Warner Bros Discovery Stock: Invest In Entertainment And Its Global Reach

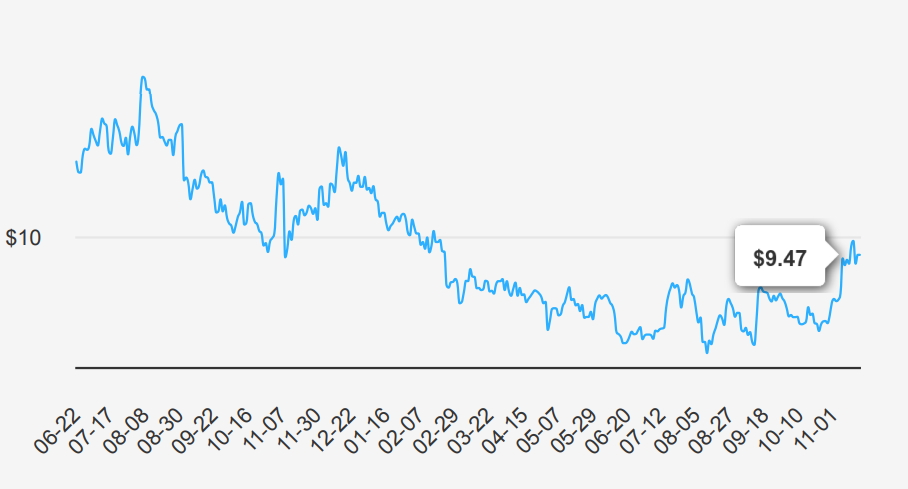

Warner Bros. Discovery (WBD) was formed in 2022 through the combination of WarnerMedia and Discovery Communications. It operates in three global business segments: studios, networks, and direct-to-consumer. Warner Bros. Pictures is the crown jewel of the studios business, producing, distributing, and licensing movies and television shows. The network business consists of basic cable networks, such as CNN, TNT, TBS, Discovery, HGTV, and the Food Network. Direct-to-consumer includes HBO and the firm’s streaming platforms, which have now been consolidated to Max and Discovery+. Much of the DTC content is created within the firm’s other two business segments. Each segment operates with a global reach, with Max available in over 60 countries. WBD stock is currently trading near $9.5. Let’s explore Warner Bros stock forecast.

Quarterly Earnings Analysis and Growth Projections

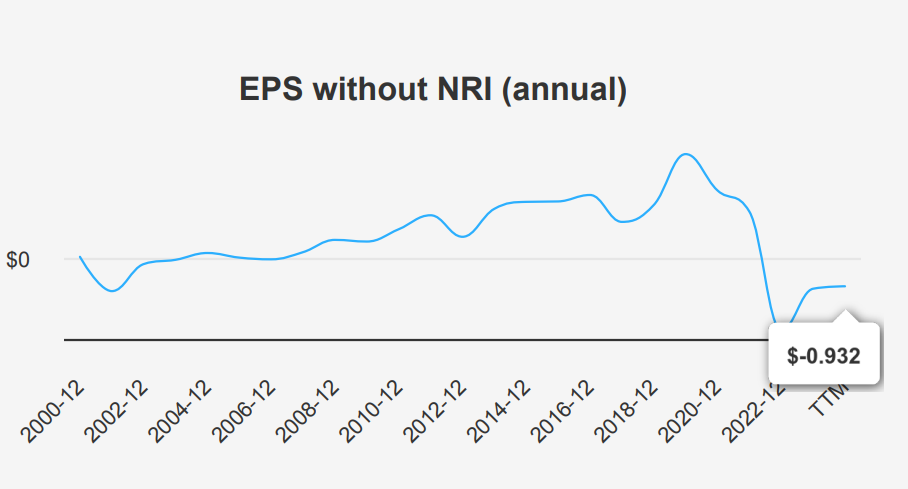

Warner Bros. Discovery reported an EPS without NRI (excluding non-recurring items) of $0.054 for Q3 2024, a significant improvement from the previous quarter’s loss of $0.463 and the same quarter last year at a loss of $0.053. This indicates a positive trend in quarterly performance. The latest industry forecast predicts a growth rate of approximately 4% annually over the next decade.

WBD’s gross margin for the quarter stood at 41.03%, which is lower than the 5-year median of 62.10% and the 10-year median of 62.64%, indicating pressure on profitability. The company’s share buyback ratio over the past year was -0.60%, reflecting a reduction in the number of shares outstanding, which can enhance EPS by increasing the earnings attributed to each remaining share. Over 10 years, the buyback ratio was -18.20%, implying a consistent strategy of reducing share count, although the impact on EPS has been limited by other financial challenges.

Looking forward, analysts estimate the next fiscal year’s EPS at -4.369, with a slight positive shift to $0.009 in the subsequent year. This outlook suggests challenges in achieving profitability in the near term. Revenue estimates for the next three years indicate modest growth, with figures projected at $39,567 million, $39,818 million, and $39,871 million, respectively. The next earnings release is expected on February 21, 2025, providing more insight into the company’s financial trajectory and potential adjustments to these estimates under Warner Bros stock forecast.

Financial Efficiency: Comparing ROIC and WACC

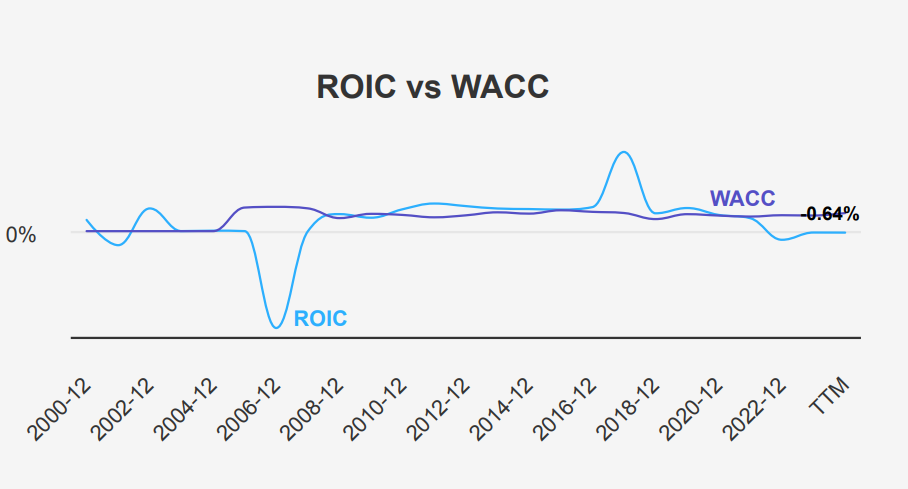

Under Warner Bros stock forecast, WBD shows a challenging financial performance regarding economic value creation, as evidenced by its recent Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). Over the past five years, WBD’s median ROIC stood at 5.70%, while its WACC was slightly higher at 6.88%. This indicates that the company has struggled to consistently cover its cost of capital, potentially destroying shareholder value in the process.

Furthermore, the current ROIC of -0.64% compared to a WACC of 7.98% underscores a significant gap, suggesting that WBD is not generating sufficient returns to justify its capital investments. This negative spread between ROIC and WACC highlights inefficiencies in capital allocation. Despite historical peaks, such as a 10-year high ROIC of 34.90%, recent performance metrics reflect ongoing financial difficulties.

Undervaluation Signals: Key Valuation Metrics

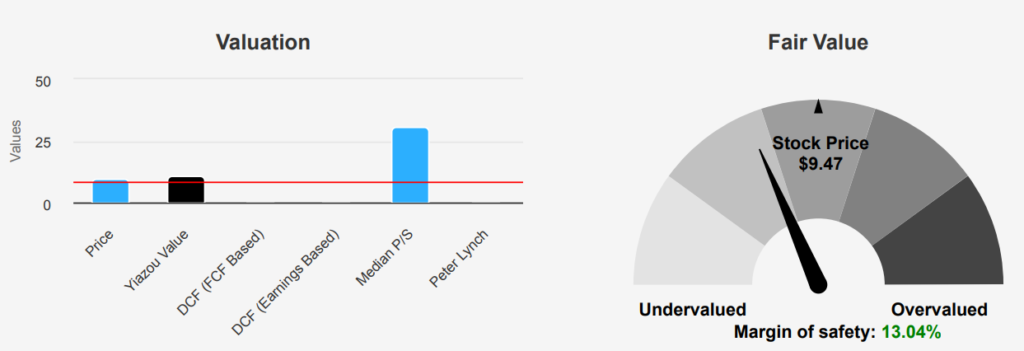

Warner Bros. Discovery currently trades at $9.47, below its intrinsic value of $10.89, suggesting a margin of safety of 13.04%. Analyzing the Forward P/E shows the stock at a loss, indicating no earnings forecast available, which aligns with historical lows. The TTM EV/EBITDA ratio stands at 4.94, slightly below the 10-year median of 5.76, suggesting potential undervaluation. The TTM P/S ratio is 0.59, closer to its 10-year low of 0.43, reinforcing the undervaluation trend. However, the TTM P/B ratio of 0.66, near its 10-year low of 0.40, further implies that the market might be undervaluing WBD’s assets.

The TTM Price-to-Free-Cash-Flow ratio of 4.36 is significantly lower than the 10-year median of 8.89, indicating undervaluation in cash flow generation ability. These metrics collectively suggest that WBD is trading below its historical valuation levels, providing a potential opportunity for investors. However, the lack of earnings visibility remains a risk factor, as reflected in the Forward P/E at a loss.

Analyst price targets have shown an upward trend over the past three months, currently at $11.22, indicating optimism about future prospects. With 30 analyst ratings, this shows a broad interest and potentially positive sentiment toward WBD’s future performance. The intrinsic value exceeding the current price by a margin suggests a potential buying opportunity, though investors should weigh this against the company’s earnings uncertainties and overall market conditions.

Assessing Risk Factors and Long-term Sustainability

Warner Bros. Discovery presents a mixed risk profile with several warning signs suggesting financial instability. The company’s assets have been growing at a rate of 36.1% annually, which significantly outpaces its revenue growth of 2.8% over the past five years. This could indicate declining operational efficiency and might be unsustainable in the long term. The gross margin has been experiencing a long-term decline at a rate of -10.1% per year, which further raises concerns about profitability and cost management. Additionally, the revenue per share has decreased over the past 12 months, pointing to potential challenges in maintaining sales levels.

The Altman Z-score of 0.09 places WBD in the distress zone, indicating a heightened risk of bankruptcy within the next two years. However, there are some positive indicators, including insider confidence, as evidenced by a recent insider purchase of 58,000 shares. Moreover, the Beneish M-Score of -3.02 suggests that the likelihood of financial manipulation is low. While these factors provide some reassurance, the overall financial health of WBD requires careful monitoring and strategic adjustments to mitigate the risks highlighted by the declining margins and low Z-score.

Insider Trading Trends and The Smart Street Confidence

In analyzing Warner Bros stock forecast, through insider trading activities over the past year, there have been four insider purchases against two sales. This indicates a net positive buying trend, suggesting that insiders may have confidence in the company’s prospects. In the most recent three-month period, there has been one insider purchase and no sales, which may imply a continued belief in the company’s performance or an undervaluation of its stock.

Insiders reported only one purchase and no sales over a six-month period, indicating steady but cautious buying behavior. Insider ownership remains relatively low at 1.10%, indicating that insiders do not hold a significant stake in the company.

On the institutional side, ownership stands at 61.03%, reflecting a strong institutional presence in WBD’s shareholder base. This high level of institutional ownership often points to market confidence and can imply that professional investors see potential in the company’s strategic direction and financial health. Overall, the insider and institutional trends suggest a cautiously optimistic outlook for WBD.

WBD Stock: Increased Liquidity and Market Sentiment

Warner Bros. Discovery has recently shown an increase in trading activity, with a current daily trading volume of 29,927,662 shares, surpassing its two-month average daily volume of 28,377,489 shares by 5.5%. This uptick suggests heightened interest or volatility in the stock, possibly driven by recent news or investor sentiment shifts.

Liquidity appears robust, as indicated by the high volume, which facilitates easier entry and exit for traders without significantly impacting the stock price. This level of liquidity is advantageous for both retail and institutional investors, allowing for efficient trade execution. The Dark Pool Indexes (DPI) for WBD stands at 47%, indicating that a significant portion of trading activity occurs in private exchanges, away from public markets.

A DPI below 50% suggests that dark pool trading does not dominate the stock’s trading volume, which can be a positive sign for transparency and price discovery in public markets. Overall, WBD’s current trading and liquidity metrics reflect a stable yet active market environment, offering both liquidity and transparency to market participants. Investors should monitor these metrics for any significant changes that could affect trading conditions or signal broader market sentiment shifts.

Congressional Trading Activity On WBD Stock and Market Impact

In recent congressional trading activity, two representatives from the House have engaged in sales involving Warner Bros. Discovery shares. On August 12, 2024, Representative Carol Devine Miller, a Republican, reported a sale valued between $1,001 and $15,000. This transaction was documented in a report dated September 13, 2024, and last modified on September 16, 2024. Similarly, on July 9, 2024, Democratic Representative Earl Blumenauer also executed a sale of WBD shares within the same value range. His transaction was reported on August 6, 2024, with the report last updated a day later on August 7, 2024.

These transactions might indicate a strategic shift or a reaction to market conditions affecting WBD. It is noteworthy that both sales occurred within a month of each other, suggesting potential coordinated actions or responses to similar market intelligence. Observers may wish to monitor further trading activities or statements from these representatives for additional insights.

Disclosures:

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.