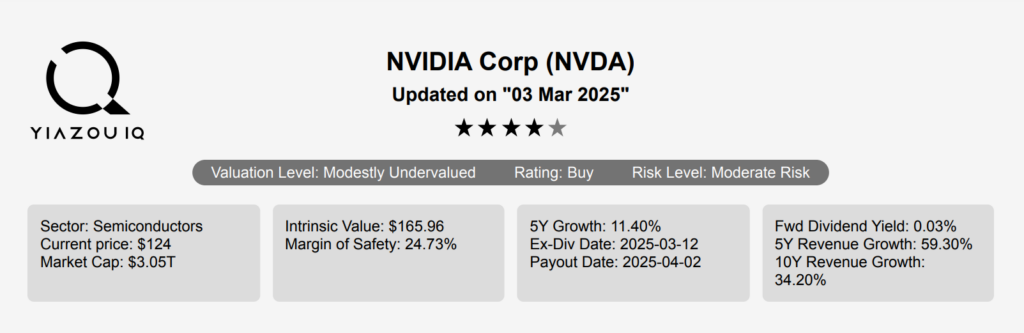

NVIDIA’s AI Expansion and Market Position

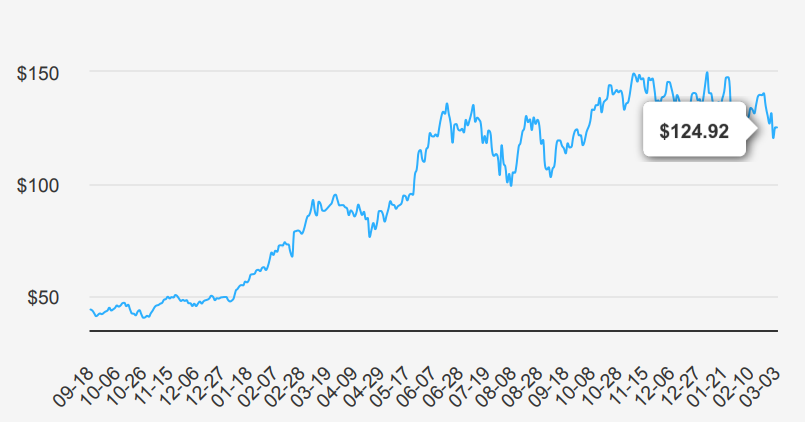

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, CUDA, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads. Nvidia’s stock is currently trading at $125.

74.70% 5-Year EPS CAGR and Revenue Forecasts

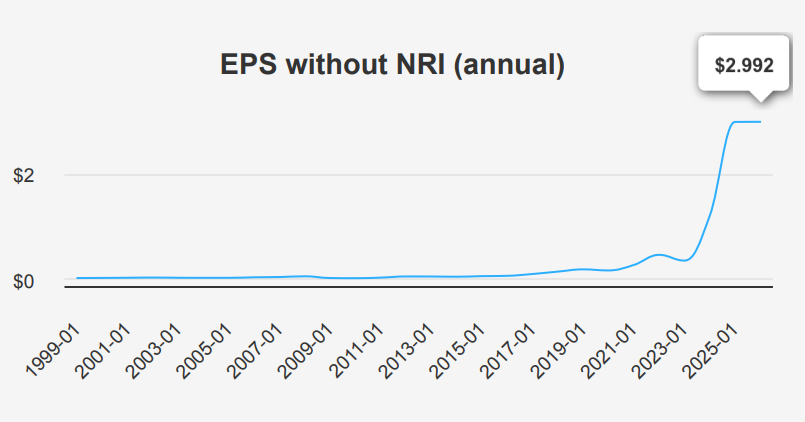

In the latest quarter ending January 31, 2025, Nvidia reported an EPS without non-recurring items (NRI) of $0.89, showing a robust growth from $0.81 in the previous quarter (QoQ) and $0.49 in the same quarter last year (YoY). This reflects the company’s continued strong performance and strategic management, with a 5-year compound annual growth rate (CAGR) of 74.70% and a 10-year CAGR of 47.60% in annual EPS without NRI. Revenue per share also increased to $1.592 from $1.416 in the last quarter, highlighting solid sales growth.

Nvidia’s gross margin reached a high of 74.99%, exceeding its 5- year median of 64.93% and the 10-year median of 61.60%. This margin improvement indicates better operational efficiency and pricing power in the market. The company’s share buyback ratio over the past year was 0.70%, meaning 0.70% of outstanding shares were repurchased. This positively impacts EPS by reducing the share count. Over 10 years, the buyback ratio has averaged -1.30%, reflecting a more conservative approach historically, but recent buybacks have supported earnings per share growth.

Looking forward, analysts estimate that Nvidia’s revenue will grow significantly, with forecasts of $201.8 billion by January 2026, rising to $289.2 billion by January 2028. This growth is supported by industry forecasts predicting a sustained rise in demand for Nvidia’s products, especially in AI and data centers, over the next decade. The company’s next earnings report is on May 22, 2025, with anticipated EPS for the next fiscal year at $4.316, and $5.543 for the following year, suggesting continued positive momentum.

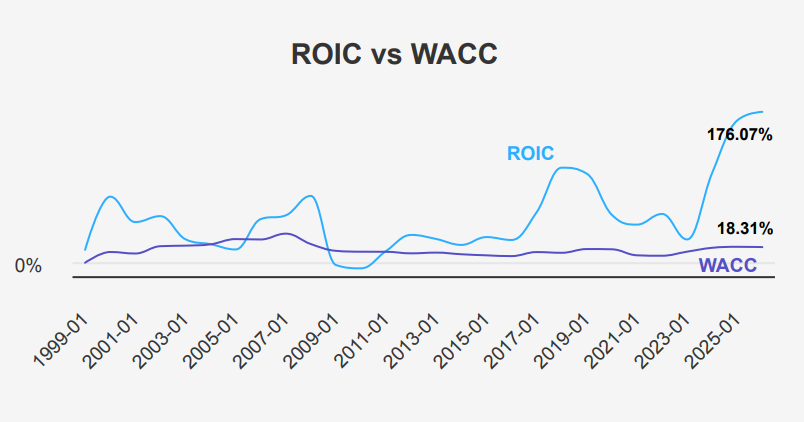

ROIC at 176.06% vs. 18.31% WACC—Strong Value Creation

NVIDIA’s financial performance, particularly in capital allocation, demonstrates strong economic value creation. The company’s Return on Invested Capital (ROIC) significantly exceeds its Weighted Average Cost of Capital (WACC). With a current ROIC of 176.06% compared to a WACC of 18.31%, NVIDIA is generating substantial positive value for its investors. Over the past five years, the median ROIC was 57%, consistently surpassing the median WACC of 12.98%, indicating a robust trend of efficient capital use.

This performance is further highlighted by NVIDIA’s Return on Equity (ROE). This currently stands at 123.32%, a high level indicating effective management in generating returns on shareholders’ equity. The substantial difference between ROIC and WACC implies that NVIDIA is not only covering its capital cost but also creating additional value and enhancing shareholder wealth. Overall, NVIDIA’s ability to sustain ROIC well above its WACC underscores its strong competitive position and efficient capital management, which are key drivers of its long-term financial success.

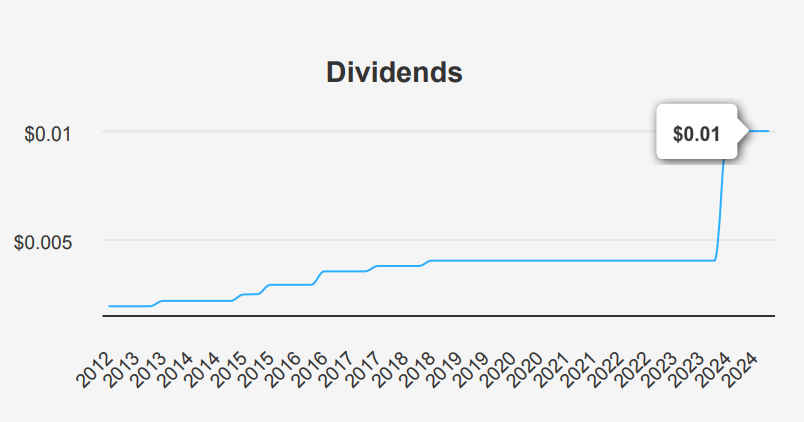

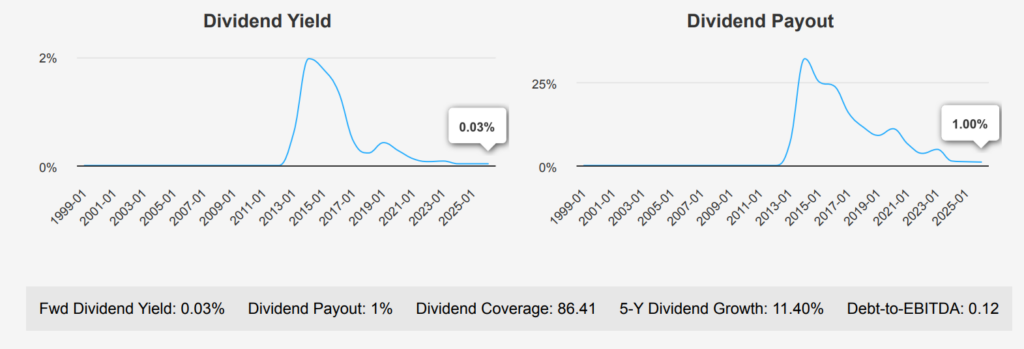

Nvidia Stock Holds 11.40% 5-Year Dividend Growth, But Only 0.03% Yield

NVIDIA’s recent dividend performance showcases a stable yet modest growth trajectory. Over the past five years, the company achieved a dividend growth rate of 11.40%, with an impressive 28.60% growth over the last three years. The forward dividend yield stands at a low 0.03%, reflecting NVIDIA’s strategy of retaining earnings to fuel growth rather than returning large amounts to shareholders as dividends.

The company maintains a low Debt-to-EBITDA ratio of 0.12, indicating minimal financial leverage and robust debt-servicing capability, well below the industry guideline of 2.0 for low financial risk. The dividend payout ratio remains constant at 1.0%, highlighting a cautious approach to dividend payouts, consistent with its 10-year median.

Sector comparison reveals NVIDIA’s dividend yield is on the lower end, with a 10-year high of 1.65% and a median of 0.24%, suggesting the company prioritizes reinvestment over dividends. The forecasted dividend growth rate over the next 3-5 years is healthy at 10.07%.

The next ex-dividend date is on June 10, 2025, ensuring it falls on a future weekday, continuing its quarterly distribution pattern. Overall, NVIDIA’s dividend policy reflects a balanced approach between growth and shareholder returns.

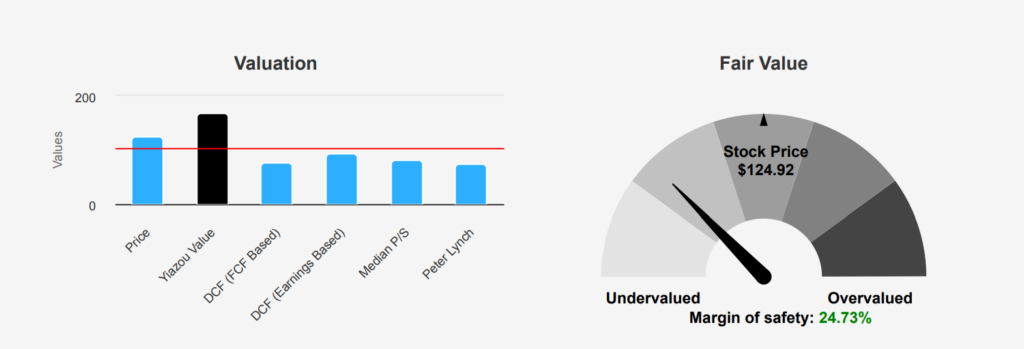

Nvidia Stock’s 24.73% Margin of Safety—Undervalued or Justified Premium?

NVIDIA stock appears to be trading below its intrinsic value of $165.96, with a current market price of $124.92, suggesting a margin of safety of 24.73%. This indicates that the stock may hold undervaluation, providing a potential buffer against market volatility. Analyzing its valuation metrics, the TTM P/E ratio stands at 42.52, which is below its 10-year median of 52.32 but higher than its 10-year low of 16.74, indicating moderate valuation compared to historical extremes. The Forward P/E ratio is 27.72, suggesting expectations of future earnings growth.

Examining the TTM EV/EBITDA of 35, it is lower than the 10-year median of 41.81, indicating a relatively fair valuation in this context. However, the TTM P/B ratio at 38.54 is significantly above the 10-year median of 18.24, suggesting possible overvaluation in terms of asset values. The TTM Price-to-Free-Cash-Flow ratio is 50.88, which is slightly below the 10-year median of 53.34, implying a reasonable valuation concerning cash flows.

Analyst ratings reflect optimism with a price target of $173.02, slightly increasing from previous months, indicating positive sentiment towards NVIDIA’s future performance. Despite some high valuation metrics, the overall outlook suggests NVIDIA is positioned for growth, supported by consistent analyst confidence and a substantial margin of safety. This presents a potentially attractive entry point for investors seeking growth in the tech sector, considering the intrinsic value calculations and market price dynamics.

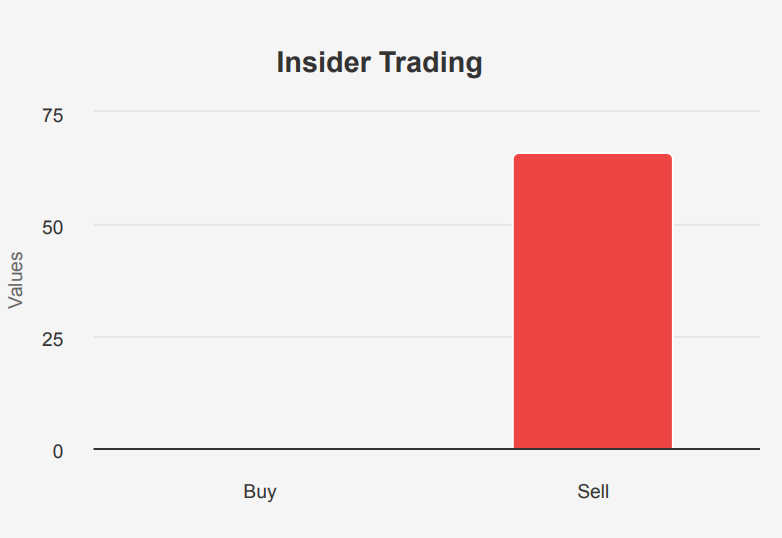

Nvidia Stock: Insider Selling vs. Strong Financial Health—What’s the Verdict?

NVIDIA stock presents a mixed risk profile. The recent insider activity, with 1,107,865 shares sold and no insider buying, could signal potential concerns from those close to the company, although it’s not necessarily indicative of long-term issues. The Beneish M-Score of -0.99 suggests possible financial manipulation, which warrants caution. Additionally, the Sloan ratio of 26.18% indicates earnings may significantly rely on accruals, which could affect the quality of reported profits.

On the positive side, NVIDIA shows robust financial health with a Piotroski F-Score of 8, suggesting a strong operating environment. The company’s ability to cover all debt with existing cash enhances its financial stability, further supported by an expanding operating margin. The stock’s price-to-sales ratio is near its two-year low, potentially offering a buying opportunity. Its Altman Z-score of 61.85 reflects a very low risk of bankruptcy. Furthermore, the company’s dividend yield is near a one-year high, which may attract income-focused investors.

Overall, while there are some red flags regarding financial transparency and insider confidence, NVIDIA’s strong operational and financial metrics provide a solid foundation, making it a potentially attractive investment with due diligence.

66 Insider Sell Transactions, 0 Buys—A Warning Sign?

The insider trading activity for NVIDIA stock over the past year shows a consistent trend of selling by company insiders. Over the last 12 months, there have been 66 insider sell transactions, with no insider buys recorded during this period. In the past 6 months, there were 17 sell transactions and again, no buys. In the most recent 3-month period, insiders executed 4 sell transactions, maintaining the pattern of sales without any purchases.

This selling trend may reflect insiders capitalizing on the stock’s performance or adjusting their personal portfolios, though it does not necessarily indicate negative prospects for the company. Insider ownership remains low at 0.39%, suggesting limited insider control or influence. In contrast, institutional ownership is significantly higher, at 64.76%, indicating strong confidence from institutional investors. These trends could suggest that while insiders are selling, the broader market remains optimistic about NVIDIA’s long-term potential, as shown by substantial institutional investment.

High Dark Pool Activity—What It Means for Investors

NVIDIA stock exhibits robust trading activity with a daily trading volume of approximately 382.94 million shares. This figure significantly exceeds the average daily trading volume over the past two months, which is 274.37 million shares, indicating heightened investor interest or market activity.

The Dark Pool Index (DPI) for NVDA is at 51.4%. A DPI above 50% typically suggests a higher proportion of trades occurring in dark pools rather than on public exchanges. This could imply that institutional investors are heavily involved in trading NVDA shares, potentially leading to less transparency in price discovery.

The substantial trading volume in conjunction with a high DPI suggests that NVDA’s liquidity is strong, facilitating large trades without significant price impact. This level of liquidity is attractive to both institutional and retail investors who require the ability to enter and exit positions efficiently.

Overall, NVDA’s liquidity position is solid, but the high DPI indicates that investors might need to consider potential implications for market transparency. This trading dynamic is crucial for stakeholders to understand when making investment decisions or assessing market conditions for NVDA.

Political Interest in Tech Stocks—What It Reveals

Looking at the recent trades involving Congress, the most notable transaction was executed by Senator Jon Tester from Montana. On September 15, 2023, Tester reported purchasing shares of Apple Inc. (AAPL) valued between $15,000 and $50,000. This trade was processed through E-Trade, a platform known for its extensive brokerage services.

Another significant trade occurred on September 21, 2023, involving Representative John Carter from Texas. Carter disclosed selling shares of Amazon (AMZN), valued in the range of $50,000 to $100,000, through Fidelity Investments.

These trades are quite telling of the ongoing interest among Congress members in technology sectors, reflecting a potential bullish outlook on tech giants despite market volatility. However, such trades, especially from influential policymakers, often stir discussions about the intrinsic balance between public service and private financial interests.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.