This is NOT just another AI stock pitch. This is a deep, institutional-level dive into a company I’m betting my money on.

Nebius Group (NBIS) it’s a high-growth, post-spinout disruptor with elite AI engineering talent, a first-mover advantage in Europe, and a clear path to challenging the hyperscalers (AWS, Google Cloud, Microsoft Azure).

With NVIDIA (NVDA) as an equity investor, a 74% “Yiazou Alpha Score”, and a market cap still under $7B, Nebius could be one of the most under-the-radar AI cloud plays today.

But make no mistake—this is high risk, high reward. If it executes, the stock could at least 2-3X. If it fails? It burns cash fast. That’s why this report covers EVERYTHING—business model, financials, risks, valuation, and competitive positioning—so you can see what I see before making your own call.

Summary: Must-Know Insights Before You Read:

1. Understanding the Business: The 4 Pillars of Nebius Group

- Full-Stack AI Play – (Nebius.AI + Toloka + TripleTen + Avride) = an integrated AI ecosystem.

- AI Cloud Powerhouse – Competing with AWS, Azure, and Google Cloud.

2. Network Effects, Moat, and Platform Dominance Potential

- AI Flywheel Effect – Cloud, AI data, and developer tools create sticky adoption.

- T2T Model – AI startups can hire, label, train, and deploy all within Nebius.

- Europe’s AI Cloud Leader? – First-mover advantage vs. U.S. hyperscalers.

3. Competitive Position: Challenging Hyperscalers in the AI Cloud Race

- AI Compute Shortage = Opportunity – Microsoft can’t meet demand, Nebius fills the gap.

- CoreWeave at $23B, Nebius at $6B? – AI cloud valuations suggest huge upside potential.

- 22,000 Nvidia GPUs in 2025 – Expanding compute faster than many rivals.

4. Financial Performance: Growth vs. Sustainability

- 602% AI Cloud Growth – But $1.13B cash burn raises sustainability questions.

- $2.45B Cash Reserves – Runway for 2–3 years to reach break-even.

- 7X CapEx-to-Revenue – Massive investment now = potential high margins later.

5. Risk Assessment: The Biggest Hurdles Nebius Must Overcome

- Cloud Giants Can Undercut Prices – AWS and Azure could squeeze Nebius out.

- Cash Burn = Future Dilution? – Needs $1B ARR soon to avoid more fundraising.

- Global Perception Risks – Shedding Russian ties, but U.S. & EU trust is crucial.

6. Valuation Analysis: How Big Can Nebius Get?

- 36X Revenue Multiple – Too High? – If Nebius hits $1B revenue in 2025, valuation looks cheap.

- Favorable Risk/Reward – Asymmetric play:

- Downside Limited – $15-18/share floor backed by cash reserves ($10/share).

- Bull Case: $15B+ Market Cap? – If it executes, 2–3X upside is on the table.

7. Yiazou Alpha Score: 74% Multibagger Confidence

- 9/10 Leadership – Arkady Volozh + Nvidia backing = strong execution.

- 8/10 AI Tech Edge – Exclusive Nvidia access + AI cloud specialization.

- 7.3/10 Overall – High-risk, high-reward—potential for 2–3X upside.

Unlock Asymmetry

High-conviction ideas in mispriced assets

You’re Almost In!

Check your inbox (+ spam folder) to verify your email.

Nebius is essentially a new technology company with decades-old roots. It was formerly Yandex N.V. – the holding company of Russia’s largest tech firm – until international sanctions during the Ukraine war prompted Yandex’s breakup. In July 2024, Yandex N.V. sold all Russian and CIS operations to a local consortium for ~$5.4 billion. The remaining assets were four AI-centric businesses outside Russia:

- a cloud computing unit,

- an AI data crowdsourcing platform,

- a self-driving tech team, and

- an online education service

These were reorganized under the Nebius Group name, with Yandex co-founderArkady Volozh returning as CEO once EU sanctions on him were lifted. All Yandex branding was ceased and “all connections with Russia have now been severed”. Nebius Group is headquartered in Amsterdam and listed on Nasdaq as of October 2024, when trading in the stock finally resumed after an 18-month suspension.

1. Understanding the Business: The 4 Pillars of Nebius Group

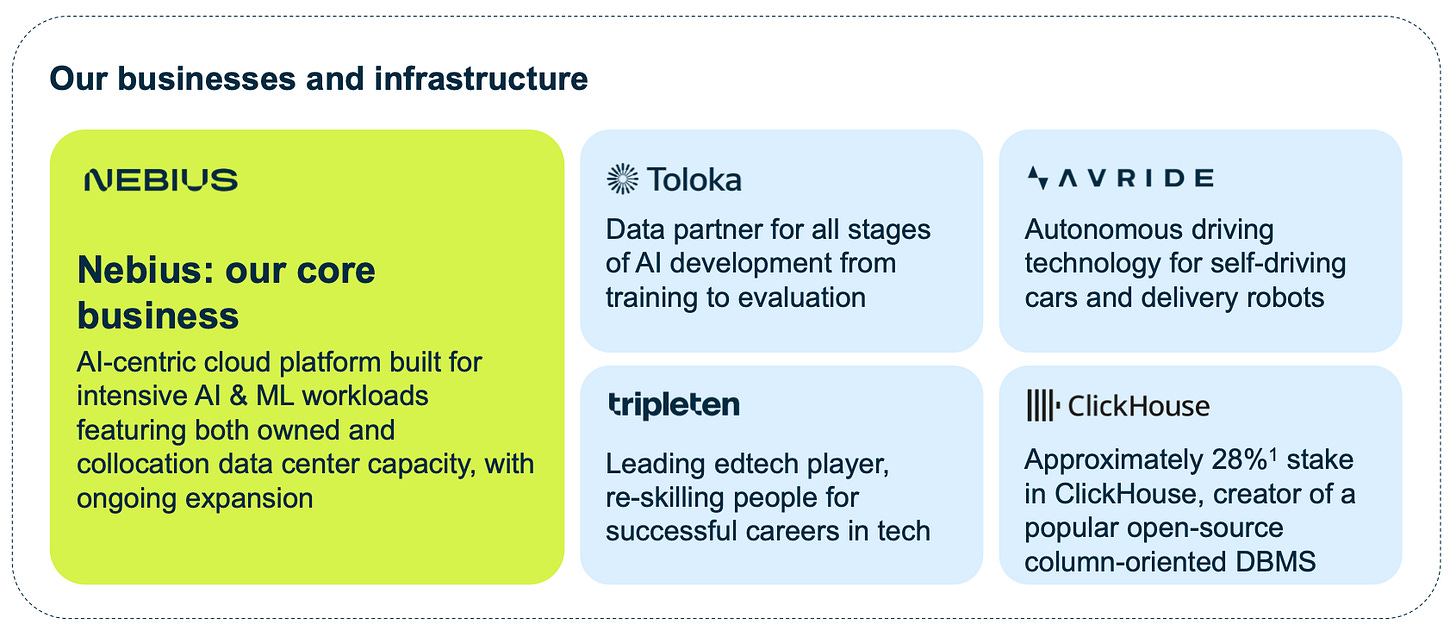

Today Nebius positions itself as a “leading AI infrastructure company”. Its flagship division, Nebius.AI, is building a full-stack cloud platform optimized for AI workloads – effectively a GPU-rich cloud service for training and deploying machine learning models. Supporting this core are three subsidiaries: Toloka, an AI data labeling and crowdsourcing platform; TripleTen, an education technology (bootcamp) business focused on reskilling in tech; and Avride, an autonomous vehicle R&D unit.

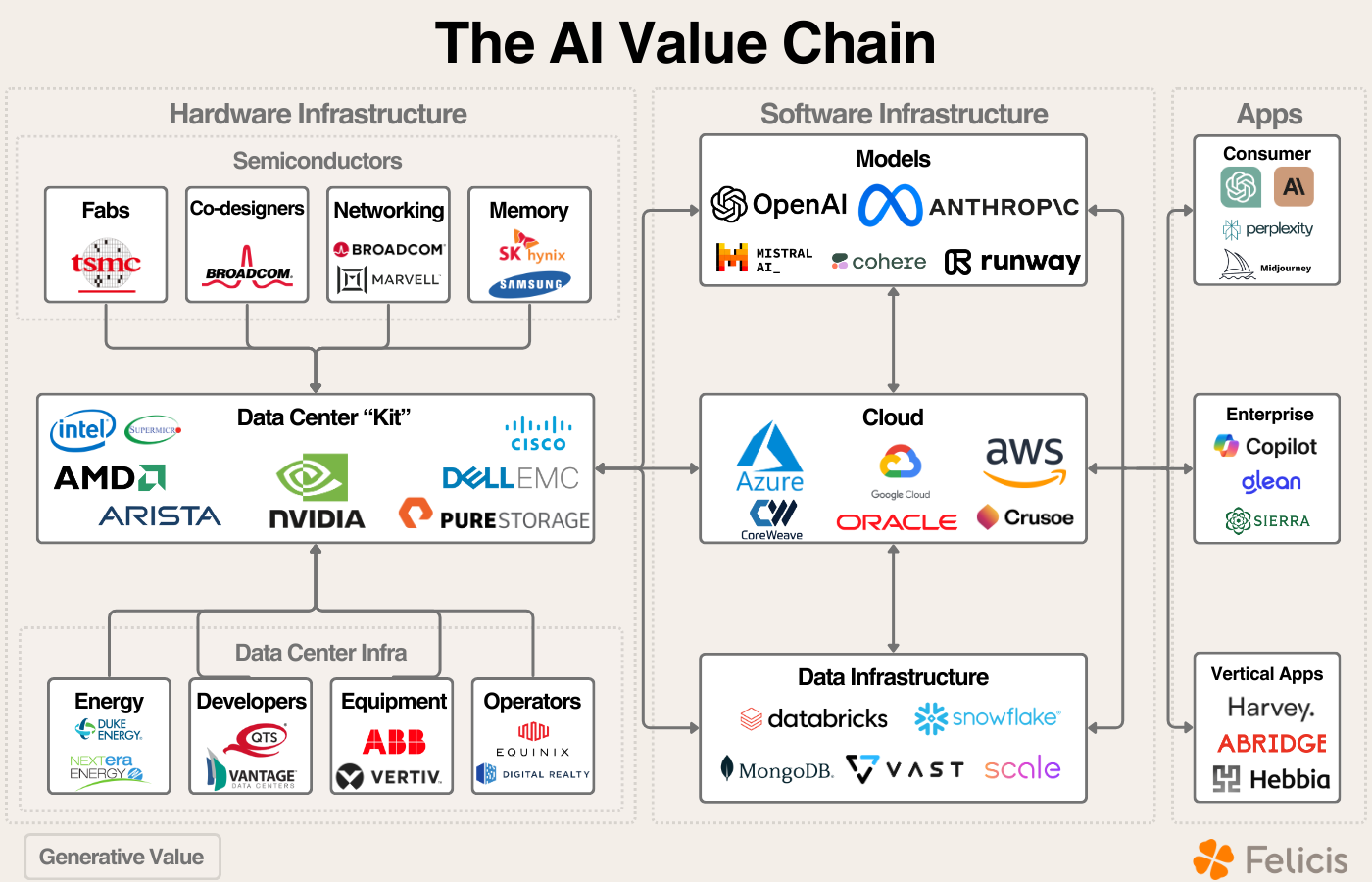

This portfolio approach gives Nebius exposure across the AI value chain: from providing computing power and tools, to supplying training data, to developing AI talent and even autonomous driving algorithms. Management describes it as a unique combination of expertise addressing “fundamental bottlenecks in AI” with a“tech-to-tech (T2T) model” targeting AI builders.

Notably, Nebius inherited a formidable talent base from Yandex. Over 1,000 highly skilled engineers (many PhDs in AI) transitioned to Nebius, bringing deep experience in building large-scale search, cloud, and AI systems. This continuity partly explains how Nebius could hit the ground running – its businesses were already operating globally by mid-2024, serving clients worldwide even before the spin-off completed.

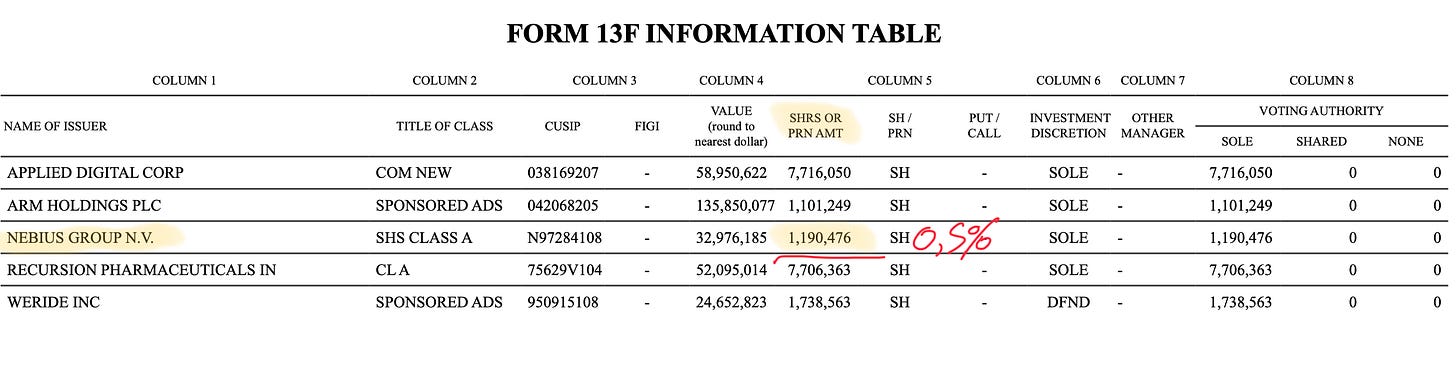

The company established R&D and commercial hubs in Europe, the US, and Israel to tap talent and be close to key markets. Early partnerships have been forged with industry leaders: NVIDIA not only supplies Nebius with cutting-edge GPUs but also joined as an equity investor (holding ~0.5% stake), underscoring alignment with the world’s top AI chipmaker. This organizational strength – an experienced team, global footprint, and strategic alliances – provides a strong foundation as Nebius embarks on its high-growth strategy.

Nebius’s 4+1 Core Segments: The AI and Cloud Powerhouse Behind the Next Tech Breakthrough

Nebius Group operates as a cloud computing and AI infrastructure provider, competing with industry giants like Amazon (AMZN) Web Services (AWS), Microsoft (MSFT) Azure, and Google (GOOG) Cloud. The company focuses on delivering cloud-based solutions tailored to enterprises, startups, and government institutions, leveraging its advanced AI capabilities to optimize performance and efficiency.

At its core, Nebius provides Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) solutions, enabling businesses to run applications and store data securely in the cloud. Its unique value proposition lies in its integration of high-performance computing (HPC) and AI-driven automation, which enhances scalability and reduces costs for clients.

One of Nebius’ key differentiators is its proprietary AI-driven resource allocation system, which dynamically adjusts computing power based on real-time workload demands. This enables clients to minimize wastage and lower operational expenses while ensuring high availability and performance. For example, an e-commerce company experiencing peak traffic during holiday sales can seamlessly scale its cloud infrastructure without over-provisioning resources, ensuring smooth customer experiences without excessive costs.

Nebius Group operates through five primary business segments, each playing a crucial role in the AI infrastructure and cloud computing ecosystem. These segments—Nebius.AI, Toloka, TripleTen, and Avride—are designed to work synergistically, leveraging Nebius’s technological expertise to serve diverse industries. Additionally, Nebius holds a 28% strategic stake in ClickHouse, but ClickHouse is not a fullyintegrated business segment.

- At the center of its operations is Nebius.AI, the company’s flagship cloud infrastructure designed for AI and machine learning workloads. Unlike traditional cloud providers, Nebius.AI focuses on high-performance computing, providing GPU-accelerated cloud services optimized for AI training and inference. This allows businesses developing AI models—such as financial institutions running fraud detection algorithms or AI startups training chatbots—to scale their computational power efficiently while keeping costs lower than hyperscalers like AWS.

- Explain Like I’m 5: Think of Nebius.AI as a GYM FOR AI. Just like bodybuilders need weights and machines to train, AI models need powerful computers to process data and learn.

- Nebius.AI provides these “workout machines” in the form of cloud-based, high-performance computing, allowing AI developers to train smarter and faster. If a company wants to build an AI assistant like ChatGPT, they can use Nebius.AI’s cloud platform to process huge amounts of data and train their model efficiently.

- Toloka, Nebius’s AI data labeling and crowdsourcing platform, supports this core infrastructure. AI models require vast amounts of labeled data, and Toloka provides this by combining a global workforce with AI-assisted annotation tools. Companies building autonomous driving systems or generative AI applicationscan use Toloka’s services to create high-quality training datasets. Unlike legacy competitors such as Appen, which struggled to pivot to the generative AI boom, Toloka has rapidly grown by securing contracts with leading AI developers, making it a crucial component in Nebius’s ecosystem.

- Explain Like I’m 5: For an AI model to work properly, it needs good training data—this is where Toloka comes in. Think of Toloka as a TEACHER WHO GRDES HOMEWORK. AI models, like students, learn from examples, but someone has to make sure they are learning the right things.

- Toloka provides labeled data—such as images, speech, or text—so AI can recognize patterns correctly. For example, a self-driving car company needs to teach its AI how to recognize stop signs, pedestrians, and traffic lights. Toloka’s team helps label thousands of images so the AI knows what it’s looking at.

- TripleTen, formerly known as Yandex Practicum, serves as the company’s edtech division, focusing on upskilling individuals for careers in AI, software engineering, and data science. It differentiates itself from platforms like Udacity and Coursera by emphasizing real-world projects, preparing professionals for AI-driven roles. By training talent that could eventually work with AI and cloud technologies, TripleTen strengthens Nebius’s long-term position in the AI workforce ecosystem.

- Explain Like I’m 5: TripleTen is like a SCHOOL FOR AI ENGINEERS. Not everyone knows how to build AI, so TripleTen offers online courses that teach people coding, data science, and AI development.

- Imagine someone working in marketing who wants to switch to tech but doesn’t know where to start. TripleTen helps them learn AI-related skills so they can get a job in the fast-growing tech industry.

- On the frontier of AI applications, Avride is Nebius’s autonomous vehicle R&D unit, developing AI-powered self-driving systems and delivery robots. While competitors like Waymo and Cruise focus solely on robotaxi services, Avride explores a broader scope, including logistics automation and industrial AI applications. Though still in early development, Avride benefits from Nebius’s cloud infrastructure for AI model training, making it a long-term bet on the future of mobility.

- Explain Like I’m 5: Avride is like a SELF-DRIVING PIZZA DELIVERY SERVICE.

- It focuses on AI-powered autonomous vehicles and developing technology that can drive cars and deliver packages without human drivers. If you’ve ever seen a small robot delivering food on a college campus, that’s an example of what Avride is working on—except on a much bigger scale.

- Beyond these operational segments, Nebius also holds a 28% stake in ClickHouse, an open-source, high-performance database management system widely used in AI and big data applications. While not an active operating segment, ClickHouse complements Nebius’s AI cloud strategy by enhancing data processing capabilities, reinforcing Nebius’s presence in AI infrastructure. Together, these segments form a vertically integrated AI ecosystem, uniquely positioning Nebius as a next-generation cloud and AI solutions provider.

- If Nebius.AI is the gym, ClickHouse is like a PROTEIN SHAKE, helping AI models store and retrieve huge amounts of information quickly, making everything run smoother.

- Together, these segments make Nebius a one-stop shop for AI development, helping companies build, train, and deploy artificial intelligence in the real world.

Additionally, Nebius offers specialized cybersecurity features, including AI-enhanced threat detection and encryption technologies that safeguard sensitive data against cyber threats. This makes it an attractive option for enterprises such as financial institutions and government agencies that handle confidential information.

Beyond its core cloud computing services, Nebius has been expanding into the edge computing market, enabling faster data processing closer to end-users. This is particularly valuable in applications requiring low-latency responses, such as autonomous vehicles, real-time analytics, and industrial IoT deployments.

In summary, Nebius Group stands out in the cloud computing industry by blending AI-driven optimization, robust security measures, and scalable infrastructure solutions. Its strategic focus on automation and efficiency positions it as a formidable competitor in the evolving cloud landscape, offering businesses a cost-effective yet powerful alternative to mainstream cloud providers.

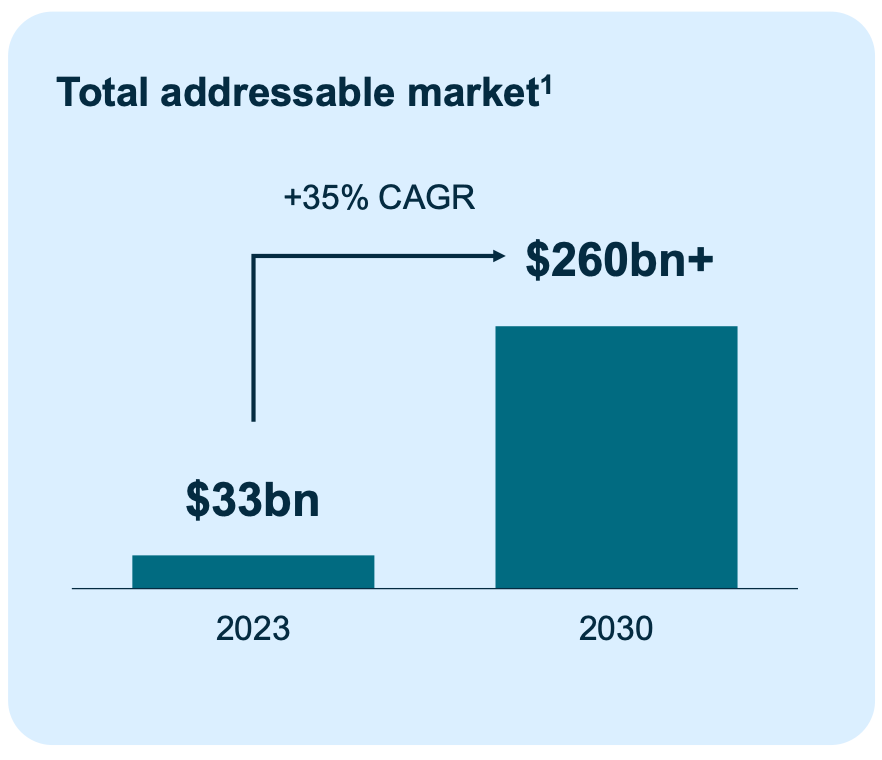

Targeting a $260 Billion Opportunity by 2030

Nebius Group operates within the rapidly expanding AI cloud computing and infrastructure industry, tapping into multiple high-growth markets. The company estimates that the total addressable market (TAM) for AI technologies is set to reach $800 billion by 2030, with a compound annual growth rate (CAGR) of 29% from 2023 to 2030. Within this broader AI market, Nebius specifically targets the GPU-as-a-Service and AI cloud sector, which is projected to grow to $260 billion by 2030 at an even higher CAGR of 35%. This suggests that Nebius is operating in one of the fastest-growing segments within AI, driven by increasing demand for high-performance computing, machine learning workloads, and data processing at scale.

2. Network Effects, Moat, and Platform Dominance Potential

Nebius is striving to build more than just a collection of businesses – it aims to establish an AI ecosystem that reinforces network effects. This is pivotal for its long-term competitive moat. Let’s dissect how each component contributes to network effects and where vulnerabilities lie:

As more AI developers use Nebius’s cloud, it can attract more third-party tool integrations, possibly create a marketplace for AI models, and gather workload data to optimize performance. However, infrastructure services typically have higher switching costs rather than classic network effects – i.e. the more you use it and build on it, the harder it is to switch to another cloud due to data gravity and integration.

Nebius is trying to augment this with actual network effects by offering AI Studio and serverless platforms (Tracto) that could become community hubs if they gain popularity. For example, if Nebius’s AI Studio supports popular open-source models and attracts a developer community, those users sharing solutions and models could make Nebius’s platform more valuable for the next user (a network effect similar to how AWS Lambda grew by community adoption). At this early stage, Nebius’s network effect is weak– it’s more about a promise. The company explicitly calls its approach:

This implies a focus on developer-centric features. If Nebius becomes known as the go-to cloud for AI startups (perhaps due to performance or cost advantages), areputation network effect can form (everyone goes there because that’s where cutting-edge AI companies are). This is analogous to how certain cloud providers became favorites in niches (e.g., GCP for machine learning research early on, or AWS for startups). Nebius has a shot at carving out such a niche, especially in Europe, but it must execute flawlessly on product and support to earn that status.

Toloka & Data Network: Toloka adds a different kind of network effect – a TWO-sided network of AI developers (clients) and crowdworkers (labelers). The more clients Toloka has, the more tasks for crowdworkers, attracting a larger/more skilled crowd; conversely, a large, diverse crowd attracts more clients who need complex data tasks done quickly.

Yandex had already nurtured Toloka’s crowd in the past, so Nebius inherits that network. If Nebius smartly links Toloka with its cloud clients, it can offer an integrated pipeline:

“Bring your data, label it on Toloka, then train on Nebius Cloud”.

This one-stop convenience can be a moat if executed – competitors would need to match both elements.

Also, as Toloka handles more AI-specific tasks (like safety testing for AI models), it gains proprietary knowledge of how to do these efficiently, improving quality for future clients. So there is a Learning Effect Moat: every project Toloka completes can feed into better tools and reputation for the next. The risk is that large AI labs sometimes prefer to develop internal data tools or use multiple vendors to avoid reliance on one. Nebius will need to keep Toloka’s quality and speed high to remain indispensable. Right now, Toloka’s momentum (140% growth) indicates it is doing something right.

TripleTen & Talent Pipeline: TripleTen’s network effect is more indirect. More students graduating from TripleTen could eventually join the AI industry, including as employees or users of Nebius’s platform – a long-term ecosystem feeder. In the nearer term, TripleTen’s partnerships (like with financing providers and employers) can extend Nebius’s network into academia and enterprise L&D (learning & development).

While TripleTen alone doesn’t create a moat for Nebius (since education doesn’t strongly tie to cloud services), it does enhance Nebius’s brand in the AI community. If Nebius becomes known for not only providing infrastructure but also training people (imagine sponsoring hackathons or AI courses), it can cultivate loyalty and mindshare. This is more of a strategic synergy than a direct network effect, but it contributes to the platform narrative. Nebius is involved in all stages, from learning AI to building AI to scaling AI.

Avride & Cross-Pollination: Avride, the AV platform, could potentially leverage Nebius’s cloud and data capabilities (autonomous driving requires enormous training data and simulation, which can be done on Nebius Cloud and annotated via Toloka). If Avride achieves breakthroughs, Nebius might gain valuable IP or a flagship use-case for its cloud (e.g., “our cloud enabled X million miles of AV simulation”). However, until Avride has something concrete, it’s more of an R&D project. One could view Avride’s team as an internal heavy user of Nebius’s infrastructure – their feedback can improve the platform for external customers, too. In that sense, Nebius is eating its own cooking, which can be beneficial in refining the product.

Nebius’s AI Fortress: Strengthening Its Moat Through Full-Stack Integration and Network Effects

Platform Dominance & Moat Outlook: For Nebius to achieve platform dominance, it needs to entrench itself across the AI value chain so that customers use multiple Nebius services by default.

A hypothetical scenario: an AI startup

- Uses TripleTen to hire trained talent,

- Uses Toloka to prep data,

- Trains models on Nebius Cloud, and possibly even

- Leverages Nebius’s AV expertise if relevant (for robotics).

This depth and breadth would make Nebius hard to displace.

While ambitious, Nebius’s integrated approach is a differentiator against pure-play competitors who might only do cloud or only data. It’s essentially trying to create a mini-ecosystem akin to what a large tech company would have, but under one roof as a focused AI specialist.

If successful, network effects would manifest as high customer retention and cross-sell. We will want to see metrics like net revenue retention (NRR) above 120% (meaning existing customers expand usage), or multiple product adoption (clients using both Nebius Cloud and Toloka, for instance). Such data, if disclosed in future, would validate a growing moat.

At present, Nebius’s moat is emerging but NOT established. Its proprietary tech (e.g., custom cloud orchestration for AI) and exclusive access to certain hardware (through Nvidia partnership) give it a head start. But over a 2–3 year horizon, others will acquire similar hardware and could develop similar platforms. Therefore, Nebius’s moat will depend on the execution of network effects, which will turn early adopters into a self-reinforcing community. It appears management is aware of this: Arkady Volozh’s statements emphasize the combination of expertise and “our engineers… deep expertise” as a key asset.

This hints that Nebius might foster a culture of innovation that itself is a moat (hard to replicate talent clusters). Also, being the first major European-focused AI infra provider gives Nebius a chance to lock in partnerships (with universities, governments, enterprises) before U.S. rivals pay attention to that segment. If Nebius can achieve a critical mass in Europe, that regional stronghold can be defensible.

Nebius’ Defining Years (2-3 yrs): Reaching Escape Velocity or Falling into Obscurity

Despite the moat-building efforts, Nebius must remain vigilant about what could disrupt its plans. The primary vulnerability is if a superior technology emerges. For example, if a new startup offers a more user-friendly AI cloud or significantly lower cost through some innovation (say, leveraging idle GPUs globally in a decentralized way), Nebius could lose its edge.

Another vulnerability is if network effects invert – meaning if Nebius fails to scale clients quickly, it could actually be at a disadvantage (smaller community, less data to learn from, etc.). This is the classic platform risk: grow fast or risk irrelevance. There’s also a human capital network effect: the best AI researchers and developers tend to gravitate to platforms where they see the most action.

Nebius needs to cultivate thought leadership (perhaps via open-source contributions or high-profile AI projects on its platform) to attract talent and users. If it cannot crack into the consciousness of the global AI developer community, it may remain a second-tier platform with mostly regional or niche usage. Given Arkady Volozh’s experience in scaling Yandex against Google in Russia, he knows about carving a niche in the presence of giants – that experience is a plus for Nebius’s strategy.

In conclusion, Nebius has all the ingredients to create a robust platform with network effects (integrated services, strong tech talent, strategic backing). It is not there yet, but the next 2–3 years will likely determine if Nebius can achieve “escape velocity” and become a self-sustaining ecosystem. If it does, the investment upside could be exponential due to the winner-takes-most dynamic in platform markets. If it falls short, it might end up as a capital-intensive niche provider. This dovetails directly into our multibagger analysis next.

3. Competitive Position: Challenging Hyperscalers in the AI Cloud Race

Nebius’s investment thesis must be weighed against the broader industry landscape. The company sits at the intersection of several sectors – cloud infrastructure, AI/ML services, data labeling, and edtech – each with its own competitive dynamics. Here we benchmark Nebius in each area, using peer data and disclosures to gauge its relative position:

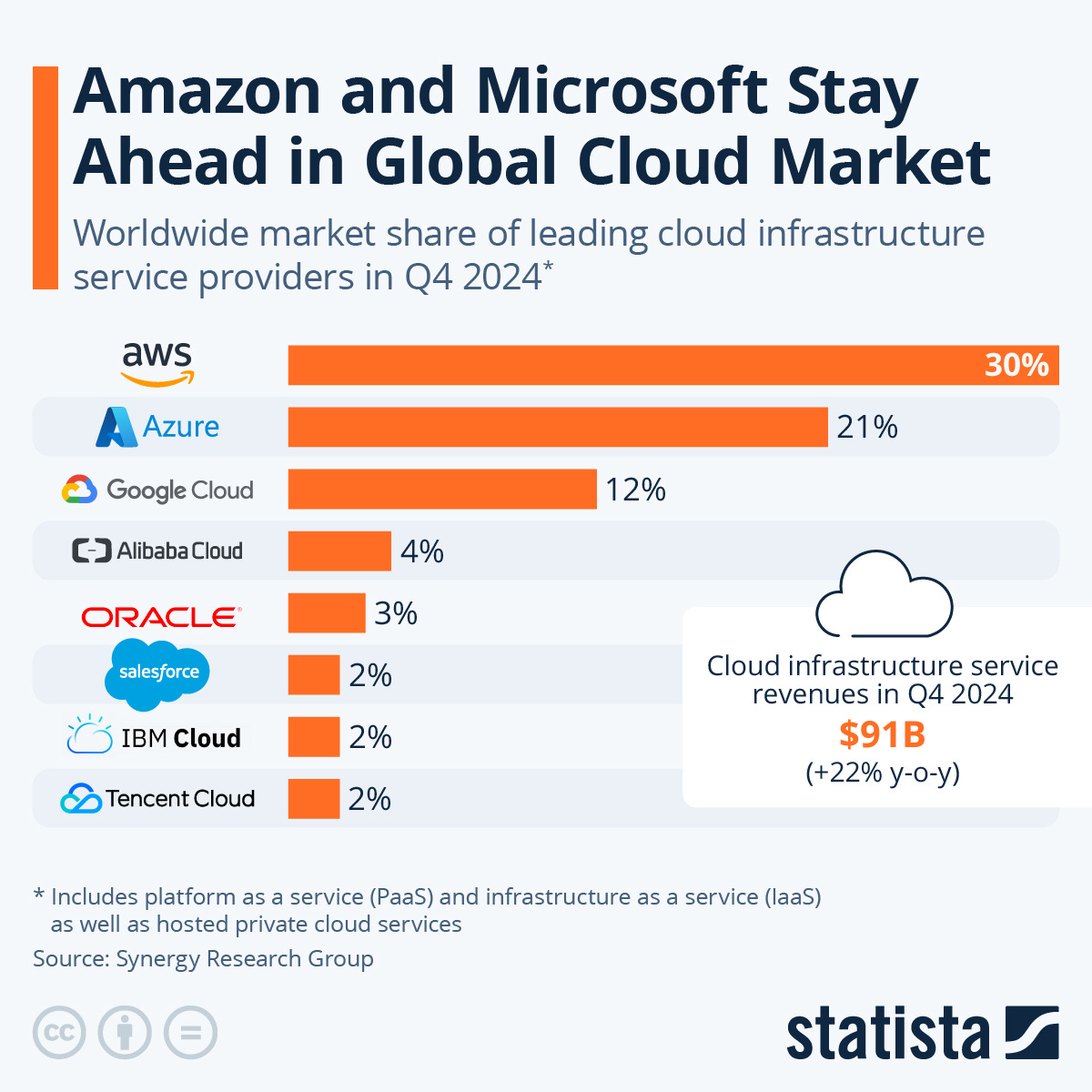

AI Cloud Infrastructure: This is Nebius’s core business and the key to its multi-year growth. The industry is currently dominated by hyperscalers (Amazon AWS, Microsoft Azure, Google Cloud) which together hold ~63% of the cloud market.

However, 2023–24 saw an unprecedented surge in demand for AI-specific computing (particularly GPU clusters for training large language models). Even the giants struggled to meet demand – Microsoft noted that AI infrastructure capacity constraints were tempering Azure’s growth rates.

This supply-demand imbalance created an opening for specialized players. CoreWeaveis a prime example: a startup focused purely on renting GPU compute, CoreWeave expanded from 3 data centers to 14 in one year and secured over $2.3 billion in funding. Investors valued CoreWeave at a staggering $19–23 billion by late 2024 – despite it likely having <$200 M revenue at the time (estimates based on its scale).

Nebius’s approach is very similar: build massive GPU supercomputers and lease them to AI model developers. Nebius had 2 major GPU clusters online in 2024 (Finland and Paris) and announced a new U.S. cluster in Kansas City for early 2025. By end-2024, Nebius’s deployed NVIDIA Hopper/H200 GPU base had nearly doubled QoQ, and planned deployments (22k next-gen GPUs) could make it one of the larger GPU cloud operators in Europe.

Compared to peers, Nebius is punching above its weight in tech but still behind in market traction. Its GPU infrastructure plans are ambitious – on par with CoreWeave’s in scale – and being an independent pure-play can attract customers who want alternatives to AWS/Azure (which have their own AI offerings but also competing priorities).

Furthermore, Nebius’s close partnership with Nvidia (which also invested in CoreWeave) suggests it will have access to the latest GPUs, a critical advantage given the global shortage. Where Nebius lags is in enterprise customer reach: AWS and Azure have entrenched enterprise relationships, and CoreWeave has already landed marquee AI customers (reports suggest OpenAI, Microsoft, and others are tapping CoreWeave’s capacity).

Nebius is just now building its sales pipeline. Encouragingly, in Q4 it reported adding “several prominent names in the AI industry” as clients, and signed multi-million contracts boosting its ARR. But winning trust outside of Europe will take time.

As a benchmark, Azure’s AI run-rate hit $13 billion in 2024. Nebius’ targeted $0.75–1 billion ARR by end-2025 is still tiny relative to the giants, but high growth could narrow the gap. In short, Nvidia’s AI cloud unit is riding a strong industry wave (Nvidia’s data center GPU revenue more than doubled in 2023, reflecting booming demand) and is competitively positioned on technology. Its challenges will be scaling customer acquisition to approach the utilization levels of peers, and potentially facing price competition down the line as supply catches up.

Industry benchmarks suggest gross margins for cloud GPU services can be healthy (~60% range) if utilization is high, but Nebius will likely run at low utilization initially, depressing margins. By contrast, hyperscalers subsidize AI services with other profits; Nebius must achieve efficient scale on its own. This makes its progress in the next 12–18 months critical – it needs to attain platform-like adoption in the AI community (e.g. be the go-to cloud for certain AI workloads) before competitors replicate its offerings or cut prices.

Toloka’s AI Data Play: Capturing Market Share as Legacy Rivals Struggle

AI Data Labeling (Toloka) and Services: Nebius’s Toloka division operates in the AI data annotation market – a field that has seen upheaval. The leader, Appen (Australia), went from a $4 billion market cap darling to under $200 million as its revenues shrank and it failed to pivot to generative AI quickly.

Appen’s revenue fell 13% in 2022 and another 24% in H1 2023, amid reduced spending by big customers and challenges in quality control. This industry turmoil presents an opportunity for Toloka, which appears to be capitalizing: growing 140% in 2024 and onboarding top AI labs as clients. Toloka’s strategy to provide specialized data for GenAI (such as model “red-teaming”, AI reasoning evaluation, etc.) aligns with current needs of AI developers.

In effect, while Appen struggled to acquire the niche data types needed for GenAI and suffered from a disjointed organization, Toloka (as a more tech-driven, agile team spun out of Yandex) has quickly refocused on these high-value areas. Competitors in this space also include Scale AI (US-based, private) and CloudFactory, among others.

Many are private so financials are opaque, but anecdotal evidence suggests the entire annotation industry went through a trough in 2022–2023 and is now seeing renewed demand from generative AI projects. Nebius’s qualitative disclosures back this up: Toloka added several of the world’s largest model producers to its portfolio in Q4, implying it might be serving well-known AI firms (perhaps OpenAI, Anthropic, or big tech AI labs).

If so, those are prestigious clients that could lead to follow-on business. The competitive benchmark here is quality and speed: whoever can deliver high-quality training data faster wins. Toloka’s Yandex heritage in crowdsourcing (Yandex launched Toloka years ago as an in-house crowd platform) is a strength – it has an existing global crowd workforce and custom tools. We will monitor if Toloka can continue its triple-digit growth; if it does, Nebius may have a quiet gem within its portfolio.

Financially, data labeling can have decent margins (Appen historically had ~35% EBITDA margins in good years), but scaling requires managing a distributed workforce and ensuring data security. Nebius should be benchmarked on how Toloka performs relative to peers like Appen: for instance, if Appen’s 2024 annual report (expected in Mar 2025) shows continued decline or slow growth, and Toloka is growing 100%+, Nebius would clearly be gaining share.

TripleTen’s Rapid Growth: Defying EdTech Slowdown with Aggressive Market Expansion

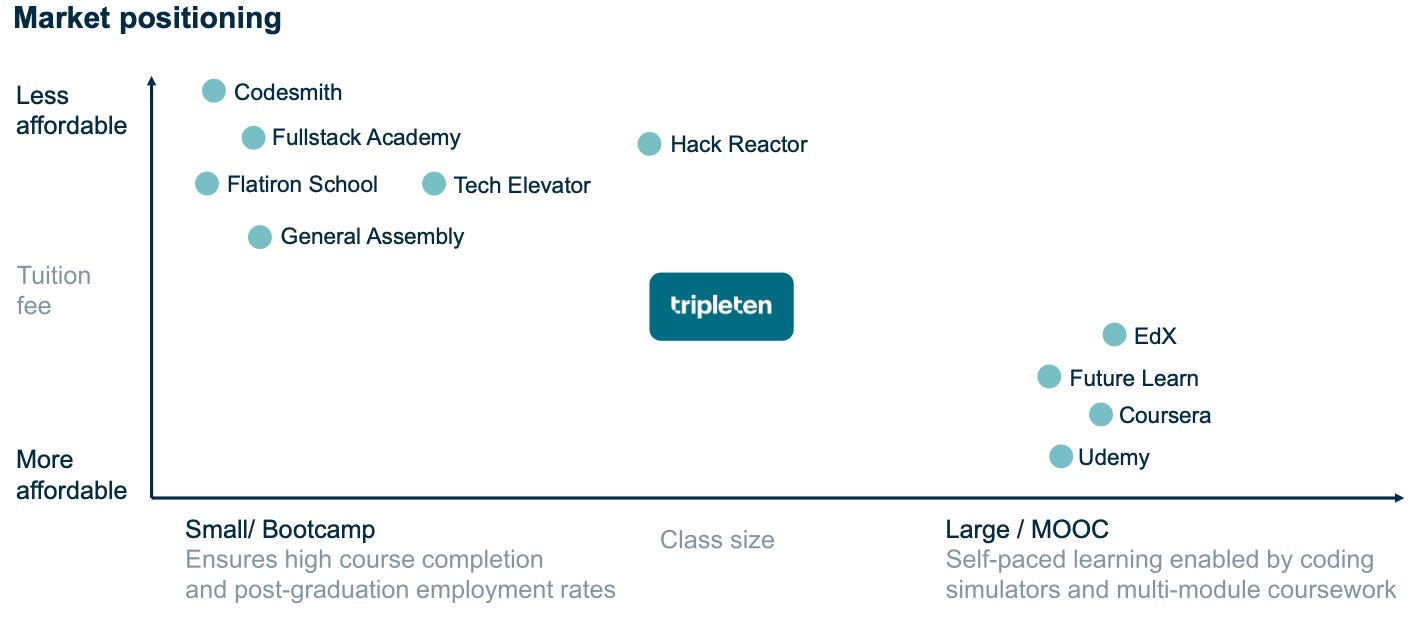

Education (TripleTen): TripleTen is an online coding bootcamp and tech education service (formerly “Yandex Practicum”). The edtech bootcamp industry in the West has many players (e.g., Coursera, Udacity, General Assembly, etc.), and growth has moderated as the market matured. However, TripleTen claims to be a leading tech reskilling player in the U.S. and certain markets.

Its 149% YoY increase in new student enrollments in 2024 is impressive, suggesting it is outpacing many peers. A possible benchmark: Coursera’s registered user count grew ~21% in 2023, and revenue grew ~26% (Coursera is broader MOOC, not bootcamp). TripleTen’s doubling of students implies it is either successfully expanding in geographies or taking share with an affordable offering (they highlight having “one of the most affordable” tuitions and new financing options for students).

While TripleTen contributes some revenue, it is likely a single-digit percentage of Nebius’s total. Its strategic value is more about ecosystem: it creates a talent pipeline and echoes Nebius’s mission (training AI-era workforce). In benchmarking, we see TripleTen’s growth as solid, but this segment is less critical to Nebius’s valuation than AI cloud or data. Still, it’s notable that while many edtech firms struggled post-pandemic, TripleTen grew – possibly leveraging Yandex’s content and quick pivot to U.S. markets. We will watch if TripleTen can maintain ~100% growth; if so, it could eventually be a spin-off candidate or a steady revenue contributor with decent margins (bootcamps often operate at ~20-30% gross margins after instructor costs).

Avride’s High-Stakes Bet: A Costly Moonshot or a Future AI Goldmine?

Autonomous Vehicles (Avride): Avride is essentially Nebius’s moonshot bet – a team developing self-driving car and delivery robot technology. This pits Nebius against giants like Waymo (Alphabet), Cruise (GM), Amazon’s Zoox, and a host of startups. The AV industry has seen consolidation and setbacks (for instance, Ford and VW-backed Argo AI shut down in 2022). Nebius’s Avride inherits Yandex’s AV program, which was quite advanced – Yandex had operated robotaxis and delivery rovers in controlled environments.

The benchmark here is technological: Yandex’s AV team was considered among the more experienced globally, and keeping this team could have long-term payoff if Nebius finds partners or markets for its AV tech. However, in the near term, Avride is likely consuming R&D funds with NO revenue. Most peers are either in similar R&D stage or have been absorbed into larger entities. We consider Avride a call option in Nebius’s portfolio – potentially valuable if its technology can be commercialized or sold (for example, selling the tech to an automaker), but also a source of ongoing expense.

Competitor disclosures (e.g., Waymo reports) indicate that the true commercialization of robotaxis at scale is still years away. Thus, Avride’s presence slightly elevates Nebius’s risk profile, as it’s another capital sink. The company will need to balance investment here versus the core business; one mitigating factor is that Nebius could leverage its own cloud to train AV algorithms (synergy) and perhaps use Toloka for labeling driving data. Unless Avride shows a clear path to market (like a pilot city deployment or external funding), investors might prefer Nebius to minimize spend on it.

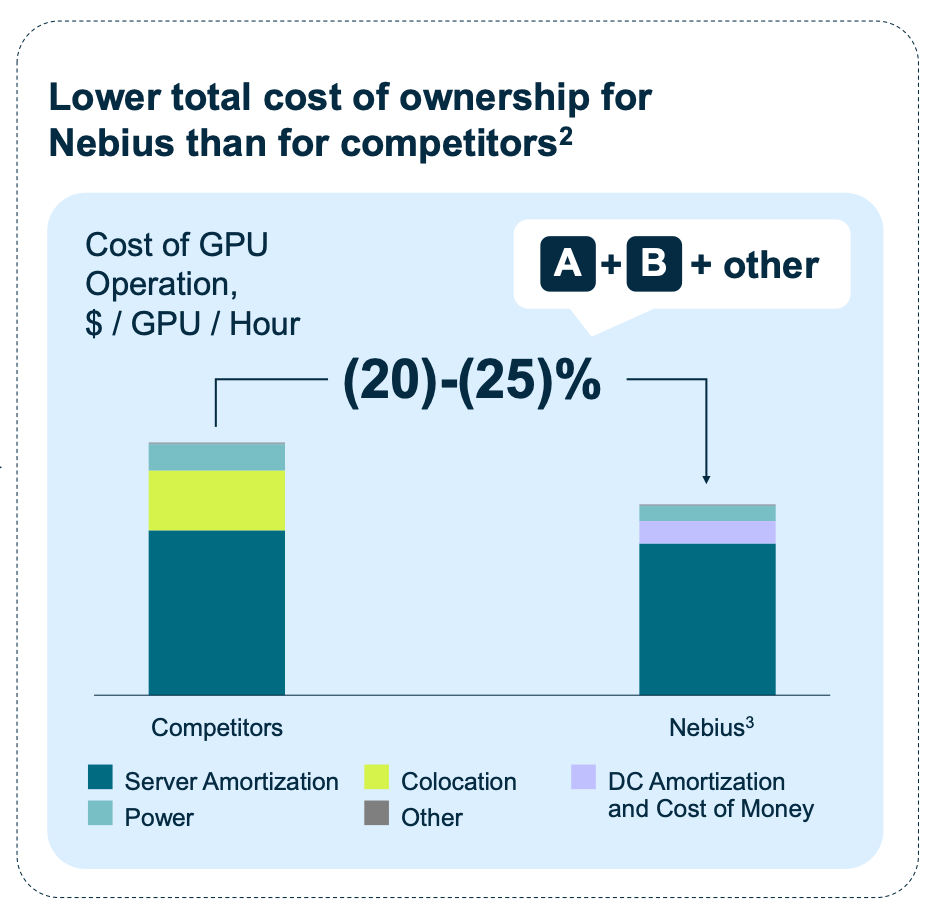

Cost Advantage: Disrupting AI Cloud Computing with 25% Lower GPU Costs

Nebius Group holds a cost leadership advantage in the AI cloud infrastructure market, offering 20-25% lower total cost of ownership (TCO) per GPU-hour than competitors. This efficiency stems from optimized server amortization, reduced colocation costs, and efficient data center management, allowing Nebius to allocate capital more effectively.

Unlike hyperscalers and specialized AI cloud providers that rely heavily on third-party colocation services, Nebius integrates both owned and collocation data center capacity, leading to lower power and infrastructure expenses. Competitors, by contrast, face higher operating costs due to greater colocation dependency, increased power consumption, and heavier amortization burdens, making their GPU services more expensive.

This cost advantage positions Nebius as a strong challenger to industry giants like AWS, Google Cloud, and CoreWeave, particularly for AI startups and cost-conscious enterprises seeking high-performance cloud computing without premium pricing. By offering affordable yet powerful AI-optimized cloud services, Nebius can attract market share in the rapidly growing GPU-as-a-Service sector, appealing to businesses scaling machine learning workloads efficiently.

4. Financial Performance: Growth vs. Sustainability

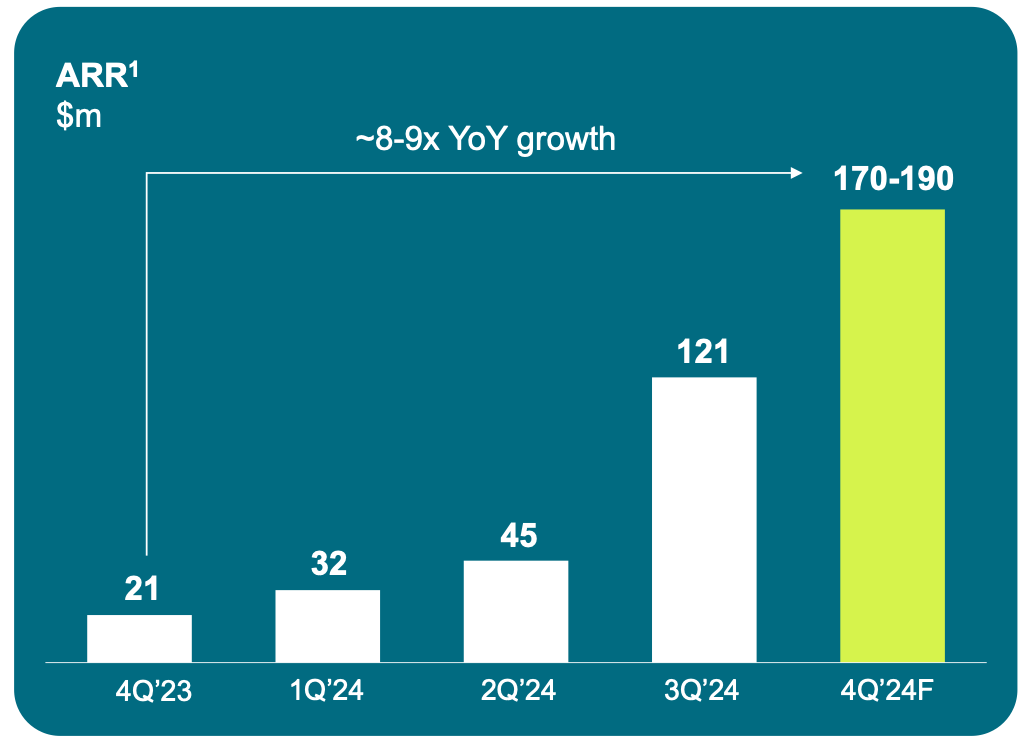

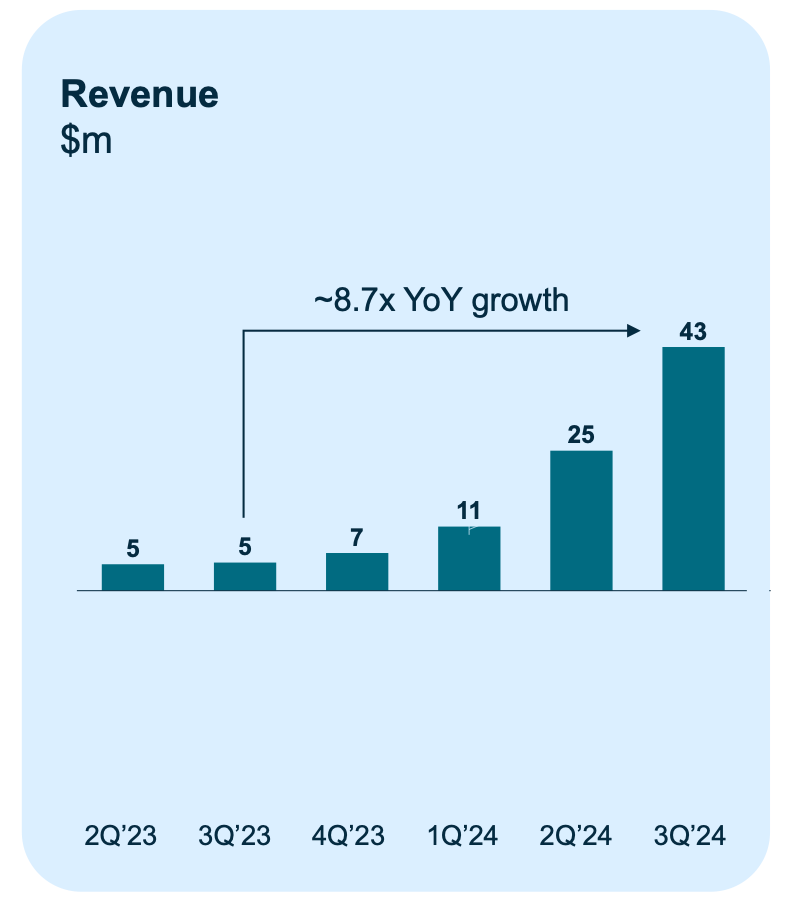

Nebius Group has demonstrated explosive revenue growth, achieving an 8.7X year-over-year (YoY) increase, with revenue surging from $5 million in 2Q’23 to $43 million in 3Q’24. This rapid expansion is fueled by its AI-centric cloud infrastructure, which continues to gain traction among enterprises and developers requiring high-performance computing.

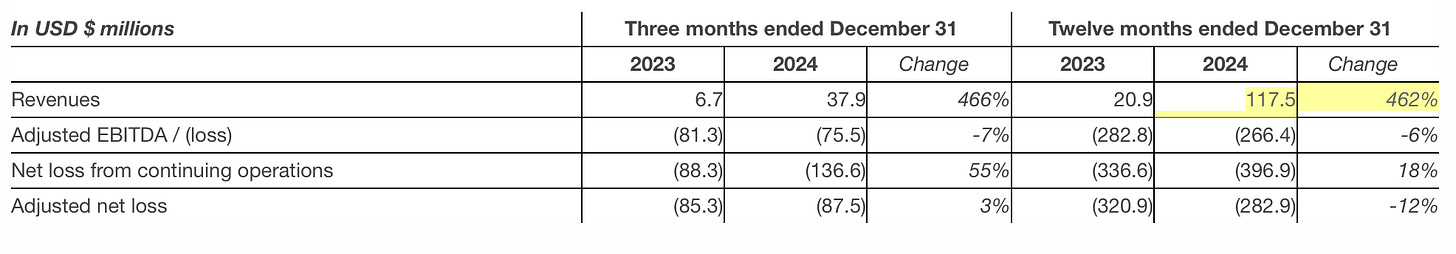

Full-year 2024 revenue was $117.5 million, up 462% from 2023. The growth accelerated in late 2024: Q4 revenue alone grew +466% YoY to $37.9 million, implying Q4 2023 was only ~$6.7 million. Such growth far outpaces typical industry rates and signals a startup-like ramp.

A closer look reveals two drivers:

- AI Cloud (Nebius.AI)– which in Q4 contributed over half of Nebius Group’s revenue and

- AI services (Toloka). The core cloud business grew 602% YoY in Q4

As Nebius rapidly onboarded AI-heavy customers (e.g. AI model developers, ML tool providers) and expanded compute capacity. Toloka, meanwhile, benefited from surging demand for generative AI training data, achieving +140 % YoY revenue growth in 2024 by signing several of the world’s largest foundation model labs as clients. In effect, Nebius’s top-line is being propelled by the secular boom in AI model development across industries.

However, not all segments contribute equally. TripleTen (edtech) is growing but off a modest base: it doubled student enrollments in Q4 2024 (adding 4,000 new students, +100% YoY), which drove revenue growth, yet its absolute revenue is likely much smaller than cloud or Toloka.

Avride (autonomous vehicles) remains in R&D mode with negligible revenue. The sharp overall revenue increase, therefore, masks a concentration in the core AI cloud segment– a positive in that Nebius is focusing on its highest potential business, but a risk if that nascent AI cloud market slows. One anomaly is the growth rate disparity: Nebius’s consolidated growth (+462%) far exceeds even high-growth peers (for context, global cloud infrastructure grew ~20–30% in 2024). This reflects the company’s stage (scaling from near-zero after carve-out) rather than a sustainable long-term rate.

Nebius Delivers Hyper-Growth, But Massive Cash Burn Raises Sustainability Questions

We cross-verified management’s growth narrative with segment disclosures and find them consistent: management stated Nebius.AI was the primary engine in Q4, which is supported by the >50% revenue share and 602% growth figure. Toloka’s pivot to GenAI data was emphasized qualitatively and is backed by its triple-digit growth metric.

In sum, no red flags emerge in revenue recognition– the extreme growth appears real (customer count and usage are climbing sharply), albeit from a tiny prior base. Investors should expect growth rates to normalize as the revenue base expands, but Nebius’s guidance suggests another year of hyper-growth ahead (more on that in the outlook).

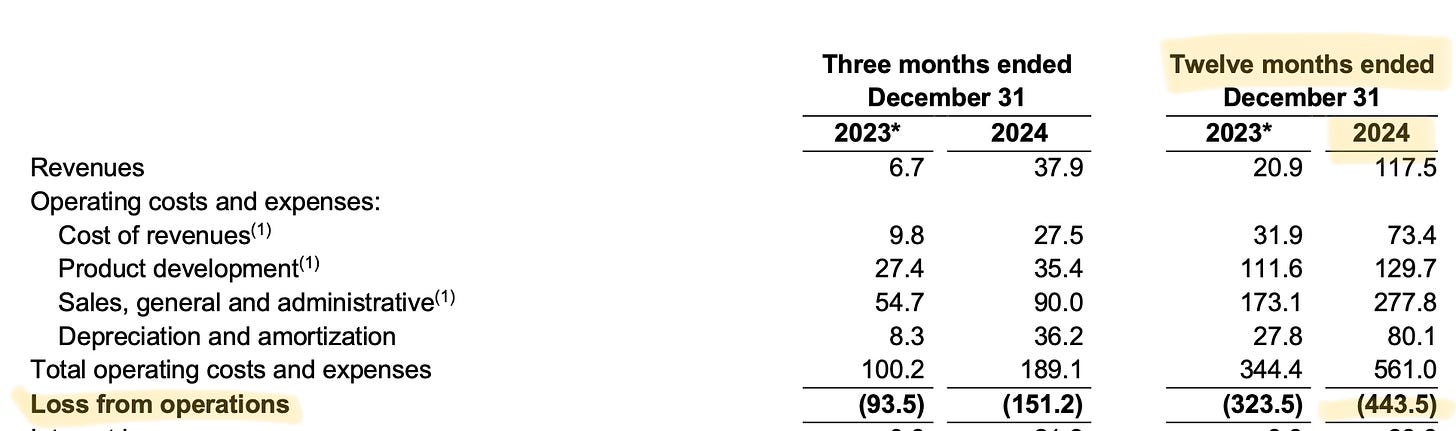

Unsurprisingly for a company building “the railways of the AI revolution”, Nebius is deeply in investment mode and unprofitable. For 2024, operating losses ballooned– GAAP operating loss was roughly –$443 million (computed as –$396.9 million net from continuing ops plus net interest/other benefits) and Adjusted EBITDA was –$266.4 million.

The wide gap between EBITDA and operating loss is largely due to substantial stock-based compensation and one-off expenses that Nebius excludes in its adjusted metrics. We note one accounting nuance: because Nebius paid out some legacy Yandex RSUs in cash, it left those expenses in Adjusted EBITDA (i.e. did not add them back), making Adjusted EBITDA a bit more conservative (lower) than if all SBC were excluded. Even so, adjusted losses are huge – Nebius’s Adjusted EBITDA margin was approximately –227% for 2024, an extreme figure even compared to other cloud startups.

Management also provides “Adjusted net loss” (excluding discontinued operations and certain remeasurement items); this was –$85.3 million in Q4, versus a GAAP net loss of –$136.6 million for continuing ops in Q4. The adjustments primarily strip out a ~$51 million loss related to discontinued Russian operations or currency effects, so that adjusted net more closely reflects the ongoing businesses. These adjustments appear reasonable, and we found no evidence of aggressive accounting to mask losses. Nebius is quite transparent in that it is burning cash to pursue growth.

On the cash flow side, the numbers underscore the investment intensity. Nebius’s cash flow from operations (CFO) was –$319.6 million in 2024, roughly matching its EBITDA deficit once working capital changes are included. Capital expenditures were $808.1 million for 2024 – a massive outlay on data centers, GPU hardware, and platform development. This CapEx is nearly 7X ($812/$117) the year’s revenue, an abnormally high ratio indicating that Nebius is front-loading infrastructure build-out well ahead of current demand.

Such an imbalance is a classic red flag in mature companies, but in this context it aligns with the company’s strategy (to capture future demand, Nebius must invest heavily now). Management’s commentary validates this: they nearly doubled their deployed base of NVIDIA high-end GPUs in Q4 alone and announced plans to deploy 22,000 next-gen NVIDIA Blackwell GPUs in 2025 – a CapEx-heavy gambit to ensure they have capacity when customers come.

The critical question for investors is cash burn sustainability. Free cash flow (CFO + CapEx) was approximately –$1.13 billion in 2024, far exceeding Nebius’s revenue. However, the company raised $700 million in December and ended 2024 with $2.45 billion in cash. That war chest, largely a result of the Yandex sale proceeds, gives Nebius roughly 2–3 years of runway at the current burn rate. We also note Nebius earns material interest on this cash (helping reduce net loss by ~$47 million in 2024, inferred from the gap between operating and net loss), which partially offsets operating burn.

A look for anomalies in cash flow or expenses doesn’t reveal major concerns, but does highlight areas to watch. One is capitalization of expenses: Nebius is likely capitalizing some R&D or software development costs as part of CapEx (e.g., building its “AI-native cloud platform” from scratch). If too much cost is capitalized, EBITDA would be flattered. We will scrutinize this in future filings, but given the huge losses, it’s clear Nebius is expensing most growth costs through the P&L.

Another area is related-party or one-time charges: the separation from Yandex might have involved fees or indemnities, but none are flagged in the earnings release. The clean break suggests no ongoing cash leakage back to Russia (reinforced by statements that all ties are cut).

Overall, the financial picture is one of high growth, high burn, and heavy investment – consistent with management’s narrative. The key anomaly – spending nearly $1 on CapEx for every $0.15 of revenue – is a deliberate strategic choice. This puts Nebius in a race against time: it must translate CapEx into revenue growth before the cash runs low.

5. Risk Assessment: The Biggest Hurdles Nebius Must Overcome

On the other hand, competitive risks are significant:

- Nebius faces extremely well-capitalized opponents in cloud, must keep up with rapid tech cycles in AI (if, say, new AI chip architectures or software paradigms emerge, Nebius must adapt quickly), and has to overcome any residual perception issues from its Yandex lineage when dealing with global customers.

- Cash Burn & Execution Risk: The foremost risk is cash flow sustainability. With no guarantee of positive cash flow for several years, Nebius relies on its cash reserves to fund operations. As noted, 2024 free cash outflow was over $1.1 billion.

- If Nebius’s revenue ramp falls short (for example, if it achieves only a fraction of the forecast ARR by 2025), the company could face a cash crunch or need to raise additional capital in a less favorable market.

- The December 2024 raise was done when the AI hype was strong and Nebius could showcase some initial traction – future financing might not be as “oversubscribed” if results disappoint. This makes execution on sales and product delivery absolutely critical in 2025. The encouraging news is Nebius already has $220 million ARR effectively contracted by Q1 2025, so we expect quarterly revenues to start reflecting a steep upward trajectory in 2025.

- However, closing the remaining gap to reach $750M+ ARR by year-end will require landing big customers and usage commitments. Any delays in the new data centers coming online (e.g., if supply of NVIDIA GPUs or facility build-outs are slower than planned) could bottleneck revenue – a risk management explicitly flagged by striving to secure Blackwell GPUs early.

- There’s also operational risk in integrating new capacity: Nebius is simultaneously launching new hardware sites across continents and migrating customers to new software platforms.

- The complexity of scaling both the physical infrastructure and the software stack could lead to service reliability issues if not well-managed, which in turn could hurt reputation in this trust-driven business (enterprise clients demand high uptime).

- So far, Nebius appears to have managed transitions well (they migrated all customers to the new AI cloud platform by the end of 2024 without reported disruption). Still, investors should monitor uptime and customer satisfaction indicators(perhaps gleaned from testimonials or any public outages) as the client base grows.

- Competitive & Market Risks: On the competitive front, a major risk is if big cloud providers aggressively target Nebius’s niche.

- For example, Amazon, Microsoft, and Google all offer AI-focused cloud instances and are developing proprietary AI chips (AWS has Trainium/Inferentia, Google has TPUs).

- If these prove as effective as NVIDIA GPUs for common workloads and are cheaper, Nebius could face pricing pressure or loss of differentiation. Thus far, Nvidia’s ecosystem remains dominant for cutting-edge models, so Nebius is safe riding that wave.

- But over a 2–3 year horizon, we can’t rule out a competitive response – e.g., hyperscalers bundling AI compute at steep discounts for large clients, undercutting specialized providers.

- Market conditions in tech could also change: the current “AI boom” sentimentmight cool if, say, corporate AI projects don’t yield ROI as quickly as hoped.

- There’s already a hint of this in the data labeling space, where Appen’s woes came partly from big tech cutting spending on experimental projects. If AI investment enters a digestion phase, Nebius’s growth could slow at a time when it needs to justify its cost base.

- On balance, however, the next few years look favorable for AI infrastructure demand, given the broad adoption of AI features across software and the compute-intensive nature of new models.

- Another market risk is regulation: Europe is working on AI regulations (e.g., the EU AI Act) that could impose requirements on AI service providers.

- As a European company, Nebius might have to comply with these earlier or more stringently than U.S. rivals. This could mean additional costs for model transparency, data handling, etc., but could also be an opportunity if Nebius becomes a trusted, compliant provider for regulated industries.

- Geopolitical and Governance Risks: While Nebius has severed Russian ties, geopolitical factors still loom indirectly.

- For instance, U.S.–China tech tensions affect AI chip availability; if export controls tighten on advanced GPUs, Nebius (as a Netherlands company) could theoretically be caught between policies. That seems unlikely since Nvidia is allowed to sell to Western entities, but any global shock affecting Nvidia’s supply chain would hit Nebius.

- On governance, Nebius retains Yandex’s dual-class share structure (likely, since Arkady Volozh and insiders had Class B shares). After the deal, 199 million shares were outstanding, and Arkady likely holds significant voting power.

- Minority shareholders (public investors) should be aware that control is concentrated – which can be positive (strong founder leadership) but also a risk if decisions favor insiders. We take comfort in the fact that Nebius is incorporated in the Netherlands with a board chaired by an independent (John Boynton), and thus far, transparency has been good (regular 6-K filings, shareholder letters).

- Still, the legacy of Yandex’s complex situation means investors should keep an eye on governance – e.g., executive compensation, related-party dealings (none evident so far), and strategy shifts.

- A risk of distraction also exists: Nebius is effectively managing four businesses.

- If one of the smaller divisions (like Avride) demanded significantly more capital or if any unit underperforms, management bandwidth could be strained.

- The flip side is an opportunity in portfolio diversification: Nebius could choose to monetize a non-core unit(for instance, spinning off or selling a stake in TripleTen or Avride to raise cash and streamline focus on AI cloud). Such moves could unlock value if needed.

- Technology and Disruption Risks: In the fast-moving AI field, there’s a risk of technological disruption.

- Nebius is betting on centralized large-scale compute clusters (essentially cloud supercomputers). If technology trends shift toward more efficient or decentralized computing – for example, significant breakthroughs in model efficiency that reduce the need for massive GPUs, or a move to edge AI that processes more on local devices – then demand for Nebius’s core offering might taper.

Currently, all signs (larger models, multimodal AI, etc.) point toward more need for big iron, not less. However, investors should watch for research trends like model compression, federated learning, or new chip architectures (quantum computing down the road) as long-term disruptors.

Another angle is network effects and platform stickiness. Nebius is trying to build a platform ecosystem (they launched Nebius AI Studio for easier model deployment, serverless compute with Tracto, etc.). If it succeeds, customers will integrate Nebius deeply into their AI workflows, which is a defensive moat.

However, if Nebius fails to differentiate its platform and it becomes a commodity GPU rental service, then customers could switch out easily if a cheaper or better option appears. The risk of being commoditized is real in cloud services – it’s mitigated in Nebius’s case by the current supply shortage and Nebius’s focus on AI specialization (performance optimizations for AI jobs). However, over a 2–3 year horizon, as more capacity comes online industry-wide, pricing competition may increase. Nebius will need to cultivate features (software, support, integrated data services) that make it more than just a raw compute provider.

Finally, Macroeconomic factors can’t be ignored. High interest rates can increase the discount rate for growth stocks like Nebius, pressuring its valuation regardless of execution. Moreover, Nebius’s $700 million raise in 2024 was equity; if it ever seeks debt financing, rates are much higher now than a few years ago, making borrowing expensive (though Nebius is currently debt-free).

6. Valuation Analysis: How Big Can Nebius Get?

Valuing Nebius is challenging due to its short financial history and lack of profitability. We employ multiple approaches – peer multiples, discounted cash flow (DCF), and scenario analysis – to triangulate Nebius’s long-term value and assess the potential for multi-bagger returns.

Peer Comparables: Traditional peers (large cloud companies) aren’t directly comparable, but we can look at high-growth infrastructure and AI companies. As of early 2025, Nebius’s market capitalization is around $6.6–7.6 billion and enterprise value (EV) about $ 4.3 billion (net of cash). This implies a trailing EV/Revenue multiple of roughly 36X (using 2024 revenue $117.5M).

If we use Nebius’s own guidance for ARR by end of 2025 ($750M–$1B), and assume it can reach actual recognized revenue of ~$600–700M in 2025 (midpoint scenario), theforward EV/Revenue would be ~6–7X. That would be quite reasonable in the context of cloud infrastructure peers:

For example, Oracle’s cloud and AI unit (a mature business) grew ~50% in 2024 and Oracle’s stock trades at ~9X forward sales; a high-growth mid-cap like MongoDB (database for AI apps) trades ~6X forward sales on ~30% growth. If Nebius executes well, a 6–7X forward multiple is a bargain given its growth rate. We also consider private market comps: as noted, CoreWeave at ~$19–23B valuation for an estimated ~$200M revenue run-rate implies an EV/Sales north of 95X, reflecting immense growth expectations.

Therefore, Nebius’s current ~36X trailing multiple appears modest – though it must be noted CoreWeave’s valuation came at the peak of AI frenzy. Another peer point is the AI data labeling space: Appen now trades at ~0.5X revenue (due to its decline), whereas private upstarts might fetch 5–10X revenue in acquisitions if growing.

Toloka’s strong growth could command a premium multiple on its own if carved out. These comps suggest that public market investors are giving Nebius some credit for its cash and assets, but not yet fully pricing in its growth potential– likely a reflection of “wait and see” until the company proves its targets are attainable.

Discounted Cash Flow (DCF) Perspective:

A DCF for Nebius must incorporate a period of heavy losses and then eventual profitability. We outline a rough scenario: suppose Nebius ramps revenues to $1 billion by 2026 (a CAGR of ~115% from 2024) and then growth moderates to 50% in 2027, 30% in 2028, and 20% by 2029–2030, reaching ~$2.5 billion revenue by 2030. This trajectory assumes Nebius captures a meaningful share of the AI cloud/services market.

For margins, in an optimistic case Nebius could achieve 20% EBITDA margins by 2028 (as it gains scale and utilization), and perhaps 30% by 2030 (comparable to mature cloud providers like AWS which have ~30% operating margins, although AWS has higher scale). Free cash flow would lag EBITDA initially due to ongoing CapEx needs, but we assume CapEx moderates to ~20% of revenue by 2030 (still investing but not as crazily as now).

Using a discount rate of 12% (to reflect high risk) and a terminal growth of 4%, the DCF under these assumptions could justify an equity value well above $10 billion – indeed, in our rough model the implied value was on the order of $12–15 billion (which would be a 2X or more from current market cap).

However, this DCF outcome is highly sensitive to execution. In a more conservative scenario, if Nebius only reaches ~$1 billion revenue by 2028 and margins remain in the single digits, the DCF could suggest a value at or below the current EV, meaning the stock would stagnate or worse.

Essentially, Nebius is a classic “j-curve” investment – significant value will emerge on the right side of the curve (years 3–5+) if growth and margin expansion materialize, but in the near term the company’s losses weigh on conventional valuation metrics.

Market Multiples & Investor Sentiment

Another lens is to consider what kind of exit multiples or acquisition value Nebius could fetch if it succeeds. The AI infrastructure space is strategic – large tech firms might eventually acquire specialized players to bolster their offerings. If Nebius proves its model, one could imagine interest from companies like Cisco, Dell, or even NVIDIA (though Nvidia tends to partner rather than buy service providers, to avoid competing with its customers).

A strategic acquirer might value Nebius not on current earnings, but on strategic value and replacing the need to build their own. CoreWeave’s rumored IPO plans targeting $35B+ show how exuberant valuations can get in this domain. For Nebius to be a true“multibagger” (2–3X return or more) in 2–3 years, it likely needs to demonstrate it can achieve $1B+ revenue by 2026 and a credible path to profitability. That could lead to a re-rating of the stock to tech mid-cap status. Notably, at least one independent analyst is bullish: BWS Financial recently raised its price target to $60 (up from $51), which is more than double the current ~$28 share price, citing strong growth momentum.

Such targets imply that as milestones are hit (quarterly ARR growth, etc.), investor confidence – and thus multiples – could increase. On the flip side, if Nebius stumbles, the stock could fall closer to its net cash value. With ~$10 per share in net cash (given $2.45B cash and ~236M shares, rough estimate), that might serve as a valuation floor in a downside scenario, barring extreme burn. Indeed, when trading resumed in Oct 2024, the stock languished near ~$14 (not far above cash per share), indicating skepticism. It wasn’t until Nebius demonstrated progress and raised capital that shares climbed ~100% by Jan 2025. This underscores that execution news flow will drive valuation swings.

In summary, our valuation analysis suggests that Nebius’s current market value bakes in some, but not excessive, optimism. The stock does not appear in a bubble relative to peers (especially given peer valuations like CoreWeave’s), yet it isn’t “cheap” by traditional metrics either. It’s a high-beta, high-upside equity. If Nebius even partially delivers on growth, upside could be substantial – for instance, at 8X EV/Sales on a potential $800M 2025 revenue, EV would be $6.4B (vs $4.3B now), plus the cash on hand, yielding perhaps a market cap of ~$9B (roughly +40%).

In a bull case of surpassing targets and getting a premium growth multiple, one can envision a double or triple from here. Conversely, downside risks might be mitigated by the cash cushion and breakup value of the pieces (if things went south, Nebius could conserve cash or sell a division – shareholders would still own a company with tangible assets and tech). That said, a severe miss on growth could compress the EV/Sales multiple drastically – market confidence is crucial.

Ultimately, Nebius’s valuation hinges on its evolution from an asset-rich story to a revenue-and-platform story. Given the early evidence of traction (Q4 client wins, cash raise validation) and the still enormous runway of AI demand, we lean toward a positive outlook on valuation, albeit with an understanding that volatility will be high. Portfolio managers should be prepared for wide valuation swings quarter to quarter, and thus position size accordingly, but the 2–3 year risk-reward skew appears favorable for those who believe in the AI infrastructure thesis.

7. Yiazou Alpha Score: 74% Multibagger Confidence

To quantify Nebius’s long-term upside, we construct the “Yiazou Alpha Score”reflecting the probability that Nebius could deliver multi-fold returns in 2–3 years. We factor in organizational strength, algorithm/technology resilience, network positioning, and disruption risk, as requested. Each factor is scored and weighted, yielding an overall confidence level:

- Organizational Strength (Score: 9/10) – Nebius inherits a strong leadership and engineering bench. Arkady Volozh is a proven entrepreneur (built Yandex into a multi-billion company) and is now laser-focused on Nebius.

- The team of 1,300 has shown resilience through the tumultuous separation process. Investor support from Nvidia and top VCs further bolsters credibility.

- The company’s governance under a Western framework and a seasoned board adds to execution reliability. This factor gives Nebius a high score: the human and financial capital in place greatly enhance its odds of success. Few early-stage companies have this combination of talent and funding – a key reason Nebius is more likely to be a multi-bagger than a typical startup.

- Algorithm/Technology Resilience (Score: 8/10) – Nebius’s core technology strategy is aligned with industry direction (GPU-accelerated computing, AI-tailored cloud software).

- By building on Nvidia’s platform and incorporating the latest GPUs, Nebius ensures it stays at the cutting edge of AI hardware. Its launch of proprietary tools like AI Studio and Tracto.ai shows it can develop value-added software atop raw infrastructure. The risk of technological obsolescence in the near term is low – there is no sign of the AI compute demand abating or shifting radically away from what Nebius offers.

- The company also appears adept at pivoting tech if needed (recall that two years prior, they pivoted businesses and built new systems post-Yandex). That agility is crucial if new AI techniques emerge. We dock a couple points only because the field is inherently uncertain (for instance, if a breakthrough in model efficiency cut compute needs by half, Nebius’s TAM might shrink). Overall, Nebius’s tech stack is robust and likely to adapt, supporting a strong chance of sustained growth.

- Network Positioning (Score: 7/10) – We evaluate how well Nebius is positioned in the network of industry relationships and customers.

- Positives: Nvidia partnership provides supply chain priority and co-marketing potential; having Accel and Orbis as investors could open doors to portfolio companies and enterprise clients. Nebius’s European identity positions it well with EU institutions and companies seeking non-U.S. partners. Also, early prominent clients in AI (though unnamed) indicate it’s gaining referenceability.

- Negatives: Nebius is still relatively unknown in the U.S. and Asia compared to big players. Its customer network is in infancy – it needs many more deployments to claim a broad network effect. Additionally, some large enterprises may hesitate to use a new provider until it has a longer track record (the classic “nobody got fired for buying AWS” problem).

- We give a solid score for the foundations laid, but Nebius must prove itself in building a loyal, expansive customer network. This factor is the make-or-break for multibagger outcomes: a rapid expansion of Nebius’s user network would multiply its valuation, whereas stagnation would cap it.

- Disruption Risk (Score: 5/10) – This score weighs potential negative disruptors. While Nebius is on trend now, it faces multiple axes of risk as discussed.

- There’s moderate risk from tech giants (they could bundle AI services or even cut off partnerships; e.g., if Nvidia ever had a conflict of interest, though unlikely). Market fickleness is another: AI hype cycles can swing. We assign a mid-level (neutral) risk score.

- It’s not excessively high because Nebius has hedged some risks (ample cash = lower financial risk, diversified business = some resilience if one area lags). But it’s not low either: as a single-product (mainly cloud) company relative to giants, Nebius could be vulnerable if a competitor slashes prices or if a new technology leapfrogs GPUs.

- Another disruptive scenario could be macroeconomic – if in a recession companies reduce experimental AI spending, Nebius’s growth could temporarily stall. Our 5/10 reflects that disruption could occur but isn’t overwhelmingly likely in the immediate term, and Nebius has some ability to respond if it does (e.g., focus on profitability to weather a storm, pivot services, etc.).

Yiazou Alpha Score: We assign weights to each factor:

- Organizational strength (25%),

- Tech resilience (25%),

- Network positioning (30%),

- Disruption risk (20% – higher risk lowers score).

Calculating the weighted score:

90.25 + 80.25 + 70.30 + 50.20 = 2.25 + 2.0 + 2.1 + 1.0 = 7.35 out of 10.

In percentage terms, roughly 74% confidence that Nebius can be a multi-bagger (double or more) in the next 2–3 years if these factors play out as expected. We categorize this as a “Moderately High” Multibagger Confidence.

In practical terms, this means we see better than average odds that Nebius’s stock could at least double, with a meaningful chance of even higher returns, given its exceptional growth runway and solid execution capabilities.

However, it is not without considerable risk – roughly 25-30% probability in our view that things could go wrong enough to prevent a multi-bagger outcome (or cause a loss). This is analogous to saying Nebius is a high-beta bet where we lean positive. NBIS ~7.3/10 confidence in multi-bagger potential is attractive, but position sizing should be moderated by that ~30% risk of adverse scenarios.

Investment Thesis Summary

We conclude NBIS is a high-upside, high-volatility play on the AI infrastructure boom, with financial and strategic attributes that tilt the odds in favor of long-term success. The company has passed initial hurdles (successful spin-off, capital raise, resumption of growth) and enters 2025 with strong momentum.

If management even comes close to its growth projections, Nebius will graduate from a speculative story to a proven high-growth enterprise, likely yielding significant stock appreciation. The analysis gave us comfort that there are no hidden skeletons in the financials – the main challenges are external and executional, which are easier to monitor and react to.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of NBIS either through stock ownership, options, or other derivatives.