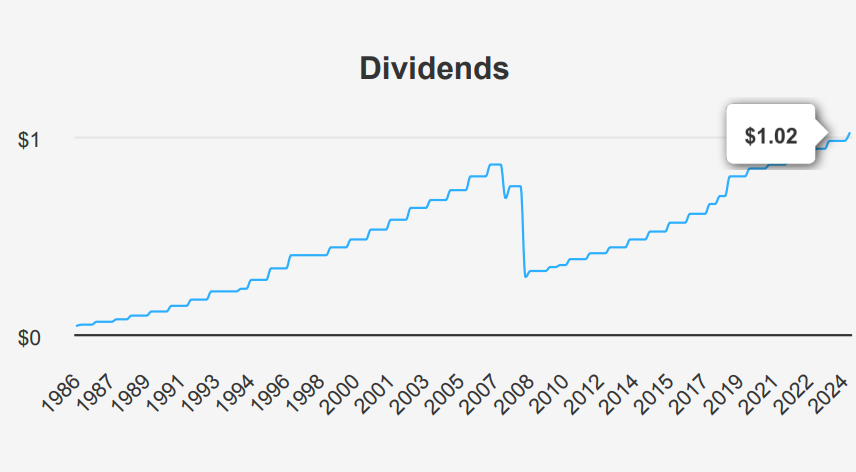

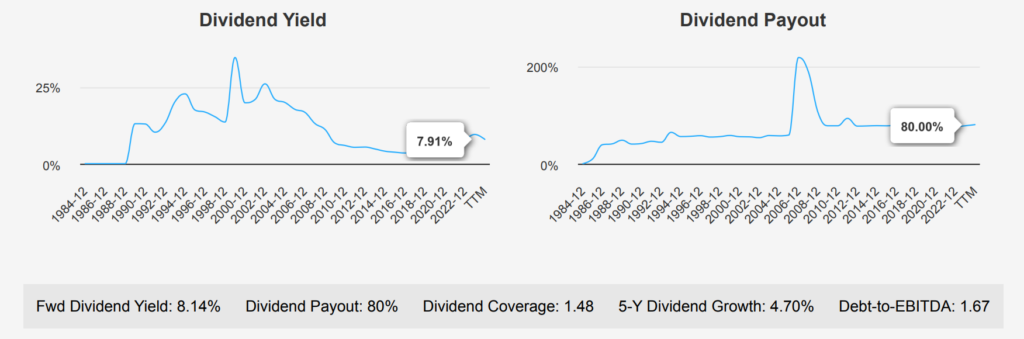

Altria has maintained a steady dividend growth, with a 5-year growth rate of 4.70% and a 3-year rate of 4.10%. In the most recent quarter, the dividend increased from $0.98 to $1.02 per share, reflecting the company’s commitment to shareholder returns. The forward dividend yield stands at a compelling 8.14%, well above the 10-year median of 6.54%, indicating a solid income opportunity for investors compared to the sector average.

MO’s debt-to-EBITDA ratio is 1.67, suggesting lower financial risk and robust capacity to service its debt, aligning with general industry guidelines. This strong balance sheet supports continued dividend payments despite a high payout ratio of 80%, which is below its 10-year high yet signals a cautious approach to future increases.

The forecasted dividend growth rate of 3.89% over the next 3-5 years suggests modest growth, aligning with the company’s past performance and market conditions. The next ex-dividend date is anticipated to be December 16, 2024, assuming a quarterly dividend frequency. This reflects MO’s consistent approach to rewarding shareholders while maintaining financial health and strategic flexibility.

Assessing Altria Stock Buy Or Sell Through Valuation

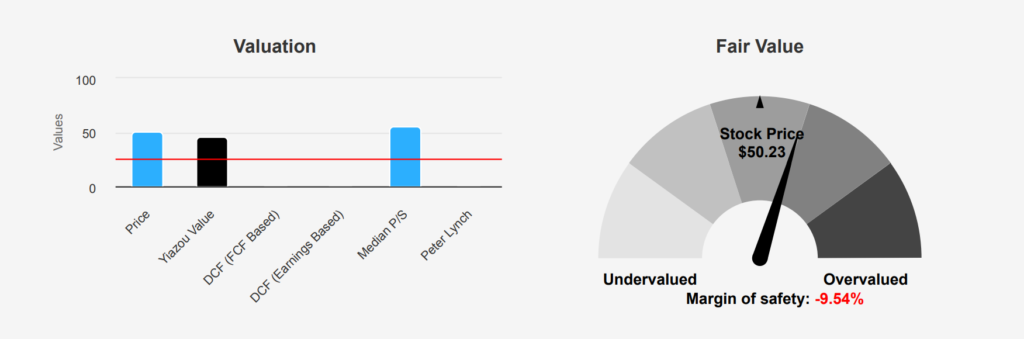

Altria currently has a market price of $50.23, above its intrinsic value of $45.85, indicating a negative margin of safety of -9.55%. The Forward P/E ratio stands at 9.48, slightly above its TTM P/E of 8.65, near the 10-year low of 7.84 but well below the 10-year median of 17.24. This suggests MO is trading at a lower valuation relative to its historical norms, which could imply undervaluation unless future earnings expectations are significantly downgraded.

The TTM EV/EBITDA ratio is 7.2, substantially below the 10-year median of 12.47, pointing towards a potentially attractive valuation from an enterprise value perspective. Meanwhile, the TTM Price-to-Free-Cash-Flow ratio of 10.06 is below the 10-year median of 12.78.

Analyst sentiment, reflected in the price target trends, has gradually increased over the past three months, with a current target of $51.60 indicating slight optimism. The number of analyst ratings at 13 supports a stable outlook, although the intrinsic value analysis suggests caution due to the negative margin of safety, pointing to a potential overvaluation if expectations do not improve.

Balancing Risks and Rewards

Altria presents a mixed risk profile. The company’s dividend payout ratio of 0.80 raises sustainability concerns, as it suggests that a significant portion of earnings are distributed as dividends, leaving less room for reinvestment or cushioning against financial downturns. Furthermore, revenue growth has decelerated over the last year, and the stock price, along with its price-to-sales ratio, is nearing a two-year high. This could indicate the stock’s overvaluation, particularly as the dividend yield is approaching a two-year low, reducing its attractiveness to income-focused investors.

On the positive side, Altria exhibits strong financial health, as evidenced by a Piotroski F-Score of 7, suggesting good operational efficiency and financial stability. Its Beneish M-Score of -3.49 implies low manipulation risk. Additionally, the company’s expanding operating margin signals improved profitability and its price-to-earnings ratio is close to a ten-year low, suggesting potential undervaluation in terms of earnings. The Altman Z-score of 4.58 indicates a low risk of bankruptcy. Overall, while there are some valuation and dividend sustainability concerns, the robust financial health metrics provide a counterbalance, warranting a cautious yet optimistic outlook toward ‘Altria Stock Buy Or Sell?’.

MO Stock’s Insider Trading Trends

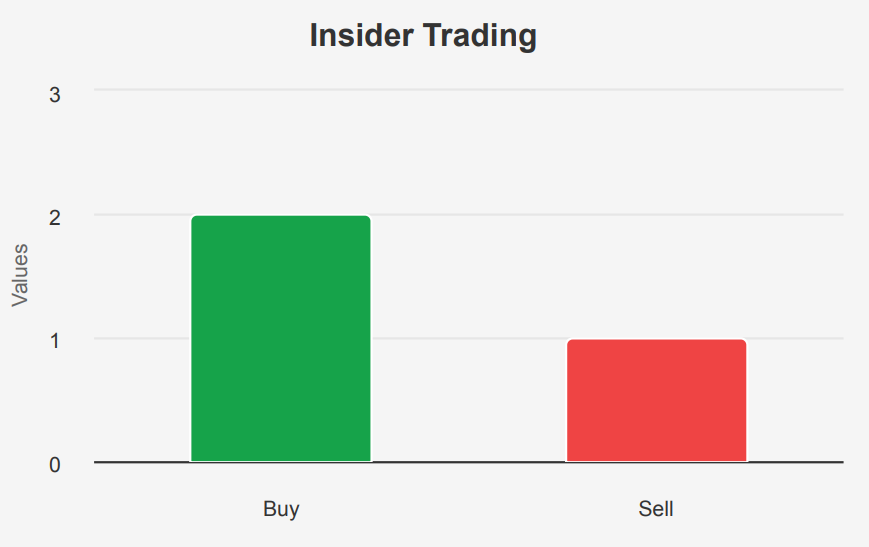

The insider trading activity for MO over the past year indicates minimal movement by company directors and management. In the last three months, there have been no insider buys or sells, suggesting a period of stability or lack of significant insider conviction in the company’s stock. Over the past six months, there was one insider sale but no buys, indicating a possible lack of confidence or a strategic sell-off by a single insider.

Looking at the 12-month trend, there were two insider buys and one insider sale. This suggests a moderate level of insider confidence in the company’s long-term prospects, although the activity is not substantial enough to indicate a strong bullish sentiment among insiders.

Insider ownership stands at 0.61%, which is relatively low, potentially limiting the influence of these transactions on the company’s stock price. Institutional ownership is significantly higher at 59.39%, indicating a greater reliance on institutional investors to steer stock performance. Overall, insider trading trends at MO appear neutral, with limited activity indicating a cautious stance on whether Altria stock is a buy or sell.

Unpacking Altria’s Trading Surge: Insights and Impacts

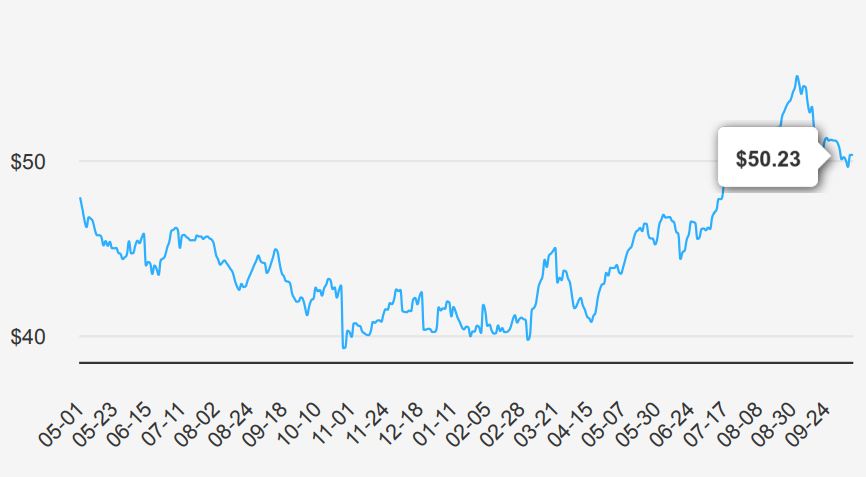

MO’s liquidity and trading analysis indicate moderate activity levels. With a daily trading volume of approximately 7,314,111 shares, MO experiences slightly less activity than its average daily trading volume over the past two months of 7,890,360 shares. This suggests a recent dip in trading activity, indicating either market sentiment shifts or temporary trading lulls.

MO’s Dark Pool Index (DPI) stands at 64.9%, highlighting substantial off-exchange trading activity. A DPI above 50% often suggests significant institutional trading, affecting market transparency and liquidity perception. A high DPI can imply strategic buying or selling by large market participants without significantly impacting the open market.

Overall, while MO’s trading volume is slightly below its recent average, the high DPI indicates that a considerable portion of trades are occurring away from public exchanges. This scenario is common for stocks with significant institutional interest or strategic trading purposes. Investors should consider the DPI level and trading volume trends when evaluating liquidity and potential stock price movements.

MO Stock Congressional Trades: Insights from Recent Transactions

In September 2024, Representative Pete Sessions, a Republican from the House of Representatives, executed a sale transaction involving shares of Altria. The transaction, reported on September 12, 2024, covered a value range of $1,001 to $15,000 and was finalized on September 10, 2024. This trade highlights a possibly strategic move by Sessions amidst any market conditions affecting tobacco stocks, such as regulatory changes or public health debates.

Earlier in the year, another Republican, Representative Virginia Foxx, also from the House, engaged in a similar transaction. On January 16, 2024, she sold shares of Altria, with the transaction reported on February 5, 2024, again within the $1,001 to $15,000 range. The repetition of selling activity in the same stock by two representatives could suggest a broader sentiment or strategy among some members of the Republican party concerning Altria’s future prospects.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.