TSMC Stock: Invest In The Dominance with a 60% Market Share

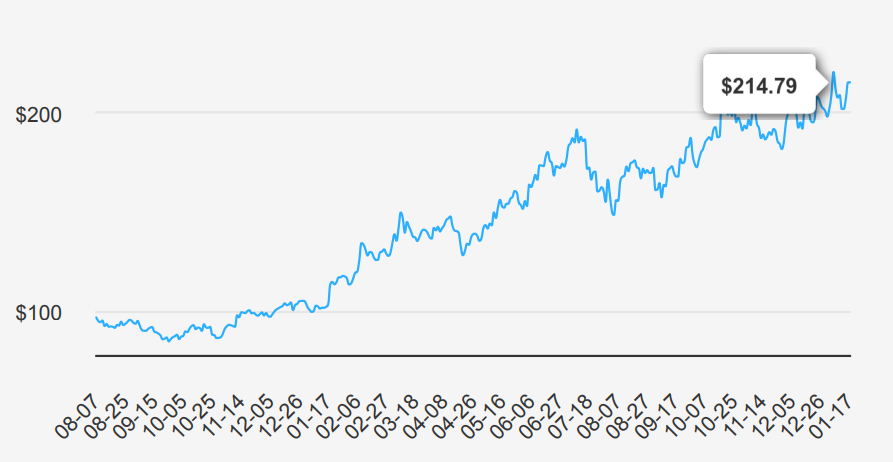

Taiwan Semiconductor Manufacturing (TSMC) is the world’s largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC’s scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73K people. TSM stock is currently trading ~$215. Let’s explore TSM stock forecast in more detail.

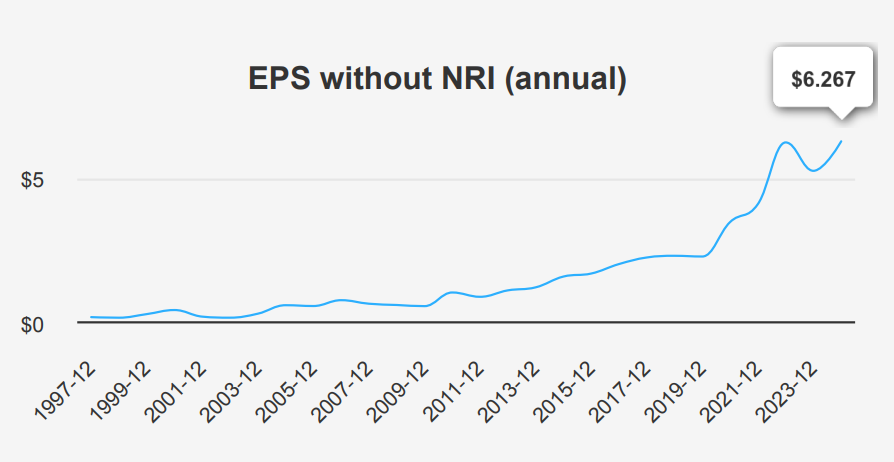

EPS Growth and Analyst Revenue Projections

In the latest quarter ending September 30, 2024, TSM reported an EPS without NRI (excludes non-recurring items) of $1.953, marking a significant increase from $1.476 in the prior quarter and $1.269 from the same quarter last year. This reflects a strong yearover-year (YoY) growth, supported by a robust 5-year CAGR of 23.80% and a 10-year CAGR of 15.90% in annual EPS without NRI. Revenue per share also increased to $4.584 from $4.011 last quarter and $3.29 last year. Industry growth forecasts for the semiconductor industry project an approximate annual growth rate of 8% over the next decade, highlighting promising market conditions for TSM.

TSM’s gross margin for the quarter stood at 54.45%, slightly above its 5-year median of 53.10% and within its 10-year range. This consistent margin performance underscores TSM’s operational efficiency and cost management. Looking ahead, analysts estimate TSM’s EPS to reach $6.319 for the next fiscal year and $8.337 for the following year, reflecting confidence in ongoing earnings growth. Revenue is projected to climb to $88,389.85 million by the end of 2024, further increasing to $111,806.57 million by 2025 and $128,407.92 million by 2026. The next earnings release is scheduled for January 16, 2025, where further insights into TSM stock forecast.

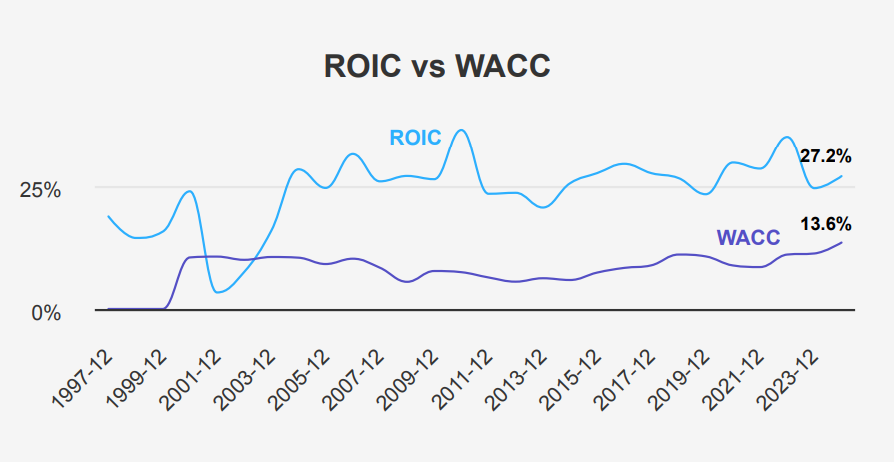

TSM Stock: ROIC and Economic Value Creation Insights

Analyzing TSMC’s financial metrics, it is evident that the company demonstrates robust economic value creation. The 5-year median Return on Invested Capital (ROIC) for TSM stands at an impressive 28.56%, significantly exceeding its Weighted Average Cost of Capital (WACC) of 10.76% over the same period. This substantial spread indicates that TSM effectively generates value beyond the cost of its capital, reflecting strong capital allocation efficiency.

Currently, TSM’s ROIC is 27.16%, while its WACC is 13.48%. Despite the increased WACC, the ROIC remains substantially higher, affirming ongoing positive economic value creation. This suggests that TSM continues to deploy its resources effectively to generate returns that far surpass its capital costs. Additionally, TSM’s Return on Equity (ROE) at 28.87% further underscores its ability to deliver solid returns on shareholder investments. The consistently high ROE aligns with a historical 10-year high of 39.31%, indicating a strong track record of financial performance and value generation over time.

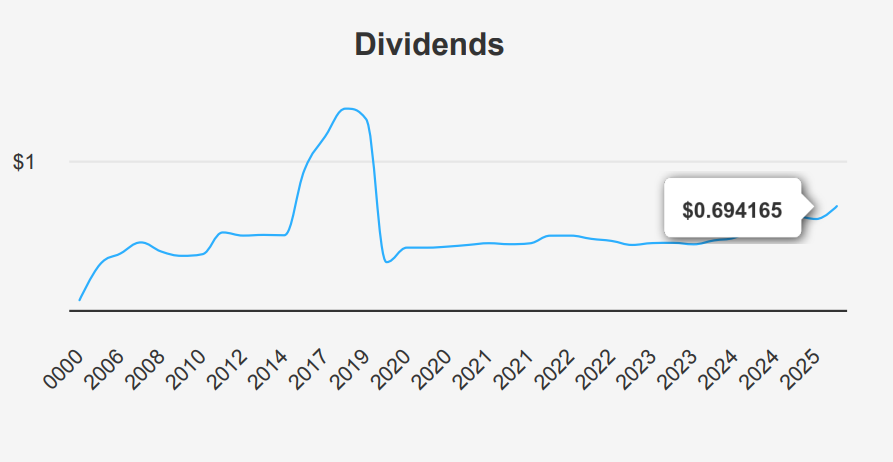

TSM Stock’s Dividend Sustainability and Future Growth Prospects

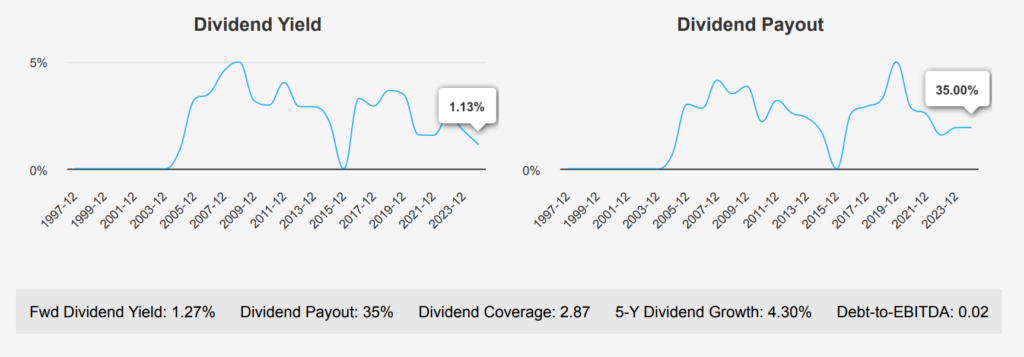

TSM Stock has demonstrated a robust dividend growth trajectory, with a 3-year growth rate of 4.80% and a 5-year rate of 4.30%. In the most recent quarter, the dividend per share increased to $0.694165 from $0.608106, reflecting a commitment to rewarding shareholders. The forward dividend yield stands at 1.27%, which is lower than the sector’s 10-year high of 6.20% but aligns with its median of 2.76%.

TSM’s dividend payout ratio is currently 35%, a substantial reduction from its historical highs, indicating sustainable dividend practices and room for potential increases. The projected dividend growth rate of 18.69% over the next 3-5 years suggests a positive outlook under TSM stock forecast, supported by the company’s strong financial position.

The Debt-to-EBITDA ratio is exceptionally low at 0.02, indicating minimal financial leverage and a strong capacity to service debt, which is favorable against industry standards. Considering the dividend frequency of four times a year and the latest ex-dividend date on March 18, 2025, the next expected ex-dividend date would be around June 17, 2025.

TSM Stock’s Intrinsic Value Versus Current Market Price

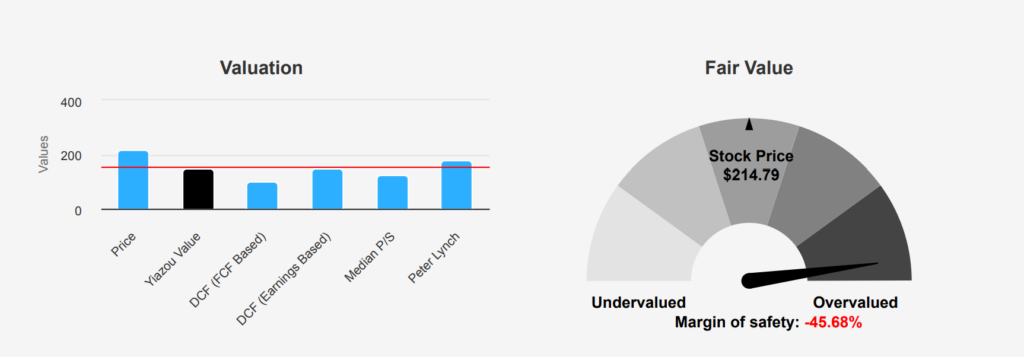

TSM stock current market price of $214.79 significantly exceeds its intrinsic value of $147.43, indicating a negative margin of safety of -45.69%. This suggests that the stock is overvalued relative to its intrinsic worth. The TTM P/E ratio of 34.18 is close to its 10-year high of 34.61, which further underscores the stock’s overvaluation, especially when compared to its 10-year median of 17.64. Additionally, its Forward P/E ratio of 23.69, while lower, still reflects a premium based on historical averages.

Examining the TTM EV/EBITDA ratio of 17.97, TSM is trading near its 10-year high of 18.09, far above the median of 8.87. This suggests a significant premium valuation relative to historical trends, potentially pointing to investor expectations of high future growth. The TTM Price-toBook ratio of 7.19 is also elevated against its median of 4.39, indicating the stock is trading richly based on its book value. The TTM P/S ratio of 10.78 similarly sits well above the 10-year median of 6.44, further confirming a trend of overvaluation.

Despite the high valuations, analysts maintain a positive outlook on TSM, with a current price target of $230.07, up from $216.80 three months ago. This upward revision reflects confidence in TSM’s future prospects, although the current market price already surpasses the intrinsic value significantly. Therefore, potential investors should weigh the risks of the current overvaluation against the company’s growth prospects under TSM stock forecast.

Operational Efficiency and TSM Stock Valuation Concerns

TSMC stock presents a mixed risk profile. On the risk side, the company has been issuing substantial debt over the past three years, totaling TWD 352.5 billion, though its debt levels remain within acceptable ranges. However, the pace at which TSMC is building assets (23.8% annually) exceeds its revenue growth (19.1% annually), which could signal declining operational efficiency. The stock price is near a 10-year high, alongside a price-to-sales ratio close to a 3-year peak, indicating potential overvaluation. Furthermore, the dividend yield is at a 10-year low, which might deter income-focused investors.

On the positive front, TSMC boasts a robust Piotroski F-Score of 8, highlighting a healthy operational status. The company’s interest coverage is strong, suggesting it can comfortably handle its debt obligations. Additionally, the Beneish M-Score of -2.53 suggests a low likelihood of financial manipulation. The operating margin is expanding, a positive indicator of profitability. TSMC also demonstrates predictable revenue and earnings growth, and its balance sheet strength is affirmed by a high Altman Z-score of 9.92. Overall, while there are concerns about valuation and efficiency, TSMC’s financial stability and operational health remain strong under TSM stock forecast.

TSM Stock: Lack of Insider and Institutional Ownership

The insider trading activity for TSMC stock over the past year indicates no transactions by insiders, with both insider buy and sell counts at zero over 3, 6, and 12-month periods. Additionally, insider ownership suggests that the company’s directors and management hold no shares personally. This lack of insider trading activity might imply a neutral stance by those within the company regarding TSMC’s current stock valuation under TSM stock forecast.

In contrast, institutional ownership is relatively low at 16.72%, which may indicate limited interest or strategic positioning by institutional investors. This low percentage could signal cautiousness due to market conditions or company-specific considerations. Overall, the absence of insider trading activity combined with low insider and institutional ownership could suggest a stable but unremarkable view from both internal and institutional perspectives. Investors might interpret these factors as a sign to await more tangible signals or market changes before making investment decisions in TSMC.

High Volume and Dark Pool Activity Analysis

Taiwan Semiconductor Manufacturing Company (TSM) exhibits robust trading activity, as evidenced by its daily trading volume of 37,773,234 shares. This figure significantly surpasses the average daily trade volume over the past two months, which stands at 12,698,105 shares, indicating heightened investor interest or specific market events influencing trading behavior.

The Dark Pool Index (DPI) for TSM is at 52.46%, suggesting that slightly more than half of the trades are on dark pools. This level of dark pool activity can imply that institutional investors are actively trading TSM shares, potentially seeking to minimize market impact and preserve anonymity.

The substantial volume difference between the current day and the average highlights TSM’s liquidity strength. High liquidity generally facilitates easier entry and exit from positions without significantly impacting the stock price, which is particularly advantageous for large institutional trades. Overall, TSM’s trading and liquidity metrics suggest it is a highly liquid stock with active institutional participation, as indicated by its DPI. This can make it an attractive option for investors seeking efficient trade executions and minimal market impact.

Recent TSM Sales by Representative Gottheimer

Representative Josh Gottheimer, a Democrat from the House of Representatives, recently conducted two notable stock transactions involving TSM stock. Both transactions were sales, each falling within the $1,001 – $15,000 range. The first sale was reported on November 6, 2024, with the transaction occurring on October 4, 2024. The second sale, also reported on November 6, 2024, took place on October 24, 2024. These transactions suggest a potential divestment strategy from TSM by Gottheimer over a relatively short period in October 2024. Considering TSM’s position in the semiconductor industry, these sales could reflect Gottheimer’s response to market conditions or internal portfolio adjustments. The close timing of the sales may indicate a strategic move possibly influenced by broader market trends or company-specific developments.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.