OCSL Dividend Emerges From Targeted Debt Investments

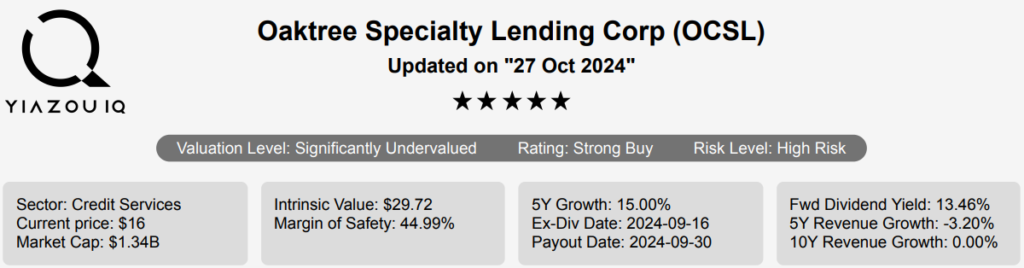

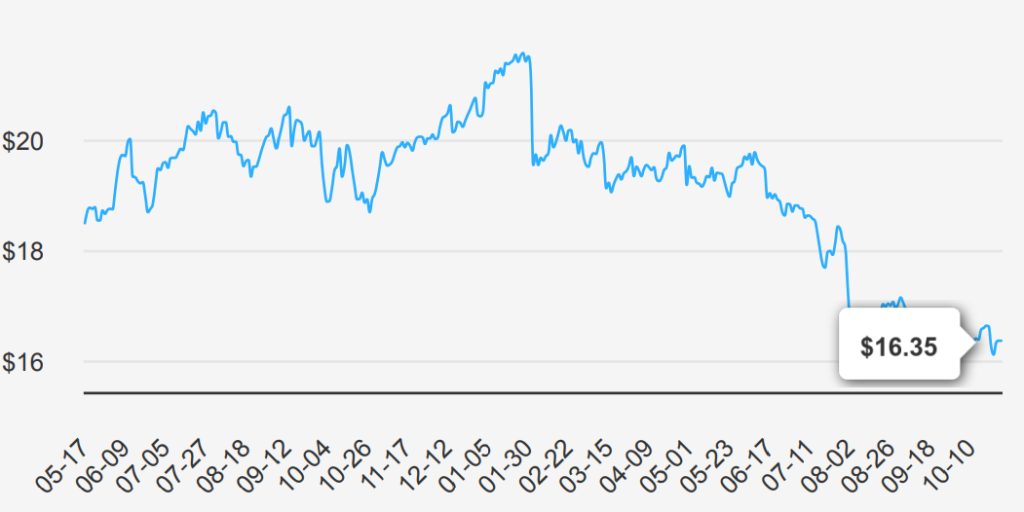

Oaktree Specialty Lending Corp is a specialty finance company. It provides lending services and invests in small and mid-sized companies. The company’s investment objective is to maximize its portfolio’s total return by generating current income from debt investments and, to a lesser extent, capital appreciation from equity investments. Its investments generally range in size from ten million dollars to a hundred million dollars and are principally in the form of the first lien, second lien, or collectively, senior secured and subordinated debt investments, which may also include an equity component made in connection with investments by private equity sponsors. OCSL stock is currently trading at $16.35.

OCSL Earnings Decline Amid Stagnant Margins and Buybacks Impact

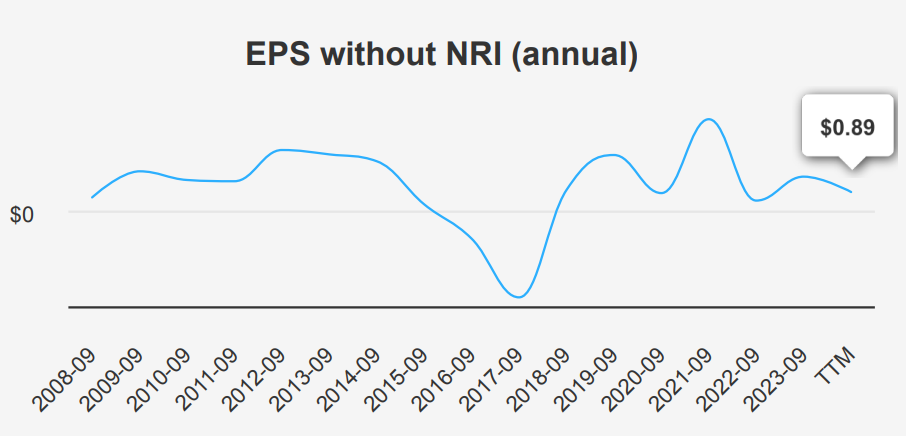

The company reported a significant decline in its earnings for the latest quarter ending June 30, 2024, with EPS without NRI (which excludes non-recurring items) dropping to $0.01 from $0.12 in the previous quarter, a decrease from $0.48 in the same quarter last year. This represents a substantial drop both quarter-over-quarter (QoQ) and year-over-year (YoY). The company’s annual EPS without NRI has seen a five-year compound annual growth rate (CAGR) of -2.80%, remaining flat over a ten-year period. The broader industry may grow at a CAGR of approximately 5-6% over the next decade, which may provide some context for OCSL’s challenges.

OCSL’s share buyback activities have been aggressive, with a one-year buyback ratio of -6.70%, indicating a reduction in shares outstanding. Over a ten-year period, the buyback ratio remains negative at -3.50%, suggesting ongoing repurchases, which can help boost EPS by reducing the share count, but this hasn’t translated into improved earnings.

Looking ahead, the estimated EPS for the next fiscal year maybe $0.827, with a significant increase to $2.200 the following year, suggesting a potential recovery or strategic shift. Analysts have forecasted revenues of $385.66 million for 2024, growing marginally to $390.35 million in 2025. The next earnings release is anticipated on November 14, 2024, which will provide further insights into whether OCSL can align with these optimistic estimates and industry growth trends.

Beyond OCSL Dividend, ROE and WACC Show Economic Value Deficit

The analysis of OCSL’s performance based on its Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) indicates that the company is struggling to generate economic value. Its WACC stands at 7.43% in the current evaluation. The Return on Equity (ROE) has shown a five-year median of 8.50%, indicating some profitability level. However, the current ROE is 4.43%, much lower than its historical median and peak of 21.30%. This decline in ROE further suggests challenges in generating shareholder value.

Overall, with a consistently zero ROIC and a WACC that surpasses it, OCSL is not creating economic value, highlighting inefficiencies in capital allocation and a need for strategic reassessment to enhance financial performance.

OCSL’s Dividend Yield and Growth: High Returns, Limited Upside

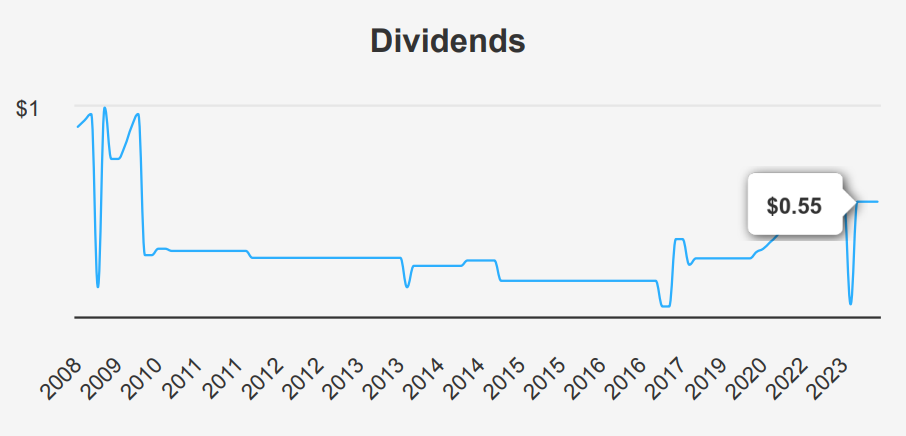

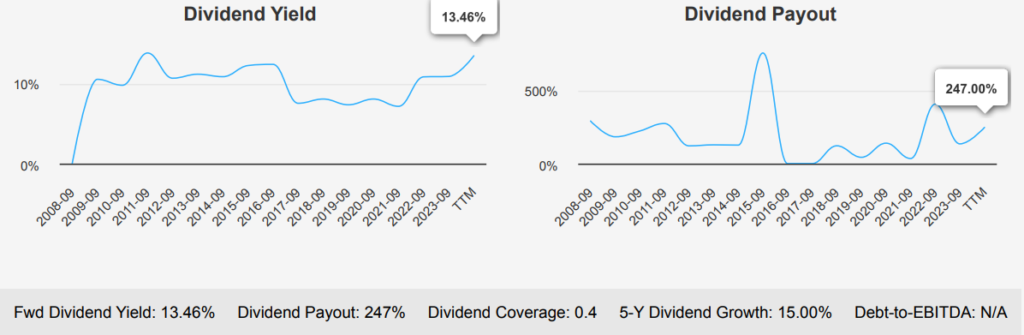

OCSL has shown a solid dividend growth trend in recent years, marked by a 5-year growth rate of 15% and a 3-year growth rate of 23.2%. However, the future 3-5 year dividend growth rate suggests potential stagnation. The company’s forward dividend yield is robust at 13.46%, significantly above its 10-year median of 9.29%. This high yield reflects a solid return for investors but might also indicate caution due to the elevated dividend payout ratio of 247%, far exceeding the 10-year high of 107.55%. This suggests that the company might be paying out more than it earns, a potential red flag for sustainability.

The forward dividend yield is notably high at 13.46%, which may appeal to income-focused investors, although it also reflects a higher risk profile than the sector average. The absence of a Debt-to-EBITDA ratio analysis makes it difficult to assess leverage and financial risk directly, but the high payout ratio implies limited flexibility in earnings. The next ex-dividend date would likely be around December 16, 2024, barring weekends. Overall, while the dividend yield is attractive, investors should be cautious about future growth potential and financial leverage.

OCSL’s Mixed Risk Profile: Debt, Dividends, Valuation & Insider Confidence

Oaktree Specialty Lending Corp (OCSL) presents a mixed risk profile for investors. On the warning side, the company has increased its long-term debt by $397.454 million over the past three years, although this debt level remains manageable. However, the company’s tax rate appears unusually low, potentially inflating current earnings in a manner that may not be sustainable. Additionally, the dividend payout ratio is at a concerning level of 2.47, suggesting that the current dividend may not be sustainable if financial conditions do not improve. Furthermore, revenue per share has declined over the past five years, hinting at potential underlying issues in generating consistent revenue growth.

On the positive side, insider buying activities, with 2,334 shares purchased recently, may indicate confidence in the company’s prospects from those closely associated with its operations. The company’s Beneish M-Score of -2.92 suggests a low likelihood of earnings manipulation, providing some reassurance regarding financial reporting integrity. Moreover, the price-to-book ratio 0.89 is near a three-year low, potentially indicating undervaluation. Additionally, the stock offers a dividend yield close to its five-year high, which could attract income-focused investors despite the concerns about dividend sustainability.

Oaktree Specialty Lending Insider and Institutional Stake Trends: 12-Month Analysis

The insider trading activity for Oaktree Specialty Lending Corporation (OCSL) over the past year indicates a positive sentiment from the company’s directors and management. Over the last 12 months, there have been three insider purchases and no insider sales, suggesting a solid belief in the company’s future prospects by those most familiar with its operations. This trend is consistent across the shorter 6-month and 3-month periods, with two insider purchases and no sales recorded in each timeframe.

Insider ownership stands at 23.08%, reflecting a significant stake held by insiders, who typically align their interests with those of shareholders. This substantial insider ownership can be viewed as a positive signal, suggesting confidence in the company’s long-term growth and success.

Institutional ownership is also notable at 36.38%, indicating a healthy level of interest and investment from institutional investors. The combination of high insider and institutional ownership, along with the lack of insider sales, suggests a stable and potentially optimistic outlook for OCSL among key stakeholders.

OCSL’s Trading Liquidity: Dark Pool Activity & Volume Trends

OCSL, a publicly traded stock, has a daily trading volume of 542,978 shares. Compared to its average daily trade volume over the past two months, which stands at 628,047 shares, OCSL’s current trading activity appears to be slightly below its recent average. This suggests a minor market interest or liquidity reduction compared to the historical norm.

The Dark Pool Index (DPI) for OCSL is 39.46%, indicating that a significant portion of its trades occurs in dark pools, private exchanges where large transactions can be made anonymously. A DPI of 39.46% suggests that nearly 40% of OCSL’s trades are executed away from public exchanges. This level of dark pool activity could imply that institutional investors are significantly involved in trading OCSL, potentially impacting the stock’s price discovery process on the open market.

Overall, OCSL’s trading environment shows moderate liquidity with a notable presence in dark pools, which may influence its price dynamics and volatility. Investors should consider these factors when evaluating OCSL’s dividend, market behavior, and potential investment opportunities.

Disclosures:

Yiannis Zourmpanos has a beneficial long position in the shares of OCSL either through stock ownership, options, or other derivatives. This report has been generated by our stock research platform, Yiazou IQ, and is for educational purposes only. It does not constitute financial advice or recommendations.