Dell Stock: Invest In Top Market Position in AI Hardware and Enterprise Solutions

Dell Technologies (DELL) is a broad information technology vendor primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales. Dell stock currently trades near $134. Here we explore Dell stock forecast.

Dell’s Quarterly Earnings Growth and Long-Term Stability

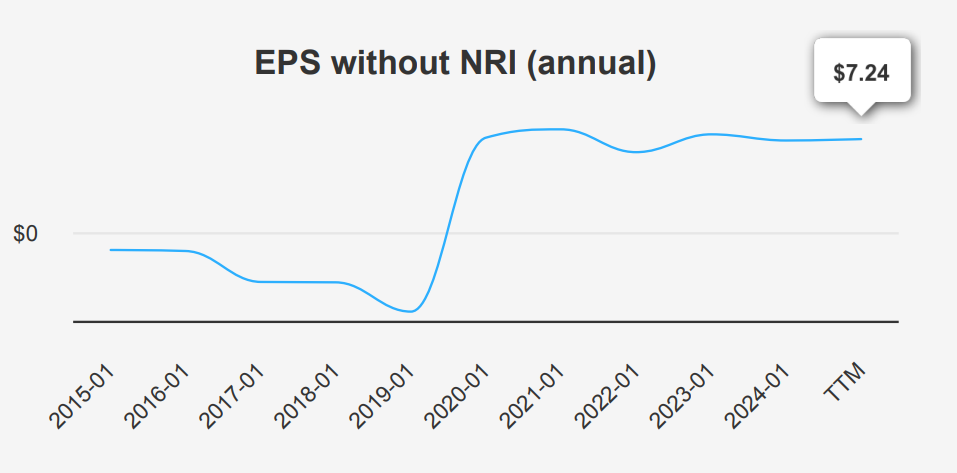

In the latest quarter ending July 31, 2024, Dell reported an EPS without NRI (excludes non-recurring items) of $1.89, a significant improvement from $1.27 in the previous quarter and $1.74 in the same quarter last year. The EPS (Diluted) also showed a robust increase to $1.17 from $0.63 year-over-year, although it slightly decreased from $1.32 quarter-over-quarter. Revenue per share rose to $34.566, compared to $30.597 in the prior quarter and $31.076 a year ago, indicating a steady growth trajectory.

Dell’s gross margin for the quarter stood at 22.41%, slightly below its 5-year median of 23.24% but well within its 10-year median of 22.71%. The company actively executed its share buyback strategy, repurchasing 2.5% of its shares over the past year, as indicated by its 1-year buyback ratio of 2.50%. This activity can enhance the EPS by reducing the number of shares outstanding, thus increasing the earnings allocated to each share. Over three years, the buyback ratio stood at 2.10%, highlighting consistent shareholder value return efforts under Dell stock forecast.

Looking forward, analysts estimate Dell’s EPS to reach $6.064 for the fiscal year ending 2025 and $6.790 for 2026. Revenue projections foresee growth from $97,604.53 million in 2025 to $110,229.05 million by 2027. Industry forecasts predict a steady growth rate of approximately 4% annually over the next decade. Dell’s next earnings announcement is scheduled for November 26, 2024, which will provide further insights into its strategic progress and financial health.

Return on Invested Capital vs. Cost of Capital: Dell’s Value Creation

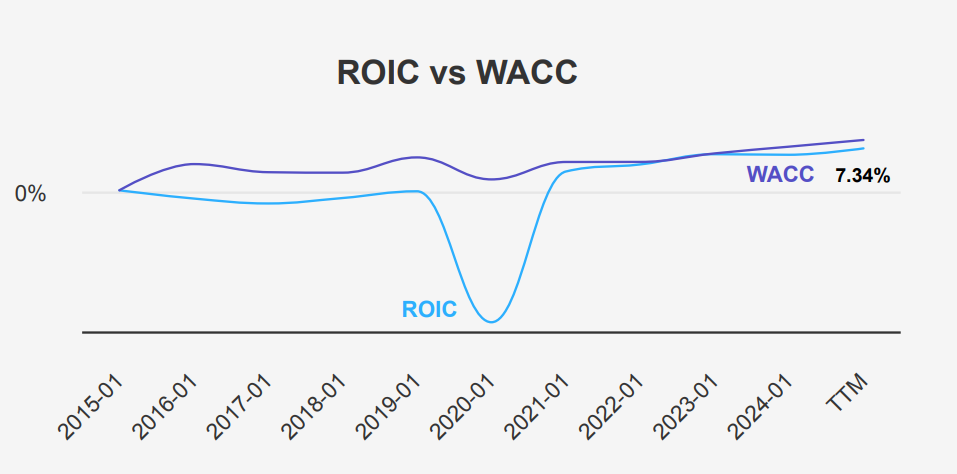

Under Dell’s stock forecast, its performance in terms of economic value creation can be analyzed by comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). Dell’s current ROIC is 7.34%, which exceeds its WACC of 8.94%, indicating that the company is creating value above its cost of capital.

However, this conclusion requires careful consideration since, over a ten-year period, the median ROIC was slightly negative at -0.17%, suggesting historical challenges in consistently generating value. The positive current ROIC indicates improved operational efficiency and profitability, potentially reflecting strategic investments and cost management. However, the negative equity over recent years and the historical volatility of ROIC highlight potential risks and past financial struggles, possibly linked to high debt levels or restructuring costs.

Despite these challenges, Dell’s ability to surpass its WACC with its current ROIC suggests a positive trajectory in value creation, although maintaining this trend will be critical to sustaining long-term shareholder value. The focus should remain on strengthening capital allocation strategies and improving financial health to ensure continued positive economic value generation under Dell stock forecast.

Dell Stock’s Dividend Growth Prospects and Historical Yield Analysis

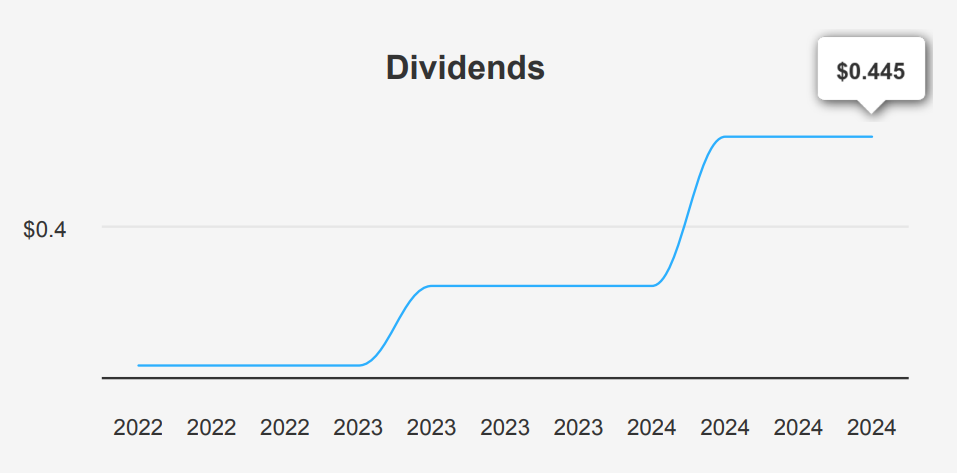

Dell’s recent dividend performance indicates a stable payout, with no growth in dividends over the past three and five years. The dividend per share has been consistently set at $0.445 in 2024, up from $0.37 in 2023, reflecting a recent adjustment. The forward dividend yield stands at 1.33%, which is below the historical median yield of 1.82% but comfortably within the sector’s typical range.

The company’s Debt-to-EBITDA ratio is 2.81, placing it in the moderate risk category. This suggests Dell has a manageable debt level, but it should be monitored closely in case of any significant changes in earnings or borrowing. The dividend payout ratio is at a healthy 23.0%, indicating that the company retains a large portion of its earnings for reinvestment or other financial strategies.

Looking ahead, the projected dividend growth rate of 11.33% over the next 3-5 years suggests optimism about future earnings growth and the sustainability of dividend increases. Given the quarterly distribution pattern, the next ex-dividend date is expected on January 22, 2025. This aligns with Dell’s strategy to maintain investor confidence while managing financial leverage prudently.

Dell Stock’s Intrinsic Value vs. Market Price: A High-Risk Outlook

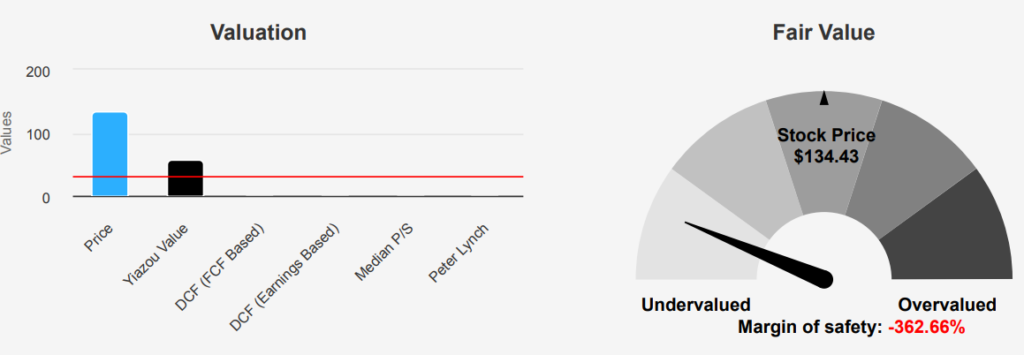

Under Dell stock forecast, the current valuation metrics reveal significant disparities when compared to its historical averages, suggesting potential overvaluation. The intrinsic value of Dell’s stock is at $29.05, while the current market price stands at $134.43, indicating a negative margin of safety of -362.75%. This stark difference highlights an overvaluation concern, as the intrinsic value does not support the current stock price. The trailing twelve months (TTM) P/E ratio of 24.48 is notably higher than the 10-year median of 10.97, although it remains below the 10-year high of 32.35. This elevated P/E ratio suggests investors are paying a premium compared to historical norms.

Examining Dell’s EV/EBITDA ratio, the TTM figure is 13.09, which is substantially higher than the 10-year median of 8.04, though still below the 10-year high of 15.93. This metric indicates that the stock is also trading at a premium relative to its enterprise value compared to historical data. The TTM Price-to-Free-Cash-Flow ratio of 29.18 is significantly above its 10-year median of 4.66, further emphasizing the current overvaluation. Notably, the TTM Price-to-Book ratio is at 0, reflecting either a negative book value or accounting adjustments, which complicates direct comparisons with historical figures.

The forward P/E ratio of 14.31 suggests expectations of improving earnings, but when weighed against Dell’s intrinsic value and other valuation metrics, caution should be there. Analysts have set a price target of approximately $147.82, with recent trends showing slight variances, indicating mixed sentiments. Overall, while there is some optimism in forward earnings, the current pricing suggests that Dell holds overvaluation with no apparent margin of safety, necessitating a cautious approach for potential investors.

Financial Risks and Strategic Advantages: An Investor’s Guide

Dell Technologies Inc. presents a mixed risk profile based on recent financial data. The company’s declining gross margin, with an average annual decrease of 3.2%, raises concerns about its ability to maintain profitability in a competitive market. Additionally, the Altman Z-score of 1.72 places Dell in the distress zone, suggesting a potential risk of bankruptcy within the next two years. Furthermore, the return on invested capital falling short of the weighted average cost of capital questions Dell’s capital efficiency.

The recent significant insider selling, totaling 30,051,320 shares without any insider buying, may signal a lack of confidence from within the company. On the positive side, Dell’s Piotroski F-Score of 7 indicates solid financial health, suggesting that the company is managing its financial resources effectively. Moreover, the Beneish M-Score of -2.51 suggests that Dell is unlikely to be manipulating its financial statements.

However, the company’s lower-than-average tax rate, which may artificially inflate earnings, could pose sustainability challenges in the long term. When considering Dell’s stock for their portfolio, investors should weigh these conflicting indicators, balancing the company’s robust financial management against its operational and financial risks.

Heavy Insider Selling: What it Means for Dell’s Outlook

The insider trading activity for Dell Technologies over the past year reveals a significant trend of selling by insiders, with no recorded purchases. Over the last three months, there have been 8 insider sell transactions and none for buying. Extending the analysis to six months, the sell transactions increase to 35, and over the entire year, a total of 62 sell transactions. This consistent pattern of selling may indicate that insiders are capitalizing on high stock valuations, or it could reflect their lack of confidence in the short-term outlook and Dell stock forecast.

Insider ownership stands at a modest 3.01%, indicating that insiders hold a relatively small portion of the company’s shares. Meanwhile, institutional ownership is at 31.81%, suggesting that institutions have a more substantial stake and possibly greater influence on the company’s governance and strategic decisions. The high volume of insider selling and low ownership percentages might raise concerns for investors about the internal sentiment toward Dell’s future performance and strategic direction.

Trading Volume Trends and Institutional Investment Activity in Dell

Dell stock demonstrates a moderate level of liquidity, with a current daily trading volume of 3,366,137 shares. This volume is significantly below its average daily trade volume of 9,025,416 shares over the past two months, indicating a reduction in trading activity. This drop in volume could potentially impact the stock’s liquidity, making it more challenging for large orders to happen without affecting

the market price.

The Dark Pool Index (DPI) for Dell currently stands at 51.15%, suggesting that over half of the trading volume is occurring in non-transparent dark pools. A DPI above 50% indicates a substantial amount of trading is taking place off-exchange, which could affect price discovery and lead to less transparency in trading activities.

Overall, while Dell remains a liquid stock, the current lower trading volume compared to its average and the high DPI suggest that investors should be mindful of potential liquidity constraints and the impact of off-exchange trading on market dynamics. These factors may necessitate more cautious trading strategies or a reevaluation of timing when placing large trades.

Congress Trading Activity: Representative Interest in Dell Stock

The analysis of recent trades by Representative Marjorie Taylor Greene highlights two purchases of Dell stock, both reported within the past two months. The first transaction was executed on October 4, 2024, and was reported on October 8, 2024. The second followed on November 7, 2024, and reported on November 8, 2024. Each transaction fell within the $1,001 to $15,000 range.

As a member of the Republican Party in the House of Representatives, Greene’s consistent acquisition of DELL shares suggests a strategic interest in this technology company. The proximity of these trades indicates possible confidence in Dell’s future performance, or it could be part of a broader investment strategy. Monitoring her future transactions could provide further insight into her investment approach and any potential implications or signals concerning Dell’s market outlook.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.