Core Markets and Channel Strategy Boost Dell Stock’s Enterprise Hardware Lead

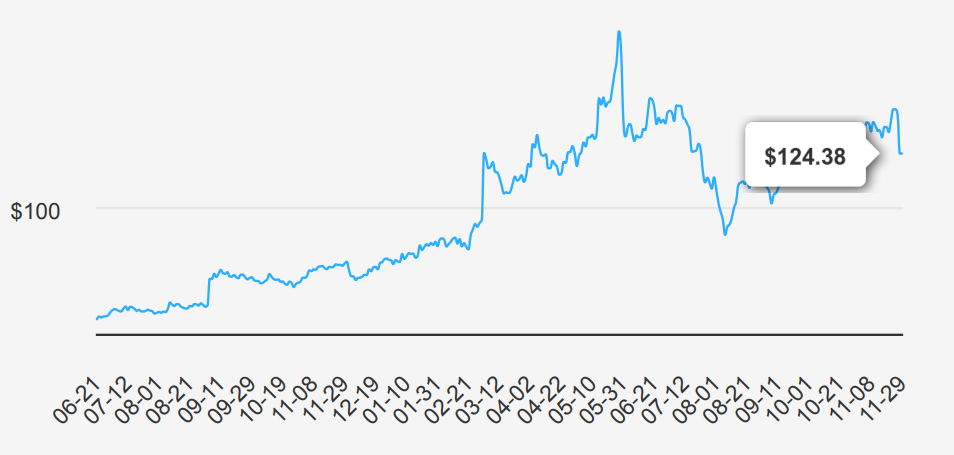

Dell Technologies (DELL) is a broad information technology vendor, primarily supplying hardware to enterprises. It offers premium and commercial personal computers and enterprise on premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales. Dell stock is currently trading at a price of ~$124-$127. Learn more on Dell stock forecast.

EPS Margins and Revenue Trends Indicate Flat Long-Term Growth

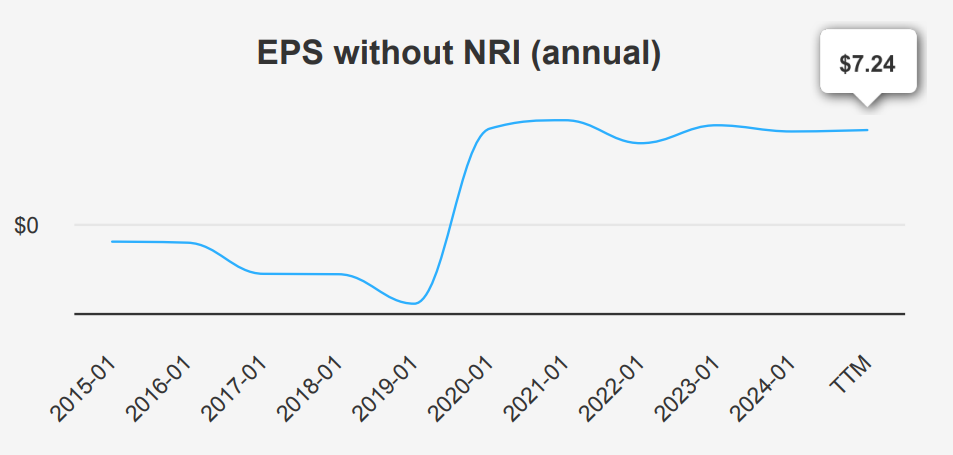

In the latest quarter ending October 2024, Dell reported an EPS without NRI (excluding non-recurring items) of $1.58, a decrease from $1.89 in the prior quarter but slightly up from $1.36 a year ago. Revenue per share was $34.009, stable compared to $34.61 in the previous quarter, and significantly above $30.069 in the same period last year. The company’s 5-year and 10-year Compound Annual Growth Rates (CAGR) for EPS remain at 0%, indicating stagnant growth over the periods. In contrast, the industry may grow at a robust rate of around 5% annually over the next decade.

Dell’s gross margin for the quarter was 22.08%, below its 5-year median of 23.24% and well under the 10-year high of 27.65%. The company’s share buyback ratio over the past year was 1.80%, meaning 1.8% of its outstanding shares were repurchased. This can enhance EPS by reducing the share count. Over the last three years, the buyback ratio was 2.10%, reflecting a more aggressive repurchase strategy. This activity focuses on returning value to shareholders, potentially offsetting some earnings dilution from lower margins.

Looking ahead, analysts estimate Dell’s EPS to reach $6.062 for the next fiscal year ending January 2025, and $6.781 for the following year. Revenue may grow from $96.54 billion in 2025 to $111 billion by 2027, suggesting a positive outlook amidst industry growth. The next earnings report will be on February 25, 2025, which will provide further insights into Dell stock forecast and strategic direction.

ROIC vs. WACC: Mixed Signals on Capital Efficiency

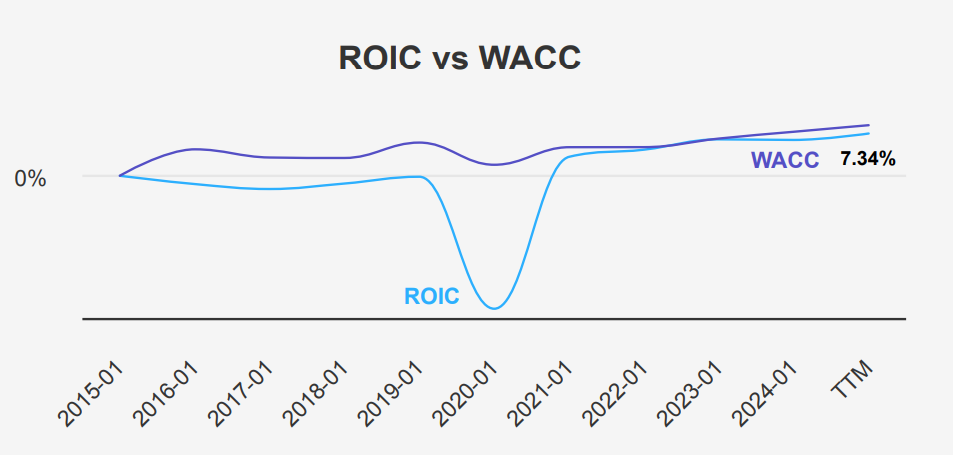

Dell’s financial performance and value creation can be assessed through its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). Over the last decade, Dell’s median ROIC has been 4.53%, with more recent figures reaching 7.72%, indicating an improvement in capital efficiency. This suggests Dell is becoming more effective at generating returns from its capital investments.

Comparatively, Dell’s WACC has varied, with a current figure of 8.66% reflecting the company’s cost of capital from both equity and debt. Historically, the median WACC has been approximately 4.96%, indicating a low-cost capital environment.

Over the past five years, Dell’s ROIC (4.53%) has often lagged behind its WACC (4.97%), suggesting that during this period, Dell struggled to create economic value as the cost of capital exceeded the returns generated. However, the recent ROIC of 7.72% surpasses the WACC of 8.66%, indicating positive value creation is beginning to take place, albeit marginally. This shift is promising but suggests Dell needs to continue enhancing its capital efficiency to sustain value creation.

Dell Stock: Low Dividend Yield with Room For 11.34% Growth by 2027

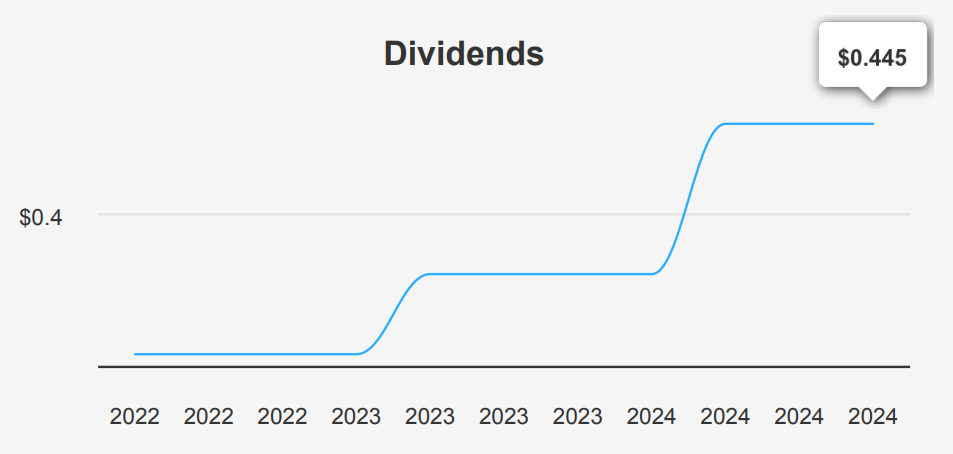

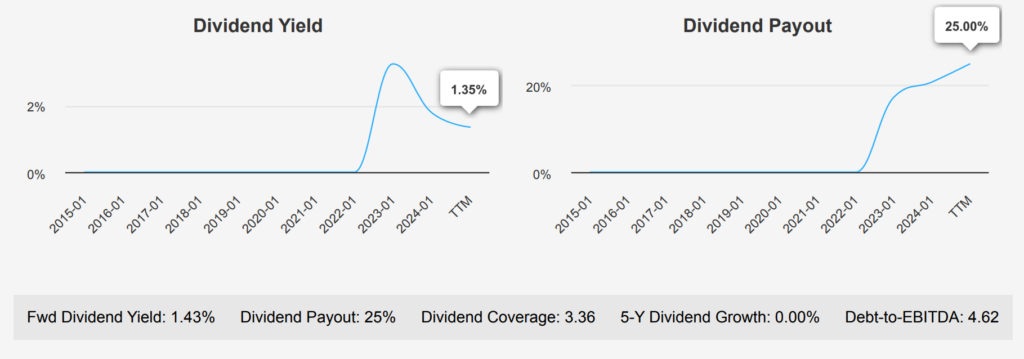

Dell stock has maintained a flat dividend growth rate over the past 3 to 5 years, with no increase in dividends per share observed. However, the company recently raised its quarterly dividend from $0.37 to $0.445, indicating a potential shift towards dividend growth. The forward dividend yield stands at 1.43%, which is below the sector median. This suggests that dividend returns are not a primary focus for Dell compared to its peers.

The company’s Debt-to-EBITDA ratio is 4.62, indicating a higher financial risk and potential concerns about its capacity to manage debt effectively. This ratio exceeds general guidelines, suggesting that Dell may need to prioritize debt reduction to improve its financial health. The dividend payout ratio is low at 25%, providing room for future dividend increases. Despite the historical flat growth, the estimated future 3- 5 year dividend growth rate is 11.34%, which is promising under Dell stock forecast.

The next ex-dividend date is on January 23, 2025. Given the quarterly frequency, the subsequent ex-dividend date should be around January 21, 2025, which is a Tuesday. This projection reflects Dell’s commitment to maintaining consistent dividend payments.

Dell Stock: Valuation Metrics Raise Red Flags Despite Analyst Optimism

Dell Technologies’ forward Priceto-Earnings (P/E) ratio stands at 13.22, lower than the trailing twelve months (TTM) P/E of 21.68, hinting at anticipated earnings growth. Historically, the 10-year P/E ratio median is 10.98, illustrating a potential overvaluation against its historical median.

When examining other valuation metrics, Dell’s TTM Price-to-Sales (P/S) ratio is 0.95, positioned above its 10-year median of 0.34, suggesting a relatively higher valuation compared to historical norms. The TTM EV/EBITDA ratio of 19.76 is also high against its 10-year median of 8.04, further indicating overvaluation. Notably, the TTM Price-to-Book (P/B) ratio is at 0, which implies either data inconsistency or an accounting anomaly, as the historical median is 9.58. The TTM Price-to-Free-Cash-Flow ratio is 31.44, substantially above its 10-year median of 4.71, reinforcing concerns of overvaluation.

Analyst sentiment reflects a slightly optimistic view, with a price target of approximately $150.63. Although this target suggests some upside potential from the current price, the negative margin of safety derived from intrinsic valuation raises caution. The analyst ratings indicate mixed opinions, with a slight tilt towards buying, but the valuation metrics suggest Dell stock may hold overvaluation relative to historical averages and intrinsic value, warranting careful consideration for investors assessing entry points under Dell stock forecast.

Declining Margins, Insider Selling Highlight Long-Term Risk

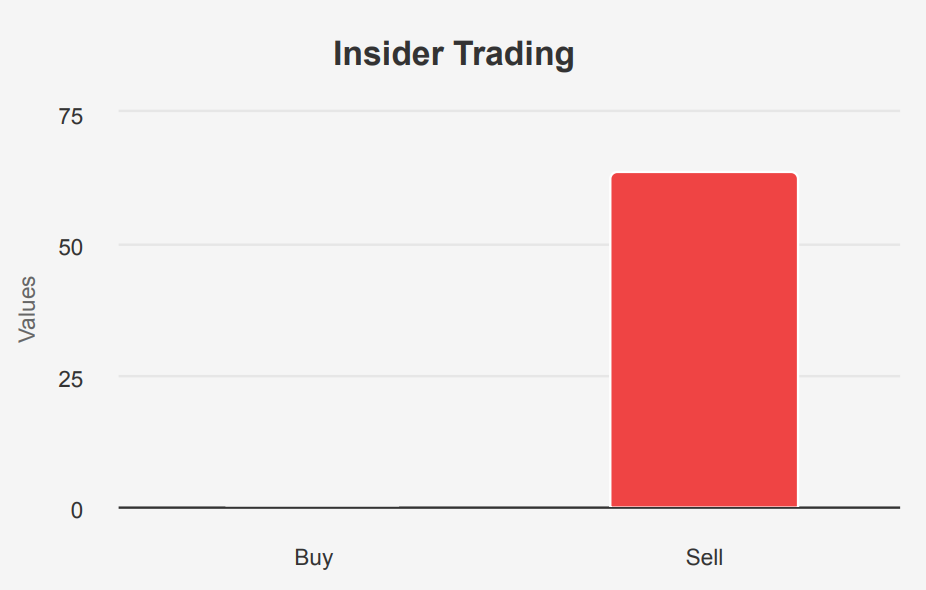

Dell Technologies Inc. faces several financial risks that potential investors should consider. Firstly, the company’s gross margin has shown a long-term decline at an average rate of 3.2% per year, indicating potential challenges in maintaining profitability. This declining margin could be exacerbated by the unsustainably low tax rate the company currently benefits from, which, if normalized, might negatively impact earnings. Additionally, insider activity reveals a concerning trend, with 10 insider sell transactions and no purchases in the past three months, suggesting a possible lack of confidence in Dell’s stock forecast.

Further compounding these issues, Dell’s return on invested capital is lower than its weighted average cost of capital, raising questions about its capital efficiency. The Altman Z-score of 1.78 places the company in the distress zone, indicating a higher risk of bankruptcy within the next two years. However, Dell’s Piotroski F-Score of 8 suggests a strong overall financial health, and the Beneish M-Score indicates low likelihood of financial manipulation. While these positive indicators provide some reassurance, potential investors should weigh these against the more pressing risk factors before making investment decisions.

Consistent Insider Selling with Zero Purchases in the Last Year

In reviewing insider trading activities for Dell, a clear trend emerges from the past year showing significant insider selling activity. Over the past 12 months, there have been 64 insider sell transactions with no corresponding insider buy transactions. This pattern is consistent across the 3-month and 6- month periods, with 10 and 37 insider sales respectively, and still no purchases.

The absence of insider buying alongside substantial selling may indicate that company insiders are taking profits or possibly expressing concerns about future company performance. However, it’s crucial to consider these activities in the broader context of market trends and company-specific developments.

Insider ownership stands at 3.01%, suggesting a relatively modest stake by those within the company, which may reduce the direct impact of insider transactions on market perceptions. Institutional ownership is higher at 31.81%, signifying that a significant portion of the company’s shares are held by institutional investors, who may have differing insights on Dell stock forecast and strategies compared to individual insiders.

Trading Volume Spikes with 54.98% Dark Pool Activity In Dell’s Stock

Dell has demonstrated significant trading activity with a recent trading volume of 37,481,367 shares, showing a substantial increase compared to its average daily trading volume of 7,575,568 shares over the past two months. This surge suggests heightened investor interest and could be indicative of market-moving news or events influencing Dell’s stock.

The Dark Pool Index (DPI) for Dell stands at 54.98%, implying that more than half of the trading in Dell’s stocks occurs in dark pools rather than on public exchanges. This level of dark pool activity can indicate significant institutional interest, as large investors utilize dark pools to execute trades without impacting market prices excessively.

Overall, Dell’s current liquidity position appears robust, with the ability to accommodate large trades without significant price impact. The elevated trading volume further enhances liquidity, making it easier for investors to enter and exit positions. However, the high DPI percentage also suggests that a considerable portion of trading is happening out of the public eye, which could affect transparency and pricing efficiency in the broader market.

Recent Congressional Buys Indicate Potential Confidence in Dell

In recent months, Representative Marjorie Taylor Greene, a Republican from the House of Representatives, made two notable purchases of Dell. The most recent transaction was on November 7, 2024, with a reported amount range of $1,001 to $15,000. The report was filed a day later on November 8, 2024, and subsequently updated on November 11, 2024. A similar purchase was made earlier on October 4, 2024, with the same amount range, reported on October 8, 2024, and last modified on October 9, 2024.

These transactions suggest a continued interest in Dell stock by Representative Greene, possibly indicating her confidence in the company’s performance or strategic positioning. This pattern of investment might also reflect broader trends or anticipated developments in the tech sector that Greene expects to benefit from. As always, the timing and frequency of such trades can offer insights into the investor’s expectations or strategy.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.