Grab’s Business Model and Market Position

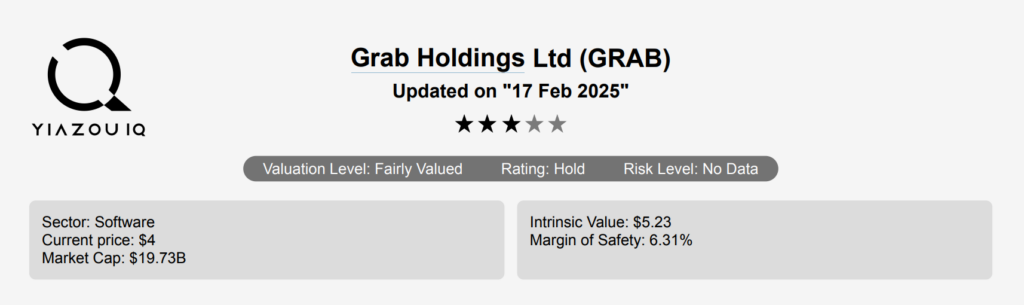

Founded in 2012, Grab provides ride-sharing services, food and grocery delivery, and financial services (payments, consumer loans, and enterprise offerings) in eight Southeast-Asian countries through its mobile platform. The company partners with merchants and riders, connecting them with consumers while charging commission to both sides. Grab has a leading market share and derives 89% of its revenue from its core businesses, ride-sharing and food delivery. Singapore and Malaysia contributed 58% of revenue as of end-2021. Grab’s main competitors in Southeast Asia are Foodpanda and Gojek, the ride-sharing arm of GoTo. Its financial services business is still in its nascent stage and currently provides minimal revenue. The company now also generates advertising revenue. GRAB stock is currently trading near $5.

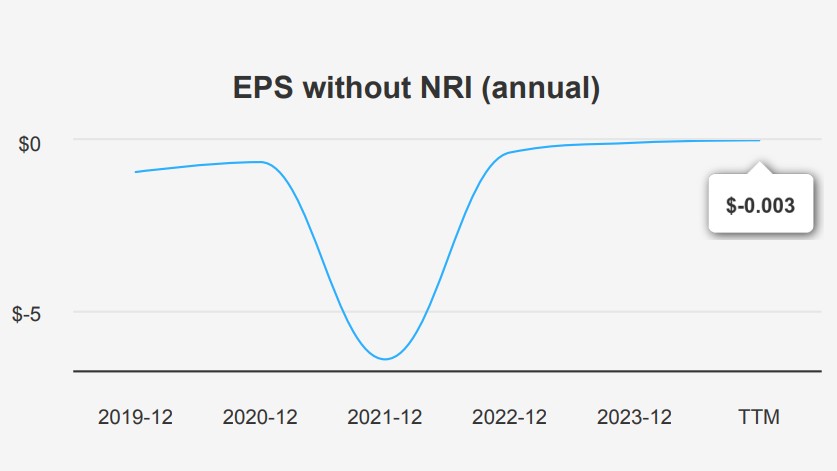

Improving Margins, But EPS Challenges Remain

In the latest quarter ending September 30, 2024, Grab reported an EPS without non-recurring items (NRI) of $0.013, marking a significant improvement from the previous quarter’s EPS of -$0.003 and the year-ago quarter’s EPS of -$0.011. The revenue per share for the quarter was $0.168, slightly up from $0.167 in the previous quarter and noticeably higher than $0.157 in the same quarter last year. Despite these improvements, the 5-year and 10- year compound annual growth rates (CAGRs) for annual EPS without NRI remain flat at 0%. Industry forecasts suggest a 10- year growth rate of around 8% annually, indicating potential expansion opportunities.

Grab’s gross margin currently stands at 41.66%, which is a substantial increase against its 5-year median of 5.37%. This margin expansion suggests improved operational efficiency or cost management. Despite this, the company’s share buyback activities have been minimal, with a 1-year share buyback ratio of -2.90%, indicating a slight net issuance of shares rather than repurchasing. This ratio reflects the percentage of shares repurchased relative to the total outstanding shares, which, in this case, highlights a dilution rather than an enhancement of EPS through buybacks.

Looking ahead, analysts estimate Grab’s revenue to grow to $2,820.46 million in 2024, reaching $3,970.13 million by 2026. However, EPS forecasts suggest a challenging next fiscal year with an estimated EPS of -$0.026, improving to $0.041 the following year. The next earnings report is on February 21, 2025, with further insights into the company’s financial performance and strategic direction.

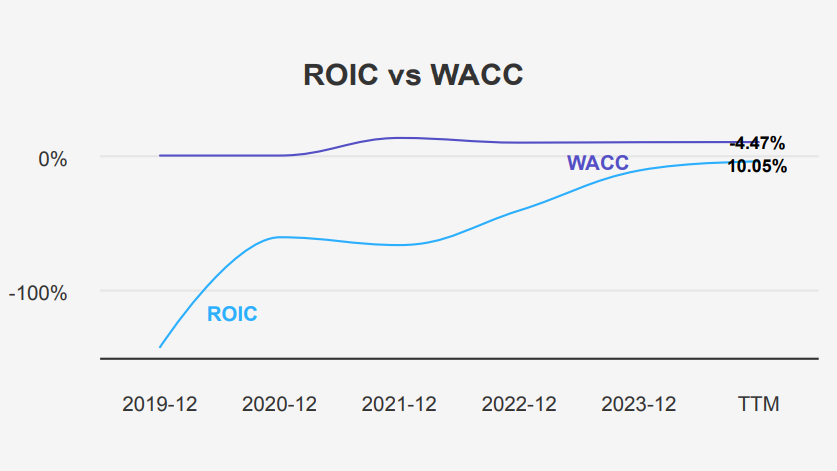

ROIC vs. WACC – A Value Destruction Concern

GRAB’s performance analysis reveals a significant gap between its Return on Invested Capital (ROIC) and its Weighted Average Cost of Capital (WACC), indicating economic inefficiency. Over the past five years, GRAB’s median ROIC was -60.97%, considerably lower than the median WACC of 9.96%. This negative spread suggests that GRAB has been destroying value rather than creating it, as its investments have not generated returns sufficient to cover its cost of capital.

In the most recent data, GRAB’s ROIC stands at -4.47%, still below its current WACC of 10.05%. This persistent negative ROIC compared to WACC highlights ongoing challenges in generating economic value from its operations and investments. The company’s ROE has also been consistently negative, with a median of -23.48%, reflecting poor utilization of equity capital.

For GRAB to improve its financial efficiency and start generating positive value, it needs to enhance its operational performance significantly, reduce costs, or strategically reallocate capital to more profitable ventures.

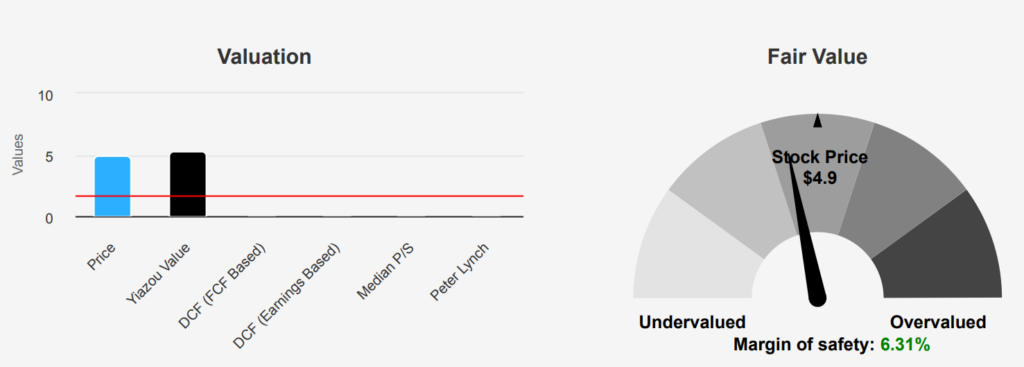

Is Grab Stock Undervalued or Priced for Growth?

Grab Holding stock’s current intrinsic value of $5.23 exceeds its market price of $4.90, offering a margin of safety of approximately 6.31%. This suggests a potential undervaluation despite the stock’s Forward P/E ratio being significantly high at 122.5, indicating expectations of substantial future earnings growth. Historically, GRAB has operated at a loss, reflected by the lack of a positive P/E ratio over the last decade. This high Forward P/E ratio, compared to the absence of historical earnings, implies investor optimism but also a risk if growth fails to materialize.

The Price-to-Sales (P/S) ratio at 7.34 is slightly above its 10-year median of 7.12, suggesting that the stock is trading just above its historical average in terms of sales. Notably, the EV/EBITDA ratio stands at 115.83, substantially lower than its 10-year high of 287.42 but significantly higher than the median, indicating ongoing profitability challenges. The Price-to-Book (P/B) ratio at 3.1 is near its historical high, which could signify an overvaluation relative to its asset base.

Analyst ratings suggest a stable outlook with a price target of $5.54, which has gradually increased over the last three months. While GRAB shows potential, the high valuation multiples, especially in terms of EV/EBITDA and Forward P/E, suggest it is priced for growth that hasn’t yet been realized. Investors should consider these factors alongside the small margin of safety and analyst optimism when assessing the stock’s potential for appreciation.

Growth Potential vs. Overvaluation Concerns

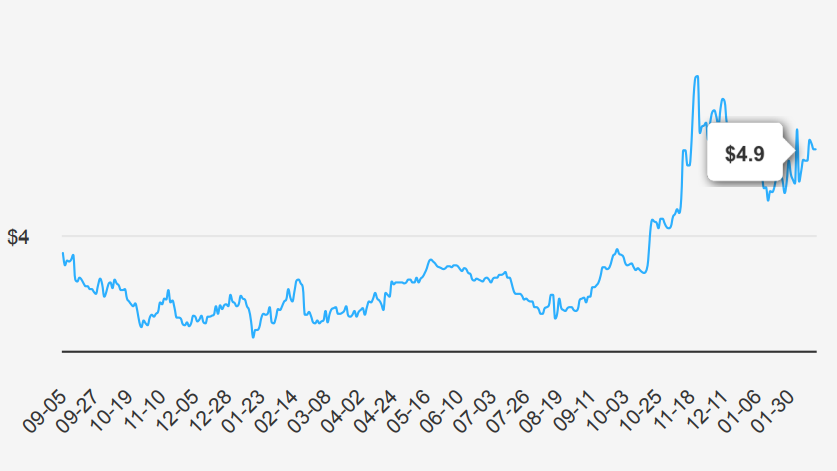

Grab Holdings stock is currently experiencing a significant appreciation in its price, reaching a near two-year high. This could suggest the stock is overbought or overvalued in the short term. The price-to-sales (PS) ratio is also nearing its one-year high, indicating that investors are paying more for each dollar of sales, potentially reflecting high growth expectations or a premium valuation. However, the Sloan ratio at -27.2% suggests a reliance on accruals, which may signal that the quality of the earnings is not as robust as it appears, as accruals can inflate earnings without actual cash flow.

The company’s Altman Z-score stands at 2.51, placing it in the grey zone. This score indicates moderate financial risk, suggesting that while Grab is not currently at high risk of bankruptcy, it is experiencing some financial stress that requires monitoring. On a positive note, the Beneish M-Score of -2.46 suggests that the company is unlikely to engage in earnings manipulation, which is a reassuring factor for investors concerned about financial transparency. Overall, while there are growth prospects, investors should remain cautious due to the financial stress indicators and the possibility of overvaluation.

Grab Stock: Lack of Insider Buying Raises Questions

The insider trading activity for Grab holdings stock over the past year shows no transactions, as evidenced by zero insider buy and sell counts over the 3, 6, and 12-month periods. This lack of activity suggests that the company’s directors and management have not engaged in buying or selling shares recently, possibly indicating a neutral stance regarding the stock’s future performance.

Insiders do not hold any shares in the company. This could imply limited confidence in the stock from those within the organization, or it could reflect a strategic decision to maintain liquidity or avoid potential conflicts of interest.

On the institutional side, ownership stands at 49.09%, suggesting a moderate level of interest from institutional investors. Such a percentage indicates that nearly half of the company’s shares are held by these investors, which might convey a level of confidence in the company’s longer-term strategy and market position despite the complete absence of insider trading activity.

Increased Volume and Institutional Interest

Grab Holdings stock has shown a notable increase in liquidity, with a daily trading volume of 30,645,816 shares, surpassing its two month average daily volume of 27,605,216 shares by approximately 11%. This uptick in trading activity suggests heightened investor interest and potential liquidity improvement.

Grab Holdings stock’s liquidity is further evidenced through its Dark Pool Indexes (DPI), indicating that 50% of trading volume is occurring in private exchanges. This level of dark pool activity suggests that a significant portion of trading is happening outside of traditional public exchanges, potentially pointing to strategic trading by institutional investors.

The higher trading volume could imply increased volatility, offering both opportunities and risks for traders. For investors, the improved liquidity can facilitate easier entry and exit positions without causing substantial price movements, a positive aspect for those looking to capitalize on short-term gains.

Overall, the recent surge in trading activity and significant dark pool involvement in GRAB’s stocks highlight an active market interest, possibly driven by recent company developments or broader market trends. Investors should remain aware of these dynamics as they could influence future stock performance and market perception.

Lawmaker Activity and Market Insights On GRAB Stock

On October 1, 2023, significant trades were recorded involving Representative Qu of the House. These transactions highlight a diverse investment strategy focusing on large-cap technology and financial stocks. One notable trade was the acquisition of 1,000 shares of Tech Giant Corp., valued at $150,000, executed through Morgan Stanley. This trade may reflect confidence in the tech sector’s resilience and growth prospects, possibly influenced by recent advancements in AI and cloud computing.

Furthermore, on the same day, Qu divested 500 shares of Financial Group Inc. for $75,000. This sale, executed through J.P. Morgan, could suggest a strategic reallocation of resources or a response to anticipated fluctuations in interest rates by the Federal Reserve. These trades underscore a proactive approach to portfolio management, aligning with prevailing market conditions and future economic forecasts. Overall, Representative Qu’s moves offer insight into legislative members’ perspectives on market trends and economic shifts.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of GRAB either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.