Broadcom Stock: Billions In Revenue and Multi-Sector Expansion

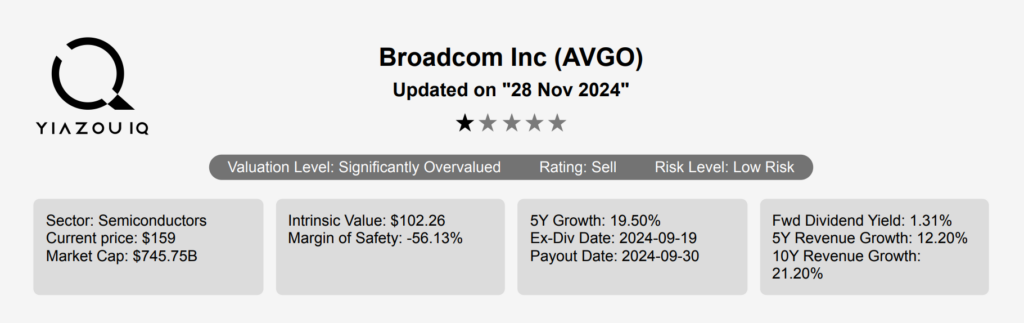

Broadcom (AVGO) is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments. Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software. AVGO stock is currently trading at ~$160. Discover more on AVGO stock forecast.

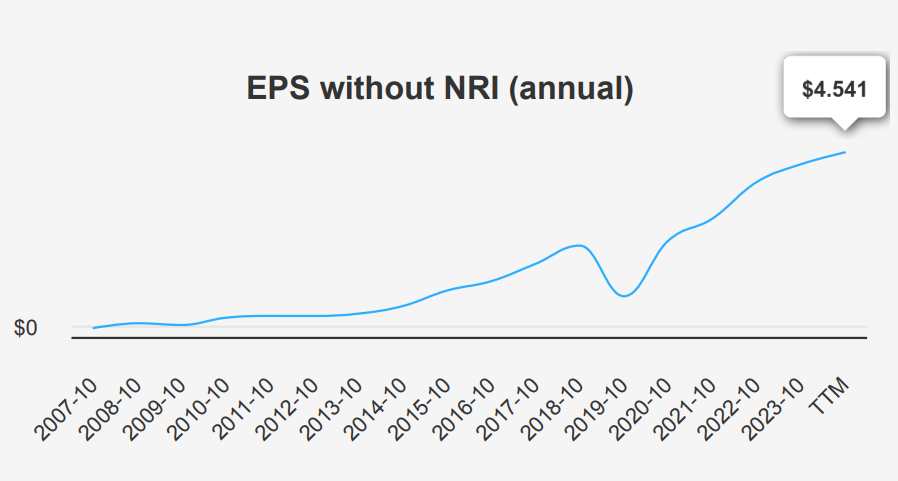

Broadcom’s EPS Climbs 27.9% CAGR Despite Challenges

In the latest quarter ending July 31, 2024, Broadcom reported an EPS without non-recurring items (NRI) of $1.24, marking an increase from the $1.096 in the prior quarter (Q2 2024) and the $1.054 reported in Q3 2023. On a year-over-year basis, this represents an improvement, driven by strong revenue per share growth, which rose to $2.803 from $2.079 a year ago. The 5- year compound annual growth rate (CAGR) for annual EPS without NRI is 27.90%, while the 10-year CAGR stands at 26.10%, reflecting consistent long-term growth. Industry forecasts suggest a growth rate of around 7% annually over the next decade, indicating a favorable market environment for Broadcom.

Broadcom’s gross margin for the latest quarter was 63.90%, slightly above the 5-year median of 61.36%, indicating robust operational efficiency and cost management. The company is actively engaging in share buybacks, with a 1-year buyback ratio of -13.10%, meaning 13.10% of the previous shares were repurchased. Over a 10-year period, the buyback ratio is -5.40%, showing a significant reduction in outstanding shares which has supported EPS growth by reducing the denominator in the EPS calculation, enhancing shareholder value under AVGO stock forecast.

Looking forward, analysts project strong revenue growth with estimates of $51,650.51 million in 2024, $60,549.41 million in 2025, and $68,337.6 million in 2026. The estimated EPS for the fiscal year ending in 2025 is $1.196, with a significant jump to $4.008 in 2026, suggesting strong future earnings potential. The next earnings report is on December 12, 2024, which will provide further insights into the company’s performance and whether it meets these optimistic forecasts.

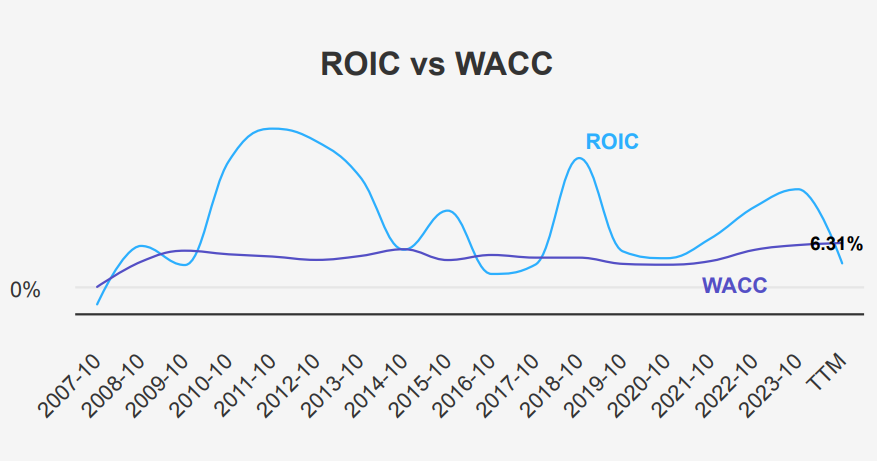

ROIC vs. WACC: Broadcom Stock’s Economic Value Shift

Under AVGO stock forecast, the company’s financial performance can be assessed by examining its ROIC in comparison to its WACC. Over the past five years, AVGO’s median ROIC stands at 13.03%, which is well above the five-year median WACC of 6.94%. This indicates that historically, AVGO has been generating positive economic value, as its ROIC exceeds its WACC, demonstrating efficient capital allocation and value creation for shareholders.

However, the most recent ROIC is 6.31%, which is below the current WACC of 11.78%. This suggests a shift where AVGO is not covering its cost of capital, potentially indicating challenges in maintaining its earlier level of financial efficiency and value creation. The disparity between its ROIC and WACC in the current period could suggest issues such as increased operational costs or less efficient capital usage that need addressing to revert back to value-positive operations.

Overall, while AVGO has shown strong historical performance, the current figures suggest a need for strategic adjustments to restore positive economic value generation.

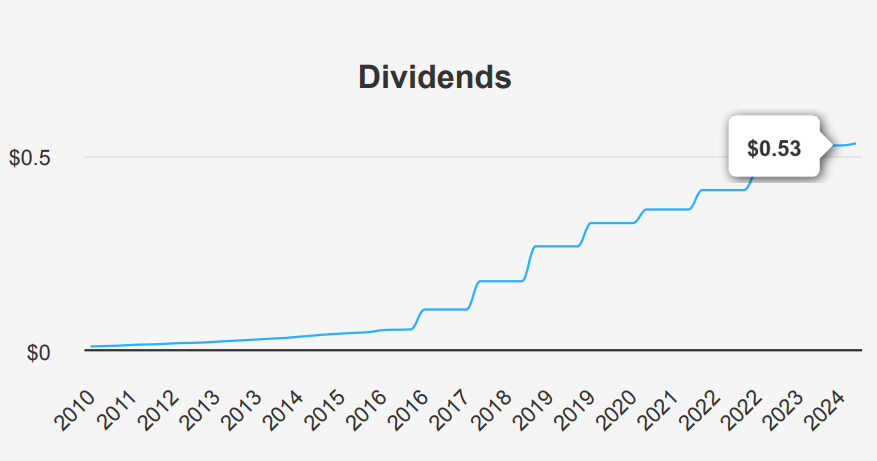

AVGO Stock Holds Dividend Growth at 13.18% Over 3 Years

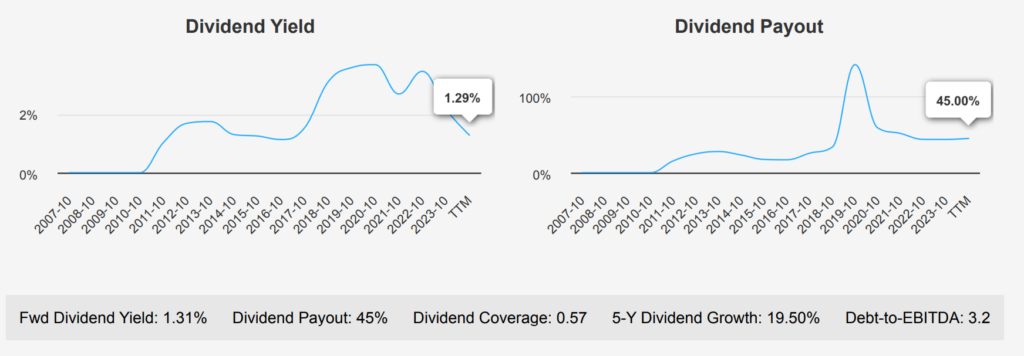

AVGO has demonstrated notable dividend growth, with a 5-year growth rate of 19.5% and a more recent 3-year rate of 12.3%. The most recent quarterly dividend increased to $0.53 per share from $0.525, reflecting consistent growth. The forward dividend yield stands at a modest 1.31%, which, while lower than historical highs, suggests steady income under the AVGO stock forecast.

In a sector comparison, AVGO’s dividend yield is below its 10-year median of 2.16%, indicating a potential underperformance relative to historical norms. The company’s dividend payout ratio is currently a sustainable 45.0%, significantly lower than its 10-year high of over 100%, which suggests improved earnings or reduced payout commitments.

AVGO’s Debt-to-EBITDA ratio is 3.20, placing it in a moderate risk category. This suggests the company has manageable leverage, although sector-specific dynamics should be considered.

The estimated dividend growth rate for the next 3-5 years is 13.18%, indicating continued confidence in dividend sustainability and growth. The next ex-dividend date is on December 19, 2023, assuming quarterly distributions. This reflects a stable dividend policy despite high industry competition and economic fluctuations.

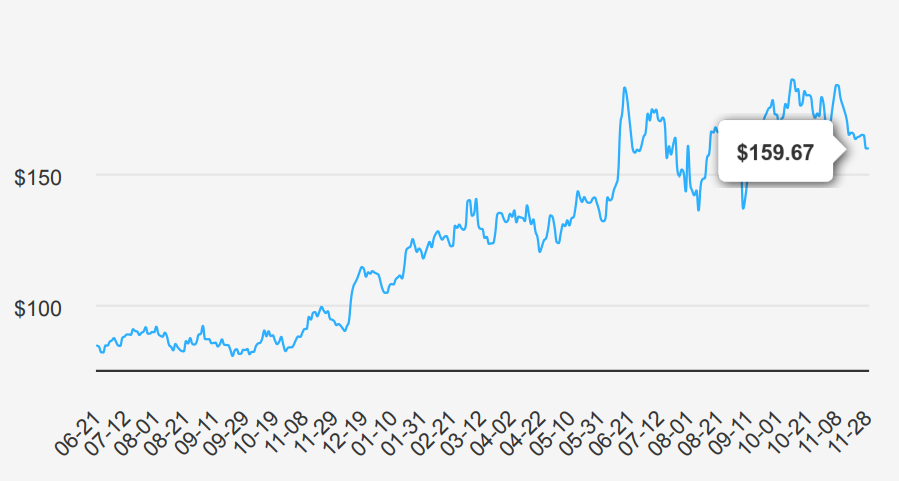

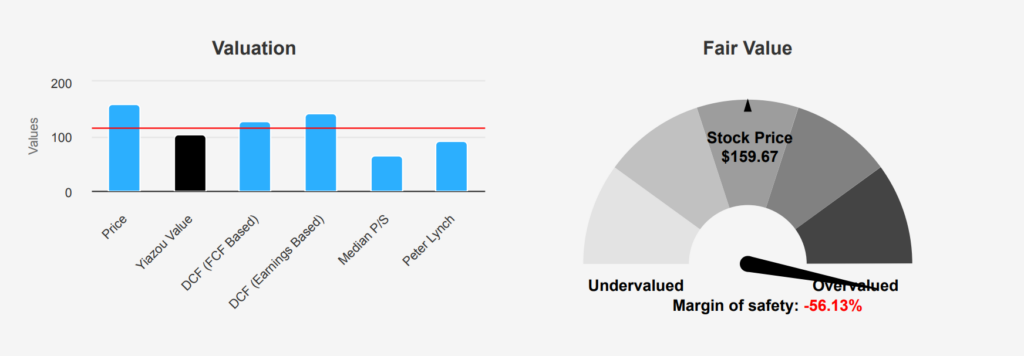

AVGO Stock Trades 56% Above Intrinsic Value

Broadcom currently trades at $159.67, which significantly exceeds its intrinsic value of $102.26, suggesting a negative margin of safety of -56.14%. This indicates that there is potentially overvalued under the AVGO stock forecast. The TTM P/E ratio stands at 138.72, well above the 10- year median of 37.46, hinting at high valuation levels. The forward P/E is more reasonable at 25.95, suggesting expectations of improved earnings. However, the TTM EV/EBITDA ratio is 37.89, also above the 10-year median of 17.72, which indicates an inflated valuation compared to historical norms.

In terms of price-to-sales (P/S) and price-to-book (P/B) ratios, AVGO’s figures are notably high. The TTM P/S ratio is 16.41, compared to a 10- year median of 6.34, and the TTM P/B ratio is 11.36, compared to a median of 7.64. These elevated ratios suggest that investors are paying a premium relative to the company’s sales and book value. The price-to-free-cash-flow (P/FCF) ratio at 40.98 is also significantly higher than the median of 18.36, reflecting high expectations for cash flow generation.

Despite these valuation concerns, analyst sentiment remains positive, with a price target of $196.23, indicating potential for price appreciation. However, the stock’s current valuation metrics suggest caution, as they deviate significantly from historical averages, implying overvaluation. Investors should weigh these metrics carefully against the company’s growth prospects and market conditions when considering AVGO as an investment option.

Mixed Indicators: Insider Selling vs. Operational Stability

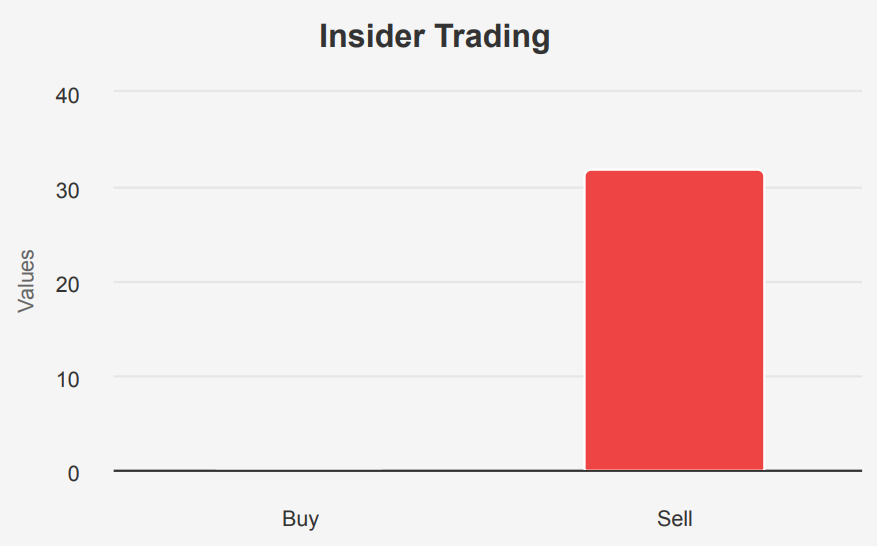

Broadcom presents a mixed risk profile. On the downside, insider activity shows a concerning trend, with 10 insider selling transactions and no insider buys in the past three months, involving the sale of 349,980 shares. This could indicate a lack of confidence from insiders. Additionally, the company’s return on invested capital (ROIC) is below its weighted average cost of capital (WACC), suggesting potential inefficiencies in capital use, which could impact long-term profitability.

However, there are positive indicators that suggest stability. The Beneish M-Score of -2.01 suggests that the company is unlikely to be manipulating its financial results, providing some reassurance of financial reporting integrity. Broadcom’s operating margin has been expanding, a positive indicator of improving operational efficiency. Consistent revenue and earnings growth per share further reinforces the company’s stable performance outlook. The strong Altman Z-score of 5.05 indicates a low probability of financial distress, reflecting a solid financial position.

In summary, while there are some red flags regarding insider sentiment and capital efficiency, Broadcom’s robust financial health and operational improvements counterbalance, suggesting a moderately cautious yet optimistic outlook under the AVGO stock forecast.

Minimal Insider Ownership, Continued Selling Trend

Based on the recent insider trading activity for Broadcom, there is a notable trend of insider selling over the past year, with no recorded buying activity. In the last three months, there have been 10 insider sell transactions, increasing to 14 over six months, and 32 within the past year. This consistent selling pattern might indicate that insiders are capitalizing on stock valuations or reallocating their portfolios.

The insignificant insider ownership of 0.03% suggests that company executives and directors hold a very small portion of the company’s total shares, which may limit their influence on stock price movements. Meanwhile, institutional ownership stands robust at 78.54%, indicating a strong institutional presence and potential confidence from large-scale investors.

The ongoing selling trend by insiders, coupled with minimal insider ownership, suggests that while insiders are divesting, institutional investors maintain a dominant position in the stock, which could be reassuring for other stakeholders. However, investors might view continued insider selling as a signal to scrutinize potential reasons behind these transactions further.

AVGO Trades High Volume with 36.9% Dark Pool Activity

Broadcom exhibits robust liquidity with a current daily trading volume of 19,373,822 shares. This figure surpasses its two-month average daily trade volume of 18,816,530 shares, indicating heightened market activity and investor interest. Such volume suggests that investors can enter or exit positions relatively easily without significantly impacting the stock price, a key consideration for both retail and institutional investors.

The Dark Pool Index (DPI) stands at 36.9%, suggesting that a significant portion of AVGO trades occur off the major exchanges in private trading venues or “dark pools.” This may imply that institutional investors are actively trading AVGO, although it might also limit transparency and affect price discovery.

Overall, AVGO’s trading metrics reflect a liquid market with active participation, while the substantial dark pool activity highlights the stock’s appeal to institutional players. This combination of factors provides a favorable environment for both short-term traders and long-term investors, given the ease of executing large trades without substantial price disruption.

Representative Trades: AVGO Sales Signal Market Strategy

In the recent trading activities from Congress, Representative Josh Gottheimer, a Democrat from the House of Representatives, executed notable sales of AVGO shares on two occasions. The first transaction occurred on September 12, 2024, where he sold shares valued between $1,001 and $15,000. This was followed by another similar sale on October 3, 2024, with the same value range. Both transactions were reported within a month of their occurrence, with the first being reported on October 3, 2024, and the second on November 6, 2024. These transactions could suggest a strategic repositioning of Gottheimer’s portfolio, possibly in response to market conditions or personal financial strategies. Monitoring such trades can offer insights into potential market trends or individual financial strategies of lawmakers.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.