Target Stock Represents $100B Sales with 2 Billion Orders Annually

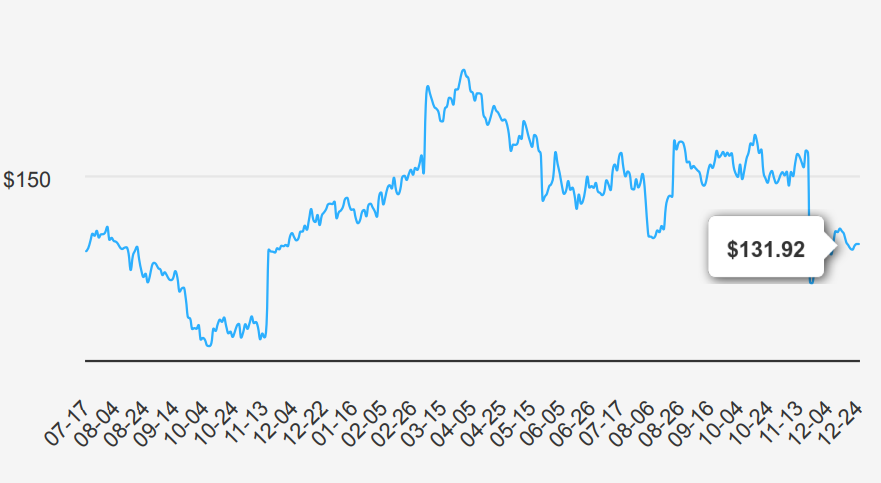

Target (TGT) serves as the nation’s seventh-largest retailer, with its strategy predicated on delivering a gratifying in-store shopping experience and a wide product assortment of trendy apparel, home goods, and household essentials at competitive prices. Target’s upscale and stylish image began to carry national merit in the 1990s—a decade in which the brand saw its top line grow threefold to almost $30 billion—and has since cemented itself as a leading US retailer.Today, Target operates over 1,950 stores in the United States, generates over $100 billion in sales, and fulfills over 2 billion customer orders annually. The firm’s vast footprint is typically concentrated in urban and suburban markets as the firm seeks to attract a more affluent consumer base. TGT stock is currently trading ~$132. Lets explore Target stock forecast.

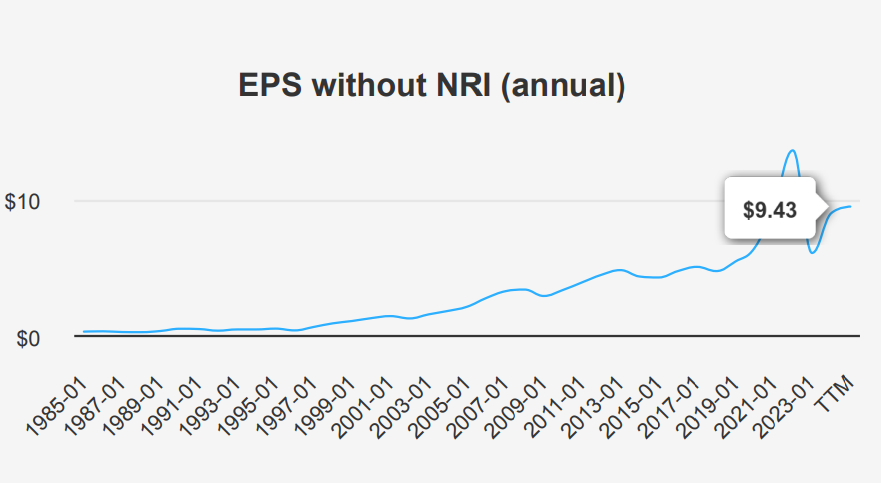

EPS Decline to $1.85 Amid Margin Pressures and Stable Revenue

In the latest quarter ending October 2024, Target reported an EPS without non-recurring items (NRI) of $1.85, down from $2.57 in the previous quarter and $2.10 a year ago. This reflects a challenging period with a quarter-over-quarter (QoQ) decline of approximately 28% and a year-over-year (YoY) decrease of about 12%. Revenue per share increased slightly to $55.619 from $54.913 last quarter, showcasing a modest improvement in sales. Over the past five years, TGT has maintained a Compound Annual Growth Rate (CAGR) in EPS of 8.10%, while the 10-year CAGR stands at 9.40%.

Target’s gross margin for the quarter was 28.40%, slightly below its 5-year median of 29.27%, indicating some pressure on profitability relative to historical levels. The company has been engaging in share repurchase activities, with a 1-year buyback ratio of 0.50, meaning it repurchased 0.5% of its outstanding shares, contributing to an enhanced EPS by reducing the number of shares in circulation. Over the last decade, the buyback ratio averaged 3.50, suggesting a consistent strategy to return value to shareholders through buybacks.

Looking forward, analysts estimate Target’s EPS for the next fiscal year ending 2025 to reach $8.606, growing to $9.232 by the following year. Revenue projections for the next three years anticipate steady growth, with estimates reaching $112,571.2 million by 2027. The industry growth forecast over the next decade suggests a moderate increase, aligning with TGT’s strategic initiatives to capitalize on market trends. The next earnings release is on March 5, 2025, providing further insight into the company’s performance and strategic direction.

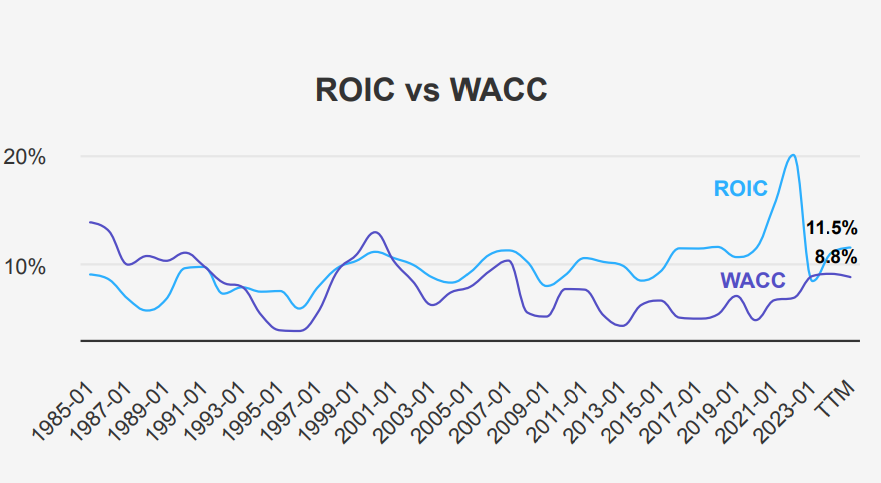

ROIC of 11.5% Surpasses 8.8% WACC, Signaling Value Creation

Analyzing Target’s financial performance through its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) provides insight into its value creation. The 5-year

median ROIC for Target stands at 11.36%, with a current ROIC of 11.50%. In comparison, the 5-year median WACC is 6.90%, while the current WACC is 8.86%. Notably, Target’s ROIC consistently exceeds its WACC, indicating that the company is generating positive economic value over time.

This positive spread between ROIC and WACC suggests that Target is efficiently using its capital to generate returns above its cost of capital. Such a performance is indicative of strong management and effective capital allocation strategies. Additionally, the 5-year median ROE of 33.25% further supports this view, highlighting robust profitability and efficient equity utilization. Overall, Target’s ability to sustain an ROIC above its WACC highlights its capability to create shareholder value and maintain its competitive advantage in the retail sector.

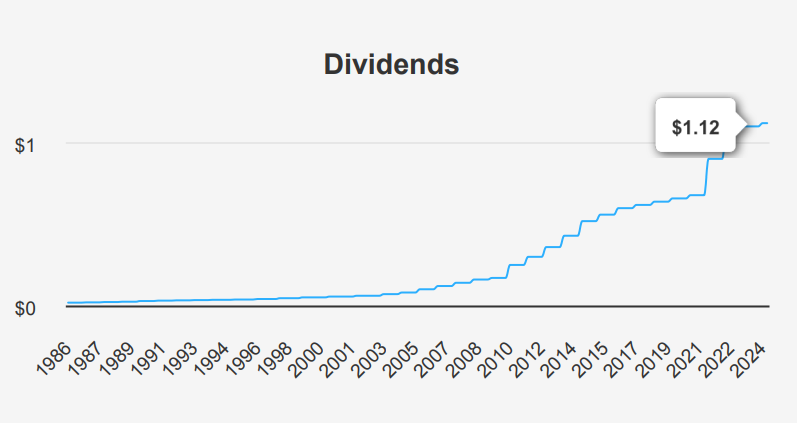

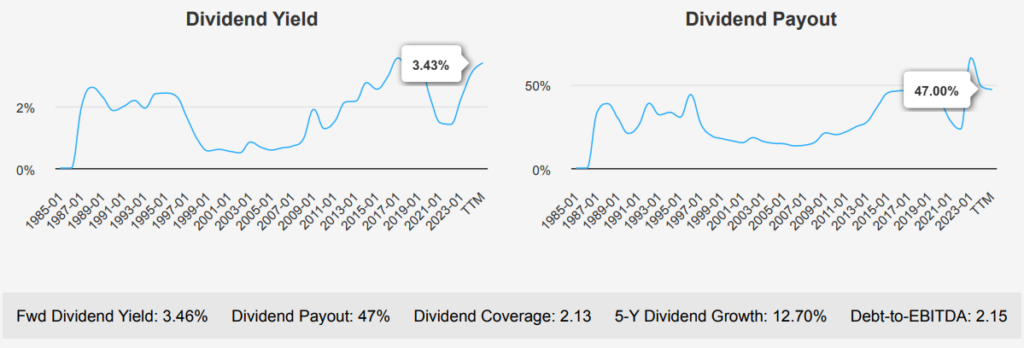

Dividend Growth Slows to 2.1% Forecast; Yield Stands at 3.46%

Target stock has demonstrated robust dividend growth over the past five years with a growth rate of 12.70%. The recent increase in the dividend per share from $1.10 to $1.12 reflects a commitment to returning value to shareholders. However, future dividend growth is estimated at a more modest 2.10%, indicating a potential slowdown. The forward dividend yield of 3.46% is competitive within the retail sector, providing an attractive income stream for investors. The dividend payout ratio remains healthy at 47%, suggesting sustainability in dividend payments even as the company balances growth and capital allocation.

The Debt-to-EBITDA ratio stands at 2.15, which is within a moderate range. This suggests that while TGT carries some debt, it maintains a reasonable capacity for debt servicing without overly stretching its financial limits. Sector comparison shows TGT’s dividend yield is higher than its 10-year median yield of 2.78%, which can appeal to income-focused investors. The next ex-dividend date is set for November 20, 2024, aligning with its quarterly distribution pattern. This date ensures that eligible shareholders will receive the upcoming dividend payout scheduled for December 10, 2024.

Overall, Target’s dividend strategy appears stable, though cautious, with potential growth tempered by broader financial considerations.

Target Stock Forecast Undervalued by 14%

Target stock currently trades at $131.92, below its intrinsic value of $153.23, suggesting a margin of safety of 13.91%. The stock’s TTM P/E ratio stands at 13.99, which is below its 10-year median of 16.10, indicating potential undervaluation. The Forward P/E of 14.29 remains relatively aligned with the TTM value, suggesting stable earnings expectations. The TTM EV/EBITDA ratio is 8.46, close to its 10-year median of 9.07, pointing to a fair valuation relative to historical norms. Meanwhile, the TTM P/B ratio of 4.18 is slightly below the 10-year median of 4.36, although higher than the 10-year low of 2.54, showing some room for downward adjustment if market conditions worsen. The TTM P/S ratio is 0.57, under the 10-year median of 0.66, which may indicate undervaluation in terms of revenue generation.

Notably, the TTM Price-to-Free-Cash-Flow ratio is 13.45, aligning closely with its 10-year median of 13.59, suggesting the stock is fairly valued on cash flow metrics. Historical trends reveal that TGT’s valuation multiples are compressed compared to their highs, reflecting potential market skepticism or macroeconomic pressures affecting retail. Analysts have set a price target of $143.77, consistent with previous estimates but reflecting a downward adjustment over the past few months. With 39 analyst ratings and 8 analysts actively following the stock, the consensus suggests cautious optimism. Given the intrinsic value and supportive valuations, TGT appears to be undervalued, offering a modest margin of safety for investors willing to bet on its longer term fundamentals.

Mixed Signals: Declining Margins vs. Solid Financial Indicators

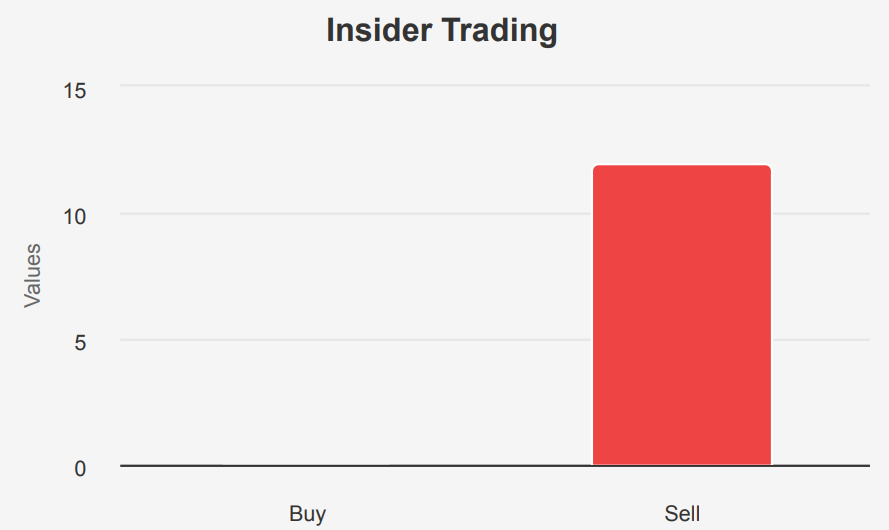

Target stock presents a mixed risk profile. On the downside, the company has been increasing its long-term debt, although the current debt levels remain within acceptable limits. The recent performance of share buybacks has been suboptimal, with the stock trading significantly below the average buyback price, which may suggest poor timing. Operational challenges are evident as well, with both gross and operating margins experiencing annual declines of 2.4% and 4.2%, respectively. The lack of insider buying and the occurrence of insider selling could hint at internal confidence concerns. Additionally, a slowdown in revenue growth over the past year adds to these worries.

Conversely, TGT exhibits several robust financial health indicators. The Piotroski F-Score of 8 suggests strong financial health, while a Beneish M-Score of -2.72 indicates a low likelihood of earnings manipulation. The company’s valuation metrics, including PB, PE, and PS ratios, are near recent lows, which may present attractive entry points for value-focused investors. Moreover, the stock’s dividend yield is nearing a one-year high, and the Altman Z-score of 3.17 indicates strong financial stability. These positive factors could mitigate some of the operational and market risks, providing a balanced Target stock forecast.

12 Insider Sells, 0 Buys in 12 Months: Confidence Concerns?

Over the past year, insider activity at Target stock has shown a notable trend towards selling, with no insider purchases recorded. In the last 12 months, there have been 12 insider sell transactions, indicating a consistent pattern of insiders divesting their shares. This trend has persisted over the shorter term as well, with 4 sell transactions in the last 6 months and 1 in the last 3 months.

The absence of insider buying could suggest that insiders might not perceive the current stock price as undervalued or that they foresee potential challenges ahead in Target stock forecast. However, it is important to consider that insider ownership stands at 0.68%, which is relatively low, implying that management and directors do not hold substantial stakes in the company. In contrast, institutional ownership is quite high at 88.01%, suggesting that institutional investors have significant confidence in the company’s prospects.

Overall, the selling trend among insiders could be a signal for investors to closely monitor upcoming developments and the company’s performance.

Daily Trading Volume Hits 4M Shares; Dark Pool Index at 40%

Target stock shows a daily trading volume of 4,092,623 shares, compared to an average daily trade volume of 7,490,162 shares over the past two months. This indicates that the current trading activity is below the recent average, suggesting reduced liquidity in the market. Lower trading volumes can potentially lead to higher volatility and wider bid-ask spreads, as there are fewer participants in the market

to facilitate trades efficiently.

The Dark Pool Index (DPI) for TGT stands at 40.01%. This figure indicates that a significant portion of TGT’s trades are occurring in dark pools, which are private exchanges or forums for trading securities. A DPI of 40.01% suggests substantial non-transparent trading activity, which could impact the stock’s price discovery process and lead to less visibility on actual trading intentions in the market.

Overall, while TGT’s current trading volume is below its two-month average, the high DPI suggests a notable level of trading in less public venues. Investors should be aware of the potential implications for liquidity and price transparency under Target stock forecast.

Senator Carper Buys TGT Stock Twice in 2024, Signals Confidence

Senator Thomas R. Carper, a Democrat from the Senate, executed two notable stock purchases involving Target stock in 2024. The first transaction occurred on February 16, 2024, with a reported range of $1,001 to $15,000. This trade was disclosed on March 4, 2024.

Following this, Carper made another purchase of Target stock on May 22, 2024, with the same financial range, which was reported on June 3, 2024. Both transactions reflect a consistent investment interest in Target over a short period. This could indicate a strategic move by Carper based on his analysis of the company’s performance potential or news. These trades are relatively modest in scale, suggesting a cautious yet optimistic approach towards the retail sector. Monitoring the performance of Target and any legislative discussions around retail could provide insight into Target stock forecast.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.