JPMorgan Stock: Backed By $4.1 Trillion Asset Foundation

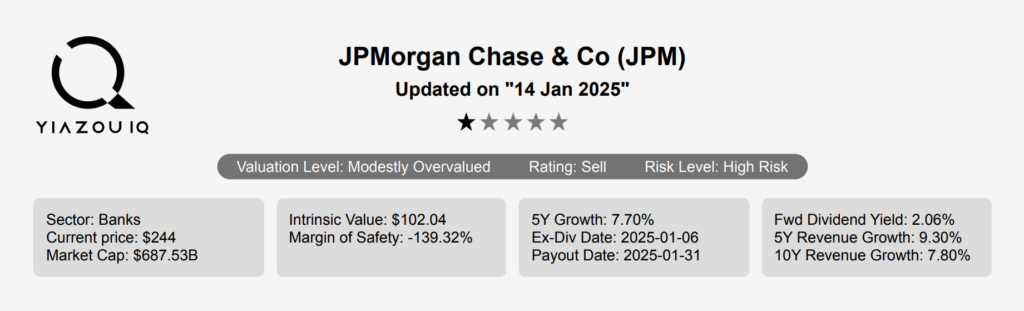

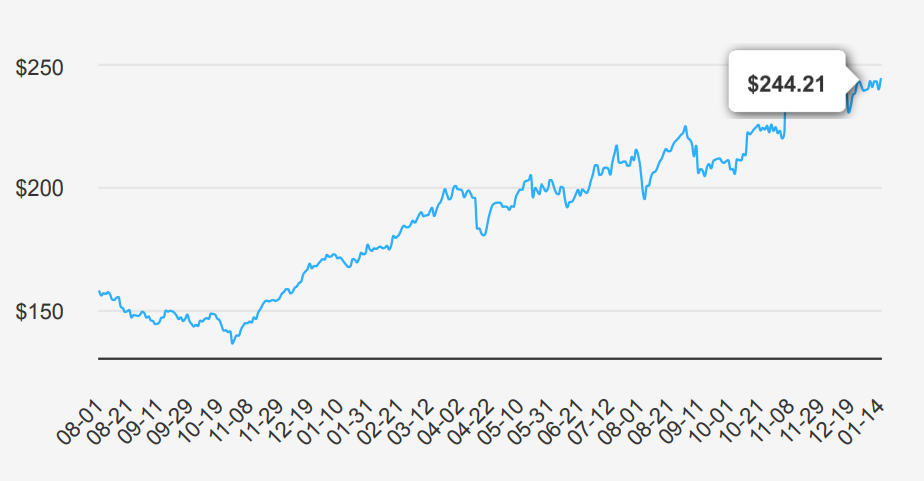

JPMorgan Chase (JPM) is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is operates through four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries. JPM stock is currently trading at ~$244. Let’s explore JPM stock forecast 2025 in detail.

2024 Performance and 2025 EPS Projections

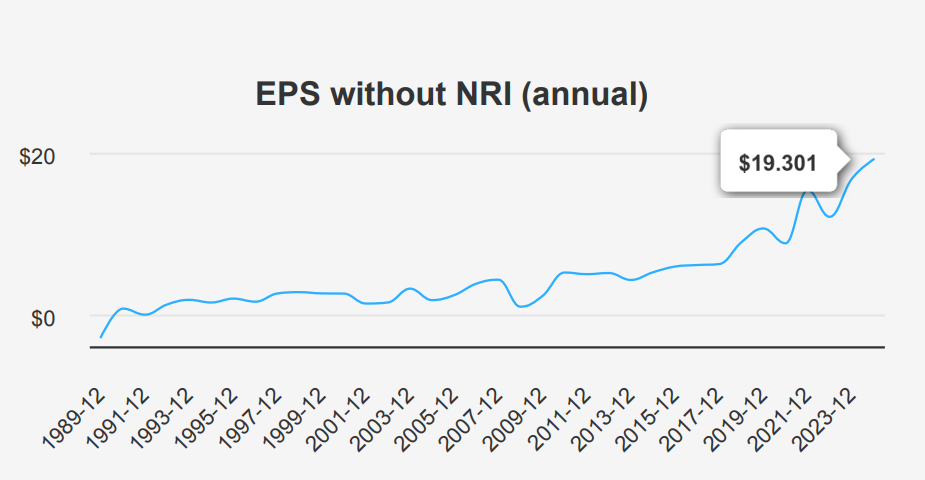

In the third quarter of 2024, JPMorgan Chase reported an EPS without non-recurring items (NRI) of $4.476, down from $6.173 in Q2 2024, but slightly up from $4.547 in the same quarter last year. The company’s revenue per share decreased to $14.884 from $17.292 in the previous quarter, yet showed improvement from $13.561 a year ago. Over the past five years, JPMorgan has achieved a 12.30% compound annual growth rate (CAGR) in EPS without NRI, while the 10-year CAGR stands at 13.80%. According to current industry forecasts, the financial services sector may grow at an annual rate of approximately 5% over the next decade.

JPMorgan’s gross margin remains consistently reported at 0%, highlighting that as a financial institution, traditional gross margin metrics are not applicable as they are for manufacturing firms. Share buybacks continue to be a significant strategy, with a 1-year buyback ratio of 2.60%, indicating that 2.6% of the previously outstanding shares were repurchased over the past year. This strategy has positively impacted EPS by reducing the number of shares outstanding, thereby increasing the earnings attributed to each share.

Looking ahead, analysts have set an estimated EPS of $18.992 for the fiscal year ending in 2025 and $17.134 for 2026, suggesting expectations of strong earnings performance despite economic challenges. The next earnings announcement is on January 15, 2025, which will provide further insights into JPMorgan’s financial health and strategic direction. Revenue estimates for the upcoming years underline consistent performance, with projections of $178.04 billion in 2024, $172.13 billion in 2025, and $178.58 billion in 2026.

ROIC vs. WACC—A Capital Efficiency Challenge

JPMorgan Chase’s financial performance and value creation can be evaluated by examining its Return on Invested Capital (ROIC) in relation to its Weighted Average Cost of Capital (WACC). Meanwhile, the WACC over the 5-year median is 7.80%, and currently, it is 14.11%, indicating the cost of capital is quite high. This disparity implies that JPM is not efficiently utilizing its capital to generate returns that exceed its capital costs, resulting in negative economic value creation.

Despite a strong Return on Equity (ROE) of 16.12%, which reflects profitability and shareholder value generation, the zero ROIC indicates potential inefficiencies in capital allocation or operational performance. This suggests that while JPM may be profitable, it is not effectively leveraging its investments to create economic value, warranting further strategic review to enhance capital efficiency and long-term value generation under the JPM stock forecast 2025.

JPM Stock: Growth, Yield, and Payout Potential

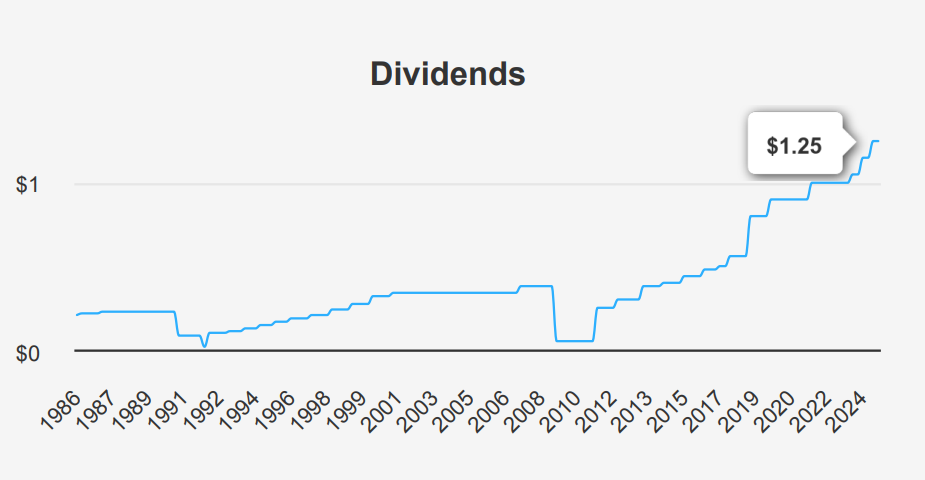

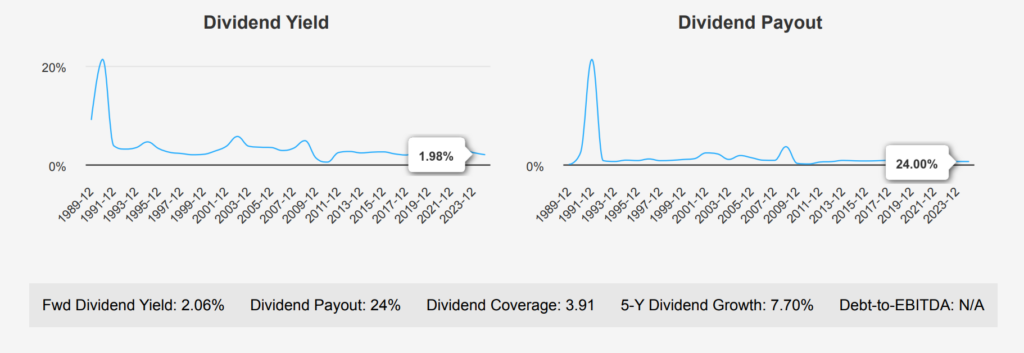

JPM stock has demonstrated steady dividend growth, reflected in its 5-year growth rate of 7.70% and a more recent 3- year growth rate of 4.40%. In the latest quarter, the dividend per share increased from $1.15 to $1.25, showcasing a commitment to returning value to shareholders. The company’s forward dividend yield stands at 2.06%, slightly below its 10-year median of 2.56%, indicating a stable dividend policy, albeit with room for yield improvement.

The dividend payout ratio is currently at 24%, suggesting ample room for future dividend increases, as it is well below historical highs. The estimated future dividend growth rate of 10.77% aligns with this potential for increased payouts. Compared to the broader financial sector, JPMorgan’s dividend growth and stability are commendable. With the next ex-dividend date set for April 6, 2025, investors can anticipate the continuation of this trend. The calculated ex-dividend dates illustrate regular quarterly distributions, supporting consistent income expectations under the JPM stock forecast 2025.

Overvaluation Concerns Amid Stable Growth

JPMorgan Chase & Co.’s financial position reflects both opportunities and potential risks. The company has been actively issuing new debt, totaling $56.7 billion over the past three years. However, this level of debt remains within an acceptable range, suggesting manageable leverage. Despite the increase in debt, the company’s Beneish M-Score of -2.34 indicates a low likelihood of financial manipulation, which reinforces the reliability of its financial reporting.

In terms of valuation, JPM’s stock is currently trading near its 10-year highs in several key metrics. The Price-to-Book (PB) ratio at 2.08 and the Price-to-Sales (PS) ratio at 4.01 are both approaching their highest levels in a decade, which may raise concerns about overvaluation. Furthermore, the dividend yield is near a 5-year low, potentially affecting income-focused investors. Despite these valuation concerns, the company has demonstrated consistent revenue and earnings growth on a per-share basis, suggesting strong operational performance that could justify its current pricing levels under JPM stock forecast 2025.

Overall, while there are signals of potential overvaluation, JPMorgan Chase & Co.’s stable financial reporting and predictable growth provide a solid foundation. Investors should weigh these factors carefully, considering the current market conditions and their own risk tolerance.

Selling Trends and Institutional Confidence

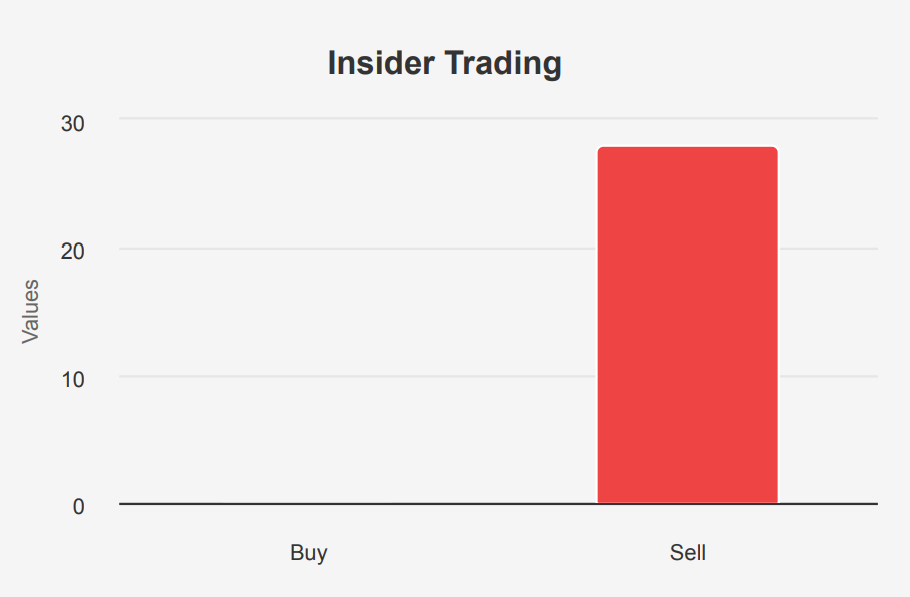

Over the past year, there has been a notable lack of insider buying activity at JPMorgan Chase & Co., with no purchases made by directors or management within the last 3, 6, or 12 months. In contrast, there have been 28 instances of insider selling over the same 12-month period. This pattern suggests a potential lack of confidence or need for liquidity among insiders, as they have opted to divest rather than invest further in company shares.

Insider ownership remains relatively low at 0.70%, indicating that company insiders have a minor stake in the firm. This level of ownership might imply limited alignment between management and shareholder interests. Meanwhile, institutional ownership stands at a significant 78.38%, reflecting strong confidence and control by large institutional investors.

The trend of insider selling, coupled with the minimal insider stake, could be a signal for investors to approach with caution. However, the high institutional ownership suggests that professional investors still hold a favorable view of the JPM stock forecast for 2025.

High Volume Reflecting Investor Interest

As of the latest data, JPMorgan Chase stock exhibits a daily trading volume of 9,952,978 shares, which is above its average daily trading volume of 8,672,973 shares over the past two months. This suggests heightened trading activity, potentially driven by recent news or market events affecting the company.

The Dark Pool Index (DPI) stands at 48.65%, indicating a moderate level of trading occurring in dark pools, which are private exchanges for institutional investors. A DPI below 50% suggests that a larger proportion of trades are happening on public exchanges compared to dark pools, which can imply transparency in trading and possibly less volatility driven by large, undisclosed trades.

Overall, the higher-than-average trading volume coupled with the current DPI reflects a healthy liquidity position for JPM, allowing investors to easily enter or exit positions with minimal impact on the stock’s price. This liquidity is essential for maintaining investor confidence and market efficiency in JPM stock forecast 2025, particularly amidst fluctuating market conditions.

Bipartisan Confidence in JPM Stocks

In recent congressional trading activity, two notable purchases of JPMorgan Chase & Co. (JPM) stocks were recorded. On November 25, 2024, Representative Marjorie Taylor Greene, a Republican from the House of Representatives, made a purchase valued between $1,001 and $15,000. The transaction was reported two days later on November 27, 2024.

Similarly, Representative Jared Moskowitz, a Democrat, also from the House, engaged in a purchase of JPM stocks on November 8, 2024, within the same value range. This transaction was reported on December 9, 2024. These trades reflect a bipartisan interest in JPMorgan Chase, potentially indicating confidence in the financial sector’s performance or strategic positioning in anticipation of market movements. The timing of these purchases, close to each other but differing in political party representation, might suggest broader economic factors influencing investment decisions among legislators.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.