PayPal’s Evolution and Current Landscape

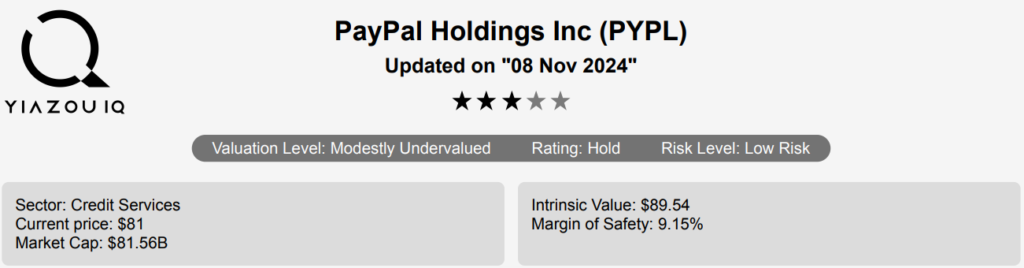

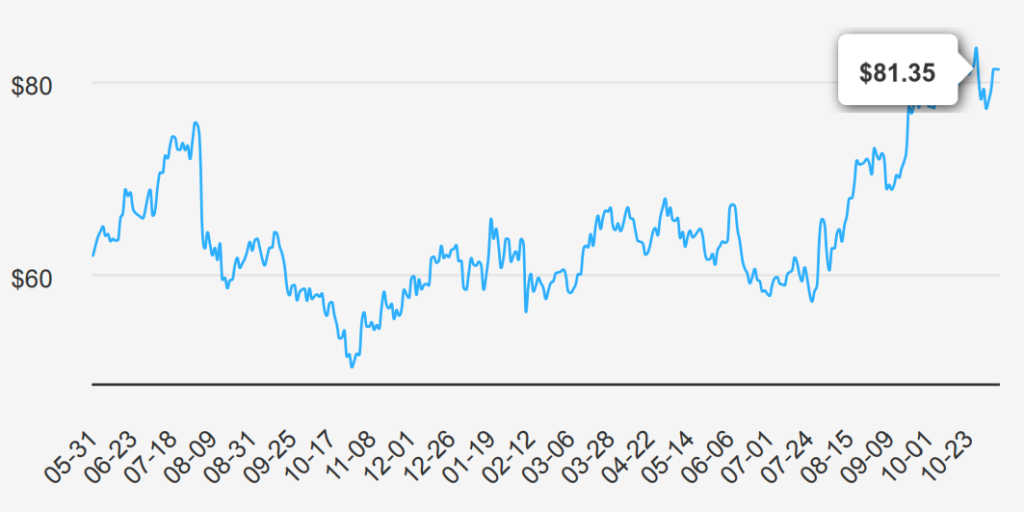

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform. PYPL stock is currently trading at $81.35. Let’s assess the Paypal price target 2025.

Performance Metrics and Future Projections

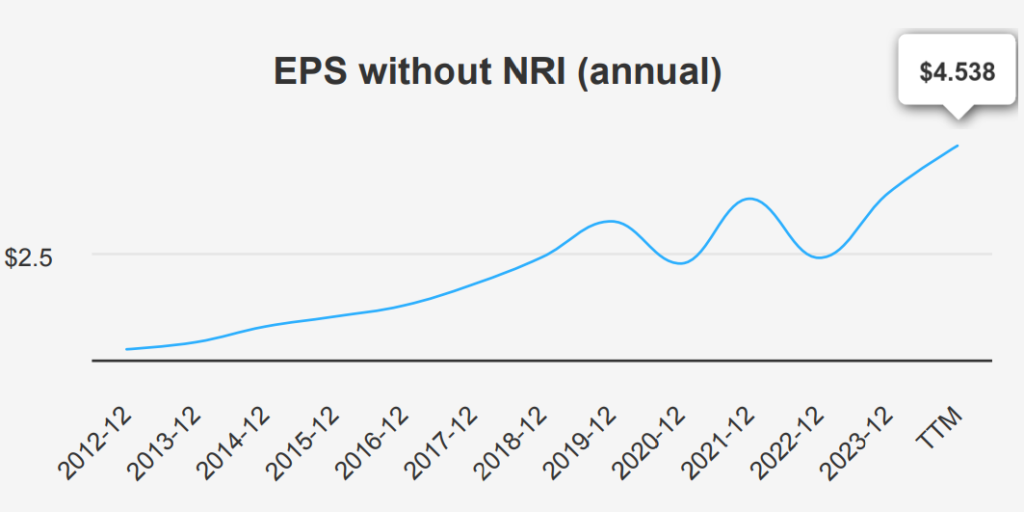

PayPal reported its Q3 2024 results, with EPS without NRI (excludes non-recurring items) increasing to $1.20, compared to $1.19 in Q2 2024 and $0.941 in Q3 2023. This reflects a strong year-over-year (YoY) growth, highlighting the company’s positive trajectory. The revenue per share also showed a consistent rise to $7.663, up from $7.531 in the previous quarter, indicating robust sales performance. Over the past five years, PayPal’s annual EPS has grown at a Compound Annual Growth Rate (CAGR) of 14.70%, while the 10-year CAGR stands at 5.00%, demonstrating sustained long-term growth.

The company’s gross margin for Q3 2024 was 45.76%, slightly below its 5-year median of 54.03%, indicating some margin compression. Over the last year, PayPal has repurchased 6.90% of its outstanding shares, enhancing EPS by reducing the share count, which is beneficial for shareholders as it increases their percentage ownership. The 10-year buyback ratio is 0.90%, showing a consistent commitment to returning value to shareholders through buybacks.

Looking ahead, analysts estimate that PayPal will achieve an EPS of $3.988 for the next fiscal year ending in December 2025 and $4.709 for the following year. Revenue estimates suggest continued growth, with forecasts of $31,704.64 million for 2024, increasing to $35,669.92 million by 2026. The industry is expected to grow at around 10% annually over the next decade, aligning with PayPal’s strategic growth initiatives. The next earnings announcement is anticipated on February 7, 2025, which will provide further insights into the Paypal price target 2025.

PayPal Holds Capital Efficiency

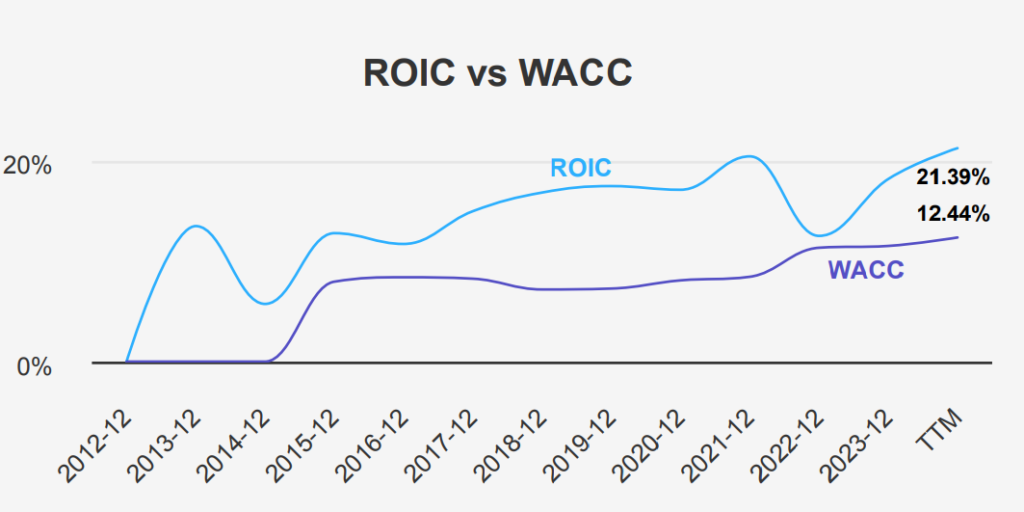

PayPal demonstrates strong financial performance through its efficient use of capital and value creation. The company’s Return on Invested Capital (ROIC) stands at 21.39%, significantly exceeding its Weighted Average Cost of Capital (WACC) of 12.44%. This substantial spread indicates that PayPal is generating positive economic value by earning returns well above its cost of capital. Over the past five years, PayPal’s ROIC has maintained a median of 17.59%, consistently outperforming the median WACC of

8.50%. This suggests a sustained ability to allocate capital efficiently, contributing to its long-term growth and Paypal price target 2025.

Furthermore, PayPal’s Return on Equity (ROE) at 21.64% highlights its effective management and profitability, reflecting strong returns on shareholders’ equity. The stability and growth in ROE over the years further confirm robust financial health and strategic capital allocation. In conclusion, PayPal is not only meeting but exceeding key financial benchmarks, ensuring it continues to create economic value and maintain a competitive edge in the market.

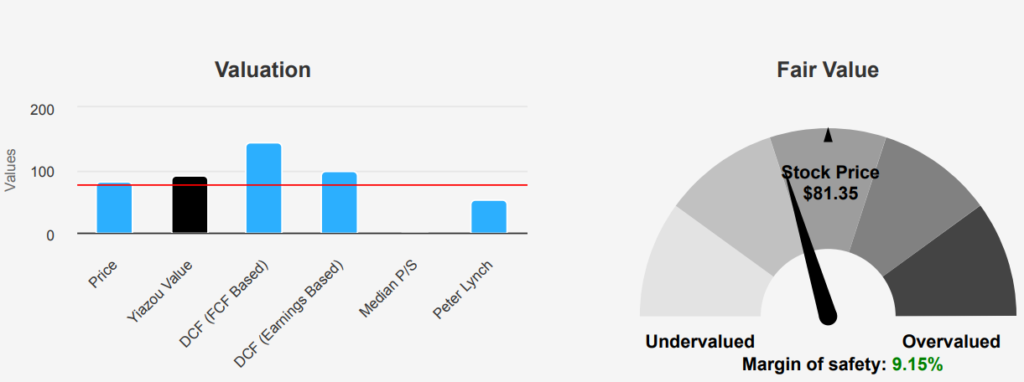

Is PayPal Stock Currently Undervalued?

PayPal Holdings Inc. (PYPL) currently trades at $81.35, below its intrinsic value of $89.54, suggesting a margin of safety of 9.15%. The Forward P/E ratio of 16.69 indicates a promising valuation compared to its trailing twelve months (TTM) P/E of 19.42, and significantly lower than its 10-year median of 45.40. These P/E figures suggest that PYPL is trading at a more attractive valuation relative to its historical high of 108.15. This indicates potential undervaluation, especially considering the consistent downward trend in price targets over recent months.

The TTM EV/EBITDA ratio of 11.17 is well below the 10-year median of 25.58, highlighting a relatively favorable enterprise value compared to earnings before interest, taxes, depreciation, and amortization historically. The TTM P/B ratio of 4.06 is also under the 10-year median of 5.17, reinforcing the notion that PYPL might be undervalued. However, while modest, the P/S ratio of 2.72 aligns closely with its 10-year low, suggesting cautious optimism.

Analyst ratings continue to reflect a cautiously optimistic outlook, with a slight upward revision in the price target over the last month. The TTM Price-to-Free-Cash-Flow of 12.23 is significantly below its 10-year median of 24.16, indicating substantial cash flow value. Overall, PYPL appears to offer an attractive valuation relative to its historical averages, coupled with a potential margin of safety, suggesting it could be a suitable investment for those looking for entry at a discounted level.

Assessing Financial Health and Market Challenges

PayPal Holdings Inc’s financial position presents a mixed risk profile. The company has been increasing its debt over the past three years, with a total issuance of $3.3 billion, though the overall debt level remains manageable. A declining gross margin, averaging a decrease of 3.3% annually, signals potential cost management issues or competitive pressures impacting profitability. Additionally, the Altman Z-score of 2.01 places the company in the grey zone, indicating moderate financial stress and suggesting close monitoring of liquidity and solvency metrics.

On the positive side, PayPal’s Piotroski F-Score of 7 reflects robust financial health, suggesting strong fundamentals and efficient operational management. The Beneish M-Score of -2.51 indicates a low risk of earnings manipulation, enhancing the credibility of financial reporting. Despite its stock price and price-to-sales (PS) ratio nearing one-year highs, suggesting a potentially overvalued status, the company’s revenue and earnings have demonstrated predictability, a favorable sign for Paypal price target 2025.

In conclusion, while PayPal exhibits potential financial stresses and valuation concerns, its fundamental strength and low manipulation risk provide a solid foundation. Investors should weigh these factors carefully, particularly monitoring future debt levels and margin trends.

Understanding Executive Confidence and Ownership Trends

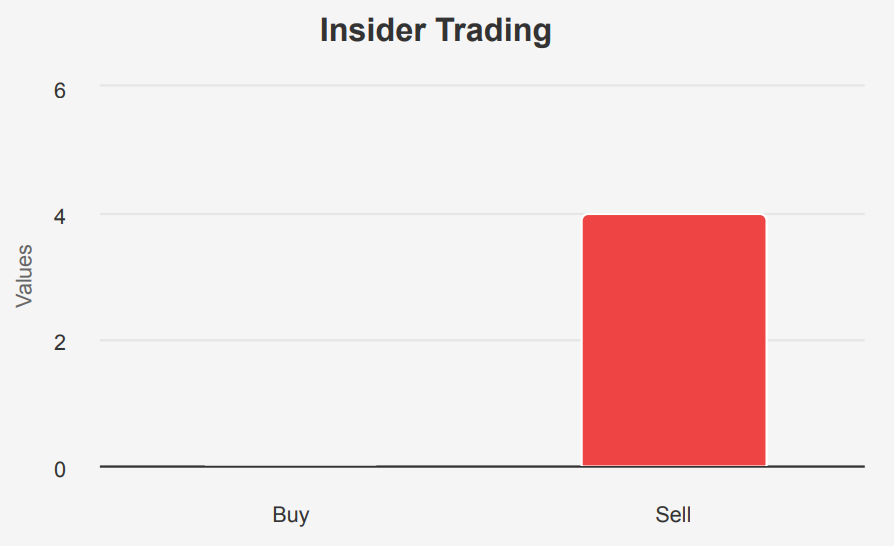

The insider trading activity for PayPal (PYPL) over the past year indicates a trend of selling by company insiders, with no recorded insider purchases. In the last 12 months, there were four insider sales and no purchases, suggesting a lack of confidence or cashing in on performance gains by insiders. In the more recent six-month period, this trend continued with one insider sale and no purchases. Over the last three months, there have been neither insider buys nor sells, indicating a potential pause in insider trading activity.

The overall insider ownership of PYPL stands at 7.25%, which is relatively modest and suggests that insiders hold a moderate level of stake in the company. Meanwhile, institutional ownership is significantly higher at 71.59%, reflecting strong interest and potential influence from institutional investors. The absence of insider buying may raise questions among investors about the insiders’ perspectives on the company’s near-term prospects, while the lack of recent selling could indicate stabilization in insider sentiment.

PayPal Stock: Market Activity and Stable Liquidity

PayPal stock exhibits a current daily trading volume of 9,018,004 shares, which is slightly lower than its two-month average daily trade volume of 11,166,023 shares. This indicates a potential decrease in trading activity against the recent average, which could be attributed to various market factors such as investor sentiment or broader market conditions.

The Dark Pool Index (DPI) for PYPL is at 34.99%, reflecting the percentage of shares traded in dark pools versus traditional exchanges. A DPI of 34.99% can suggest a moderate level of off-exchange trading activity, which might indicate institutional investors’ involvement, given their tendency to use dark pools for executing large trades to minimize market impact.

Overall, PYPL’s liquidity appears relatively robust, with ample daily trading activity to facilitate transactions without significant price disruptions. However, the lower-than-average recent trading volume could suggest a temporary decline in market interest or cautious trading behavior among participants. Monitoring changes in these metrics over time could provide further insights into evolving market dynamics around the Paypal price target 2025.

Innovation and Intellectual Property Developments

Between 2019 and 2023, PayPal exhibited a steady trend in patent filings, with an initial count of 275 in 2019. After a slight decline to 274 in 2020, there was a notable increase to 325 in 2021, indicating a focus on innovation. However, a slight decrease followed, with 312 and 316 patents in 2022 and 2023, respectively. The projected decline to 244 patents in 2024 suggests a potential shift in strategic focus or market dynamics.

Congress Trading on PayPal Stock

The recent trades involving PayPal stock by members of Congress reflect differing strategies and timing. On September 26, 2024, Representative Josh Gottheimer, a Democrat in the House of Representatives, purchased PYPL shares valued between $1,001 and $15,000. This transaction, reported on October 3, 2024, suggests a belief in the stock’s potential for growth or undervaluation at that time.

In contrast, Senator Tommy Tuberville, a Republican, executed a complete sale of his PYPL holdings on May 3, 2024. The sale, valued between $100,001 and $250,000, was reported over a month later on June 14, 2024. Tuberville’s decision to divest could indicate a strategy to capitalize on gains or concerns about the company’s future performance.

These transactions underscore the diverse investment strategies among legislators, potentially influenced by differing market outlooks or financial goals.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.