Meta Stock Is All About Core Business and Strategic Investments in Reality Labs

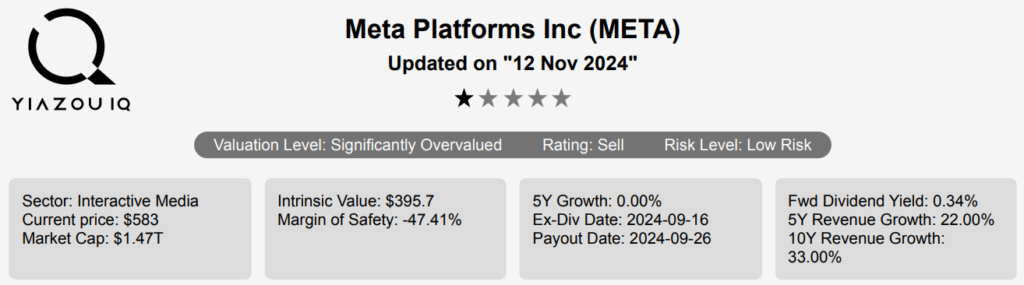

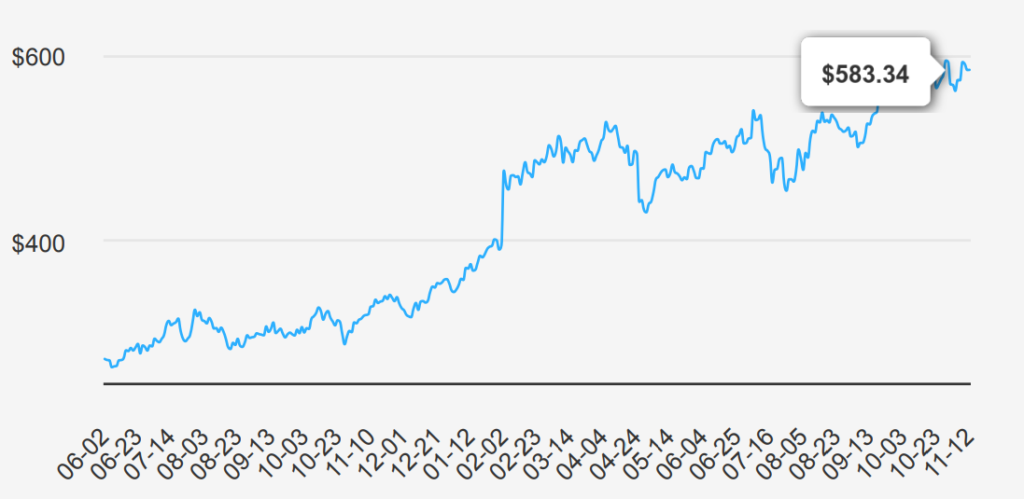

Meta (META) is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm’s “Family of Apps,” its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta’s overall sales. META stock is currently trading at ~$583. Explore a critical Meta stock analysis here.

Q3 2024 Results: EPS and Revenue Growth Outpace Expectations

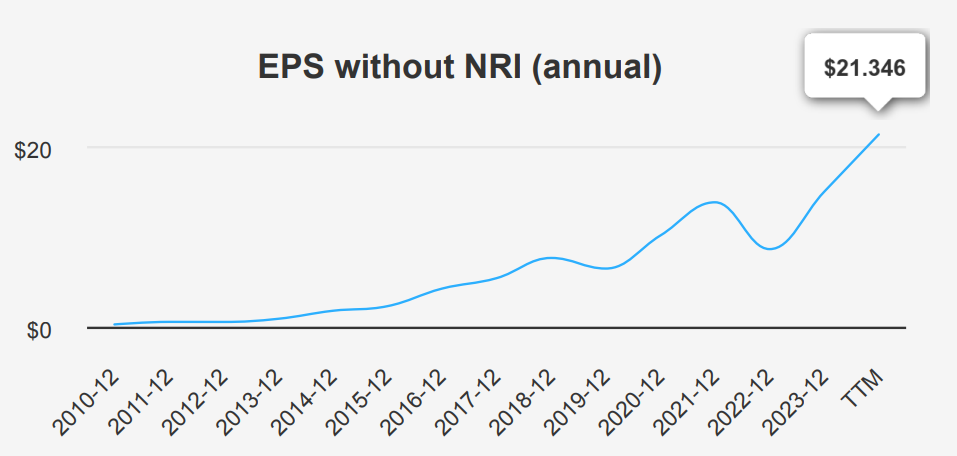

Meta reported strong financial performance for the third quarter of 2024, with an EPS without non-recurring items (NRI) of $6.026, showing a significant increase from the previous quarter’s $5.217 and a remarkable rise compared to $4.421 in the same period last year. Revenue per share also grew to $15.611 from $14.97 in the prior quarter and $12.929 year-over-year (YoY). Meta’s 5-year and 10-year compound annual growth rates (CAGR) for EPS without NRI stand at 13.90% and 28.80%, respectively, indicating robust growth over the last decade. The digital advertising and social media industry may grow at a rate of around 10% annually over the next ten years, underscoring the favorable market conditions for Meta’s continued expansion.

Meta’s gross margin for the quarter was 81.43%, slightly above its 5-year median of 80.76% but below the 10-year high of 86.58%. The company’s share buyback activities have positively impacted its EPS, with a 1-year buyback ratio of 1.80%, meaning 1.80% of shares were repurchased, enhancing shareholder value by reducing the total shares outstanding. Over the past decade, the buyback ratio has averaged 0.30%, reflecting consistent efforts to return capital to shareholders. These efforts, coupled with strong operational performance, indicate Meta’s strategic focus on maintaining healthy margins and boosting EPS through buybacks.

Looking ahead, analysts estimate an EPS of $22.572 for the fiscal year ending in 2025 and 25.311 for the subsequent year, reflecting continued optimism in Meta’s growth trajectory. Revenue may reach $163,065.11 million in 2024, with expectations of it growing to $210,642.04 million by 2026. Meta’s next earnings announcement may be on January 31, 2025, with further insights into the company’s strategic initiatives and performance outlook. This outlook, combined with favorable industry growth forecasts, supports a positive long-term growth narrative under Meta stock analysis.

Meta’s Strong ROIC and ROE Signal Solid Profit Generation

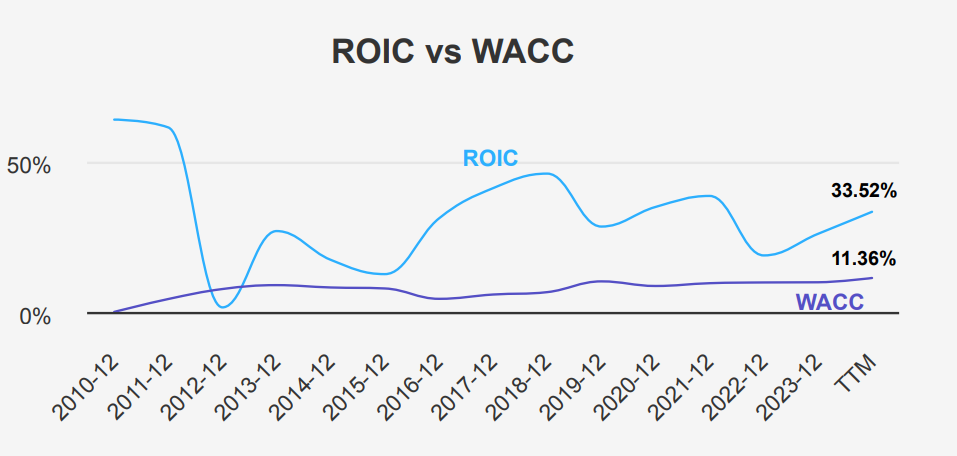

Meta Platforms, Inc. has demonstrated strong financial efficiency and value creation through its recent performance metrics. Its return on invested capital (ROIC) stands at 33.52%, significantly surpassing the weighted average cost of capital (WACC) of 11.36%. This substantial difference indicates that Meta is generating positive economic value, as its ROIC exceeds the cost of capital required to fund its operations. Over the past five years, Meta’s median ROIC has been 28.57%, consistently above the WACC median of 9.86%, reinforcing its ability to maintain value creation over time.

Additionally, Meta’s return on equity (ROE) of 36.21% further highlights its efficiency in generating profits from shareholders’ investments. This figure not only marks a high in a decade-long performance range but also underscores Meta’s strong profit-generating capacity. Under Meta stock analysis, these metrics collectively reflect Meta’s strategic capital allocation and operational efficiency, positioning it advantageously to sustain shareholder value and competitive advantage in the market.

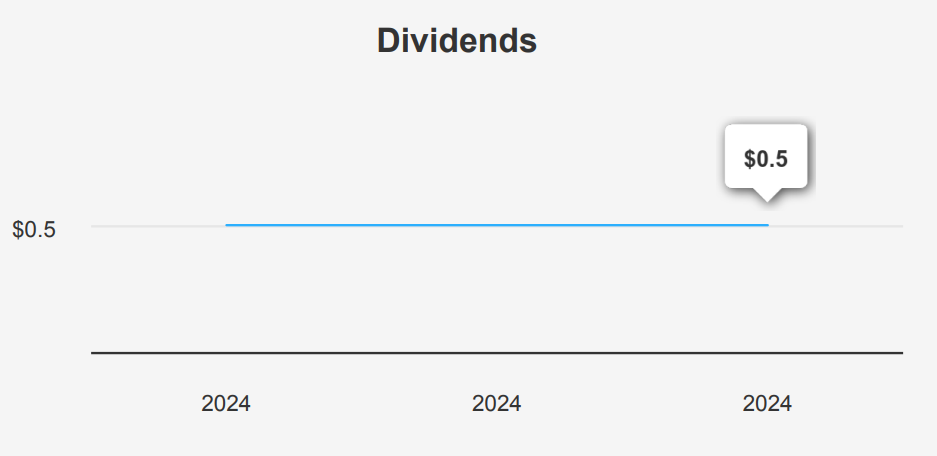

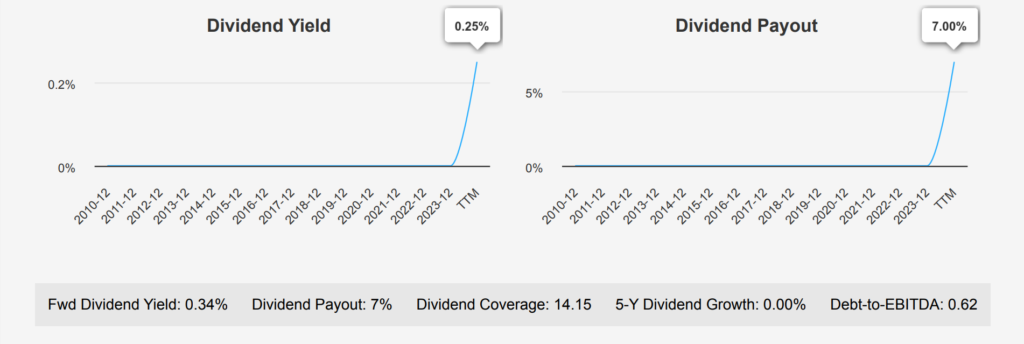

META’s Low Dividend Yield Reflects Reinvestment Focus

Meta has maintained a stable dividend policy. The company’s current forward dividend yield is 0.34%, which is relatively low against many sectors, reflecting its focus on reinvestment and growth rather than dividend payouts.

META’s Debt-to-EBITDA ratio is 0.62, well below the general threshold of 2.0, indicating a strong capacity to service its debt and low financial risk. This financial health allows META to maintain flexibility in its capital allocation. The dividend payout ratio stands at 7.0%, significantly lower than its historical highs, suggesting that META retains a substantial portion of its earnings for growth and operational needs rather than distributing them to shareholders.

The next ex-dividend date is on December 16, 2024, given the quarterly frequency of dividends. This approach aligns with META’s strategy of focusing capital on growth opportunities, which may appeal to investors seeking capital appreciation over immediate income returns.

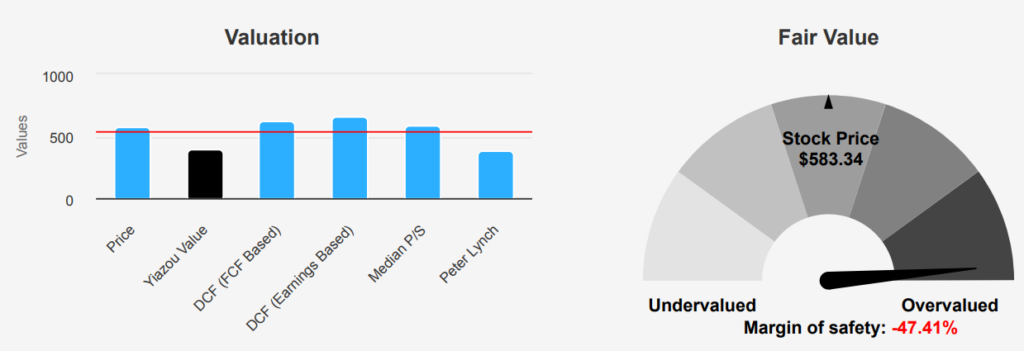

META’s High Valuation: Intrinsic Value vs. Market Price

META’s current market price of $583.34 significantly exceeds its intrinsic value of $395.7, indicating a negative margin of safety of -47.42%. This suggests that the stock may be overvalued, as the intrinsic value does not provide a buffer against the current price. When examining the Forward P/E ratio at 23.06 and the TTM P/E ratio at 27.48, both are below the 10-year median of 30.83, indicating the stock is valued more conservatively compared to historical highs. However, the TTM Price-to-Book ratio stands at 8.95, well above its 10-year median of 6.38, suggesting potential overvaluation under Meta stock analysis.

In terms of revenue and earnings valuation, the TTM P/S ratio is 9.76, close to its 10-year median of 9.50, indicating a stable valuation relative to sales. The TTM EV/EBITDA ratio is 18.45, slightly below the 10-year median of 19.20, suggesting that the stock is not excessively valued based on earnings before interest, taxes, depreciation, and amortization. The Price-to-Free-Cash-Flow ratio, at 29.29, is slightly below its 10- year median of 31.57, pointing to a reasonable valuation relative to cash generation.

The outlook on META remains positive, with a price target of $639.93, following an upward trend over the last three months. Despite the current price exceeding intrinsic value, analysts maintain a favorable position, suggesting confidence in future growth. However, investors should remain cautious due to the negative margin of safety and consider the potential risks associated with the current valuation metrics, particularly the elevated P/B ratio.

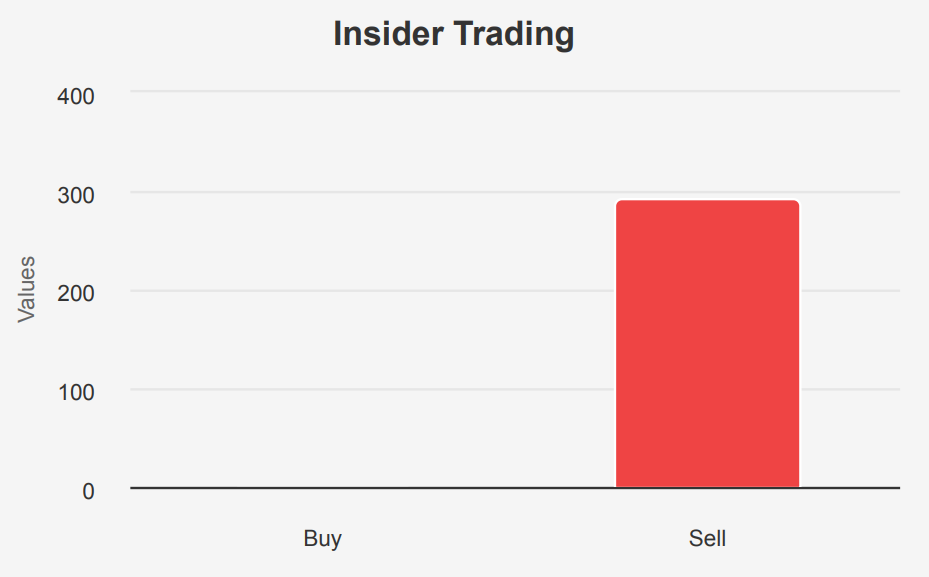

Potential Risks To Meta Stock: Insider Selling and High Valuation Concerns

The recent surge in insider selling could raise concerns for potential investors, as 329,930 shares were offloaded over the past three months with no insider buying. This activity might suggest a lack of confidence in the stock’s short-term performance. Additionally, Meta’s operating margin has been on a steady decline at an average rate of 6% per year over the last five years, which could indicate challenges in sustaining profitability. The price-to-book (PB) ratio and price-to-sales (PS) ratio being at or near multi-year highs further suggest that the stock may be overvalued, increasing the risk of a price correction.

On the positive side, Meta Platforms demonstrates robust financial health, with a Piotroski F-Score of 8 indicating a very healthy financial situation and a Beneish M-Score suggesting no likelihood of financial manipulation. The company’s consistent revenue and earnings growth underscore its operational stability. Furthermore, Meta’s Altman Z-score of 11.89 reflects strong financial strength, reducing the risk of bankruptcy. Despite the high valuation metrics, the stock’s dividend yield is near a one-year high, offering potential income benefits for investors. Overall, while there are valuation concerns, the company’s strong fundamentals provide a buffer against significant downside risks under Meta stock analysis.

Insider Selling Trends: Implications for Stock Confidence

The insider trading activity for META stock over the past year indicates a significant trend toward selling rather than buying. In the last 3 months, there have been 50 insider sells and no buys, continuing a pattern observed over the past 6 and 12 months with 116 and 290 sells, respectively, and still no purchases. This consistent selling trend might suggest that insiders are capitalizing on the company’s stock performance, potentially signaling a lack of confidence in near-term stock appreciation or a strategic liquidation of assets.

Insider ownership in META is relatively low at 0.22%, which might limit the impact of insider transactions on the stock’s perception. Nonetheless, institutional ownership is substantial at 67.76%, indicating that large institutional players hold a significant stake in the company. This could mitigate some concerns regarding the insider selling trend, as institutional investors may provide stability and continuity in investment philosophy. Overall, while insider sales are notable, the high level of institutional ownership suggests confidence in the company’s longer-term prospects under Meta stock analysis.

Liquidity Profile and Trading Patterns: Analysis of Recent Activity

Meta stock has shown a recent trading volume of 9,822,196 shares, which is lower than its two-month average daily trade volume of 12,135,944 shares. This indicates a temporary dip in trading activity, potentially due to market conditions or investor sentiment. The DPI (Dark Pool Indexes) percentages provide additional insights into the liquidity of META. The DPI30 at 37% and DPI60 at 34% suggest

that a significant portion of trading activity is occurring in dark pools, which are private exchanges for trading securities. This level of dark pool activity can imply that institutional investors are actively trading META shares, possibly to maintain confidentiality or to execute large trades without impacting the market price significantly.

The DPI90 at 30% shows a consistent trend of dark pool trading over the longer term, indicating sustained institutional interest and involvement. Such dark pool activity can affect the stock’s liquidity by potentially reducing the number of shares available in public markets, thereby impacting price volatility. Overall, META’s liquidity appears strong, but the lower recent trading volume and high dark pool activity could affect short-term price movements and investor strategies.

Volatility in META’s Patent Growth: 2021 to 2024

META’s patent activity shows significant growth and volatility from 2021 through 2024. In 2021, META secured only 2 patents, but this number surged dramatically to 597 in 2022, suggesting increased innovation efforts or strategic acquisitions. The growth continued in 2023 with 936 patents, indicating a peak in research and development initiatives. However, in 2024, there was a notable decline to 438 patents, which might reflect market adjustments or shifts in strategic focus.

Congressional Trades in META Stock: Different Perspectives Across Parties

The recent trades involving Meta Platforms, Inc. (META) by members of the U.S. House of Representatives reflect contrasting strategies from different political parties as of late 2024. On November 1, 2024, Representative Marjorie Taylor Greene (R) purchased META shares valued between $1,001 and $15,000, suggesting a bullish outlook or confidence in the company’s future performance. This transaction was reported on November 4, 2024.

Conversely, Representative Josh Gottheimer (D) executed a sale of META shares within the same value range on October 17, 2024, reported on November 6, 2024. This sale might indicate a strategic decision to capitalize on gains or a shift in investment priorities. These transactions highlight differing perspectives on META’s market trajectory among legislative members, reflecting broader economic sentiments or individual financial strategies. The timing and nature of these trades could be influenced by market conditions or upcoming legislative decisions impacting the tech sector.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.