SoFi’s Stock: Evolution from Loan Refinancing to Full-Service Finance

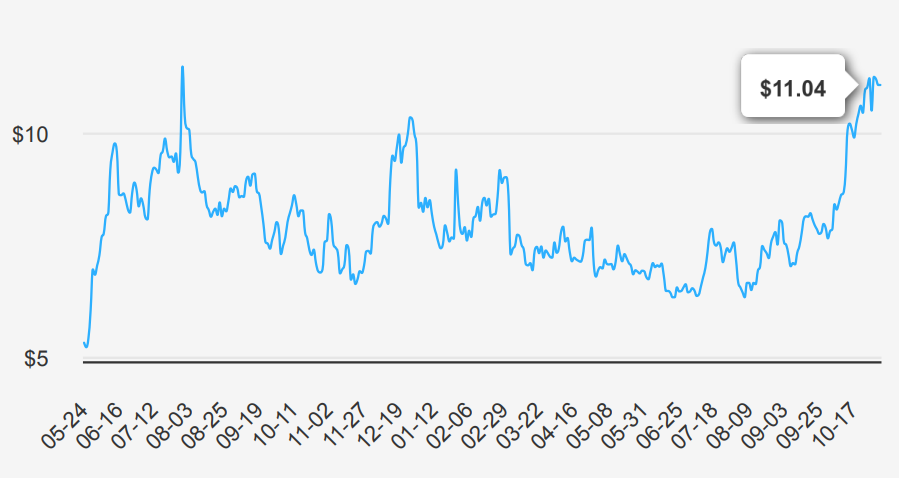

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients’ finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking. SOFI stock is currently trading near $11. Explore more on SoFi stock forecast 2025.

Recent Earnings Surge: Revenue & EPS Projections for 2025-2026

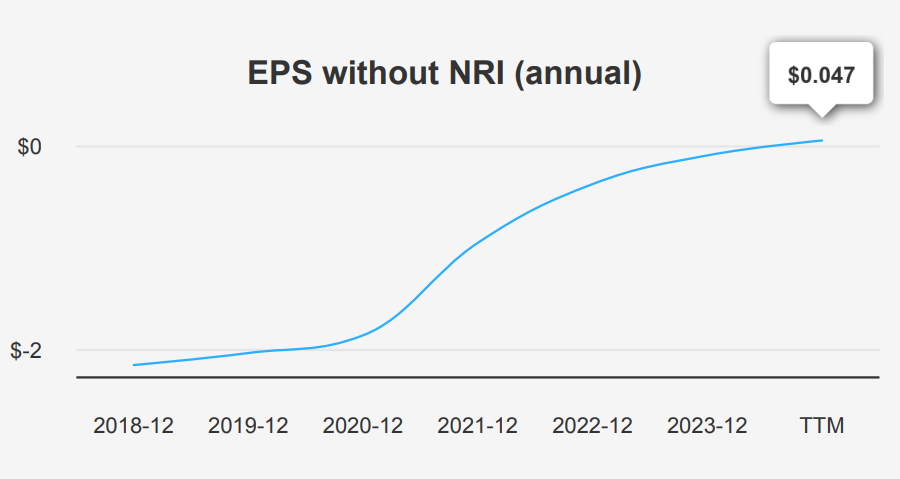

SoFi reported a significant improvement in its quarterly earnings for Q3 2024, achieving an EPS without NRI (excludes non-recurring items) of $0.049, compared to $0.011 in Q2 2024, and a loss of $0.03 in Q3 2023. This marks a substantial turnaround, highlighting a 45.30% 5-year CAGR in annual EPS without NRI, indicating strong earnings growth over the medium term. Revenue per share also increased to $0.628 from $0.562 in the previous quarter, reflecting consistent revenue progress. Over the past 10 years, the compound annual growth rate (CAGR) remains unchanged at 0%, suggesting more recent operational improvements have driven current performance.

Despite the positive earnings trend, SoFi’s gross margins remain at 0%, which may raise concerns about operational efficiency and cost management. The company’s share buyback strategy reflects a negative trend with a 1-year buyback ratio of -13.20%, indicating an increase in the number of shares outstanding rather than a reduction. This dilution could potentially offset EPS gains, although the recent EPS growth suggests the company is effectively navigating this challenge. A negative buyback ratio means that the company has issued more shares than it has repurchased, which can dilute existing shareholders’ equity.

Looking forward, SoFi’s outlook appears optimistic with analysts projecting revenues to grow to $2,533.23 million in FY2025, reaching $3,513 million by FY2026. The estimated EPS for FY2025 is $0.115, increasing to $0.272 for FY2026, illustrating expected continued earnings growth. With the next earnings report scheduled for January 29, 2025, investors will be keenly watching for confirmation of these growth trends and further insights into SoFi’s strategic direction in a competitive industry expected to grow steadily over the next decade.

Evaluating ROIC, WACC, and Shareholder Value Creation

Evaluation of SOFI’s financial performance and value creation potential requires comparing its Return on Equity (ROE) with its Weighted Average Cost of Capital (WACC). Over the past five years, its WACC has a median value of 6.64%, which suggests the average cost of capital is higher than any derived returns.

This disparity between ROIC and WACC indicates that SOFI is not currently creating economic value, as it fails to cover its cost of capital. The situation is further highlighted by the company’s ROE, which, while positive at 3.68%, is not sufficient to offset the higher WACC of 19.65% observed recently. This suggests that SOFI’s capital allocation strategies may not be effectively generating sufficient returns relative to the costs, leading to a negative impact on shareholder value. Strategic adjustments may be necessary to enhance financial efficiency and achieve positive value creation.

Debt Load, Valuation Concerns, and Earnings Quality Analysis

SoFi exhibits some warning signals that warrant attention from potential investors. The company has been increasing its debt load, issuing $680.398 million over the past three years, though its overall debt level remains acceptable. However, the company’s revenue per share has been declining over the last five years, suggesting potential challenges in sustaining growth. Additionally, the stock price is near a two-year high, with a PS ratio close to its peak at 4.65, indicating that the stock may holds overvaluation relative to its historical norms. Furthermore, the Sloan ratio at -29.31% suggests that current earnings may rely heavily on accruals, which could raise concerns about the quality of reported earnings.

Under SoFi stock forecast 2025, the recent insider activity also raises red flags, with four insider selling transactions and no purchases in the last three months, totaling 111,636 shares sold. This could be interpreted as a lack of confidence in the company’s future performance. Conversely, the Beneish M-Score of -1.82 suggests that SoFi is unlikely to be manipulating its financial statements, which is a positive indicator of financial integrity. However, the low tax rate boosting earnings might not be sustainable long-term, potentially impacting future profitability if tax conditions change.

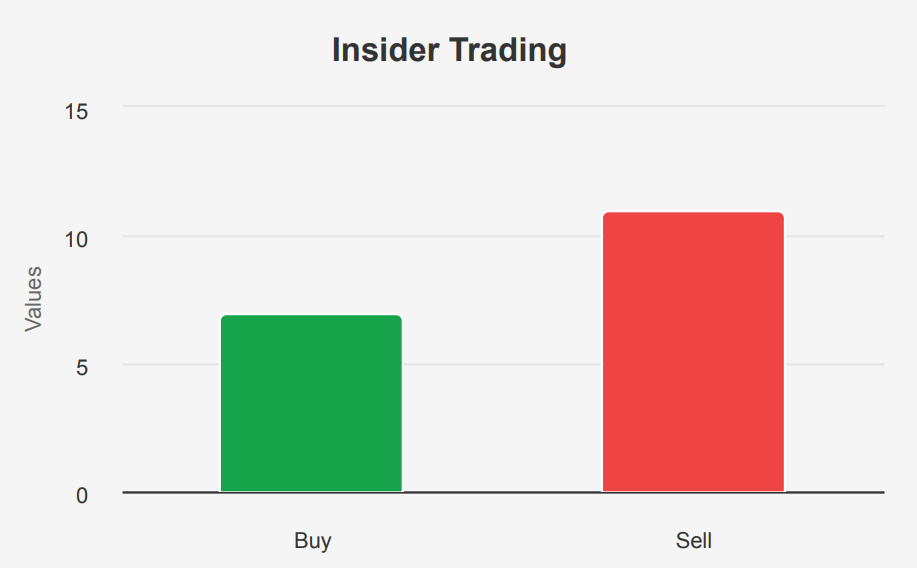

Insider Trading Trends: High Selling vs. Low Ownership

Under SoFi stock forecast 2025, the insider trading activity shows a trend where selling transactions by insiders have outpaced buying transactions over different time frames. In the last three months, insiders have not made any purchases, but there have been four selling transactions. Extending this observation to six months, there have been four purchases and six sales, indicating a cautious sentiment among insiders. Over the past year, there have been seven purchases compared to eleven sales, reinforcing a trend where insiders are more inclined to sell than buy.

Insider ownership at SoFi stands at a relatively low 1.95%, suggesting that insiders have a limited financial stake in the company. Meanwhile, institutional ownership is significantly higher at 43.87%, indicating that institutional investors hold a substantial portion of SoFi’s shares. The higher institutional involvement could imply confidence in the company’s long-term prospects. However, the recent selling trend by insiders might signal concerns or profit-taking at current price levels. Investors should consider these patterns alongside other financial indicators when evaluating SoFi’s stock.

SoFi Stock: Trading Volume and Dark Pool Impact

SoFi exhibits robust liquidity with a daily trading volume of 41,114,788 shares. This is slightly below its two-month average daily trading volume of 49,957,272 shares, indicating a healthy level of investor interest and market activity. The current trading volume suggests that the stock has sufficient liquidity to accommodate large transactions without significant price impact.

The Dark Pool Index (DPI) for SOFI is 40.46%, which implies a substantial portion of the trading volume occurs in dark pools, where orders are not visible to the public before execution. A DPI of 40.46% indicates a moderate level of non-transparent trading, which can affect overall market dynamics and price discovery.

Overall, SOFI’s liquidity profile is strong due to its high trading volume, allowing for efficient buying and selling by investors. However, the relatively high DPI suggests that investors should be aware of the potential for price movements that might not be immediately apparent in the public market. This could impact short-term trading strategies and necessitates monitoring for any significant deviations in dark pool activity versus public trading volumes.

Patent Growth as a Measure of SoFi’s Innovation Strategy

Under SoFi stock forecast 2025, analyzing the U.S. patent data for SOFI over the years 2018 to 2023 reveals a significant growth trajectory. Starting with just 10 patents in 2018, SOFI has progressively increased its patent portfolio, peaking at 25 in 2023. This consistent upward trend reflects SOFI’s commitment to innovation and technological advancement, underscoring its strategic focus on broadening its intellectual property assets to potentially enhance competitive positioning within the financial services industry.

Senator Carper’s Strategic Buy and Sell of SOFI Stock

Senator Thomas R. Carper, a Democrat, made two notable trades involving SOFI stock over a span of several months. On August 10, 2023, he purchased shares of SOFI, with the transaction valued between $1,001 and $15,000. This acquisition was reported on September 5, 2023. Subsequently, on March 21, 2024, Senator Carper executed a full sale of his SOFI holdings, again within the same value range of $1,001 to $15,000. This sale was reported on March 29, 2024.

The purchase and subsequent sale suggest a strategic trade, possibly influenced by market movements or changes in the company’s outlook. The relatively modest size of the transactions indicates a cautious approach, consistent with diversification or speculative investment strategies. This activity highlights the senator’s engagement with the fintech sector, represented by SOFI, which has been a dynamic market segment in recent years.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of SOFI either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.